Automotive Differential Market Size - Analysis

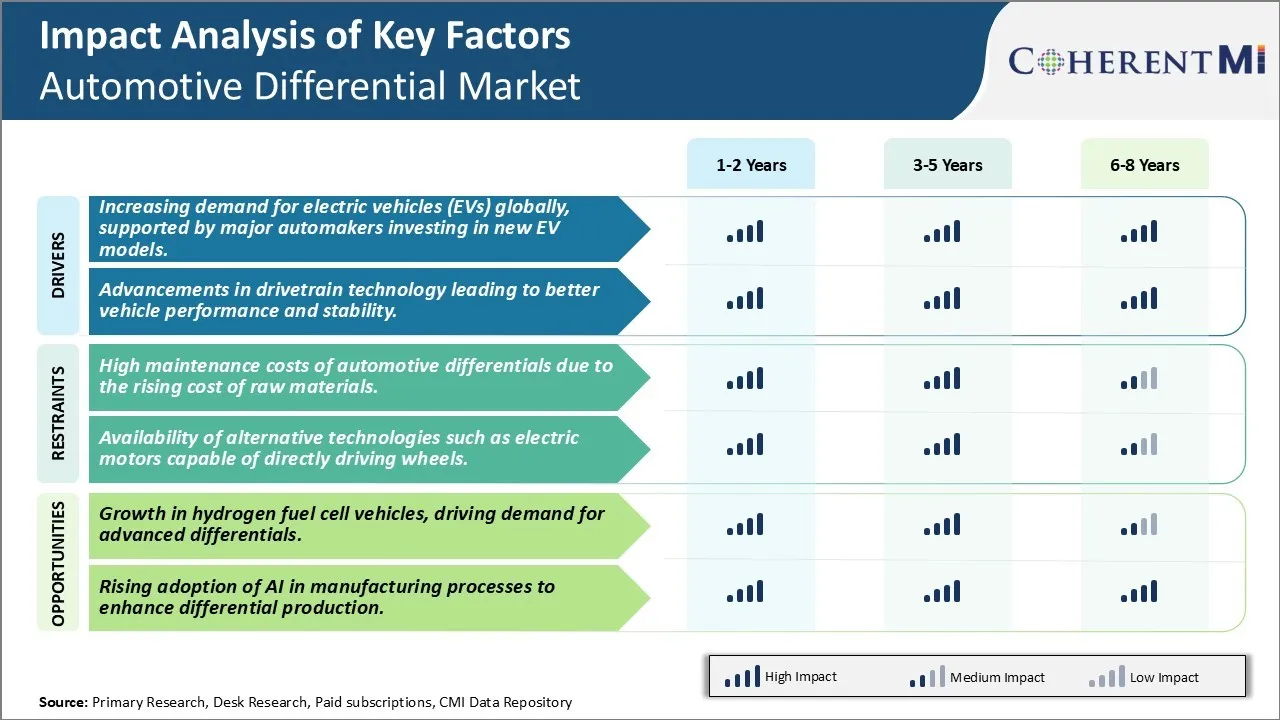

The market is expected to witness positive trends over the forecast period. Growing demand for all-wheel drive and four-wheel drive vehicles especially in off-road and heavy commercial segments will drive new differential system adoptions. Also, regulatory mandates pertaining to vehicle emissions and fuel economy will propel innovations bringing more efficient and durable differential designs. However, increasing popularity of electric vehicles may slightly hamper the demand for traditional differential systems in the coming years.

Market Size in USD Bn

CAGR4.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.7% |

| Market Concentration | Medium |

| Major Players | American Axle & Manufacturing Inc., BorgWarner Inc., Dana Incorporated, Hyundai WIA Corporation, JTEKT Corporation and Among Others |

please let us know !

Automotive Differential Market Trends

The automotive industry has seen a major shift towards electrification in recent years. Stringent emission norms around the world are pushing automakers to invest heavily in the development of electric vehicles. Most top automakers like Volkswagen, GM, Ford, and Nissan have announced bold electric vehicle plans and lineups. They aim to launch multiple affordable long-range EV models over the next five years to capitalize on the growing market opportunity.

The strong policy push for electric mobility is compelling major automakers to pour billions of dollars into battery and electric powertrain technologies. New factories are being set up for large-scale production to meet demand. However, designing electric powertrains poses unique engineering challenges compared to traditional internal combustion engines. Advanced components like the electric motor, battery management systems, and differentials need continuous innovation. Auto components manufacturers are gearing up to cater to this transition in a big way. The differential market is expected to play a vital role in the seamless operation of electric drivetrains and ensuring optimal performance and efficiency.

