The gingival recession market is estimated to be valued at USD 3.56 Bn in 2025 and is expected to reach USD 5.32 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2032. The aging global population is more prone to gum diseases such as gingivitis and periodontitis, driving the need for treatments of gingival recession. Furthermore, the growing awareness about oral healthcare and rising disposable incomes are also contributing to the growth of this market.

Market Size in USD Bn

CAGR5.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.9% |

| Market Concentration | High |

| Major Players | Straumann Group, Dentsply Sirona, Geistlich Pharma, Zimmer Biomet Dental, BioHorizons and Among Others |

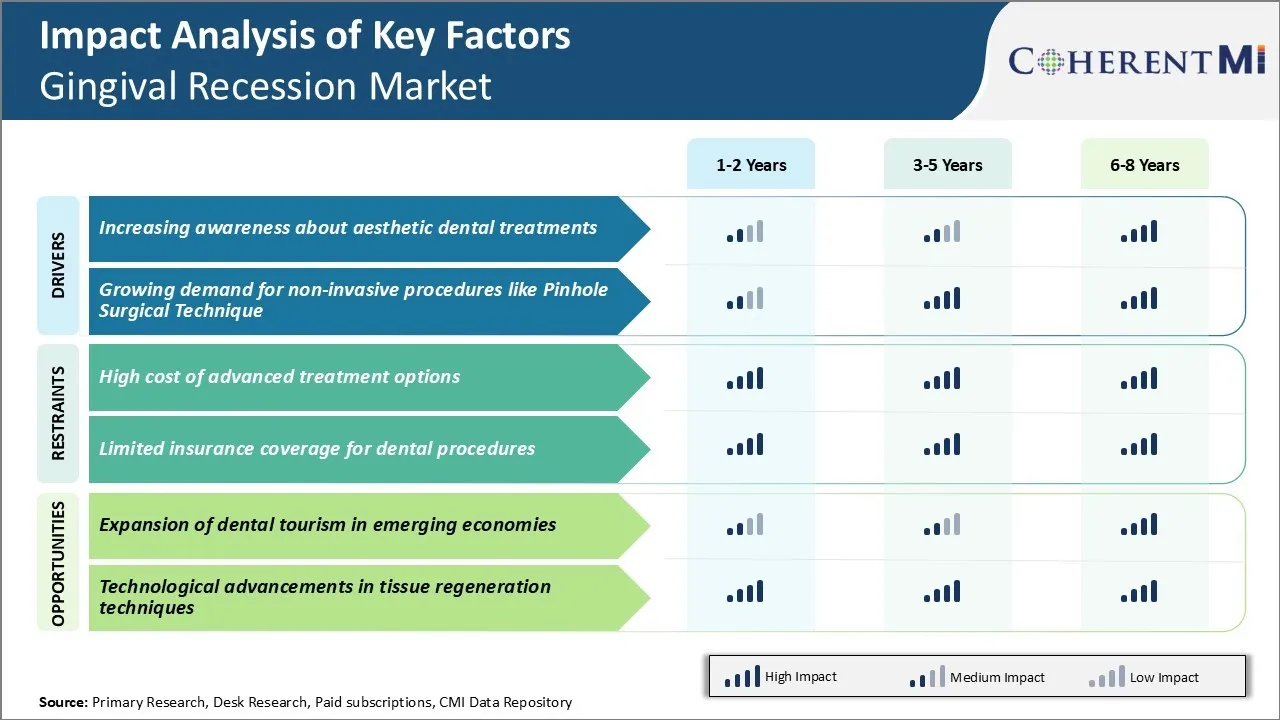

Market Driver - Increasing Awareness about Aesthetic Dental Treatments

With greater exposure to fashion and media through the internet and worldwide advancements in dentistry, people have become increasingly aware of the importance of dental aesthetics. Growing focus on physical appearance and flawed smiles has driven many individuals to seek cosmetic improvements. Gingival recession, where gum tissues pull away from the teeth, is one such condition that can mar the look of one's smile. While previously overlooked, patients today wish to preserve their natural teeth and have youthful looking smiles.

This has pushed more cases of gum recession into the limelight. People now understand recession can result in sensitivity, root exposure and an aged appearance. They recognize correcting it through procedures like gum grafts and regenerative techniques helps mask underlying bone and tooth structure for a balanced smile.

Further, with social media connecting people globally, physical attributes receive more attention than before. A perfect set of white teeth with healthy pink gums has become a desirable, almost mandatory, trait for many. This places psychosocial pressure on those with visible signs of gum recession. The promise of reversing recession's cosmetic impact therefore draws more patients who now value aesthetic dental treatments on par with medical needs.

