Absorbable Hemostats Market Size - Analysis

The absorbable hemostats market is estimated to be valued at USD 3.06 Bn in 2025 and is expected to reach USD 4.82 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.7% from 2025 to 2032. Absorbable hemostats are increasingly being adopted by healthcare professionals owing to their ability to aid in homeostasis and get absorbed by the body after surgery.

Market Size in USD Bn

CAGR6.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.7% |

| Market Concentration | High |

| Major Players | B. Braun, Baxter, Johnson & Johnson, BD, Cura Medical and Among Others |

please let us know !

Absorbable Hemostats Market Trends

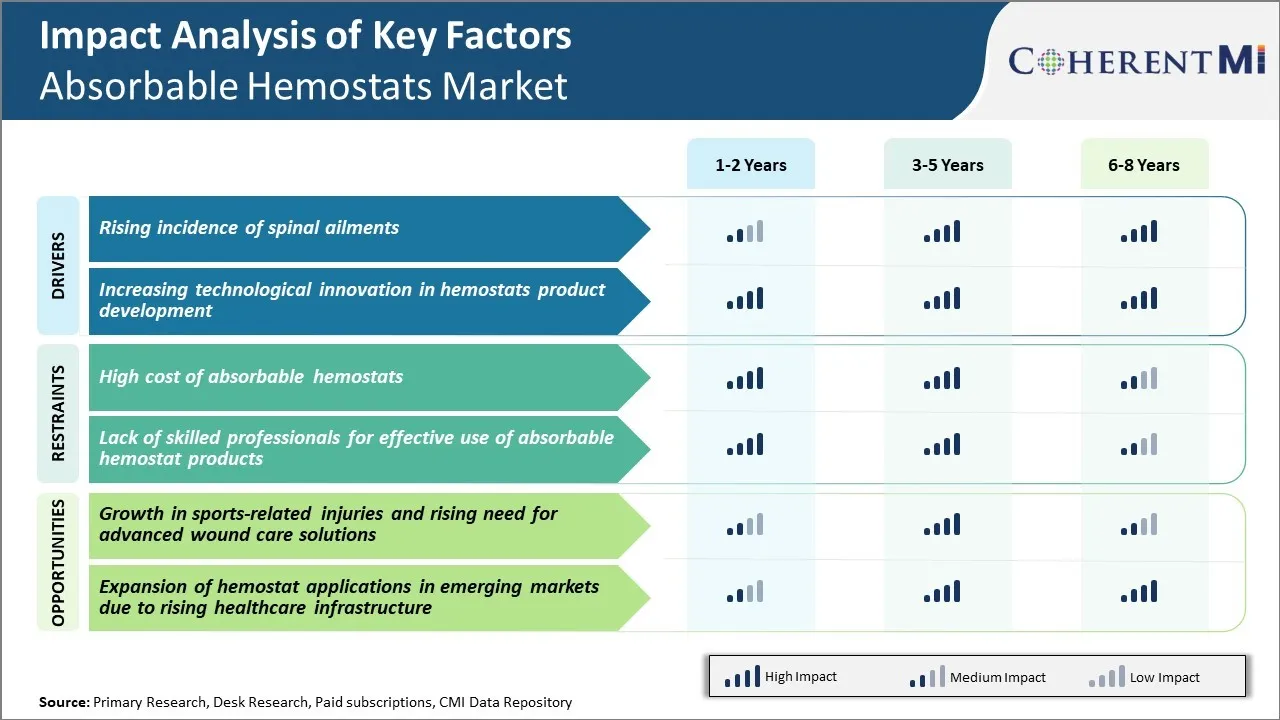

Market Driver - Rising Incidence of Spinal Ailments

There has been significant rise in various types of spinal ailments over the past couple of decades. Spinal issues could range from minor backache caused due to posture or obesity to more critical conditions like slipped disc, damages discs or vertebrae fractures. Aging population across developed nations has also contributed to higher cases of degenerative spine diseases. Prolonged lifestyle associated diseases and lack of physical activity has made populations more prone to spinal disorders. Studies show nearly 80% of Americans will experience back pain at some point which could last from few days to sometimes months.

Spinal surgeries have thus seen substantial increase annually. Whether it is conventional open spine surgery requiring incision or minimally invasive procedures like spinal fusion, decompression surgery etc., all involve certain amount of blood loss. Absorbable hemostats are extensively used in such complex spine surgeries to control bleeding, absorb blood and fluids and promote clotting. Various forms like oxidized cellulose, gelatin matrix thrombin mixtures etc. are preferred depending on severity of bleeding and surgical requirements

Further, as spinal surgeries involving delicate nerves become more advanced, need for minimal blood loss and improved visibility becomes critical for success of such high-stake operations. This drives significant demand for technologically advanced hemostats in spine segment.

