Open-Angle Glaucoma Drugs Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Open-Angle Glaucoma Drugs Market is segmented By Types of Open-Angle Glaucoma (Primary Open-Angle Glaucoma, Secondary Open-Angle Glaucoma), By Risk Fa....

Open-Angle Glaucoma Drugs Market Size

Market Size in USD Bn

CAGR8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8% |

| Market Concentration | High |

| Major Players | Aerie Pharmaceuticals, Alcon Research, Allergan, Bausch and Lomb, Chong Kun Dang Pharmaceutical and Among Others. |

please let us know !

Open-Angle Glaucoma Drugs Market Analysis

The open-angle glaucoma drugs market is estimated to be valued at USD 8.51 Bn in 2024 and is expected to reach USD 14.6 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8% from 2024 to 2031. This growth can be attributed to the increasing prevalence of glaucoma due to rising geriatric population and growing awareness about early detection and treatment of the condition.

Open-Angle Glaucoma Drugs Market Trends

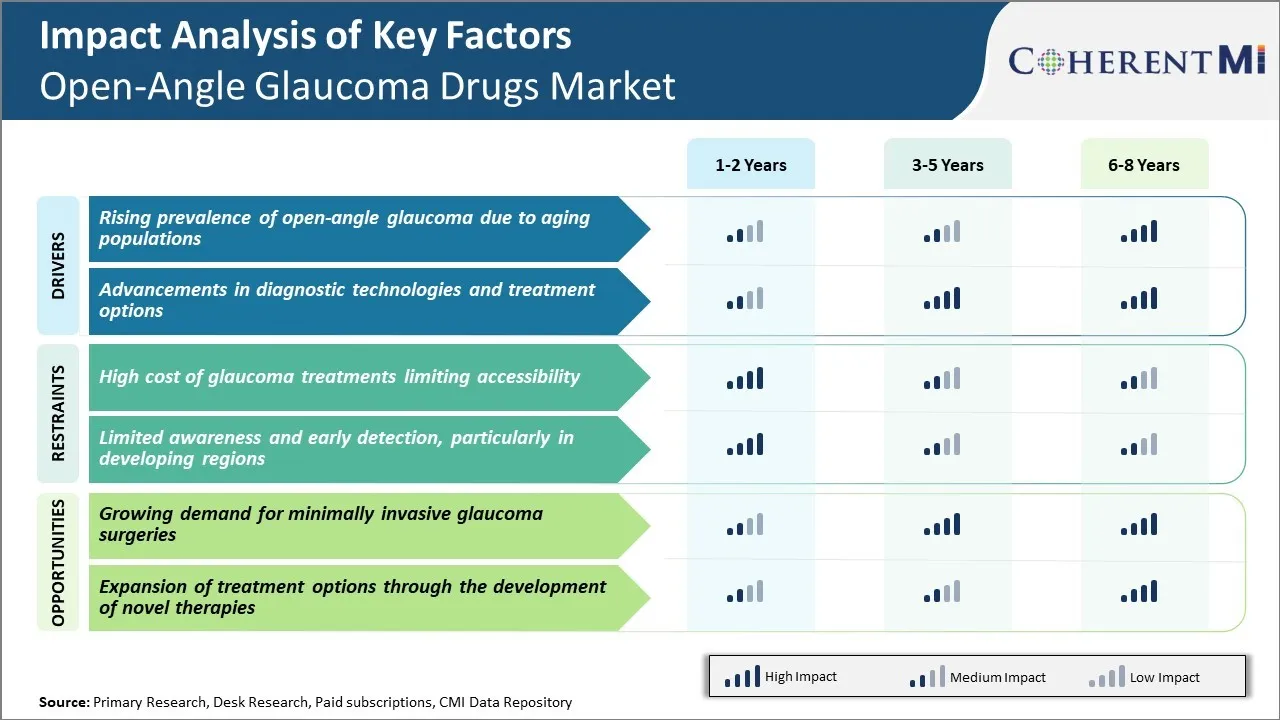

Market Driver - Rising Prevalence of Open-angle Glaucoma due to Aging Populations

Analysis of recent demographic trends indicates the number of people aged 60 years or older will nearly double from the present figures to over 2 billion by 2050. With aging comes an increased susceptibility to a variety of age-related chronic diseases. Open-angle glaucoma is strongly associated with advancing age, with older individuals facing a much higher risk of developing the debilitating disease.

