The carpal tunnel release system market is estimated to be valued at USD 0.91 Bn in 2025 and is expected to reach USD 1.43 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.7% from 2025 to 2032. This steady growth can be attributed to the rising incidence of wrist injuries and carpal tunnel syndrome worldwide. With growing geriatric population prone to such conditions, the demand for effective treatment options like carpal tunnel release systems is also expected to grow steadily in the coming years.

Market Size in USD Bn

CAGR6.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.7% |

| Market Concentration | Medium |

| Major Players | Stryker Corporation, Smith & Nephew plc, Integra LifeSciences, MicroAire Surgical Instruments, LLC, Sonex Health and Among Others |

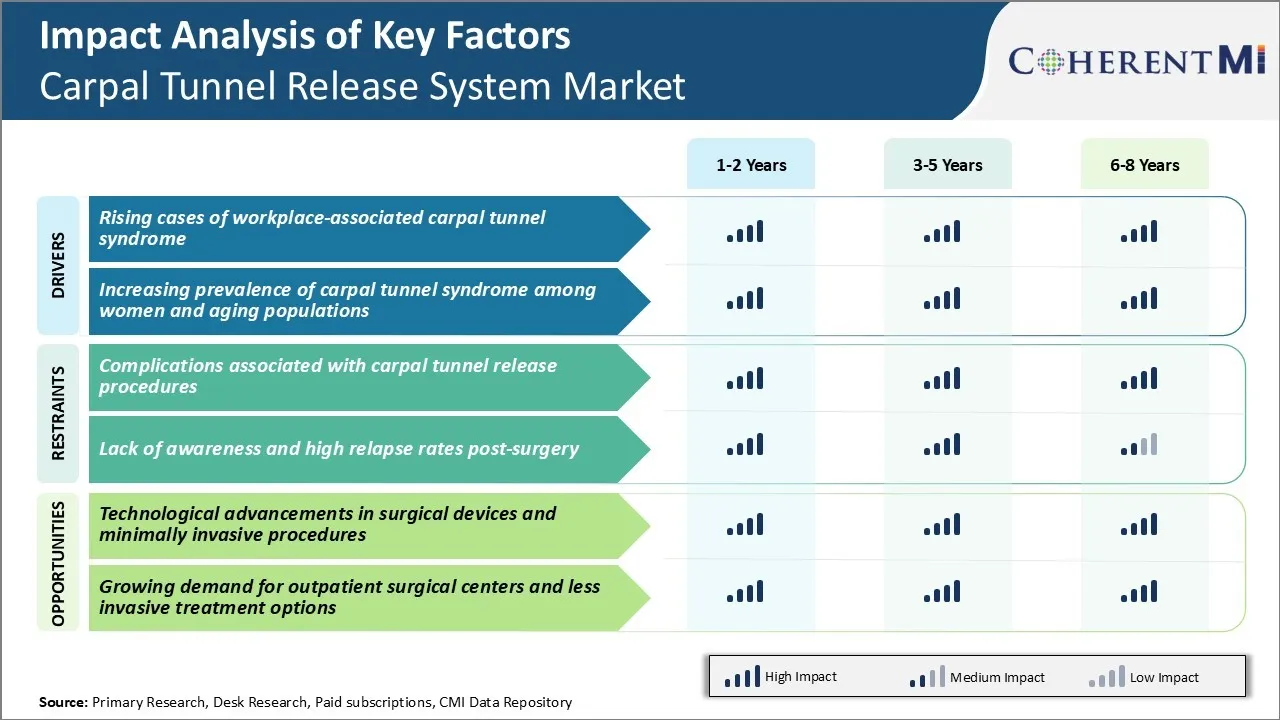

Market Driver - Rising Cases of Workplace-Associated Carpal Tunnel Syndrome

Prolonged exposure to repetitive hand and wrist motions required for activities like typing on keyboard and mouse usage, assembly line work, and equipment handling has made workers more prone to developing carpal tunnel syndrome. Carpal tunnel (CT) syndrome occurs when the median nerve located in the carpal tunnel of the hand gets compressed or squeezed.

Occupations involving intensive and regular use of hands and wrists like data entry operators, customer service representatives, engineers, factory workers have seen a concerning rise in CT cases in recent years. Help desk operators and call center employees who have to maintain unnatural wrist postures for extended periods while using computer keyboards or phones are particularly at high risk.

