Australia Automotive Aftermarket Market Size - Analysis

The Australia Automotive Aftermarket Market is estimated to be valued at USD 13.98 Bn in 2025 and is expected to reach USD 18.27 Bn by 2032, growing at a compound annual growth rate (CAGR) of 3.9% from 2025 to 2032.

Market Size in USD Bn

CAGR3.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.9% |

| Market Concentration | Medium |

| Major Players | Denso Corporation, Hella KGaA Hueck & Co., Continental AG, Delphi Automotive, ACDelco and Among Others |

please let us know !

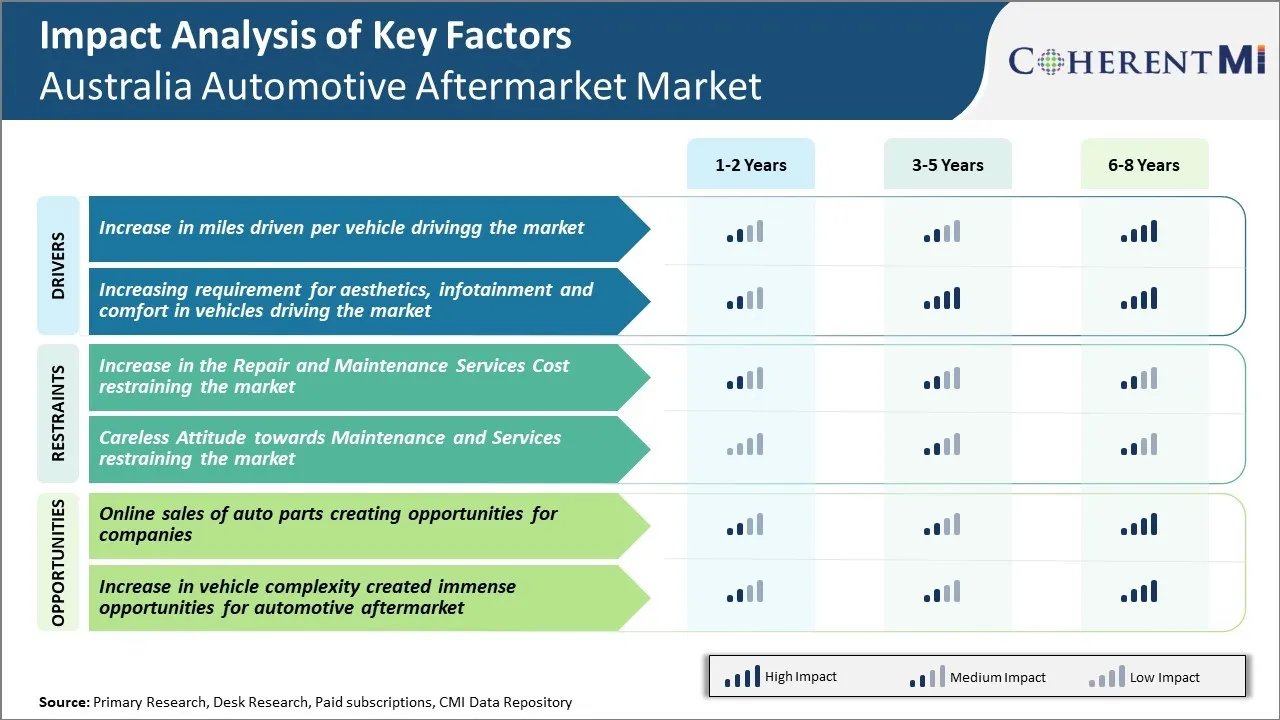

Australia Automotive Aftermarket Market Trends

With more people living further away from their workplaces and social hubs due to housing affordability issues, average annual mileage travelled by vehicles has been steadily increasing in Australia over recent years. Vehicle owners are required to drive longer daily commutes which inevitably leads to faster wear and tear of components like tires, brake pads, belts and hoses. Moreover, a large section of the population in cities like Melbourne and Sydney regularly undertake long weekend drives to beaches and countryside areas outside city limits for relaxation. All of this has contributed to average Australian cars now averaging close to 20,000 km of driving annually compared to only 15,000 km around 5 years back.