Aging causes the eye to weaken in structure and function over time. The eye undergoes cellular and molecular changes as one grows older making it harder for the eye to perform important functions such as processing fluids and maintaining healthy pressures inside the eyeball. As people get older, the drainage canals in the eye often narrow or become blocked, elevating internal pressure and straining the optic nerve.

This cumulative age-related damage and physiological deterioration is a major driving factor for open-angle glaucoma to develop. With such a sizeable portion of global population soon entering their 60s and beyond, the prevalence of open-angle glaucoma is expected to surge tremendously in the coming decades.

Market Driver - Advancements in Diagnostic Technologies and Treatment Options

Continuous research and development efforts from both public and private entities have led to major breakthroughs in the detection, diagnosis and management of open-angle glaucoma. State-of-the-art technologies that allow for early and accurate diagnosis have significantly improved clinical outcomes. Devices such as scanning laser polarimetry and optical coherence tomography now enable detection of even mild nerve fiber loss, permitting intervention well before vision loss occurs. New imaging techniques provide deeper visualization of optic disc structures and retinal nerve fiber layer thickness, aiding differentiation between normal and glaucomatous conditions.

On the treatment front, advanced drug delivery systems and novel pharmaceutical formulations now ensure better compliance and around-the-clock IOP control. Topical eye drops containing newer prostaglandin analogs and alpha agonists offer superior efficacy, lower dosing frequency and increased tolerability.

Minimally-invasive surgical procedures like trabeculectomy, trabeculoplasty, and newer MIGS options provide alternative treatment pathways for controlling IOP. Furthermore, adjunct therapies such as neuroprotection and neuro-rescue are addressing glaucoma from a neuroprotection viewpoint.

Current research also focuses on stem cell therapy and gene therapy with promising potential. Together, ongoing technological and therapeutic developments are positively impacting patient care and clinical outcomes, translating to a beneficial environment for the glaucoma drug market.

Market Challenge - High Cost of Glaucoma Treatments Limiting Accessibility

One of the key challenges facing the open-angle glaucoma drugs market is the high cost of glaucoma treatments, which is limiting their accessibility to many patients. Glaucoma treatments primarily involve prescription eye drops that must be taken for life in order to control the condition. However, these eye drops can be very expensive, with some of the leading brands costing over $100 per month without insurance. This financial burden means that many glaucoma patients are non-compliant with their medication regimen due to inability to consistently afford the prescriptions.

Non-compliance, in turn, increases the risks of glaucoma progression and permanent vision loss. The high out-of-pocket costs are also contributing to underdiagnosis of glaucoma, as many patients avoid seeing an ophthalmologist due to concerns over treatment costs. Generic versions of glaucoma drugs have lower prices but have limited presence currently. If left unaddressed, the issue of treatment affordability could significantly limit the growth potential of the open-angle glaucoma drugs market.

Market Opportunity - Growing Demand for Minimally Invasive Glaucoma Surgeries

One major opportunity for the open-angle glaucoma drugs market is the growing demand for minimally invasive glaucoma surgeries (MIGS). MIGS procedures are emerging as an attractive alternative to traditional surgeries such as trabeculectomy, as they are associated with reduced risks of complications and quicker recovery times. The minimal invasiveness of these new procedures is appealing to both ophthalmologists and patients.

Furthermore, MIGS have shown potential to reduce reliance on topical glaucoma medications in post-operative management by offering additional IOP (intraocular pressure) lowering ability compared to medications alone. This enhances treatment effectiveness and compliance. The market sees significant promise in MIGS to potentially shift treatment paradigms, drive longer term medication use, and expand the addressable patient population.

As procedure adoption accelerates and payors provide greater coverage for reimbursed MIGS, it could spur new growth opportunities across the overall glaucoma drugs landscape.

Prescribers preferences of Open-Angle Glaucoma Drugs Market

The standard first-line treatment for open-angle glaucoma is eye drop medication to lower intraocular pressure (IOP). For early stage disease with IOP between 21-24 mmHg, ophthalmologists commonly prescribe PGAs such as Travatan Z ( travoprost ophthalmic solution). If IOP is above 24 mmHg, a fixed combination of PGA/beta blocker is preferred, e.g. Combigan (brimonidine/timolol).