The demanding production targets and performance metrics in manufacturing plants often do not allow workers sufficient breaks and rest periods. Even white-collar professionals working in offices have reported increasing symptoms of CT due to longer duration of computer usage.

With evolving job roles and work cultures across industries, the risk factors for developing CT seem to be continuously growing in the professional environment. This surge in occupation-linked CT cases indicates a potential rise in demand for carpal tunnel release procedures and postoperative rehabilitation therapies.

Market Driver - Increasing Prevalence of Carpal Tunnel Syndrome among Women and Aging Populations

Carpal tunnel syndrome has historically affected women more than men. It is estimated that women are nearly 3 times more likely than men to develop CT. Biological and anatomical reasons have been associated with this gender predisposition. Women naturally have smaller carpal canals which cramp the median nerve more tightly.

Additionally, hormonal changes during menstrual cycles and pregnancy can cause the hands and wrist to swell leading to further nerve compression. With rising women workforce participation and dual-income households now common globally, women are just as actively engaged in high-risk jobs and activities as men, increasing their exposure to causative factors.

Age is another prominent non-occupational risk factor for CT. As people grow older, the synovial tissues in the carpal tunnel tend to thicken gradually due to normal wear and tear. Combined with loss of muscle strength and grip, the median nerve gets more easily entrapped in the wrist.

With advancements in medicine improving life expectancy, populations across countries are rapidly greying. The combination of innate biological predispositions and a proliferation of susceptible age groups points towards a scenario of enhanced CT prevalence rates among women and senior citizens globally. The needs for surgical and therapeutic interventions are expected to escalate accordingly.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Complications Associated with Carpal Tunnel Release Procedures

There are several complications associated with carpal tunnel release procedures that pose challenges to the growth of the carpal tunnel release system market. One of the major challenges is nerve injuries resulting from surgical errors during open carpal tunnel release procedures. Performing intricate manual procedures in a narrow anatomical space increases the risks of injuring the median nerve branches passing through the carpal tunnel.

Post-operative median nerve damage or incomplete release of the transverse carpal ligament can result in continued symptoms or new symptoms like pain and tingling in the hand and fingers. Device-related complications due to breakage or migration of fixation devices like screws also negatively impact the clinical outcomes.

Persistent symptoms and loss of hand function due to complications often require revision surgeries, adding to the treatment costs and reducing patient satisfaction with the procedure. The risks and medico-legal liabilities associated with open surgery make both patients and surgeons cautious about relying only on conventional procedures.

Market Opportunity - Technological advancements in surgical devices and minimally invasive procedures

The carpal tunnel release system market has been presented with significant growth opportunities owing to technological advancements in endoscopic and minimal access surgical devices. Minimally invasive endoscopic carpal tunnel release systems have revolutionized the procedure by enabling surgeons to access the carpal tunnel through a small incision with the aid of an endoscope and specialized cutting and widening devices. This reduces tissue trauma compared to open techniques and lowers the risks of nerve injuries, scarring and complex regional pain syndrome. It also allows for faster recovery and return to normal activities.

Advancements like mechanized cutting and tissue dilating components in endoscopic portals have improved ergonomics and consistency in application. With rising adoption, further refinement of these closed procedures could help address the complications restricting the carpal tunnel release system market potential for open carpal tunnel surgeries. Emerging technologies integrating robotics, haptics and 3D imaging are also expected to enhance precision and outcomes of minimally invasive carpal tunnel release.

Carpal tunnel syndrome is commonly treated with a stepwise approach based on the severity of symptoms. Initial mild cases may be treated with non-surgical options such as wrist splints, anti-inflammatory medications, and lifestyle modifications. Commonly prescribed pain relievers include over-the-counter NSAIDs like ibuprofen (Advil) or naproxen (Aleve) which can help reduce inflammation and associated pain.

For moderate or persistent mild symptoms, prescription strength corticosteroid injections such as betamethasone (Celestone Soluspan) may be administered. These have been shown to reduce swelling and provide relief in approximately 50% of cases. However, multiple injections are not usually recommended due to risk of side effects.

Surgical intervention is considered the standard treatment for severe, persistent Carpal Tunnel syndrome symptoms. The most common procedure performed is carpal tunnel release surgery. This involves cutting the transverse carpal ligament to relieve pressure on the median nerve. Post-surgical factors like a physician's experience with the procedure and a patient's comorbidities may influence prescribers' preference when choosing between open-incision or endoscopic-assisted minimally invasive techniques.

