Adult Diapers Market Size - Analysis

The adult diapers market is estimated to be valued at USD 18.70 Bn in 2025 and is expected to reach USD 30.62 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. The adult diapers market is expected to witness positive growth over the forecast period owing to the rising geriatric population worldwide.

The adult diapers market is estimated to be valued at USD 18.70 Bn in 2025 and is expected to reach USD 30.62 Bn by 2032.

It is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032.

The adult diapers market is expected to witness positive growth over the forecast period owing to the rising geriatric population worldwide.

Market Size in USD Bn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | High |

| Major Players | Kimberly-Clark Corporation, Procter & Gamble (P&G), Unicharm Corporation, Essity AB, Domtar Corporation and Among Others |

please let us know !

Adult Diapers Market Trends

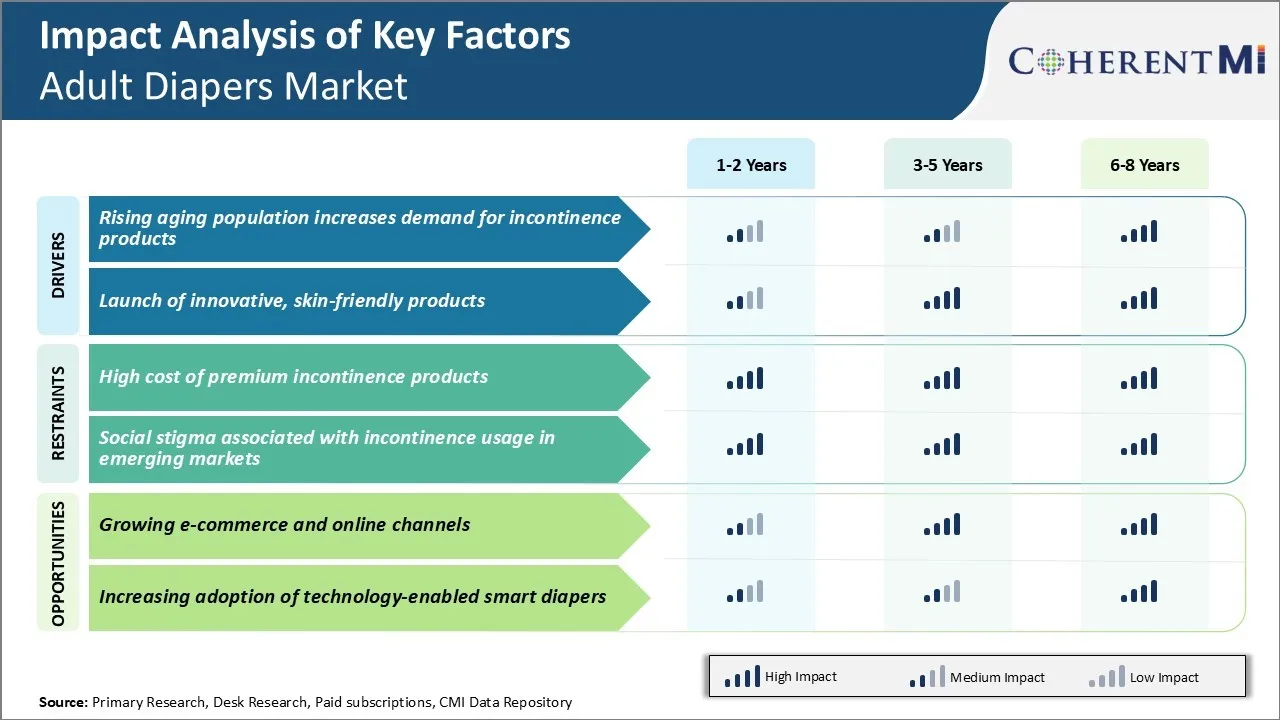

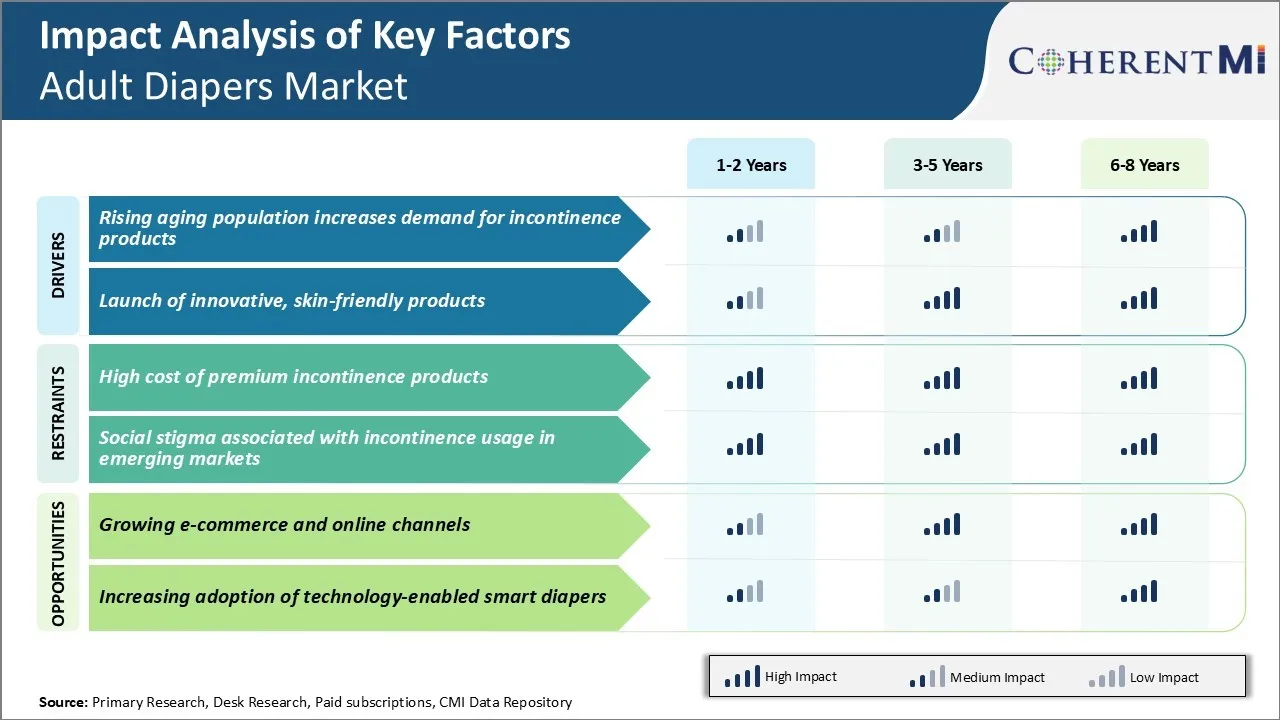

Market Driver - Rising Aging Population and Need for Incontinence Care

As life expectancy continues to increase around the world, the population of seniors is growing at an unprecedented rate. According to the United Nations, there are currently around 703 million people aged 65 years or over globally, and this number is projected to double to nearly 1.5 billion by 2050.

Urinary incontinence refers to the accidental leakage of urine and is very common among the elderly. It has been estimated that nearly 40-50% of people living in nursing homes and 25-45% of community dwelling older adults suffer from some form of urinary incontinence.

The stigma around incontinence often deters people from openly discussing their condition. However, with greater awareness, more seniors are opting for absorbent products like adult diapers to manage their incontinence discreetly and maintain their independence. With life expectancy on the rise, this aging of populations worldwide is expected to significantly boost sales volumes in the years to come. This is expected to drive growth of the adult diapers market.

