Vector Purification Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Vector Purification Market is segmented By Type of Vector (Adeno-Associated Viruses (AAV), Adenoviruses, Lentivirus, Retroviruses, Others) By Type of ....

Vector Purification Market Size

Market Size in USD Mn

CAGR21.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 21.3% |

| Market Concentration | High |

| Major Players | Agilent Technologies, BIA Separations, Bio-Rad Laboratories, Merck, Thermo Fisher Scientific and Among Others. |

please let us know !

Vector Purification Market Analysis

The vector purification market is estimated to be valued at USD 336 Mn in 2024 and is expected to reach USD 1,300 Mn by 2031, growing at a compound annual growth rate (CAGR) of 21.3% from 2024 to 2031.

The market is expected to witness significant growth during the forecast period. The growing demand for highly pure vectors for gene therapy and vaccine production is driving the market. Moreover, the increasing R&D investments by pharmaceutical and biotechnology companies and the rising adoption of advanced technologies such as big data and machine learning for vector purification are further fueling the market growth. However, the complexity in downstream processing and high costs associated with vectors purification techniques may hinder the market expansion to some extent.

Vector Purification Market Trends

Market Driver - Increasing demand for viral vectors due to the rising adoption of gene and cell therapies

The increasing demand for viral vectors is one of the primary drivers spurring growth in the vector purification market. Viral vectors serve as efficient vehicles to deliver therapeutic genetic materials into target cells and have become indispensable in the development and manufacture of gene and cell therapies. With a substantial number of gene and cell therapy candidates in clinical trials or undergoing regulatory review, the demand for high-quality, GMP-grade viral vectors is expected to skyrocket in the coming years.

A majority of gene and cell therapy developers are relying on viral vectors such as retroviruses, lentiviruses, adenoviruses, and AAV to stably integrate therapeutic genes into patient cells or transiently deliver gene payloads. As per industry estimates, nearly 70% clinical programs employ viral vectors in some form or other. The encouraging clinical proof-of-concept demonstrated by some commercialized gene and cell therapies such as Kymriah, Yescarta, Luxturna have added to the enthusiasm around these transformative treatment modalities. An increasing number of pharmaceutical companies are making large investments in developing their own gene and cell therapy pipelines or forming partnerships to this end. This is driving the need for industrial-scale vector manufacturing capabilities supported by robust upstream and downstream processing systems including advanced purification equipment and consumables.

At present, viral vector manufacturing is largely outsourced by smaller biotechs and startups to large CMOs with integrated capabilities. However, as promising candidates move into late-stage trials and commercialization, more producers are building or expanding their internal viral vector production capacity to ensure security of supply. This is prognosticated to boost capital equipment procurement in the coming years. Also, continuous technological advances are enabling higher yields and more productive processes requiring fewer raw material inputs. However, enhanced purification at industrial scales remains critical for removing contaminants, facilitating downstream processing and ensuring product quality, stability and safety. This will sustain demand for high-performance vector purification solutions in the foreseeable future.

Market Driver - Advances in purification technologies

Technological progress is another key factor bolstering the vector purification market. Purification technologies have come a long way towards achieving higher resolution separation, greater selectivity, and more efficient capture of viral particles. Continuous efforts are being made to develop robust, scalable solutions that facilitate GMP manufacturing of clinical-grade viral vectors. This includes upgrades to chromatography media, optimized buffer systems, and automated modular equipment.

Chromatography remains the method of choice for most industrial-scale purification steps. Several companies are enhancing column chromatographic techniques through novel stationary phase chemistries tailored for specific vector types. For example, expanded bed adsorption has emerged as an advantageous unit operation for purifying high-titer AAV preparations. Also, membranes designed for efficient tangential ultra/diafiltration are finding increased usage for concentrating as well as exchanging buffers in purified virus preparations.

