Aerial Work Platforms Market Size - Analysis

The aerial work platforms market is estimated to be valued at USD 12.19 Bn in 2025 and is expected to reach USD 20.89 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 8.00% from 2025 to 2032. The aerial work platforms market is driven by the growth in construction industry as these machines enable efficient and safer working at height for various construction activities.

The aerial work platforms market is estimated to be valued at USD 12.19 Bn in 2025 and is expected to reach USD 20.89 Bn by 2032.

It is projected to grow at a compound annual growth rate (CAGR) of 8.00% from 2025 to 2032.

The aerial work platforms market is driven by the growth in construction industry as these machines enable efficient and safer working at height for various construction activities.

Market Size in USD Bn

CAGR8.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.00% |

| Market Concentration | Medium |

| Major Players | JLG Industries (Oshkosh Corporation), Terex Corporation, Haulotte Group, Linamar Corporation (Skyjack), Aichi Corporation (Toyota Industries) and Among Others |

please let us know !

Aerial Work Platforms Market Trends

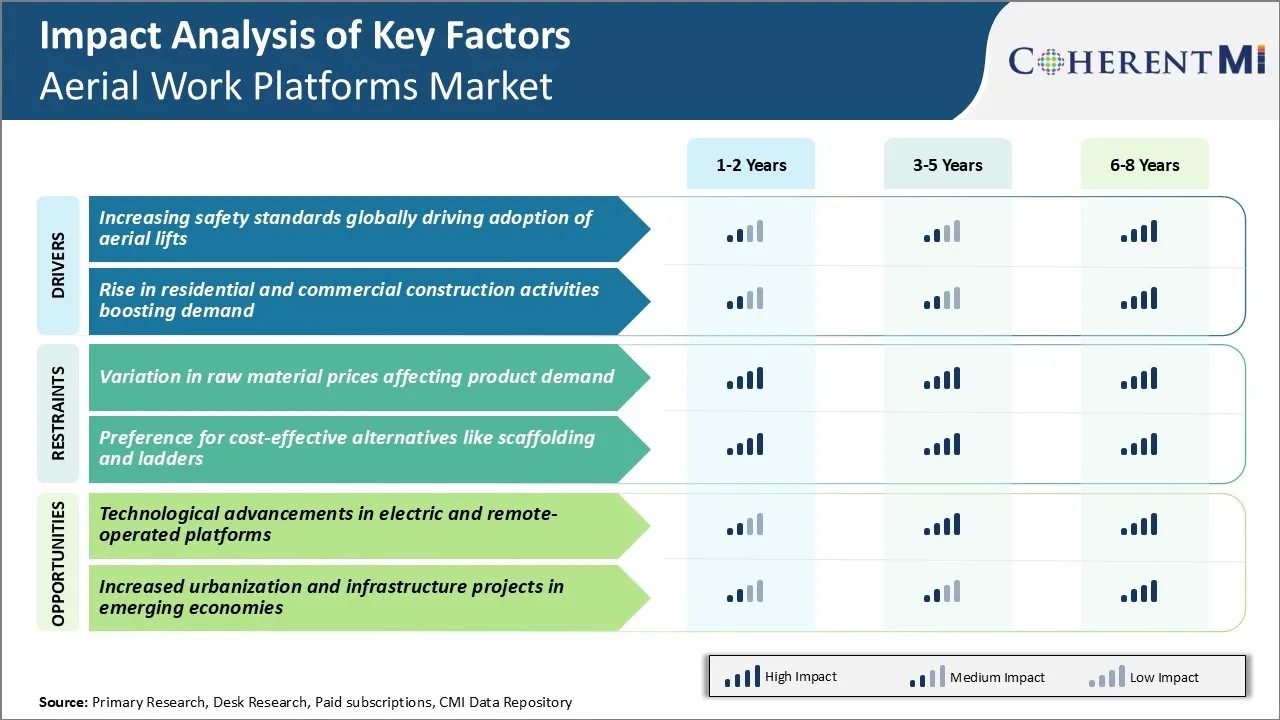

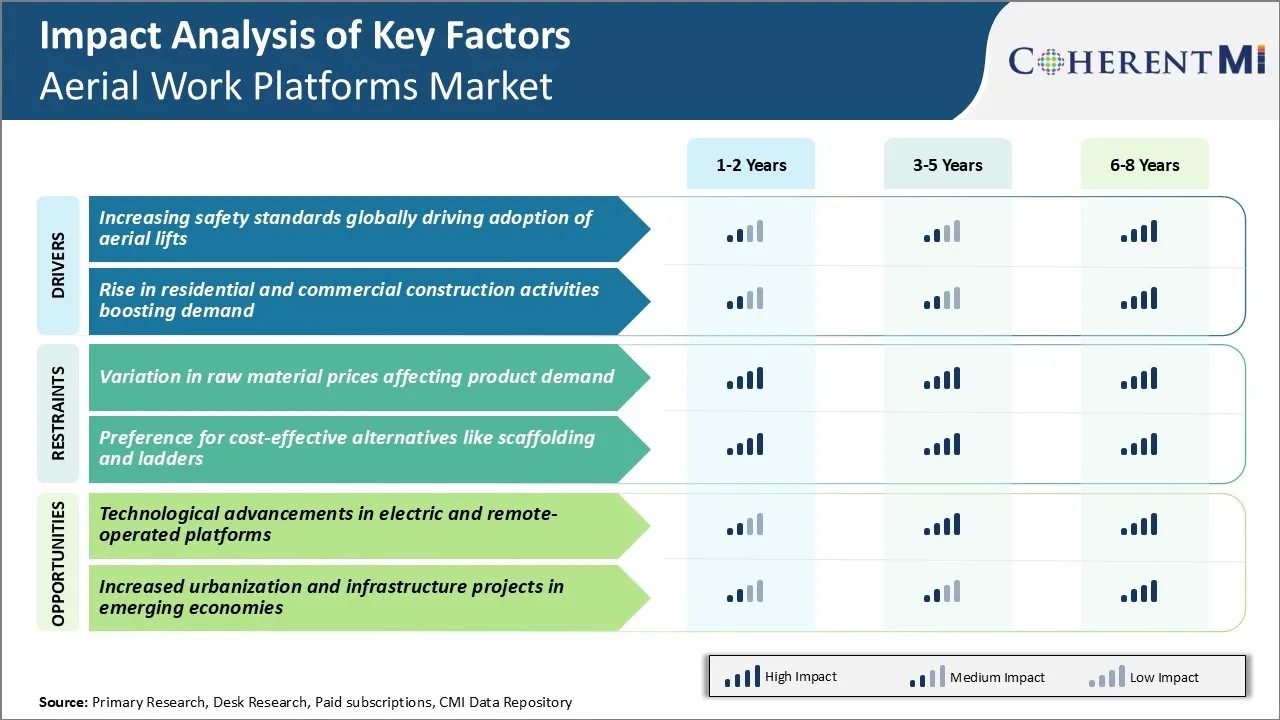

Market Driver - Increasing Safety Standards Globally Driving Adoption of Aerial Lifts

With increased emphasis on workplace safety and risk management across industries globally, adoption of aerial work platforms for hazardous tasks at height is growing steadily. Stringent regulations mandating the use of fall protection equipment when working at elevations have pushed many companies to invest in mechanized lifting platforms instead of unreliable ladders or scaffolds.

Municipal authorities and government contracting agencies particularly in developed markets have made the usage of aerial platforms mandatory for various outdoor jobs. This is driving higher procurement among utility line workers, builders, arborists, and other vocational fields, driving growth of the aerial work platforms market.

Consulting experts and rental firms knowledgeable about latest safety standards and regulatory compliances help end-users seamlessly integrate aerial solutions into their work processes. The combination of regulatory enforcement and availability of versatile technologies at optimal prices ensure that safety driven adoption of aerial work platforms continues at a steady pace.

