Sanfilippo Syndrome Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Sanfilippo Syndrome Market is segmented By Diagnosis (GAG Analysis, Genomic DNA Sequencing, Activity Assay, Others), By Treatment (Enzyme Replacement ....

Sanfilippo Syndrome Market Size

Market Size in USD Bn

CAGR9.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.3% |

| Market Concentration | Medium |

| Major Players | Amgen Inc, Alkem Labs, LUPIN, Hope Pharmaceuticals, Sanifit and Among Others. |

please let us know !

Sanfilippo Syndrome Market Analysis

The Global Sanfilippo Syndrome Market is estimated to be valued at USD 9.7 Bn in 2024 and is expected to reach USD 19.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2031. This represents significant growth in the market which is being driven by increasing research and development into new therapies for this rare genetic condition.

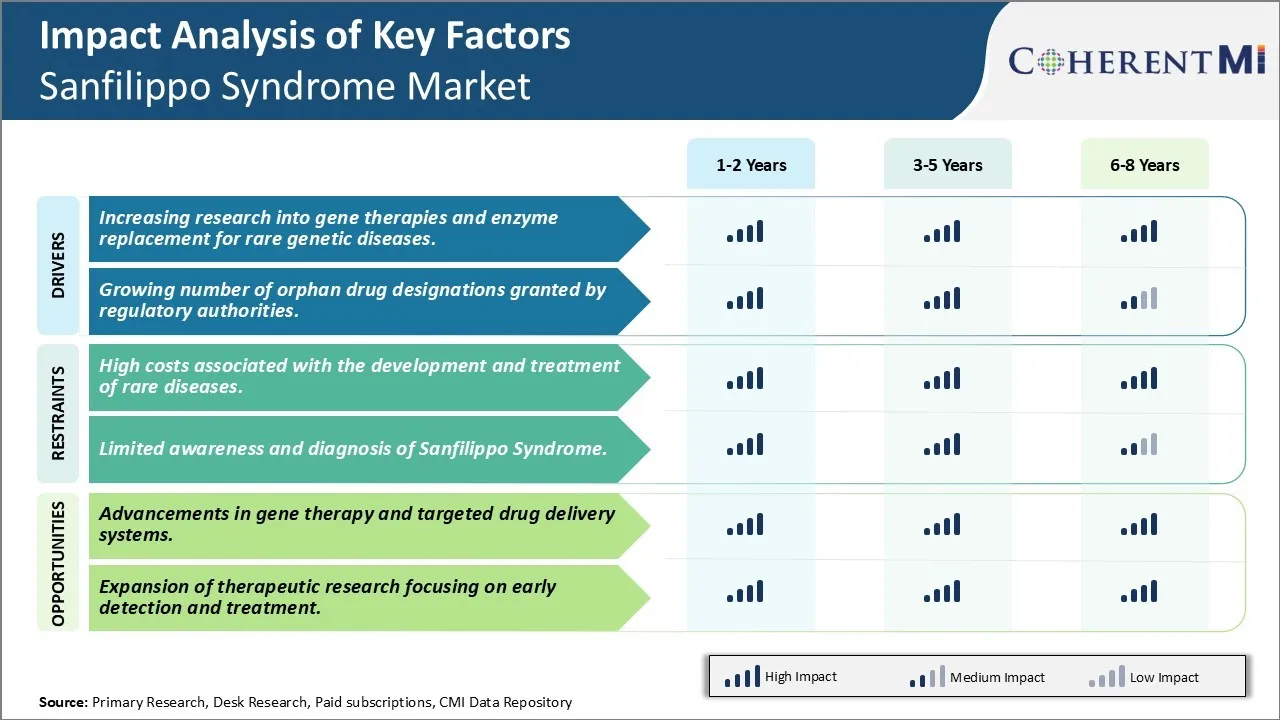

The market is expected to witness positive growth over the forecast period due to a growing pipeline of drugs under development and an increased focus on developing effective treatments. Additionally, improving diagnosis and awareness about Sanfilippo Syndrome is also supporting the growth of the market. However, the high cost of treatment and lengthy drug development cycles remain a major challenge to growth in the Sanfilippo Syndrome market.

