Energy-efficient Motor Market Size - Analysis

Market Size in USD Bn

CAGR9.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.8% |

| Market Concentration | High |

| Major Players | Johnson Controls Inc., AG Regal, General Electric Company, Bosch Rexroth, Schneider Electric SE and Among Others |

please let us know !

Energy-efficient Motor Market Trends

One of the major drivers spurring the growth of energy-efficient motor market is the lower life cycle costs associated with it as compared to traditional motors. Energy-efficient motors have significantly higher efficiency levels which translates to lower operating expenses for end users over the lifespan of the motor.

Significant savings in electricity bills and operational costs more than offset the higher initial price tag of efficient motors. Various studies have shown energy-efficient motors can reduce lifecycle costs up to 35% in some applications. With rising electricity prices across the globe, the operating expenses savings are set to increase further thereby strengthening the economics case for energy-efficient motors. This will prove to be an important driver for growth of the energy-efficient motor market.

Market Driver - Increasing Adoption of Energy-efficient Motors in the Industrial Sector

These regulations have compelled industries across sectors reliant on motor-driven equipment to consciously shift towards purchasing of higher efficiency motors. In a bid to remain compliant and cut energy costs, industries are proactively replacing aging motors with energy-efficient alternatives. Regulations also mandate periodic efficiency monitoring of in-use motor population which has heightened replacement needs. Government initiatives such as financial incentives for each unit of efficient motor adoption further strengthen the business case.

Market Challenge - High Initial Investment Costs Due to Premium Components

Energy-efficient motors use premium electronic components and advanced magnetic materials to achieve higher levels of efficiency. These components such as rare earth permanent magnets, and state of the art power electronics and control systems make the production of energy-efficient motors a complex and expensive process. The manufacturing costs are significantly higher compared to conventional design motors.

This cost barrier needs to be addressed through innovative financing options and attractive rebate schemes to help drive greater adoption of these motors across different industry verticals.

Market Opportunity - Growth in Robotics and Automation Driving the Need for Energy-efficient Motors

More companies in the energy-efficient motor market are automating their operations to stay competitive. Consequently, the demand for intelligent motion control systems powered by energy-efficient motors is also growing tremendously.

Robotics and automation providers are thus increasingly integrating high performance yet low energy usage motors within their product lines. This emerging sector will be a key driver of future revenues for players in the energy-efficient motor market.

Key winning strategies adopted by key players of Energy-efficient Motor Market

One of the most successful strategies adopted by leading players like ABB, Siemens, and Rockwell Automation has been investing heavily in research and development to produce innovative and cutting-edge energy-efficient motor technologies. For example, between 2010-2015, ABB invested over $3 billion in R&D and introduced its newly developed IE4 (Super Premium Efficiency) motors that exceed IE3 efficiency levels by 10-20%. This helped ABB gain significant share in the energy-efficient motor market share, especially in the industrial segment.

Offering value-added services and complete system solutions instead of standalone products is another winning formula. For example, Siemens' digital offerings like Sinamics drives, remote monitoring solutions, and digital services have seen strong demand and helped increase wallet share and customer loyalty.

