Global Sacroiliac Joint Fusion Market Size - Analysis

The global sacroiliac joint fusion market size is expected to reach US$ 2001.6 Mn by 2032, from US$ 809.8 Mn in 2025, at a CAGR of 13.8% during the forecast period. Sacroiliac (SI) joint fusion is a minimally invasive surgical procedure that fuses the iliac bone to the spine’s sacrum for stabilization. It helps in alleviating chronic lower back and leg pain arising from sacroiliac joint dysfunction. The surgery is performed using specially designed implants, screws, rods, and bone grafts to stabilize the joint.

The sacroiliac joint (SIJ) connects the sacrum to the ilium bones of the pelvis. SIJ dysfunction can cause lower back and pelvic pain. There are several SIJ fusion devices and procedures available to treat chronic SIJ pain that has not responded to more conservative therapies. The main device types are rods, plates, and screws. Rod systems like iFuse involve inserting triangular titanium implants across the SIJ to permanently stabilize the joint. Plate systems like SI-BONE's iFuse-3D use a triangular titanium implant attached to a plate on one side for fixation.

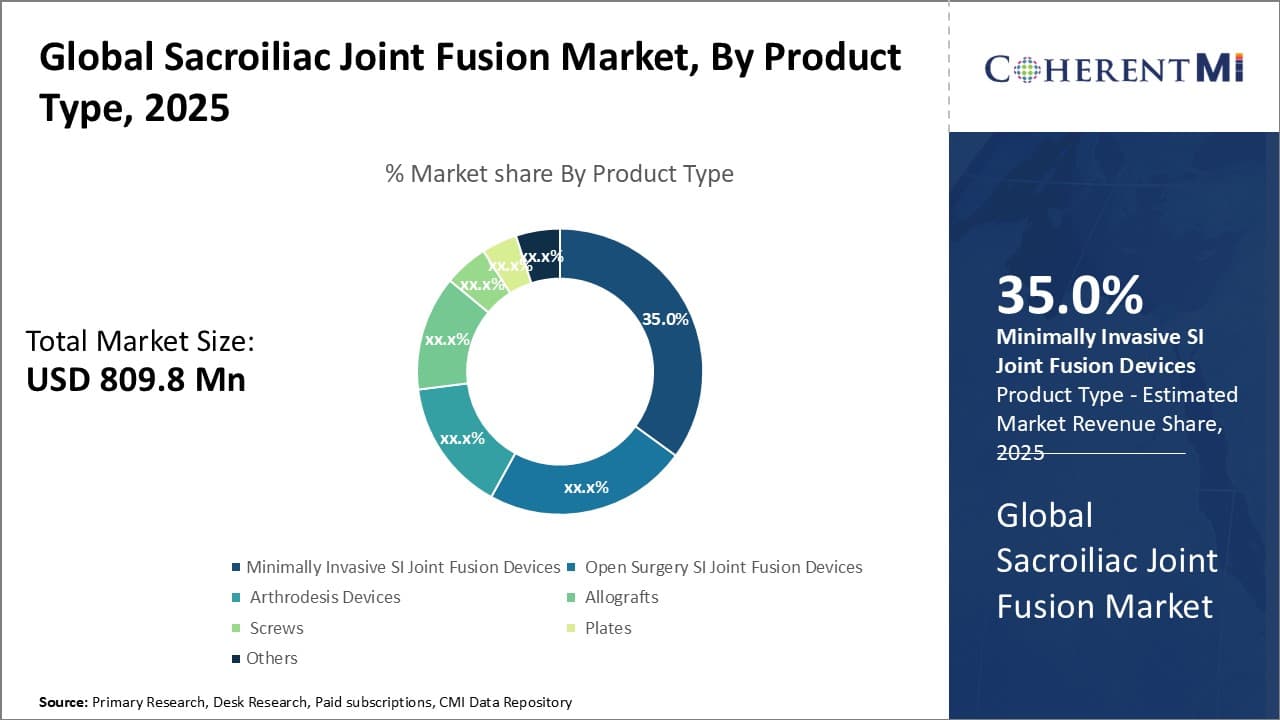

The global sacroiliac joint fusion market is segmented based on product, indication, end users, and region. By product, the minimally invasive SI joint fusion devices segment accounts for the largest share. The growth is attributed to the benefits of minimally invasive procedures, shorter recovery times, and fewer complications.

