Gas Turbine Air Filter Market Size - Analysis

The gas turbine air filter market is estimated to be valued at USD 1.95 Bn in 2025 and is expected to reach USD 2.95 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.1% from 2025 to 2032. Strict emission standards for gas turbines globally are driving the demand for efficient air filters. Replacement of aging gas turbine infrastructure also contributes to the growth of gas turbine air filter market.

Market Size in USD Bn

CAGR6.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.1% |

| Market Concentration | High |

| Major Players | Camfil AB, Donaldson Company, Inc., Parker Hannifin Corporation, MANN+HUMMEL, General Electric Company and Among Others |

please let us know !

Gas Turbine Air Filter Market Trends

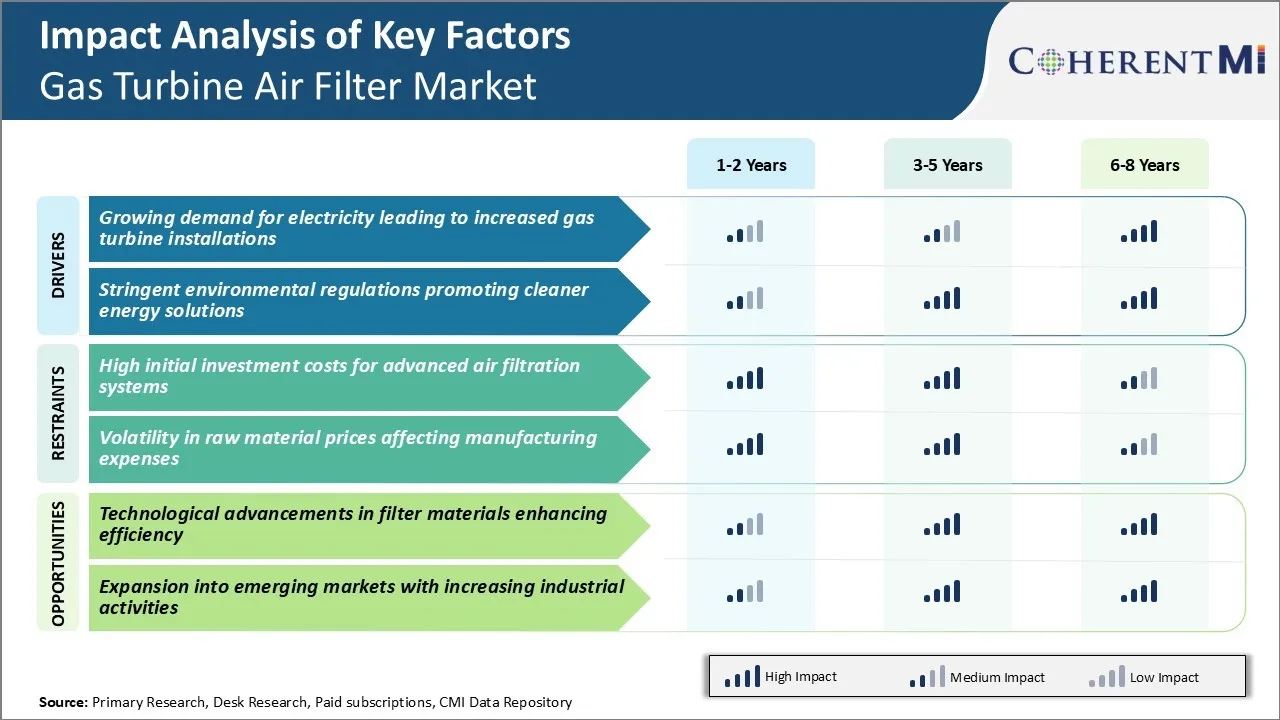

Market Driver - Growing Demand for Electricity Leading to Increased Gas Turbine Installations

Growing demand for electricity across both developed and developing nations has been one of the key drivers for the increased adoption of gas turbines for power generation in the past decade. Gas turbines have emerged as one of the preferred alternatives for utilities and independent power producers to add new generation capacities in a relatively short timeframe.

Many countries in Asia Pacific and Middle East regions are witnessing high economic growth which has translation into rapidly rising demand for reliable power supply. This has led to large investments into new gas turbine-based power projects to bridge the demand-supply gap. Even in developed regions of North America and Europe, gas turbines are helping utilities to meet peal power needs and also aid integration of renewables by providing fast-ramping balancing capabilities.

Electricity demand is set to rise further in coming years across both developing and developed regions. So, new gas turbine installations are expected to continue at strong pace providing opportunities for companies in the gas turbine air filter market.

