Hydrogen Generation Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Hydrogen Generation Market is segmented By Technology (Steam Methane Reforming, Electrolysis, Partia...

Hydrogen Generation Market Size - Analysis

The hydrogen generation market is estimated to be valued at USD 156.6 Bn in 2024 and is expected to reach USD 232.6 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2031. The hydrogen generation market is set to grow considerably over the forecast period due to rising demand for low-carbon fuel alternatives to curb environmental pollution.

Market Size in USD Bn

CAGR5.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.8% |

| Market Concentration | High |

| Major Players | Air Products and Chemicals, Inc., Air Liquide International S.A., Linde plc, Messer Group GmbH, Praxair, Inc. and Among Others |

please let us know !

Hydrogen Generation Market Trends

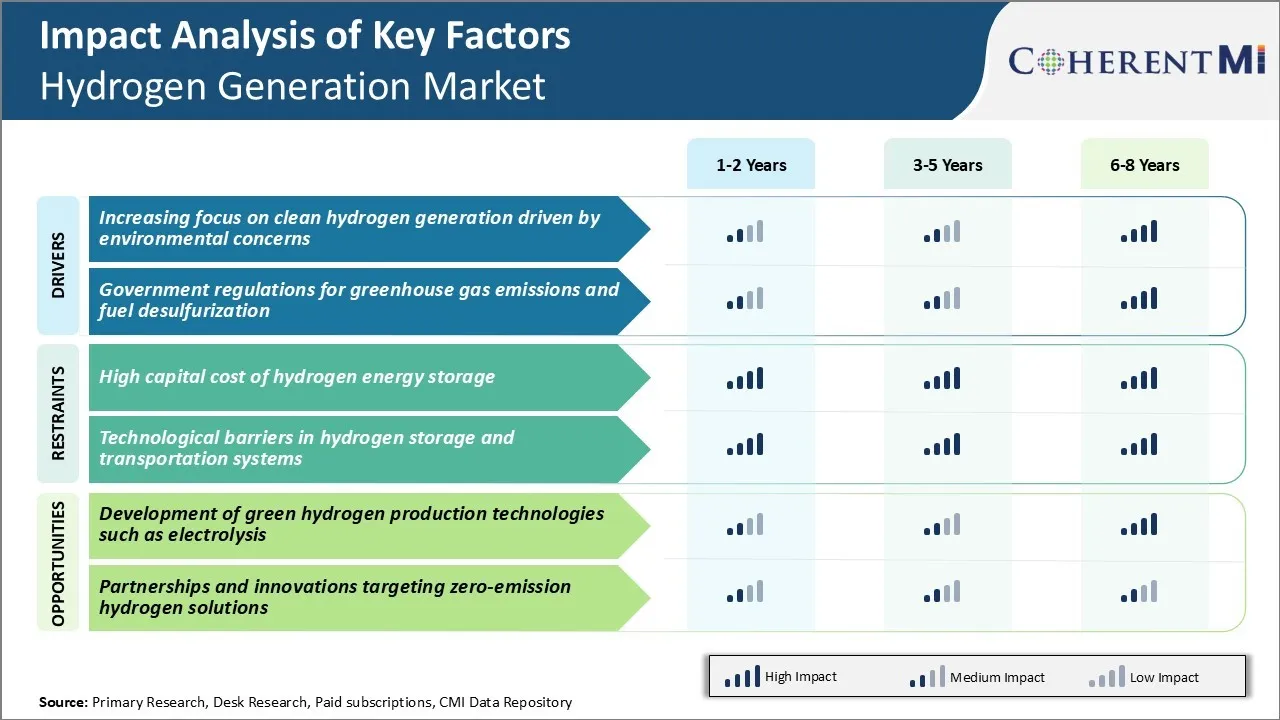

Market Driver - Increasing Focus on Clean Hydrogen Generation Driven by Environmental Concerns

The hydrogen generation market is witnessing increasing focus towards cleaner production methods of hydrogen driven by growing environmental concerns worldwide. Hydrogen has potential to act as an important fuel for realizing a low carbon future if it is generated through renewable resources.

There is rise in demand from end use industries like oil refineries, chemical and fertilizer producers which are major consumers of hydrogen, for obtaining supplies from cleaner production routes. This is propelling related companies to invest in innovative electrolysis technologies that use renewable electricity to split water into hydrogen and oxygen.

Even automobile sector is showing willingness to adopt hydrogen fuel cell vehicles provided the fuel is generated sustainably without carbon footprint. This requires scaling up renewable hydrogen economy. Investments are pouring in research aimed at reducing costs of electrolysis and renewable hydrogen technologies. Manufacturers in the hydrogen generation market are aiming to compete effectively with traditional means of production. Concerted efforts are ongoing globally to accelerate commercialization of clean hydrogen.