Global Sacroiliac Joint Fusion Market Drivers:

- Increasing prevalence of sacroiliac joint disorders: Sacroiliac joint dysfunction and degenerative sacroiliitis are progressively emerging as major causes of chronic lower back pain. Studies estimate that 15-30% of all chronic lower back pain cases may be attributed to sacroiliac joint disorders. The condition is especially common among the geriatric population owing to age-related wear and tear. Furthermore, incidences of sacroiliac joint injuries caused by trauma or pregnancy are also not uncommon. The growing patient pool is expected to be a key driver of the sacroiliac joint fusion devices and implants market. Surgeries are often recommended when conservative approaches like physical therapy fail to provide adequate long-term pain relief.

- Strong efficacy of minimally invasive SI joint fusion procedures: Minimally invasive SI joint fusion techniques have shown great clinical promise with high fusion rates, significant pain reduction, and low complication rates. Compared to open surgery, these procedures involve smaller incisions, use advanced navigation systems, cause less tissue damage, and allow quicker recovery. Several studies have validated the safety and effectiveness of devices like titanium plasma coated implants for minimally invasive SI joint fusion. This is anticipated to boost procedure volumes and market growth.

- Advancements in device designs and surgical techniques: Ongoing product innovations focused on improving clinical outcomes, as well as enabling minimally invasive surgery are the key growth factors. Technological advancements, such as 3D printed porous titanium implants, variable angle screws, and robotic navigation, are enhancing the precision, stability, and longevity of SI joint fusion surgery. Surgeons also have access to advanced intraoperative imaging, neurophysiological monitoring equipment, and other technologies, aiding them in performing these complex procedures with greater accuracy.

- Favorable reimbursement framework: Supportive reimbursement policies provide coverage for SI joint fusion procedures under Medicare and private insurance plans. Many consider the surgery medically necessary for degenerative sacroiliitis unresponsive to at least 6 months of conservative management. While out-of-pocket costs remain high, reimbursement helps improve accessibility and drives market expansion. Coverage is especially robust in developed countries like the U.S. where a majority of these surgeries are performed.

Global Sacroiliac Joint Fusion Market Opportunities:

- Growing demand for outpatient procedures: The transition towards outpatient or ambulatory surgical settings presents an attractive opportunity for market growth. Minimally invasive SI joint fusion can be safely performed in ASCs, significantly reducing hospitalization and procedure costs. Device manufacturers are increasingly targeting ambulatory surgery centers along with hospitals. ASCs allow for same-day discharges and faster post-op recovery timelines compared to hospital settings.

- Emergence of biologics-based bone grafting: Traditionally, iliac crest autograft has been considered gold standard for bone grafting in SI joint fusion surgery. However, this often causes donor site morbidity. Advances in biologics like stem cell derived allografts, recombinant human proteins, and synthetic bone graft substitutes are overcoming these limitations. Next-generation bone grafting solutions minimize complications, risk of disease transmission, and eliminate the need for a secondary site for bone harvesting.

- Launch of specialty devices for revision surgeries: Growing incidence of SI joint fusion failures and the need for revisions present scope for specialty implants and instrument sets, targeting more complex revision procedures. Companies are coming up with innovative modular and adjustable fixation systems capable of addressing anatomical variations and simplifying redo surgeries. Strong future demand is foreseen for these specialized products.

Global Sacroiliac Joint Fusion Market Restraints:

- High costs and unfavorable reimbursement policies: SI joint fusion surgery is expensive, with costs ranging from US$ 20,000 to US$ 30,000 in the U.S. Reimbursement is often insufficient from private insurers and does not fully cover out-of-pocket expenses in many countries. While procedures are deemed medically necessary, prior authorizations and high deductibles limit access mainly in price-sensitive emerging markets. This can hinder the market growth.

- Availability of traditional conservative therapies: Sacroiliac joint pain is initially managed through methods like physical therapy, chiropractic care, Non-steroidal anti-inflammatory drugs (NSAIDs), steroid injections, etc. Patients are able to obtain pain relief through these non-surgical treatments in a significant share of cases. This restricts the patient pool eligible for fusion surgery. Conservative management options will remain the first line of treatment, thereby restricting the market potential.

- Risk of post-surgical complications: Reported complications like implant malpositioning, fracture, loosening, non-union etc., although infrequent, can adversely impact outcomes if not addressed appropriately. Surgeons require specialized training and expertise to accurately place devices and achieve solid fusion. Such risks can deter many patients from undergoing what is considered an elective, non-essential procedure. Sustained educational efforts are crucial to increase procedure reliability and acceptance.

