Glycated Haemoglobin Testing Market Size - Analysis

The glycated haemoglobin testing market is estimated to be valued at USD 239 Mn in 2024 and is expected to reach USD 426 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2031.

Market Size in USD Mn

CAGR8.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.6% |

| Market Concentration | High |

| Major Players | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Tosoh Corporation, Bio-Rad Laboratories and Among Others |

please let us know !

Glycated Haemoglobin Testing Market Trends

The increasing prevalence of diabetes cases around the globe has been a key growth driver for the glycated haemoglobin testing market. Diabetes is a chronic condition that affects millions worldwide, with numbers continuing to grow each year due to lifestyle changes, urbanization and an aging population. According to estimates by the International Diabetes Federation, over 460 million adults were living with diabetes in 2019, with the figure projected to rise to around 630 million by 2030 and 700 million by 2045.

Another crucial factor is the growing awareness regarding the importance of HbA1c monitoring among both physicians and diabetics. Strict glucose control through medicines, lifestyle changes and HbA1c monitoring has been shown to significantly reduce the risks of diabetes-related complications like heart disease, kidney damage and nerve damage. With rising health education, more patients are willing to undergo regular testing as recommended by clinical guidelines. Doctors too place greater focus on HbA1c levels for enhanced diabetes care. These trends have substantially expanded the customer base for HbA1c testing products and services globally.

Market Driver - Increased adoption of Point of Care (POC) devices due to ease of use and quick results

POC HbA1c analyzers deliver lab-accurate results within a short span of 5-15 minutes from a small blood sample, without the need for sample shipment. Their portability and small footprint allow testing to be conveniently performed near the patient. This serves as a major advantage in busy clinical settings as well rural locations where access to central labs may be limited. The rapid availability of HbA1c results assists healthcare practitioners in making timely treatment changes or medication adjustments directly during consultations.

Market Challenge - High cost of HbA1c testing devices

The glycated haemoglobin testing market has strong growth opportunities through expansion into emerging markets that have large and growing diabetic patient pools. Countries in Asia Pacific, Latin America, Africa and the Middle East are witnessing rapid economic development along with a rise in obesity and sedentary lifestyles. This has led to increased incidence of diabetes in these regions. According to estimates, over 80% of people with diabetes live in low and middle-income countries. As diabetes management practices advance in emerging nations, demand for regular HbA1c testing will increase significantly. Market players can tap into these regions by setting up local manufacturing, obtaining regulatory approvals, conducting awareness programs and partnering with regional healthcare providers. A focus on affordable product offerings tailored to these price-sensitive markets will be critical. This provides a large untapped market for companies and supports the long term growth prospects of the global glycated haemoglobin testing industry.

Key winning strategies adopted by key players of Glycated Haemoglobin Testing Market

Continuous innovation and development of new products has helped players gain an edge. For example, in 2017 Abbott launched its new Afinion HbA1c Dx assay, an advanced point-of-care test that provides accurate HbA1c results in 2 minutes. This allowed for faster diagnosis and treatment monitoring of diabetes in clinics and physician offices.

Strategic acquisitions of smaller companies has helped big players augment their product portfolios and capabilities. For instance, in 2015 Danaher acquired Cepheid for $4 billion, enhancing its molecular diagnostics business. Cepheid owned the Veritor System, a popular rapid HbA1c point-of-care testing platform, boosting Danaher's position in that segment.