Market Driver - Stringent Environmental Regulations Promoting Cleaner Energy Solutions

Environmental regulations around the world have been getting more and more stringent over the past decade as climate change risks became more apparent. At the same time, there is a growing preference amongst policymakers and public to switch towards cleaner sources of energy to achieve long term sustainability targets.

Many gas turbine models available today also have capabilities to fire low-carbon fuels like hydrogen either in a blended form or as a single fuel. Leading OEMs are further optimizing the combustion systems of gas turbines to minimize NOx and other regulated emissions without compromising on efficiency. The ability to demonstrate lower carbon and green credentials through emissions compliances has provided an edge to gas turbines over alternatives while seeking approvals and incentives under support schemes.

Overall, the tightening environmental regulatory landscape is promoting greater adoption of clean and efficient technologies like modern gas turbines for utilities and industrials. This is expected to drive growth of the gas turbine air filter market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Initial Investment Costs for Advanced Air Filtration Systems

One of the key challenges faced by the gas turbine air filter market is the high initial investment costs associated with advanced air filtration systems. Implementing high-efficiency particulate air (HEPA) or ultra-low particulate air (ULPA) filter technologies for industrial gas turbines requires significant capital expenditure. This is a barrier for end-users, especially in developing markets where budgets are constrained. The advanced filter media and housing needed to achieve stringent filter classes like e12, f7 or h14 per ISO can increase total project costs substantially.

Additionally, regular filter replacement drives long-term operational expenditures higher compared to conventional methods. The payback period for such investments may extend beyond 18-24 months in some application areas. However, with growing environmental regulations and performance requirements, advanced air filtration will need to become more cost-competitive to see wider acceptance across all regions and industry verticals.

Market Opportunity - Technological Advancements in Filter Materials Enhancing Efficiency

One of the key opportunities for the gas turbine air filter market lies in ongoing technological advancements in filter materials. Continuous research and development are enhancing the efficiency and lifespan of filtration media, helping to reduce overall costs.

Additive manufacturing is also enabling complex three-dimensional lattice structures for filters with optimized flow characteristics. There is also progress in surface modification techniques that help repel dirt and extend cleaning cycles.

Such innovations are improving the price to performance ratios of advanced solutions. This makes premium filtration options more accessible and appeals to a broader set of end-use applications. Going forward, further material engineering can boost filtration efficiencies and help accelerate payback periods for capital expenditures on high-end gas turbine air filter systems.

Key winning strategies adopted by key players of Gas Turbine Air Filter Market

Focus on product innovation through R&D: In 2018, Donaldson launched its Dynapurge Ultra air filter that uses patented pleated filter technology to provide up to 10x longer life compared to conventional filters. Such innovative products help companies gain an edge over competitors.

Strategic partnerships and collaborations: In 2020, HONEYWELL partnered with SAFRAN to develop advanced air filtration technology for next-gen jet engines. This allowed both companies to leverage each other's expertise and strengths.

Focus on emerging markets: In 2017, Donaldson expanded its manufacturing footprint in India and China to cater to increasing demand from power, mining, gas turbine air filter segments. This early mover advantage helped companies gain larger shares in gas turbine air filter market.

Acquisitions and mergers: Companies pursue acquisitions to enhance product portfolios, expand geographically, and attain synergies. For example, Clarcor acquired Bergstrom Inc. in 2017 for USD 925 Mn to become a leading supplier of ventilation and air filtration solutions for multiple industries including turbines.

Segmental Analysis of Gas Turbine Air Filter Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

