FemTech Market Size - Analysis

Market Size in USD Bn

CAGR15.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 15.8% |

| Market Concentration | High |

| Major Players | Clue by BioWink, Flo Health, Inc., Ava Science Inc., Elvie (Chiaro Technology Ltd.), Willow Innovations, Inc. and Among Others |

please let us know !

FemTech Market Trends

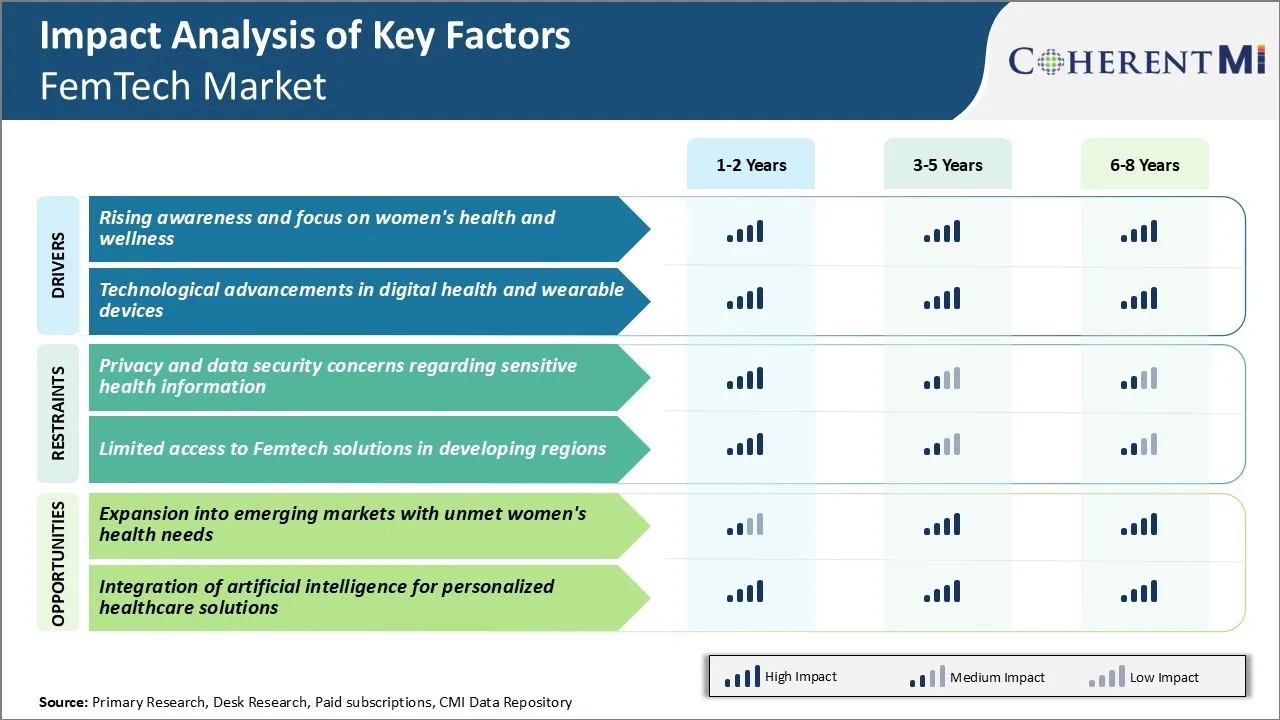

There has been a significant rise in awareness about women's health and well-being in recent years. Issues like pregnancy, fertility, menstrual health that were once considered private topics are now being openly discussed. Many women now recognize how their lifestyle choices like stress, diet, exercise impact their wellness and are taking active measures to monitor vital signs, track cycles and catch any anomalies early. This has boosted demand for FemTech solutions that provide personalized insights and support concerning hormones, fertility, pregnancy and more.

In all, higher health-consciousness among women driven by widely accessible information and inspiration from role models has generated demand for technology assisting the feminine experience with health from menarche to menopause in a supportive and caring manner. This works as a key driver propelling the FemTech industry and aids in tackling problems uniquely relevant to women through digital solutions.

Market Driver - Technological Advancements in Digital Health and Wearable Devices

Popular health and lifestyle brands have ventured into this space with their expertise in formulating devices consumers love to use. This confers a feel of reliability to these products which are often associated with sensitive topics. Their strategic tie-ups with medical institutes yield clinically backed features reassuring anxious buyers.

Overall, convergence of digital health, machine learning and user experience innovation has equipped FemTech founders to tackle female wellness challenges holistically through non-invasive means. Tech-savvy millennials globally have enthusiastically endorsed these solutions seeking relief from discreetly tracking issues like endometriosis, menopause symptoms or breastfeeding patterns in public.