Sanfilippo Syndrome Market Trends

Market Driver - Increasing Research into Gene Therapies and Enzyme Replacement for Rare Genetic Diseases

There is a significant increase in research being carried out to develop new therapies for rare genetic disorders like Sanfilippo Syndrome. Researchers are hopeful that advancements in gene therapy and enzyme replacement therapy can help address the underlying cause of this fatal metabolic condition in children.

Over the past few years, various biotechnology and pharmaceutical companies have initiated research projects aimed at developing effective gene therapy for Sanfilippo Syndrome. Some of the notable projects currently underway include clinical trials of an AAV gene therapy being developed by Lysogene to deliver functional copies of the SGSH gene which is deficient in patients. Preliminary results from animal studies have demonstrated long-term expression of the enzyme and improvement in disease pathology. Another potential gene therapy approach being explored involves the use of lentiviral vectors to deliver the deficient genes. While gene therapy holds immense promise, the complexities associated with delivering and expressing genes across the blood-brain barrier in Sanfilippo Syndrome patients poses significant technical challenges.

In addition to gene therapy research, scientists are also working on developing new enzyme replacement therapies for this condition. Several biotechs have engineered recombinant versions of the deficient enzymes involved such as Heparan-N-sulfatase (SGSH), Naglu, etc in hopes of replenishing enzyme levels through intravenous administration. BioMarin pharmaceutical's Valoctocogene Roxaparvovec, an investigational gene therapy, has shown early signs of reducing disease symptoms in a phase 1/2 clinical trial. Similarly, JCR pharmaceuticals' JR-041, an intravenous enzyme replacement therapy, is currently in Phase I/II trials with plans to expand to global markets.

Market Driver - Growing Number of Orphan Drug Designations Granted by Regulatory Authorities

Regulatory agencies around the world have recognized Sanfilippo syndrome as a rare disease of high unmet medical need deserving of policy support and incentives. Drug developers are therefore accelerating their efforts in this disease area assured of preferential treatment through the orphan drug pathway. In the US, both the FDA and EMA have granted orphan drug designations to several investigational therapies in development for Sanfilippo syndrome. For instance, BioMarin Pharmaceutical's BMN 270, an investigational AAV gene therapy, was awarded orphan drug status by the FDA as well as the EMA. Similarly, JCR Pharmaceuticals received orphan drug designation for JR-041, an enzyme replacement therapy, from both US FDA and EU authorities. These designations qualify the sponsors for benefits like clinical protocol assistance, tax credits for clinical costs and marketing exclusivity upon approval.

The accelerated approval process helps drug developers shave off years from the normal drug development cycle. It provides an avenue for sponsors to obtain marketing authorization based on surrogate or intermediate clinical endpoints, rather than waiting for long term patient outcomes. This is crucial for rare diseases where natural history studies are challenging due to the small patient populations. The supportive regulatory framework has created a favorable environment for Sanfilippo syndrome drug development.

More companies are actively seeking orphan drug status based on the incentives available. The growing number of designations signals increased focus of the biopharma industry on developing therapies for rare diseases like Sanfilippo syndrome.

Market Challenge - High Costs Associated with The Development and Treatment of Rare Diseases

One of the key challenges facing the Sanfilippo Syndrome market is the high costs associated with the development and treatment of rare diseases. Sanfilippo syndrome is considered an ultra-rare disease, affecting only around 1 in 100,000 births globally. With such a small patient population, conducting clinical trials to test new drugs or therapies is extremely expensive and difficult. Pharmaceutical companies are often hesitant to invest heavily in the research and development of new treatments due to small commercial viability from limited sales. Additionally, manufacturing drugs in small commercial batches increases per unit costs significantly. The high costs of developing new therapies directly impact pricing, making approved treatment options out of reach for many patients and healthcare systems. Government incentives and programs have helped offset some costs but have not solved the underlying economic challenges with developing drugs for niche, rare disease markets like Sanfilippo syndrome.