Market Driver - Rise in Construction Activities

In recent years, the construction industry worldwide has witnessed consistent growth driven by robust demand from both residential and commercial sectors. The residential real estate sector particularly is booming with increased foreign investments, population growth, easy availability of financing, and shifting lifestyles fueling strong demand for new homes. Commercial verticals like malls, offices, warehouses are also mushrooming across urban and suburban areas.

Governments have embraced pro-development strategies with sweeping reforms, tax incentives and land policy changes to catalyze construction activities nationwide. This has spurred opportunity for related industries as well from architecture, interiors to HVAC, glazing, cladding etc. which boost demand for aerial work platforms.

Vendors offering aerial work platform rentals on flexible terms have expanded strategically to capture this large untapped market potential. The growing skylines of major cities and continuously evolving infrastructure in developing regions ensure that construction growth remains a steadfast driver for aerial lifts market in the foreseeable future.

Market Challenge - Variation in Raw Material Prices Affecting Product Demand

The aerial work platforms market has been facing significant challenges due to the volatility in raw material prices over the past few years. Manufacturers have been affected considerably as raw materials constitute a major part of the total production cost. Steel, aluminum and petroleum-based products are some of the key raw materials used in manufacturing aerial work platforms. Prices of these raw materials tend to fluctuate frequently depending on factors like global demand-supply dynamics, geopolitical issues, speculations etc.

When input costs increase substantially, manufacturers are compelled to pass on at least some portion of the rise in prices to the customers in order to maintain their margins. This makes aerial work platforms expensive for buyers and negatively impacts the demand. The fluctuating prices introduce an element of unpredictability in business planning and strategy formulation for manufacturers. Frequent rise in material costs also reduce the price competitiveness of products in international aerial work platforms markets.