Engineered particles are competing with ligands to achieve selective capture of viral vectors. This includes nanobodies, oligonucleotide aptamers and other affinity tags that recognize epitopes on capsid proteins. Systems integrating such affinity materials offer high binding capacity and easy scalability. Similarly, continuous chromatography utilizing fluidized bed adsorbers can achieve superior resolution at high dynamic binding capacities.

Analytics likewise continue to become more robust and automated, from release testing to real-time process monitoring using inline controls. The deployment of machine learning and artificial intelligence is helping to advance chromatographic method development and optimization. Overall, advances in purification technologies are helping to address current bottlenecks, maximize yield and throughput while ensuring uniform quality - complementing the heightened focus on vector characterization. This will galvanize growth in the high-potential viral vector purification solutions market.

Market Challenge - High cost associated with the purification processes

One of the major challenges faced by players in the vector purification market is the high costs associated with purification processes. Purifying vectors is a multi-step process that relies on expensive equipment and materials. Viral purification involves steps like transfection, filtration, purification through chromatographic columns or ultracentrifugation. These processes require costly capital equipment like chromatography systems, filtration systems, and centrifuges. They also utilize expensive disposable consumables like filters, columns, buffers, and reagents. Developing and optimizing new purification protocols is a lengthy process that involves considerable research and development investments. Additionally, due to stringent regulatory requirements, purification facilities need to meet high quality standards involving qualified equipment, clean rooms, and trained personnel which adds significantly to operational expenses. The complex multi-step purification workflows are also time-consuming and labor-intensive.

All of these factors contribute to high fixed and variable costs of goods that directly impact the overall profitability of vector manufacturers. With rising R&D expenses and intense competition, it is challenging for companies to reduce costs and prices without compromising on quality and yields. This cost burden acts as a deterrent for smaller companies and startups with limited resources from entering this market. It also restricts the adoption of advanced gene and cell therapy products which rely on viral vectors by healthcare systems with constrained budgets.

Market Opportunity - Expansion in emerging markets

The Asia-Pacific region is emerging as a significant opportunity for the vector purification market, fueled by the rapid expansion of its biotechnology and pharmaceutical industries. Countries like China, India, and South Korea are witnessing substantial investments in biotech research and manufacturing, supported by favorable government policies and growing infrastructure. This region is becoming a global hub for biopharmaceutical innovation, with a particular focus on gene therapy, vaccine production, and other advanced therapies. As these industries grow, the demand for efficient and scalable vector purification technologies is expected to surge, presenting a lucrative market for companies operating in this space. The increasing prevalence of chronic diseases, coupled with a rising middle-class population, further amplifies the need for advanced medical treatments, making Asia-Pacific a critical region for future growth in vector purification.

Key winning strategies adopted by key players of Vector Purification Market

Leading players have formed strategic partnerships with research institutes and hospitals to gain access to new technologies and expertise in vector purification. For example, in 2017, Merck KGaA partnered with GeneWerk to leverage their expertise in plasmid production and gene vector purification. This partnership helped Merck expand its viral vector manufacturing capabilities.

Companies have acquired smaller players with complementary technologies to enhance their product portfolios. In 2019, Lonza acquired the U.S.-based molecular testing services company Cognate BioServices. This acquisition expanded Lonza's viral vector development and manufacturing capabilities using Cognate's recombinant AAV (rAAV) and lentiviral technologies.

Players continuously invest in R&D to develop advanced vector purification solutions. For example, Thermo Fisher invested $500 million in R&D in 2020 to launch new chromatography products and single-use technologies for viral vector purification. Their new EXPERION automated electrophoresis system helps researchers develop and optimize vector purification processes.

Leading companies have expanded into emerging Asian and Latin American markets through new facilities. Sartorius opened new production sites in China and Puerto Rico in 2018-19 to better serve the rising local demand for viral vectors due to growing gene and cell therapy research. This effective localization strategy helped Sartorius gain significant market share.