Market Driver - Increasing Technological Innovation in Hemostats Product Development

Medical technology industry has been witnessing rapid pace of innovation especially in hemostats domain. Numerous startups and large companies are investing heavily in R&D to develop next generation hemostatic products. There is growing focus on developing combination style hemostats bridging limitations of individual agents. Also, hemostats featuring faster deployment and clotting abilities are being introduced.

For instance, combination of oxidized regenerated cellulose with thrombin or gelatin is gaining favor as they provide dual action hemostasis and sealant effect reducing time in operating room. Similarly, hemostats integrating antibacterial properties are new entrants helping cut down postoperative infections especially important in spinal and brain surgeries.

At the same time, development of resorbable synthetic polymer-based hemostats is opening up new avenues. Compared to natural agent-based options, synthetics provide consistency in performance and absorption properties besides being free from issues like disease transmission.

Advances in material sciences and polymer engineering have enabled design of tailor-made synthetics perfectly suited for specialized surgery requirements. For example, 3D printed hemostats customized as per anatomical areas are new developments. Nanotechnology and drug loading capabilities in hemostats are other innovations unlocking new therapeutic possibilities.

Market Challenge - High Cost of Absorbable Hemostats

One of the major challenges currently being faced by the absorbable hemostats market is the high cost of these products. Absorbable hemostats are manufactured using advanced technologies and materials like oxidized cellulose, polysaccharides, and gelatin to allow for quick clotting and absorption within the body.

However, these advanced production processes and materials come at a significant price. For example, some of the leading absorbable hemostats such as Surgicel and Gelita-Cel cost around $150-200 per unit. This high cost makes absorbable hemostats prohibitive for use in many routine surgical procedures and restricts their adoption to mainly larger and complex surgeries.

The high costs also limit the penetration of these products in price-sensitive developing markets. To address this challenge, manufacturers will need to focus on innovation that allows for cost reduction without compromising on effectiveness. This could include exploring alternative raw materials, streamlining production workflows, and standardizing designs. Overcoming the barrier of high costs will be crucial to realizing the full growth potential of the absorbable hemostats market.

Market Opportunity - Growth in Sports-related Injuries and Rising Need for Advanced Wound Care Solutions

One of the major opportunities for the absorbable hemostats market is the steady rise in sports-related injuries globally. More people are taking up various recreational and competitive sports. However, this has also led to an increase in injuries like muscle tears, bone fractures, and lacerations that often require surgical intervention.

Sports medicine has emerged as a specialized clinical discipline focused on addressing sports-related wounds and injuries. The demand for advanced wound care solutions is witnessing significant growth in this field to aid faster recovery of athletes. Absorbable hemostats that promote quick clotting and healing without leaving any residues in the body have a clear advantage over conventional gauze and cloth wound dressings for sports medicine applications. Their effectiveness in minimally invasive surgeries is also boosting uptake.

With lifestyle disease prevention through regular exercise becoming a priority, the demand for specialized sports injury management and wound care solutions like absorbable hemostats is expected to keep rising in the coming years.

Key winning strategies adopted by key players of Absorbable Hemostats Market

Product Innovation: Developing new and innovative absorbable hemostats products is a key strategy adopted by market players. For example, in 2018, Baxter launched GAVEL Surgical Sealant, an absorbable hemostatic agent designed to control mild to moderate bleeding during surgery. It was the first absorbable hemostat approved for use in a broad range of general, vascular and cardiovascular procedures. This innovative product helped Baxter gain market share.

Acquisitions: Acquiring other companies to gain access to new technologies and markets has been a successful strategy. In 2019, Johnson & Johnson acquired Auris Health to strengthen its position in robot-assisted surgery. This gave J&J absorbable hemostats like SURGICEL products entry into a growing segment.

Partnerships: Establishing partnerships with other players complements product offerings and strengths. For example, in 2017, Baxter partnered with Apollo Endosurgery to offer a comprehensive portfolio of surgical products including absorbable hemostats to customers. In 2020, C.R. Bard partnered with Ethicon to leverage their expertise and expand access to absorbable hemostats like SPONGOSTAN.

Market Expansion: Top players have focused on emerging regions through collaborations, acquisitions and new product launches. For example, in 2015, Baxter established a joint venture with Claris Injectables to manufacture and market hemostats including TachoSil in India.

