Global Optical Instrument and Lens Market Size - Analysis

The optical instrument and lens market consists of a variety of products that are used for examining eyes and vision. Some of the key products in this market are slit lamps, retinoscopes, phoropters, fundus cameras, optical coherence tomography systems, and lenses. Slit lamps are used for the close examination of the external eye and anterior chamber. Retinoscopes help in objective refraction of the eye during an eye exam. Phoropters assist in subjective refraction by rotating lenses to determine the best corrective lens. Fundus cameras capture images of the interior surface of the eye to examine the retina. Optical coherence tomography systems use light to capture high resolution cross-sectional images of the retina and anterior segment.

Optical Instrument and Lens Market Drivers

- Aging Population is Driving the Demand for Corrective Lenses: As life expectancy increases globally, the average age of populations in many countries is rising significantly. According to data from the United Nations, the percentage of persons aged 65 years or over is projected to rise from 7% to 16% between 2015 and 2050. The growing geriatric population is expected to drive the demand for corrective lenses to a notable extent. Many eye disorders, such as presbyopia and cataracts, are more common among older individuals. Presbyopia, where the eye's ability to focus on near objects decreases with age, affects nearly everyone who live long enough. It usually develops in a person's early to mid-40s and continues to worsen until reading glasses or bifocals/trifocals are needed. Cataracts, where the lens of the eye becomes progressively opaque, is another vision impairment strongly associated with aging. As per the World Health Organization (WHO), cataracts already cause impaired vision in over 20 Bn people aged 50 years or older. With longevity increasing almost everywhere, the prevalence of age-related eye conditions requiring vision aids is set to surge significantly. Spending on corrective lenses by the expanding base of older consumers is thus expected to drive revenues for optical instrument and lens manufacturers.

- Growth in Healthcare Applications: The increasing use of optical systems in medical devices and diagnostics is boosting the growth of the optical instrument and lens market. Advanced microscopes are enabling cellular and molecular imaging for biomedical research. Optical coherence tomography (OCT) systems are being widely used in ophthalmology for retinal imaging. Endoscopy procedures utilize specialized imaging systems for improved visualization in minimally invasive surgeries. Optics also plays a key role in laser based diagnostic, therapeutic, and surgical systems. The rising prevalence of chronic diseases is further escalating the demand for such healthcare devices and systems.

- Rising Screen Time is Increasing the Demand for Computer Vision Correction: The ubiquitous use of digital devices like smartphones, tablets, laptops, and computers has dramatically increased screen time worldwide over the past decade. Recent data from the European Working Conditions Survey revealed that two-thirds of respondents spent 3 hours or more per day on digital screens at work. Multiple studies have linked excessive screen usage to digital eye strain symptoms like headaches, blurred vision, dry eyes, and fatigue. Besides, extensive near work can exacerbate or accelerate the development of myopia or ‘nearsightedness’ in children and young adults. The World Health Organization has declared myopia an important public health concern and its projections estimate that almost half the world's population will be nearsighted by 2050 without intervention. With people spending growing hours gazing at devices, the demand for computer glasses, blue light blocking lenses and myopia management options is rising. Several governments have recognized programs to address accelerating myopia rates. For example, in 2021, Taiwan announced strategies to halt further myopia progression in children by 2032. The growing awareness about and prioritization given to digital eye health signals is a thriving market opportunity for optical instrument and lens brands that offer solutions for computer vision issues.

- Scope in Medical Diagnostics and Imaging: The expanding applications of optical technologies in medical diagnostics, imaging and image guided therapies provide lucrative prospects for market growth. Optical biopsy techniques using Raman spectroscopy, OCT (Optical Coherence Tomography), and photoacoustic tomography enable non-invasive diagnosis. Portable and handheld OCT systems and AI (artificial inelegance)-based screening tools are being developed for point-of-care testing. Multimodal imaging systems combining OCT, ultrasound, and other techniques are emerging. Robot assisted endoscopy and microsurgery are new application areas. Optics also plays an enabling role in photodynamic and optogenetic therapies. Personalized medicine is further driving the need for advanced real-time visualization tools.

- Rising Demand for Optics in Emerging Markets: The increasing demand for optical instruments and vision care products in developing countries represents key opportunities for optics manufacturers. Growing healthcare expenditure, improving standards of living, and expanding middle class population in countries like China, India, and Brazil are escalating the uptake of microscopes, endoscopy systems, ophthalmic devices, and other optics-enabled medical equipment. The growing electronics manufacturing and rising construction activities are also fueling the adoption of optics-based measurement and inspection systems in these regions. Investments into R&D centers and collaborations with regional players can help companies tap into emerging markets.