Market Driver - Government Regulations for Greenhouse Gas Emissions and Fuel Desulfurization

Stringent regulations introduced by various governments worldwide to curb greenhouse gas emissions. They also aim at reducing sulfur content in transportation fuels are functioning as a key driver for hydrogen generation market. Many nations have implemented policies and imposed limits on industrial facilities as well as transportation sector regarding permissible levels of polluting emissions.

Growing sulfur regulations especially in developed markets are also augmenting hydrogen demand from oil refineries significantly. Even maritime sector regulations are pushing adoption of low sulfur bunker fuels which again needs large scale hydrogen consumption at refineries for deep desulfurization of heavy fuel oils.

Implementation of stricter emission performance standards for factories, power plants, and other fixed installations have led to far greater use of carbon capture, utilization, and storage technologies. Rising compliance with emission norms is propelling process industries to make modifications and retrofits at their plants which are fueling hydrogen consumption. Such policy driven factors are significantly contributing to growth of global hydrogen generation market.

Market Challenge - High Capital Cost of Hydrogen Energy Storage

One of the major challenges faced by the hydrogen generation market is the high capital cost associated with hydrogen energy storage. Storing hydrogen requires either compressed hydrogen gas tanks or cryogenically cooled liquid hydrogen storage tanks, both of which require expensive equipment and infrastructure.

Compressed gas storage tanks need to withstand extremely high pressure of up to 700 bars, making them costly to manufacture. Liquid hydrogen storage also requires cooling hydrogen down to -253°C, which is an energy intensive process.

Further, hydrogen has a very low energy density by volume as compared to fossil fuels, requiring large storage spaces. The high initial capital investments required for production, storage, transportation and dispensing of hydrogen is a drag on the growth of the hydrogen economy.

While costs may reduce with expected technological improvements and economies of scale in production, high capital costs continue to be a major roadblock for widespread commercialization of hydrogen technologies currently.

Market Opportunity - Development of Green Hydrogen Production Technologies such as Electrolysis

One significant opportunity for the hydrogen generation market lies in the development of green hydrogen production technologies such as electrolysis. Electrolysis involves using renewable electricity to split water into hydrogen and oxygen gas, thus providing a clean method of producing hydrogen without greenhouse gas emissions.

Considerable research is ongoing to improve the efficiency and lower the costs of electrolysis technologies. Advancements in areas such as improved catalysts, membrane materials and system design offer potential to bring down the costs to commercially competitive levels compared to fossil fuel-based hydrogen generation. Growing focus on developing renewable energy capacities also provides ample low-cost electricity input for electrolysis plants.

Increased investments in electrolysis and other green hydrogen production methods could help address sustainability objectives and accelerate the energy transition while creating growth prospects for the hydrogen generation market. This presents a major opportunity for vendors to establish themselves in this emerging clean technology space.

Key winning strategies adopted by key players of Hydrogen Generation Market

One of the most successful strategies adopted by major players has been strategic partnerships and collaborations. For instance, in 2020 Air Products partnered with ACWA Power and Saudi Aramco to develop a $5 billion hydrogen-based industrial complex in Neom, Saudi Arabia. The project will help Air Products gain a foothold in the rapidly growing Saudi hydrogen generation market.

Another strategy seen is heavy investments in research and development to produce hydrogen at scale using renewable resources. For example, Cummins invested $60 million in 2020 to develop proton exchange membrane electrolyzers to produce carbon-free hydrogen.

Companies are also acquiring startups working on innovative hydrogen technologies. For example, Linde acquired Praxair in 2018, gaining access to its membrane separation technology. It also acquired advanced pressure swing adsorption and cryogenic technology from Air Liquide's Lurgi business in 2021.

Geographical expansion into markets expected to drive future hydrogen demand has also been a key strategy. For instance, Engie expanded to Belgium, Netherlands, Germany etc. to be closer to major hydrogen hubs and projects announced by the European Union.

Segmental Analysis of Hydrogen Generation Market

Insights, By Technology: Steam Methane Reforming (SMR) Transition to Low Carbon Technologies

In terms of technology, steam methane reforming (SMR) contributes 47.6% share of the hydrogen generation market in 2024, owning to its commercial viability and cost-effectiveness. Being the most mature and established technology available at an industrial scale, SMR allows for large-scale hydrogen production which meets bulk of the demand from key application industries.

However, carbon emissions arising from SMR have led governments and companies to focus on reducing dependency on fossil fuels. Various incentives and subsidies are encouraging transition towards greener hydrogen generation routes like electrolysis to steer decarbonization efforts. Sustained policy push and technology improvements are expected to increase their hydrogen generation market penetration going forward. SMR companies are also working on carbon capture solutions to make the process more environment-friendly and extend the lifespan of the technology.

Insights, By Application: Rising Energy Security Concerns in Petroleum Refineries

In terms of application, petroleum refinery contributes 40.1% share of the hydrogen generation market in 2024, due to substantial hydrogen demand from oil refineries. Hydrogen acts as a crucial feedstock for removing Sulphur from gasoline and diesel to meet stringent environmental regulations. It is also utilized in various hydrotreatment activities within refineries. Steady fuel consumption growth, tightening emission norms as well as need for producing cleaner fuels have amplified hydrogen demand from oil refineries globally.