Segmental Analysis of Absorbable Hemostats Market

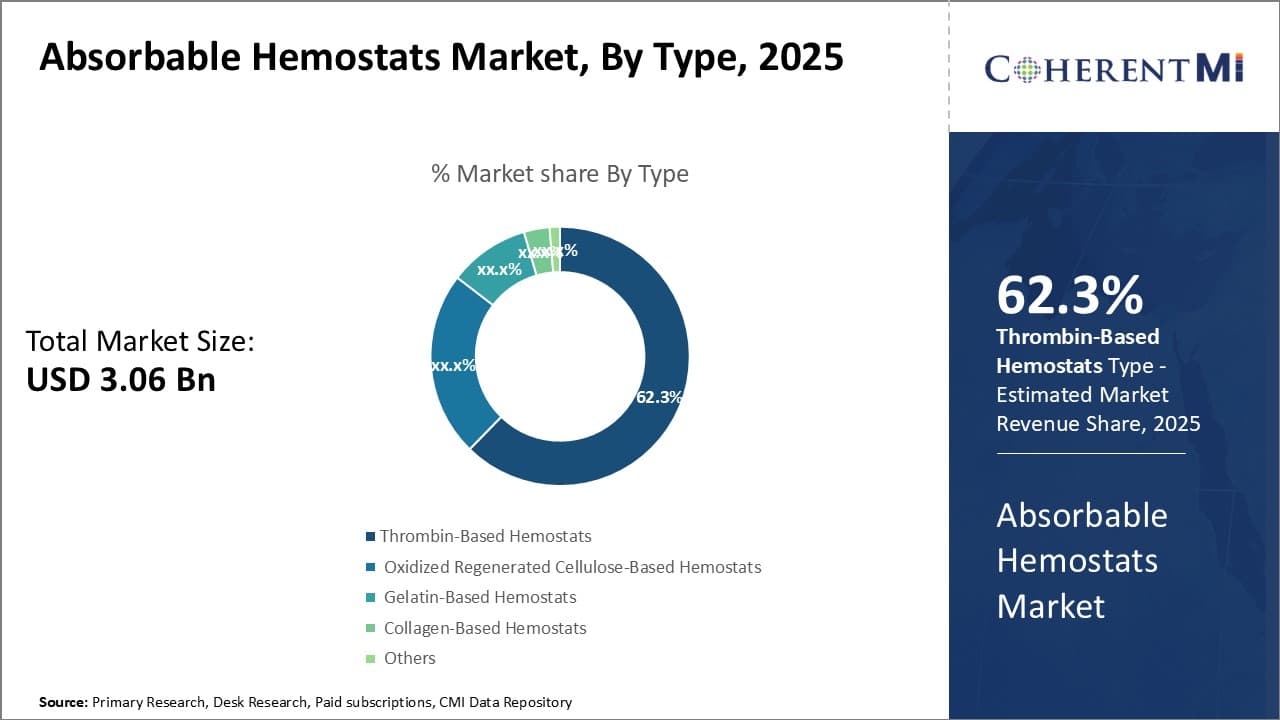

Insights, By Type: Versatility and Wide Applicability Drives Growth of Thrombin-Based Hemostats

Insights, By Type: Versatility and Wide Applicability Drives Growth of Thrombin-Based Hemostats

In terms of type, thrombin-based hemostats contribute the highest share of the market owning to its versatility and wide range of applications. Thrombin-based hemostats work by activating platelets and aiding in the conversion of fibrinogen to fibrin to form blood clots. This mechanism of action makes them effective hemostatic agents for a variety of procedures across surgery types. They are compatible with most tissue types and do not require complex preparation steps prior to application. Moreover, being protein-based, they degrade and absorb quickly in the body post-surgery with minimal inflammatory response.

Thrombin-based hemostats are widely used in cardiovascular, neurosurgery, orthopedic, and trauma procedures due to their rapid and effective hemostasis. In cardiovascular surgery, they help control bleeding from vascular anastomoses and arterial cannulation sites. In neurosurgery, they are preferred for achieving hemostasis in brain matter without promoting excessive swelling. Their malleable formulations make them easy to apply in minimally invasive orthopedic procedures for joints.

In trauma cases, thrombin-based hemostatic pads and powders provide rapid hemostasis for bleeding wounds and lacerations. The versatility of thrombin-based hemostats in terms of applications across surgical specialties as well as compatibility with different tissue types has made it the leading type in the absorbable hemostats market.