- High Cost: High cost associated with optical instrument such as fundus cameras is expected to hinder the growth of the global optical instrument and lens market. For instance, VisuCam 200 (Carl Zeiss), non-mydriatic color fundus camera, costs in the range of US$ 25,000 to US$ 30,000, which may be significantly high for private clinics or tier II and tier III hospitals.

- Complexity Involved in the Usage of Optical Instruments: The operation of microscopy devices often requires specialized training and expertise, which can be a barrier for many users, particularly in regions where such training is not readily available or accessible. Moreover, the interpretation of results obtained from these devices also requires a high level of expertise, further complicating their usage. This complexity can deter many potential users, thereby hindering the market growth. Additionally, the need for a controlled environment for the optimal functioning of these devices can also pose challenges. Any slight variation in the environment can affect the performance of the devices and the accuracy of the results, which can be a significant deterrent for many institutions, especially those in regions with unstable environmental conditions.

Market Size in USD Bn

CAGR4.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.9% |

| Fastest Growing Market | Middle East & Africa |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Carl Zeiss AG, Hoya Corporation, Canon Inc., Nidek Co., Ltd., Topcon Corporation and Among Others |

please let us know !

Global Optical Instrument and Lens Market Trends

- Increased Patient Awareness: Various awareness campaigns have been successful in educating people about common eye disorders like dry eyes, allergies, and infections. For example, in September 2021, Specsavers UK, an ophthalmology company launched its annual ‘Love Your Eyes’ campaign during Macular Degeneration Awareness Week to raise awareness about age-related macular degeneration (AMD) symptoms. Such efforts are helping people understand the importance of regular eye exams and daily eye care, thereby augmenting the sales of contact lenses, eye drops, and other ophthalmic products.

- Increasing Use of Inverted Microscopes: Inverted microscopes, which provide a 'bottom-up' view, are increasingly being used in cell culture and tissue engineering studies. This is due to their ability to provide a more natural environment for cells and tissues

- Technological Advancements: Increasing number of technologically advanced product launches by market players are expected to fuel the growth of the global optical instrument and lens market over the forecast period. For instance, in April 2021, Samsung, a multinational electronics corporation launched a device called the Eyelike fundus camera. The new device is developed under the Galaxy Upcycling program that aims to repurpose company’s older Samsung Galaxy smartphones into medical diagnosis cameras. The newly launched Eyelike fundus camera connects to a lens attachment and uses an artificial intelligence (AI) algorithm on older Samsung Galaxy smartphones to analyze and diagnose the images for ophthalmic diseases.