FemTech applications collect highly sensitive personal health data about women, such as menstrual cycle tracking, fertility status, and symptoms. There are real concerns amongst potential users about how this intimate data could be used, shared or exposed through a data breach.

Earning and maintaining users' trust on privacy risks being an ongoing challenge as new applications emerge and data risks evolve over time. Without adequate privacy protections, many women may choose not to adopt FemTech products at all, limiting the size of the available market.

Market Opportunity - Expansion into Emerging Markets with Unmet Women's Health Needs

Features like period trackers, fertility monitors, and symptom checkers may be especially beneficial. These emerging markets represent a major opportunity for FemTech's growth, as infrastructure and economic development spreads mobile connectivity. Localizing products for cultural appropriateness and language will be important to successfully enter new regions.

Key winning strategies adopted by key players of FemTech Market

Focus on personalization: Many leading FemTech companies are focusing on personalization to provide tailored solutions to individual women's needs. For example, Natural Cycles, a fertility app, allows users to personalize their cycle and fertility predictions based on their personal menstrual patterns and behaviors.

Prioritize user experience: Companies ensure their products and apps are designed keeping users' needs and preferences in the center. Applications have intuitive and easy-to-use interfaces. For example, Natural Cycles won the 2018 German Design Award for its simple and pleasing UI. The app's ease of use contributed to its growing popularity.

Focus on awareness campaigns: Many FemTech companies actively run awareness campaigns on social media to promote women's health topics. For example, Flo was one of the early movers to educate women on menstrual cycles and fertility through blogs and articles.

Segmental Analysis of FemTech Market

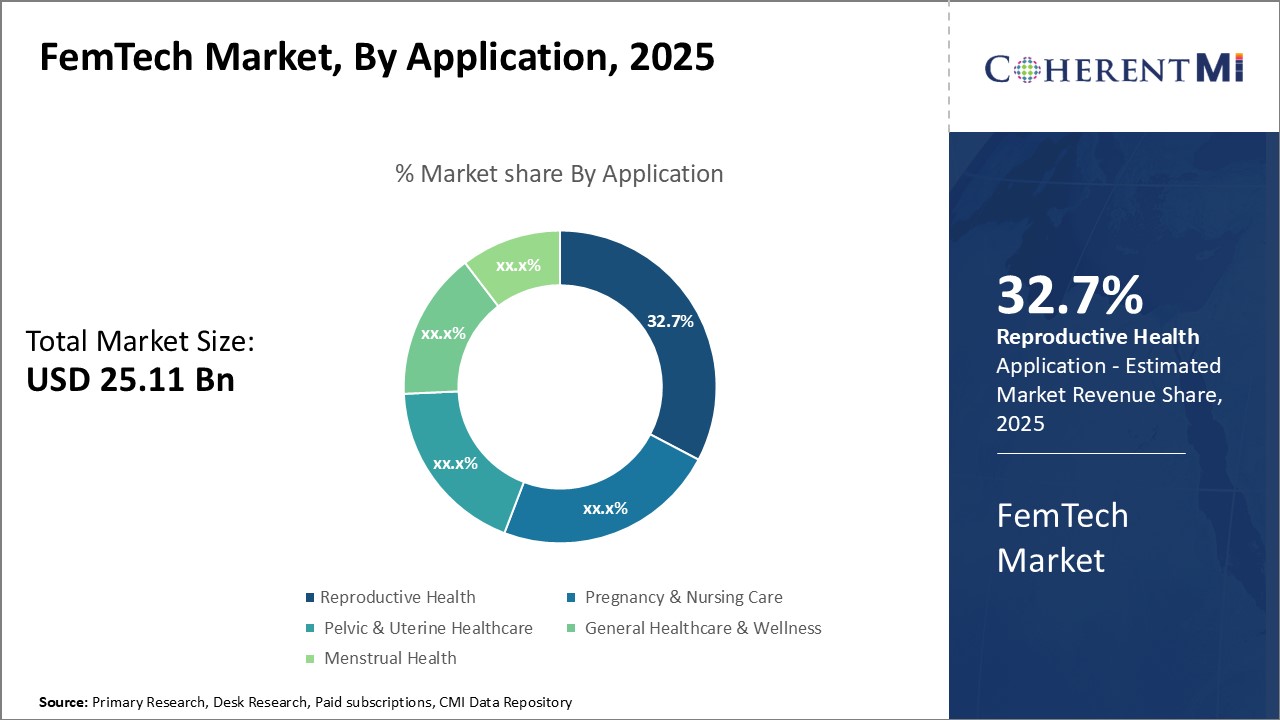

Insights, By Application: Growing Awareness of Women's Reproductive Health Drives Demand

Insights, By Application: Growing Awareness of Women's Reproductive Health Drives DemandIn terms of application, reproductive health segment is expected to hold 32.7% market share in 2025, owning to the growing awareness among women regarding their reproductive health and rights. Women are now more empowered and informed to take charge of their fertility journey. Services like fertility tracking, family planning, egg freezing etc. allow women to delay or plan motherhood as per their career and lifestyle needs.