Segmental Analysis of Vector Purification Market

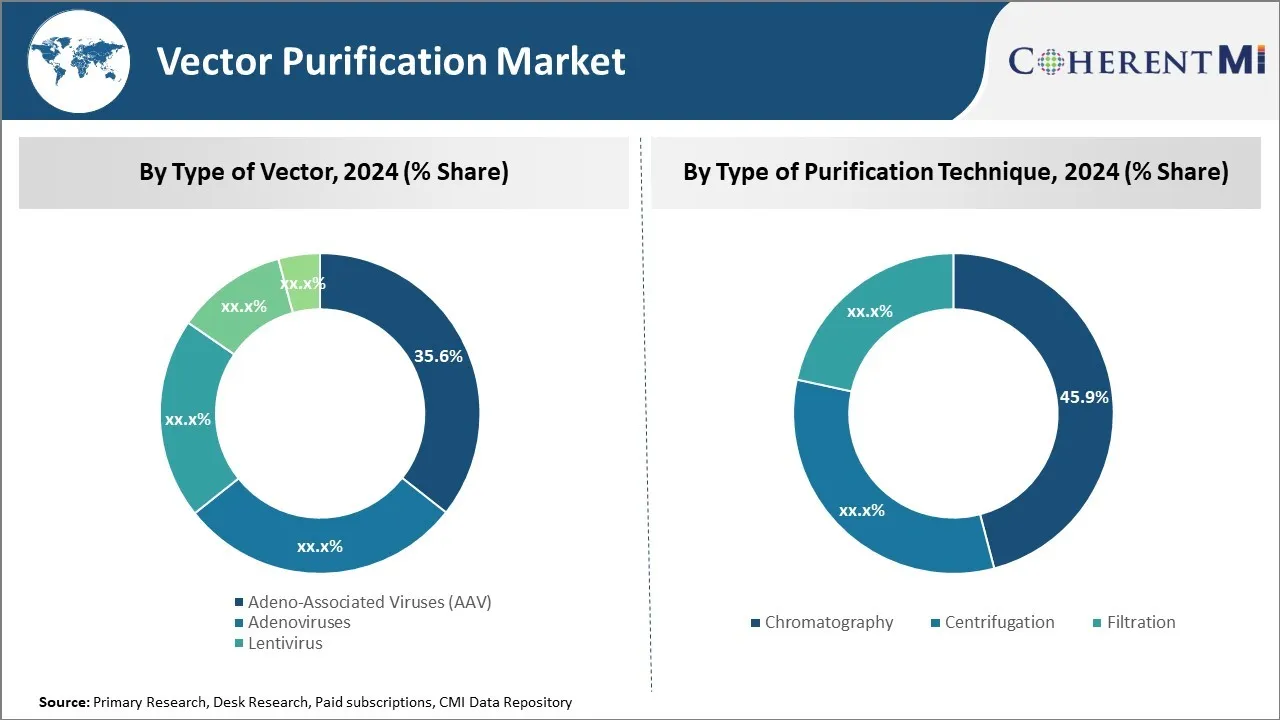

Insights, By Type of Vector: Versatility and safety of AAV

In terms of type of vector, adeno-associated viruses (AAV) sub-segment contributes the highest share of 35.6% in the market owing to its versatility and safety. Adeno-associated viruses, also known as AAV, have emerged as the preferred vector for many gene therapy and genetic engineering applications due to their attractive properties. AAV can efficiently deliver genes to both dividing and non-dividing cells without integrating into the host cell's genome, making it safer than other viral vectors. Their composition allows for stable, long-term gene expression without disrupting native cell functions or triggering significant immune responses.

AAV's small DNA genome also gives it a high carrying capacity for transgenic payloads. Numerous naturally occurring AAV variants have been identified that show tissue or cell type specificity, expanding opportunities for targeted gene therapies. Several AAV gene therapy products have received regulatory approvals in recent years, demonstrating its potential. Areas like ophthalmology have seen notable success treating genetic disorders like Leber's congenital amaurosis.

