Hydrocephalus Shunts Market Size - Analysis

The hydrocephalus shunts market is estimated to be valued at USD 371.4 Mn in 2025 and is expected to reach USD 543.9 Mn by 2032, growing at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2032. The increasing prevalence of hydrocephalus disorders globally is expected to drive the demand for hydrocephalus shunts during the forecast period. Additionally, growing research and development activities for technologically advanced hydrocephalus shunts is expected to provide new opportunities in the hydrocephalus shunts market.

Market Size in USD Mn

CAGR5.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.6% |

| Market Concentration | Medium |

| Major Players | Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Natus Medical Incorporated and Among Others |

please let us know !

Hydrocephalus Shunts Market Trends

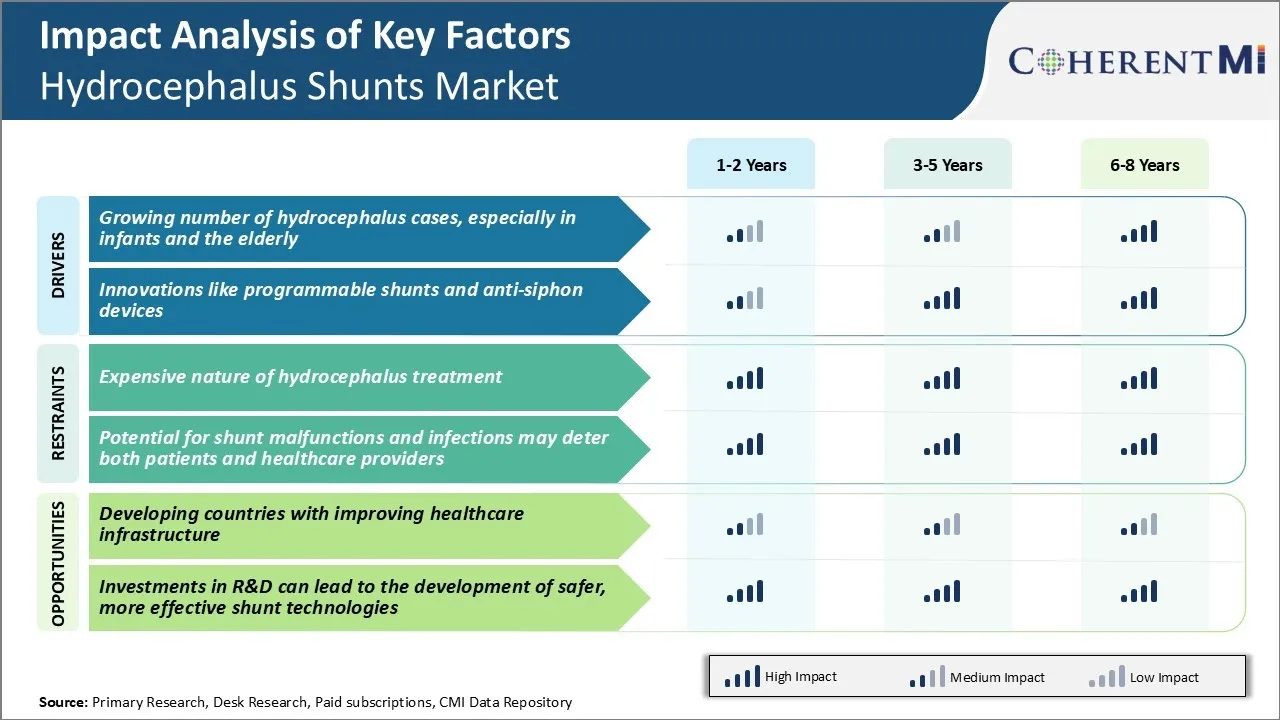

Market Driver - Growing Number of Hydrocephalus Cases, Especially in Infants and the Elderly

Hydrocephalus is a condition characterized by the abnormal accumulation of cerebrospinal fluid in the brain which increases pressure inside the skull. This excessive fluid buildup is commonly seen in infants and the elderly population.

