Power Sports Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Power Sports Market is segmented By Vehicle (Heavyweight Motorcycles, ATVs, Side-by-side Vehicles, Personal Watercraft, Snowmobiles), By Propulsion (G....

Power Sports Market Size

Market Size in USD Bn

CAGR5.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.7% |

| Market Concentration | High |

| Major Players | Polaris Industries Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., BRP Inc., Kawasaki Heavy Industries and Among Others. |

please let us know !

Power Sports Market Analysis

The power sports market is estimated to be valued at USD 37.8 billion in 2024 and is expected to reach USD 55.72 billion by 2031, growing at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2031. The power sports market has been witnessing positive trends with growing consumer preference towards open-air recreational activities and introduction of technologically advanced features.

Power Sports Market Trends

Market Driver - Rising Interest in Adventure Activities and Sports Culture

With rising incomes and more leisure time, people are spending more on activities that provide an adrenaline rush. Power sports like motorcycles, ATVs, and personal watercraft allow people to explore new terrains be it on land, water, or snow. Many are now choosing weekend getaways involving power sports as it makes for a more memorable experience compared to standard sightseeing.

Rental and experience services for power sports vehicles are growing rapidly to cater to this demand. Even casual riders are getting interested to try different power sport categories for the thrill. With easy availability of good quality affordable vehicles, more people don't mind the initial investment for a hobby they can enjoy for years.

Social media has also fueled interest as riders share photos and videos of their riding adventures. Also, many cities and towns are now developing dedicated trails, tracks, and riding areas to cash in on this trend and promote tourism. The culture of power sports allows people to connect over a shared passion for riding. This will remain a major driver for the power sports market.

Market Driver - Technological Advancements in Power Sports Vehicles

Advancements in materials, engine technologies and electronics have transformed the performance capabilities of modern power sports vehicles. Companies continuously invest in R&D to deliver vehicles with higher power, better fuel efficiency, advanced safety features, and greater riding comfort. Riders today expect the latest innovations and expect a premium experience from high-end brands.

Lightweight but durable composite plastics and metals are replacing traditional materials to reduce weight without compromising strength. Advanced traction and stability control functions provide less experienced riders with tools to improve control. Technologies like GPS, Bluetooth, and infotainment allow integration of smartphones and help navigate routes efficiently.

Customization is another strong trend with many after-market accessories and performance upgrades available. Software tweaks also unlock additional performance capabilities. Cameras are being added to capture memorable riding experiences in vivid detail. All these developments will further widen the appeal of power sports by enhancing the overall ownership experience.

Market Challenge - High Carbon Emissions from Gasoline-powered Vehicles

One of the key challenges currently faced by the power sports market is high carbon emissions from gasoline-powered vehicles. These vehicles are major contributors of greenhouse gas emissions as most of them still rely on internal combustion engines that run on gasoline. Stringent emission regulations around the world are pushing automakers to reduce vehicle emissions.

However, the power sports market has been slower to adopt alternative powertrain technologies compared to the automotive industry. Most consumers in this market continue to favor traditional gasoline models due to their affordability and adequate driving range on a single charge.

Manufacturers need to invest heavily in developing electric and hybrid variants of power sports vehicles that can provide similar performance along with low emissions. High battery costs are also a major hurdle for widespread adoption of electric models currently. The power sports market will have to overcome technological challenges and bring down costs to make electric vehicles a viable alternative to gasoline variants.

Market Opportunity - Increasing Adoption of Electric and Hybrid Models for Power Sports Market

One significant opportunity for the power sports market is the increasing adoption of electric and hybrid models. With growing environmental concerns and stringent emission regulations, consumers are now showing more inclination towards low or zero emission electric vehicles. Several major power sports manufacturers have introduced new electric models of ATVs, motorcycles, and others in recent years.

Government incentives and subsidies in many countries for purchasing electric vehicles are also encouraging consumers to switch from gasoline to electric variants. Declining battery prices are making electric mobility more affordable. New technologies are improving power and performance of electric vehicles comparable to gasoline models.

This opens up opportunities for power sports makers to cater to a wider customer base looking for green transportation solutions. The potential for electric vehicles in the power sports market is huge and expected to grow substantially in the coming years.

Key winning strategies adopted by key players of Power Sports Market

Strategy 1: Product innovation and expansion

Players like Polaris, Arctic Cat, and BRP have consistently invested in R&D to develop new and innovative product lines. For example, in 2017 Polaris launched the Slingshot - an entirely new vehicle category of a three-wheeled motorcycle.

Strategy 2: Strategic acquisitions

Many players have pursued growth through strategic acquisitions. For example, in 2020 Polaris acquired Boat Holdings (which owned key brands like Boat, Bennington, Godfrey, Hurricane etc.) for $805 million.

