Plastic Alternative Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Plastic Alternative Packaging Market is segmented By Type (Starch-Based Plastic, Cellulose-Based Plastics, Polylactic Acid (PLA), Polyhydroxyalkanoate....

Plastic Alternative Packaging Market Size

Market Size in USD Bn

CAGR16.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 16.8% |

| Market Concentration | High |

| Major Players | Amcor Plc, Mondi, DS Smith, Sealed Air, Tetra Pak International SA and Among Others. |

please let us know !

Plastic Alternative Packaging Market Analysis

The plastic alternative packaging market is estimated to be valued at USD 6.11 Billion in 2024 and is expected to reach USD 18.13 Billion by 2031, growing at a compound annual growth rate (CAGR) of 16.8% from 2024 to 2031. The market is set to expand significantly over the next seven years as concerns around plastic waste management and sustainability continue to rise globally.

Plastic Alternative Packaging Market Trends

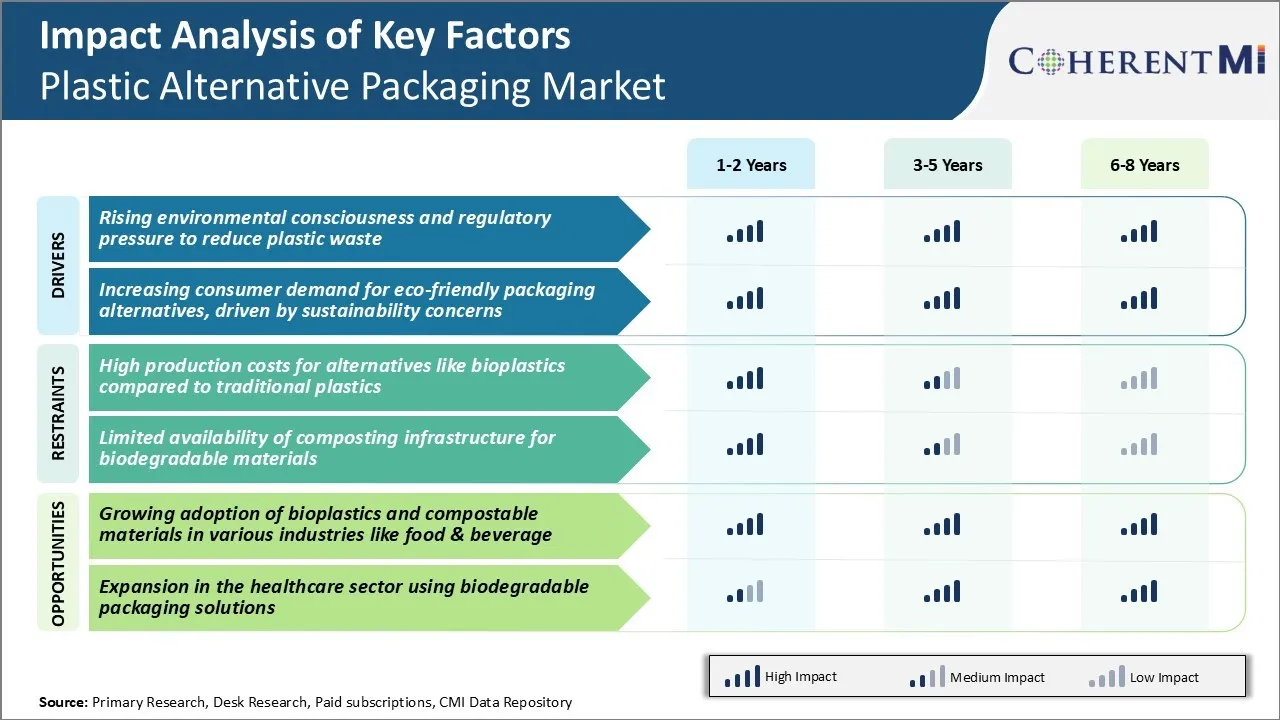

Market Driver - Rising Environmental Consciousness and Regulatory Pressure to Reduce Plastic Waste

Environmental concerns related to plastic pollution have grown exponentially in recent years. Plastic waste has become one of the most pressing environmental issues globally, with an estimated 300 million tons of plastic waste being produced every year.

Governments worldwide have introduced regulations to tackle the plastic waste crisis. Some nations have outright banned specific single-use plastic items like straws, bags and cutlery. Many others have implemented taxes or levies on virgin plastic production. Compliance with regulatory norms is driving large corporations to look beyond conventional plastics for their packaging needs, creating growth avenues for the plastic alternative packaging market.

The need to be socially responsible as well as follow regulatory mandates will continue propelling the adoption of plastic alternative packaging materials. While plastic pollution remains an enormous challenge, it is heartening to see consumers and governments around the world taking meaningful action through their choices and policies.

Market Driver - Increasing Consumer Demand for Eco-friendly Packaging Alternatives, Driven by Sustainability Concerns

Consumers today, especially millennials and generation Z, are highly sustainability conscious. Being mindful about reducing one's own plastic footprint through opting for plastic alternative packaging has become a priority for many buyers.