Market Opportunity - Technological Advancements in Electric and Remote-operated Platforms

The aerial work platforms market is presenting substantial opportunities for players engaged in developing innovative technologies. There is immense scope for growth in electric and remote-operated platforms owing to the rising focus on sustainability. Electric aerial work platform sales are increasing at a rapid pace due to various benefits like zero emission, low noise, ease of maintenance.

On the other hand, remote-operated platforms address important safety concerns by eliminating the risks associated with working at heights. Advancements in robotics, IoT, AI and automation are enabling the development of autonomous aerial work platforms with robust functionality.

Technological innovation is playing a pivotal role in enhancing productivity, jobsite safety as well as end-user experience. The demand for future-ready products aligned with sustainability and industry 4.0 trends will continue driving opportunities in the aerial work platforms market for players investing in R&D.

With increased emphasis on workplace safety and risk management across industries globally, adoption of aerial work platforms for hazardous tasks at height is growing steadily.

Stringent regulations mandating the use of fall protection equipment when working at elevations have pushed many companies to invest in mechanized lifting platforms instead of unreliable ladders or scaffolds.

Municipal authorities and government contracting agencies particularly in developed markets have made the usage of aerial platforms mandatory for various outdoor jobs.

This is driving higher procurement among utility line workers, builders, arborists, and other vocational fields, driving growth of the aerial work platforms market.

Consulting experts and rental firms knowledgeable about latest safety standards and regulatory compliances help end-users seamlessly integrate aerial solutions into their work processes.

The combination of regulatory enforcement and availability of versatile technologies at optimal prices ensure that safety driven adoption of aerial work platforms continues at a steady pace.

In recent years, the construction industry worldwide has witnessed consistent growth driven by robust demand from both residential and commercial sectors.

The residential real estate sector particularly is booming with increased foreign investments, population growth, easy availability of financing, and shifting lifestyles fueling strong demand for new homes.

Commercial verticals like malls, offices, warehouses are also mushrooming across urban and suburban areas.

Governments have embraced pro-development strategies with sweeping reforms, tax incentives and land policy changes to catalyze construction activities nationwide.

This has spurred opportunity for related industries as well from architecture, interiors to HVAC, glazing, cladding etc.

which boost demand for aerial work platforms.

Vendors offering aerial work platform rentals on flexible terms have expanded strategically to capture this large untapped market potential.

The growing skylines of major cities and continuously evolving infrastructure in developing regions ensure that construction growth remains a steadfast driver for aerial lifts market in the foreseeable future.

The aerial work platforms market has been facing significant challenges due to the volatility in raw material prices over the past few years.

Manufacturers have been affected considerably as raw materials constitute a major part of the total production cost.

Steel, aluminum and petroleum-based products are some of the key raw materials used in manufacturing aerial work platforms.

Prices of these raw materials tend to fluctuate frequently depending on factors like global demand-supply dynamics, geopolitical issues, speculations etc.

When input costs increase substantially, manufacturers are compelled to pass on at least some portion of the rise in prices to the customers in order to maintain their margins.

This makes aerial work platforms expensive for buyers and negatively impacts the demand.

The fluctuating prices introduce an element of unpredictability in business planning and strategy formulation for manufacturers.

Frequent rise in material costs also reduce the price competitiveness of products in international aerial work platforms markets.

The aerial work platforms market is presenting substantial opportunities for players engaged in developing innovative technologies.

There is immense scope for growth in electric and remote-operated platforms owing to the rising focus on sustainability.

Electric aerial work platform sales are increasing at a rapid pace due to various benefits like zero emission, low noise, ease of maintenance.

On the other hand, remote-operated platforms address important safety concerns by eliminating the risks associated with working at heights.

Advancements in robotics, IoT, AI and automation are enabling the development of autonomous aerial work platforms with robust functionality.

Technological innovation is playing a pivotal role in enhancing productivity, jobsite safety as well as end-user experience.

The demand for future-ready products aligned with sustainability and industry 4.0 trends will continue driving opportunities in the aerial work platforms market for players investing in R&D.

Key winning strategies adopted by key players of Aerial Work Platforms Market

Product innovation and expansion – Players in the aerial work platforms market like JLG, Terex, and Genie have seen success through continuous investment in R&D to develop new and innovative products.

Focus on fleet management solutions - Many large players like Snorkel and Manitou have invested in developing digital fleet management capabilities in the last 5 years.

Strategic acquisitions - Consolidation remains an important strategy for growth in the aerial work platforms market. In 2018, Terex acquired Genie from TPG Capital for USD 3.9 Bn, creating the largest AWP company. Such mergers expand product breadth, strengthening leadership.

Geographic expansion - Regional players in the aerial work platforms market are expanding globally through new facilities. For example, Haulotte set up a new manufacturing plant in Brazil in 2019 to reduce costs and better serve Latin American customers.

Product innovation and expansion – Players in the aerial work platforms market like JLG, Terex, and Genie have seen success through continuous investment in R&D to develop new and innovative products.