Additionally, reliance on imports for crude oil processing has heightened energy security concerns for many countries. This has prompted refiners to invest in on-purpose hydrogen plants within refinery premises for ensuring secure supply and avoiding logistical challenges with hydrogen transport. Captive hydrogen generation aims to address such security of supply priorities for refineries in the long-run.

Insights, By System: Captive Systems Focus on Cost Optimization

In terms of system, captive systems contribute the highest share of the hydrogen generation market owing to the need for continuous supply and localized hydrogen generation. Setting up in-house hydrogen plants allows refineries, ammonia/methanol producers to secure feedstock availability and mitigate supply chain risks. It also helps minimize transportation and logistics costs associated with hydrogen delivery.

However, high capital expenditures for such projects continue to challenge growth prospects for captive systems. Ongoing initiatives towards improving energy efficiency, utilizing by-product gases, and capacity debottlenecking aim to reduce the overall cost of hydrogen generation from captive facilities.

Adoption of modular production designs, digitalization and use of renewable energy further aid in enhancing cost-competitiveness of captive systems. Meanwhile, merchant segment is gaining traction in regions with well-developed pipeline infrastructure and abundance of natural gas reserves.

Additional Insights of Hydrogen Generation Market

- Hydrogen in Steel Production: Companies are piloting the use of hydrogen to replace coke in steel manufacturing, potentially reducing CO₂ emissions by up to 90%.

- Hydrogen Fuel Cell Vehicles: Automotive manufacturers are investing in hydrogen fuel cell technology as an alternative to battery electric vehicles, offering longer ranges and faster refueling.

- Projected Hydrogen Demand: Global hydrogen demand is expected to reach 800 million tons by 2050, driven by industrial and mobility applications.

- Investment Trends: Over $70 billion has been invested globally in hydrogen projects and technologies since 2020, indicating strong momentum in the hydrogen generation market.

- Asia Pacific remains the leading region in hydrogen consumption in the world. The hydrogen generation market in Asia Pacific is expected to reach USD 136.99 Billion by 2033 with a CAGR of 6.94%. North America is poised for significant growth in the global hydrogen generation market, particularly in hydrogen fuel cell vehicle adoption.

Competitive overview of Hydrogen Generation Market

The major players operating in the hydrogen generation market include Air Products and Chemicals, Inc., Air Liquide International S.A., Linde plc, Messer Group GmbH, Praxair, Inc., Hydrogenics, Inoxcva, Weldstar, Inc., McPhy Energy SA, and LNI Swissgas.

Hydrogen Generation Market Leaders

- Air Products and Chemicals, Inc.

- Air Liquide International S.A.

- Linde plc

- Messer Group GmbH

- Praxair, Inc.

Hydrogen Generation Market - Competitive Rivalry

Hydrogen Generation Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Hydrogen Generation Market

- In November 2021, Woodside Energy announced that it plans to invest $5 billion in new energy products and lower-carbon services by 2030. This investment includes projects related to hydrogen generation, ammonia, and renewable power generation. The announcement was part of Woodside's strategy to transition towards cleaner energy solutions and reduce carbon emissions.

- In January 2021, Plug Power Inc. and Brookfield Renewable Partners announced a strategic partnership to build a green hydrogen generation plant in the United States. The facility is expected to produce 15 metric tons of liquid hydrogen per day using renewable energy supplied by Brookfield Renewable Partners.

Hydrogen Generation Market Segmentation

- By Technology

- Steam Methane Reforming (SMR)

- Electrolysis

- Alkaline Electrolysis

- Proton Exchange Membrane (PEM) Electrolysis

- Partial Oxidation (POX)

- Coal Gasification

- By Application

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Transportation

- Power Generation

- By System

- Captive

- Merchant

Would you like to explore the option of buyingindividual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the hydrogen generation market?

The hydrogen generation market is estimated to be valued at USD 156.6 Bn in 2024 and is expected to reach USD 232.6 Bn by 2031.

What are the key factors hampering the growth of the hydrogen generation market?

High capital cost of hydrogen energy storage and technological barriers in hydrogen storage and transportation systems are the major factors hampering the growth of the hydrogen generation market.

What are the major factors driving the hydrogen generation market growth?

Increasing focus on clean hydrogen generation driven by environmental concerns and government regulations for greenhouse gas emissions are the major factors driving the hydrogen generation market.

Which is the leading technology in the hydrogen generation market?

The leading technology segment is steam methane reforming (SMR).

Which are the major players operating in the hydrogen generation market?

Air Products and Chemicals, Inc., Air Liquide International S.A., Linde plc, Messer Group GmbH, Praxair, Inc., Hydrogenics, Inoxcva, Weldstar, Inc., McPhy Energy SA, and LNI Swissgas are the major players.

What will be the CAGR of the hydrogen generation market?

The CAGR of the hydrogen generation market is projected to be 5.8% from 2024-2031.