Market Driver - Growing Demand for Non-Invasive Procedures like Pinhole Surgical Technique

As with other medical fields, there is increasing preference for minimally invasive procedures in dentistry as well. People desire solutions allowing preservation of natural tissues and rapid recovery times. The pinhole surgical technique for gum recession fulfills this need superbly. It involves raising gum flaps and carefully suturing them to the cemento-enamel junction with minimal incisions. This closes gum pockets without necessitating grafting of additional tissues.

Compared to conventional techniques, pinhole surgery causes negligible post-procedural pain and swelling. Patients resume regular activities promptly rather than taking several days off for healing. Minimal sutures also translate to barely noticeable gum lines, avoiding an augmented look. Such predictable esthetic outcomes and convenience spark appeal among working individuals with active lifestyles. They are keen to try protocols respecting natural dental architecture over extensive restorative measures.

Likewise, pinhole attracts a larger segment by being less technique sensitive. It does not demand complex flap manipulations or membrane placements common to grafting procedures. This reduces the skill level, learning curve and chair-time associated with addressing recession cases. It has potential for wider adoption by general dentists beyond specialists. As a result, more practices are investing in pinhole surgery, expanding its availability.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Cost of Advanced Treatment Options

One of the major challenges being faced by the gingival recession market is the high cost of advanced treatment options for gingival recession such as gingival grafting. Gingival grafting involves surgical procedures where periodontal cells or tissues are transplanted from one area of the mouth to another area to cover exposed root surfaces. These surgical procedures require advanced equipment, specially trained periodontists, specialized surgical skills and involve a long recovery time for patients. All of these factors contribute to making gingival grafting a very costly procedure, often exceeding $1,000-$2,000 per affected site. This high cost puts it out of reach for many patients suffering from gingival recession, especially those with low income or no dental insurance coverage. Many patients simply cannot afford such expensive treatments and either live with the condition or opt for less effective non-surgical options. This significantly impacts the potential demand and growth prospects for advanced treatment modalities in the market. Unless new technologies are able to drive down costs or more affordable alternative procedures are introduced, high treatment expenses will continue to restrict the gingival recession market size.

Market Opportunity - Expansion of Dental Tourism in Emerging Economies

One significant opportunity for growth being presented to the gingival recession market is the expansion of medical and dental tourism industries in emerging economies. Countries such as India, Thailand, Mexico and Hungary have been actively promoting themselves as popular low-cost destinations for dental procedures and cosmetic dentistry.

Dental facilities in these countries are able to offer treatment for conditions like gingival recession at a fraction of the cost compared to developed markets like the United States and Western Europe. This cost advantage is attracting significant numbers of international patients travelling to these emerging countries specially for dental treatments.

As awareness increases about affordable dental tourism options, it will help drive the demand for treatments of gingival recession globally. This provides an opportunity for clinicians as well as product manufacturers in these low-cost markets to tap into the expanding dental tourism industry and boost their share of the worldwide gingival recession market.

For mild cases (Class I), prescribers typically prefer non-surgical treatments as the first line of defense. Topical drugs like chemically modified tetracycline gels (Arestin, Oracea) and topical steroids (Kenalog in Orabase) are commonly prescribed to reduce inflammation and stimulate tissue growth.

In moderate cases (Class II), while topicals may still be used, most prescribers opt for minimally-invasive procedures like sub-epithelial connective tissue grafts or acellular dermal matrix allografts (GraftJacket). This allows covering of root surfaces for aesthetic reasons and prevention of further recession.

For severe cases (Class III/IV), surgical techniques are favored as the primary approach. Prescribers commonly perform pedicle soft tissue grafts or free gingival grafts to fully cover denuded roots and obtain optimal results. This may be supplemented with use of enamel matrix derivative gel (Emdogain) to aid regeneration.

Additional factors influencing preferences include cost, risks, patient compliance and severity of aesthetic/functional issues. Younger patients tend to prioritize esthetics, leading prescribers to often choose tissue grafting procedures early on in treatment. Overall, the general approach is to exhaust conservative options before moving to invasive techniques.

Gingival recession is classified into different stages based on the depth of recession from the cementoenamel junction. Stage I recession is 1-2mm of visible root surface. Stage II is 3-4mm and Stage III is ≥5mm of recession.

