3D Cardiac Mapping System Market Size - Analysis

The 3D cardiac mapping system market is estimated to be valued at USD 1.77 Billion in 2025 and is expected to reach USD 3.17 Billion by 2032, growing at a compound annual growth rate (CAGR) of 8.7% from 2025 to 2032. This growth can be attributed to the increasing prevalence of cardiovascular diseases and the rising demand for minimally invasive surgeries.

Market Size in USD Bn

CAGR8.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.7% |

| Market Concentration | High |

| Major Players | Biosense Webster, Inc. (Johnson & Johnson), Boston Scientific Corporation, Abbott, Medtronic, Kardium, Inc. and Among Others |

please let us know !

3D Cardiac Mapping System Market Trends

The American Heart Association estimates that by 2035, approximately 130 million American adults will be diagnosed with some form of cardiovascular disease. As per the WHO, cardiovascular diseases now claim more lives than any other causes globally and are projected to remain the single leading cause of death worldwide by 2030. With over 75% of cardiovascular deaths taking place in low and middle-income countries, this rising epidemic is devastating populations across both developed and developing regions.

Great focus is being laid on innovative medical solutions that can optimize operational efficiencies, save costs and support better cardiac treatment outcomes at a wider population level. To summarize, the towering prevalence of heart disorders emerging as a leading cause of mortality makes a compelling case for the increasing dependence on advanced mapping technologies in the years ahead.

Market Driver - Technological Advancements Improving Cardiac Mapping Accuracy

Integration of cardiac MRI, CT and rotational angiography further strengthen 3D visualization of cardiac anatomy along with real-time CT image integration during procedures. Non-fluoroscopic navigation solutions have eliminated radiation risks, while high-density mesh mapping catheters deliver up to 128 electrodes of high-resolution electroanatomic data for precise localization and ablation of arrhythmias. Overall procedural times and X-ray exposure for patients and physicians have reduced remarkably with such technical enhancements.

Market Challenge - High Costs of 3D Cardiac Mapping Systems Limiting Adoption

Moreover, the additional running costs including maintenance, software upgrades, disposables and accessories also add to the overall expenditure. The high costs of these systems make them unaffordable for many healthcare facilities, particularly those located in price-sensitive developing regions. The presence of budget constraints in public healthcare systems and the inability of private healthcare facilities to recover the high costs also limit the widespread adoption of these advanced cardiac mapping technologies.

One of the key opportunities for the 3D cardiac mapping systems market lies in the increasing demand from emerging economies due to expanding healthcare infrastructure in these regions. Many developing countries are witnessing considerable economic growth and a subsequent rise in healthcare expenditure.

As a part of this ongoing infrastructure development, there is a growing focus on investing in advanced cardiac care as well. This is propelling the demand for state-of-the-art technologies like 3D cardiac mapping systems in these emerging markets.

Key winning strategies adopted by key players of 3D Cardiac Mapping System Market

- In 2021, Biosense Webster (Johnson & Johnson) launched the RhythmMap 3D Cardiac Mapping System. It provides high-resolution 3D mapping and allows complex cases to be carried out efficiently.

- Companies like Medtronic invested over $2.5 billion in R&D in 2021 alone to develop novel solutions like the NavX Navigation System launched in 2018.

- Such continuous innovation has helped Medtronic maintain its #1 spot with over 30% market share.

Partnerships for geographic expansion:

- This helped the small player access the large US market and gain volumes to achieve economies of scale.