The automotive industry is continuously working towards enhancing the performance, efficiency and driving dynamics of vehicles. Advancements in materials, design and manufacturing are allowing automakers to build more powerful yet efficient drivetrains. Modern vehicles are expected to deliver high torques instantly, adaptive responses on different surfaces and seamless transmission of power generated. This pushes auto component suppliers to innovate continuously.

At the same time, improvements in transmission design are complementing the drivetrain's performance capabilities. New dual-clutch and continuously variable transmission solutions enable faster gear shifts compared to conventional automatic transmissions. Combining them with state-of-the-art differentials contributes to sharper acceleration, better handling and fuel efficiency. The integration of driver-assist systems further requires differentials to work in tandem with other components like electric power steering for accurate torque vectoring responses. All these technologically enabled capabilities are enhancing the holistic driving experience considerably. Consequently, it is raising performance standards for drivetrain suppliers globally.

Market Challenge - High Maintenance Costs of Automotive Differentials Due to the Rising Cost of Raw Materials

Higher raw material prices have directly impacted the maintenance and repair costs for differentials. Manufacturers have been forced to pass on some of the increased raw material costs to customers in the form of higher differential component and assembly prices. This has made routine repairs and replacements more expensive for vehicle owners. The need to replace damaged differential components also arises more frequently as vehicles age. The combination of rising component prices and greater repair needs has inflated the overall cost of differential maintenance significantly. Unless raw material price stabilization measures are implemented, maintenance cost burden will continue climbing. This could negatively impact consumer demand and undermine the price competitiveness of automakers.

Market Opportunity: Growth of Hydrogen Fuel Cell Vehicles Encourages Industry Developments

Differential suppliers experienced in developing electric vehicle components have an advantage in securing large supply contracts. Capturing early mover positions in hydrogen vehicle differentials allows manufacturers to establish product reliability and branding. It also provides an opportunity to drive innovation through next-gen materials, integrated motor solutions and technologies tailored for commercial vehicle duty cycles. Successful hydrogen vehicle programs could open up a huge new market for advanced differentials, acting as a catalyst for long term revenue growth.

Key winning strategies adopted by key players of Automotive Differential Market

Product Innovation: One of the most important strategies adopted by leading differential manufacturers is continuous product innovation and development. Companies like GKN, Eaton, and American Axle have invested heavily in R&D to develop new differential technologies that improve efficiency, enhance vehicle control and safety. For example, in 2018 GKN introduced its Twinster fully-variable all-wheel drive system which can vary torque distribution between front and rear axles continuously. This has helped OEMs develop advanced all-wheel drive vehicles.

Strategic Partnerships: Forming strategic partnerships with major automakers has also proven advantageous. In 2012, GKN partnered with Volkswagen to supply advanced driveline technologies for several Volkswagen AG vehicle platforms globally. Similarly, Eaton joined hands with GM in 2018 to cooperatively develop integrated drive units for future electric vehicles. These partnerships lead to long-term supply agreements and help manufacturers capture a large share of a particular automaker's annual production volumes.

In summary, continuous innovation, modular product strategies, strategic partnerships with OEMs and optimizing manufacturing footprint have been instrumental in helping major differential manufacturers achieve global leadership in this highly competitive market.