Sustainable brands extensively utilize platforms like Instagram and YouTube to highlight their green credentials and market the environmental benefits of the materials they employ. Furthermore, transparent product information through online research enables discerning customers to identify packaging made from genuinely sustainable sources like plants. They desire materials that are certified compostable or biodegradable.

Labels showcasing a product's recyclability, recycled content, or proximity to natural elements like trees and leaves are attractive selling points. With awareness and change starting at the individual level, today's consumers vote for environmental protection through every purchase.

This paradigm shift driven by end-user sustainability priorities is set to revolutionize packaging design, material innovation, and supplier choices. Consequently, this is expected to drive growth of the plastic alternative packaging market in the coming years.

Market Challenge - High Production Costs for Alternatives like Bioplastics Compared to Traditional Plastics

One of the key challenges facing the plastic alternative packaging market is the high production costs for materials like bioplastics. While bioplastics are more environmentally sustainable since they are produced from renewable biomass sources rather than fossil fuels, the manufacturing costs are significantly higher.

Producing bioplastics at scale requires specialized production equipment and processes that drive up capital expenditures. The key input materials for bioplastics such as corn starch, sugarcane or cellulosic biomass also have higher supply costs than crude oil. These higher raw material procurement costs ultimately make bioplastics more expensive than conventional plastics on a per unit basis.

All of these factors contribute to bioplastics having production costs that are approximately 2-3 times higher than traditional plastic materials like polyethylene and polypropylene currently. The premium pricing of bioplastics has hindered wider adoption by brand owners and restricted the market growth potential.

Market Opportunity – Growing Demand for Plastic Alternative Packaging in Food & Beverage Industry

A significant opportunity for the plastic alternative packaging market is growing adoption of bioplastics and compostable materials in various industries, especially food and beverage. There is increasing pressure on companies in the food and beverage sector to reduce their use of single-use plastics.

Major food and beverage retailers, brands, and restaurant chains are actively searching for plastic alternative packaging materials like bioplastics or pulp-based solutions for their packaging needs. This will help drive higher and more consistent volumes for bioplastic resin manufacturers in the plastic alternative packaging market.

This volume growth will in turn help lower production costs through economies of scale and make bioplastics more cost competitive against traditional plastics over the long run. Consequently, this is expected to create lucrative opportunities in the plastic alternative packaging market.

Key winning strategies adopted by key players of Plastic Alternative Packaging Market

Focus on bio-based and biodegradable materials: Companies like Amcor, Sealed Air Corp, and Pactiv have focused on developing plastic alternative packaging using bio-based and biodegradable materials like paper, sugarcane and bamboo instead of plastics. For example, in 2018 Amcor launched new fiber-based packaging called EcoFlex made from renewable agricultural byproducts like sugarcane for food and consumer goods companies.

Emphasis on reusable packaging: Players are promoting plastic alternative packaging options made from glass, aluminum and steel to reduce single-use plastics. For example, PepsiCo partnered with Loop in 2019 to trial reusable packaging delivery system for drinks and snacks.

Partnerships and acquisitions: Companies partner with material innovators or acquire startup firms developing novel plastic alternative packaging options. For example, Danone's acquisition of Rise Bar in 2018 helped them launch products packaged in biodegradable cellulose pouches. Procter & Gamble's partnership with TerraCycle led to launching Loop reusable packaging.

Green branding and marketing campaigns: Players promote their plastic alternative packaging and sustainability goals aggressively through ad campaigns, social media etc. For example, Coca Cola's 'World Without Waste' campaign run since 2018 highlights their investments in recyclable aluminum cans and bioPET bottles.

Segmental Analysis of Plastic Alternative Packaging Market

Insights, By Type: Sustainability Priorities Drive Starch-Based Plastic Growth

In terms of type, starch-based plastic segment is projected to hold 38.7% share of the plastic alternative packaging market in 2024. This is due to the growing preference for more environment-friendly options. Being plant-derived and compostable, starch-based plastics align well with the expanding focus on sustainability and waste reduction across industries. Their degradability addresses concerns around plastic pollution, a key trigger for the increased search for plastic alternatives packaging. Some of their properties like printability and moisture resistance also enable usage in a variety of plastic alternative packaging applications.

Food producers have widely adopted starch-based plastics for products where transparency about organic and natural sources is important to the target consumers. Continued education highlighting the 'green' attributes of these plastics compared to traditional petroleum-based ones helps maintain their popularity.

Insights, By Application: Changing Consumer Demands Fuel Food & Beverage Packaging Evolution

In terms of application, food & beverage segment is projected to account for 45.8% share of the plastic alternative packaging market in 2024. Companies consistently examine packaging formats that enhance customer experience and sentiment towards their products. As buyers emphasize health, wellness, and eco-friendliness, many are switching to brands with plastic alternative packaging.