Analyst’s Views: The sacroiliac joint fusion market is expected to grow steadily driven by the rising geriatric population and increasing prevalence of degenerative diseases. The growing number of people suffering from arthritis, spondylitis, and lower back pain will drive the uptake of minimally invasive SI joint fusion procedures. Additionally, growing awareness about the benefits of fusion over medication and the availability of new generation bone graft materials will support the market expansion. However, the high cost of these specialized fusion surgeries and longer learning curve for surgeons may restrain the market growth in the short term.

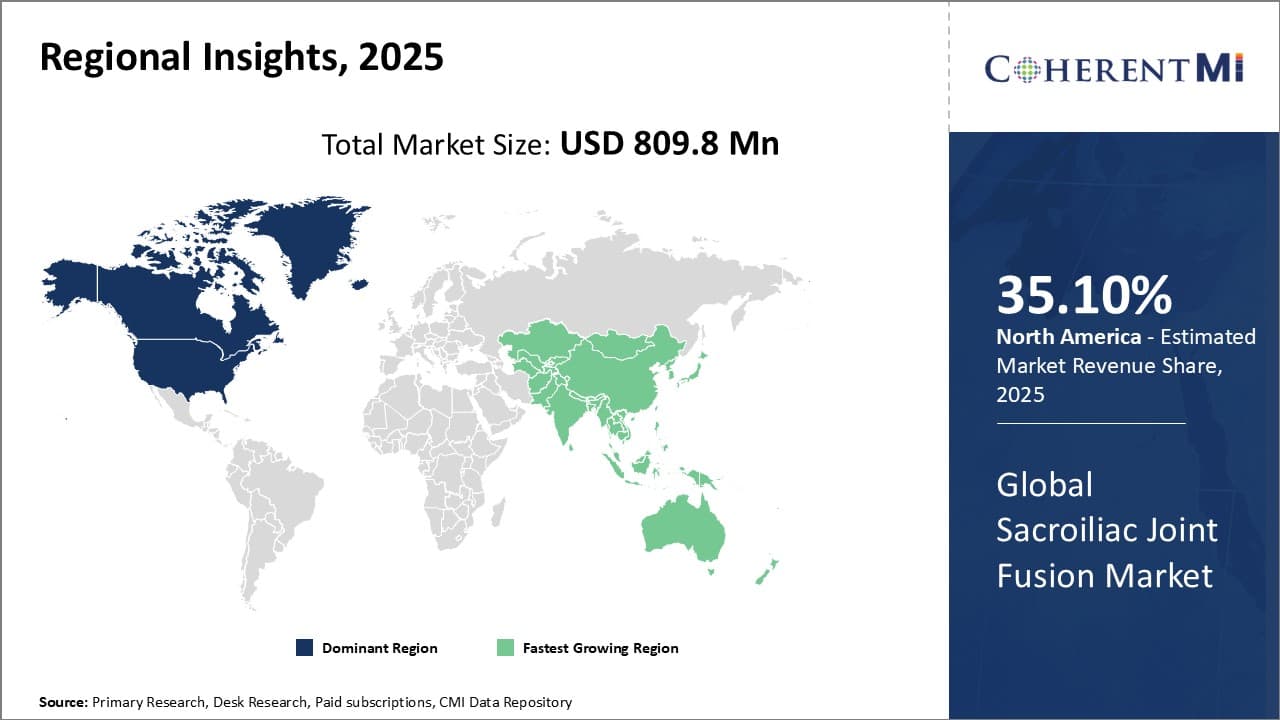

The North America region currently dominates the sacroiliac joint fusion market owing to the presence of major players and the availability of reimbursement policies. In the coming years, Asia Pacific is likely to witness fastest growth fueled by the growing medical tourism industry and increasing patient population within developing countries. Furthermore, favorable regulations and improving healthcare infrastructure will boost the adoption of technologically advanced fusion methods. Among various product types, bone graft substitutes are expected to gain popularity globally due to their ability to facilitate fusion and relieve pain.

Market Size in USD Mn

CAGR13.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 13.8% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | SI-BONE, Medtronic, SIGNUS Medizintechnik GmbH, Xtant Medical, Life Spine and Among Others |

please let us know !

