Global Robotic Prosthetics Market Size - Analysis

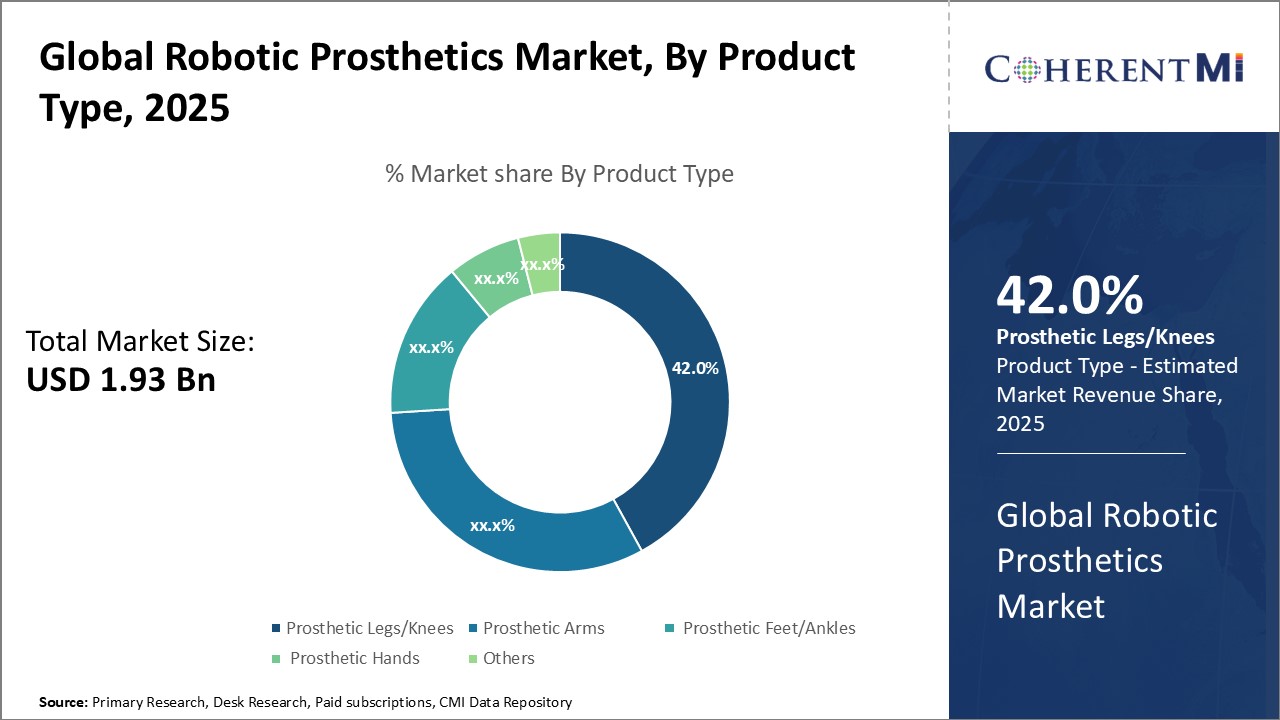

Global robotic prosthetics market is segmented into product type, technology, end user, and region. By product type, the market is segmented into prosthetic arms, prosthetic feet/ankles, prosthetic legs/knees, prosthetic hands, and others. The prosthetic legs segment accounts for the largest share due to rising incidence of lower limb amputations and demand for advanced robotic knees and legs.

Global Robotic Prosthetics Market Drivers:

- Technological advancements in prosthetic design and functionality: Technological advancements in last decade have greatly improved the design and functionality of robotic prosthetic devices. Companies are integrating advanced technologies like artificial intelligence (AI), machine learning, and robotics to develop more responsive, intuitive, and dexterous prosthetic limbs. The use of lightweight alloys, 3D printing, and advanced electrode interfaces has enabled the creation of prosthetics that closely mimic natural limb movement with multiple axes of motion. The launch of multi-articulating prosthetic hands with individually powered fingers, ankles that dynamically adapt to different terrains, and neural-integrated prosthetic arms that can interpret signals from muscles have expanded options for amputees. With continued significant investments in research and development (R&D), rapid prototyping, and clinical testing, robotic prosthetics are becoming more sophisticated, personalized, and life-like. The promise of further enhancing mobility and independence for amputees is a key factor driving the growth of the global robotic prosthetics market.