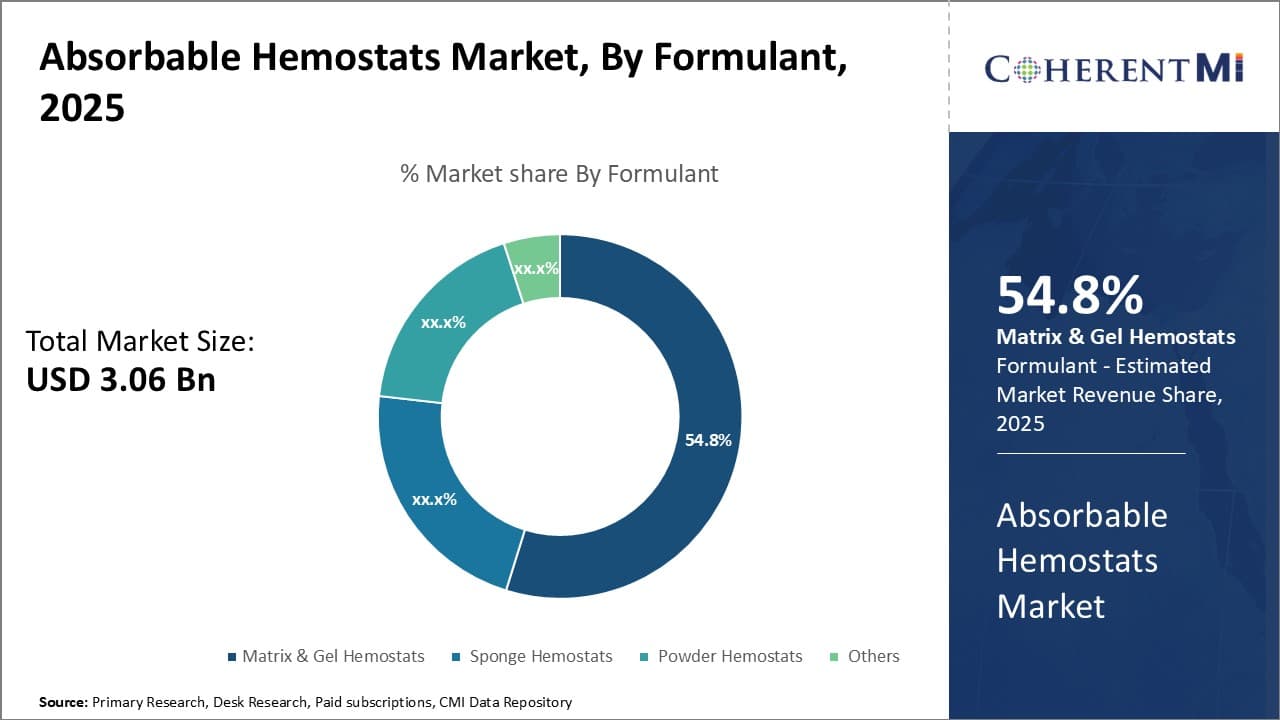

Insights, By Formulant: Superior Performance of Matrix and Gel Hemostats

In terms of formulant, Matrix & Gel Hemostats contributes the highest share of the market owing to their superior performance characteristics over other formulations. Matrix and gel hemostats form an interconnected network upon application that mechanically fills wound cavities to establish hemostasis. Being pliable gels or matrices, they conform well to irregular tissue surfaces and anatomic defects.

Compared to sponge and powder formulations, matrix and gel hemostats exert stronger and faster mechanical compression at the bleeding site. They maintain this compression over an extended duration during the clotting process. Moreover, modern matrix and gel hemostats have added bioactive agents like thrombin to accelerate platelet aggregation for faster hemostasis. Some advanced formulations release clotting factors gradually to sustain hemostasis until natural healing occurs.

The uniformly distributing properties of matrix and gel hemostats allow for more reliable hemostasis compared to sponges which rely on internal compression forces. They are also less disruptive to the surgical site than loose powders and granules. Due to their user-friendly formulations, matrix and gel hemostats have increased uptake in minimally invasive endoscopic procedures where tight gel formulations achieve adequate compression in confined spaces. Overall, superior performance attributes have made Matrix & Gel Hemostats the leading formulant type in the absorbable hemostats market.

Insights, By Application: Higher Complexity and Volume of Neurosurgery Cases Boosts its Share

In terms of application, neurosurgery contributes the highest share of the market. Neurosurgical procedures tend to be highly complex owing to the delicate nature of neural tissues. Achieving secure hemostasis during excision or repair of lesions located near sensitive structures like blood vessels and cranial nerves is critically important.

At the same time, excessive swelling and scar formation must be avoided in the brain post-surgery. Absorbable hemostatic agents are thus indispensable adjuncts that minimize blood loss without increasing tissue inflammation. Furthermore, as neurological disorders and life expectancies rise globally, the case volume and complexity of brain and spine surgeries are increasing rapidly.