Overall, prescribers consider efficacy, safety, cost and convenience when choosing between treatment options. Brand reputation and detailing also have some impact, with popular brands like Celebrex and Relafen favored for anti-inflammatory drugs.

Carpal tunnel syndrome has three main stages - mild, moderate, and severe - dependent on symptoms and function. Treatment involves both non-surgical and surgical options.

Mild CTS involves intermittent symptoms that can be managed with wrist splints, anti-inflammatory medications like ibuprofen, steroid injections, and physical/occupational therapy focused on wrist stretches and exercises. This is usually first-line treatment as it is minimally invasive.

For moderate CTS with frequent tingling, pain or weakness, corticosteroid injections containing medications like betamethasone and lidocaine are commonly used. Brand names include Celestone Soluspan and Depo-Medrol with Lidocaine. Injections are preferred here as they reduce symptoms in 80% of patients, are lower risk than surgery, and may eliminate need for later invasive options if effective.

Severe CTS with constant symptoms and loss of hand function likely requires carpal tunnel release surgery. The gold standard is open carpal tunnel release which has success rates over 90%. During this procedure, the transverse carpal ligament is cut to widen the carpal tunnel. Post-surgical recovery involves splinting and therapy, but symptoms are often immediately relieved and function restored. Endoscopic carpal tunnel release, using specialized equipment inserted through small incisions, is also an option but has a slightly higher risk of nerve damage.

Product Innovation: Continuous innovation has helped players gain an edge over competitors and capture market share. In 2019, Arthrex introduced its EndoButtons Carpal Tunnel Release System which allows for a mini-open or endoscopic carpal tunnel release procedure. The low-profile titanium buttons provide extra stability and less post-operative pain compared to traditional metal stakes.

Market Expansion: Players have expanded into emerging markets which are expected to see higher growth compared to developed nations. In 2015, Smith & Nephew launched its ENDONATE Carpal Solution in key Asian markets like India and China.

Strategic Acquisitions: Acquisitions have enabled companies to enhance their product portfolio and presence across sectors. In 2017, Stryker acquired Wright Medical, a leader in extremities. This gave Stryker access to Wright's advanced carpal tunnel release technologies and strengthened its position in small joint reconstruction.

Marketing & Promotions: Aggressive promotions and education programs have driven awareness and adoption. In 2018, MicroAire launched the "Carpal Relief Challenge" encouraging surgeons to perform more endoscopic carpal tunnel surgeries using its Snap system. Over 300 participants received training and saw 15% higher patient satisfaction scores compared to open techniques. This helped MicroAire become among the fastest growing players.