Rising disposable incomes over the last decade have seen Australian consumers prioritizing in-car comfort, connectivity and customization features more than ever before. There is a growing need amongst drivers to personalize the interior and exterior appearance of their vehicles through aftermarket modifications. Installing flashy alloy wheels, tinting windows, upgrading sound systems and adding other visual customizations have become increasingly mainstream hobby and passion for many in cities. Similarly, the always-on connectivity demands of modern life are also driving enhancements to factory-fitted infotainment interfaces. Upgrades such as bigger touchscreens, driver assistant technologies, phone mirrors and rear seat entertainment suites are examples seeing brisk demand.

Market Challenges and Opportunities:

Increase in the Repair and Maintenance Services Cost restraining the market

The rising cost has made vehicle repair and maintenance activities more expensive for both individual consumers and commercial fleet operators. With the cost rising so sharply, consumers are deferring their repair needs or switching to cheaper alternatives like used parts to save costs. This has negatively impacted the demand for new spare parts. Commercial fleet operators are also finding it difficult to justify higher maintenance budgets, thereby potentially reducing the frequency of repair and maintenance cycles. The increasing cost is restraining further growth of the auto parts and service market in Australia. Unless costs are controlled, this trend may continue restricting the market size and revenue potentials in the coming years.

Online sales of auto parts creating opportunities for companies

Leading this opportunity is the convenience offered by online platforms for customers to research technical specifications of thousands of parts, read reviews, make price comparisons within minutes and get doorstep delivery. Companies that establish strong online sales channels with better search functionality, mobile friendliness and customer support are well poised to capitalise on this growing trend. Having an integrated online and offline strategy allows companies to serve both tech-savvy younger customers as well as older customers who still prefer traditional retail stores. Overall, the digital transformation of auto parts sales and increasing preference for online purchases provide significant market opportunities for brands that make the right investments and have an omnichannel strategy.