Focus on fleet management solutions - Many large players like Snorkel and Manitou have invested in developing digital fleet management capabilities in the last 5 years.

Strategic acquisitions - Consolidation remains an important strategy for growth in the aerial work platforms market.

In 2018, Terex acquired Genie from TPG Capital for USD 3.9 Bn, creating the largest AWP company.

Such mergers expand product breadth, strengthening leadership.

Geographic expansion - Regional players in the aerial work platforms market are expanding globally through new facilities.

For example, Haulotte set up a new manufacturing plant in Brazil in 2019 to reduce costs and better serve Latin American customers.

Segmental Analysis of Aerial Work Platforms Market

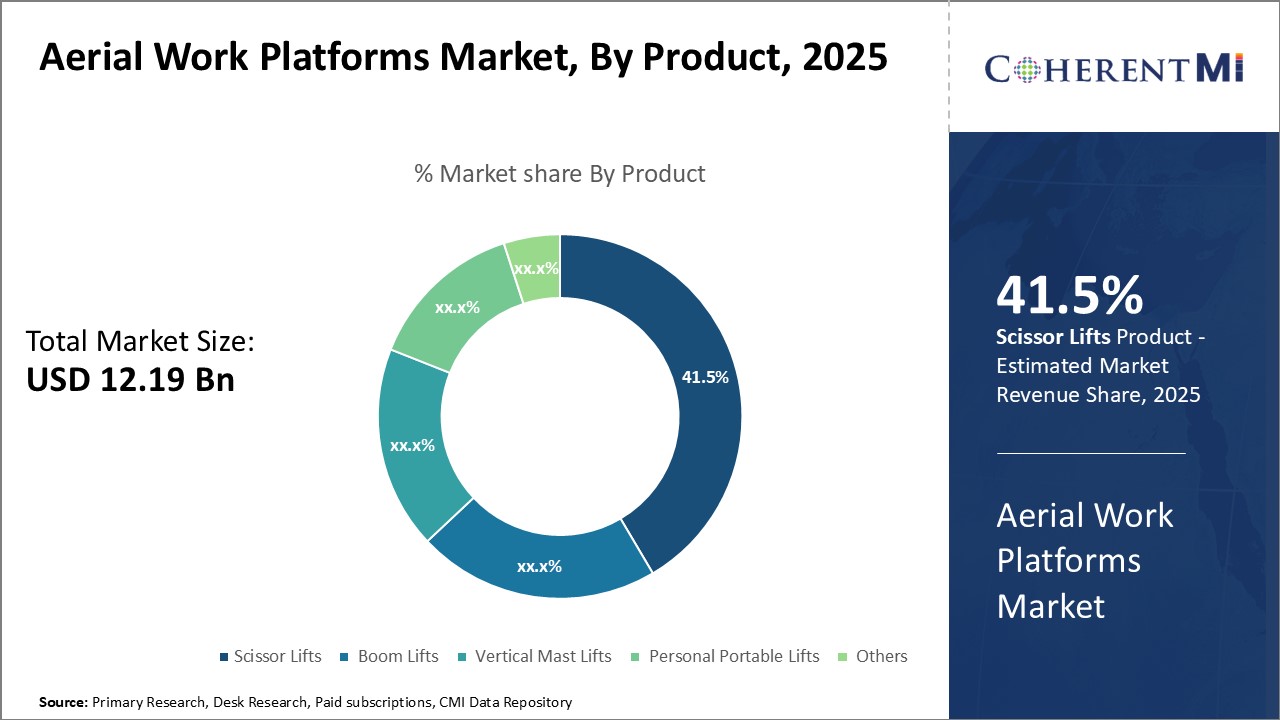

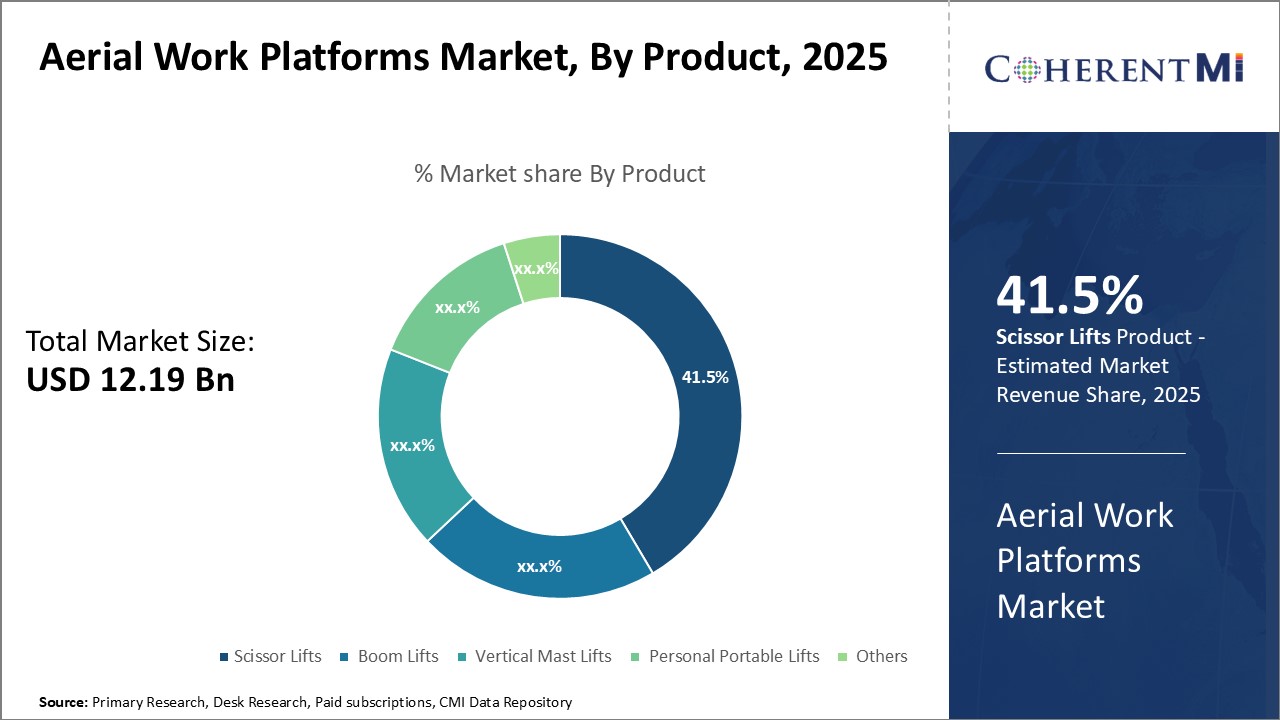

Insights, By Product: Functional Flexibility Fuels Scissor Lift Dominance

Insights, By Product: Functional Flexibility Fuels Scissor Lift Dominance

In terms of product, scissor lifts contributes 41.5% share of the aerial work platforms market in 2025. This is owning to their functional flexibility. Scissor lifts offer operators an ideal balance of mobility, lift height, and platform size for a wide range of common tasks in construction and industrial settings. Their scissors-style lifting mechanism takes up little space and allows the lifts to navigate confined work areas easily.

The compact lifting dimensions of scissor lifts allow them to fit into tighter working environments than larger aerial work platforms. This includes worksites in urban areas with limited space as well as indoor applications like warehouses. Many scissor lifts can even fold up against walls or fit through standard doorways, expanding their utilization. Operators value how easily scissor lifts can access all areas of a jobsite. Their flexibility to work in confined or congested spaces without obstruction drives strong and consistent demand.