Segmental Analysis of 3D Cardiac Mapping System Market

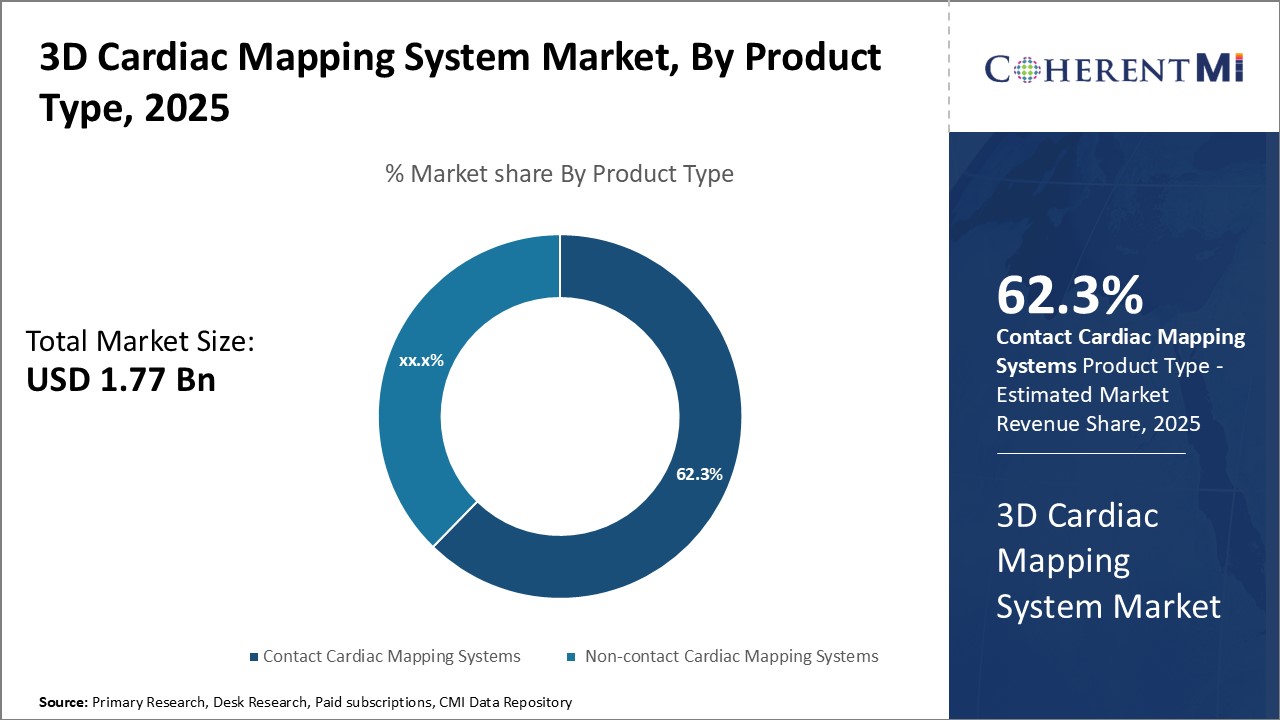

Insights, By Product Type: Technological Advancements Fuel Growth of Contact Systems

Insights, By Product Type: Technological Advancements Fuel Growth of Contact SystemsIn terms of product type, contact cardiac mapping systems contributes the highest share of the market owning to technological advancements that have made them more efficient and user-friendly. Contact systems offer high-resolution maps of the heart anatomy and enable physicians to accurately identify arrhythmogenic substrates. Advancements such as basket catheter designs with enhanced flexibility and more electrodes have expanded the capabilities of contact systems. Further, the development of integrated technology platforms combining ablation catheters, 3D mapping, and navigation aid features within a single catheter has driven their adoption. Contact systems also allow customization of settings based on specific arrhythmia characteristics and heart conditions. Their ability to provide high-density maps in complex cardiac chamber anatomies makes them useful for a wide range of ablation procedures.