- Favorable reimbursement policies and government funding: Various public and private insurance providers have recognized the benefits of robotic prosthetics, resulting in favorable reimbursement policies that improve device accessibility and affordability. The Veterans Affairs health system in the U.S. provides advanced prosthetics to veteran amputees. Government and non-profit funding focused on prosthetic R&D and fitting amputees with devices also enables access to robotic prosthetics. Rising healthcare expenditure by public and private bodies is expected to enhance funding for advanced prosthetics. For instance, in October 2020, the University of Michigan was awarded with a US$ 940,000 National Science Foundation (NSF) grant to develop an open source framework for robotic prosthetic legs that function more naturally and have a broader variety of capabilities.

- Rising incidence of limb loss and amputation: Rising number of trauma-related injuries, vascular diseases, accidents, and congenital disorders leading to limb amputation are the major factors fueling the adoption of robotic prosthetic devices. As per Amputee Coalition, there are nearly 2 million people living with limb loss in the U.S. alone, with hundreds of thousands of new amputations occurring every year. The increase in lower limb amputations due to diabetes, and the rise in upper limb amputations of soldiers injured in conflicts have further added to the demand for advanced prosthetics. Robotic prosthetics are being increasingly sought out by the growing pool of amputees to restore function and aesthetics.

- User demand for more advanced, high-performing prosthetics: Unlike basic prosthetics, robotic prosthetics enable amputees to carry out daily tasks, maintain balance and stability while walking on inclines, grasp and lift objects using a prosthetic hand, and avoid overcompensation injuries. The ability to closely replicate natural limb movement patterns and provide sensory feedback has made robotic prosthetics the preferred choice over traditional devices for most users. Younger, more active amputees like wounded soldiers are significant drivers of demand for high-tech prosthetics that do not limit mobility and independence.

- Emerging markets offer significant growth potential: Developing countries in Asia, Latin America, the Middle East, and Africa represent large untapped markets for robotic prosthetics due to their sizable and growing patient populations. These regions have lower adoption of advanced prosthetics to date but are expected to display rapid growth in demand fueled by rising healthcare spending, increasing amputation incidence, and improving insurance coverage. Local manufacturing, partnerships with governments, and pricing innovations can help companies expand robotic prosthetics sales in high-growth emerging markets. For instance, in September 2021, Robo Bionics, an India-based prosthetic firm, launched Grippy, an artificial arm that is one of the most economical prosthetic hands for amputees to aid them with daily tasks. The cost of Grippy, a 3D-printed prosthetic hand, is between US$ 3,000 and US$ 4,000, which is less than the US$ 9,000 of bionic arms already on the market.

- Development of customized solutions for specialized needs: Companies have significant opportunities to capture niche markets by designing and marketing robotic prosthetics tailored to the unique needs of diverse patient segments. Custom devices for pediatric amputees integrating growth adjustability, recreational prosthetics for athletics and extreme sports, and specialty prosthetics for activities like music and cooking can improve user satisfaction and quality of life. Focused R&D efforts, user studies, and partnerships with specialized rehabilitation centers can aid development of customized robotic prosthetics.

- Integration with advanced technologies such as AI and robotics: Incorporating emerging technologies like artificial intelligence, cloud computing, robotics, and 5G connectivity can help make robotic prosthetics smarter, more intuitive, and easier to use. AI-enabled automated gait pattern recognition and natural motion control, remote diagnostics via cloud, and haptic gloves for touch sensation offer enormous potential for improving future prosthetic performance and user experience. Companies can stay ahead by strategic collaborations with technology firms and sustained R&D investment in applying cutting-edge innovations to robotic prostheses. For instance, in October 2025, Nvidia Corporation, an U.S. based multinational technology company, and FANUC Germany, an automation company, have partnered with NTT DATA's Innovation Centre, a Japan-based organization devoted to the introduction of emerging and growth digitalization technologies, to create a digital twin of robotic arms for industrial digitalization use cases. The prosthetic arms project is built around a platform that connects businesses' 3D apps, creation and collaboration tools, 5G connection, and AI algorithms.

