Australia Knife Market Size - Analysis

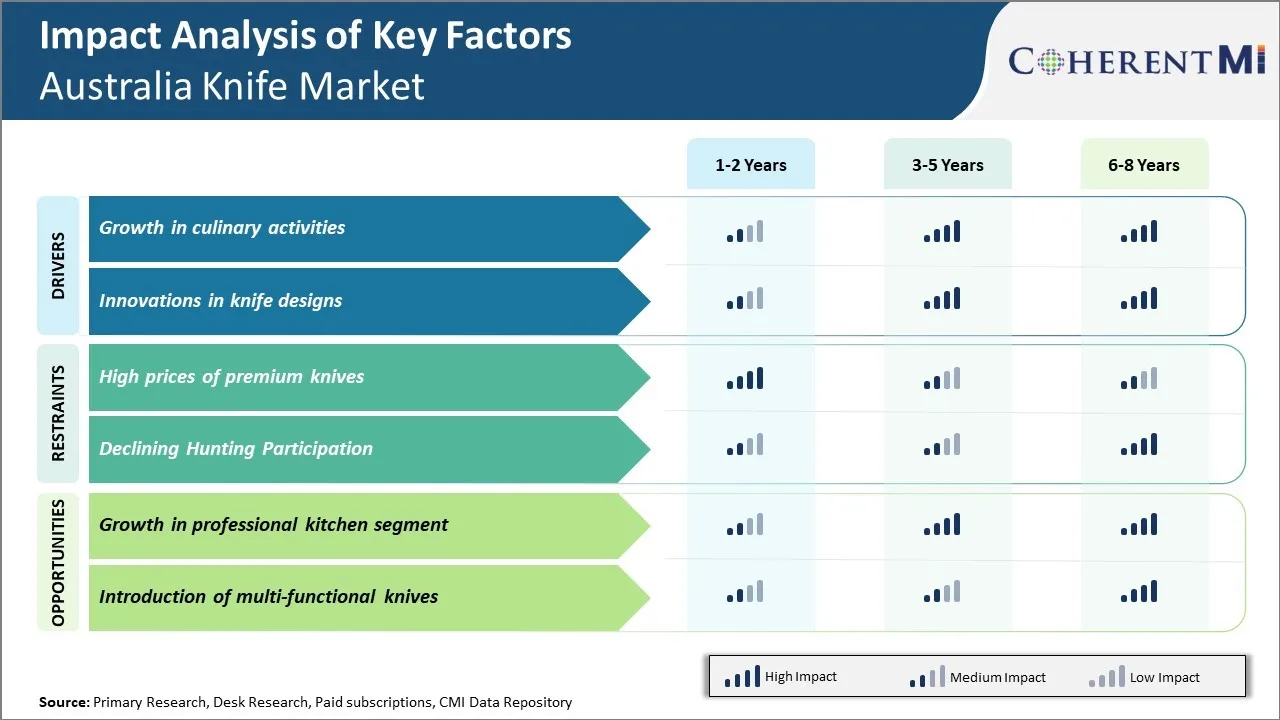

The Australian knife market has been witnessing a positive growth trend over the past few years. Rising culinary interest among consumers for cooking different cuisine at home has increased the demand for quality kitchen knives in the country. Additionally, increasing outdoor recreational activities such as camping, hiking and hunting has also contributed to the sales of pocket knives and tactical knives. Ongoing product innovations featuring superior blade materials and elegant designs to cater to different consumer segments are further expected to support the market expansion through 2032. However, availability of low-cost counterfeit products may hamper the growth of established brands and restrain the market to a certain extent over the forecast period.

Market Size in USD Mn

CAGR4.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.5% |

| Market Concentration | High |

| Major Players | Knife Depot, Wusthof, Gerber, Cold Steel, Columbia River Knife & Tool and Among Others |

please let us know !

Australia Knife Market Trends

The Australians have always had a strong food culture and over the years, culinary activities have become quite popular in the country. Cooking shows on television and online videos have generated a lot of enthusiasm among people of all age groups to experiment more in kitchen and try new recipes. This has led to higher demand for better quality cooking knives that can help in cutting, chopping and preparing wide variety of ingredients easily and efficiently.