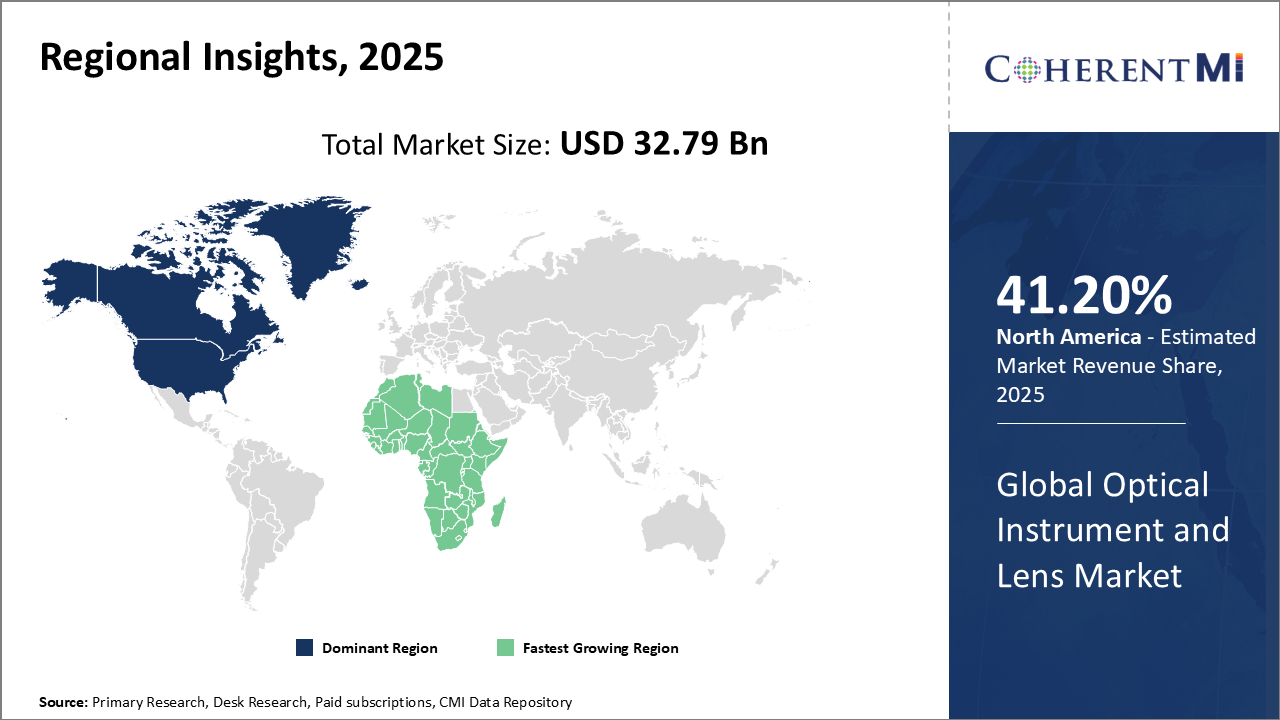

- North America is expected to be the largest market for optical instrument and lens during the forecast period, accounting for over 41.2% of the market share in 2025. The growth of the market in North America is attributed to the early adoption of technologically advanced products and an established healthcare infrastructure.

- Asia Pacific is expected to be the second-largest market for optical instrument and lens, accounting for over 28.5% of the market share in 2025. The growth of the market in Europe is attributed to increasing disposable incomes and rapid urbanization in emerging economies.

- The Middle East & Africa is expected to be the fastest-growing market for optical instrument and lens, which is estimated to grow at a CAGR of over 5.8% during the forecast period. The growth of the market in the Middle East & Africa is attributed to the improving healthcare infrastructure and surging demand of Optical Instrument and Lenses from Middle East & Africa countries.

Segmental Analysis of Global Optical Instrument and Lens Market

Competitive overview of Global Optical Instrument and Lens Market

The global optical instrument and lens market included market players such as Carl Zeiss AG, Hoya Corporation, Canon Inc., Nidek Co., Ltd., Topcon Corporation, Intelligent Retinal Imaging Systems, Inc., Kowa Company Ltd., Optomed, Vision Equipment Inc., Clarity Medical Systems, Inc., Medimaging Integrated Solution Inc., S4OPTIK LLC., Shenzhen Thondar Technology Co., Ltd., CenterVue SpA, Alton Vision LLC, LENSTECH OPTICALS, Alcon Inc.

Global Optical Instrument and Lens Market Leaders

- Carl Zeiss AG

- Hoya Corporation

- Canon Inc.

- Nidek Co., Ltd.

- Topcon Corporation

Global Optical Instrument and Lens Market - Competitive Rivalry

Global Optical Instrument and Lens Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Optical Instrument and Lens Market

Key Strategic Initiatives

- In October 2023, Alcon Inc., an ophthalmology company, announced the launch of TOTAL30 Multifocal Contact Lenses for patients with presbyopia

- In July 2023, Carl Zeiss AG, a company manufacturing optical systems and optoelectronics including microscopes, announced the launch of a new manufacturing facility in India. The new facility will be operational from the year 2024.

- In November 2020, Optomed, a healthcare technology company, launched Aurora IQ. Aurora IQ is a handheld fundus camera with integrated artificial intelligence for faster eye screening. Aurora IQ is CE-approved product.

Agreements and partnerships

- In August 2023, Abacus dx, a distributor of specialized pathology instrumentation, announced a collaboration with Nikon Australia’s healthcare business for the expansion of the microscopy business in Australia. Nikon Australia is a company specializing in creating and marketing optics and imaging products.

- In August 2021, Thirona B.V., a high-tech company focusing on the development and marketing of automated analysis tools for medical images partnered with NIDEK CO., LTD., an organization engaged in the design, manufacture, and distribution of ophthalmic, optometric, and lens edging equipment, announced the integration of Thirona's RetCAD artificial intelligence eye disease detection software and NIDEK's NAVIS-EX image filing software. The partnership between the two companies allows the instant screening of Age-related Macular Degeneration (AMD) and Diabetic Retinopathy (DR) on color fundus images captured by the AFC-330 and Retina Scan Duo from NIDEK.

- In April 2021, MellingMedical, a Center for Verification and Evaluation (CVE)-verified Service Disabled Veteran-Owned Small Business (SDVOSB), announced a distribution agreement with, Optomed, a healthcare technology company. Under the distribution agreement, MellingMedical will deliver Optomed's Aurora IQ camera to federal health facilities across the country. Aurora IQ is a handheld fundus camera with integrated artificial intelligence for faster eye screening.