When monotherapy fails to adequately reduce IOP, prescribers step up to adjunctive therapy using another class of drops. Common additions to PGAs include nonspecific beta blockers like Timoptic (timolol maleate). For patients who cannot tolerate beta blockers, a carbonic anhydrase inhibitor such as Trusopt (dorzolamide) may be prescribed. Brand affinity and prior authorization approval influence these medication choices.

When eye drops are insufficient, laser trabeculoplasty may be considered, especially for younger patients. The most widely used option is selective laser trabeculoplasty using devices like Select or Iridex IQ 532. For uncontrolled glaucoma despite maximum medical therapy, prescribers may recommend incisional surgeries such as trabeculectomy or tube shunt placement to further lower IOP. Aquashunt is a popular tube device.

Age, comorbidities, lifestyle factors, and third-party reimbursement also guide prescribers' decisions between the various treatment escalation options.

Treatment Option Analysis of Open-Angle Glaucoma Drugs Market

In early-stage disease with minimal vision loss and optic nerve damage, the first-line treatment is usually eyedrops such as prostaglandin analogs (e.g. latanoprost, travoprost, bimatoprost), beta-blockers (e.g. timolol), alpha agonists (e.g. brimonidine), or carbonic anhydrase inhibitors (e.g. dorzolamide, brinzolamide). These drugs work to lower eye pressure and slow progression.

For moderate stage disease with moderate vision loss and optic nerve damage, prostaglandin analogs remain the most effective first-line treatment due to their ability to lower pressure over 24 hours with once-daily dosing. Combination eyedrops may be used if single agents are insufficient.

In severe stage disease with significant vision loss, surgery such as trabeculectomy or tube shunt placement is the preferred treatment option. Trabeculectomy creates an alternate drainage channel to lower pressure. Tube shunts involve placing a tiny tube to divert aqueous humor from the anterior chamber to the subconjunctival space, providing another outflow pathway. This aggressive interventional approach aims to prevent further vision loss when medical therapy has failed or is unlikely to control pressure adequately.

Key winning strategies adopted by key players of Open-Angle Glaucoma Drugs Market

Focus on innovative drug delivery mechanisms: Companies have focused on developing drugs with improved delivery mechanisms that can treat glaucoma more effectively than existing eyedrops. For example, Durysta (bimatoprost intracameral implant), launched by Allergan in 2017, is the first biodegradable implant designed to continuously release a glaucoma drug inside the eye for up to 6 months.

Target underserved patient populations: For example, Kala Pharmaceuticals' EYSUVIS (loteprednol etabonate ophthalmic suspension) 0.25%, approved in 2020, is the first and only prescription therapy for the short-term (up to two weeks) treatment of signs and symptoms of dry eye disease.

Focus on combination therapy: Drugs combining two existing molecules into one are popular as they improve efficacy while maintaining a strong safety profile. For example, Simbrinza (brinzolamide/brimonidine tartrate ophthalmic suspension), launched in 2014 by Novartis, combines carbonic anhydrase inhibitor brinzolamide and alpha agonist brimonidine tartrate in one bottle.

Strategic M&A activity: Companies acquire smaller players with promising drug candidates to build out their glaucoma pipeline. For instance, in 2019 Allergan acquired Pra Health Sciences for $2.1 billion to gain access to uveitis and glaucoma drug candidate XP-8233.

Segmental Analysis of Open-Angle Glaucoma Drugs Market

Insights, By Types of Open-Angle Glaucoma: Primary Open-Angle Glaucoma Drives Highest Market Share Due to Its Prevalence and Symptoms

Primary open-angle glaucoma contributes the highest share of the open-angle glaucoma drugs market owing to its widespread prevalence and identifiable risk factors.

A key driver of the primary open-angle glaucoma segment is its association with identifiable risk factors such as family history, race, hypertension, and high eye pressure. Patients can be regularly monitored and screened for these risk factors to enable early diagnosis and treatment intervention. One of the most significant risk factors is elevated eye pressure, also known as ocular hypertension. While ocular hypertension itself does not cause vision loss, it significantly increases the odds of developing primary open-angle glaucoma in future if left uncontrolled. Regular eye check-ups are thus important to monitor pressure levels and detect signs of the disease even before vision loss occurs.

Growing awareness initiatives focused on encouraging regular eye screening, especially in at-risk demographic groups, are expanding diagnosis rates. This promotes early treatment intervention using a variety of drugs that lower eye pressure and slow disease progression to preserve vision over the long term.

Additional Insights of Open-Angle Glaucoma Drugs Market

- The report identifies a substantial need for therapies that target the underlying disease mechanism of open-angle glaucoma, as current treatments primarily focus on symptom management.