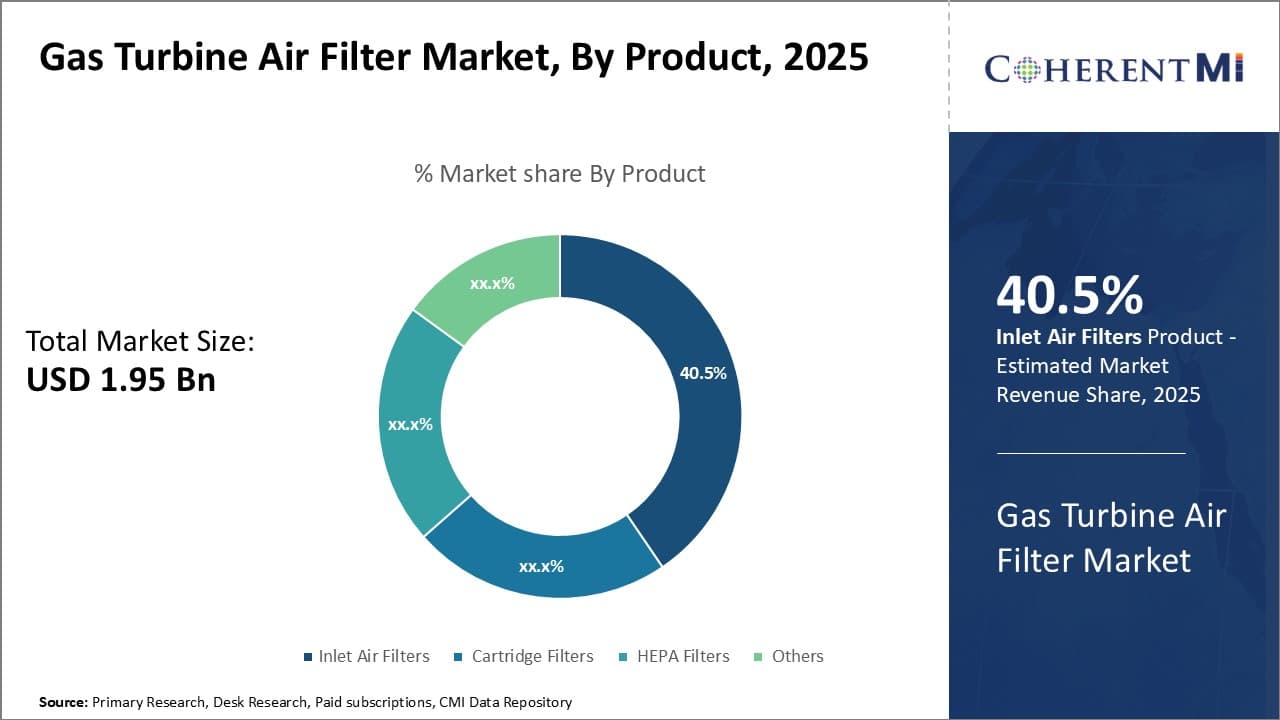

Insights, By Product: Inlet Air Filters Cater to Critical Filtration Needs

The inlet gas turbine air filter segment accounts for 40.5% share of the gas turbine air filter market in 2025. This is due to the critical role it plays in preventing contaminants from entering gas turbines. Gas turbines require an uninterrupted supply of clean air for effective and efficient combustion. This makes inlet air filtration a high-priority area for power producers and industrial facilities utilizing gas turbines.

Furthermore, power plants and industrial installations using gas turbines are often located in areas with varying environmental and climatic conditions which produce different types of airborne contaminants. This dictates the need for heavy-duty, customized inlet air filters that can withstand site-specific challenges.

The development of advanced composite filter media and automatic cleaning mechanisms has also improved the performance consistency of inlet gas turbine air filters over time. Overall, the criticality of inlet air filtration combined with technological enhancements drives the majority share of this segment in the gas turbine air filter market.

