Acoustic Neuroma Market Size - Analysis

The acoustic neuroma market is estimated to be valued at USD 2.50 Bn in 2025 and is expected to reach USD 4.66 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9% from 2025 to 2032.

Market Size in USD Bn

CAGR9.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.3% |

| Market Concentration | High |

| Major Players | Amgen, Roche, Natus Medical Incorporated, Elekta, Pfizer Inc. and Among Others |

please let us know !

Acoustic Neuroma Market Trends

With advanced diagnostic testing capabilities and growing physician awareness about conditions such as acoustic neuroma, more cases are being identified today than ever before. Traditionally considered a rare condition, it is now widely recognized that it may not be as uncommon as previously thought.

This is enabling earlier detection when the tumor is still small in size and highly treatable through minimally invasive procedures. With timely diagnosis and intervention, chances of preserving facial nerve function and preventing other complications are also higher. Public demand for improved access to screening and diagnostic services is on the rise.

Developed countries worldwide are dedicating higher budgetary allocations year after year towards modernization of their public health infrastructure and health technology advancements. Governments are investing heavily in latest diagnostic and treatment technologies, upgradation of medical facilities, expansion of insurance coverage and strengthening of primary care network.

Neurosurgery in particular has witnessed immense progress driven by technologically advanced tools, resources and skilled workforce. Minimally invasive endoscopic techniques are fast replacing conventional open surgeries resulting in shorter hospital stay and faster recovery times for patients. This has made managements of benign brain and skull base tumors more accessible.

Well-insured populations have widespread purchasing power to avail costly but life-changing medical interventions without facing financial hardship.

One of the major challenges faced by the acoustic neuroma market is the high treatment costs associated with managing the condition. Acoustic neuroma is a rare and non-cancerous tumor that develops on the eighth cranial nerve, which connects the inner ear with the brain.

The costs are further amplified for patients who require multiple surgeries or additional treatments such as proton beam radiation therapy or stereotactic radiosurgery, which have average costs of $50,000-$100,000 per session. With such high price tags associated with managing this rare condition, patient access to treatment gets severely restricted without adequate insurance coverage or subsidies. This financial burden poses a significant challenge for market growth in acoustic neuroma globally.

Market Opportunity - Increasing Collaborations between Major Pharmaceutical Companies

However, large pharmaceutical players are now partnering with biotech startups and academic research centers to share risks and costs associated with researching newer treatment alternatives like drug therapies. For example, Novartis has partnered with academic researchers to investigate potential drug targets.

Prescribers preferences of Acoustic Neuroma Market

Acoustic neuroma is typically treated via a staged approach depending on the size and growth rate of the tumor. For small, non-growing tumors, prescribers may recommend active surveillance with regular MRI scans to monitor the tumor. If the tumor grows or causes symptoms, treatment is pursued.

For large tumors (>3cm), surgeons may recommend microsurgery to remove the tumor. This involves careful dissection near critical cranial nerves due to the tumor's location in the inner ear region. Prescribers consider the patient's age, tumor size/location, prior radiation exposure and comorbidities in recommending surgery vs SRS.

Ongoing surveillance with serial MRI scans remains important to monitor treatment effectiveness and detect any regrowth over time.

Treatment Option Analysis of Acoustic Neuroma Market

Stage I (small): <1 cm. Treatment options include wait-and-scan or stereotactic radiosurgery (SRS). SRS uses highly focused radiation to destroy tumor tissue, such as with Gamma Knife or CyperKnife. This noninvasive option is preferred for slow-growing tumors.

Stage III (large): 2-3 cm. Microsurgery via total resection is the standard treatment. Complete tumor removal is challenging but provides best chance of tumor control. Conservation surgery may also be considered.

Recurrent tumors are retreated based on prior therapy—SRS if previously treated with surgery or conservation approach, or repeat surgery/SRS if recurrence after prior radiation. Ongoing monitoring for regrowth is important as acoustic neuromas have high recurrence rates without complete resection.

Key winning strategies adopted by key players of Acoustic Neuroma Market

Focus on patient advocacy and awareness programs: Leading players like GENEWIZ and Accuray have invested heavily in patient advocacy and awareness programs related to acoustic neuroma. GENEWIZ launched a campaign in 2018 called "AN Champions" which aimed to educate people about signs, symptoms and treatment options for acoustic neuroma. It featured real patient stories and expert interviews.

Invest in new radiosurgery techniques: Leaders like ELEKTA invested heavily in developing new gamma knife radiosurgery systems like Leksell Gamma Knife Icon in 2015. It offered higher conformity and precision in tumor targeting compared to older models. This allowed treatment of larger and complicated tumor cases. After its launch, Icon captured over 30% market share in key regions within 2 years. Its clinical success strengthened ELEKTA's brand dominance in radiosurgery segment. Ongoing R&D in areas like real-time MRI-guided radiation holds promise.