Global Optical Instrument and Lens Market Segmentation

- By Product Type:

-

- Instruments

- Fundus Camera

- Slit Lamps

- Tonometers

- Mircoscopes

- Others

- Lenses

- Corrective lenses

- Contact lenses

- Objective lenses

- Others

- Instruments

- By Application:

-

- Ophthalmology

- Diagnostic

- Therapeutics

- Research & Academics

- Ophthalmology

- By End User:

- Hospitals

- Ophthalmic Clinics

- Diagnostic Labs

- Academic & Research institutes

- Others

- By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the Global Optical Instrument and Lens Market?

The Global Optical Instrument and Lens Market is estimated to be valued at USD 32.8 in 2025 and is expected to reach USD 45.8 Billion by 2032.

What are the major factors driving the optical instrument and lens market growth?

Aging population driving, demand for corrective lenses, and growth in healthcare applications are some major factors driving the growth of the optical instrument and lens market.

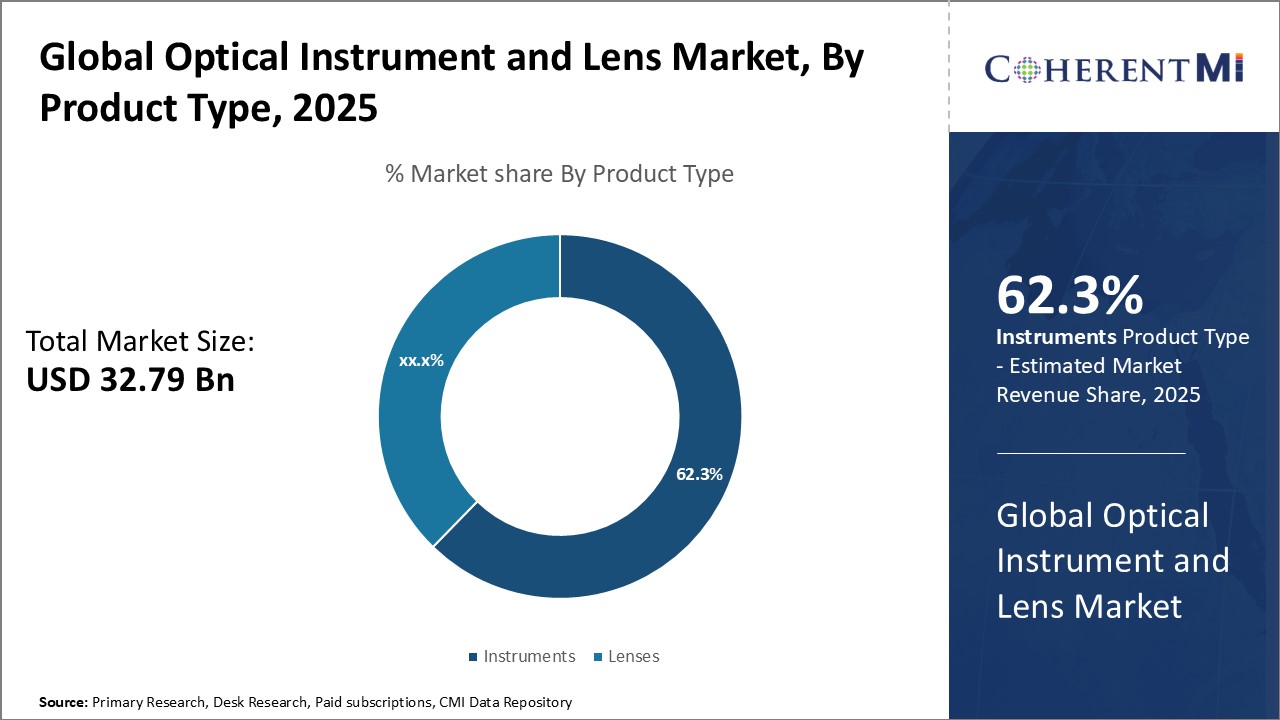

Which is the leading product type segment in the optical instrument and lens market?

The instrument segment accounted for the largest share in the optical instrument and lens market.

Which are the major players operating in the optical instrument and lens market?

The global optical instrument and lens market included market players such as Carl Zeiss AG, Hoya Corporation, Canon Inc., Nidek Co., Ltd., Topcon Corporation, Intelligent Retinal Imaging Systems, Inc., Kowa Company Ltd., Optomed, Vision Equipment Inc., Clarity Medical Systems, Inc., Medimaging Integrated Solution Inc., S4OPTIK LLC., Shenzhen Thondar Technology Co., Ltd., CenterVue SpA, Alton Vision LLC, LENSTECH OPTICALS, Alcon Inc.

Which region will lead the optical instrument and lens market?

North America is expected to dominate the optical instrument and lens market during the forecast period.

What will be the CAGR of the optical instrument and lens market?

The optical instrument and lens market is expected to grow at a CAGR of 4.9% during 2025-2032.