To learn more about this report, Download Free Sample Copy

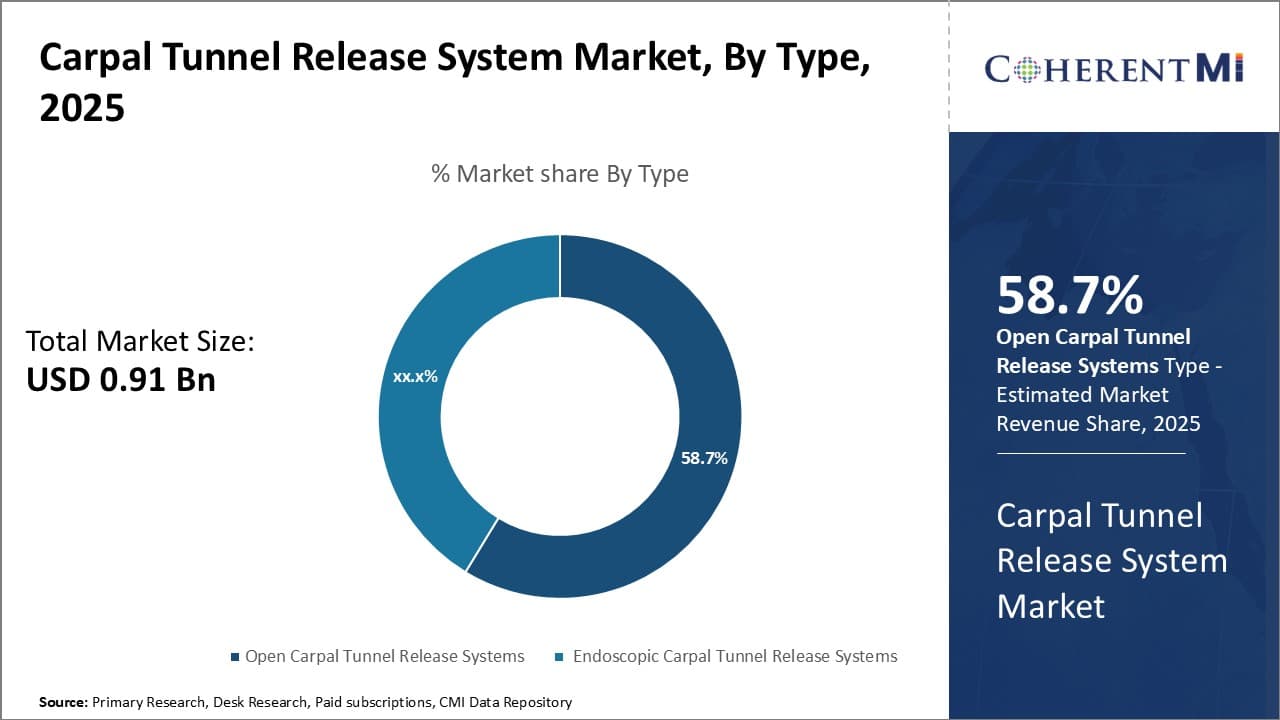

Insights, By Type: Open Carpal Tunnel Release Systems Witness Dominance of Open Surgery Procedures

To learn more about this report, Download Free Sample Copy

Insights, By Type: Open Carpal Tunnel Release Systems Witness Dominance of Open Surgery Procedures

In terms of type, open carpal tunnel release systems is likely to hold 58.7% of the total share in 2025 in the carpal tunnel release system market owing to greater adoption among orthopedic surgeons. Open surgery techniques have been utilized for decades to treat carpal tunnel syndrome. Surgeons are well-versed in the procedural steps and risks involved, allowing for more predictable outcomes. Some surgeons also perceive open release to provide better visualization of anatomical structures compared to endoscopic techniques. This allows for more complete division of the transverse carpal ligament and potential identification and treatment of concurrent pathologies like synovitis or tendon disorders.

The open surgical approach remains the gold standard treatment option recommended for more severe cases involving significant nerve dysfunction or concurrent pathology. The extensive division of the ligament facilitated by open surgery may achieve higher resolution of symptoms in these complex cases. Open release also enables appropriate treatment of complications should they arise intraoperatively.

Certain attributes of open surgery, such as direct anatomical visualization and convenience in complicated cases, appeal to some surgeons. This favorability bolsters the carpal tunnel release system market share of open carpal tunnel release systems. The approach remains entrenched as the primary recommended treatment for severe symptomology or complex surgical cases.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