Market Opportunity - Advancements in Gene Therapy and Targeted Drug Delivery Systems

Emerging technologies within gene therapy and targeted drug delivery systems present opportunities for more impactful treatments for Sanfilippo syndrome. Researchers are developing gene therapy approaches that aim to repair the underlying genetic defects that cause Sanfilippo syndrome, potentially providing lifelong benefits with a single treatment course. Ongoing clinical trials evaluating potential gene therapy candidates have shown early promise. Advancements have also been made in designing nanotherapies that can cross the difficult-to-penetrate blood-brain barrier to deliver drugs specifically to cells in the central nervous system affected by Sanfilippo syndrome. These targeted delivery approaches have potential to improve drug potency and reduce unwanted side effects. If proven safe and effective, new platform technologies like gene therapy and nanotherapies may change the treatment landscape for Sanfilippo syndrome and other rare lysosomal storage disorders.

Prescribers preferences of Sanfilippo Syndrome Market

Sanfilippo Syndrome is a rare, progressive genetic disorder where the body is unable to break down complex sugar molecules called heparan sulfate. There are three main stages of the disease - mild, moderate and severe - which influence treatment approaches.

In the early or mild stage, symptom management is key. Prescribers commonly focus on medications to address behavior issues like anti-anxiety drugs (e.g. alprazolam) and sleep aids (melatonin). Physiotherapy is also utilized.

As the disease progresses to the moderate stage, additional support is needed. Enzyme replacement therapy (ERT) has shown promise, with drugs like Elaprase (idursulfase) and Naglazyme (galsulfase) prescribed to help reduce buildup of heparan sulfate. Speech therapy and occupational therapy are also important.

In the late or severe stage, full-time care is required. Prescribers shift focus to keeping patients comfortable via pain medications and anti-seizure drugs like clobazam as cognitive decline occurs. Experimental therapies may be explored, though current options mainly center on symptom management as the underlying causes remain incurable.

Other factors like a patient's responsiveness to previous treatments, progression speed and family support system also influence individualized treatment plans. Close monitoring allows for adjusting approaches appropriately at each disease stage.

Treatment Option Analysis of Sanfilippo Syndrome Market

Sanfilippo syndrome is a rare genetic lysosomal storage disease that is divided into 4 types (A, B, C, D) based on the enzyme deficiency. All types result in progressive neurological deterioration.

For Type A/B in early stages, enzyme replacement therapy (ERT) is preferred. Naglazyme (galsulfase) is the only FDA approved ERT for Type A. It aims to slow disease progression by replacing the deficient enzyme. For Type B, recombinant enzyme Elaprase (idursulfase) shows improvement in clinical endpoints.

As the disease progresses to moderate stages, ERT continues to be first-line therapy along with supportive care. For severe stages, no disease-modifying treatments exist. Symptom management includes antibiotics for recurrent infections, anti-seizure medications, pain relievers, etc. Physical, occupational and speech therapies help maintain motor skills and functioning.

Upcoming novel treatment options in clinical trials show promise. Intrathecal delivery of recombinant enzymes aims to bypass the blood-brain barrier and provide higher concentrations in the brain - the major site of pathology. Intrathecal heparan N-sulfatase gene therapy seeks to deliver the missing enzyme-coding gene directly into the brain. Substrate reduction therapies like miglustat help reduce substrate build-up by inhibiting their synthesis.

In summary, ERT remains the standard first-line therapy for early and moderate stages of Type A and B to slow progression. Advanced stages require multidisciplinary care for symptom relief. Novel therapies target underlying causes and may become preferred options if proven effective and safe.

Key winning strategies adopted by key players of Sanfilippo Syndrome Market

Product Development: One of the main strategies adopted by leading players has been investments in research and development to develop novel treatment options for Sanfilippo Syndrome. For example, in 2018, Abeona Therapeutics received orphan drug designation from the FDA for its gene therapy candidate ABO-102 for Sanfilippo syndrome type A. If approved, ABO-102 has the potential to be the first approved treatment for this rare fatal disease.