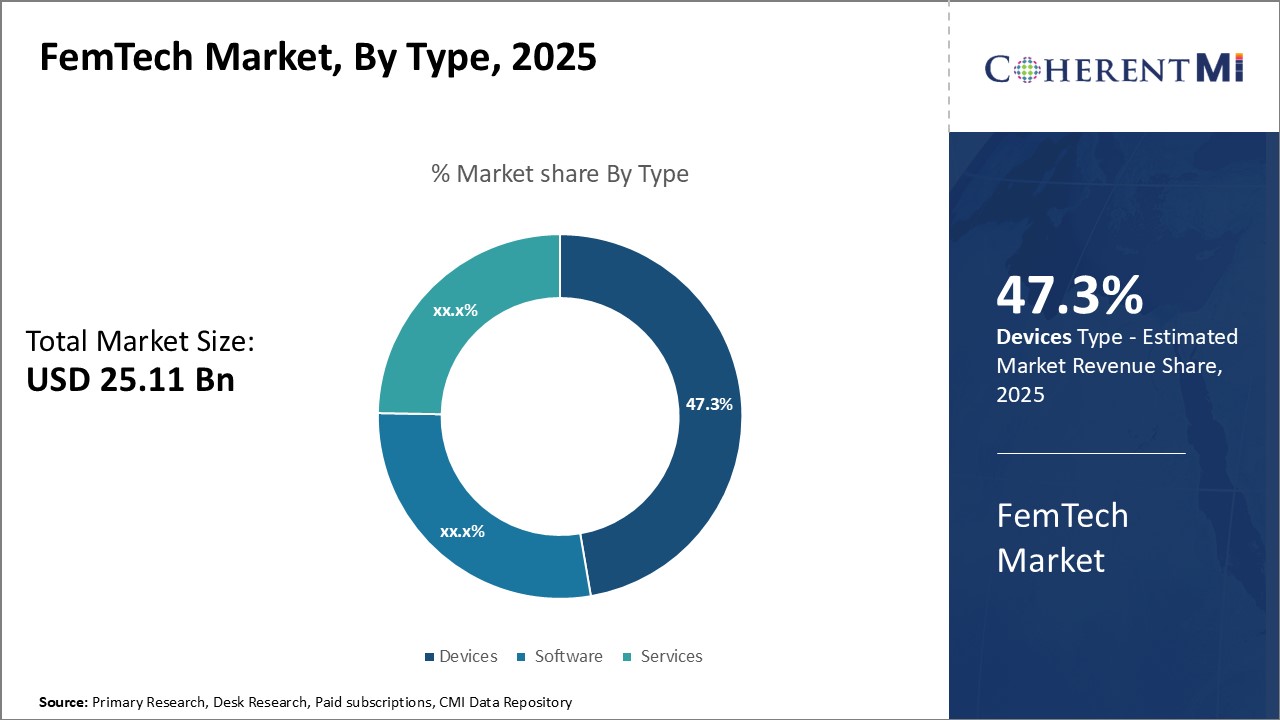

Insights, By Type: Growing Acceptance of Connected Care Boosts Wearables and Telehealth Platforms

Wearable glucose monitors have emerged as gamechangers for diabetes management in menstruating women facing hormonal fluctuations. Surge in telehealth platforms offering remote gynecological consultations benefit working women and those in remote locations.

In terms of end user, direct-to-consumer segment contributes the highest share of the market owing to growing consumer preference for privately addressing sensitive feminine issues. Women now research and purchase FamCare products discreetly online rather than visit clinics. E-commerce platforms populated with feminine hygiene and wellness brands have made women health essentials easily accessible from homes.

Home based diagnostic tools and services further empower women to test and track their health privately, a factor that greatly benefits the direct-to-consumer user base. Sleek packaging and design of DTC femcare products further destigmatize feminine issues and normalize self-care routines.

Additional Insights of FemTech Market

- FemTech solutions are expected to serve over 1 billion women globally by 2030.