Market Driver - Comfort and Discretion with Innovative Designs

Bladders weaken with age necessitating frequent bathroom trips for some and absorbent products for others. Traditional adult diaper designs were often bulky and uncomfortable to wear for long periods. However, major brands in the adult diapers market have intensified their focus on product innovation to address these pain points and make absorbent solutions more user-friendly.

Thinner, breathable materials and discreet designs that do not resemble baby diapers have gained popularity. Skin-friendly formulations have also been incorporated to prevent rashes. Some adult diapers now come with wetness indicators, elasticized sides for a better fit and leak-guards for added assurance. Dri-weave top sheets wick moisture away from the skin while gels and granules lock liquid inside the absorbent core.

Novel products like belted-briefs and underwear-style pads provide flexibility of use. Such consumer-centric innovations have enhanced comfort, discretion and quality of life for users. Continuous efforts to optimize adult diaper design, fit and materials thus augur well for revenues of the adult diapers market in the future.

Market Challenge - High Cost of Premium Incontinence Products

One of the key challenges facing the adult diapers market is the high cost of premium incontinence products. These more absorbent and discreet products come at a significant price premium compared to basic adult diapers. While the extra protection and discretion they offer is valuable to those suffering from moderate to severe incontinence issues, the high prices make them unaffordable for many consumers. This is a major barrier as it prevents people from accessing the best adult diaper products for their needs.