Segmental Analysis of Acoustic Neuroma Market

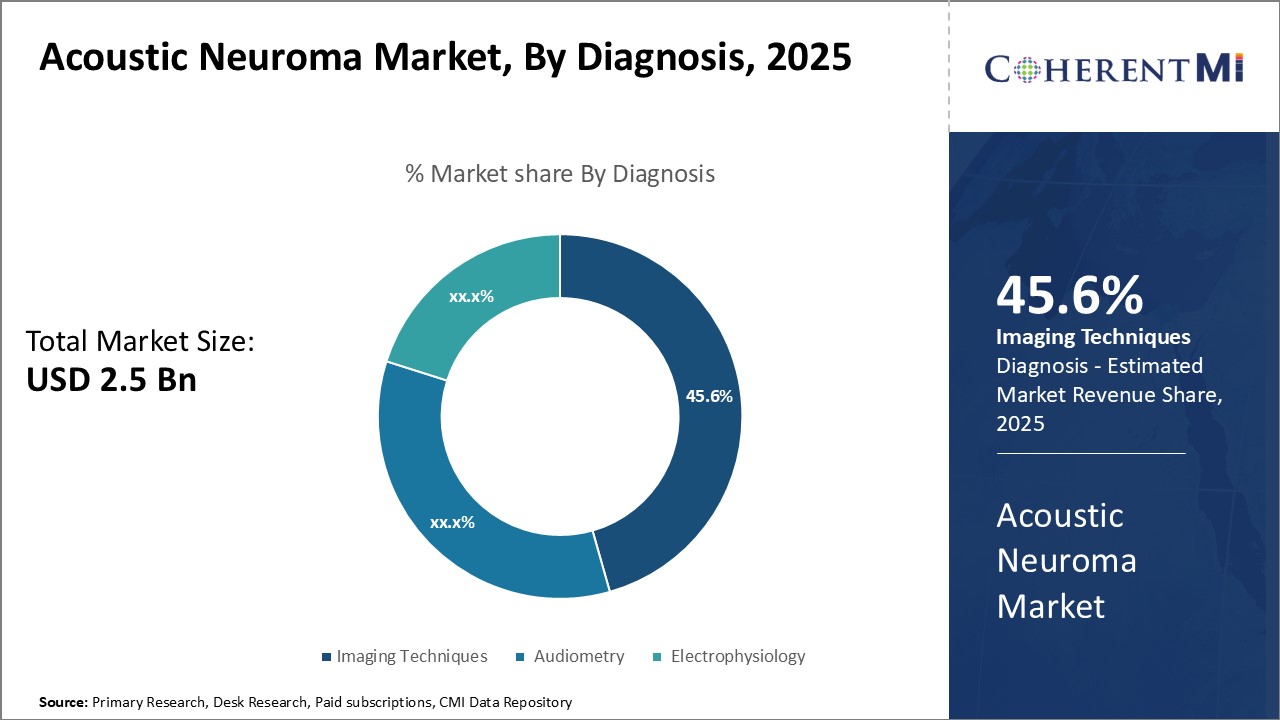

Insights, By Diagnosis: Imaging Techniques Dominates Acoustic Neuroma Diagnosis owing to Effective Tumor Detection

Insights, By Diagnosis: Imaging Techniques Dominates Acoustic Neuroma Diagnosis owing to Effective Tumor DetectionIn terms of diagnosis, imaging techniques such as magnetic resonance imaging (MRI) and computed tomography (CT) scans constitute the major segment owing to their effectiveness in acoustic neuroma detection. MRI has established itself as the gold standard diagnostic technique due to its unparalleled soft-tissue contrast capability. The multi-planar imaging ability of MRI allows accurate identification of the size, location and extent of compression of nerves by the tumor. Furthermore, MRI does not involve use of ionizing radiation unlike CT scans.

