Road Rollers Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Road Rollers Market is segmented By Type (Vibratory Rollers, Static Rollers, Tandem Rollers, Pneumatic Rollers), By Application (Road Construction, Ro....

Road Rollers Market Size

Market Size in USD Bn

CAGR4.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.7% |

| Market Concentration | Medium |

| Major Players | Wirtgen Group, Caterpillar Inc., Bomag XCMG, Dynapac Compaction Equipment AB, Sakai Heavy Industries and Among Others. |

please let us know !

Road Rollers Market Analysis

The road rollers market is estimated to be valued at USD 4.68 Bn in 2024 and is expected to reach USD 6.46 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2031. The road rollers market is expected to witness steady growth over the forecast period owing to increasing government investments in infrastructure development projects.

Road Rollers Market Trends

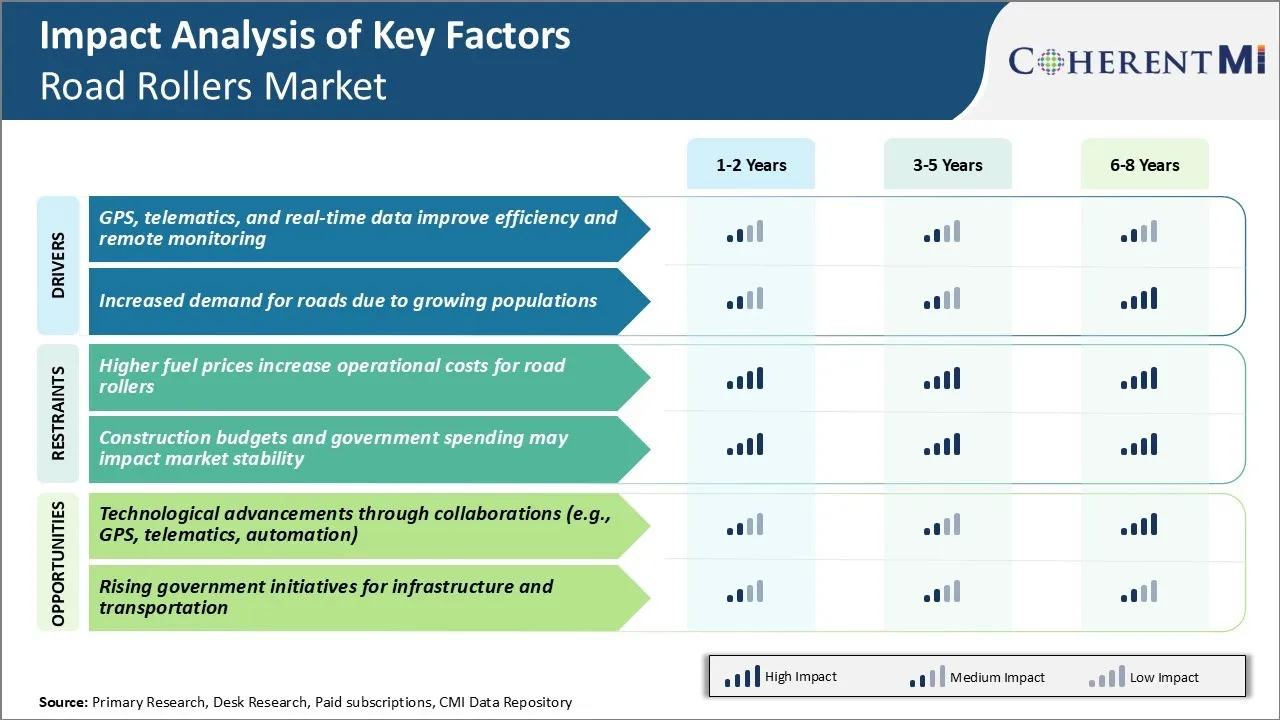

Market Driver - GPS, Telematics, and Real-time Data Improve Efficiency and Remote Monitoring

The ability to track the location and operations of road rollers in real-time has significantly improved work efficiency on construction sites. Telematics is also useful for collaborative scheduling of tasks between multiple pieces of equipment. Site managers no longer need to physically oversee each machine - they can view overall progress from their computers or mobile devices. This level of control and transparency lets them optimize work assignments and ensure all resources are productively deployed.