If prices could come down through innovations, economies of scale or subsidies, it would help boost demand and allow more consumers to get the protective products they need. However, it remains a challenge for brands in the adult diapers market to significantly lower costs given the intensive production and high-performance materials required for premium incontinence items.

Market Opportunity - Growing E-Commerce and Online Channels

One significant opportunity for the adult diapers market is the growing space of e-commerce and online retail channels. As people become increasingly comfortable shopping online, especially for sensitive products, it opens up new avenues for brands to promote and sell incontinence items.

On websites and apps, consumers can discreetly browse the range of options, read reviews, and have products discreetly delivered to their door. This removes the discomfort some may feel when purchasing such items in person. It also makes a wider selection of products available to rural and remote communities.

Leading companies have invested in building out their own e-commerce platforms as well as selling through marketplaces like Amazon. If more brands follow suit and improve their online shopping experience, it could help boost adult diapers market penetration. Increased online accessibility may also help lower the perceived stigma surrounding incontinence and encourage more people to seek solutions earlier.

As life expectancy continues to increase around the world, the population of seniors is growing at an unprecedented rate.

According to the United Nations, there are currently around 703 million people aged 65 years or over globally, and this number is projected to double to nearly 1.5 billion by 2050.

Urinary incontinence refers to the accidental leakage of urine and is very common among the elderly.

It has been estimated that nearly 40-50% of people living in nursing homes and 25-45% of community dwelling older adults suffer from some form of urinary incontinence.

The stigma around incontinence often deters people from openly discussing their condition.

However, with greater awareness, more seniors are opting for absorbent products like adult diapers to manage their incontinence discreetly and maintain their independence.

With life expectancy on the rise, this aging of populations worldwide is expected to significantly boost sales volumes in the years to come.

This is expected to drive growth of the adult diapers market.

Bladders weaken with age necessitating frequent bathroom trips for some and absorbent products for others.

Traditional adult diaper designs were often bulky and uncomfortable to wear for long periods.

However, major brands in the adult diapers market have intensified their focus on product innovation to address these pain points and make absorbent solutions more user-friendly.

Thinner, breathable materials and discreet designs that do not resemble baby diapers have gained popularity.

Skin-friendly formulations have also been incorporated to prevent rashes.

Some adult diapers now come with wetness indicators, elasticized sides for a better fit and leak-guards for added assurance.

Dri-weave top sheets wick moisture away from the skin while gels and granules lock liquid inside the absorbent core.

Novel products like belted-briefs and underwear-style pads provide flexibility of use.

Such consumer-centric innovations have enhanced comfort, discretion and quality of life for users.

Continuous efforts to optimize adult diaper design, fit and materials thus augur well for revenues of the adult diapers market in the future.

One of the key challenges facing the adult diapers market is the high cost of premium incontinence products.

These more absorbent and discreet products come at a significant price premium compared to basic adult diapers.

While the extra protection and discretion they offer is valuable to those suffering from moderate to severe incontinence issues, the high prices make them unaffordable for many consumers.

This is a major barrier as it prevents people from accessing the best adult diaper products for their needs.

If prices could come down through innovations, economies of scale or subsidies, it would help boost demand and allow more consumers to get the protective products they need.

However, it remains a challenge for brands in the adult diapers market to significantly lower costs given the intensive production and high-performance materials required for premium incontinence items.

One significant opportunity for the adult diapers market is the growing space of e-commerce and online retail channels.

As people become increasingly comfortable shopping online, especially for sensitive products, it opens up new avenues for brands to promote and sell incontinence items.

On websites and apps, consumers can discreetly browse the range of options, read reviews, and have products discreetly delivered to their door.

This removes the discomfort some may feel when purchasing such items in person.

It also makes a wider selection of products available to rural and remote communities.

Leading companies have invested in building out their own e-commerce platforms as well as selling through marketplaces like Amazon.

If more brands follow suit and improve their online shopping experience, it could help boost adult diapers market penetration.

Increased online accessibility may also help lower the perceived stigma surrounding incontinence and encourage more people to seek solutions earlier.