- Growing rehabilitation industry promotes prosthetic adoption: The prosthetics market is closely linked to the rehabilitation services segment that prepares amputees for using devices and provides gait training. Growth of rehabilitation services focused on prosthetic rehabilitation especially in emerging markets further aids adoption of advanced prosthetics. Leveraging cross-sector partnerships with rehabilitation providers and investing in training programs can support companies’ prosthetic businesses. The robotics rehabilitation market crossover also presents product development and commercialization opportunities.

Global Robotic Prosthetics Market Restraints:

- High costs of advanced robotic prosthetic devices: While costs are declining with technology improvements, premium-priced robotic prosthetics are still largely unaffordable for the majority of amputees without insurance coverage. Multi-articulating myoelectric hands cost over US$100,000 and microprocessor-controlled knees over US$50,000 in the U.S. High costs especially limit adoption in low and middle income countries, thus restraining market growth. Minimizing costs through manufacturing innovations, volume production, and pricing strategies remains a key challenge for the industry.

- Reimbursement issues and lack of coverage in developing regions: Many private and public insurance plans still lack adequate coverage for advanced robotic prosthetics, thereby hampering device accessibility for patients. Obtaining reimbursements is complex due to lengthy documentation requirements. Developing countries lag further behind in prosthetic device coverage, thus adversely impacting adoption among target populations. Advocacy for better insurance coverage and efforts to validate health economics benefits to payers can help enhance access and drive market expansion.

- Difficulties achieving truly natural movement and control: Despite major advances, mimicking the nuanced motor capability and fluidity of natural limbs remains challenging for modern robotic prosthetics. Fine finger dexterity, bimanual coordination, dynamic speed/force adjustment, and balance/proprioception are difficult to precisely replicate. Limited training data, algorithm limitations, and neural interface challenges pose technology barriers. Though improving continuously, current prosthetic devices still cannot match natural limb functionality. Addressing control, agility, and stability issues is vital for market growth.

Market Size in USD Bn

CAGR9.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.7% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Ottobock, Ossur, Blatchford Group, HDT Global, Fillauer LLC, Steeper Inc and Among Others |

please let us know !

Global Robotic Prosthetics Market Trends

- Development of more lightweight and compliant prosthetic limbs: A major trend is the engineering of prosthetic components using new lightweight alloys, 3D printed lattice structures, carbon fiber, and compliant materials to enhance prosthesis flexibility, durability, and agility while reducing weight. Lighter prostheses require less energy expenditure for limb movement, thus enabling easier mobility over long term use and improving user comfort. Compliant prosthetic joints better absorb shocks from walking impact. More widespread adoption of lightweight, complaint structural designs matched to patient anatomy will be a key trend. For instance, in August 2021, the Massachusetts Institute of Technology developed a neuroprosthetic hand that is lightweight, soft, and inexpensive. The researchers discovered that the prosthesis, which was developed with a tactile feedback system, restored some rudimentary sensation in a volunteer's residual leg. The smart hand weighs approximately half a pound and is supple and stretchy.

- Advancements in neural control systems for improved motion control: Sophisticated neural interfaces that seamlessly translate nerve impulses into prosthetic movements represent an important ongoing R&D focus in the market. Control systems based on pattern recognition, targeted muscle reinnervation, and implantable neural links aim to achieve more intuitive and finer motor control for dexterous arm and hand prostheses. Machine learning integration further enhances responsiveness to muscle signals. Neural control is a pivotal trend pushing dexterity of prosthetics closer to natural limb capability.

- Development of sensory feedback systems: Enabling touch sensation and proprioceptive feedback in prosthetics through sensors and electrodes interfaced with peripheral nerves and the brain is an emerging trend. Sensory inputs allow adjustability of grip strength, maintain balance, and avoid inadvertent damage. Developments include bioelectric skin, haptic pressure sensors, and cuff electrodes providing sensory stimulation. Sensory feedback along with advanced motor control will be crucial in improving utility and use of robotic prostheses.

- Adoption of 3D printing to enable low-cost customization: 3D printing of prosthetics using digital patient scans facilitates low-cost mass customization of components, while eliminating lengthy fitting procedures. On-demand printing of sockets, joints, hands, and others matched to limb shape and size ensures comfort and performance. Easy adjustability enables optimizing prosthesis weight distribution. 3D printing also aids rapid prototyping of new designs. The trend of leveraging 3D printing for economical, personalized prosthetics manufacturing will accelerate.