To learn more about this report, Download Free Sample Copy

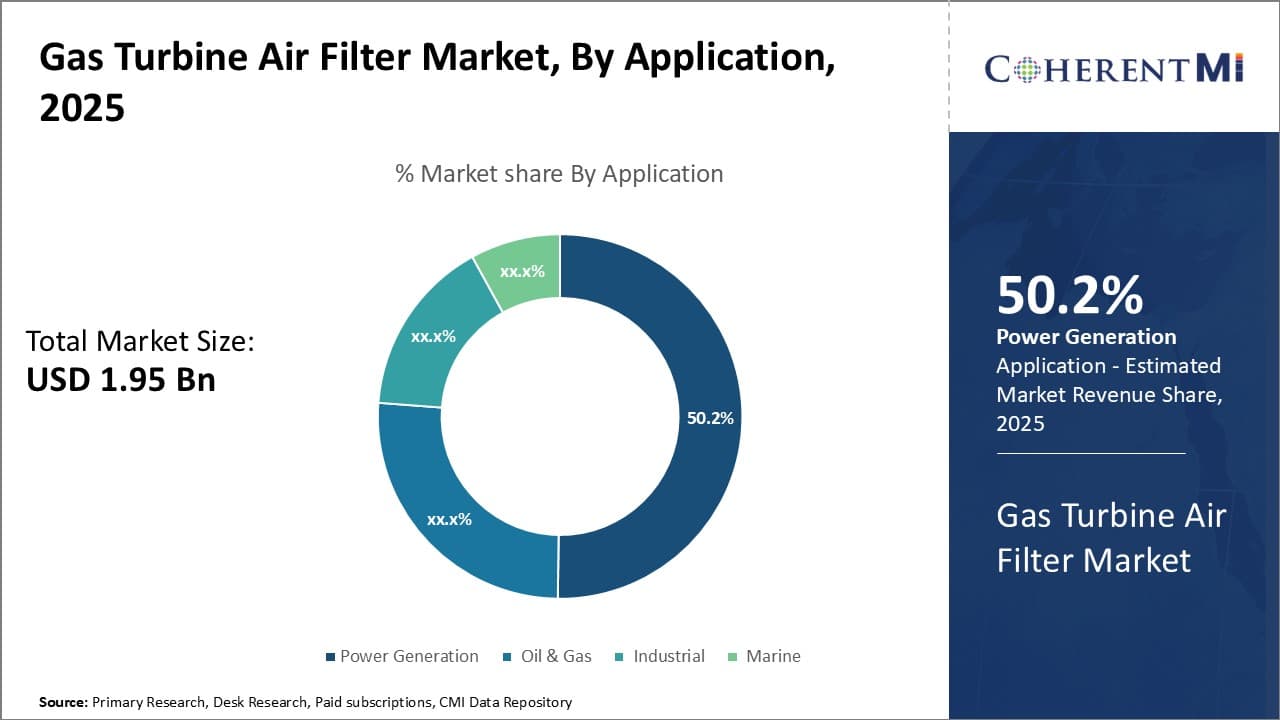

Insights, By Application: Power Generation Dominate Applications of Gas Turbine Air Filter

To learn more about this report, Download Free Sample Copy

Insights, By Application: Power Generation Dominate Applications of Gas Turbine Air Filter

The power generation application segment accounts for 50.2% share of the gas turbine air filter market in 2025. This is due to the widespread use of gas turbines in the electricity industry. As worldwide energy consumption rises with industrialization and economic growth, power producers are increasingly relying on gas turbines to meet expanding electricity demand. Regional grids as well as off-grid and backup power solutions in remote areas also utilize gas turbine-powered generators on a large scale.

Furthermore, stringent emission regulations are also driving the shift towards natural gas-based power generation over coal. Modern gas turbines offer a comparatively cleaner production method while maintaining comparable output. Tight filtration standards and the massive scale of power plant operations make it an attractive end-use segment.

Overall, stable long-term energy requirements and preferences for gas turbines as a flexible, efficient solution underpin the leadership of the power generation application in the gas turbine air filter market.

Additional Insights of Gas Turbine Air Filter Market

- The energy and power sector’s increased demand for electricity and efficient filtration for power generation.

- Oil and gas segment's rapid growth due to gas turbines' effectiveness in diverse operations and energy consumption reduction.

- Asia Pacific dominates the gas turbine air filter market due to urbanization and industrial growth, especially in India and China.

- North America is expected to grow the fastest in the gas turbine air filter market, driven by policies promoting renewable energy.

Competitive overview of Gas Turbine Air Filter Market

The major players operating in the gas turbine air filter market include Camfil AB, Donaldson Company, Inc., Parker Hannifin Corporation, MANN+HUMMEL, General Electric Company, Siemens AG, Filtration Group Corporation, Nordic Air Filtration, Koch Filter, W. L. Gore & Associates, Inc., Purolator Air Filters, Graver Technologies, Inc., Engineering Co., Ltd., Japan Air Filter, TYK Filters, PNC Co., Ltd., and EMW Filtertechnik GmbH.

Gas Turbine Air Filter Market Leaders

- Camfil AB

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- MANN+HUMMEL

- General Electric Company

Recent Developments in Gas Turbine Air Filter Market

- In September 2024, Camfil inaugurated a 10,000-square-meter Airborne Molecular Contamination (AMC) air filter regeneration service center in Chiayi, Taiwan. This state-of-the-art facility is designed to meet the stringent demands of the semiconductor industry, utilizing advanced processes and equipment to uphold Camfil's commitment to environmental sustainability.

- In June 2024, Ahlstrom introduced a new range of fluorine-free filtration materials designed to enhance sustainability and water resistance in various applications, including gas turbine air filter systems. These materials offer water-repellent properties, increasing the durability and stability of filters in wet conditions.

- In September 2023, Donaldson Company, Inc. expanded its manufacturing facility in the Asia Pacific region to meet the growing demand for gas turbine air filters. This expansion is expected to reduce lead times and improve customer service in the region.

- In June 2023, Camfil AB introduced a new high-efficiency air filter specifically designed for gas turbines operating in harsh environments. This innovation aims to enhance turbine performance and reduce maintenance costs, solidifying Camfil's position in gas turbine air filter market.

Gas Turbine Air Filter Market Segmentation

- By Product

- Inlet Air Filters

- Cartridge Filters

- HEPA Filters

- Others

- By Application

- Power Generation

- Oil & Gas

- Industrial

- Marine

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.