- Significant pipeline activity with several therapies in Phase II and III trials, indicating ongoing innovation in treatment options.

- The prevalence of open-angle glaucoma is expected to increase, with the highest prevalence in the United States among the 7MM (United States, EU5, Japan).

- Age, family history, and ethnic background are critical risk factors for developing open-angle glaucoma.

Competitive overview of Open-Angle Glaucoma Drugs Market

The major players operating in the Open-Angle Glaucoma Drugs Market include Aerie Pharmaceuticals, Alcon Research, Allergan, Bausch and Lomb, Chong Kun Dang Pharmaceutical, D.Western Therapeutics Institute (DWTI)/Kowa LTD., Envisia Therapeutics, Laboratorios Sophia S.A de C.V., Merck Sharp & Dohme Corp., Nicox Ophthalmics, Novartis/Alcon Research, Ocuphire Pharma, Ono Pharmaceutical, Peregrine Ophthalmic, Perrigo Company, Santen Inc., Santen Pharmaceutical, Sun Pharma Advanced Research Company Limited (SPARC), and Sylentis.

Open-Angle Glaucoma Drugs Market Leaders

- Aerie Pharmaceuticals

- Alcon Research

- Allergan

- Bausch and Lomb

- Chong Kun Dang Pharmaceutical

Open-Angle Glaucoma Drugs Market - Competitive Rivalry, 2024

Open-Angle Glaucoma Drugs Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Open-Angle Glaucoma Drugs Market

- In August 2024, Aerie Pharmaceuticals has been active in the glaucoma treatment space with previously launched drugs like Rhopressa and Rocklatan. Both of these drugs target the reduction of intraocular pressure (IOP) in patients with open-angle glaucoma. Rocklatan, for example, is a combination of netarsudil and latanoprost and has shown positive results in IOP reduction in clinical trials.

- July 2024: Alcon Research received FDA approval for its latest glaucoma treatment, projected to enhance patient compliance with fewer side effects. Alcon has been actively involved in glaucoma treatment with products like the Hydrus® Microstent, a MIGS device that aims to reduce intraocular pressure and is designed to be used during cataract surgery. For FDA-approved treatments, another company has introduced iDose® TR, a first-of-its-kind glaucoma implant that continuously releases medication for up to three years. This treatment reduces the need for daily eye drops and enhances patient compliance while minimizing side effects.

Open-Angle Glaucoma Drugs Market Segmentation

- By Types of Open-Angle Glaucoma

- Primary Open-Angle Glaucoma

- Secondary Open-Angle Glaucoma

- By Risk Factors

- General Factors

- Ocular Factors

- Non-ocular Factors

- Ocular Hypertension

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the open-angle glaucoma drugs market?

The open-angle glaucoma drugs market is estimated to be valued at USD 8.51 Bn in 2024 and is expected to reach USD 14.6 Bn by 2031.

What are the key factors hampering the growth of the open-angle glaucoma drugs market?

The high cost of glaucoma treatments limiting accessibility and limited awareness and early detection, particularly in developing regions are the major factors hampering the growth of the open-angle glaucoma drugs market.

What are the major factors driving the open-angle glaucoma drugs market growth?

The rising prevalence of open-angle glaucoma among aging populations and advancements in diagnostic technologies and treatment options are the major factor driving the open-angle glaucoma drugs market.

Which is the important type of open-angle glaucoma in the open-angle glaucoma drugs market?

The important type of open-angle glaucoma is primary open-angle glaucoma.

Which are the major players operating in the open-angle glaucoma drugs market?

Aerie Pharmaceuticals, Alcon Research, Allergan, Bausch and Lomb, Chong Kun Dang Pharmaceutical, D.Western Therapeutics Institute (DWTI)/Kowa LTD., Envisia Therapeutics, Laboratorios Sophia S.A de C.V., Merck Sharp & Dohme Corp., Nicox Ophthalmics, Novartis/Alcon Research, Ocuphire Pharma, Ono Pharmaceutical, Peregrine Ophthalmic, Perrigo Company, Santen Inc., Santen Pharmaceutical, Sun Pharma Advanced Research Company Limited (SPARC), and Sylentis are the major players.

What will be the CAGR of the open-angle glaucoma drugs market?

The CAGR of the open-angle glaucoma drugs market is projected to be 8% from 2024-2031.