Refractory Angina Treatment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Refractory Angina Treatment Market is segmented By Drug Development (Clinical, Preclinical, Discovery), By Route of Administration (Oral, Intravenous,....

Refractory Angina Treatment Market Size

Market Size in USD Mn

CAGR5.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.4% |

| Market Concentration | Medium |

| Major Players | Imbria Pharmaceuticals, Angionetic Inc, Xylocor Therapeutics Inc, Caladrius Biosciences Inc and Among Others |

please let us know !

Refractory Angina Treatment Market Analysis

The Global Refractory Angina Treatment Market is estimated to be valued at USD 200.1 Mn in 2024 and is expected to reach USD 312.1 Mn by 2031, growing at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2031. Refractory angina refers to a rare form of angina that does not respond to conventional treatments such as medication or surgery. This condition severely impacts the quality of life of those affected.

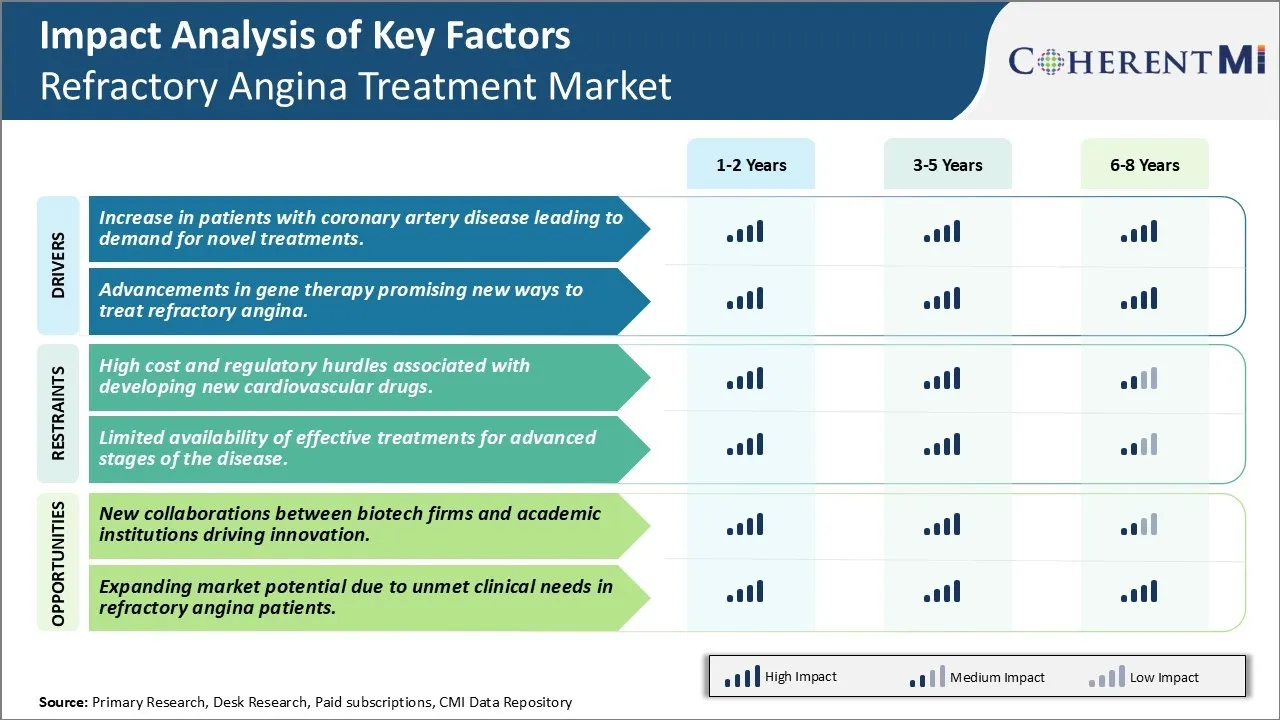

The market is expected to witness steady growth over the forecast period driven by the increasing prevalence of cardiovascular diseases along with limited treatment options for refractory angina. Various pipeline drugs and refractory angina treatment devices in clinical trials can potentially drive the market if approved. However, lack of awareness about refractory angina and high treatment costs remains major challenges to adoption.

Refractory Angina Treatment Market Trends

Market Driver - Increase in Patients with Coronary Artery Disease Leading to Demand for Novel Treatments

Coronary artery disease has been on the rise in past few decades across major markets such as United States, China and European countries. In United States alone, as per estimates from American Heart Association, over 605,000 new cases of myocardial infarction are reported each year, indicating increasing prevalence of atherosclerosis or narrowing of coronary arteries causing angina or chest pain. The number is expected to increase further with rising risk factors like obesity, unhealthy lifestyles and stress. Once coronary artery disease develops and patient experiences frequent or chronic angina symptoms that are refractory to conventional treatments, there are limited therapeutic options available and patient's quality of life declines significantly.