Food blogging has become a major trend in Australia which brings attention to unique cooking styles and ingredients. Many Australians travel within the country and get influenced by regional cuisines. They like recreating these dishes in their own kitchens which requires having right tools. Furthermore, culinary schools and short courses on topics like baking, grilling etc are attracting large number of enthusiasts. All these aspiring foodies recognize the importance of right knives for smoothly gliding through preparations. Apart from home use, restaurants and cafes are also expanding their menus and introducing global flavors. This has increased their demand for professional grade knives that can withstand high volume prepping and last longer. Certain regions and communities in Australia have also gained popularity for their food festivals where artisanal processing involves ethnic style bread making, curing meats, filleting fish - activities that require specialist knives.

Market Driver - Innovations in Knife Designs

Full tang construction is now common where the internal bolster is extended through the entire handle for better balance and control during intense use. Non-slip ergonomic handles made of diverse materials like wood, plastic and Santoprene provide firmer grips. Blade materials have undergone massive evolution as well - high carbon stainless steel and ceramics are replacing softer steel and providing sharper, durable and rust-resistant edges.

Market Challenges: High prices of premium knives

One significant opportunity for the Australia knife market lies in catering to the growing professional kitchen segment. With the booming foodservice and hospitality industry in Australia, the number of restaurants, cafes, hotels and commercial kitchens has been increasing steadily over the past few years. This has led to a surge in the demand for high-quality knives that can withstand the rigors of daily commercial use. While the basic needs of these commercial kitchens are already being met, there exists scope for premium brands to tap into this segment by developing blade shapes, styles and features customized for professional sharpening and durability. New product innovations focused around safety, ergonomics and maintenance could attract more professional establishments. In addition, targeted marketing activities, promotion offers and tie-ups with culinary schools and institutions would help boost awareness and trial among professional chefs and kitchen staff. Catering to the discerning needs of commercial food businesses therefore provides an avenue for growth to Australia's knife manufacturing industry.

Key winning strategies adopted by key players of Australia Knife Market

Focus on product innovation - Global leaders like Victorinox and Wusthof Tekk have continuously invested in R&D to develop new and innovative knife products. In 2015, Victorinox launched their innovative "Fibrox" range with breakthrough Scandinavian styling and ultra-sharp serrated edges for efficient cutting. These knives were an instant success in Australia due to their modern design and superior performance.

Establish omnichannel presence - Players are expanding their reach through both online and offline channels. MAC Knives started selling directly on Amazon in 2017 to tap the fast-growing e-commerce market. This helped them grow sales by 35% in the first year. Offline, brands sponsor culinary shows and events to enhance in-store branding and trial.

The above examples showcase how innovation, branding, omni-channel strategies and education have helped global brands gain significant market share in the competitive Australia knife industry. Data indicates Victorinox, Wusthof and Shun captured over 60% of the market by 2020 due to their relentless focus on winning consumer mindshare.

