Cardiac Restoration Systems Market Size - Analysis

Market Size in USD Bn

CAGR5.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.4% |

| Market Concentration | Medium |

| Major Players | Abbott Laboratories, Artivion, Inc., BioVentrix, Inc., Edwards Lifesciences Corporation, ANCORA HEART, INC. and Among Others |

please let us know !

Cardiac Restoration Systems Market Trends

People are becoming far less active due to more sedentary jobs and entertainment options that keep them stationary for extended periods. At the same time, consumption of alcohol, tobacco and foods high in unhealthy fats and sugars is on the rise. This has contributed significantly to growing levels of obesity across populations. Needless to say, such behavioral changes have serious health impacts. Cardiovascular diseases in particular have seen alarming increases globally. Conditions like coronary artery disease, heart failure, cardiomyopathy, and arrhythmias are all more widely prevalent today than ever before.

All of these then raise the risk of heart attacks, strokes and other serious disorders. Unfortunately, reversal or treatment of these underlying conditions is a challenge, making prevention through lifestyle modification extremely important. Nonetheless, as more people are affected, the need for advanced medical solutions continues growing.

Market Driver - Technological Advancements Enhancing Adoption

This has translated to drastically reduced recovery times for patients and fewer overall complications. Device developers have worked hard to miniaturize components, make materials more biocompatible, and enhance functionalities for addressing complex problems. Doctors too have gained valuable expertise in navigating modern workflow protocols.

Some treatment options can now be administered percutaneously in cardiac catheterization labs. This has enabled treating a wider pool of eligible cases, both emergencies and electives, in specialized centers. Wider physician training programs along with supportive clinical evidence are helping drive standardization and trust in modern techniques. Continued evolution of next-gen products will likely further stimulate market expansion in the coming years.

The high costs associated with treatment and management of cardiovascular disorders pose a significant challenge for the growth of the cardiac restoration systems market. Cardiovascular diseases often require long-term drug treatment, recurrent hospitalizations, complex surgical procedures and extensive post-operative care. This ongoing financial burden on patients and healthcare systems means that cardiac restoration systems, while beneficial, may not be widely adopted or accessible to all patients due to their high upfront costs.

Government support through reimbursement programs and insurance coverage needs to grow significantly to help overcome this financial barrier and allow more patients access to advanced cardiac therapies. With aging populations in developed nations becoming more susceptible to heart diseases, controlling escalating healthcare expenditures remains a key public policy challenge.

Market Opportunity - Rising Demand for Minimally Invasive Treatments for Cardiovascular Diseases

As patients grow more aware of these benefits, their willingness to opt for advanced cardiac restoration systems and minimally invasive therapies is spurring demand. Moreover, the growing geriatric demography worldwide is leading to a rise in the incidence of age-related cardiovascular conditions. This is propelling the need for effective solutions to improve clinical outcomes for aged patients with higher surgical risks.

Key winning strategies adopted by key players of Cardiac Restoration Systems Market

Focus on innovation through R&D: Players like Abbott Laboratories have been continuously investing in R&D to develop innovative and technologically advanced cardiac restoration systems. In 2016, Abbott received FDA approval for its MitraClip device, a clip-based mitral regurgitation treatment. This was a major win as it established Abbott as the leader in this space. Other players like Edwards Lifesciences are also focusing on R&D to develop novel products like the PASCAL transcatheter mitral valve repair system.

Adopt customized marketing strategies: Each key player adopts tailored marketing strategies based on their product portfolios. For instance, Abbott focuses on extensive physician education and training programs to promote MitraClip. These programs have helped increase MitraClip adoption rates. Edwards raises disease awareness through patient advocacy campaigns and physician outreach using clinical evidence from pivotal trials.