Segmental Analysis of Energy-efficient Motor Market

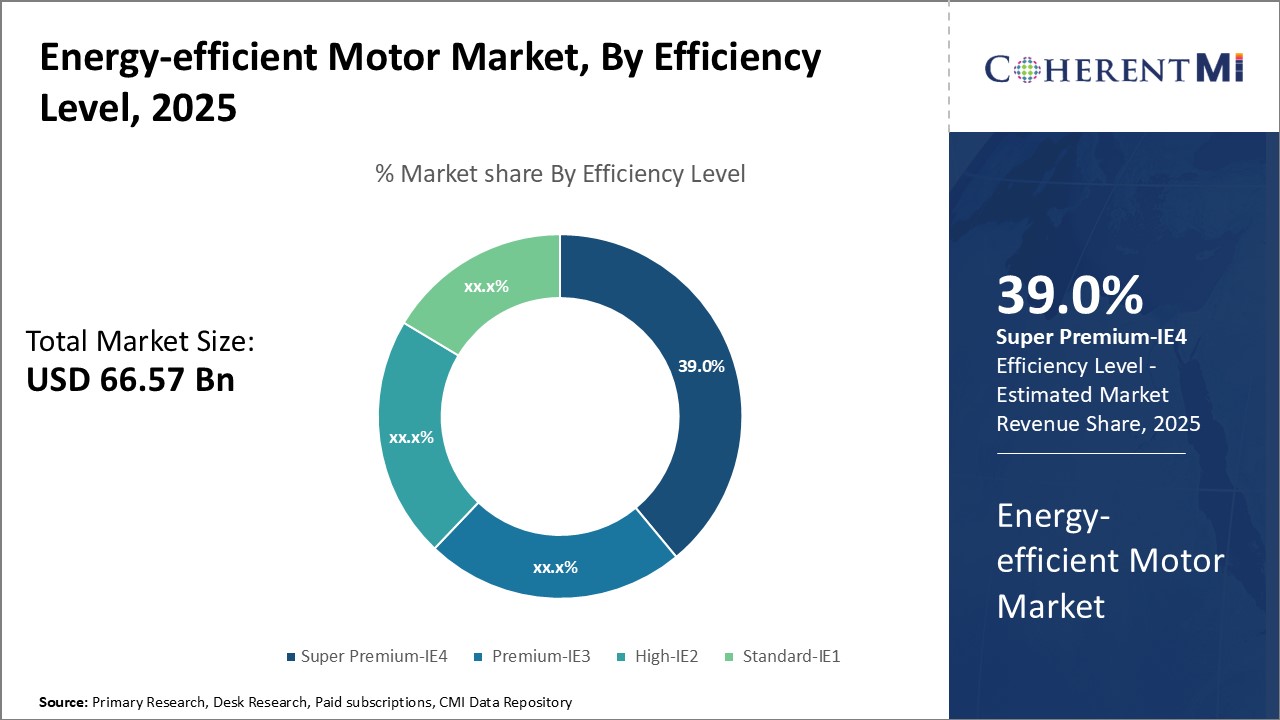

Insights, By Efficiency Level: Super Premium-IE4 Highlight the Importance of Energy Efficiency

Stringent government regulations and policies focusing on energy efficiency and conservation are a key driver for this segment's growth. Many countries have drafted policies mandating the use of IE4 motors for new installations and also replacing old motors with new IE4 ones wherever feasible. This is compelling factories and commercial establishments to upgrade their motor systems to higher efficiency variants.

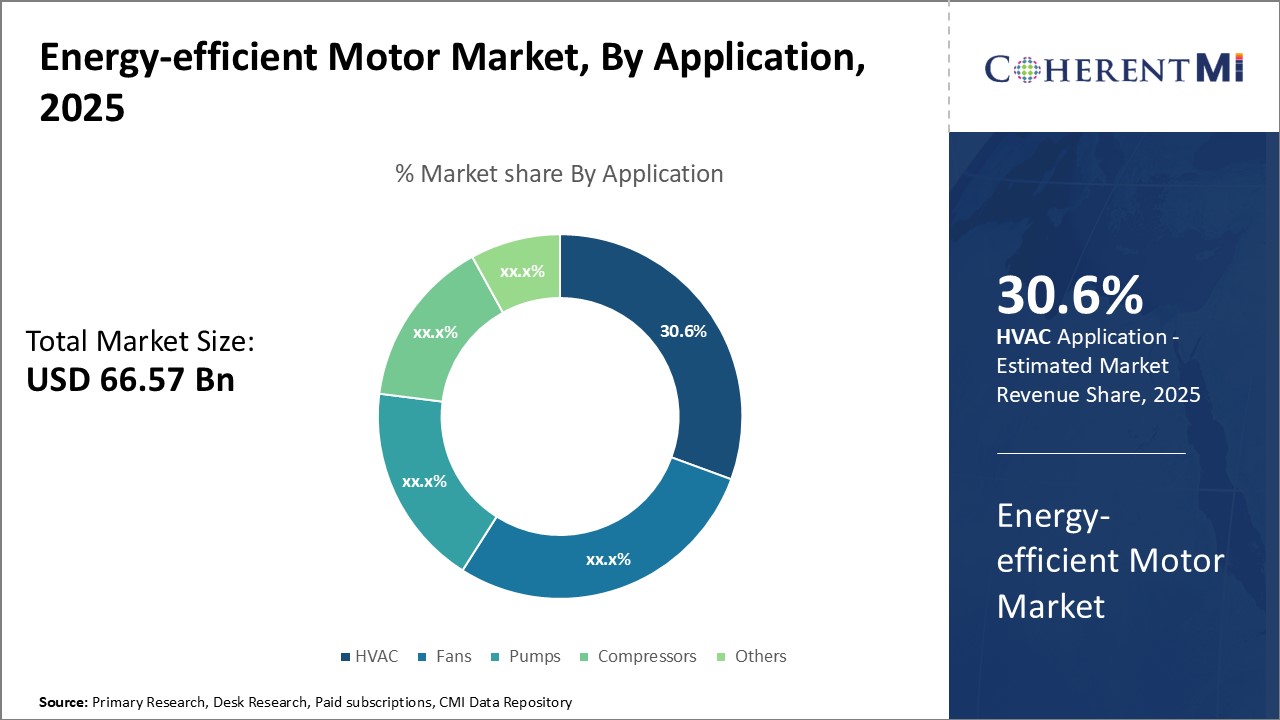

Insights, By Application: HVAC Systems Find Extensive Usage in Residential, Commercial, and Industrial Sectors