Operators themselves benefit from telematics as their performance metrics can now be digitally logged. This provides valuable feedback to improve efficiency over time. With data-backed reviews, operators are also more accountable which motivates high standards.

For equipment owners, remote monitoring substantially cuts repair costs by catching malfunctions in early stages before major damage occurs. It allows repairs to be scheduled at the most economical time instead of waiting for breakdown calls. Overall, the integration of real-time tracking systems has heightened productivity, boosted utilization rates, and lowered operating expenses across road construction sites.

Market Driver - Increased Demand for Road Construction

Growing populations both in urban and rural areas have exponentially driven up the need for new road infrastructure and expansion of existing road networks. New expressways, ring-roads, and access-controlled highways are being planned and executed on fast-tracks in highly congested areas. At the same time, smaller regional roads also require continuous widening and strengthening to accommodate heavier vehicular loads and volumes. This indicates a growth potential for companies in the road rollers market.

As long as population trends continue upwards, the requirement for enhanced road connectivity will remain an unstoppable driver of demand. Governments across the world have committed massive infrastructure spending packages towards this imperative over the coming decade. Private contractors are also heavily investing in fleets to gain work in these publicly funded projects.

With road construction emerging as a strategic priority, the number of rollers deployed at any given time is set to multiply manifold. Road roller market players therefore can expect improved sales and rental businesses to achieve sustained growth well into the foreseeable future.

Market Challenge - Higher Fuel Prices Increase Operational Costs

The road rollers market has been facing increasing operational costs due to skyrocketing fuel prices across major global economies. Fuel accounts for a considerable portion of the total cost of ownership for road machinery equipment such as road rollers. In the recent past, fuel prices have witnessed a steady rise owing to various macroeconomic and geopolitical factors.

This surge in fuel expenditure has significantly impacted the profit margins of road construction contractors and rental service providers who utilize road rollers on a daily basis. With fixed contract prices, the additional burden of higher diesel cost is making many road rollers projects financially unviable.

It is also discouraging infrastructure development firms from procuring new road rollers given the uncertainty around long-term fuel price movement. Unless diesel and gasoline prices stabilize in the coming years, the road rollers market growth might remain subdued as operators strive to control operating expenses.

Market Opportunity - Technological Advancements through Collaborations

Major road rollers manufacturers are collaborating with technology companies to integrate advanced connectivity and automation solutions into their products. For instance, some OEMs have enabled functionalities like global positioning system (GPS) tracking and telematics monitoring on new models which provide real-time equipment position and performance data to owners. This allows remote monitoring of road roller fleet health and optimized deployment of assets.

Furthermore, partnerships between automation software developers and road machinery brands are facilitating innovations such as semi-autonomous compaction and partial driving automation. Such technologies have potential to improve overall compaction quality while reducing dependency on skilled operators. Collaborative innovations in areas like guided driving, machine learning-based predictive maintenance can make road construction faster and more cost-effective. If implemented successfully, technological advancements through cross-industry alliances are well-positioned to open new prospects for the road rollers market globally.

Key winning strategies adopted by key players of Road Rollers Market

Focus on product innovation - Leading players such as Volvo Construction Equipment, Caterpillar, and Bomag have consistently invested in R&D to develop innovative road roller models that are more fuel efficient, productive, easy to operate and meet stringent emission norms.

Leverage emerging technologies - Companies are rapidly adopting new technologies like connected solutions, telematics, remote monitoring and predictive maintenance to enhance the capabilities of their road rollers.