Segmental Analysis of Cardiac Restoration Systems Market

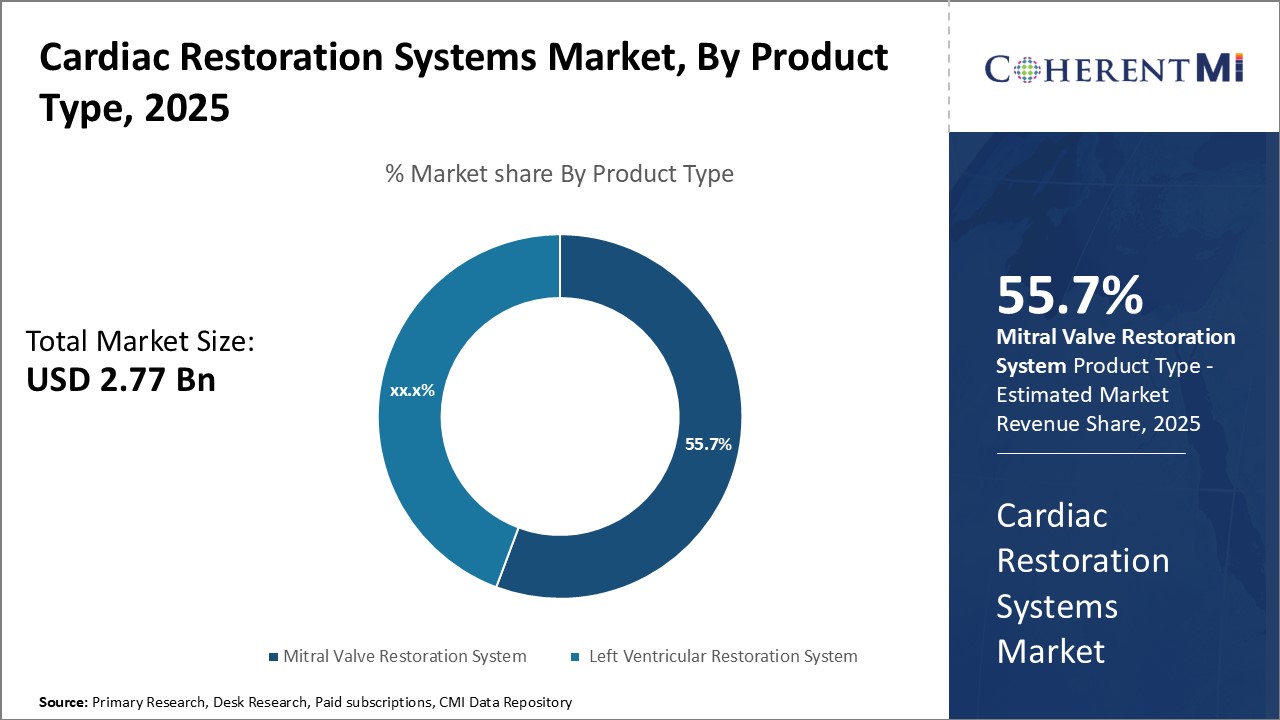

Insights, By Product Type: Mitral Valve Restoration System Maintain High Demand

Insights, By Product Type: Mitral Valve Restoration System Maintain High DemandMitral valve restoration systems have seen increased adoption rates primarily due to the rising number of mitral regurgitation procedures globally. Mitral regurgitation, also known as mitral insufficiency, occurs when the mitral valve does not close properly, allowing blood to flow backward in the heart. It is one of the most common types of heart valve disorders encountered in clinical practice. With aging populations in developed nations and higher risks of heart conditions in developing countries, the caseload of mitral regurgitation has been growing steadily.

Moreover, restoration procedures allow the original tissue to be preserved as compared to full replacement with artificially implanted materials. This biological advantage along with procedural benefits such as faster recovery times have increased the preference for mitral valve restoration systems among patients and clinicians.