Current standard treatment for refractory angina includes optimizations of medical therapy with multiple anti-anginal drugs, revascularization therapies like coronary artery bypass grafting or angioplasty. However, in 15-30% of patients with severe coronary artery disease, these options are not feasible due to diffuse and extensive nature of blockages. This has created major unmet need for new treatment modalities that can improve symptoms, exercise tolerance and overall functioning of patients with few or no options left. Several pharmaceutical companies and clinical researchers are now focusing on developing novel drugs, devices and alternative treatment approaches targeting the underlying pathology and pathways involved in chronic angina symptoms. If successful, these new emerging therapies have potential to access a huge patient pool worldwide and bring considerable relief.

Market Driver - Advancements in Gene Therapy Promising New Ways to Treat Refractory Angina

Gene therapy is an evolving area of treatment with promising applications for various cardiovascular conditions. In case of refractory angina, researchers are exploring possibility of gene transfer methods to supplement deficiency of specific genes involved in regulation of blood vessels, myocardial function and response to ischemia. One such approach involves delivery of vascular endothelial growth factor (VEGF) gene to stimulate growth of collateral blood vessels in heart via angiogenesis. In animal studies, transfer of VEGF gene directly to heart muscle via gene delivery vehicles has shown to induce growth of new microvessels and reduce anginal symptoms. Similarly, boosting expression of certain cardioprotective proteins through gene therapy hold potential to make heart muscle more resistant to ischemia.

Several biotech companies are working on formulating safe and targeted gene delivery systems like modified viruses, liposomes or nanoparticles to transfer therapeutic genes specifically to cardiac tissues. Ongoing phase 1 and 2 clinical trials have demonstrated feasibility and safety of intravenous or intracoronary administration of gene therapy vectors in patients with no option left. If proven effective in reducing angina frequency and improving functional status in later stage trials, gene therapy interventions may emerge as invaluable treatment strategies especially for those not responding to other modalities. With further enhancements, this approach also offers possibility of one-time treatment eliminating need for lifelong medication intake.

Market Challenge - High Cost and Regulatory Hurdles Associated with Developing New Cardiovascular Drugs

One of the major challenges faced in the refractory angina treatment market is the high cost and strict regulatory requirements associated with developing new cardiovascular drugs. Bringing a new drug to the market involves extensive research and development over many years along with large clinical trials to prove the safety and efficacy of the drug. This drug development process is both time consuming and expensive, with costs often estimated in the hundreds of millions of dollars. Additionally, regulatory requirements from bodies like the FDA are intensely rigorous for drugs intended to treat serious heart conditions. Extensive documentation must be provided across non-clinical and clinical testing to receive approval. Any issues can lead in further loss of opportunity. This heavy investment burden combined with stringent regulations deters many smaller biotech and pharmaceutical companies from pursuing new refractory angina therapies. The risk of drug development failure or delays in approval also makes investors wary, limiting the financing options for innovators in this field. Overcoming these financial and regulatory hurdles is a major challenge restricting growth in refractory angina treatment solutions.

Market Opportunity - New Collaborations Between Biotech Firms and Academic Institutions Driving Innovation

One opportunity in the refractory angina treatment market is the increasing collaborations between biotech firms and academic medical centers. By linking up with universities and research hospitals, biotech companies are able to tap into cutting-edge research that may provide novel drug targets or approaches. Academic institutions have significant expertise but often lack the resources and experience to fully develop new therapies. Biotech companies meanwhile have drug development capabilities but benefit from access to fresh ideas and research coming out of academic labs. These partnerships are driving more innovation by bringing together the complementary strengths of both sectors. They allow academic discoveries to be advanced further into applied clinical research and commercialization more quickly. Such collaborations are also enabling more risk sharing across the drug development process and spreading costs among multiple partners. This new model of open innovation through cross-sector alliances is opening up more potential for refractory angina treatment breakthroughs that can address unmet needs in the market.

Prescribers preferences of Refractory Angina Treatment Market

Refractory angina is a debilitating cardiovascular condition with limited treatment options. It typically arises when standard angina therapies such as medications, angioplasty or surgery are no longer effective. Managements involves a stepwise approach with multiple lines of treatment.

In early refractory angina, calcium channel blockers such as Amlodipine (Norvasc) and Nicardipine (Cardene) are prescribed to relax and dilate blood vessels. For moderate cases, short-acting nitrates like Isosorbide Dinitrate (Isordil) and long-acting versions including Isosorbide Mononitrate (Imdur) help relax veins and arteries.