AAV vectors are relatively easy to produce at scale in vitro using engineered cell lines. Improvements in upstream and downstream purification methods have significantly increased yields. Their non-pathogenic nature means minimal biocontainment is required during manufacturing. Overall, AAV offers an unmatched balance of safety, efficiency and customizability prized by both researchers and drug developers. As gene and cell therapies advance, the breadth of applications for AAV looks poised to grow substantially.

Insights, By Type of Purification Technique: High resolution and scalability of chromatography

In terms of type of purification technique, chromatography sub-segment contributes the highest share of 45.9% in the market due to its high resolution and scalability. Chromatography has become the primary method used to purify viral vectors like AAV from production cell cultures. It allows for high-resolution separations based on chemical and physical properties. Various chromatography modalities like ion exchange, size exclusion and affinity are employed individually or in combination to selectively capture the targeted virus particles from impurities.

Chromatography operations can be readily scaled-up in tandem with increasing bioreactor volumes. Multiple columns may be linked in series or parallel configurations to boost throughput to industrial levels. Automation further enhances productivity and reproducibility. Its analytical capabilities also provide critical quality control, allowing manufacturers to confirm key product attributes like purity, identity and potency.

As gene and cell therapies accelerate into late-stage clinical trials and commercialization, ensuring robust, scalable downstream purification grows more pressing. Chromatography is uniquely suited to meet these escalating demands through continuous optimization. The wealth of process and equipment knowledge accumulated makes chromatography Column the reliability and flexibility required for widespread manufacture of life-saving viral vectors. Fr further regulatory compliance and commercial viability depend on purification via chromatography.

Additional Insights of Vector Purification Market

- The vector purification market is driven by the increasing demand for viral vectors, particularly due to the rising adoption of gene and cell therapies. The market faces challenges related to the cost and technical complexities of purification processes. However, advancements in purification technologies and the growing number of clinical trials for viral vector-based therapies are expected to drive significant market growth.

Competitive overview of Vector Purification Market

The major players operating in the vector purification market include Thermo Fisher Scientific, Merck, Agilent Technologies, BIA Separations, Bio-Rad Laboratories, Cytiva (formerly GE Lifesciences), Sartorius, Takara Bio and BioVision.

Vector Purification Market Leaders

- Agilent Technologies

- BIA Separations

- Bio-Rad Laboratories

- Merck

- Thermo Fisher Scientific

Vector Purification Market - Competitive Rivalry, 2024

Vector Purification Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Vector Purification Market

- In July 2023, Biovian invested EUR 50 million to expand its manufacturing facility in Turku, Finland, for adenoviral and adeno-associated viral therapies.

- In June 2023, Texcell opened a testing facility in North America to improve the viral safety of biotherapeutics and medical devices.

Vector Purification Market Segmentation

- By Type of Vector

- Adeno-Associated Viruses (AAV)

- Adenoviruses

- Lentivirus

- Retroviruses

- Others

- By Type of Purification Technique

- Chromatography

- Centrifugation

- Filtration

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the vector purification market?

The high cost associated with the purification processes and technical challenges in large-scale purification of viral vectors are the major factors hampering the growth of the vector purification market.

What are the major factors driving the vector purification market growth?

The increasing demand for viral vectors due to the rising adoption of gene and cell therapies and advances in purification technologies enhancing yield and efficiency are the major factors driving the vector purification market.

Which is the leading type of vector in the vector purification market?

The leading type of vector segment is adeno-associated viruses (AAV).

Which are the major players operating in the vector purification market?

Thermo Fisher Scientific, Merck, Agilent Technologies, BIA Separations, Bio-Rad Laboratories, Cytiva (formerly GE Lifesciences), Sartorius, Takara Bio, and BioVision are the major players.

What will be the CAGR of the vector purification market?

The CAGR of the vector purification market is projected to be 21.3% from 2024-2031.