UAE Freight Forwarding Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

UAE Freight Forwarding Market is Segmented By Mode of Transport (Sea, Air, Land), By Industry Vertical (Retail, Oil & Gas, Manufacturing, Construction....

UAE Freight Forwarding Market Size

Market Size in USD Bn

CAGR7.01%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.01% |

| Market Concentration | High |

| Major Players | DHL Global Forwarding, DB Schenker, CEVA Logistics, Emirates SkyCargo, Aramex and Among Others. |

please let us know !

UAE Freight Forwarding Market Analysis

The UAE Freight Forwarding Market is estimated to be valued at USD 20.11 Bn in 2024 and is expected to reach USD 30.19 Bn by 2031, growing at a CAGR of 7.01% from 2024 to 2031.

Freight forwarding in the UAE involves the procurement of transportation and logistics services by facilitating the movement of goods across borders on behalf of shippers. The market handles shipments through various modes of transportation including ships, planes, trucks and railroads.

UAE Freight Forwarding Market Trends

Market Driver – E-commerce Growth

The rapid growth of e-commerce has significantly impacted the freight forwarding market in UAE. With more consumers and businesses doing transactions online, there has been a substantial rise in cross-border shipments of goods. E-commerce retailers are heavily reliant on logistic and shipping companies to move products from warehouses to customers located around the world.

This surge in e-commerce activity has created booming demand for freight forwarding services in UAE. Forwarders play a crucial role in the international supply chain by arranging shipments, handling documentation needs, and facilitating customs clearance for e-commerce companies. They ensure timely and efficient transportation of parcels from overseas vendors to people's doorsteps within UAE and other destinations. According to the United Nations Conference on Trade and Development (UNCTAD), the share of individuals using the internet to purchase foreign goods increased from 15% in 2019 to 19% in 2021. The International Post Corporation also reported that cross-border e-commerce shipments grew globally by 26% in 2021 compared to the previous year.

Market Driver – Government Initiatives for Trade

The UAE government has taken various trade-friendly initiatives in recent years which have significantly propelled the growth of the freight forwarding market in the country. One of the most impactful moves was the establishment of free trade zones across major cities like Dubai, Abu Dhabi, Sharjah etc. These zones offer 100% foreign ownership, 0% corporate and income tax, and world-class infrastructure to foster global trade. With over 40 free trade zones currently operational, the UAE has emerged as a key regional trade and logistics hub connecting Asia, Africa and Europe. This has boosted the demand for freight forwarding services multi-fold as a wide range of industries have set up base in these zones to leverage the strategic advantages.

The government has also signed comprehensive trade agreements with several nations to promote both exports and imports. Notable among them is the Gulf Cooperation Council (GCC) agreement which allows for the free movement of goods between GCC countries without any custom duties or import restrictions. As per World Bank data, the total value of goods traded between GCC countries increased from $80 billion in 2020 to an estimated $105 billion in 2022.

Market Challenge – Regulatory and Compliance Challenges

The UAE freight forwarding market faces significant regulatory and compliance challenges that restrain its growth potential. As a global trade and logistics hub, the UAE has established strict protocols to ensure security and transparency in cargo movements. However, frequent changes in laws and lack of coordination between various government agencies sometimes creates hurdles for freight forwarding companies.

New regulations around safety, customs procedures, and transportation of restricted goods are regularly introduced but the implementation guidelines are not always clear or uniform across different jurisdictions within the country. This leads to delays in cargo clearance and uncertainty regarding duty structures. Small and medium freight forwarders struggle to keep up with the dynamic compliance environment as it requires substantial legal and process expertise.

Additionally, while free zones and dedicated economic regions offer tax incentives to boost trade, inconsistencies remain in documentation requirements between mainland and offshore locations. For example, as per a 2020 report by the United Nations Conference on Trade and Development, differences still persist in authorized customs brokers and insurance policies between Dubai mainland and Jebel Ali free zone which causes delays and uncertainties for transporters moving goods between the two areas.

Market Opportunity – Diversification into Specialized Services

Diversification into specialized services presents a huge opportunity for growth in the UAE freight forwarding market. As one of the major trade and logistics hubs in the world, the nation handles massive volumes of cargo through its ports and airports on a daily basis. However, the market has traditionally relied on conventional services like transportation and warehousing. With rising expectations from customers and evolving supply chain complexities, there is a need to offer differentiated value-added services.