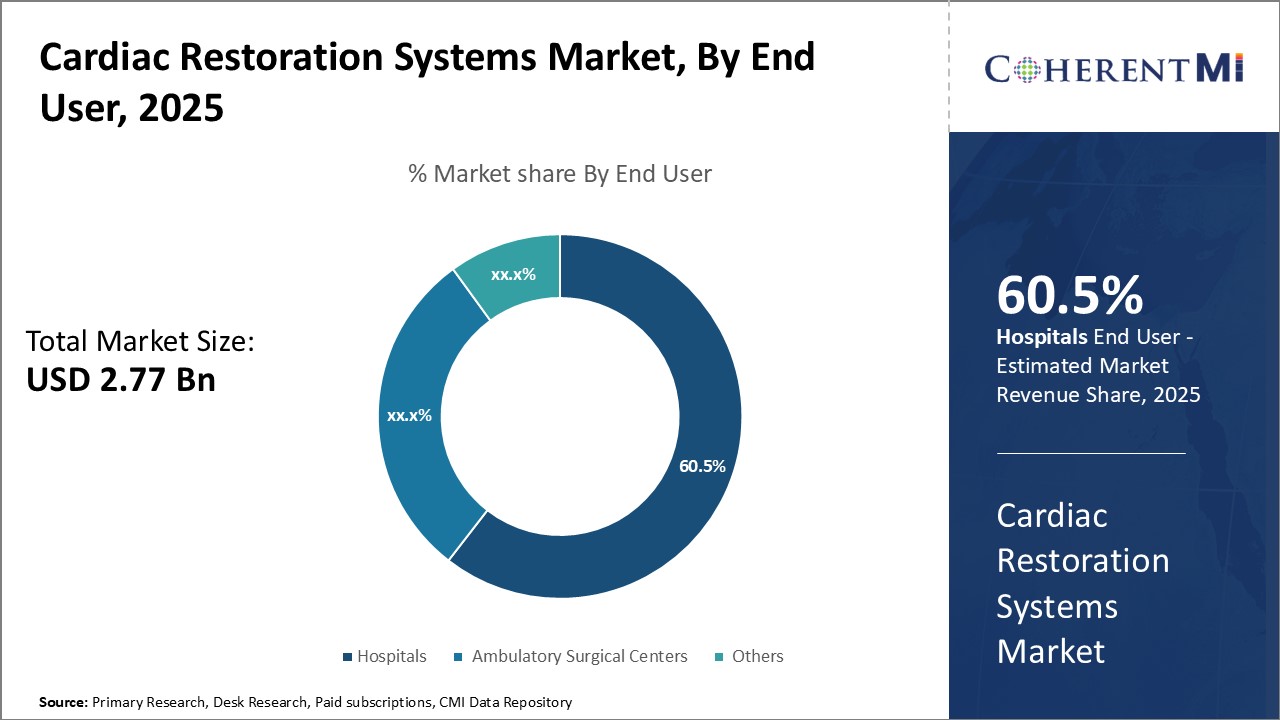

Insights, By End User: Hospitals Continue to Focus on Maintaining Availability of Specialized Infrastructure

Moreover, hospitals offer a conducive clinical environment for surgeons and interventionists to enhance their skills through a higher caseload. The concentration of trained cardiologists, cardiac surgeons, nurses and technicians supporting heart programs at hospitals helps to efficiently conduct the cardiac restoration workflow. These resources coupled with state-of-the-art cardiac units enable effective treatment outcomes for patients.

Additional Insights of Cardiac Restoration Systems Market

- According to the World Health Organization, 17.9 million people died from cardiovascular diseases globally in 2019. This makes cardiovascular diseases the leading cause of death worldwide, emphasizing the demand for effective treatments like cardiac restoration systems.

- By 2022, approximately 39% of the world’s population was categorized as overweight, with more than 650 million people living with obesity. This significantly contributes to the rising demand for cardiac restoration treatments.

Competitive overview of Cardiac Restoration Systems Market

The major players operating in the Cardiac Restoration Systems Market include Abbott Laboratories, Artivion, Inc., BioVentrix, Inc., Edwards Lifesciences Corporation, ANCORA HEART, INC., NeoChord, Inc., CryoLife, Syntach AB, Affluent Medical SA, and CardioKinetix.

Cardiac Restoration Systems Market Leaders

- Abbott Laboratories

- Artivion, Inc.

- BioVentrix, Inc.

- Edwards Lifesciences Corporation

- ANCORA HEART, INC.

Cardiac Restoration Systems Market - Competitive Rivalry

Cardiac Restoration Systems Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cardiac Restoration Systems Market

- In February 2023, Abbott Laboratories announced its acquisition of Cardiovascular Systems, Inc. (CSI), a medical device company specializing in atherectomy systems used for treating peripheral and coronary artery diseases. This acquisition, valued at approximately $890 million, enhances Abbott's cardiovascular portfolio and positions the company for further growth in treating complex vascular diseases. By integrating CSI’s innovative technologies, Abbott aims to improve care for patients dealing with arterial blockages, supporting their overall strategy to expand in the vascular device market.

- In January 2022, CryoLife announced its rebranding as Artivion, Inc. The change became effective on January 18, 2022, reflecting the company's focus on providing innovative technologies for the treatment of aortic diseases. The name "Artivion" was derived from the words "aorta," "innovation," and "vision." Additionally, the company's ticker symbol on the New York Stock Exchange was changed to "AORT" from "CRY" on January 24, 2022.