In infants, hydrocephalus is usually caused due to genetic abnormalities or issues during pregnancy and childbirth. The condition affects about 1 in every 500 live births. If left untreated, hydrocephalus in infants can seriously hamper brain development and motor function. On the other hand, elderly individuals are more susceptible to hydrocephalus secondary to other age-related factors like dementia, infections, brain tumor or hemorrhage. With rising life expectancy globally, the geriatric population has been growing rapidly which has contributed to the increasing burden of hydrocephalus.

Doctors recommend permanent treatment of hydrocephalus with cerebrospinal fluid shunting procedures wherein a catheter is placed inside the ventricles to drain excess fluid to another part of the body like the abdomen. This ensures normal pressure is maintained inside the brain.

The increasing prevalence of hydrocephalus, especially in at-risk groups has directly influenced the demand for hydrocephalus shunting devices in recent times. With limited treatment options available, shunt systems continue to be the mainstay for long-term management of the condition.

Market Driver - Innovations like Programmable Shunts and Anti-siphon Devices

The hydrocephalus shunts industry has witnessed significant technological advancement over the past decade with the introduction of new generation programmable as well as anti-siphon shunt devices. Programmable shunts allow physicians and patients to non-invasively adjust the drainage rate of cerebrospinal fluid according to changing intracranial pressure conditions. This provides better long-term regulation of fluid flow compared to traditional fixed-pressure valves. Recently developed programmable valves integrated with wireless technology have further enhanced convenience and improved treatment outcomes.

Similarly, anti-siphon technologies help prevent backflow of cerebrospinal fluid and overdrainage issues which commonly occur with standard shunts, especially in upright positions. Such intelligent designs have reduced complications and revision surgeries substantially. Advanced materials used in catheter construction have improved biocompatibility and longevity as well.

Moreover, miniature device sizes have increased comfort for patients. Rising clinical evidence backing the effectiveness of innovative hydrocephalus shunt designs has persuaded more neurosurgeons and patients to opt for premium programmable and anti-siphon systems.

Continuous product refinement by major manufacturers focused on safety, reliability and optimizing the shunt performance in response to body movements is escalating their adoption. This has provided a strong momentum to the growth of technically advanced shunt varieties within the hydrocephalus shunts market.

Market Challenge - Expensive Nature of Hydrocephalus Treatment

Hydrocephalus treatment involves surgically implanting a hydrocephalus shunt to drain excess cerebrospinal fluid from the brain. This process requires highly skilled neurosurgeons to perform a delicate procedure. The shunt itself is a medical device that needs to be customized based on each patient's anatomy and condition.

Furthermore, shunts may need to be replaced or revised over time if they malfunction or become blocked. All of these factors contribute to hydrocephalus treatment being an expensive endeavor. The high costs associated with shunt implantation, revision surgeries if needed, and lifetime shunt maintenance are a financial burden not only on patients but also on the healthcare systems.

This cost factor restricts access to treatment for many patients, especially in developing nations where resources are more limited. Addressing the issue of costs will be critical for the long-term growth prospects of the hydrocephalus shunts market.

Market Opportunity - Developing Countries with Improving Healthcare Infrastructure

A growing opportunity for the hydrocephalus shunts market lies in developing countries that are witnessing rapid improvements in their healthcare infrastructure and capabilities. As access to specialized neurosurgical care expands in emerging markets, more patients will be able to receive timely diagnosis and treatment for hydrocephalus. This will translate to an increased demand for hydrocephalus shunt systems and procedures.

A number of developing nations have large populations and are experiencing rising standards of living as well, which will augment the affordability of treatment costs over time. Market players need to focus on launching more affordable shunt product lines and train local surgeons to perform interventions. This can help address the major unmet needs in developing regions and unlock new markets for substantial business growth.

Key winning strategies adopted by key players of Hydrocephalus Shunts Market

Product Innovation - Continual innovation in shunt technology and design has helped players gain an edge. For example, in 2019 Medtronic launched the Strata NSC adjustable valve, featuring NightWatch technology that helps reduce overdrainage risks. This addressed a major patient issue and boosted Medtronic's market share.

Effective Marketing - Aggressive marketing campaigns highlighting the benefits of new products have driven sales. For example, when Medtronic launched Strata NSC, it conducted extensive physician outreach programs explaining the product's features. This increased awareness and trials, helping to quickly gain FDA clearance and market adoption.