Segmental Analysis of Australia Automotive Aftermarket Market

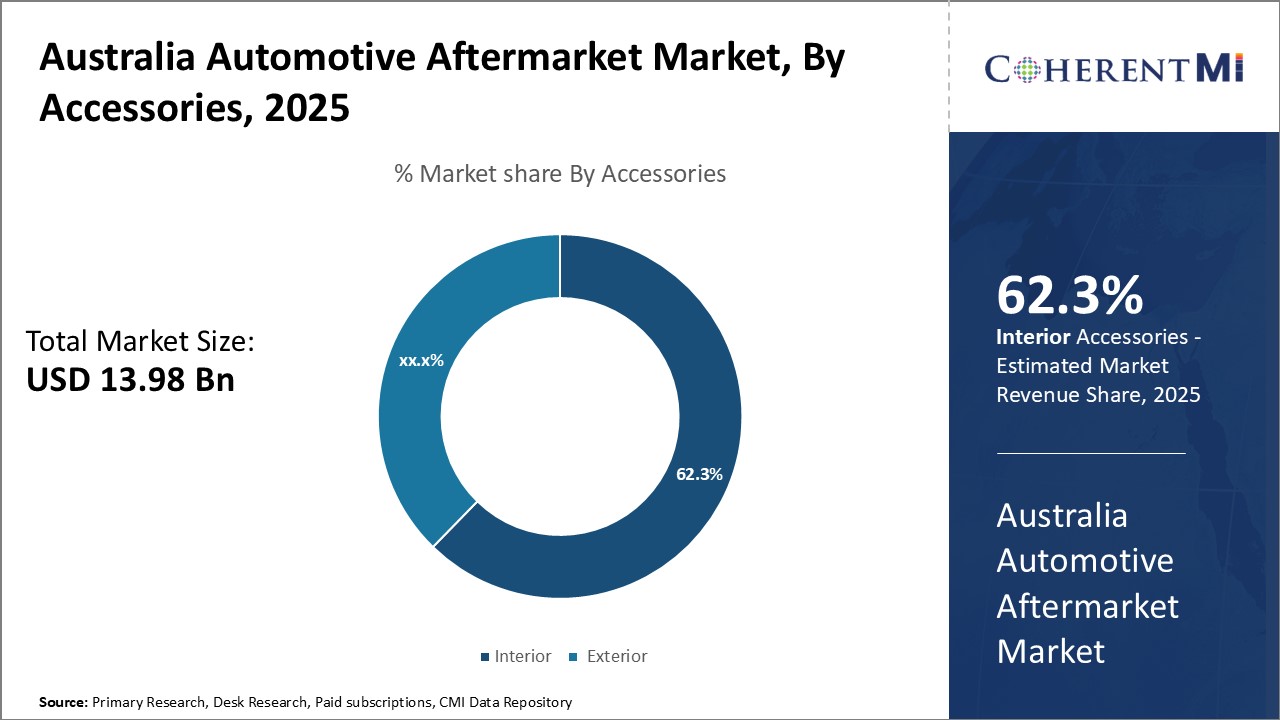

Insights By Accessories - Comfort and Convenience Drive Interior Accessories

Insights By Accessories - Comfort and Convenience Drive Interior AccessoriesIn terms of By Accessories, Interior contributes the 63.20% share of the market owning to consumers' rising focus on comfort and convenience when travelling. Interior accessories such as seat covers, floor mats, steering wheel covers and dash mats have become very popular as they help protect a vehicle's interior from dirt and wear & tear. Australians drive significant yearly distances and want their vehicle interior to remain clean, scratch-free and ergonomic for long rides. Interior accessories appeal to this need for durability as well as adding a personalized touch.

Ease of do-it-yourself installation is another factor spurring interior accessory sales. Most products come with detailed fitting instructions and mounting solutions so that drivers can set them up independently without professional help. This saves on installation costs and allows customizing the interior as per changing needs or moods. Do-it-yourself setup has made interior accessories an impulse buy for many Australians.

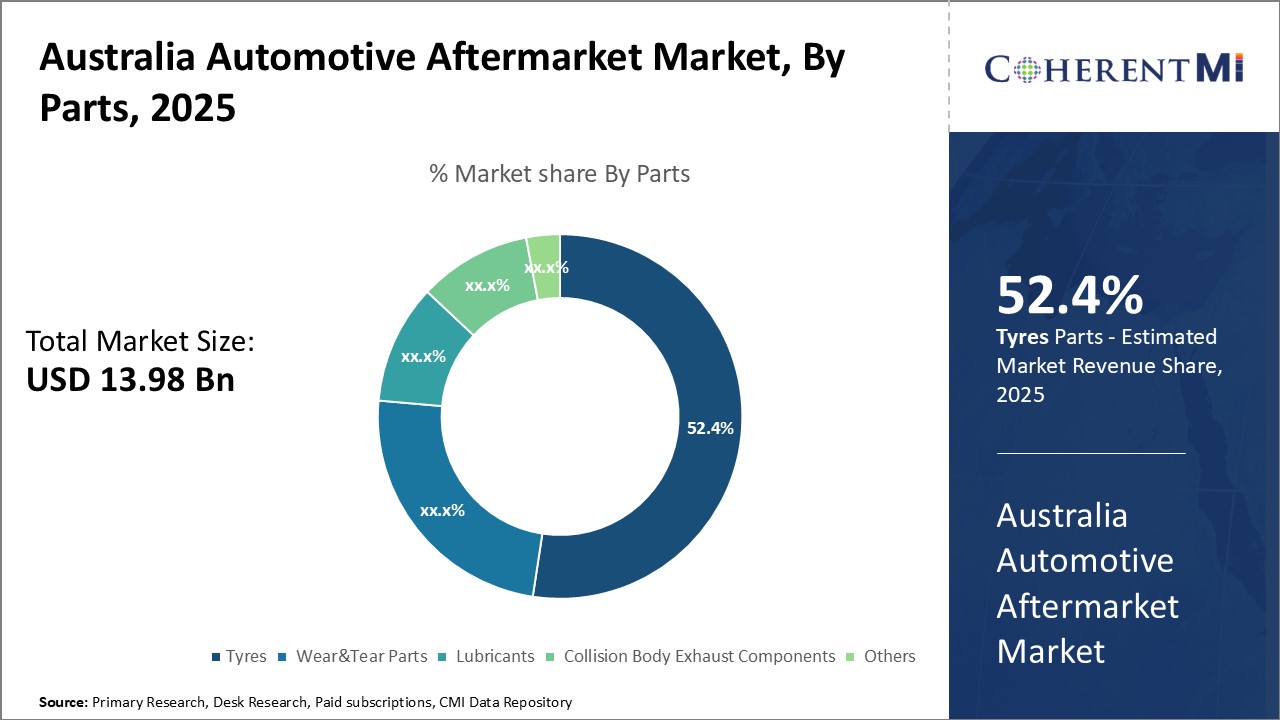

In terms of By Parts, Tyres contribute the 52.40% share due to their critical role in vehicle performance and safety. Australian roads range from highways to off-roads, putting continual wear and tear on tyres. Their reliable function is a top priority, with drivers needing replacements regularly. While OEM tyres are an option, affordable aftermarket tyres are widely available in different brands, sizes, tread patterns and price points.