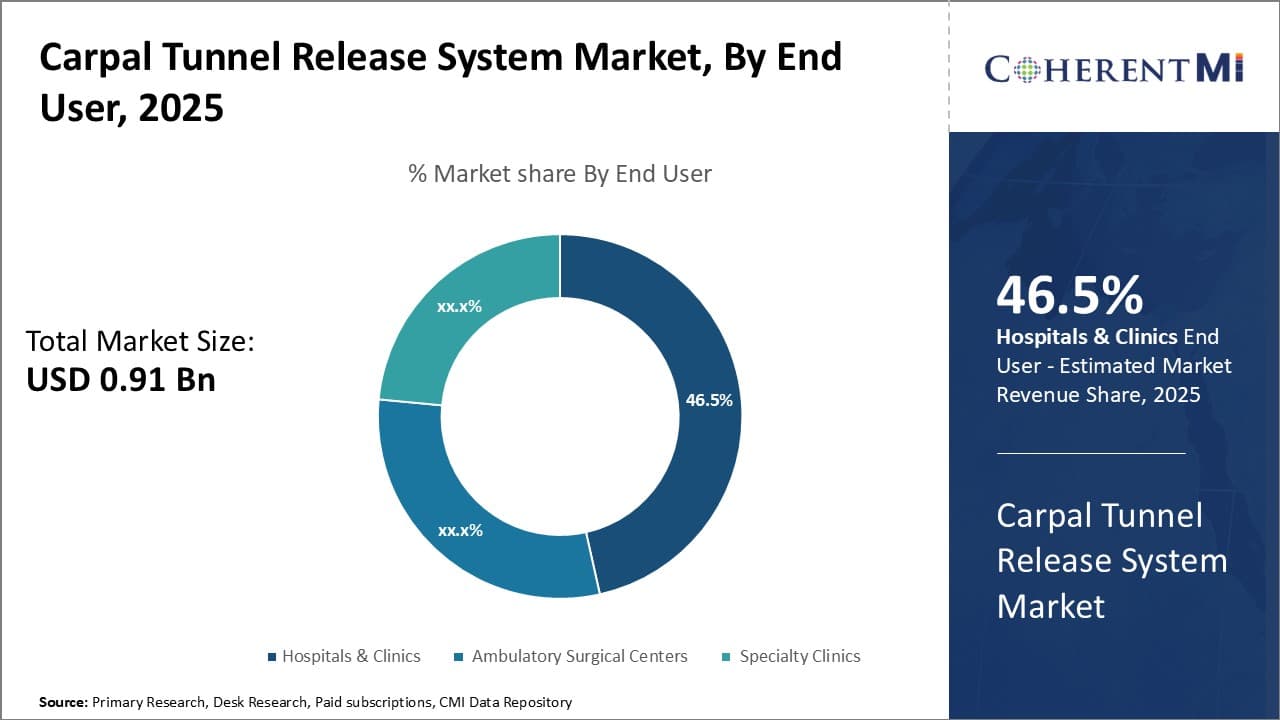

Insights, By End User: Hospitals as the Hub of Carpal Tunnel Treatment

In terms of end user, hospitals & clinics is likely to account for 46.5% share of the carpal tunnel release systems market in 2025. Most carpal tunnel surgical procedures occur in hospital-based settings owing to availability of comprehensive facilities and specialized care. Hospitals provide all necessary resources and personnel to properly manage carpal tunnel release cases of varying complexity.

The hospital setting allows for integration of carpal tunnel surgery with other departments like physical therapy, occupational therapy, and hand specialists that provide important postoperative treatment and rehabilitation. Coordinated multidisciplinary management in a hospital streamlines optimal post-surgical recovery. Many insurance plans also have network affiliations that incentivize treatment at hospitals and minimize patient out-of-pocket costs to increase accessibility of care. The concentration of specialized personnel, full surgical capabilities, and multidisciplinary resources available uniquely position hospitals for handling the majority of carpal tunnel release procedures.

The vast support infrastructure of hospitals makes them the natural hub for carpal tunnel surgery. Their advantages for managing routine as well as complex cases along with integrated rehabilitation continue attracting treatment of this common orthopedic condition primarily to the hospital environment. This consolidates hospitals as the dominant end user segment driving demand within the carpal tunnel release systems market.

The major players operating in the Carpal Tunnel Release System Market include Stryker Corporation, Smith & Nephew plc, Integra LifeSciences, MicroAire Surgical Instruments, LLC, Sonex Health, Arthrex, Inc., CONMED Corporation, and A.M. Surgical, Inc.

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Carpal Tunnel Release System Market is segmented By Type (Open Carpal Tunnel Release Systems, Endosc...

Carpal Tunnel Release System Market

How big is the carpal tunnel release system market?

The carpal tunnel release system market is estimated to be valued at USD 0.91 Bn in 2025 and is expected to reach USD 1.43 Bn by 2032.

What are the key factors hampering the growth of the carpal tunnel release system market?

The complications associated with carpal tunnel release procedures and lack of awareness and high relapse rates post-surgery are the major factors hampering the growth of the carpal tunnel release system market.

What are the major factors driving the carpal tunnel release system market growth?

The rising cases of workplace-associated carpal tunnel syndrome and increasing prevalence of carpal tunnel syndrome among women and aging populations are the major factors driving the carpal tunnel release system market.

Which is the leading type in the carpal tunnel release system market?

The leading type segment is open carpal tunnel release systems.

Which are the major players operating in the carpal tunnel release system market?

Stryker Corporation, Smith & Nephew plc, Integra LifeSciences, MicroAire Surgical Instruments, LLC, Sonex Health, Arthrex, Inc., CONMED Corporation, and A.M. Surgical, Inc. are the major players.

What will be the CAGR of the carpal tunnel release system market?

The CAGR of the carpal tunnel release system market is projected to be 6.7% from 2025-2032.