Plastic alternative materials that are lightweight, recyclable and compostable address this emergent preference better than conventional plastics. Their acceptance thus grows in food packaging for snacks, dry grocery, ready meals, and beverages. Customization abilities also support the introduction of varied stock-keeping units catering to niche tastes.

Insights, By Material Type: Paper & Paperboard Leads as the Optimum Sustainable Solution

In terms of material type, paper & paperboard contributes the highest share of the market. It finds extensive implementation as the go-to alternative material across industries. Being biodegradable and derived from renewable tree sources positions paper in line with the rising sustainability orientation. Manufacturers favor paper for its printability and ability to be recycled multiple times. It replicates certain properties of plastic like moisture resistance after chemical treatments.

Additionally, established recycling infrastructure streams ease reuse of paper waste. These advantages, coupled with reasonable costs, make paper & paperboard high a preferable substitution for plastic packaging, driving further advances in application formats like flexible paper pouches and laminated cartons.

Additional Insights of Plastic Alternative Packaging Market

- In the U.S., the plastic alternative packaging market reached USD 1.45 billion in 2023 and is expected to grow at a CAGR of 17.03%, driven by increasing consumer and regulatory demand for sustainable packaging options.

- The Asia Pacific region is projected to be the fastest-growing market for plastic alternative packaging due to government initiatives and increasing environmental concerns.

- Ocean Pollution: An estimated 8 million tons of plastic waste enter oceans annually, underscoring the urgent need for plastic alternative packaging solutions.

- Consumer Preference: Surveys indicate that over 70% of consumers are willing to pay a premium for products with plastic alternative packaging.

- Regulatory Impact: Over 60 countries have implemented bans or levies on single-use plastics, accelerating the adoption of plastic alternative packaging.

Competitive overview of Plastic Alternative Packaging Market

The major players operating in the plastic alternative packaging market include Amcor Plc, Mondi, DS Smith, Sealed Air, Tetra Pak International SA, Ball Corporation, WestRock, Huhtamaki, BASF SE, Berry Global, and Nampak.

Plastic Alternative Packaging Market Leaders

- Amcor Plc

- Mondi

- DS Smith

- Sealed Air

- Tetra Pak International SA

Plastic Alternative Packaging Market - Competitive Rivalry, 2024

Plastic Alternative Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Plastic Alternative Packaging Market

- In April 2024, Orlandi introduced a new recyclable paper material known as EcoPro™ Paper-Wrap, designed specifically for wrapping fragrance and cosmetic products. This innovative, plastic alternative packaging solution replaces traditional plastic-based films. It is characterized by its high-barrier properties, heat-sealability, and versatility, allowing it to wrap various hard goods currently using plastic packaging.

- In November 2023, TIPA launched a fully biodegradable tray made from rice waste. This innovative product is designed to be both compostable and recyclable, providing an eco-friendly alternative to plastic packaging. The trays are intended for various applications, such as packaging fruits, vegetables, baked goods, and hot foods.

- In August 2023, Mondi Group announced a significant investment of $50 million aimed at expanding its paper-based packaging facilities in Europe. This move is part of their strategy to meet the growing demand for sustainable, plastic alternative packaging solutions.

- In March 2023, Amcor plc launched a new line of compostable flexible packaging specifically designed for the coffee and snack sectors. This initiative was aimed at reducing plastic waste and responding to the increasing consumer demand for plastic alternative packaging options.

Plastic Alternative Packaging Market Segmentation

- By Type

- Starch-Based Plastic

- Cellulose-Based Plastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Others

- By Application

- Food & Beverage

- Packaged Foods

- Beverages

- Ready-to-Eat Meals

- Personal Care

- Cosmetics

- Toiletries

- Healthcare

- Others

- Household Products

- Industrial Goods

- Food & Beverage

- By Material Type

- Paper & Paperboard

- Metal

- Glass

- Bioplastics

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the plastic alternative packaging market?

The plastic alternative packaging market is estimated to be valued at USD 6.11 billion in 2024 and is expected to reach USD 18.13 billion by 2031.

What are the key factors hampering the growth of the plastic alternative packaging market?

High production costs for alternatives like bioplastics compared to traditional plastics and limited availability of composting infrastructure for biodegradable materials are the major factors hampering the growth of the plastic alternative packaging market.

What are the major factors driving the plastic alternative packaging market growth?

Rising environmental consciousness and regulatory pressure to reduce plastic waste, and increasing consumer demand for eco-friendly packaging alternatives, driven by sustainability concerns, are the major factors driving the plastic alternative packaging market.

Which is the leading type in the plastic alternative packaging market?

The leading type segment is starch-based plastic.

Which are the major players operating in the plastic alternative packaging market?

Amcor Plc, Mondi, DS Smith, Sealed Air, Tetra Pak International SA, Ball Corporation, WestRock, Huhtamaki, BASF SE, Berry Global, and Nampak are the major players.

What will be the CAGR of the plastic alternative packaging market?

The CAGR of the plastic alternative packaging market is projected to be 16.8% from 2024-2031.