When symptoms progress, prescribers may add antianginal drugs like Ranolazine (Ranexa). This acts by inhibiting the late sodium current and reducing chest pain. For severe refractory angina, prescribers rely on intravenous anti-ischemic drugs like Esmolol (Brevibloc), a short-acting beta blocker or Amiodarone (Cordarone).

For patients with frequent angina episodes despite optimal medical therapy, additional options include spinal cord stimulation and Enhanced External Counterpulsation (EECP). Both work by improving blood flow to the heart. Other newer treatments on the horizon include Gene and Stem Cell therapies but large trials are still ongoing to prove safety and efficacy.

The stage of disease and individual patient characteristics also affect which treatment is preferred. Younger patients are more likely to receive revascularization procedures if suitable. Comorbidities influence drug choices due to potential interactions.

Treatment Option Analysis of Refractory Angina Treatment Market

Refractory angina has multiple stages based on disease severity and treatment response. For mild-moderate cases, medical management is preferred. This includes drugs like Ranolazine which acts by reducing calcium influx and potassium channel activation, helping relieve chest pain. It is often used in combination with standard treatment like nitrates or beta-blockers.

For moderate-severe cases where symptoms are not adequately controlled, Revascularisation via Coronary artery bypass grafting (CABG) or percutaneous coronary intervention (PCI) is considered. CABG aims to bypass blockages and improve blood flow. PCI uses balloon angioplasty and stenting to open blockages. However, 20-30% remain symptomatic post-revascularization due to diffuse coronary artery disease.

For these refractory cases, Spinal cord stimulation (SCS) is increasingly preferred. SCS involves implanting electrodes alongside the spinal cord which stimulate nerve fibers to block pain signals from reaching the brain. Devices like the Genesis by St Jude Medical are widely used. It provides pulsed electrical signals to target thoracic spinal sites and relieve angina symptoms for over 12-18 months in 70-80% patients. SCS offers improved quality of life compared to prolonged medical management alone and has better outcomes than repeated revascularization attempts.

Thus, a staged approach with medical management, revascularization and newer options like SCS forms the mainstay of treating varying severity of refractory angina nowadays. SCS provides an effective supplementary treatment for those with recurrent symptoms post-revascularization.

Key winning strategies adopted by key players of Refractory Angina Treatment Market

The global Refractory Angina Treatment market is dominated by few large players like Amgen Inc., Baxter International Inc., Bristol-Myers Squibb Company, Cardiovascular Systems, Inc., and others. Some of the key strategies adopted by these players to gain competitive advantage are:

Product Innovation: In 2021, Baxter International launched a new intravenous vasodilator drug called Bempedoic acid (NEXLETOL) for treatment of refractory angina. This was the first new molecular entity approved for this indication in over 10 years. This helped Baxter gain a strong foothold in the market.

Strategic Acquisitions: In the past, Amgen acquired Nuevolution AB, a biotech company focusing on protein and antibody-based therapeutics. This strengthened Amgen's drug portfolio and pipeline of molecules targeting various cardiovascular conditions including refractory angina.

Geographic Expansion: Cardiovascular Systems expanded its business operations and marketed its peripheral arterial disease drug Cohort in key European markets like UK, Germany, and France in 2023. International revenues grew by 50% during this period contributing 42% of total revenue.

Partnerships: Bristol-Myers Squibb partnered with Daiichi Sankyo in 2019 to co-develop and commercialize novel angiogenesis inhibitor DS-1062 for refractory angina. The drug is currently in Phase 2 trials and this alliance strengthened both partners' presence and pipeline in this market.

These strategic initiatives helped key players augment their product offerings, accelerated new drug development, expanded geographic footprint and market share in the lucrative refractory angina segment. Examples of past successful strategies, stats on revenue/market share growth achieved validates how such moves provided these companies a competitive edge.

Segmental Analysis of Refractory Angina Treatment Market

Insights, By Drug Development: Driving Growth in the Clinical Segment of Refractory Angina Treatment Market

The clinical segment currently contributes the largest share to the refractory angina treatment market owing to the extensive research and development activities being carried out. Several drug candidates are presently in Phase II and Phase III clinical trials with promising results.

For instance, Vericiguat by Merck is being evaluated in the VICTORIA trial for its efficacy in reducing angina frequency and improving exercise capacity in patients. Early data suggests it may achieve its primary endpoints of reducing angina episodes. Another candidate, Ralinepag by United Therapeutics is under Phase III evaluation. It acts by stimulating soluble guanylate cyclase and preliminary findings show fewer angina attacks in patients.