Segmental Analysis of Glycated Haemoglobin Testing Market

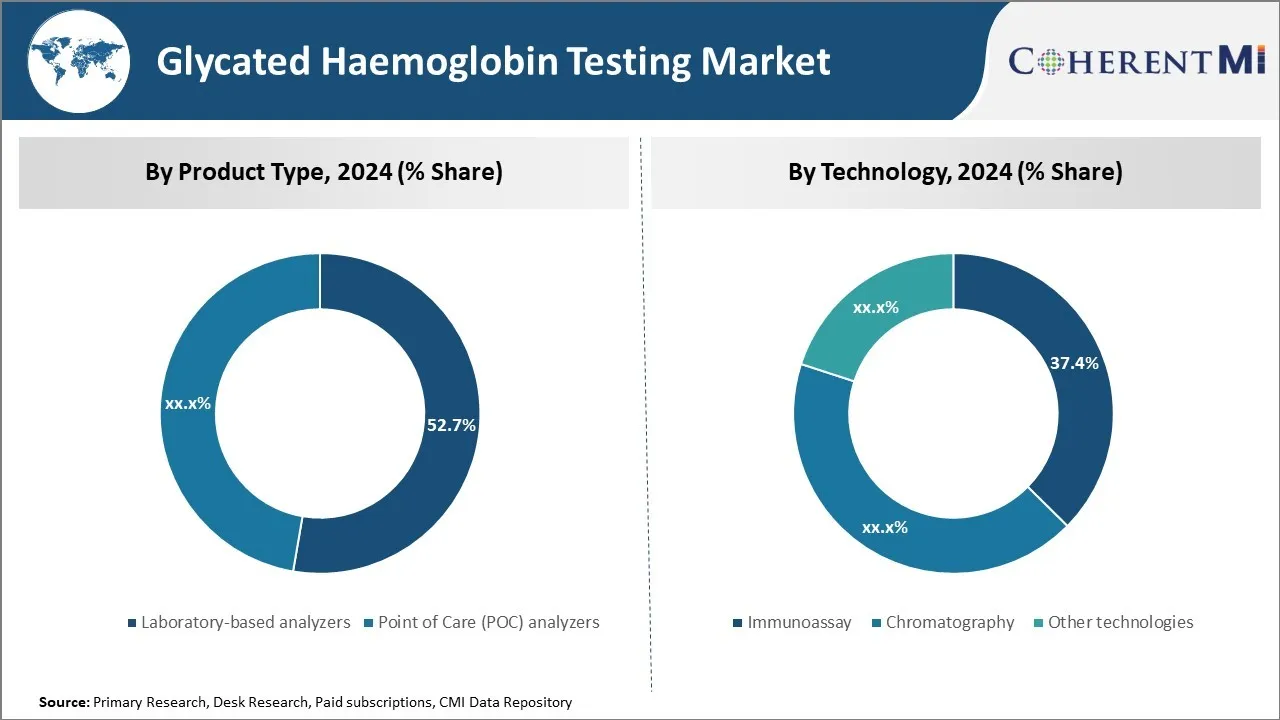

In terms of product type, laboratory-based analyzers sub-segment contributes the highest share of 52.7% in the glycated haemoglobin testing market owing to the growth in central lab testing. Traditional HbA1c testing is increasingly shifting from PoC instruments to centralized clinical labs as they offer accurate and standardized analysis of large sample volumes with minimal manual intervention and error risks. The automation and high-throughput capabilities of Laboratory-based analyzers allow clinical labs to process hundreds of samples within a few hours, with consistent results, thus improving efficiencies. This centralized approach aligned with treatment guidelines recommending HbA1c monitoring for diabetes management at least twice a year. Further, many healthcare providers prefer the accuracy and traceability of lab instruments over PoC devices. Being primarily used in clinical labs with experienced technicians, Laboratory-based analyzers also have lower requirements for operator training and ongoing calibrations compared to PoC instruments. Going forward, the growing preference of healthcare providers for reliable laboratory testing due to legal liability concerns is expected to continue driving the laboratory-based analyzers segment.

In terms of technology, immunoassay sub-segment contributes the highest share of 37.4% in the glycated haemoglobin testing market owing to its high accuracy and throughput ideal for large-volume centralized testing. Clinically-validated immunoassay techniques such as HPLC, Boronate Affinity Chromatography and Enzymatic Assays are capable of automating the entire glycated hemoglobin testing process from sample preparation to quantitation and result reporting within clinical labs. This end-to-end automation streamlines high-volume HbA1c testing with consistent quality and minimum manual errors. Additionally, immunoassays offer superior accuracy for determining HbA1c levels, which is critical for treatment decisions and monitoring diabetes progression. Their reproducibility and reliability help standardize lab results across multiple samples and instruments in centralized settings. These advantages, along with continuous technology advancements lowering analysis time and costs, have made immunoassay the preferred technology for high-capacity clinical HbA1c testing. Immunoassays' centralized lab focus will allow the segment to grow in parallel with the overall migration of HbA1c testing from point-of-care to labs.

Additional Insights of Glycated Haemoglobin Testing Market

- The market for HbA1c testing is driven by the growing prevalence of diabetes worldwide. As diabetes becomes more common, especially in regions with large populations such as China and India, the demand for accurate and efficient diagnostic tests is increasing. HbA1c tests offer several advantages over traditional glucose monitoring, including no need for fasting, high stability, and less variability.

Competitive overview of Glycated Haemoglobin Testing Market

The major players operating in the glycated haemoglobin testing market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Tosoh Corporation, Bio-Rad Laboratories, ARKRAY, Inc., Danaher Corporation, Transasia Bio-Medicals Ltd. and PTS Diagnostics.