Cardiac Restoration Systems Market Segmentation

- By Product Type

- Mitral Valve Restoration System

- Left Ventricular Restoration System

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the cardiac restoration systems market?

The cardiac restoration systems market is estimated to be valued at USD 2.77 Billion in 2025 and is expected to reach USD 4.00 Billion by 2032.

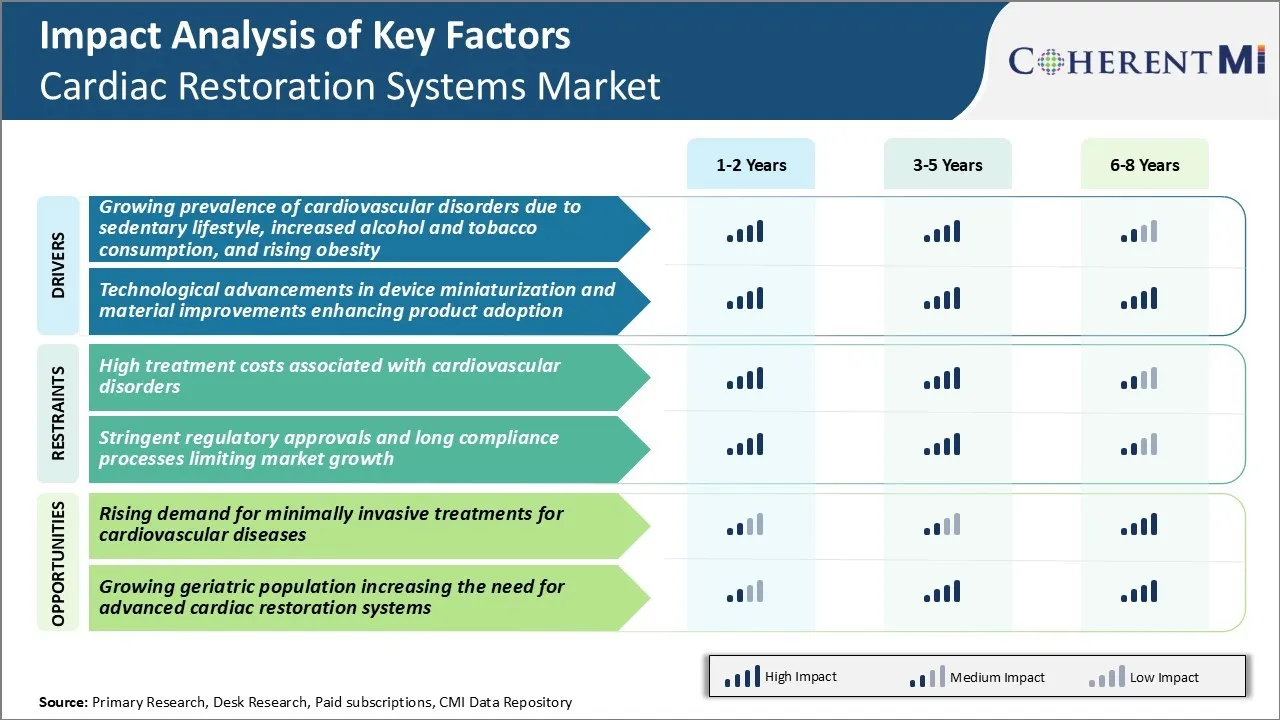

What are the key factors hampering the growth of the cardiac restoration systems market?

The high treatment costs associated with cardiovascular disorders, stringent regulatory approvals, and long compliance processes are the major factors hampering the growth of the cardiac restoration systems market.

What are the major factors driving the cardiac restoration systems market growth?

The growing prevalence of cardiovascular disorders due to sedentary lifestyle, increased alcohol and tobacco consumption, and rising obesity, and technological advancements in device miniaturization and material improvements are the major factors driving the cardiac restoration systems market.

Which is the leading product type in the cardiac restoration systems market?

The leading product type segment is mitral valve restoration system.

Which are the major players operating in the cardiac restoration systems market?

Abbott Laboratories, Artivion, Inc., BioVentrix, Inc., Edwards Lifesciences Corporation, ANCORA HEART, INC., NeoChord, Inc., CryoLife, Syntach AB, Affluent Medical SA, and CardioKinetix are the major players.

What will be the CAGR of the cardiac restoration systems market?

The CAGR of the cardiac restoration systems market is projected to be 5.4% from 2025-2032.