Segmental Analysis of Australia Knife Market

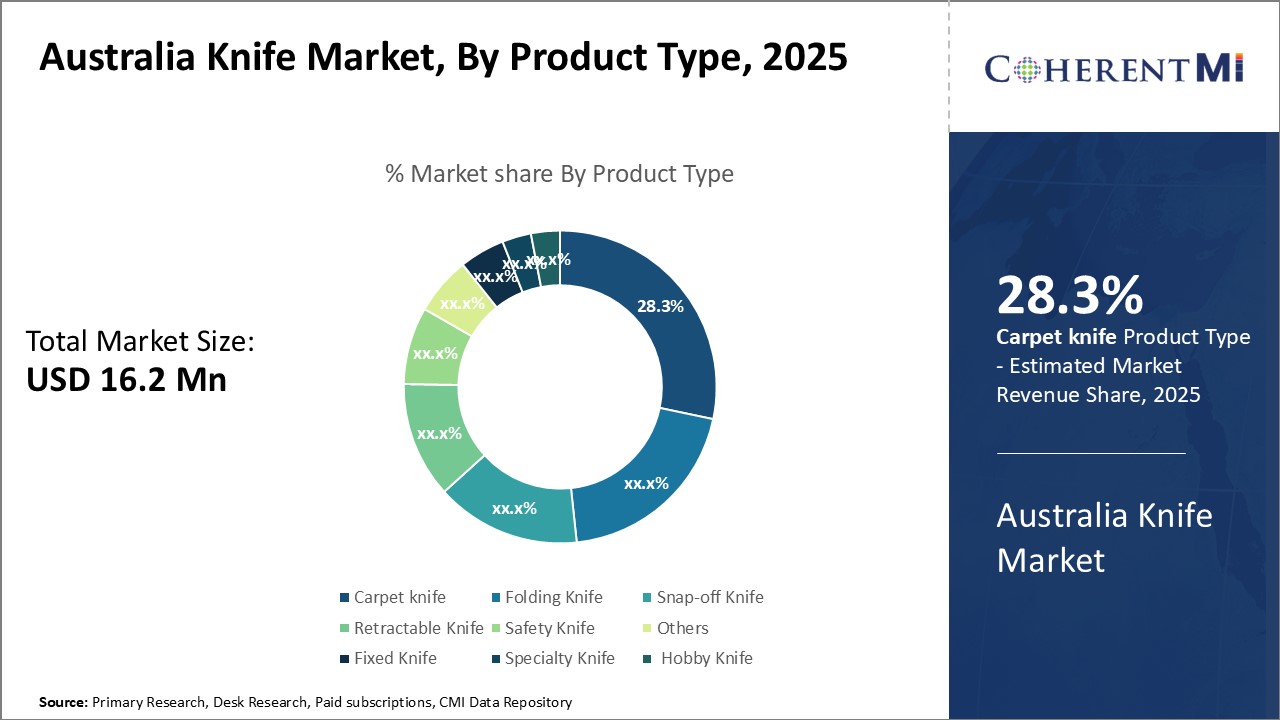

Insights by product type: Quality and cost effectiveness

Insights by product type: Quality and cost effectiveness The Australia knife market is segmented by product type, with the carpet knife type being the dominant segment. In 2025, the carpet knife type accounted for a 28.30% share of the overall Australia knife market. Carpet knives are versatile cutting tools primarily used for cutting and trimming carpets, rugs, and other types of flooring materials. Their sharp, serrated blades make them well-suited for cleanly slicing through thick, dense materials like carpets. The popularity of carpet knives in Australia can be attributed to the country's thriving construction and home renovation industries, which drive ongoing demand for carpet installation and replacement. Other key product type segments in the Australia knife market include utility knives, box cutters, and pocket knives, each capturing a significant share of the overall market. However, the carpet knife segment remains the largest and most dominant, reflecting Australians' preferences for specialized cutting tools tailored to their home improvement and flooring needs.