Key winning strategies adopted by key players of Adult Diapers Market

Focus on product innovation and expanding product portfolio- Major players in the adult diapers market like Kimberly-Clark, Essity, and Unicharm have extensively invested in R&D to develop innovative adult diaper designs that offer improved fit, comfort and discretion.

Target senior care facilities and hospitals- Most adult incontinence issues occur in the elderly population living in nursing homes or undergoing rehab.

Aggressive marketing and branding - Leaders invested heavily in marketing campaigns to reduce the social stigma around adult diapers. For instance, Depend's "I'm comfortable with it, why aren't you?" campaign from 2016 helped normalize their use.

Pricing strategies - While premium players dominate the adult diapers market through innovation, private label companies utilize competitive pricing. Private label brands captured 25% US market share by 2020 through affordable prices set at 20-30% below branded counterparts.

Focus on product innovation and expanding product portfolio- Major players in the adult diapers market like Kimberly-Clark, Essity, and Unicharm have extensively invested in R&D to develop innovative adult diaper designs that offer improved fit, comfort and discretion.

Target senior care facilities and hospitals- Most adult incontinence issues occur in the elderly population living in nursing homes or undergoing rehab.

Aggressive marketing and branding - Leaders invested heavily in marketing campaigns to reduce the social stigma around adult diapers.

For instance, Depend's "I'm comfortable with it, why aren't you?" campaign from 2016 helped normalize their use.

Pricing strategies - While premium players dominate the adult diapers market through innovation, private label companies utilize competitive pricing.

Private label brands captured 25% US market share by 2020 through affordable prices set at 20-30% below branded counterparts.