Strategy 3: Geographical expansion

Leaders have focused on expanding into high growth international markets. For example, between 2015-2019 BRP aggressively expanded its dealership network across Europe, Asia and Latin America.

Strategy 4: Alliances and partnerships

Players formed strategic partnerships for additional growth opportunities. For example, in 2018 Polaris partnered with Mahindra Group, a leading tractor manufacturer in India, to improve their presence in international markets. Similarly, BRP collaborated with triple-A automotive group in Mexico to strengthen distribution.

Segmental Analysis of Power Sports Market

Insights, By Vehicle: Heavyweight Motorcycles Highlight the Dominance of Personal Freedom and Thrill

In terms of vehicle, heavyweight motorcycles contributes 50% share of the power sports market in 2024, owning to riders seeking the thrill and sense of personal freedom that such powerful machines provide. Weighing 600 pounds or more, heavyweight motorcycles deliver a feeling of unbridled power and exhilaration on the open road. Their beefy engines generate stirring vibrations and roars through riders' helmets, immersing them in a visceral connection with the machine.

While safety equipment has improved, heavyweight motorcycles still retain an aura of danger that some find intoxicating. For dedicated riders, massive touring bikes represent an escape from life's daily responsibilities and allow exploring scenic vistas while embracing risks and satisfying a need for adrenaline.

Insights, By Propulsion: Recreation in the Great Outdoors

In terms of propulsion, gasoline contributes 69% share of the power sports market as it provides the power needed for off-road fun and adventuring in remote natural settings. Gasoline-fueled vehicles for power sports dominate the side-by-side and ATV segments because they offer the range and torque essential for navigating unpredictable terrains far from civilization.

Whether scaling hills, plowing through thick brush, or fording streams, gasoline is the most practical fuel for outdoor recreation machinery requiring bursts of energy over long durations without access to charging. While battery technologies advance, gasoline remains the top choice for side-by-sides and ATVs used in power sports applications. This is mainly due to concerns over limited electric ranges and difficulties swapping out bulky battery packs in the field.

Insights, By Application: The Allure of the Water

In terms of application, recreational activities contributes the highest share of the power sports market largely due to the popularity of personal watercraft. Zipping across lakes, bays and oceans, personal watercraft satisfy thrills seeks while allowing relaxation in scenic natural settings. Skimming softly above the water's surface at high speeds delivers an unparalleled sensation of flow and contact with the aquatic environment many find exhilarating and stress-reducing. Personal watercraft are easy to operate yet hard to outgrow, retaining a sense of excitement even for experienced riders. Affordable and versatile, they remain firmly embedded in recreational culture as a premier way to enjoy time on the water surrounded by fresh air and scenic vistas.

Additional Insights of Power Sports Market

- Adventure Tourism Boost: The surge in adventure tourism has led to increased demand for ATVs and snowmobiles, especially in regions with suitable terrains like North America and Europe.

- Technological Integration: Manufacturers in the power sports market are integrating GPS navigation, Bluetooth connectivity, and advanced driver-assistance systems (ADAS) into vehicles to enhance user experience and safety.

- Regional Dominance: North America holds a significant share of the power sports market due to its expansive outdoor recreational areas and higher consumer spending power.

- Environmental Impact: There's a growing consumer shift towards environmentally friendly vehicles, pushing manufacturers to invest in electric and hybrid models.

Competitive overview of Power Sports Market

The major players operating in the power sports market include Polaris Industries Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., BRP Inc., Kawasaki Heavy Industries, Suzuki Motor Corporation, Arctic Cat Inc. (a subsidiary of Textron Inc.), KTM AG, John Deere, Kubota Corporation, Kawasaki Heavy Industries, Ltd., Textron Inc., Harley Davidson Inc., and Kwang Yang Motor Co.

Power Sports Market Leaders

- Polaris Industries Inc.

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- BRP Inc.

- Kawasaki Heavy Industries

Power Sports Market - Competitive Rivalry, 2024

Power Sports Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Power Sports Market

- In March 2024, Volkswagen announced plans to launch an entry-level electric vehicle (EV) by 2027, aiming to make EVs more affordable. VW brand chief Thomas Schäfer mentioned that the company would decide in the coming weeks which model to proceed with, with the working title being ID.1.

- In March 2024, India's Ministry of Heavy Industries (MHI) launched the Electric Mobility Promotion Scheme 2024 (EMPS 2024) to accelerate the adoption of electric vehicles (EVs) in the country.

- In March 2024, Taiga Motors Corporation partnered with Alterra Mountain Company to supply electric snowmobiles, aiming to reduce carbon emissions across Alterra's North American mountain destinations. This collaboration involved the deployment of Taiga's Nomad electric snowmobiles at 15 of Alterra's ski resorts, supporting their commitment to achieving carbon neutrality.