For stage I recession, non-surgical treatments are usually preferred first. This includes improved oral hygiene with brushing and flossing to remove plaque, and use of an antiseptic mouthwash to reduce gingival inflammation. If needed, drug treatment with topical application of lignocaine gel along with a synthetic polymer (BioMimetic agents like Arestin) can help regrow gum tissue.

For stage II recession, the treatment of choice is often a modified Widman flap procedure along with grafting. The graft material used depends on case-to-case basis but connective tissue graft is preferred for predictable root coverage and esthetics. Alternatively, acellular dermal matrix allograft like AlloDerm can also be used which provides sufficient graft volume and less post-procedure sensitivity.

For stage III/advanced recession, soft tissue graft alone may not be sufficient and enamel matrix proteins like Emdogain are supplemented to promote periodontal regeneration. A study showed combination of Emdogain gel and subepithelial connective tissue graft achieved over 90% root coverage for class III/multiple recession defects.

Focus on innovative product development - Key players like Allergan, Plc and Merz Pharma GmbH & Co. KGaA have invested heavily in R&D to develop innovative products for gingival recession treatment. For example, in 2017 Allergan launched a collagen-based soft tissue dermal matrix product Zenplexx for root coverage procedures.

Strategic acquisitions to enhance product portfolio - In 2020, AbbVie completed the acquisition of Allergan, mainly to strengthen its medical aesthetics portfolio with the addition of Allergan's gingival recession treatment products. Such strategic acquisitions allowed companies to offer a more comprehensive set of products to patients and practitioners, thereby boosting revenues.

Partnerships with dental clinics for promotions and trials - Companies partnered with top dental clinics and key opinion leaders for promotions as well as clinical trials of new products. For example, in 2015 Zenplexx was evaluated in multiple clinical studies across the U.S. led by renowned periodontists.

Effective social media campaigns - Players actively promoted gingival recession awareness as well as their treatment solutions through social media platforms. For instance, social media campaigns run by Merz in 2018 highlighted the significance of gum line aesthetics for smiles.

To learn more about this report, Download Free Sample Copy

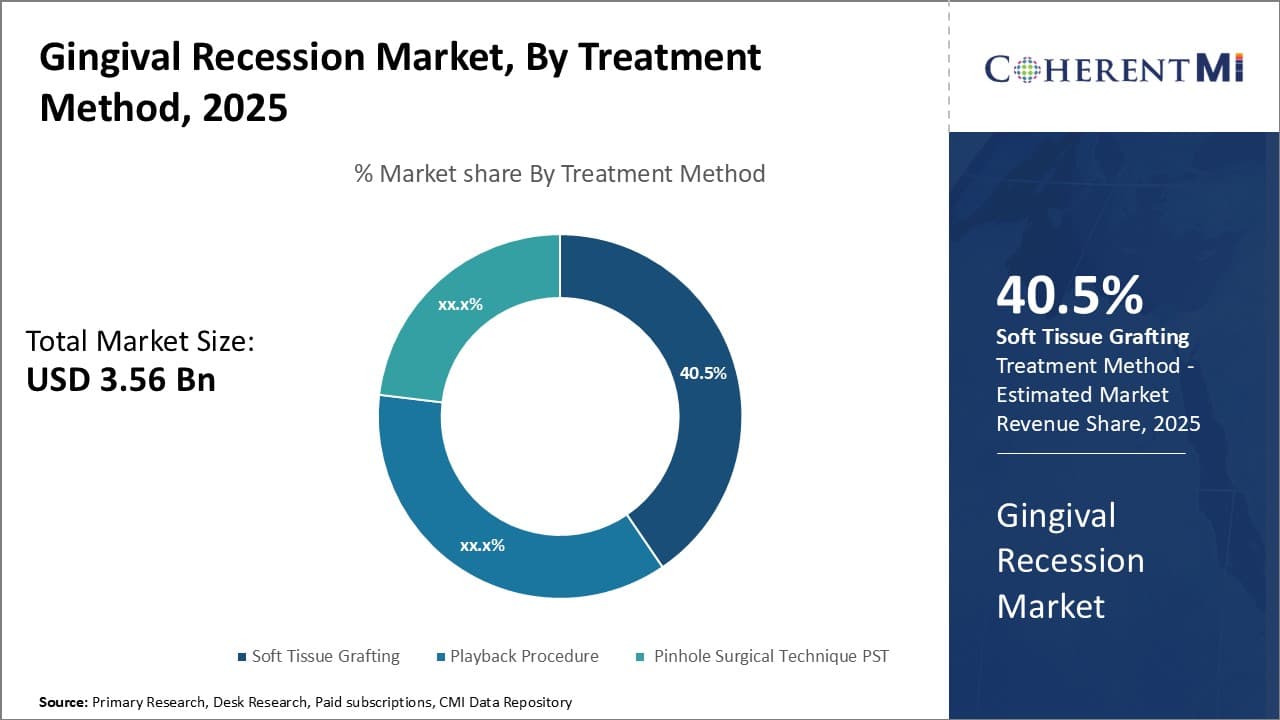

Insights, By Treatment Method: Advancing Techniques Drive Soft Tissue Grafting Procedures