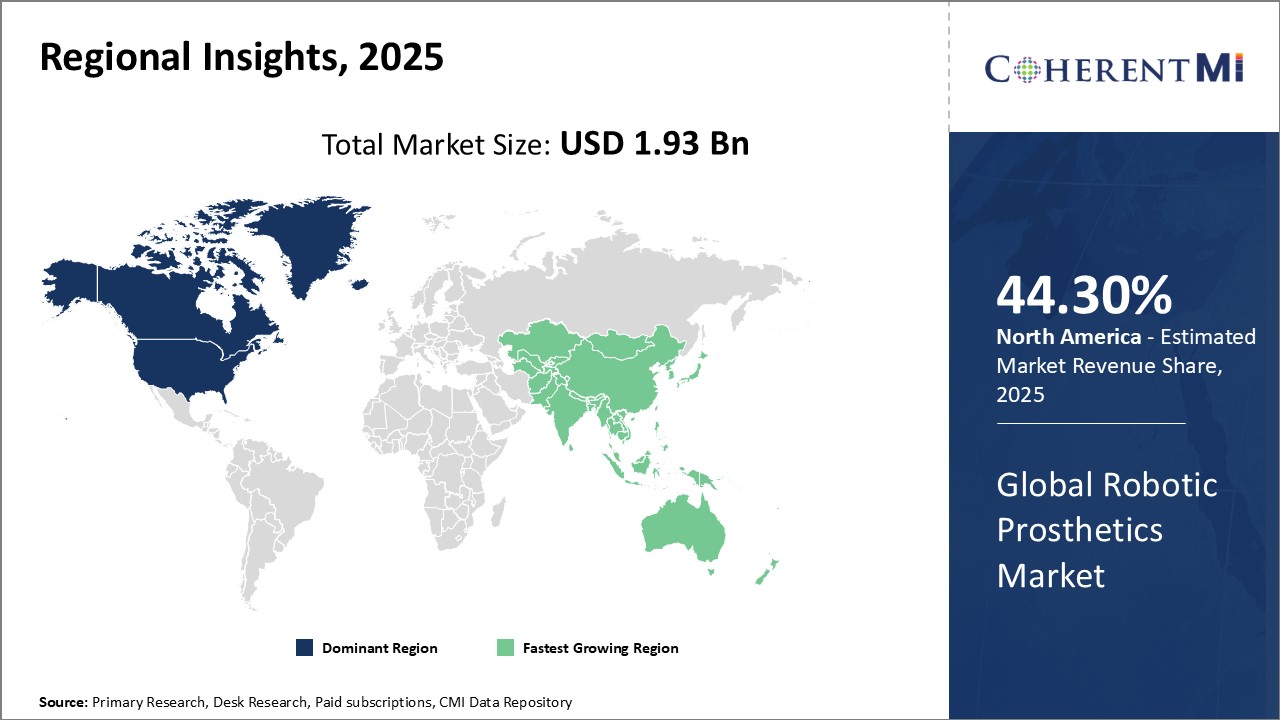

Global Robotic Prosthetics Market Regional Insights:

- North America is expected to be the largest market for global robotic prosthetics market during the forecast period, accounting for over 44.3% of the market share in 2025. The growth of the market in North America is due to high healthcare expenditure, favorable reimbursement policies, and early adoption of advanced technologies. For instance, in December 2021, Centers for Medicare & Medicaid Services released a guideline, outlining the changes related to The Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) fee schedule that amounts to ensure access to items and services in rural areas; procedures for making benefit category and payment determinations for new items and services that are Durable medical equipment (DME), prosthetic devices, orthotics and prosthetics, therapeutic shoes and inserts, surgical dressings, or splints, casts, and other devices used for reductions of fractures and dislocations under Medicare Part B.

- The Europe market is expected to be the second-largest market for global robotic prosthetics market, accounting for over 30.2% of the market share in 2025. The growth of the market in Europe due to increasing cases of limb loss and presence of key market players in the region.