- Approximately 10% of global healthcare venture funding is now directed towards FemTech companies.

- North America is expected to dominate the FemTech market due to high prevalence of chronic diseases in women, high disposable income, and advanced healthcare infrastructure.

- According to 2023 CDC data, 45.2% of U.S. women over 20 years had hypertension, fueling the demand for FemTech products.

- The surge in telehealth adoption during the COVID-19 pandemic has accelerated the use of FemTech solutions for remote consultations and health monitoring.

Competitive overview of FemTech Market

The major players operating in the FemTech market include Flo Health, Inc., Clue by BioWink, Ava Science Inc., Elvie (Chiaro Technology Ltd.), Willow Innovations, Inc., Natural Cycles Nordic AB, Maven Clinic Co., Nurx Inc., Nuelle, Inc., and Glow, Inc..

FemTech Market Leaders

- Clue by BioWink

- Flo Health, Inc.

- Ava Science Inc.

- Elvie (Chiaro Technology Ltd.)

- Willow Innovations, Inc.

FemTech Market - Competitive Rivalry

FemTech Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in FemTech Market

- In June 2023, Elvie launched a new smart breast pump with enhanced features, aiming to improve convenience for nursing mothers. This innovation is expected to strengthen their market position and cater to a larger customer base. Elvie is a leading company in women's health technology, renowned for products like the Elvie Pump and Elvie Stride, which offer discreet and hands-free breast pumping solutions.

- In April 2023, Flo Health, Inc. introduced an AI-powered feature for more accurate menstrual cycle predictions, enhancing user engagement and retention. Flo Health is known for its Flo Period Tracker app, which already utilizes AI to provide personalized menstrual cycle predictions and health insights to its users.

- In November 2022, FemTech Lab, a London-based accelerator, launched the FemTech Hub, which is the first physical innovation hub specifically dedicated to women’s health. This hub aims to unite entrepreneurs, investors, healthcare providers, and academics to advance the women's health agenda.

- In June 2022, several Japanese companies, under the guidance of the Ministry of Economy, Trade, and Industry (METI), launched FemTech initiatives aimed at addressing female employee health issues. These initiatives focused on leveraging technology to support women's health in the workplace, particularly in areas such as menstruation, menopause, and fertility. The program was part of broader efforts to improve the working environment for women, particularly under Japan's "womenomics" policy, which encourages more female participation in the workforce. METI provided subsidies and support for FemTech projects to help companies integrate these solutions, which are designed to enhance female employee well-being and reduce workplace attrition due to health-related issues.

- In April 2022, Conceive, a FemTech startup focused on fertility solutions, raised USD 3.7 million in a seed funding round. This round was led by Kindred Ventures, with participation from Founder Collective, Great Oaks, and more than 40 angel investors, including the founders of Natalist, Tia, and other FemTech companies. The funds were aimed at scaling operations and expanding their business reach. Along with the funding, Conceive launched a nationwide public beta for its fertility platform, designed to help individuals and couples navigate fertility challenges with personalized support, education, and 1:1 coaching.

FemTech Market Segmentation

- By Application

- Reproductive Health

- Pregnancy & Nursing Care

- Pelvic & Uterine Healthcare

- General Healthcare & Wellness

- Menstrual Health

- By Type

- Devices

- Wearables

- Diagnostic Tools

- Software

- Mobile Apps

- Telehealth Platforms

- Services

- Consultation Services

- Subscription Models

- Devices

- By End User

- Direct-to-Consumer

- Hospitals & Clinics

- Research Institutes

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the FemTech market?

The FemTech market is estimated to be valued at USD 25.11 Bn in 2025 and is expected to reach USD 70.11 Bn by 2032.

What are the key factors hampering the growth of the FemTech market?

The privacy and data security concerns regarding sensitive health information and limited access to FemTech solutions in developing regions are the major factors hampering the growth of the FemTech market.

What are the major factors driving the FemTech market growth?

The rising awareness and focus on women's health and wellness and technological advancements in digital health and wearable devices are the major factors driving the FemTech market.

Which is the leading application in the FemTech market?

The leading application segment is reproductive health.

Which are the major players operating in the FemTech market?

Flo Health, Inc., Clue by BioWink, Ava Science Inc., Elvie (Chiaro Technology Ltd.), Willow Innovations, Inc., Natural Cycles Nordic AB, Maven Clinic Co., Nurx Inc., Nuelle, Inc., and Glow, Inc. are the major players.

What will be the CAGR of the FemTech market?

The CAGR of the FemTech market is projected to be 15.8% from 2025-2032.