To learn more about this report, Download Free Sample Copy

Insights, By Treatment Method: Advancing Techniques Drive Soft Tissue Grafting Procedures

In terms of treatment method, soft tissue grafting is estimated to account for 40.5% share of the market in 2025, owning to its effectiveness and evolving techniques. Soft tissue grafting involves harvesting tissue from the palate or other intraoral sites to replace or cover exposed root surfaces. This method is widely used because it can be performed under local anesthesia in an office setting and results in excellent graft maturity and color matching.

Advancements in techniques have made soft tissue grafting even more appealing. For example, the subepithelial connective tissue graft has become a gold standard procedure due to its high success rates in treating gingival recession defects. This is partly because it provides an intermediate layer of tissue that aids in new attachment of collagen fibers. Double-pedicle grafting is another evolving soft tissue grafting technique that involves sliding a partial-thickness flap from an adjacent tooth.

Lasers are also being used more frequently in soft tissue grafting to cut and coagulate tissue with greater precision. This results in improved blood supply to grafted areas and less postoperative discomfort for patients. Digital imaging and computer-guided surgery allow for precise graft measurements and placements as well. Overall, continual refinement of soft tissue grafting approaches through innovative technologies and techniques makes it the most popular treatment method.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

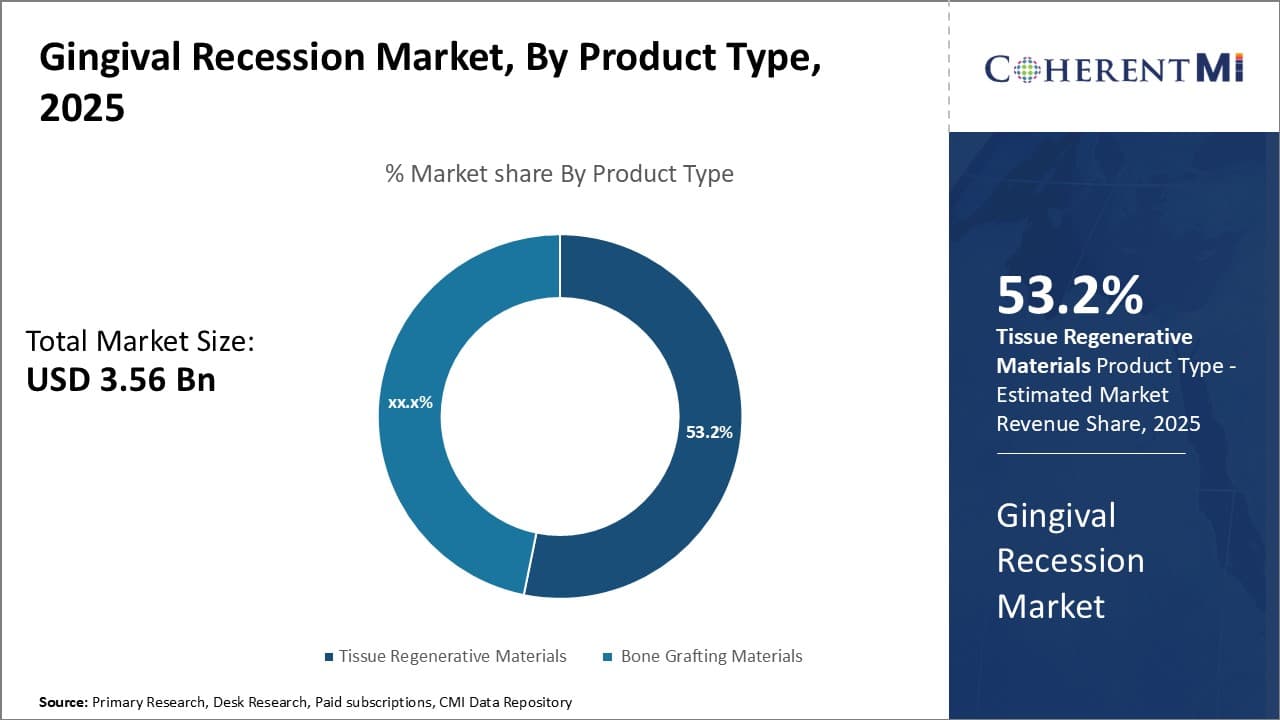

Insights, By Product Type: Tissue Regenerative Materials Dominate Due to Ability to Stimulate Natural Healing