The refractory angina market also sees a lot of pipeline drugs entering early phase clinical trials. KBP-5074 by Kaleido Biosciences aims to stimulate metabolic pathways in the gut and reduce chest pain. It has cleared Phase I safety testing. Likewise, Setrusumab by Mereo Biopharma entered Phase II studies recently to investigate its anti-anginal effects.

The large number of ongoing clinical studies provides regular updates and data readouts, sustaining interest in this space. Successful trials may result in new product approvals and labeling expansions, helping the clinical segment capture more revenue share over time. Constant R&D progress keeps investor confidence high in this market as well.

Insights, By Route of Administration, Oral Drug Convenience Boosts Administration Route Segment

Among routes of administration, the oral segment holds the major market share in refractory angina treatment currently. This can be attributed to convenience factors associated with the oral drug format.

Oral medications are easy for long-term use as patients can self-administer them at home. This avoids frequent hospital or clinic visits for intravenous injections. Good compliance and adherence to oral drugs are thus achieved.

The oral route also provides steadier and consistent drug levels in the body over time as opposed to intermittent injections. This makes oral treatment more effective for chronic, long-lasting conditions like refractory angina.

Pharmaceutical companies also favor developing oral drugs due to their simple, low-cost manufacturing compared to other complex drug formulations. This allows affordable pricing and higher margins.

Given these numerous practical and commercial advantages, many drug candidates in the refractory angina pipeline are exploring oral drug delivery technologies. This includes tablets for non-invasive, around-the-clock therapy. Further innovations may hence boost the oral formulation segment in the future.

Additional Insights of Refractory Angina Treatment Market

The market for refractory angina treatments is currently dominated by a few emerging players focusing on gene therapy and other innovative approaches. The disease poses a significant unmet clinical need, as patients with refractory angina have exhausted conventional treatments, such as medication and surgery. The development pipeline includes several products in early and mid-stage clinical trials, aiming to address these gaps. One promising therapy, XC001 by XyloCor Therapeutics, utilizes gene therapy to stimulate the growth of new blood vessels, potentially offering patients an improved quality of life. The market is anticipated to grow steadily, driven by advancements in treatment options, collaborations, and a focus on improving patient outcomes in a highly underserved area of cardiovascular medicine.

Competitive overview of Refractory Angina Treatment Market

The major players operating in the Refractory Angina Treatment Market include Imbria Pharmaceuticals, Angionetic Inc, Xylocor Therapeutics Inc, Caladrius Biosciences Inc, Neovasc Inc, Vasomedical Inc, Ark Therapeutics Group plc, Cryopaxis and Saneron CCEL Therapeutics Inc.

Refractory Angina Treatment Market Leaders

- Imbria Pharmaceuticals

- Angionetic Inc

- Xylocor Therapeutics Inc

- Caladrius Biosciences Inc

Refractory Angina Treatment Market - Competitive Rivalry

Refractory Angina Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Refractory Angina Treatment Market

In May 2024, XyloCor Therapeutics completed enrollment for its Phase I/II trial of XC001, a gene therapy for refractory angina. The treatment aims to stimulate new blood vessel growth in areas of the heart with poor blood flow, improving patient quality of life.

Refractory Angina Treatment Market Segmentation

- By Drug Development

- Clinical

- Preclinical

- Discovery

- By Route of Administration

- Oral

- Intravenous

- Subcutaneous

- Parenteral

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How Big is the Global Refractory Angina Treatment Market?

The Global Refractory Angina Treatment Market is estimated to be valued at USD 200.1 Mn in 2024 and is expected to reach USD 312.1 Mn by 2031.

What will be the CAGR of the Refractory Angina Treatment Market?

The CAGR of the Refractory Angina Treatment Market is projected to be 5.4% from 2024 to 2031.

What are the major factors driving the Refractory Angina Treatment Market growth?

The increase in patients with coronary artery disease leading to demand for novel treatments and advancements in gene therapy promising new ways to treat refractory angina. are the major factor driving thes Refractory Angina Treatment Market.

What are the key factors hampering the growth of the Refractory Angina Treatment Market?

The high cost and regulatory hurdles associated with developing new cardiovascular drugs and limited availability of effective treatments for advanced stages of the disease are the major factor hampering the growth of the Refractory Angina Treatment Market.

Which is the leading Drug Development in the Refractory Angina Treatment Market?

Clinical is the leading Drug Development segment.

Which are the major players operating in the Refractory Angina Treatment Market?

Imbria Pharmaceuticals, Angionetic Inc, Xylocor Therapeutics Inc, Caladrius Biosciences Inc, Neovasc Inc, Vasomedical Inc, Ark Therapeutics Group plc, Cryopaxis, Saneron CCEL Therapeutics Inc are the major players.