Strong Distribution Networks - Companies like Medtronic, Integra and B. Braun have built robust global distribution networks over decades, with deep presence in key markets. Their hospital relationships and skilled sales reps ensure wide access and promotion of products. For example, after acquiring Sophysa in 2017, B. Braun could leverage its global footprint to rapidly scale Sophysa's new shunt technologies.

M&A Activity - Acquisitions have helped players expand portfolios and technologies. For example, Integra's 2010 acquisition of Codman Shurtleff added codman's reliable valve technologies, strengthening Integra's position. Similarly, B.Braun's acquisition of Sophysa as mentioned earlier, helped expand its adjustable valve offerings.

Segmental Analysis of Hydrocephalus Shunts Market

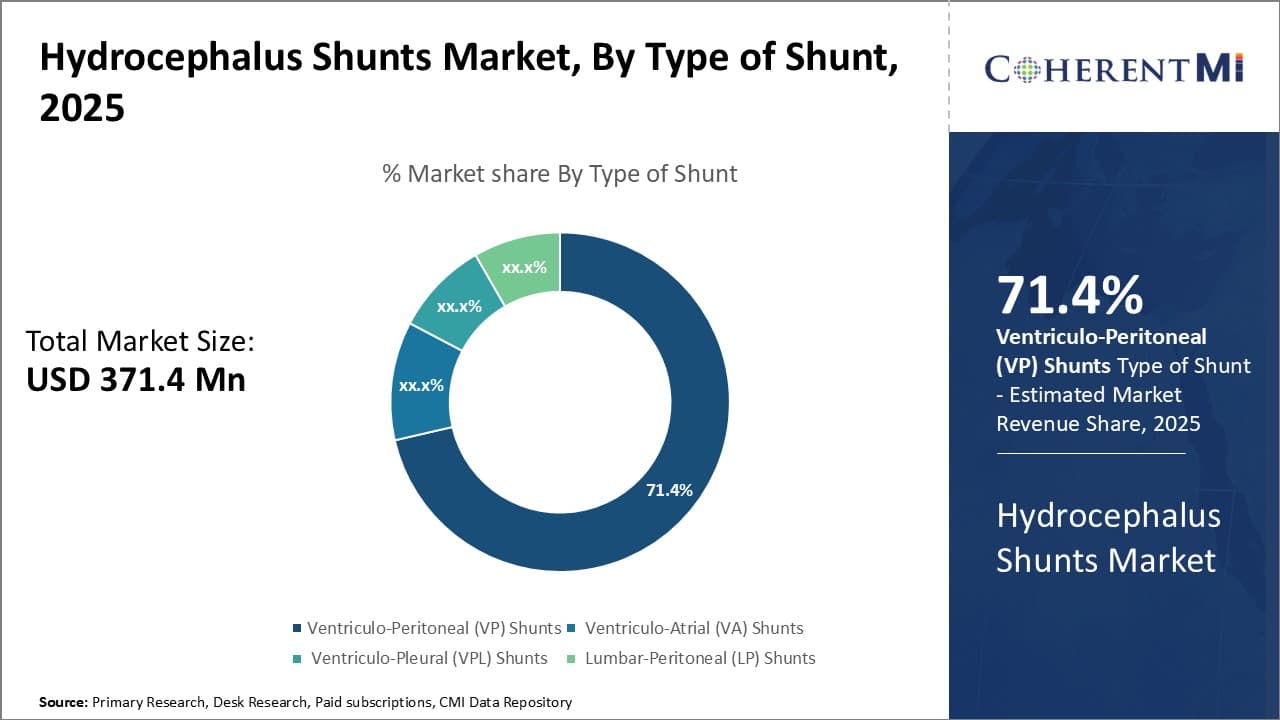

Insights, By Type of Shunt: Increased Prevalence of Hydrocephalus Drives Growth of Ventriculo-Peritoneal (VP) Shunts

In terms of type of shunt, Ventriculo-Peritoneal (VP) shunts are projected to hold 71.4% share of the hydrocephalus shunts market in 2025, owning to their effectiveness and low risk of complications. VP shunts work by draining excess cerebrospinal fluid from the brain ventricles into the abdomen cavity, where it is absorbed naturally into the bloodstream. They offer greater placement flexibility compared to other types and do not require additional surgeries for valve replacement like adjustable pressure valves. Moreover, VP shunt placement is a minimally invasive procedure with low risk of infection and less chance of fluid buildup.