Segmental Analysis of Adult Diapers Market

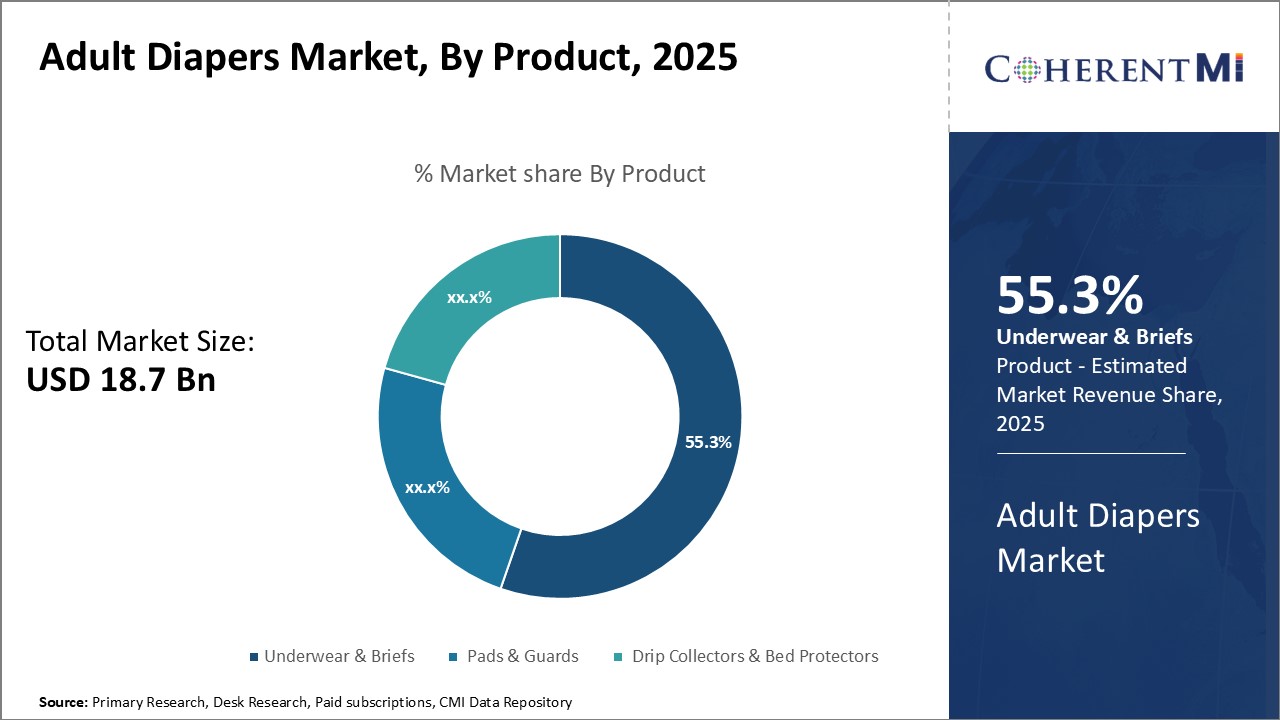

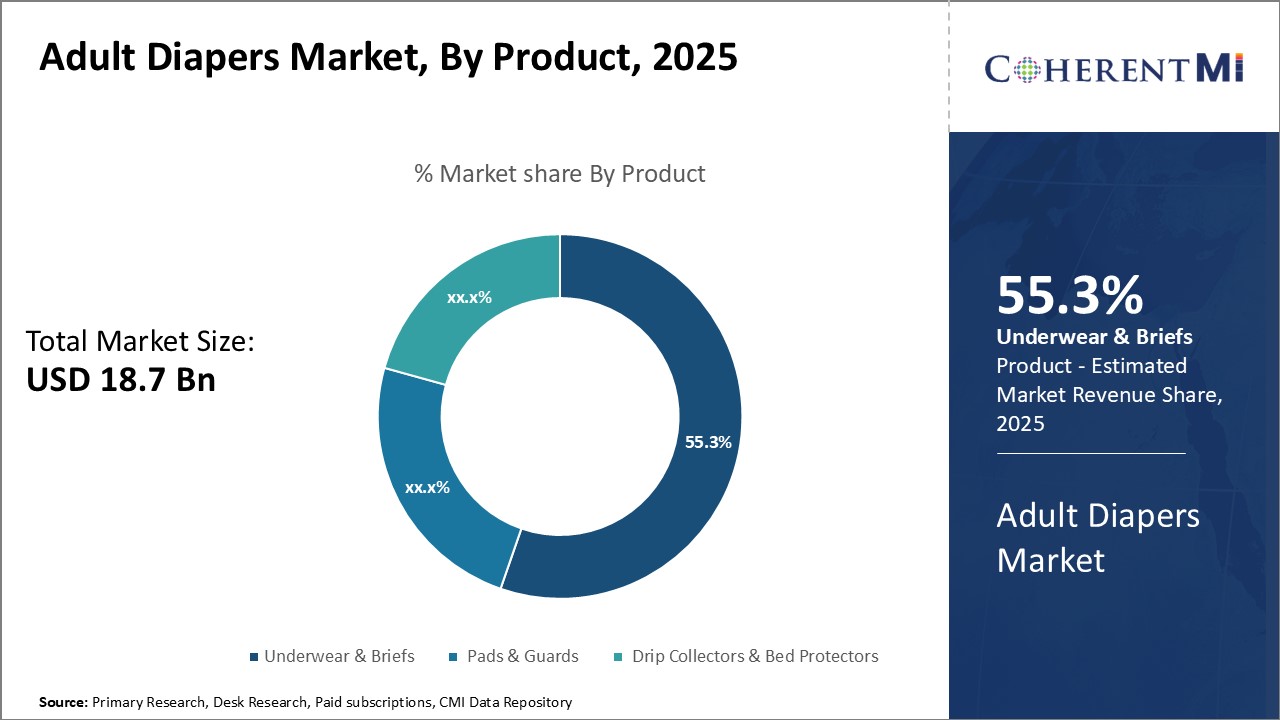

Insights, By Product: Comfort and Absorbency Drive Underwear & Briefs Segment

Insights, By Product: Comfort and Absorbency Drive Underwear & Briefs Segment

In terms of product, underwear & briefs contributes 55.3% share of the adult diapers market in 2025. This is owing to its comfortable design and superior absorbency. Underwear and briefs are designed similar to regular underwear, making them a discreet and comfortable option for consumers.

The brief-like style also ensures a secure and comfortable fit. Many brands offer different rises, cuts and waist styles to suit individual body types and preferences. These products are also simpler to use compared to external pads, which have to be fastened properly. The briefs can simply be pulled on and off like regular underwear. Their comfortable all-day-wear capability and absorbency make them a preferable choice over other product types.