Global Sacroiliac Joint Fusion Market Trends

- Increasing adoption of minimally invasive procedures: Patients and surgeons today demonstrate a strong preference for minimally invasive techniques for most spine procedures including SI joint fusion. The incisions required are extremely small, usually 2 cm or less. This reduces intraoperative bleeding, postoperative pain, and quicker recovery compared to open surgery. Robotic navigation further enhances the safety and precision of these procedures. Minimally invasive surgery (MIS) techniques are fast becoming the standard of care, fueling innovations in specialized implants and instrument sets.

- Growing number of ambulatory surgical procedures: Complex spine procedures like SI joint fusion which traditionally required hospitalization are increasingly being performed in outpatient ambulatory centers. This allows for same-day discharges, lowering costs and risks of hospital-acquired infections. Device manufacturers are aligning portfolios and distribution channels to tap into the steady rise in outpatient spine surgery volumes, especially across developed regions.

- Increasing industry consolidation through M&As: The sacroiliac joint fusion market is witnessing a wave of consolidations as large medical device players acquire smaller developers of novel implants and navigation technologies. Acquisitions provide access to innovative products while also removing competition. For instance, Stryker's 2021 acquisition of Vocera Communications a medtech company strengthened the digital and Artificial Intelligence (AI) capabilities for its pain management solutions.

Global Sacroiliac Joint Fusion Market Regional Insights:

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

- North America is expected to be the largest market for sacroiliac joint fusion during the forecast period, which accounted for over 35.1% of the market share in 2025. The growth of the market in North America is attributed to the high incidence of lower back pain, favorable reimbursement policies, and continuous product approvals by regulatory authority. For instance, on March 29, 2025, CoreLink, LLC, a leading designer and manufacturer of innovative spinal implant systems, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Siber Ti Sacroiliac Joint Fusion System.

- Europe is expected to be the second-largest market for sacroiliac joint fusion, which accounted for over 26% of the market share in 2025. The growth of the market in Europe is attributed to the rising geriatric population and investments in healthcare infrastructure.

- Asia Pacific is expected to be the fastest-growing market for sacroiliac joint fusion, which is anticipated to grow at a CAGR of over 12% during the forecast period. The growth of the market in Asia Pacific is attributed to the improving healthcare expenditure and growing awareness about SI joint fusion procedures.

Segmental Analysis of Global Sacroiliac Joint Fusion Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample CopyCompetitive overview of Global Sacroiliac Joint Fusion Market

Major players operating in the global sacroiliac joint fusion market include SI-BONE, Medtronic, SIGNUS Medizintechnik GmbH, Xtant Medical, Life Spine, Globus Medical, CoreLink, Orthofix, Zyga Technology, Alphatec Spine, Integra LifeSciences, DePuy Synthes, NuVasive, and RTI Surgical are the major players operating in the market.

Global Sacroiliac Joint Fusion Market Leaders

- SI-BONE

- Medtronic

- SIGNUS Medizintechnik GmbH

- Xtant Medical

- Life Spine

Recent Developments in Global Sacroiliac Joint Fusion Market

New product launches/ Approvals:

- In March 2022, Life Spine a medical technology manufacturer launched the SImpact SI Joint Fixation System, its sacroiliac joint fusion system with integrated compression and stabilization capabilities. It provides rigid fixation while limiting stress shielding.

- In October 2020, Orthofix, a global medical device and biologics company, received the U.S. Food and Drug Administration (FDA) 510(k) clearance for the nanotechnology feature of the FIREBIRD SI Fusion System

- On October 31, 2023, X?nix Medical, a surgical implant company, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) to market the SOLACE Sacroiliac Fixation System with proprietary NANOACTIV surface technology and compatibility with StealthStation Navigation

Acquisition and partnerships:

- In September 2021, PainTEQ, a medical device company, acquired three U.S. patents for Innovative Sacroiliac (SI) joint procedure. These new patents drive PainTEQ's breakthrough, minimally invasive fusion surgery for SI joint dysfunction.

Global Sacroiliac Joint Fusion Market Segmentation

- By Product Type

-

- Minimally Invasive SI Joint Fusion Devices

- Open Surgery SI Joint Fusion Devices

- Arthrodesis Devices

- Allografts

- Screws

- Plates

- Others (Nails, Rods, etc.)

- By Indication

-

- Degenerative Sacroiliitis

- Sacral Disruption

- Others (Failed Back Surgery, Trauma, Infection, etc.)

- By End Users

-

- Hospitals

- ASCs

- Specialty Clinics

- Others (Research, Academic Institutes, etc.)

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.