Expand product portfolio - Players diversify their offerings to address key segments and a wide range of projects. For example, between 2015-2020 Caterpillar added smaller, vibration-free tandem and single drum rollers to its portfolio.

Focus on aftersales services - Rollers require high maintenance. Companies emphasize aftersales services like extended warranty, product support, parts availability and training.

Strategic acquisitions - Big players acquire other brands to enhance production capacity and geographic footprint.

Segmental Analysis of Road Rollers Market

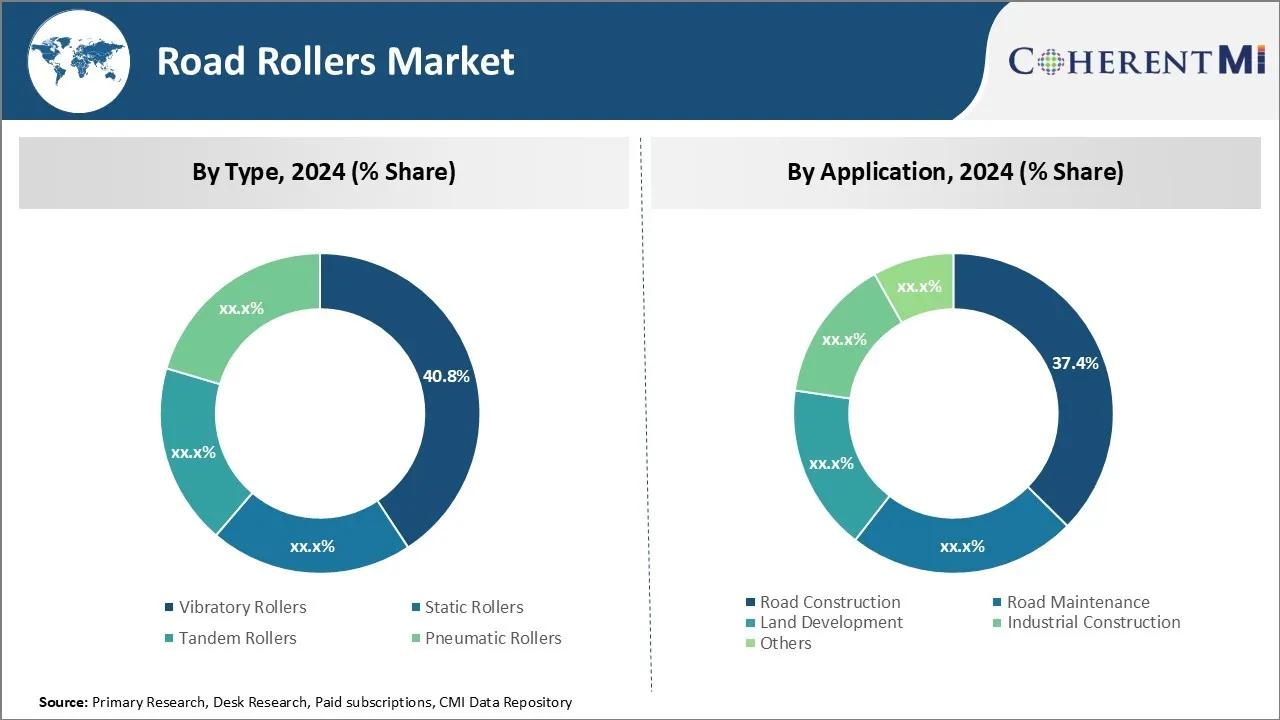

Insights, By Type: Versatility in Operations Vibratory Road Rollers

Vibratory rollers account for 40.8% share of the road rollers market in 2024. They are highly versatile machines that can be used across diverse construction applications effectively. They have the ability to compact both coarse and fine materials efficiently with their vibratory mechanism. Their vibratory mechanism allows them to achieve excellent compaction on difficult soils compared to other road roller types. Additionally, vibratory action results in smooth and consistent compaction without causing unevenness.