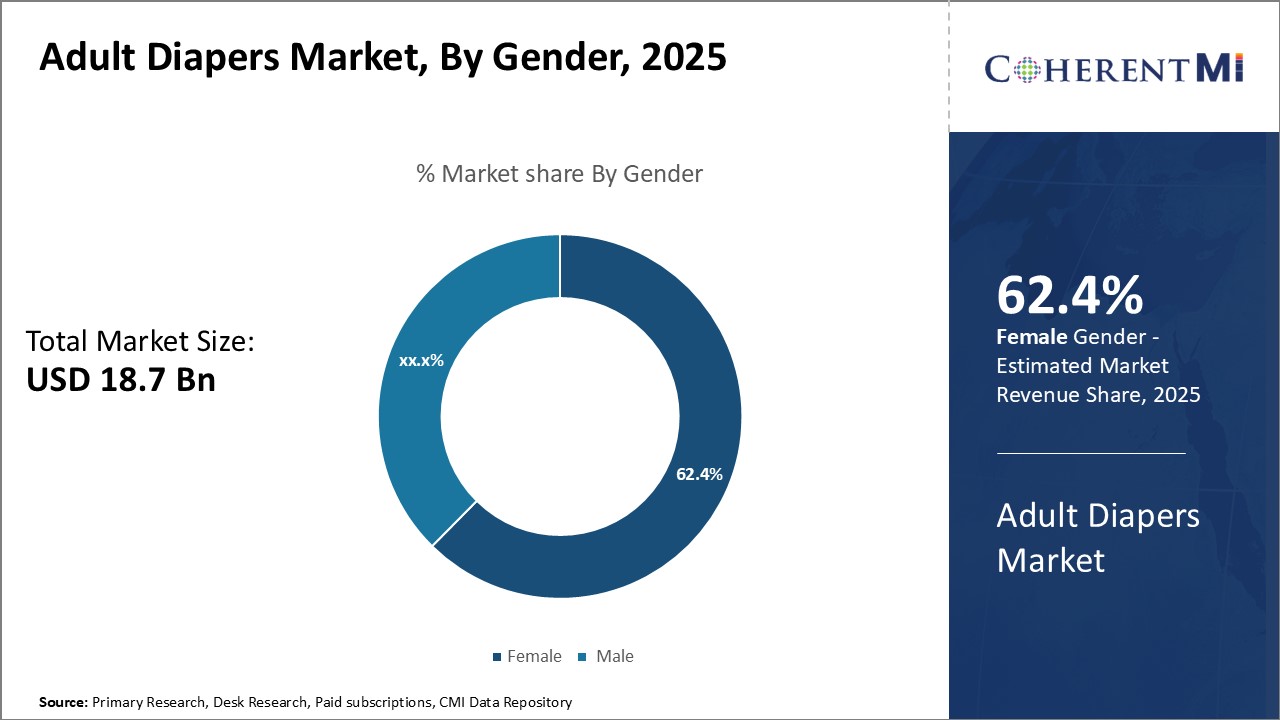

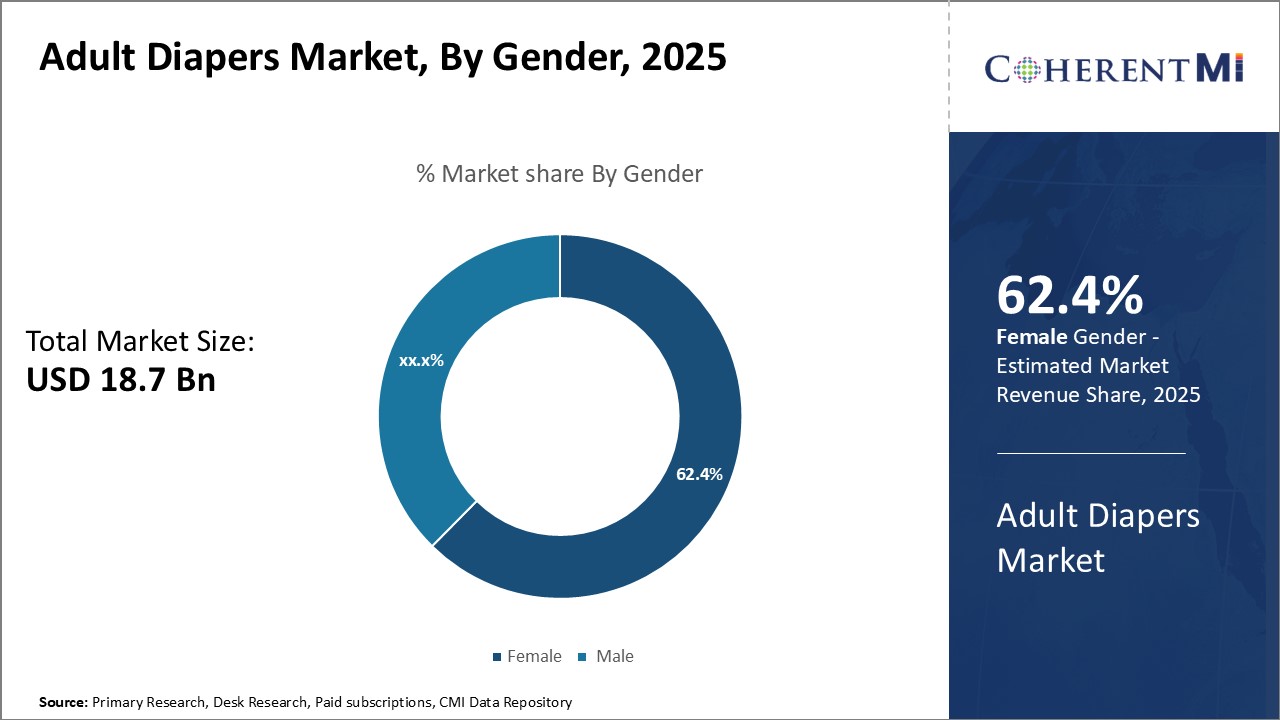

Insights, By Gender: Independence and Discretion Favor Female Segment

In terms of gender, the female segment contributes 62.4% share of the adult diapers market in 2025. This is owing to priorities of independence and discretion. Women form the largest group of consumers requiring incontinence products. With age, the prevalence of incontinence increases among females. However, dealing with the condition typically poses more challenges for women who want to remain independent. External pads or diapers can feel bulky underneath clothes and limit mobility.

Women are also generally more active than men. As a result, lightweight and discreet products that don't restrict movement are highly sought after. This makes dedicated adult diaper designs suited for women an attractive option. These gender-specific products blend in better with regular clothing compared to unisex offerings. The added privacy and discretion they provide help boost women's confidence in managing their condition without having to compromise on an active lifestyle.

Insights, By Distribution Channel: Expert Advice and Availability Drive Pharmacies Segment

In terms of distribution channel, pharmacies contribute the highest share to the adult diapers market owing to accessibility of expert advice and wide product availability. When first experiencing incontinence symptoms, many consumers prefer consulting healthcare professionals for guidance and recommendations. As trusted medical advice providers present locally, pharmacies are a convenient first-stop for such consultations.

This exposure helps consumers assess and select the most appropriate products based on first-hand inspection. The instant purchase option after consulting and sampling products adds to the convenience pharmacies provide. Their accessibility and integrated expert consultation and sales services hence drive their leading position in the adult diapers market.

Insights, By Product: Comfort and Absorbency Drive Underwear & Briefs Segment

Insights, By Product: Comfort and Absorbency Drive Underwear & Briefs SegmentIn terms of product, underwear & briefs contributes 55.3% share of the adult diapers market in 2025.