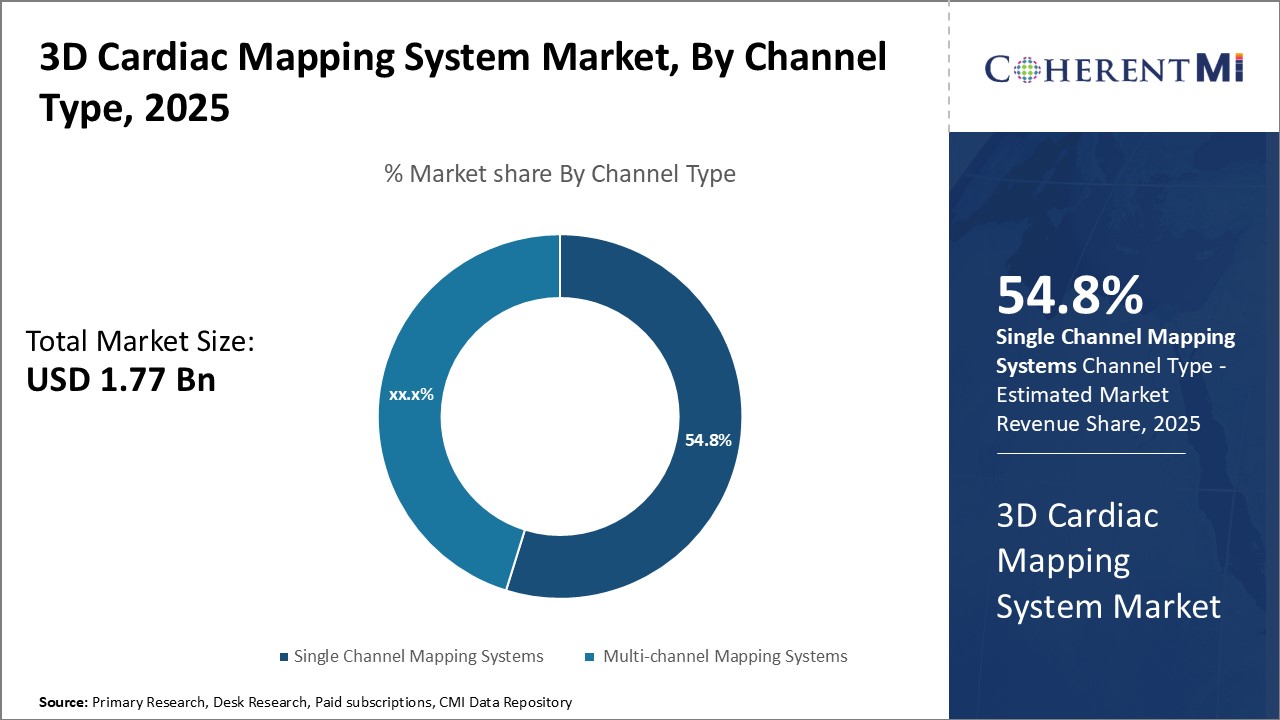

In terms of channel type, single channel mapping systems contributes the highest share of the market. Unlike multi-channel systems, single channel systems offer the convenience of a single catheter for both mapping and ablation. This avoids the inconvenience of catheter exchanges during a procedure and reduces procedure time.

In terms of end user, hospitals contribute the highest share of the market. Hospitals house specialized electrophysiology labs equipped with state-of-the-art 3D mapping systems and well-trained catheter lab staff. They can efficiently handle complex cases requiring additional support.

As arrhythmia treatment increasingly shifts towards catheter-based minimally invasive approaches, hospitals are at the forefront of delivering such offerings. Their brand image as reliable providers of specialized cardiac care further amplify hospital utilization of 3D mapping solutions.

Additional Insights of 3D Cardiac Mapping System Market

- The geriatric population, which is more prone to cardiac issues, is expected to grow by 25% globally by 2030, driving significant demand for advanced cardiac mapping systems.

- Approximately 3 million cardiac catheterization procedures are performed annually worldwide, creating a sustained demand for precision-driven mapping systems.

- Biosense Webster's Dominance: Biosense Webster has maintained its leading position due to its continuous product innovation and strategic collaborations with global hospitals.

- Emergence of Non-contact Systems: Non-contact cardiac mapping systems have been gaining traction due to their non-invasive nature and increased safety profiles.

Competitive overview of 3D Cardiac Mapping System Market

The major players operating in the 3D Cardiac Mapping System Market include Biosense Webster, Inc. (Johnson & Johnson), Boston Scientific Corporation, Abbott, Medtronic, Kardium, Inc., Catheter Robotics, Inc., Lepu Medical and EP Solutions SA.

3D Cardiac Mapping System Market Leaders

- Biosense Webster, Inc. (Johnson & Johnson)

- Boston Scientific Corporation

- Abbott

- Medtronic

- Kardium, Inc.

3D Cardiac Mapping System Market - Competitive Rivalry

3D Cardiac Mapping System Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in 3D Cardiac Mapping System Market

- In November 2023, Boston Scientific announced the launch of a new generation of 3D cardiac mapping systems designed to enhance procedural efficiency and mapping accuracy. The system, known as the RHYTHMIA HDx™ Mapping System, uses advanced technology to provide high-definition mapping with features like increased mapping speed and precision. It aims to improve the diagnosis and treatment of complex cardiac arrhythmias by offering better insights into the heart's electrical activity, helping clinicians reduce procedure times and make more informed decisions.

- In March 2024, Abbott announced that it has been making advancements in cardiac catheter technologies, particularly with the development of the Advisor HD Grid Mapping Catheter, which integrates advanced mapping capabilities for improved cardiac arrhythmia treatments. This technology received FDA clearance and has been lauded for its ability to create detailed 3D heart maps, which is crucial for treating complex heart rhythm disorders.

- In June 2023, Kardium launched a collaboration with key hospitals in Europe to study the efficacy of their next-gen cardiac mapping systems, focusing on patient outcomes.