Given their favorable clinical outcomes and safety profile, VP shunts remain the standard of care for treating non-communicating hydrocephalus conditions that affects infants and young children. Their widespread acceptance among neurosurgeons has enabled consistent growth.

Additionally, rising incidence of hydrocephalus due to higher survival of preterm babies and improved management of neonatal jaundice is driving the need for initial as well as revision VP shunt placements. Favorable reimbursement policies have further increased adoption in developed markets. These factors combined have maintained the leading position of VP shunts segment over others.

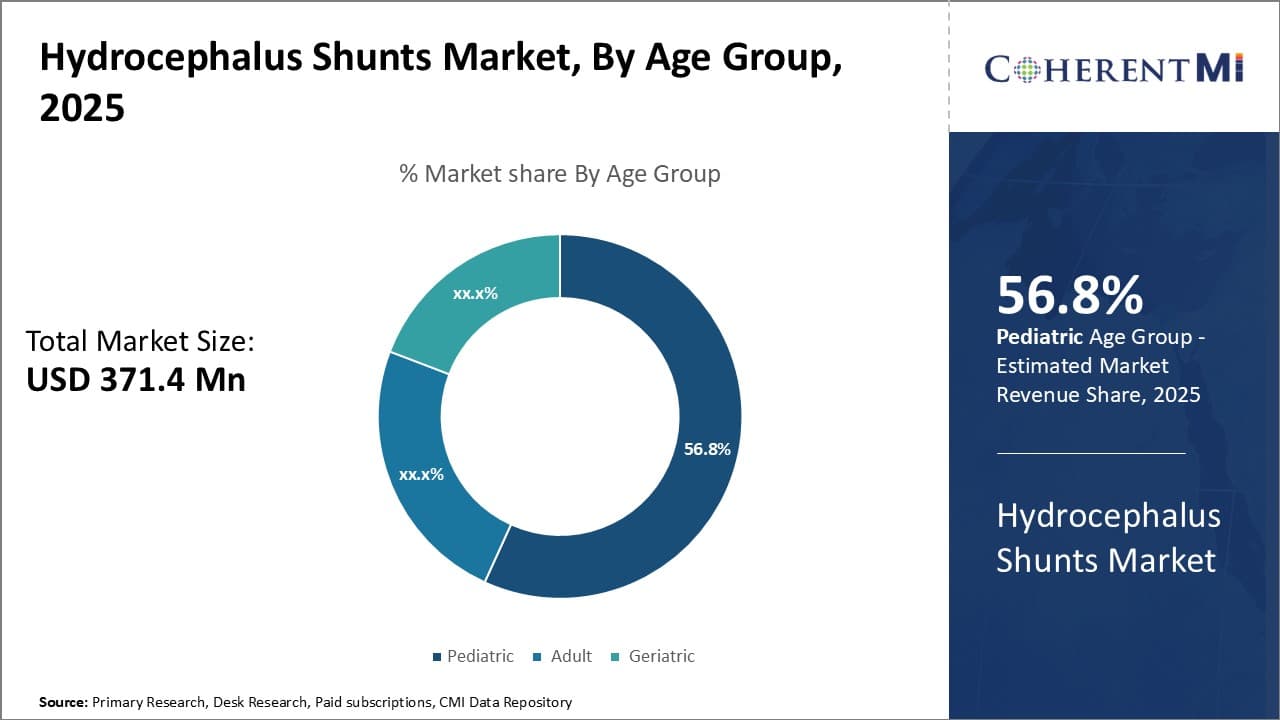

Insights, By Age Group: Increased Diagnosis of Pediatric Hydrocephalus Drives Demand

Insights, By Age Group: Increased Diagnosis of Pediatric Hydrocephalus Drives Demand

In terms of age group, pediatric segment is expected to hold 56.8% share of the hydrocephalus shunts market in 2025. Hydrocephalus has a higher prevalence in infants and children compared to adults as its causes are often related to complications during pregnancy, birth or in the first year of life. Growing awareness among parents and clinicians regarding signs and symptoms has led to enhanced diagnosis of pediatric hydrocephalus at an early stage.