This is owing to its comfortable design and superior absorbency.

Underwear and briefs are designed similar to regular underwear, making them a discreet and comfortable option for consumers.

The brief-like style also ensures a secure and comfortable fit.

Many brands offer different rises, cuts and waist styles to suit individual body types and preferences.

These products are also simpler to use compared to external pads, which have to be fastened properly.

The briefs can simply be pulled on and off like regular underwear.

Their comfortable all-day-wear capability and absorbency make them a preferable choice over other product types.

In terms of gender, the female segment contributes 62.4% share of the adult diapers market in 2025.

This is owing to priorities of independence and discretion. Women form the largest group of consumers requiring incontinence products.

With age, the prevalence of incontinence increases among females.

However, dealing with the condition typically poses more challenges for women who want to remain independent.

External pads or diapers can feel bulky underneath clothes and limit mobility.

Women are also generally more active than men. As a result, lightweight and discreet products that don't restrict movement are highly sought after.

This makes dedicated adult diaper designs suited for women an attractive option.

These gender-specific products blend in better with regular clothing compared to unisex offerings.

The added privacy and discretion they provide help boost women's confidence in managing their condition without having to compromise on an active lifestyle.

In terms of distribution channel, pharmacies contribute the highest share to the adult diapers market owing to accessibility of expert advice and wide product availability.

When first experiencing incontinence symptoms, many consumers prefer consulting healthcare professionals for guidance and recommendations.

As trusted medical advice providers present locally, pharmacies are a convenient first-stop for such consultations.

This exposure helps consumers assess and select the most appropriate products based on first-hand inspection.