In terms of product type, tissue regenerative materials is projected to account for 53.2% of market share in 2025, owing to their ability to effectively stimulate the body's own healing response. Tissue regenerative materials aim to regenerate lost periodontal tissues like gingiva, cementum and alveolar bone through natural biological mechanisms. This differentiates them from bone grafting materials which focus more on filling defects.

Common tissue regenerative materials include enamel matrix derivative (EMD), platelet-rich fibrin matrix (PRFM) and platelet-rich plasma (PRP). EMD harnesses proteins and growth factors found in developing teeth and encourages periodontal ligament and cementum regeneration when applied to denuded root surfaces. PRFM and PRP utilize the body's own concentrated growth factors from platelet-rich plasma to prompt tissue rebuilding. They cause less inflammation than traditional graft materials and stimulate natural periodontal healing.

Manufacturers are also developing innovative delivery systems like injectable gels and membranes imbedded with regenerative agents. For example, PRP gels offer beneficial growth factors in an easy-to-apply format. Membranes lined with EMD allow controlled factor release directly at defect sites. Such advancements in tissue regenerative material formulations and delivery make them appealing first-line treatments versus invasive graft harvesting. Overall, their wound healing inducing properties without introducing foreign materials contribute to their popularity.

Insights, By End User: Expanding Applications Drive Hospital Adoption of Gingival Recession Treatments

In terms of end user, hospitals contribute the highest share owing to their expanding integration of gingival recession treatments. Traditionally, dental clinics were the main end users since these conditions were primarily treated on an outpatient basis. However, hospitals are now adopting gingival recession therapies due to their increasing focus on comprehensive oral healthcare.

For instance, hospitals have started offering specialized periodontal plastic surgery for complex cases that are beyond the scope of general practices. Advanced techniques like pedicle grafts and laser treatments require operating rooms and oversight of periodontists. Hospitals can better accommodate these specialized soft tissue procedures in dedicated dental operating suites.

Additionally, gingival recession is a risk factor for serious conditions like aggressive periodontitis. Identifying and managing such patients within general hospital treatment plans drives in-house adoption. Financial incentives also affect hospital decisions, as gingival surgeries are lucrative procedures reimbursable by dental insurance.

Moreover, hospitals prioritize preventative treatments to reduce future costs associated with advanced cases. Gingival grafting helps maintain oral hygiene and prevents future attachment loss and tooth loss, thereby supporting hospital prevention goals. Overall, shifting priorities towards holistic care and the ability to better handle complex gingival therapies increases hospitalization of these treatments.

The major players operating in the gingival recession market include Straumann Group, Dentsply Sirona, Geistlich Pharma, Zimmer Biomet Dental, BioHorizons, Markman Biologics Corporation, McGuire Institute, Mesenchymal Stem Cells Research Institutes, and Ubiquinon (Coenzyme Q10) Research Institutes.

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Gingival Recession Market is segmented By Treatment Method (Soft Tissue Grafting, Regenerative Proce...

Gingival Recession Market

How big is the gingival recession market?

The gingival recession market is estimated to be valued at USD 3.56 Bn in 2025 and is expected to reach USD 5.32 Bn by 2032.

What are the key factors hampering the growth of the gingival recession market?

The high cost of advanced treatment options and limited insurance coverage for dental procedures are the major factors hampering the growth of the gingival recession market.

What are the major factors driving the gingival recession market growth?

The increasing awareness about aesthetic dental treatments and growing demand for non-invasive procedures like pinhole surgical technique are the major factors driving the gingival recession market.

Which is the leading treatment method in the gingival recession market?

The leading treatment method segment is soft tissue grafting.

Which are the major players operating in the gingival recession market?

Straumann Group, Dentsply Sirona, Geistlich Pharma, Zimmer Biomet Dental, BioHorizons, Markman Biologics Corporation, McGuire Institute, Mesenchymal Stem Cells Research Institutes, and Ubiquinon (Coenzyme Q10) Research Institutes are the major players.

What will be the CAGR of the gingival recession market?

The CAGR of the gingival recession market is projected to be 5.9% from 2025-2032.