Providers can expand beyond basic coordination and focus on niche areas that serve growing customer demands. For example, many sectors in the UAE like healthcare and manufacturing are adopting Just-In-Time and lean manufacturing techniques which require tightly integrated and time-critical logistics. Forwarders can develop capabilities in specialty services like managed inventory, cross-docking, container tracking and real-time cargo monitoring.

As another example, the e-commerce industry in the UAE recorded a shipment growth of over 32% year-on-year according to Emirates Post data for 2021. This sub-sector demands hyperlocal delivery capability within major cities along with value-added warehousing solutions for consolidation, return management and packaging.

Segmental Analysis of UAE Freight Forwarding Market

Insights, By Mode of Transport: Sea Transportation Dominates UAE Freight Forwarding Due to Strategic Port Infrastructure

Among mode of transport, se sub-segment holds the highest share of 51.3% in the market.

The UAE's geographic location has established it as a critical maritime hub linking Europe and Asia. Dubai and Abu Dhabi have invested heavily to develop world-class port facilities that can handle high volumes of containerized and bulk cargo. Jebel Ali Port in Dubai is one of the largest container ports globally and a premier logistics gateway for the region. It boasts advanced container terminal equipment and rapid customs clearance, facilitating just-in-time supply chains. Cargo volumes moving through Jebel Ali have steadily increased over the past decade, supported by additional capacity expansions.

Given the UAE's central position along major east-west trade routes, sea freight forwarding excels at transporting goods cost-effectively over long distances. Shipping by vessel allows bulk cargo like oil, gas, construction materials and industrial equipment to be moved in large volumes. This mode of transport sees widespread use for importing fuels, machinery and building materials to support infrastructure and energy sector growth. Exporters also leverage sea shipping for overseas sales of petrochemicals and refined products.

Insights, By Industry Vertical: Retail Sector Stimulates Freight Demand in UAE's Growing Consumption Economy

Among industry vertical, retail sub-segment holds the highest market share of 25.4% in the market.

Rising disposable incomes and population growth have fueled a surge in retail activity across the UAE in recent years. International brands have rushed to capitalize on the thriving consumer market by establishing stores and distribution centers. This rapid expansion inevitably creates substantial freight requirements to replenish retail inventories.

Freight forwarders play an essential role in managing complex inbound supply chains for retailers. They handle time-sensitive shipments of fashion apparel, consumer electronics, home goods and other products imported via various modes. On the export side, re-exports through distribution hubs also contribute cargo volumes. Multinational retailers leverage freight expertise to stay well-stocked and satisfy customers' demands.

E-commerce is another catalyst boosting retail freight demands. Online shopping platforms have taken off among citizens and residents looking for convenience. Forwarders ship high volumes of parcel consignments to fill individual consumer orders. They provide value-added services like customs clearance, packaging and delivery optimization.

As one of the top consumption markets in the GCC, the UAE's dynamic retail landscape will drive considerable freight forwarding business. Both traditional retailers and e-tailers depend on efficient supply chain solutions to thrive. This positions the sector as a strong and enduring source of freight demand.

Competitive overview of UAE Freight Forwarding Market

The major players operating in the UAE Freight Forwarding Market include DHL Global Forwarding, DB Schenker, CEVA Logistics, Emirates SkyCargo, Aramex, Agility, Kuehne + Nagel, GAC, Expeditors International, and Al-Futtaim Logistics.

UAE Freight Forwarding Market Leaders

- DHL Global Forwarding

- DB Schenker

- CEVA Logistics

- Emirates SkyCargo

- Aramex

UAE Freight Forwarding Market - Competitive Rivalry, 2024

UAE Freight Forwarding Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in UAE Freight Forwarding Market

- On March 13, 2024, DP World, a global ports operator, announced plans to expand its freight-forwarding network to 180 offices worldwide by the end of the year. This move aims to enhance their supply chain services amid increasing global trade disruptions. Over the past eight months, the Dubai-based company has opened 100 new freight-forwarding offices in the GCC and other regions, and it plans to add 80 more offices by the end of 2024, according to a company spokesman.

- In October 2023, Zajel, a major player in the logistics industry, took a significant step to strengthen its position as a top logistics partner for international clients. The company announced the creation of its new Freight Forwarding Department, highlighting its dedication to providing top-tier logistics solutions for air, sea, and land transport.