Insights, By Application: HVAC Systems Find Extensive Usage in Residential, Commercial, and Industrial SectorsThe HVAC (heating, ventilation and air conditioning) application is projected to hold 30.6% share in the energy-efficient motor market globally. Motors used in various HVAC equipment such as chillers, fans, blowers and pumps require high precision levels and experience extensive run hours throughout the year across different sectors.

In the commercial sector spanning offices, malls, hospitals etc., the operational hours of HVAC equipment are substantially higher than domestic use. This frequent operational nature plus stringent energy compliance of commercial buildings boosts replacement of existing HVAC motors with new energy-efficient variants.

Additional Insights of Energy-efficient Motor Market

- Energy-efficient motors account for approximately 40% of the total energy consumption in industrial applications, highlighting the impact of motor efficiency on overall energy use.

- Government incentives in countries like the United States and Germany are encouraging small and medium enterprises to invest in energy-efficient technologies, boosting growth of the energy-efficient motor market.

- The integration of energy-efficient motors in HVAC systems has led to substantial energy savings in commercial buildings, reducing operational costs significantly.

- The adoption of IE4 motors in manufacturing has improved production efficiency and decreased downtime, showcasing the tangible benefits of upgrading to high-efficiency motors.

Competitive overview of Energy-efficient Motor Market

The major players operating in the energy-efficient motor market include Johnson Controls Inc., AG Regal, General Electric Company, Bosch Rexroth, Schneider Electric SE, ABB Ltd., Nidec Corporation, WEG Industries, Rockwell Automation, Inc., Crompton Greaves Consumer Electricals Ltd., and Regal Beloit Corporation.

Energy-efficient Motor Market Leaders

- Johnson Controls Inc.

- AG Regal

- General Electric Company

- Bosch Rexroth

- Schneider Electric SE

Energy-efficient Motor Market - Competitive Rivalry

Energy-efficient Motor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Energy-efficient Motor Market

- In April 2024, ABB India launched its IEC Low Voltage IE4 cast iron super premium efficiency motors and IE3 aluminum motors. These new products are available in various frame sizes (71-132 for the IE4 cast iron motors and 71-90 for the IE3 aluminum motors) and are aimed at improving energy efficiency across several industries, including water and wastewater management, packaging, food and beverage, metals, cement, mining, plastics, rubber, and HVAC applications.

- In March 2024, Johnson Controls and Mahindra Group launched a Net Zero Buildings Initiative aimed at decarbonizing various types of buildings in India, including commercial, urban residential, and public structures. This initiative is designed to facilitate the adoption of sustainable building technologies and promote energy-efficient solutions.

Energy-efficient Motor Market Segmentation

- By Efficiency Level

- Super Premium-IE4

- Premium-IE3

- High-IE2

- Standard-IE1

- By Application

- HVAC

- Fans

- Pumps

- Compressors

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the energy-efficient motor market?

The energy-efficient motor market is estimated to be valued at USD 66.57 Bn in 2025 and is expected to reach USD 128.08 Bn by 2032.

What are the key factors hampering the growth of the energy-efficient motor market?

High initial investment costs due to premium components and limited awareness regarding the long-term benefits of energy-efficient motors are the major factors hampering the growth of the energy-efficient motor market.

What are the major factors driving the energy-efficient motor market growth?

Lower life cycle costs than traditional motors, significantly reducing operating expenses, and increasing adoption of energy-efficient motors in the industrial sector due to government regulations promoting energy efficiency are the major factors driving the energy-efficient motor market.

Which is the leading efficiency level in the energy-efficient motor market?

The leading efficiency level segment is super premium-IE4.

Which are the major players operating in the energy-efficient motor market?

Johnson Controls Inc., AG Regal, General Electric Company, Bosch Rexroth, Schneider Electric SE, ABB Ltd., Nidec Corporation, WEG Industries, Rockwell Automation, Inc., Crompton Greaves Consumer Electricals Ltd., and Regal Beloit Corporation are the major players.

What will be the CAGR of the energy-efficient motor market?

The CAGR of the energy-efficient motor market is projected to be 9.8% from 2025-2032.