Additionally, improvement in neuroimaging technologies such as MRI has enabled accurate detection of hydrocephalus in newborns and infants. This has stimulated demand for shunt placement procedures as early management results in better long-term outcomes.

Moreover, secular increase in survival rates of preterm babies who are at an elevated risk of developing post-hemorrhagic hydrocephalus is propelling the pediatric segment growth. Rising birth rates in developing nations and increasing focus on neonatal care services also contribute significantly. Proactive lifestyle changes among families with children having hydrocephalus and their preference of shunts over recurrent lumbar punctures have further augmented the pediatric segment size over time.

Insights, By End User: Increased Access and Establishment of Centers of Excellence Drive Hospital End-User Segment

In terms of end user, hospitals contribute the highest share owing to their accessibility along with concentration of skilled neurosurgeons and equipped operation theaters. Hydrocephalus shunt surgeries require specialized infrastructure and trained professionals for safe implantation and management of the medical device. Most medical insurers also prefer proven outcome track record for approving reimbursements.

Rising healthcare investments by both public and private sectors have increased networks of multispecialty and children’s hospitals across major countries. Their establishment near urban centers and constant enhancement of regional hospitals have improved geographical access for patients. Focus on neurological disorders and creation of centers of excellence through partnerships between leaders in neuroscience research and clinical care have further augmented hospital segment growth.

Standardization of protocols through clinical guidelines and digitalization of processes have enhanced quality of hospital-based hydrocephalus management as well. This has boosted patient confidence and preference for seeking expert advice from neurosurgery departments over standalone clinics or day-care facilities for such complex procedures over time.

Additional Insights of Hydrocephalus Shunts Market

- In 2019, approximately 1 million people in the United States were affected by hydrocephalus, with 1 in every 1,000 babies diagnosed with the condition. The increasing prevalence of hydrocephalus in both pediatric and adult populations highlights the demand for shunt-based interventions.

- The CDC estimates that over 223,135 TBI-related hospitalizations occurred in the US in 2019, with 64,362 TBI-related deaths in 2020, underlining the potential demand for hydrocephalus shunts in TBI treatments.

- Prevalence: Hydrocephalus affects an estimated 1 million people in the United States, including infants, older children, and adults.

- Shunt Revision Rates: Approximately 40% of shunts may require revision within the first year due to malfunctions or infections, highlighting the need for improved technologies.

- Global Impact: Developing countries are witnessing an increase in hydrocephalus cases due to higher birth rates and lack of prenatal care, emphasizing the global need for effective treatment solutions.

Competitive overview of Hydrocephalus Shunts Market

The major players operating in the hydrocephalus shunts market include Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Natus Medical Incorporated, Spiegelberg GmbH & Co. KG, Tokibo Co., Ltd., DePuy Synthes (Johnson & Johnson), Johnson & Johnson, Spiegelberg GmbH & Co. KG, TKB Corporation, G. SURGIWEAR LTD., HpBio Próteses, inc., Kaneka Medix Corp., Desu Medical, HLL Lifecare, Anuncia Inc., and Fuji Systems.

Hydrocephalus Shunts Market Leaders

- Medtronic plc

- Integra LifeSciences Corporation

- B. Braun Melsungen AG

- Sophysa

- Natus Medical Incorporated

Hydrocephalus Shunts Market - Competitive Rivalry

Hydrocephalus Shunts Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Hydrocephalus Shunts Market

- In September 2022, Anuncia Medical, Inc. received FDA clearance for its ReFlow® System Mini. This system is designed to help patients with hydrocephalus and other cerebrospinal fluid (CSF) disorders by providing a noninvasive method to flush cerebrospinal fluid shunts. The system aims to prevent shunt blockages, which can lead to severe complications requiring surgical intervention. By reducing the incidence of shunt blockages, the ReFlow System Mini is intended to improve patient outcomes and reduce the need for repeat surgeries.