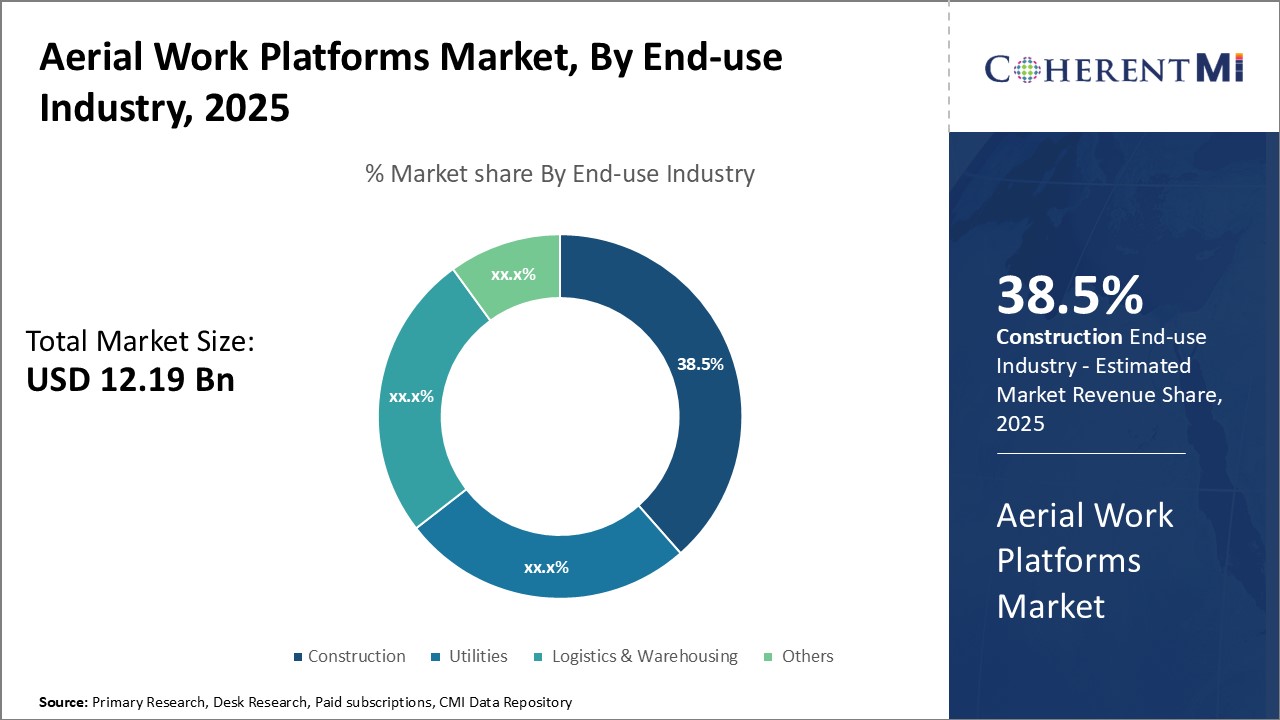

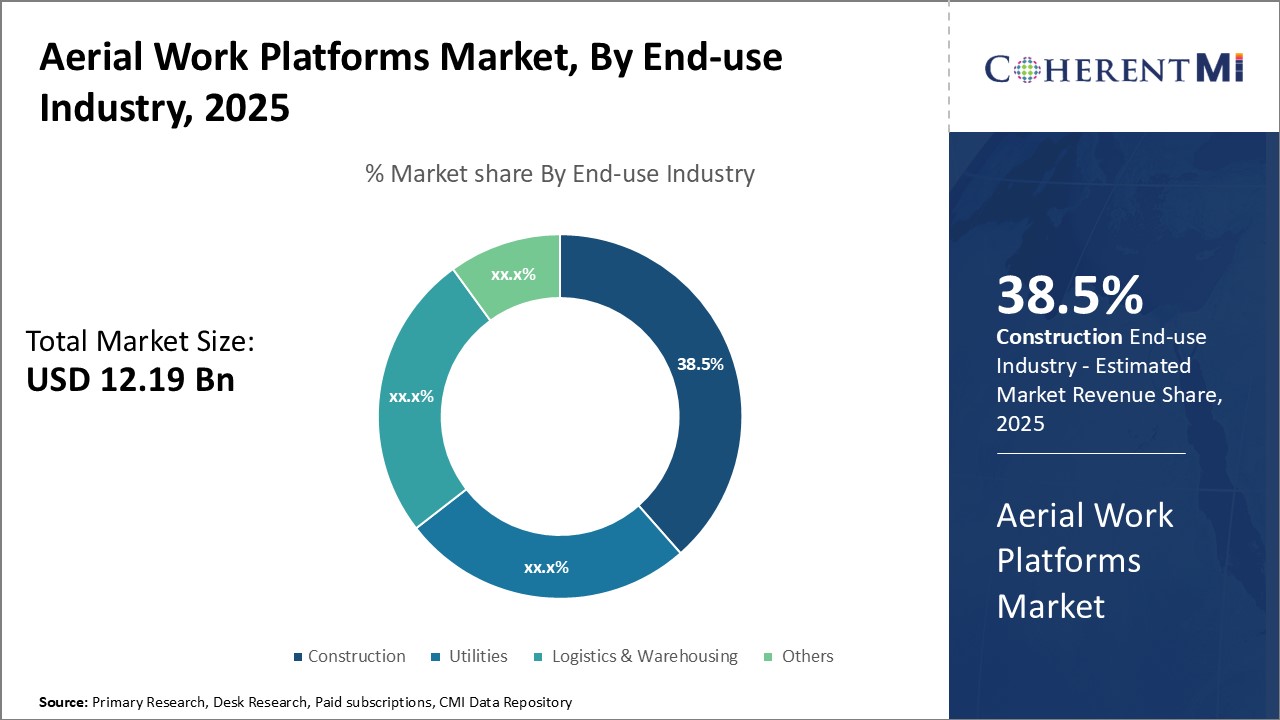

Insights, By End-use Industry: Construction Dominates on Sheer Scale of Aerial Work Platform Needs

In terms of By End-use Industry, Construction contributes 38.5% share of the aerial work platforms market in 2025. This is due to the immense scale of aerial work required. No other industry comes close to matching the sheer volume of lifting, installing, and construction tasks conducted above ground level on regular job sites. Aerial work platforms see widespread daily usage for an enormous range of construction applications from residential homes to skyscrapers.

Infrastructure like bridges and roads construction also leverages aerial work platforms for tasks such as installing signs, lights, guardrails, and utility lines. Maintenance of these structures long-term relies upon aerial access as well. Overall, no other industry comes close to matching construction's widespread daily needs for working at elevations only aerial lifts can satisfy safely and productively. This drives the sector's dominant position in aerial work platform market.

Insights, By Power Type: Engine-Powered Lifts Lead for Raw Lifting Muscle

In terms of power type, engine-powered aerial work platforms contributes the highest share of the aerial work platforms market due to their superior lifting capacity. While electric and hybrid lifts offer advantages such as lowered noise and emissions, engine-powered models provide the muscle needed to lift heavier payloads to great heights.