UAE Freight Forwarding Market Segmentation

- By Mode of Transport

- Sea

- Air

- Land

- By Industry Vertical

- Retail

- Oil & Gas

- Manufacturing

- Construction

- eCommerce

- Others

- By Warehouse Model

- Container Freight Stations

- Industrial Warehouses

- Agricultural Warehouses

- Cold Storage Facilities

- E-commerce Fulfillment Centers

- By Shipment Type

- Domestic Freight

- International Freight

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

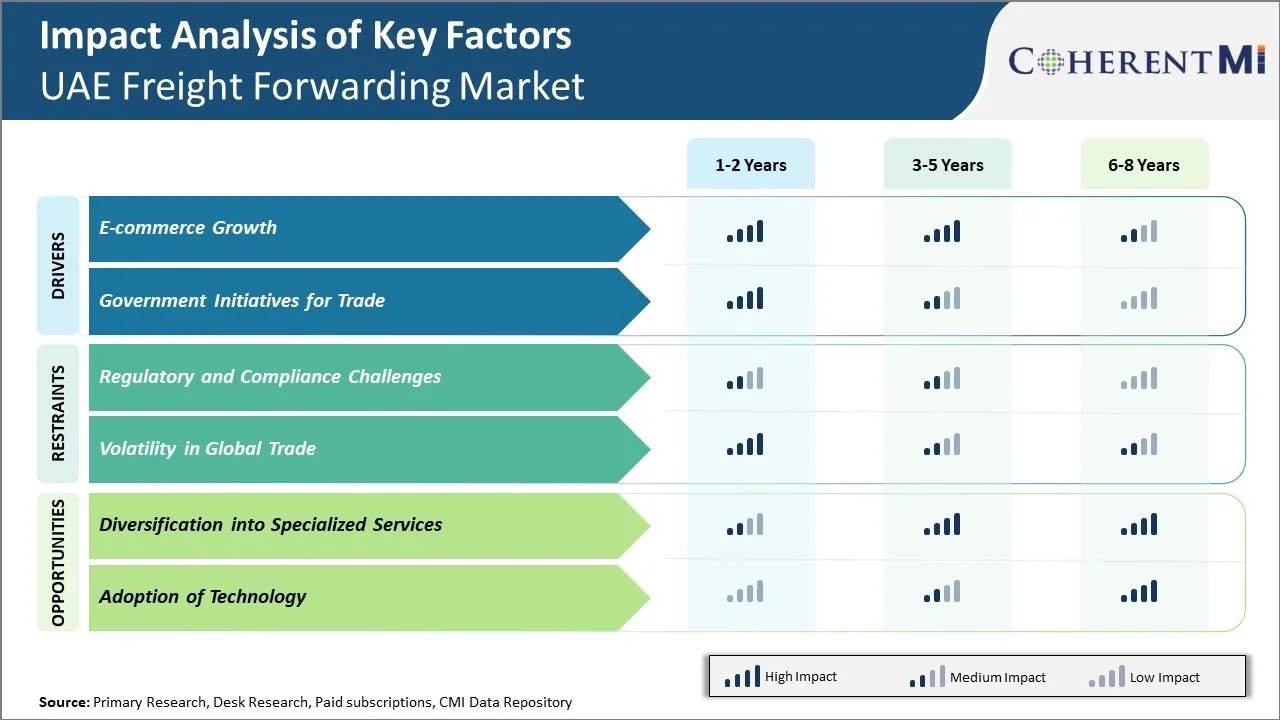

What are the key factors hampering the growth of the UAE Freight Forwarding Market?

The regulatory and compliance challenges and volatility in global trade are the major factors hampering the growth of the UAE Freight Forwarding Market.

What are the major factors driving the UAE Freight Forwarding Market growth?

The e-commerce growth and government initiatives for trade are the major factors driving the UAE Freight Forwarding Market.

Which is the leading Mode of Transport in the UAE Freight Forwarding Market?

The leading Mode of Transport segment is Sea.

Which are the major players operating in the UAE Freight Forwarding Market?

DHL Global Forwarding, DB Schenker, CEVA Logistics, Emirates SkyCargo, Aramex, Agility, Kuehne + Nagel, GAC, Expeditors International, and Al-Futtaim Logistics are the major players.

What will be the CAGR of the UAE Freight Forwarding Market?

The CAGR of the UAE Freight Forwarding Market is projected to be 7.01% from 2024-2031.