Advanced gel and matrix formulations that conform firmly yet gently to irregular neural architectures without disturbing surrounding tissues see extensive uptake. Thrombin-based hemostats that catalytically accelerate clotting while degrading harmlessly also have widespread neurosurgical applications.

Given these advantages, absorbable hemostats have become essential components of advanced hemorrhage management techniques in neuro-oncology, neurovascular, endovascular neurosurgery and trauma procedures. The growing sophistication and volume of the neurosurgical specialty compared to other application areas drives its high market share.

Additional Insights of Absorbable Hemostats Market

- Rising number of musculoskeletal conditions, especially lower back pain, which affects 1.71 billion people globally (2021).

- Increasing number of spinal cord injuries caused by road crashes and falls, with an annual incidence of 250,000 to 500,000 cases globally.

- Gelatin-based hemostats are effective due to their ability to absorb 40 times their weight in blood and fluids, expanding by 200% in vivo, making them a superior option in surgical hemostasis.

Competitive overview of Absorbable Hemostats Market

The major players operating in the Absorbable Hemostats Market include B. Braun, Baxter, Johnson & Johnson, BD, Cura Medical, GELITA MEDICAL, Curasan AG, Meril Life Sciences, Zhonghui Shengxi, Beijing Datsing Bio-tech, Guizhou Jin Jiu Biotech, Beijing Taikesiman, Foryou Medical, Saikesaisi Holdings Group, Biotemed, Hangzhou Singclean Medical Products, Teleflex Incorporated, Hemostasis, LLC, Stryker, and Samyang Holdings Corporation.

Absorbable Hemostats Market Leaders

- B. Braun

- Baxter

- Johnson & Johnson

- BD

- Cura Medical

Absorbable Hemostats Market - Competitive Rivalry

Absorbable Hemostats Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Absorbable Hemostats Market

- In March 2020, Ethicon launched the SURGICEL® POWDER ABSORBABLE HEMOSTAT in Australia, New Zealand, and Thailand, aiding efficient bleeding control in surgeries. Ethicon, part of Johnson & Johnson Medical Devices Companies, strategically introduced this product in Australia, New Zealand, and Thailand during that time. The product was designed to help surgeons control bleeding more efficiently, particularly in situations where traditional hemostasis methods were inadequate. It was already available in regions such as Singapore and Hong Kong and was later introduced in other Asia-Pacific countries, including Japan and Malaysia.

- In January 2018, Ethicon launched SURGICEL® POWDER ABSORBABLE HEMOSTAT in the US to help surgeons control disruptive bleeding, significantly improving surgical outcomes.

Absorbable Hemostats Market Segmentation

- By Type

- Thrombin-Based Hemostats

- Oxidized Regenerated Cellulose-Based Hemostats

- Gelatin-Based Hemostats

- Collagen-Based Hemostats

- Others

- By Formulant

- Matrix & Gel Hemostats

- Sponge Hemostats

- Powder Hemostats

- Others

- By Application

- Neurosurgery

- Orthopedic Surgery

- General Surgery

- Reconstructive Surgery

- Others

- By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the absorbable hemostats market?

The absorbable hemostats market is estimated to be valued at USD 3.06 Bn in 2025 and is expected to reach USD 4.82 Bn by 2032.

What are the key factors hampering the growth of the absorbable hemostats market?

The high cost of absorbable hemostats and lack of skilled professionals for effective use of absorbable hemostat products are the major factors hampering the growth of the absorbable hemostats market.

What are the major factors driving the absorbable hemostats market growth?

The rising incidence of spinal ailments and increasing technological innovation in hemostats product development are the major factors driving the absorbable hemostats market.

Which is the leading type in the absorbable hemostats market?

The leading type segment is thrombin-based hemostats.

Which are the major players operating in the absorbable hemostats market?

Braun, Baxter, Johnson & Johnson, BD, Cura Medical, GELITA MEDICAL, Curasan AG, Meril Life Sciences, Zhonghui Shengxi, Beijing Datsing Bio-tech, Guizhou Jin Jiu Biotech, Beijing Taikesiman, Foryou Medical, Saikesaisi Holdings Group, Biotemed, Hangzhou Singclean Medical Products, Teleflex Incorporated, Hemostasis, LLC, Stryker, Samyang Holdings Corporation are the major players.

What will be the CAGR of the absorbable hemostats market?

The CAGR of the absorbable hemostats market is projected to be 6.7% from 2025-2032.