3D Cardiac Mapping System Market Segmentation

- By Product Type

- Contact Cardiac Mapping Systems

- Non-contact Cardiac Mapping Systems

- By Channel Type

- Single Channel Mapping Systems

- Multi-channel Mapping Systems

- By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the 3D cardiac mapping system market?

The 3D cardiac mapping system market is estimated to be valued at USD 1.77 Billion in 2025 and is expected to reach USD 3.17 Billion by 2032.

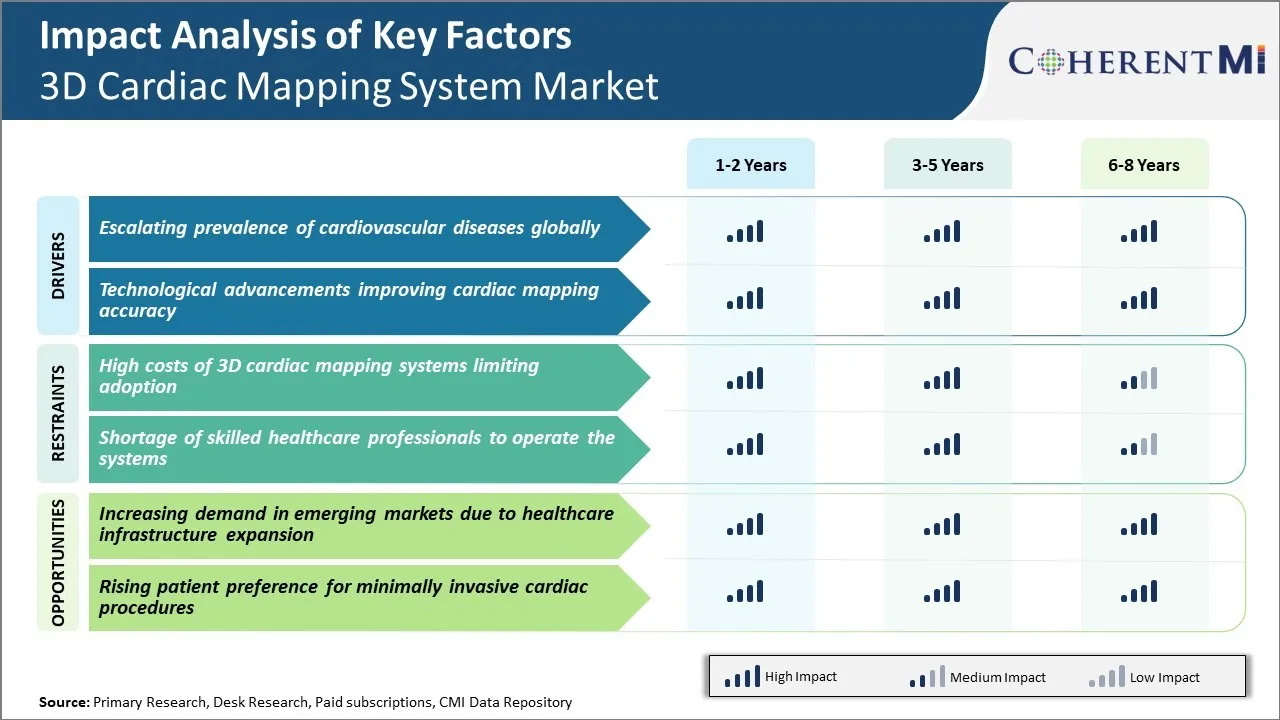

What are the key factors hampering the growth of the 3D cardiac mapping system market?

The high costs of 3D cardiac mapping systems limiting adoption and shortage of skilled healthcare professionals to operate the systems are the major factors hampering the growth of the 3D cardiac mapping system market.

What are the major factors driving the 3D cardiac mapping system market growth?

The escalating prevalence of cardiovascular diseases globally and technological advancements improving cardiac mapping accuracy are the major factors driving the 3D cardiac mapping system market.

Which is the leading product type in the 3D cardiac mapping system market?

The leading product type segment is contact cardiac mapping systems.

Which are the major players operating in the 3D cardiac mapping system market?

Biosense Webster, Inc. (Johnson & Johnson), Boston Scientific Corporation, Abbott, Medtronic, Kardium, Inc., Catheter Robotics, Inc., Lepu Medical, and EP Solutions SA are the major players.

What will be the CAGR of the 3D cardiac mapping system market?

The CAGR of the 3D cardiac mapping system market is projected to be 8.7% from 2025-2032.