Segmental Analysis of Automotive Differential Market

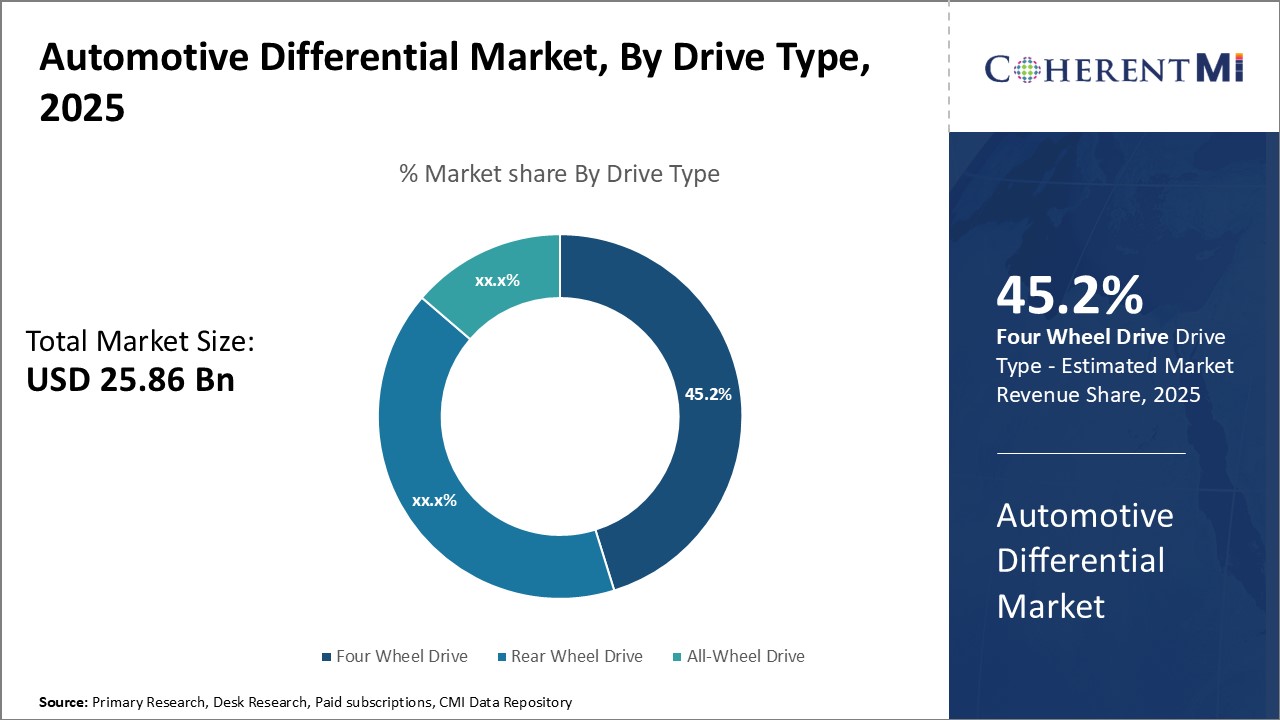

Insights, By Drive Type, Convenience and Safety Drive Growth of Four Wheel Drive Vehicles

Insights, By Drive Type, Convenience and Safety Drive Growth of Four Wheel Drive VehiclesBy Drive Type, Four Wheel Drive (FWD) is expected to contribute 45.2% market share in 2025 owing to its convenience and safety benefits. FWD vehicles provide stability and better traction in wet and slippery road conditions compared to RWD and AWD vehicles. This allows drivers to navigate rough terrains and steep slopes with more confidence. The even torque distribution of FWD also makes driving easier, especially in start-stop traffic. The enhanced control and handling have made FWD a popular choice for family vehicles used in urban driving. Furthermore, FWD is considered safer than RWD as the drive wheels also function as the steering wheels, allowing the vehicle to corner in stable manner. This has increased demand from safety-conscious customers. The convenience and safety advantages have helped cement FWD's leadership position in the drive type segment.