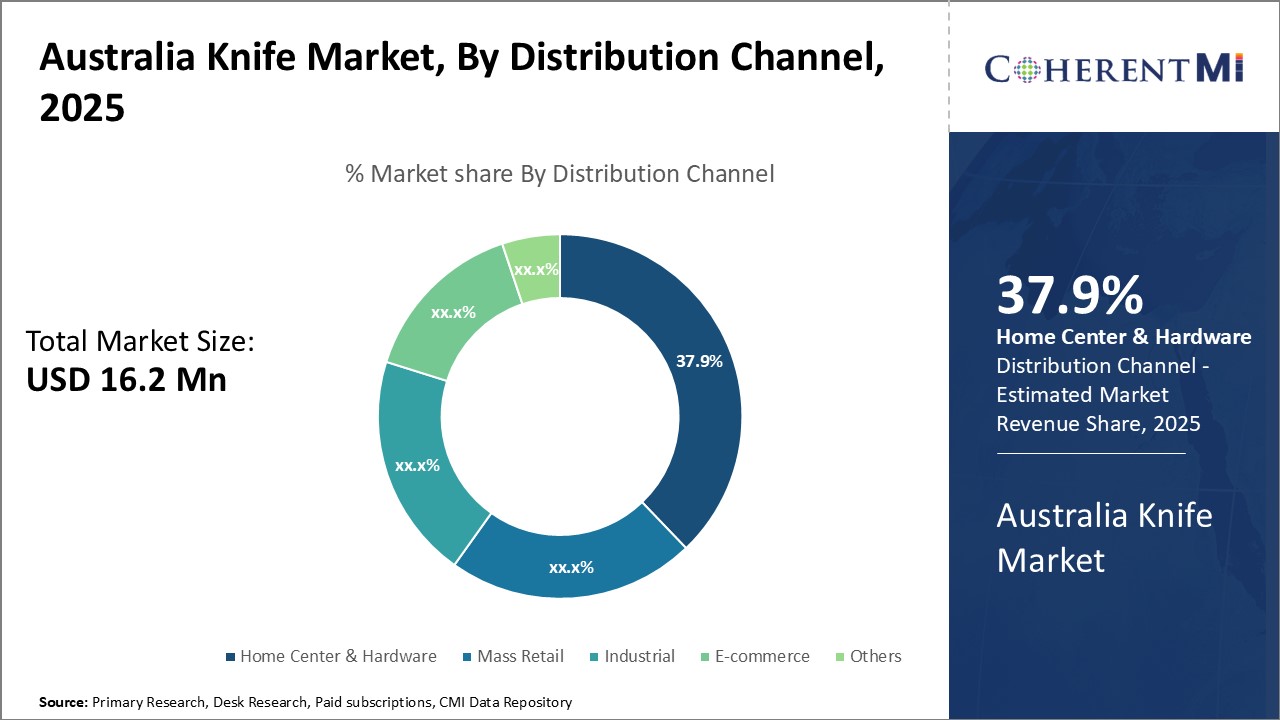

The Australia knife market is heavily dominated by the home center and hardware store distribution channel, which accounted for an impressive 37.9% share of total sales in 2025. This channel's dominance can be attributed to the widespread presence and popularity of these types of retail outlets across Australia, catering to the country's thriving home improvement, DIY, and construction sectors. Home centers and hardware stores offer Australian consumers a comprehensive selection of knives, ranging from utility blades and box cutters to specialized tools like carpet knives, all conveniently located alongside other essential hardware and supplies. The hands-on, in-person shopping experience provided by these stores, combined with the ability for customers to physically inspect and select the right knife for their needs, makes home centers and hardware stores the preferred choice for a significant portion of the Australia knife buying public. While other distribution channels, such as online sales and specialty stores, also play important roles, the home center and hardware store segment remain the dominant force, cementing its position as the primary marketplace for knife purchases in the Australian market.

Competitive overview of Australia Knife Market

The major players operating in the Australia Knife Market include Knife Depot ,Wusthof, Gerber, Cold Steel, Columbia River Knife & Tool ,Knife Depot ,Wusthof, Gerber, Cold Steel, Columbia River Knife & Tool ,Knife Depot ,Big Red Knives, Wusthof, Gerber, Australian Knife Sales, Spyderco AU, Columbia River Knife & Tool ,Ontario Knife Company

Australia Knife Market Leaders

- Knife Depot

- Wusthof

- Gerber

- Cold Steel

- Columbia River Knife & Tool

Australia Knife Market - Competitive Rivalry

Australia Knife Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Knife Market

- On 10-11, 2024 The Sydney Knife Show will organize at the Rosehill Gardens Racecourse in Parramatta, New South Wales It is Australia's largest event of its kind, showcasing the best in Australian and international knives and knife-related products.

Australia Knife Market Segmentation

- By Product Type

- Folding Knife

- Snap-off Knife

- Retractable Knife

- Safety Knife

- Others

- Fixed Knife

- Specialty Knife

- Carpet Knife

- Hobby Knife

- By Distribution Channel

- Home Center & Hardware

- Mass Retail

- Industrial

- E-commerce

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Australia Knife Market?

The Australia Knife Market is estimated to be valued at USD 16.2 in 2025 and is expected to reach USD 22.1 Million by 2032.

What are the major factors driving the Australia Knife Market growth?

The growth in culinary activities and innovations in knife designs are the major factor driving the Australia Knife Market.

Which is the leading Product Type in the Australia Knife Market?

The leading Product Type segment is carpet knife.

Which are the major players operating in the Australia Knife Market?

Knife Depot , Big Red Knives, Wusthof, Gerber, Australian Knife Sales, Spyderco AU, Columbia River Knife & Tool , Ontario Knife Company are the major players.

What will be the CAGR of the Australia Knife Market?

The CAGR of the Australia Knife Market is projected to be 4.5% from 2025-2032.