Glycated Haemoglobin Testing Market Leaders

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Tosoh Corporation

- Bio-Rad Laboratories

Glycated Haemoglobin Testing Market - Competitive Rivalry

Glycated Haemoglobin Testing Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Glycated Haemoglobin Testing Market

- In January 2024, Roche Diagnostics introduced a new HbA1c testing device aimed at improving accuracy in diabetes diagnosis.

- In May 2023, Siemens Healthineers expanded its laboratory-based HbA1c analyzer line to include more efficient and faster testing capabilities.

Glycated Haemoglobin Testing Market Segmentation

- By Product Type

- Laboratory-based analyzers

- Point of Care (POC) analyzers

- By Technology

- Immunoassay

- Chromatography

- Other technologies

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

What are the key factors hampering the growth of the glycated haemoglobin testing market?

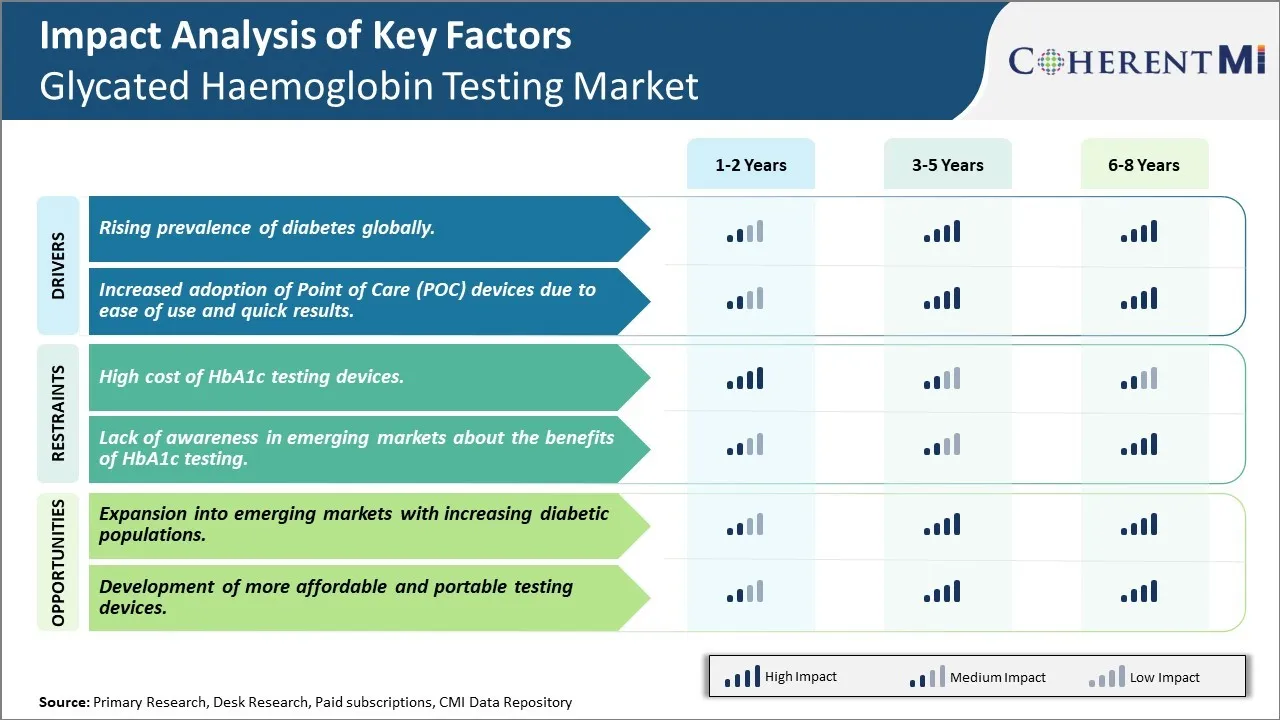

The high cost of HbA1c testing devices and lack of awareness in emerging markets about the benefits of HbA1c testing are the major factors hampering the growth of the glycated haemoglobin testing market.

What are the major factors driving the glycated haemoglobin testing market growth?

The rising prevalence of diabetes globally and increased adoption of point of care (PoC) devices due to ease of use and quick results are the major factors driving the glycated haemoglobin testing market.

Which is the leading product type in the glycated haemoglobin testing market?

The leading product type segment is laboratory-based analyzers.

Which are the major players operating in the glycated haemoglobin testing market?

Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Tosoh Corporation, Bio-Rad Laboratories, ARKRAY, Inc., Danaher Corporation, Transasia Bio-Medicals Ltd., and PTS Diagnostics are the major players.

What will be the CAGR of the glycated haemoglobin testing market?

The CAGR of the glycated haemoglobin testing market is projected to be 8.6% from 2024-2031.