Opioid Overdose Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Opioid Overdose Treatment Market is segmented By Drug Class (Methadone, Naltrexone, Buprenorphine), By Route of Administration (Oral, Parenteral), By ....

Opioid Overdose Treatment Market Size

Market Size in USD Bn

CAGR6.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.1% |

| Market Concentration | High |

| Major Players | Enalare Therapeutics Inc., Opiant Pharmaceuticals, Hikma Pharmaceuticals, Emergent BioSolutions, Purdue Pharma and Among Others. |

please let us know !

Opioid Overdose Treatment Market Analysis

The Global Opioid Overdose Treatment Market is estimated to be valued at USD 45.9 Bn in 2024 and is expected to reach USD 68.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2031. This market encompasses both prescription and illicit opioids which have led to a rise in overdose deaths in recent years. The growing elderly population which is more likely to be prescribed opioid painkillers for chronic pain conditions is expected to drive increased demand. Additionally, greater awareness and availability of naloxone which can reverse opioid overdoses will spur market growth as these drugs are more widely adopted.

An opioid overdose occurs when a person consumes too much of an opioid drug, leading to life-threatening symptoms such as slowed or stopped breathing, unconsciousness, and potentially death. Common opioids include prescription painkillers like oxycodone and illegal drugs like heroin. Immediate medical intervention, including naloxone, can reverse an overdose. The market is expected to witness the rise in prescription for opioids particularly synthetic opioids such as fentanyl. Increasing street availability of illicit fentanyl and fentanyl analogs will worsen the epidemic according to the CDC. However, greater prevention efforts and enforcement against illicit manufacturing and distribution networks may help curb non-medical use which can offset some of the projected growth.

Opioid Overdose Treatment Market Trends

Market Driver - Rising Incidence of Opioid Overdoses Due to Increasing Availability of Prescription and Illegal Opioids.

The opioid overdose crisis in 2024 includes the rise of synthetic opioids like fentanyl, which are significantly more potent than traditional opioids. Fentanyl is now a major contributor to overdose deaths due to its prevalence in both illicit drug markets and its accidental presence in other drugs. Another driver is the increased availability of counterfeit pills and a persistent gap in access to treatment for addiction and overdose reversal medications like naloxone. The expanding scope of opioid-related harm also correlates with mental health issues and economic factors exacerbated by the pandemic. In addition to synthetic opioids like fentanyl, the opioid overdose crisis is being driven by several other factors. The ongoing effects of the COVID-19 pandemic have worsened mental health challenges, leading to increased substance misuse. Social isolation, unemployment, and economic instability have contributed to higher rates of opioid abuse. The rise of polysubstance use, where individuals mix opioids with other drugs like stimulants or benzodiazepines, also increases the risk of fatal overdoses. Furthermore, barriers to healthcare, especially in rural and underserved areas, limit access to addiction treatment programs and harm-reduction services like needle exchanges and supervised injection sites.

Market Driver - Development of Novel Treatments for Opioid Overdose Boosts Demand for Opioid Drugs.

Respiratory depression is a major contributor to opioid overdose fatalities, as drugs slow breathing to dangerously low levels. Current standard of care focuses on rescue administration of naloxone to reverse opioid effects, but this treatment only provides transient reversal of symptoms and additional naloxone may be needed if the opioid is long-acting. Emersion Bio has developed ENA-001, a novel drug candidate designed to extend the duration of action of injected naloxone for improved overdose reversal. ENA-001 pairs naloxone with a component that binds to albumin in the bloodstream, effectively tethering the naloxone molecule and slowing its removal from circulation. In clinical studies, a single injection of ENA-001 maintained naloxone concentrations in the body for over 80 minutes, significantly longer than rapid-acting injectable naloxone alone.

Extended reversal of respiratory depression could help reduce risks of recurrent opioid overdose following initial naloxone treatment. With its promising results to date, ENA-001 has potential to become an important new therapy for reversal of both acute and post-acute effects of an overdose. Its targeted mechanism may also help improve outcomes for overdoses involving long-acting synthetic opioids like fentanyl, where risk of re-emergence of dangerous respiratory depression can persist for hours. If approved, ENA-001 may see uptake not just among first responders and emergency departments but also addiction treatment facilities aiming to bolster post-overdose safety. Its ability to avert repeat crises could impact overdose rates and potentially slow the growth of this costly public health issue. ENA-001 therefore represents a notable advance in the race to develop improved treatments for opioid addiction and its lethal consequences.

Market Challenge - Regulatory Challenges in Bringing New Drugs to Market.