Modern vibratory rollers are increasingly getting automated with features like automatic vibration control and precise compaction measurement. This enables automating the compaction process and achieving uniform density without much manual intervention.

The automated functions improve productivity and consistency of compaction works significantly. Many contractors prefer vibratory models for their ability to handle diverse tasks and compact different materials uniformly through automated functions.

Insights, By Application: Road Construction Witness Rise with Significant Infrastructure Development Activities

Road construction remains the dominant application with 37.4% share of the road rollers market in 2024. There is huge ongoing investment in building and upgrading road networks across both developing and developed nations. According to industry estimates, annual spending on global road construction activities is in several hundred billion dollars.

Nearly all road construction projects involve critical compaction work where rollers are indispensable. Right from preparing the subgrade to compacting base course and final wearing course materials, road rollers play a vital role at each stage of road building.

Road authorities and major contractors prefer investing in the latest high-performance vibratory models for their capability and productivity. Growing government spending on road infrastructure to support economic growth further drives demand from this application segment. Both developing and developed markets continue to witness substantial allocations towards new road building and improvement of existing road quality using advanced road rollers.

Additional Insights of Road Rollers Market

- August 2023: The Union Minister of India and Chief Minister of Odisha laid the foundation stone for expanding and reinforcing roads in Bhubaneswar, impacting the road rollers market in the region.

- Regional Insights: Asia Pacific is the largest regional road rollers market for road rollers due to heavy government investment in infrastructure.

- Market Growth: The Asia-Pacific region dominates the road rollers market, fueled by infrastructure development.

- Segment Market Share: The road construction segment held the largest share at 37% share in the road rollers market in 2023.

Competitive overview of Road Rollers Market

The major players operating in the road rollers market include Wirtgen Group, Caterpillar Inc., Bomag XCMG, Dynapac Compaction Equipment AB, Sakai Heavy Industries, J.C. Bamford Excavators Limited, Volvo Group, Shantui Construction Machinery Co., Ltd., Ammann Group, and Sany Heavy Industry Co., Ltd.

Road Rollers Market Leaders

- Wirtgen Group

- Caterpillar Inc.

- Bomag XCMG

- Dynapac Compaction Equipment AB

- Sakai Heavy Industries

Road Rollers Market - Competitive Rivalry, 2024

Road Rollers Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Road Rollers Market

- In March 2023, Dynapac announced plans to commence production of a new series of tandem asphalt road rollers, specifically the CC2200 VI to CC3800 VI models, in the 7.6- to 10-ton classes. These rollers feature drum widths ranging from 1,500 to 1,680 mm and are available in split drum and combination versions.

Road Rollers Market Segmentation

- By Type

- Vibratory Rollers

- Static Rollers

- Tandem Rollers

- Pneumatic Rollers

- By Application

- Road Construction

- Road Maintenance

- Land Development

- Industrial Construction

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the road rollers market?

The road rollers market is estimated to be valued at USD 4.68 Bn in 2024 and is expected to reach USD 6.46 Bn by 2031.

What are the key factors hampering the growth of the road rollers market?

Higher fuel prices increase operational costs for road rollers and construction budgets and government spending which may impact market stability are the major factors hampering the growth of the road rollers market.

What are the major factors driving the road rollers market growth?

The GPS, telematics, and real-time data improve efficiency and remote monitoring and increased demand for roads are the major factors driving the road rollers market.

Which is the leading type in the road rollers market?

The leading type segment is vibratory rollers.

Which are the major players operating in the road rollers market?

Wirtgen Group, Caterpillar Inc., Bomag XCMG, Dynapac Compaction Equipment AB, Sakai Heavy Industries, J.C. Bamford Excavators Limited, Volvo Group, Shantui Construction Machinery Co., Ltd., Ammann Group, and Sany Heavy Industry Co., Ltd. are the major players.

What will be the CAGR of the road rollers market?

The CAGR of the road rollers market is projected to be 4.7% from 2024-2031.