The instant purchase option after consulting and sampling products adds to the convenience pharmacies provide.

Their accessibility and integrated expert consultation and sales services hence drive their leading position in the adult diapers market.

Additional Insights of Adult Diapers Market

- Several adult diaper manufacturers have formed partnerships with hospitals and clinics to ensure their products reach patients promptly. This synergy not only improves patient care but also helps manufacturers build trust and credibility among medical professionals.

- Many brands are adopting a subscription model to provide hassle-free delivery and discounted pricing. This instance signifies a shift toward customer-centric and convenience-driven purchasing patterns.

- Increased Hospital Adoption: Hospitals globally report a 15–20% year-over-year increase in usage of adult diapers for post-operative and long-term care patients. This trend correlates with better patient mobility and hygiene management.

- Growing E-Commerce Share: Online sales of adult diapers are growing at a rate of around 25% annually, attributed to convenient home delivery, privacy benefits, and subscription discount models.

- Several adult diaper manufacturers have formed partnerships with hospitals and clinics to ensure their products reach patients promptly. This synergy not only improves patient care but also helps manufacturers build trust and credibility among medical professionals.

- Many brands are adopting a subscription model to provide hassle-free delivery and discounted pricing. This instance signifies a shift toward customer-centric and convenience-driven purchasing patterns.

- Increased Hospital Adoption: Hospitals globally report a 15–20% year-over-year increase in usage of adult diapers for post-operative and long-term care patients. This trend correlates with better patient mobility and hygiene management.

- Growing E-Commerce Share: Online sales of adult diapers are growing at a rate of around 25% annually, attributed to convenient home delivery, privacy benefits, and subscription discount models.

Competitive overview of Adult Diapers Market

The major players operating in the adult diapers market include Kimberly-Clark Corporation, Procter & Gamble (P&G), Unicharm Corporation, Essity AB, Domtar Corporation, Ontex Group, Cardinal Health, Principle Business Enterprises, Hengan International Group Company Limited, First Quality Enterprises, Inc., and PAUL HARTMANN AG.

The major players operating in the adult diapers market include Kimberly-Clark Corporation, Procter & Gamble (P&G), Unicharm Corporation, Essity AB, Domtar Corporation, Ontex Group, Cardinal Health, Principle Business Enterprises, Hengan International Group Company Limited, First Quality Enterprises, Inc., and PAUL HARTMANN AG.

Adult Diapers Market Leaders

- Kimberly-Clark Corporation

- Procter & Gamble (P&G)

- Unicharm Corporation

- Essity AB

- Domtar Corporation

- Kimberly-Clark Corporation

- Procter & Gamble (P&G)

- Unicharm Corporation

- Essity AB

- Domtar Corporation

Recent Developments in Adult Diapers Market

- In March 2024, Domtar Corporation did not announce any specific expansion of its manufacturing facilities in North America involving high-speed production lines. However, the company has been actively investing in modernizing its operations to meet rising demand and enhance competitiveness.

- In October 2023, Unicharm Corporation announced the upcoming nationwide release of the enhanced "LIFREE Ultra Slim Comfort Pants" in mid-November 2023. These adult disposable pants incorporate Ultrasonic Bonding Technology in the waist area, enhancing comfort and ease of use. This innovation also improves compression and loading efficiency, contributing to environmental sustainability.

- In March 2024, Domtar Corporation did not announce any specific expansion of its manufacturing facilities in North America involving high-speed production lines. However, the company has been actively investing in modernizing its operations to meet rising demand and enhance competitiveness.

- In October 2023, Unicharm Corporation announced the upcoming nationwide release of the enhanced "LIFREE Ultra Slim Comfort Pants" in mid-November 2023. These adult disposable pants incorporate Ultrasonic Bonding Technology in the waist area, enhancing comfort and ease of use. This innovation also improves compression and loading efficiency, contributing to environmental sustainability.

Adult Diapers Market Segmentation

- By Product

- Underwear & Briefs

- Pads & Guards

- Drip Collectors & Bed Protectors

- By Gender

- Female

- Male

- By Distribution Channel

- Pharmacies

- Online Channels

- Others

- By Product

- Underwear & Briefs

- Pads & Guards

- Drip Collectors & Bed Protectors

- By Gender

- Female

- Male

- By Distribution Channel

- Pharmacies

- Online Channels

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting.

She is proficient in market estimation, competitive analysis, and patent analysis.

Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making.

Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.