One of the major challenges facing the Opioid Overdose Treatment Market is the stringent regulations surrounding the development and approval of new drugs that aim to treat opioid overdose. Developing new medications and treatment options is a lengthy and complex process that requires extensive research, clinical trials, and regulatory review. Any new drug must undergo rigorous testing to demonstrate safety and efficacy according to the standards set by agencies like the FDA before being approved for patient use. Given the urgent need to combat the ongoing opioid crisis, developers of overdose treatments are faced with challenging timelines as lives depend on getting new treatments approved and available quickly. However, they must still adhere to all regulatory protocols to avoid risks to patients. This can slow down the drug development cycle significantly and delay access to potentially life-saving medications. Finding ways to navigate the regulatory landscape more efficiently while maintaining standards of safety and oversight remains a major stumbling block for companies in this market.

Market Opportunity- Partnerships with Agencies like BARDA to Develop Rapid Treatments for Opioid Overdose.

One opportunity available in the opioid overdose treatment market involves forming strategic partnerships with governmental agencies that can help expedite drug development efforts. An example is the Biomedical Advanced Research and Development Authority (BARDA), which aims to accelerate the research, development, and availability of medical solutions like vaccines and treatments during public health emergencies. BARDA has actively prioritized addressing the opioid crisis and has committed funding to support developing new opioid overdose reversal and treatment medications. Partnering with BARDA allows companies working in this space to gain financial and technical assistance in testing and clinical trials, helping advance promising candidates more rapidly while still fulfilling all necessary regulatory protocols. Such partnerships demonstrate the commitment of both parties to finding urgently needed solutions, and can help companies bring potentially life-saving treatments to market sooner. This presents a significant growth opportunity for stakeholders able to form effective collaborations with agencies like BARDA at the forefront of combating America's opioid epidemic.

Key winning strategies adopted by key players of Opioid Overdose Treatment Market

- Product Innovation and Development: Key players focus on developing more effective opioid antagonists like naloxone in novel forms (e.g., nasal sprays, auto-injectors) to ensure ease of use during emergencies. For example, Emergent BioSolutions introduced Narcan® nasal spray, simplifying administration for non-medical personnel. Companies are also investing in extended-release formulations of medications to provide sustained protection against opioid overdose, particularly for at-risk populations.

- Partnerships and Collaborations: Collaborating with government agencies, healthcare institutions, and NGOs to increase awareness, education, and accessibility of opioid overdose treatments. Public-private partnerships help extend the reach of life-saving treatments and ensure they are distributed where they are needed most. For instance, Emergent BioSolutions collaborates with government bodies to expand the availability of Narcan to first responders and community organizations.

- Geographical Expansion: Companies are expanding their geographical presence, particularly in regions with high opioid abuse rates, such as North America. Market leaders focus on increasing their distribution networks, regulatory approvals, and local partnerships in these areas. Mylan N.V., through its EpiPen-like naloxone auto-injector, expanded its presence globally to meet demand in areas affected by the opioid crisis.

- Cost-effective Generic Alternatives: As opioid overdose treatment requires repeated administration, especially in vulnerable populations, affordability becomes crucial. Generic naloxone alternatives by companies like Amphastar Pharmaceuticals and Teva Pharmaceuticals have gained traction by offering low-cost options, increasing accessibility and market share.

- Awareness Campaigns and Education: Market leaders invest in public health initiatives, awareness campaigns, and educational programs to inform healthcare providers, first responders, and the public about recognizing and managing opioid overdoses. These campaigns are often backed by collaborations with local authorities and public health agencies. Companies also advocate for naloxone accessibility in high-risk areas such as public spaces, schools, and workplaces.

- Strategic Acquisitions and Licensing Agreements: Acquiring smaller, innovative companies with promising pipeline products or licensing agreements allows major players to broaden their product portfolios. For example, Pfizer partnered with Adapt Pharma to commercialize Narcan nasal spray.

Segmental Analysis of Opioid Overdose Treatment Market

Insights, By Drug Class, Methadone's Widespread Availability and Use Drives its Dominance in the Market.