Utility linemen and related crews also depend on the brawny lifting ability of engine aerials for tasks like repairing and installing power lines, poles and transformers. This type of infrastructure maintenance work involves heavy equipment loads at maximum reach. When applications require lifting hefty payloads to large heights, operators trust in the muscle provided only by engine-powered aerial work platforms. Their premium lifting strength remains the top factor driving dominance in this segment in the aerial work platforms space.

Insights, By Product: Functional Flexibility Fuels Scissor Lift Dominance

Insights, By Product: Functional Flexibility Fuels Scissor Lift DominanceIn terms of product, scissor lifts contributes 41.5% share of the aerial work platforms market in 2025. This is owning to their functional flexibility.

Scissor lifts offer operators an ideal balance of mobility, lift height, and platform size for a wide range of common tasks in construction and industrial settings.

Their scissors-style lifting mechanism takes up little space and allows the lifts to navigate confined work areas easily.

The compact lifting dimensions of scissor lifts allow them to fit into tighter working environments than larger aerial work platforms.

This includes worksites in urban areas with limited space as well as indoor applications like warehouses.

Many scissor lifts can even fold up against walls or fit through standard doorways, expanding their utilization.

Operators value how easily scissor lifts can access all areas of a jobsite.

Their flexibility to work in confined or congested spaces without obstruction drives strong and consistent demand.

In terms of By End-use Industry, Construction contributes 38.5% share of the aerial work platforms market in 2025.

This is due to the immense scale of aerial work required.

No other industry comes close to matching the sheer volume of lifting, installing, and construction tasks conducted above ground level on regular job sites.

Aerial work platforms see widespread daily usage for an enormous range of construction applications from residential homes to skyscrapers.

Infrastructure like bridges and roads construction also leverages aerial work platforms for tasks such as installing signs, lights, guardrails, and utility lines.

Maintenance of these structures long-term relies upon aerial access as well.

Overall, no other industry comes close to matching construction's widespread daily needs for working at elevations only aerial lifts can satisfy safely and productively.

This drives the sector's dominant position in aerial work platform market.

In terms of power type, engine-powered aerial work platforms contributes the highest share of the aerial work platforms market due to their superior lifting capacity.

While electric and hybrid lifts offer advantages such as lowered noise and emissions, engine-powered models provide the muscle needed to lift heavier payloads to great heights.

Utility linemen and related crews also depend on the brawny lifting ability of engine aerials for tasks like repairing and installing power lines, poles and transformers.

This type of infrastructure maintenance work involves heavy equipment loads at maximum reach.

When applications require lifting hefty payloads to large heights, operators trust in the muscle provided only by engine-powered aerial work platforms.

Their premium lifting strength remains the top factor driving dominance in this segment in the aerial work platforms space.

Additional Insights of Aerial Work Platforms Market

- Rise in Rental Fleet Penetration: According to industry estimates, rental penetration rates in North America have reached over 70% for certain high-reach equipment categories, reflecting an entrenched culture of leasing rather than direct ownership.

- Electric Units on the Rise: Sales of electric scissor lifts have reportedly grown at nearly 9.0% annually over the last few years, outpacing the overall market growth and signaling a strong demand shift toward eco-friendly solutions.

- Maintenance and Service Costs: On average, lifecycle maintenance and service costs constitute approximately 20–25% of the total cost of ownership for aerial work platforms, underscoring the importance of predictive maintenance solutions.

- Shift Toward Fleet Electrification: Rental agencies and corporate fleets are seeking to replace older diesel-powered lifts with hybrid or fully electric models to meet evolving environmental guidelines and consumer preferences.

- Emphasis on Rental over Direct Purchase: High procurement costs have led many end-users, especially in emerging markets, to adopt rental models, increasing competition among rental fleet operators and boosting short-term deployment rates.

- Rise in Rental Fleet Penetration: According to industry estimates, rental penetration rates in North America have reached over 70% for certain high-reach equipment categories, reflecting an entrenched culture of leasing rather than direct ownership.

- Electric Units on the Rise: Sales of electric scissor lifts have reportedly grown at nearly 9.0% annually over the last few years, outpacing the overall market growth and signaling a strong demand shift toward eco-friendly solutions.

- Maintenance and Service Costs: On average, lifecycle maintenance and service costs constitute approximately 20–25% of the total cost of ownership for aerial work platforms, underscoring the importance of predictive maintenance solutions.

- Shift Toward Fleet Electrification: Rental agencies and corporate fleets are seeking to replace older diesel-powered lifts with hybrid or fully electric models to meet evolving environmental guidelines and consumer preferences.

- Emphasis on Rental over Direct Purchase: High procurement costs have led many end-users, especially in emerging markets, to adopt rental models, increasing competition among rental fleet operators and boosting short-term deployment rates.