Acquisitions: Companies have also pursued acquisitions to gain access to new pipeline assets and technologies for Sanfilippo Syndrome.

Partnerships: Given the small patient numbers and commercial opportunities in rare diseases, partnerships are crucial. Leading players like Abeona have formed collaborations with academic medical centers to conduct clinical trials.

Awareness Programs: Boosting awareness about Sanfilippo Syndrome and its symptoms has been a strategy to aid early diagnosis and treatment. In 2019, the National MPS Society commissioned a survey that found only 41% of pediatricians felt very knowledgeable about MPS disorders. Players conduct awareness programs targeting clinicians to boost early diagnosis rates.

The above examples indicate that investments in innovative pipeline assets through acquisitions and collaborations, boosting disease awareness, and expediting clinical development through regulatory pathways have been successful strategies adopted by key players in the Sanfilippo Syndrome market. These initiatives have expanded treatment options and driven the field forward.

Segmental Analysis of Sanfilippo Syndrome Market

Insights, By Diagnosis, GAG Analysis is Expected to Account for a Remarkable Growth in the Forecast Period

By Diagnosis, GAG Analysis is expected to contribute 40.3% in 2024 owing to its effectiveness in early detection. GAG analysis is a widely used diagnostic test for Sanfilippo Syndrome (MPS III) due to its ability to detect the disease at an early stage. GAGs, also known as glycosaminoglycans, are sugar molecules that build up in tissues and organs when one of the enzymes required for breaking them down is deficient or missing. Measuring GAG levels, especially heparan sulfate, in a patient’s urine can reliably indicate whether they have MPS III.

Since symptoms of Sanfilippo Syndrome often do not appear until later in childhood, early diagnosis through GAG analysis gives patients and their families valuable time to seek treatment options and provide supportive care. Knowing the diagnosis also reduces uncertainty and allows for genetic counseling. Furthermore, identifying MPS III at a pre-symptomatic age facilitates enrollment in potential future disease-modifying clinical trials at an earlier stage of the condition.

GAG analysis is a non-invasive and relatively low-cost laboratory test that can be performed on a urine sample. Results are usually available within a few weeks, helping clinicians make a definitive diagnosis and initiate management plans in a timely manner. It has become the preferred first-line diagnostic approach for Sanfilippo Syndrome due to its effectiveness in confirming a biochemical abnormality associated with the condition. Positive GAG screening is then often followed up with additional tests for diagnostic confirmation and subtype classification.

The widespread clinical adoption and reliance on GAG analysis demonstrates its central role in the diagnostic pathway for Sanfilippo Syndrome. It allows for the highest possible number of patients to be accurately identified at the earliest opportunity. This leads to improved long-term outcomes through early intervention and coordination of supportive measures tailored to individual needs. As such, GAG analysis justly claims the largest share of the MPS III diagnostic market segment.

Insights, By Treatment, Enzyme Replacement Therapy is the Leading Segment

Of the limited therapeutic options currently available for Sanfilippo Syndrome, Enzyme Replacement Therapy (ERT) has emerged as the standard-of-care treatment based on evidence from clinical studies. ERT is expected to account for 50.1% market share in 2024. ERT aims to supplement the missing or defective enzyme required to break down GAGs by intravenous administration of the replacement recombinant version.

Velmanase alfa (Lamzede), developed by Chiesi Farmaceutici, is the first and only ERT approved for MPS IIIA. Its international pivotal clinical trial demonstrated significant reductions in GAG levels for up to 96 weeks as well as improvements in some clinical endpoints compared to baseline natural history. An ongoing open-label extension study continues to monitor long-term safety and effects.

Additional ERTs are under investigation. A Phase 1/2 trial of rhLaronidase (Aldurazyme) for MPS IIIB reported encouraging safety and biochemical results. A Phase 1 trial of idursulfase-IT (Eltrolizumab) for MPS IIIA also showed promising initial signs of efficacy. Recombinant human naglazyme is in preclinical development for MPS IIIA/B.