- In February 2024, Swedish startup Vidde Mobility, in collaboration with Italian design firm Pininfarina, introduced the Vidde Alfa, an all-electric snowmobile. This vehicle aims to redefine winter mobility by significantly reducing carbon emissions to less than 100 grams of CO₂ per kilometer, a substantial improvement over traditional snowmobiles that emit approximately 550 grams of CO₂ per kilometer.

Power Sports Market Segmentation

- By Vehicle

- Heavyweight Motorcycles

- ATVs

- Side-by-side Vehicles

- Personal Watercraft

- Snowmobiles

- By Propulsion

- Gasoline

- Electric

- Diesel

- By Application

- Recreational

- Leisure Activities

- Sports Events

- Commercial

- Agriculture

- Military

- Law Enforcement

- Recreational

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the power sports market?

The power sports market is estimated to be valued at USD 37.8 billion in 2024 and is expected to reach USD 55.72 billion by 2031.

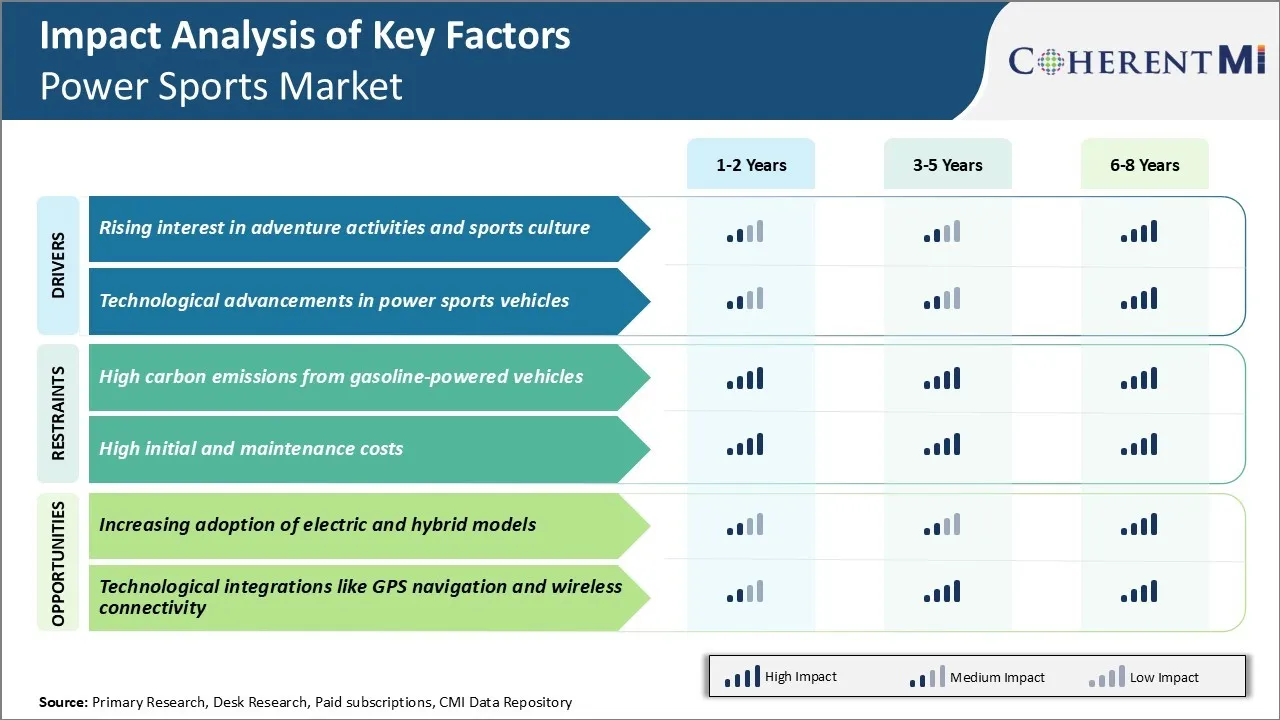

What are the key factors hampering the growth of the power sports market?

High carbon emissions from gasoline-powered vehicles and high initial and maintenance costs are the major factors hampering the growth of the power sports market.

What are the major factors driving the power sports market growth?

Rising interest in adventure activities and sports culture and technological advancements in power sports vehicles are the major factors driving the power sports market.

Which is the leading vehicle in the power sports market?

The leading vehicle segment is heavyweight motorcycles.

Which are the major players operating in the power sports market?

Polaris Industries Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., BRP Inc., Kawasaki Heavy Industries, Suzuki Motor Corporation, Arctic Cat Inc. (a subsidiary of Textron Inc.), KTM AG, John Deere, Kubota Corporation, Kawasaki Heavy Industries, Ltd., Textron Inc., Harley Davidson Inc., and Kwang Yang Motor Co. are the major players.

What will be the CAGR of the power sports market?

The CAGR of the power sports market is projected to be 5.7% from 2024-2031.