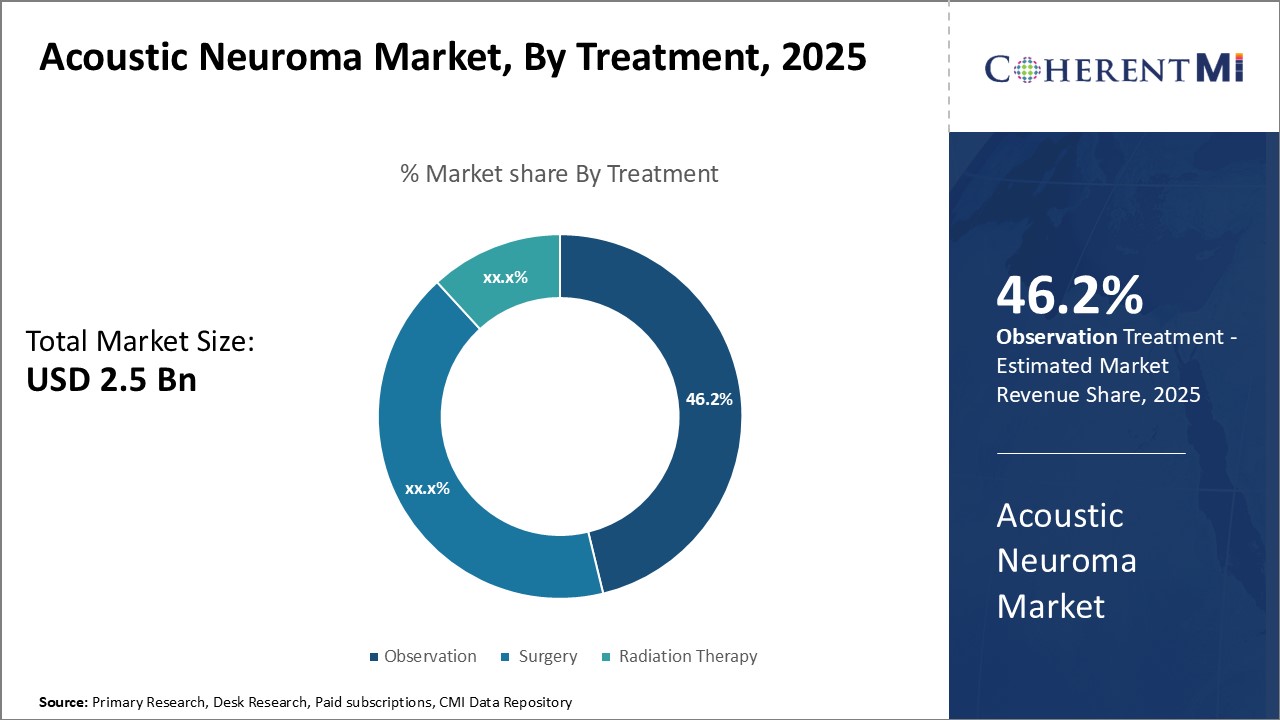

Surgery is the mainstay treatment option for acoustic neuromas as it offers the best chances of complete tumor removal and cure. The goal of surgery is to extirpate the tumor while preserving hearing and facial nerve function to the maximum possible extent. With improvements in microsurgical techniques, better understanding of tumor anatomy and advances in neuromonitoring, modern surgery can successfully resect most acoustic neuromas.

When performed by experienced neurotologists, surgery provides definitive diagnosis through histopathology and prevents future tumor enlargement. Complete resection eliminates the risks of inevitable tumor growth associated with surveillance protocols. For all these reasons, surgery remains the first treatment option offered to the majority of acoustic neuroma patients that are suitable surgical candidates. Ongoing operative and peri-operative refinements serve to expand eligibility and enhance post-operative outcomes, cementing the central role of surgery.

Additional Insights of Acoustic Neuroma Market

- The prevalence of acoustic neuroma is more common in middle-aged adults, particularly between the ages of 30 to 60.

- Acoustic neuroma accounts for 6% of brain tumor cases, and it is more frequently diagnosed in the United States, EU5, and Japan.

- Significant unmet needs in early-stage diagnostic tools are driving pharmaceutical companies to invest in new technologies for earlier detection.

- The global burden of acoustic neuroma has been increasing, with 1 in 100,000 people affected annually.

- The patient population for acoustic neuroma in the US, EU5, and Japan is forecasted to grow at a rate of 2.5% per year over the next decade.

Competitive overview of Acoustic Neuroma Market

The major players operating in the Acoustic Neuroma Market include Amgen, Roche, Natus Medical Incorporated, Elekta, Pfizer Inc., F. Hoffmann-La Roche AG, CIVCO MEDICAL SOLUTIONS, Novartis AG, MAICO Diagnostics GmbH, Siemens Healthcare GmbH, and Interacoustics A/S.

Acoustic Neuroma Market Leaders

- Amgen

- Roche

- Natus Medical Incorporated

- Elekta

- Pfizer Inc.

Acoustic Neuroma Market - Competitive Rivalry

Acoustic Neuroma Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Acoustic Neuroma Market

- In November 2023, Amgen announced a strategic collaboration with Elekta to integrate their surgical solutions, aimed at improving the precision of Acoustic Neuroma treatments. This is expected to enhance patient outcomes by reducing treatment-related risks.