Mechanics and fitment centres play a big role by recommending appropriate tyre models match a vehicle’s usage profile as well as weight and speed capabilities. Their expertise alongside tyre manufacturers’ extensive distribution networks ensure basic replacements are never in short supply. This ready access and knowledge infusion regarding the right tyre specifications to suit individual needs has made them the default urgent purchase over other parts.

Insights By Services - Value Service Drives General Automotive Repairs Dominance

Further, general repairs can sometimes be postponed for non-critical applications, but regular maintenance is still recommended to maximize vehicle life. It is more cost-effective to fix smaller problems before they worsen. Online forums too have made it easier for DIY enthusiasts to attempt basic repairs independently with guidance from experienced users. This has put downward pressure on prices.

Competitive overview of Australia Automotive Aftermarket Market

The major players operating in the Market include Denso Corporation, Hella KGaA Hueck & Co., Continental AG, Delphi Automotive, ACDelco, Faurecia SA, Magneti Marelli SpA, Robert Boosch GmbH, Aisin Seiki Co.,Ltd., Bridestone Corporation.

Australia Automotive Aftermarket Market Leaders

- Denso Corporation

- Hella KGaA Hueck & Co.

- Continental AG

- Delphi Automotive

- ACDelco

Australia Automotive Aftermarket Market - Competitive Rivalry

Australia Automotive Aftermarket Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Automotive Aftermarket Market

- In April 2024, Denso Corporation, a leading global mobility supplier based in Kariya, Japan, announced the launch of MobiQ, its new brand focused on aftermarket smart mobility and vehicle-to-everything (V2X) products and solutions. This announcement was made at the ITS America Conference & Expo 2024 in Phoenix, showcasing Denso's commitment to enhancing vehicle connectivity and safety through innovative technologies.

- In July 2023, Capricorn Society Limited, a member-based organization supporting over 25,000 automotive businesses in Australia and New Zealand, and Repairify Australia Holdings Pty Ltd, known for its innovative remote automotive repair solutions, formed a joint venture. This collaboration aims to deliver advanced remote diagnostic services to automotive repairers across the region, enhancing their capabilities to manage modern vehicle servicing efficiently.

- In January 2020, Continental AG, a leading global technology company specializing in automotive parts and systems, launched a new web portal for the automotive aftermarket. This platform consolidates all product and service information, making it easier for workshops and dealers to access a comprehensive catalog of Continental's offerings, which include tires, drive components, and diagnostic solutions.

Australia Automotive Aftermarket Market Segmentation

- By Accessories

- Interior

- Exterior

- By Parts

- Tyres

- Wear&Tear Parts

- Lubricants

- Collision Body

- Exhaust Components

- Others

- By Services

- General Automotive Repairs

- Automotive Transmission Repairs

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Frequently Asked Questions :

How big is the Australia Automotive Aftermarket Market?

The Australia Automotive Aftermarket Market is estimated to be valued at USD 13.98 in 2025 and is expected to reach USD 18.27 Billion by 2032.

What are the major factors driving the Australia Automotive Aftermarket Market growth?

The increase in miles driven per vehicle driving the market and increasing requirement for aesthetics, infotainment and comfort in vehicles driving the market are the major factor driving the Australia Automotive Aftermarket Market.

Which is the leading Accessories in the Australia Automotive Aftermarket Market?

The leading Accessories segment is Interior.

Which are the major players operating in the Australia Automotive Aftermarket Market?

Denso Corporation, Hella KGaA Hueck & Co., Continental AG, Delphi Automotive, ACDelco, Faurecia SA, Magneti Marelli SpA, Robert Boosch GmbH, Aisin Seiki Co.,Ltd., Bridestone Corporation are the major players.

What will be the CAGR of the Australia Automotive Aftermarket Market?

The CAGR of the Australia Automotive Aftermarket Market is projected to be 3.9% from 2025-2032.