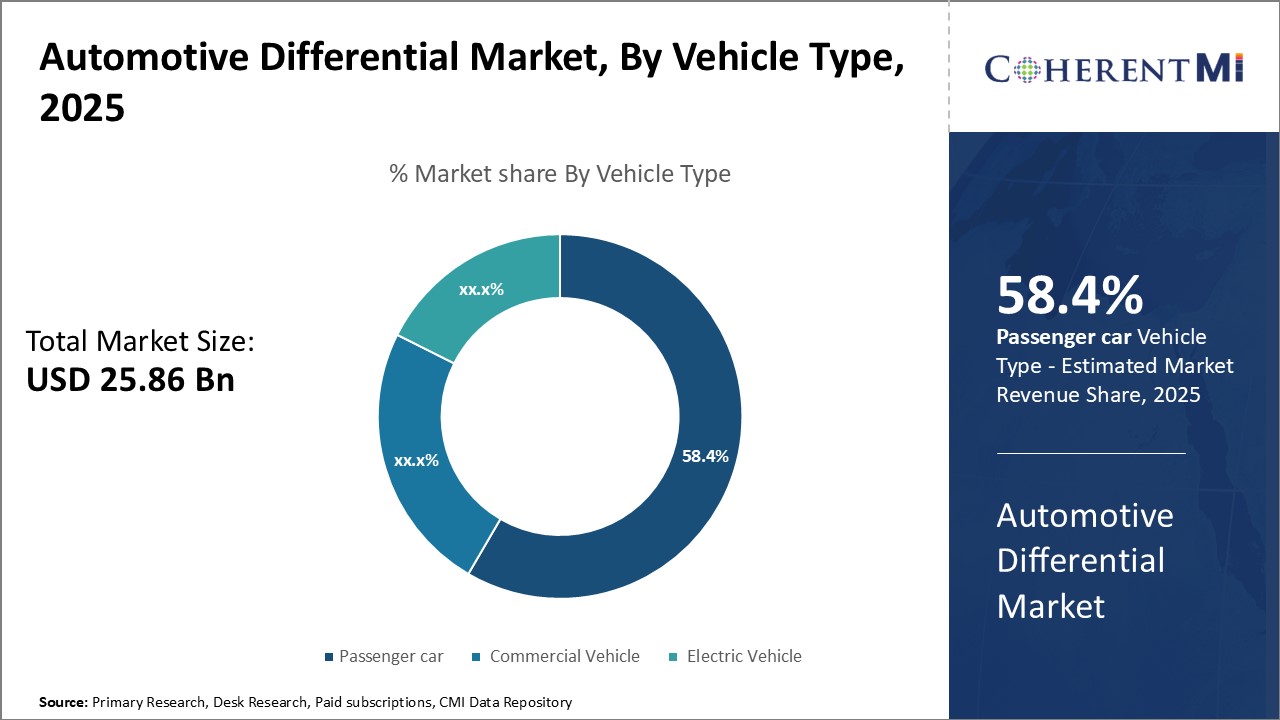

By Vehicle Type, Passenger car segment is expected to contribute 58.4% market share in 2025 due to factors driving performance and comfort requirements. Passenger cars allow for more interior space compared to commercial vehicles, catering to the needs of families and individuals. Automakers are continually enhancing passenger car performance in terms of speed, acceleration and handling. Improved vehicle dynamics and suspensions have made driving more enjoyable. Additionally, demand for luxury and premium features from affluent buyers also contributes to the passenger car segment's growth. Driving comfort is an important attribute for customer satisfaction that automakers are addressing through innovative seating, suspensions and noise reduction technologies. The focus on performance and comfort will ensure the passenger car segment remains dominant in the vehicle type category.

Insights, By Type, Simplicity and Efficiency Favor Open Differentials

Additional Insights of Automotive Differential Market

The automotive differential market is experiencing robust growth due to the rising demand for electric and hybrid vehicles across the globe. Governments and private entities are making significant investments to advance the automotive sector, particularly in developing differential systems. Companies like Hyundai, BorgWarner, and JTEKT are focusing on innovations like torque-vectoring and ultra-compact differentials to cater to the growing need for efficient, durable, and high-performance components in EVs. Additionally, the increasing adoption of AI technology in manufacturing processes is transforming production efficiency and quality, enabling manufacturers to meet the growing market demand. Emerging markets, especially in Asia-Pacific, are seeing significant growth due to favorable government policies and investments, while North America is projected to exhibit rapid growth due to technological advancements in luxury and electric vehicles.

Competitive overview of Automotive Differential Market

The major players operating in the Automotive Differential Market include American Axle & Manufacturing Inc., BorgWarner Inc., Dana Incorporated, Hyundai WIA Corporation, JTEKT Corporation, Linamar Corporation, Melrose Industries Plc, Schaeffler Group and ZF Friedrichshafen AG.

Automotive Differential Market Leaders

- American Axle & Manufacturing Inc.

- BorgWarner Inc.

- Dana Incorporated

- Hyundai WIA Corporation

- JTEKT Corporation

Automotive Differential Market - Competitive Rivalry

Automotive Differential Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Differential Market

- In May 2024, BorgWarner launched an electric Torque Vectoring and Disconnect (LVD) system for BEVs, enhancing vehicle stability and performance.

- In March 2024, Fastmarkets introduced a low-carbon-aluminium differential, addressing sustainability demands in Japan and South Korea.

- In December 2023, SPELAB launched a durable differential cover made of billet aluminum alloy, improving performance compared to conventional iron covers.

- In June 2023, TDK Corporation introduced a new noise reduction filter (TCM0403T) for interface differential transmission.

Automotive Differential Market Segmentation

- By Drive Type

- Four Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All-Wheel Drive (AWD)

- By Vehicle Type

- Passenger car

- Commercial Vehicle

- Electric Vehicle

- By Type

- Open

- Locking

- LSD

- ELSD

- Torque Vectoring

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Frequently Asked Questions :

How big is the Automotive Differential Market?

The Global Automotive Differential Market is estimated to be valued at USD 25.86 Bn in 2025 and is expected to reach USD 35.67 Bn by 2032.

What will be the CAGR of the Automotive Differential Market?

The CAGR of the Automotive Differential Market is projected to be 4.5% from 2024 to 2031.

What are the major factors driving the Automotive Differential Market growth?

The increasing demand for electric vehicles (EVs) globally, supported by major automakers investing in new EV models. and advancements in drivetrain technology leading to better vehicle performance and stability are the major factors driving the Automotive Differential Market.

What are the key factors hampering the growth of the Automotive Differential Market?

The high maintenance costs of automotive differentials due to the rising cost of raw materials and availability of alternative technologies such as electric motors capable of directly driving wheels are the major factors hampering the growth of the Automotive Differential Market.

Which is the leading Drive Type in the Automotive Differential Market?

Four Wheel Drive (FWD) is the leading Drive Type segment.

Which are the major players operating in the Automotive Differential Market?

American Axle & Manufacturing Inc., BorgWarner Inc., Dana Incorporated, Hyundai WIA Corporation, JTEKT Corporation, Linamar Corporation, Melrose Industries Plc, Schaeffler Group, ZF Friedrichshafen AG are the major players.