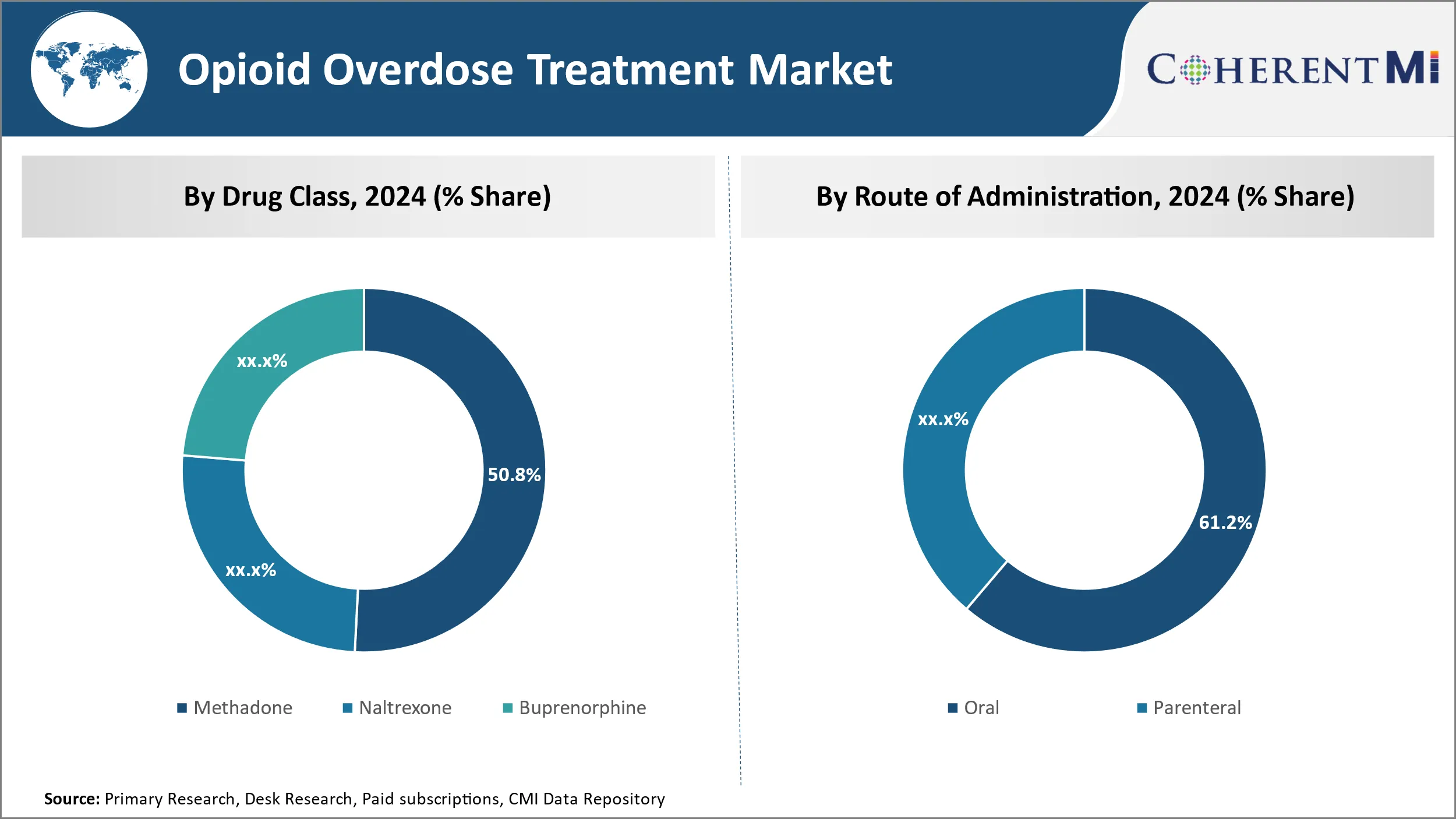

By Drug Class, Methadone is expected to contribute 50.8% market share in 2024 due to its extensive use for opioid addiction treatment and relatively low cost. As the first-line treatment for opioid use disorder in many areas, methadone maintains widespread availability through specialized opioid treatment programs. This easy accessibility means methadone is prescribed to more patients than other options like naltrexone and buprenorphine.

Methadone's status as a full opioid agonist also differentiates it from partial agonists like buprenorphine. Its similar mechanism of action to other opioids helps reduce cravings and prevents opioid withdrawal symptoms more effectively for many patients. Notably, methadone has a longer duration of action which allows for once-daily dosing in treatment programs. This dosing convenience contributes to higher rates of medication adherence compared to alternative therapies.

Some drawbacks of methadone include its greater potential for misuse due to the drug's euphoric effects. Unfortunately, methadone involved in overdose incidents is often diverted outside of treatment programs. However, methadone's established track record and tolerability have made it a reliable first-line therapy choice for opioid addiction globally. Unless new treatment options demonstrate significantly better outcomes or safety profiles, methadone is likely to hold its dominant share in the drug class segment for the foreseeable future.