- The Asia Pacific market is expected to be the fastest-growing market for global robotic prosthetics market, with a CAGR of over 9.9% during the forecast period. The growth of the market in Asia Pacific is due to rising healthcare expenditure and increasing awareness about advanced prosthetics.

Segmental Analysis of Global Robotic Prosthetics Market

Competitive overview of Global Robotic Prosthetics Market

The key market players should provide proper insurance coverage for the patients to bear the high costs associated with the use of robotics prosthetics.

Global Robotic Prosthetics Market Leaders

- Ottobock

- Ossur

- Blatchford Group

- HDT Global

- Fillauer LLC

- Steeper Inc

Global Robotic Prosthetics Market - Competitive Rivalry

Global Robotic Prosthetics Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Robotic Prosthetics Market

New product launches and Funding:

- In September 2022, Össur, a company in the orthotics and prosthetics (O&P) sector, launched the POWER KNEE, the first actively powered microprocessor prosthetic knee in the world that is designed for individuals with limb differences or above-knee amputations. The POWER KNEE is a "smart" prosthesis driven by a motor that detects human movement patterns using sophisticated algorithms. It learns and adapts in real-time to its wearer's pace and cadence, representing cutting-edge bionic technology.

- In May 2023, AMBER Robotics, a robotics development and innovation company launched its latest product, AMBER Lucid-1, a 7-axis portable robotic arm with the AI intuitive mover. The new technology simplifies robotics development and operation and speeds up the creation of films and vlogs by providing a range of features that are easy to use.

- In February 2021, Unhindr, a U.K. based startup announced US$ 613,000 in Innovate U.K. funding to grow and scale its adaptable AI prosthetic device. The technology is being developed with a team of amputee advisors to help deliver a comfortable prosthesis.

Acquisition and partnerships:

- In August 2022, Össur, a company in the orthotics and prosthetics (O&P) sector acquired Naked Prosthetics, a provider of durable, custom and functional finger prostheses for finger and partial hand amputees.

- In November 2021, Ottobock, a Germany-based medical equipment company, announced the acquisition of U.S. based exoskeleton startup SuitX. The deal will benefit Ottobock, which builds its own exoskeletons, along with prosthetics and orthotics.

- In April 2022, Phantom Neuro, a newly established neurotech firm that provides a high precision system for lifelike control of robotic orthopedic technologies, and Blackrock Neurotech, a company that specializes in brain-computer interface (BCI) technology, announced their alliance. Blackrock Neurotech has entered into a research and development partnership with Phantom Neuro for their patent-pending Phantom X system. This technology provides patients with extremely precise, almost real-time control over both existing and future assistive equipment, such as exoskeletons and prosthetic limbs.

Global Robotic Prosthetics Market Segmentation

- By Product Type

-

- Prosthetic Legs/Knees

- Prosthetic Arms

- Prosthetic Feet/Ankles

- Prosthetic Hands

- Others

- By Technology

-

- Microprocessor knees

- Myoelectric technology

- Body-Powered Technology

- Others

- By End User

-

- Hospitals

- Prosthetic Clinics

- Rehabilitation Centers

- Others

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the Global Robotic Prosthetics Market?

The Global Robotic Prosthetics Market is estimated to be valued at USD 1.9 in 2025 and is expected to reach USD 3.7 Billion by 2032.

What are the major factors driving the global robotic prosthetics market growth?

Rising incidence of limb loss and amputation, technological advancements in prosthetics design and functionality, user demand for more advanced, high-performing prosthetics, and favorable reimbursement policies and government funding are the major factors driving growth of the global robotic prosthetics market.

Which is the leading product type segment in the global robotic prosthetics market?

The prosthetic legs/knees are the leading product type segment in the global robotic prosthetics market.

Which are the major players operating in the global robotic prosthetics market?

The major players operating in the global robotic prosthetics market are Ottobock, Ossur, Blatchford Group, HDT Global, Fillauer LLC, Steeper Inc., Proteor, PROTUNIX, Endolite and Deka Research and Development Corporation.

Which region will lead the global robotic prosthetics market?

North America leads the global robotic prosthetics market.

What will be the CAGR of global robotic prosthetics market?

The CAGR of the global robotic prosthetics market is 9.7%.