- In October 2023, Roche launched a new drug aimed at targeting early-stage Acoustic Neuroma, which showed promising results in reducing tumor size. This development strengthens Roche’s position in the neurology market.

- In September 2023, Siemens Healthcare introduced a cutting-edge diagnostic tool to improve the detection of Acoustic Neuroma at earlier stages, potentially increasing patient survival rates through timely interventions.

Acoustic Neuroma Market Segmentation

- By Diagnosis

- Imaging Techniques

- Audiometry

- Electrophysiology

- By Treatment

- Observation

- Surgery

- Radiation Therapy

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the acoustic neuroma market?

The acoustic neuroma market is estimated to be valued at USD 2.50 Bn in 2025 and is expected to reach USD 4.66 Bn by 2032.

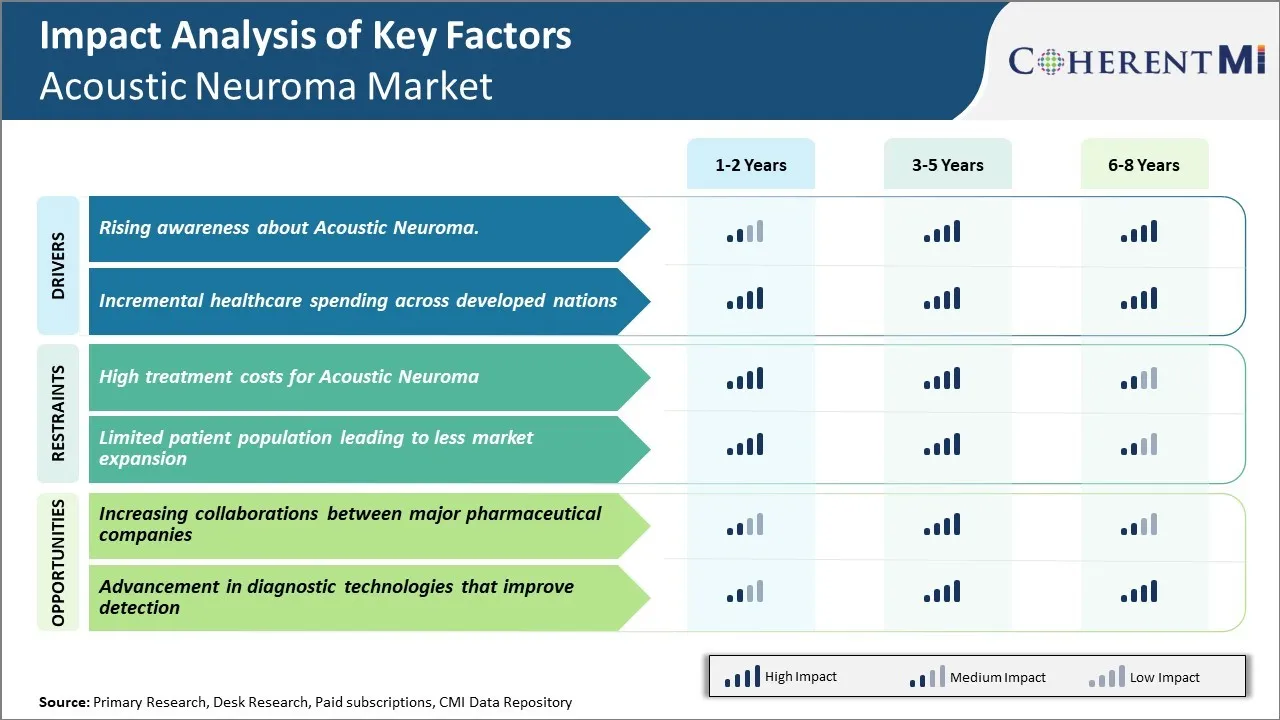

What are the key factors hampering the growth of the acoustic neuroma market?

The high treatment costs for acoustic neuroma and limited patient population leading to less market expansion are the major factors hampering the growth of the acoustic neuroma market.

What are the major factors driving the acoustic neuroma market growth?

The rising awareness about acoustic neuroma. and incremental healthcare spending across developed nations are the major factors driving the acoustic neuroma market.

Which is the leading Diagnosis in the acoustic neuroma market?

The leading diagnosis segment is imaging techniques.

Which are the major players operating in the acoustic neuroma market?

Amgen, Roche, Natus Medical Incorporated, Elekta, Pfizer Inc., F. Hoffmann-La Roche AG, CIVCO MEDICAL SOLUTIONS, Novartis AG, MAICO Diagnostics GmbH, Siemens Healthcare GmbH, and Interacoustics A/S are the major players.

What will be the CAGR of the acoustic neuroma market?

The CAGR of the acoustic neuroma market is projected to be 9.3% from 2025-2032.