- In August 2022, the FDA approved an Investigational Device Exemption (IDE) for CereVasc's eShunt system, allowing for a pilot trial to treat patients who develop communicating hydrocephalus following aneurysmal subarachnoid hemorrhage (paSAH). The eShunt system is designed as a minimally invasive alternative to traditional treatments, aiming to reduce complications such as catheter obstruction and infection associated with conventional shunts. This approval enables the study of its safety and efficacy in this patient population, enhancing treatment options for complex cases of hydrocephalus.

- In February 2022, CereVasc, Inc. received FDA Investigational Device Exemption (IDE) approval to initiate a pilot trial of its eShunt System in patients with normal pressure hydrocephalus (NPH). This IDE approval marked a significant step toward exploring a minimally invasive treatment alternative for NPH, which could offer improvements over the traditional neurosurgical methods used for hydrocephalus treatment. The eShunt System aims to provide a less invasive option that reduces the risks and complications commonly associated with current treatments, such as infection and high failure rates.

- In April 2021, Medtronic launched an advanced version of their programmable hydrocephalus shunt system, specifically the StrataMR II valve, designed to improve precision and reliability in managing cerebrospinal fluid (CSF) pressure. This shunt offers multiple programmable pressure settings to adjust CSF flow according to patient needs, which helps reduce the frequency of shunt revisions and improves overall patient outcomes. The innovation focuses on reducing complications associated with hydrocephalus treatment, such as shunt failures, and aims to enhance patient quality of life by providing a more consistent and tailored therapy.

- In July 2019, Integra LifeSciences Corporation acquired Arkis BioSciences Inc., a company specializing in advanced cerebrospinal fluid management. This acquisition expanded Integra's product portfolio and strengthened its position in the hydrocephalus market. Arkis BioSciences specialized in neurosurgical devices, including the CerebroFlo® external ventricular drainage (EVD) catheter with Endexo® technology, designed to reduce catheter obstruction and thrombus formation during CSF drainage. The acquisition expanded Integra’s product portfolio, particularly in advanced catheter technology, further positioning the company as a leader in treating hydrocephalus and other neurocritical conditions.

Hydrocephalus Shunts Market Segmentation

- By Type of Shunt

- Ventriculo-Peritoneal (VP) Shunts

- Adjustable Pressure Valves

- Fixed Pressure Valves

- Ventriculo-Atrial (VA) Shunts

- Adjustable Pressure Valves

- Fixed Pressure Valves

- Ventriculo-Pleural (VPL) Shunts

- Lumbar-Peritoneal (LP) Shunts

- Ventriculo-Peritoneal (VP) Shunts

- By Age Group

- Pediatric

- Infants

- Children

- Adult

- Young Adults

- Middle-Aged Adults

- Geriatric

- Elderly Population

- Pediatric

- By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Research and Academic Institutes

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the hydrocephalus shunts market?

The hydrocephalus shunts market is estimated to be valued at USD 371.4 Mn in 2025 and is expected to reach USD 543.9Mn by 2032.

What are the key factors hampering the growth of the hydrocephalus shunts market?

The expensive nature of hydrocephalus treatment and potential for shunt malfunctions and infections may deter both patients and healthcare providers are the major factors hampering the growth of the hydrocephalus shunts market.

What are the major factors driving the hydrocephalus shunts market growth?

The growing number of hydrocephalus cases, especially in infants and the elderly, and innovations like programmable shunts and anti-siphon devices are the major factors driving the hydrocephalus shunts market.

Which is the leading type of shunt in the hydrocephalus shunts market?

The leading type of shunt segment is Ventriculo-Peritoneal (VP) shunts.

Which are the major players operating in the hydrocephalus shunts market?

Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Natus Medical Incorporated, Spiegelberg GmbH & Co. KG, Tokibo Co., Ltd., DePuy Synthes (Johnson & Johnson), Johnson & Johnson, Spiegelberg GmbH & Co. KG, TKB Corporation, G. SURGIWEAR LTD., HpBio Próteses, inc., Kaneka Medix Corp., Desu Medical, HLL Lifecare, Anuncia Inc., Fuji Systems are the major players.

What will be the CAGR of the hydrocephalus shunts market?

The CAGR of the hydrocephalus shunts market is projected to be 5.6% from 2025-2032.