While ERT only modestly impacts cognitive outcomes, its documented therapeutic benefits have led to its first-line recommendation in international treatment guidelines. Sustained reductions in GAGs may help prevent further cellular and tissue damage. ERT also offers patients and their caregivers hope of managing the condition long-term. These factors contribute to ERT holding the largest share of the Sanfilippo Syndrome treatment segment currently.

Additional Insights of Sanfilippo Syndrome Market

Sanfilippo Syndrome is a rare genetic disorder primarily affecting the central nervous system due to the buildup of heparan sulfate, caused by enzyme deficiencies. With a progressive decline in cognitive and motor functions, Sanfilippo Syndrome presents significant challenges for affected individuals, often leading to a shortened life expectancy. Current research focuses on enzyme replacement therapies, gene therapy, and substrate reduction therapies (SRT) to address the underlying causes of the disease. Ultragenyx's UX111 and Orchard's OTL-201 are notable developments in the gene therapy space, holding promise for potentially curative treatments. The market for Sanfilippo Syndrome therapeutics is expanding, driven by advancements in molecular biology and the growing recognition of rare diseases as critical areas for pharmaceutical innovation. Despite the challenges of high development costs and the rarity of the condition, ongoing research holds the potential to significantly improve patient outcomes and quality of life.

Competitive overview of Sanfilippo Syndrome Market

The major players operating in the Sanfilippo Syndrome Market include Amgen Inc, Alkem Labs, LUPIN, Hope Pharmaceuticals, Sanifit, BSN Medical, Cipla Inc, Sun Pharmaceutical Inc, Mylan N.V. and Zydus Cadila.

Sanfilippo Syndrome Market Leaders

- Amgen Inc

- Alkem Labs

- LUPIN

- Hope Pharmaceuticals

- Sanifit

Sanfilippo Syndrome Market - Competitive Rivalry, 2024

Sanfilippo Syndrome Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sanfilippo Syndrome Market

- Ultragenyx Pharmaceutical (May 2024): UX111, an investigational gene therapy, is in Phase III trials for the treatment of Sanfilippo Syndrome type A. The gene therapy aims to address enzyme deficiency causing neurodegeneration. Its success could provide a one-time solution for patients, improving quality of life.

- Orchard Therapeutics (2023): OTL-201, an ex vivo autologous gene therapy, is under investigation in proof-of-concept trials for treating Sanfilippo Syndrome. This gene therapy targets the underlying enzyme deficiency, with promising results in early-stage trials.

Sanfilippo Syndrome Market Segmentation

- By Diagnosis

- GAG Analysis

- Genomic DNA Sequencing

- Activity Assay

- Others

- By Treatment

- Enzyme Replacement Therapy

- Gene Therapy

- Genistein

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Sanfilippo Syndrome Market?

The Global Sanfilippo Syndrome Market is estimated to be valued at USD 9.7 Bn in 2024 and is expected to reach USD 19.8 Bn by 2031.

What will be the CAGR of the Sanfilippo Syndrome Market?

The CAGR of the Sanfilippo Syndrome Market is projected to be 9.3% from 2024 to 2s031.

What are the major factors driving the Sanfilippo Syndrome Market growth?

The increasing research into gene therapies and enzyme replacement for rare genetic diseases and growing number of orphan drug designations granted by regulatory authorities are the major factor driving the Sanfilippo Syndrome Market.

What are the key factors hampering the growth of the Sanfilippo Syndrome Market?

The high costs associated with the development and treatment of rare diseases, limited awareness and diagnosis of sanfilippo syndrome are the major factor hampering the growth of the Sanfilippo Syndrome Market.

Which is the leading Diagnosis in the Sanfilippo Syndrome Market?

The leading Diagnosis segment is GAG Analysis.

Which are the major players operating in the Sanfilippo Syndrome Market?

Amgen Inc, Alkem Labs, LUPIN, Hope Pharmaceuticals, Sanifit, BSN Medical, Cipla Inc, Sun Pharmaceutical Inc, Mylan N.V., Zydus Cadila are the major players.