Insights, By Route of Administration, Oral Administration Dominates Due to Accessibility and Tolerability.

By route of administration, the oral route of administration is expected to account for 61.2% in 2024. Ease of use through oral dosing has made it the most accessible and tolerable administration route compared to other options like parenteral injections. Almost all opioid agonist therapies like methadone and buprenorphine are available in oral formulations suitable for once or twice daily dosing at home or in clinics. This dosing convenience leads to high rates of medication adherence necessary for effective addiction treatment.

Oral opioids are also generally better tolerated than injectable options by most patients. Needle-based administration carries risks of infection, discomfort, and requires medical expertise beyond simple swallowing a pill or liquid dose. Oral therapies avoid such issues while still providing steady plasma concentration levels when dosed correctly. Oral formulations allow for predetermined dosing schedules as opposed to intermittent injections under a provider's supervision.

The established oral route infrastructure, consisting of pills, films, and elixirs, has created a large familiar patient base. New opioid therapies will face difficulty surpassing oral dosing due to these entrenched preferences, tolerability advantages, and scalable manufacturing capabilities for oral dose forms. Barring a paradigm shift in drug delivery technology, the oral route segment is anticipated to maintain its lead.

Additional Insights of Opioid Overdose Treatment Market

The opioid overdose crisis has seen a dramatic increase due to the widespread availability of both prescription opioids and illicit substances like heroin. This has led to a rise in fatal overdoses, prompting urgent efforts to develop new treatments. Naloxone, an opioid antagonist, has been the cornerstone of overdose treatment. However, new drugs, like ENA-001 from Enalare Therapeutics, are exploring alternative mechanisms to treat respiratory depression in various clinical settings. With partnerships such as the one between BARDA and Enalare, efforts are underway to develop a more rapid, intramuscular administration method for emergency responders, enhancing the ability to save lives during overdose situations.

Competitive overview of Opioid Overdose Treatment Market

The major players operating in the Opioid Overdose Treatment Market include Enalare Therapeutics Inc., Opiant Pharmaceuticals, Hikma Pharmaceuticals, Emergent BioSolutions, Purdue Pharma, Indivior Plc, Alkermes, Orexo AB, Titan Pharmaceuticals Inc, Viatris Inc and Camurus.

Opioid Overdose Treatment Market Leaders

- Enalare Therapeutics Inc.

- Opiant Pharmaceuticals

- Hikma Pharmaceuticals

- Emergent BioSolutions

- Purdue Pharma

Opioid Overdose Treatment Market - Competitive Rivalry, 2024

Opioid Overdose Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Opioid Overdose Treatment Market

In 2023, the opioid overdose crisis saw both challenges and notable progress. One of the most significant developments has been the increase in harm reduction measures. The FDA’s approval of over-the-counter naloxone products, like Narcan, has expanded public access to life-saving opioid overdose treatments, contributing to a slight decline in overdose deaths in the second half of the year. By July 2023, opioid overdose deaths had decreased by about 2% compared to the previous year, with deaths continuing to fall through the end of 2023.

Opioid Overdose Treatment Market Segmentation

- By Drug Class

- Methadone

- Naltrexone

- Buprenorphine

- By Route of Administration

- Oral

- Parenteral

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Opioid Overdose Treatment Market?

The Global Opioid Overdose Treatment Market is estimated to be valued at USD 45.9 Bn in 2024 and is expected to reach USD 68.1 Bn by 2031.

What will be the CAGR of the Opioid Overdose Treatment Market?

The CAGR of the Opioid Overdose Treatment Market is projected to be 6.1% from 2024 to 2031.

What are the major factors driving the Opioid Overdose Treatment Market growth?

The rising incidence of opioid overdoses due to increasing availability of prescription and illegal opioids and development of novel treatments like ena-001 for respiratory depression related to opioid overdose. These are the major factors driving the Opioid Overdose Treatment Market.

What are the key factors hampering the growth of the Opioid Overdose Treatment Market?

The regulatory challenges in bringing new drugs to market and limited public awareness of new treatment options like intramuscular naloxone. These are the major factor hampering the growth of the Opioid Overdose Treatment Market.

Which is the leading Drug Class in the Opioid Overdose Treatment Market?

Methadone is the leading Drug Class segment.

Which are the major players operating in the Opioid Overdose Treatment Market?

Enalare Therapeutics Inc., Opiant Pharmaceuticals, Hikma Pharmaceuticals, Emergent BioSolutions, Purdue Pharma, Indivior Plc, Alkermes, Orexo AB, Titan Pharmaceuticals Inc, Viatris Inc, Camurus are the major players.