Competitive overview of Aerial Work Platforms Market

The major players operating in the aerial work platforms market include JLG Industries (Oshkosh Corporation), Terex Corporation, Haulotte Group, Linamar Corporation (Skyjack), Aichi Corporation (Toyota Industries), Tadano Ltd., Snorkel, Altec Inc., Zoomlion Heavy Industry Science and Technology Co., Ltd, Manitowoc Company Inc, Sany Group, Tadano Ltd, Palfinger AG, and Liebherr International AG.

The major players operating in the aerial work platforms market include JLG Industries (Oshkosh Corporation), Terex Corporation, Haulotte Group, Linamar Corporation (Skyjack), Aichi Corporation (Toyota Industries), Tadano Ltd., Snorkel, Altec Inc., Zoomlion Heavy Industry Science and Technology Co., Ltd, Manitowoc Company Inc, Sany Group, Tadano Ltd, Palfinger AG, and Liebherr International AG.

Aerial Work Platforms Market Leaders

- JLG Industries (Oshkosh Corporation)

- Terex Corporation

- Haulotte Group

- Linamar Corporation (Skyjack)

- Aichi Corporation (Toyota Industries)

- JLG Industries (Oshkosh Corporation)

- Terex Corporation

- Haulotte Group

- Linamar Corporation (Skyjack)

- Aichi Corporation (Toyota Industries)

Recent Developments in Aerial Work Platforms Market

- In September 2024, JLG announced updates to its electric scissor lifts, vertical lifts, and stock pickers, introducing features like AC drive motors and lithium-ion battery options to enhance productivity and efficiency.

- In September 2024, they introduced the HS18 E MAX, an 18-meter electric rough-terrain scissor lift with full-height driving capability, enhancing productivity for both indoor and outdoor environments.

- In May 2023, JCB introduced two articulated boom aerial work platforms, the A45E and A45EH, offering full battery electric and diesel/electric hybrid drivelines. These models aim to enhance efficiency, improve operator access, and reduce environmental impact through zero or low-emission operation.

- In February 2023, MEC Aerial Work Platforms introduced the NANO10-XD, an all-electric scissor lift designed for eco-friendly operations. This innovative lift features an ultra-compact design and operates without hydraulic oil, eliminating the risk of oil leaks in environmentally sensitive applications.

- In September 2024, JLG announced updates to its electric scissor lifts, vertical lifts, and stock pickers, introducing features like AC drive motors and lithium-ion battery options to enhance productivity and efficiency.

- In September 2024, they introduced the HS18 E MAX, an 18-meter electric rough-terrain scissor lift with full-height driving capability, enhancing productivity for both indoor and outdoor environments.

- In May 2023, JCB introduced two articulated boom aerial work platforms, the A45E and A45EH, offering full battery electric and diesel/electric hybrid drivelines. These models aim to enhance efficiency, improve operator access, and reduce environmental impact through zero or low-emission operation.

- In February 2023, MEC Aerial Work Platforms introduced the NANO10-XD, an all-electric scissor lift designed for eco-friendly operations. This innovative lift features an ultra-compact design and operates without hydraulic oil, eliminating the risk of oil leaks in environmentally sensitive applications.

Aerial Work Platforms Market Segmentation

- By Product

- Scissor Lifts

- Boom Lifts

- Vertical Mast Lifts

- Personal Portable Lifts

- Others

- By End-use Industry

- Construction

- Utilities

- Logistics & Warehousing

- Others (e.g., Mining, Oil & Gas, Facility Maintenance)

- By Power Type

- Engine-powered

- Electric-powered

- Hybrid

- By Lifting Height

- Less than 20 Feet

- 20 Feet - 50 Feet

- More than 50 Feet

- By Application

- Construction

- Utilities

- Transportation

- Others (Mining, Aerospace, Defense)

- By Product

- Scissor Lifts

- Boom Lifts

- Vertical Mast Lifts

- Personal Portable Lifts

- Others

- By End-use Industry

- Construction

- Utilities

- Logistics & Warehousing

- Others (e.g., Mining, Oil & Gas, Facility Maintenance)

- By Power Type

- Engine-powered

- Electric-powered

- Hybrid

- By Lifting Height

- Less than 20 Feet

- 20 Feet - 50 Feet

- More than 50 Feet

- By Application

- Construction

- Utilities

- Transportation

- Others (Mining, Aerospace, Defense)

Would you like to explore the option of buying individual sections of this report?

Monica Shevgan has 9+ years of experience in market research and business consulting driving client-centric product delivery of the Information and Communication Technology (ICT) team, enhancing client experiences, and shaping business strategy for optimal outcomes. Passionate about client success.

Monica Shevgan has 9+ years of experience in market research and business consulting driving client-centric product delivery of the Information and Communication Technology (ICT) team, enhancing client experiences, and shaping business strategy for optimal outcomes.

Passionate about client success.