India Aroma Chemicals Market Size - Analysis

- Growth Of Perfumery Industry: The perfumery industry in India has experienced massive growth over the past few years owing to rising disposable incomes, increased brand consciousness among consumers, and changing lifestyle trends. This expanding perfume market has fueled the demand for aroma chemicals which are the primary components used in perfume formulations. Aroma chemicals help impart different fragrances and smells to perfumes and thus play a vital role in the perfumery business. As more Indians embrace luxury personal care products and invest in high-end fragrances from both domestic and international brands, it has increased the need for natural and synthetic aroma compounds.

- Growing Food & Beverages Industry: The food and beverages industry in India has been witnessing strong growth over the past few years, which has significantly contributed to the rising demand for aroma chemicals. With income levels rising and lifestyles changing, consumers are increasingly looking for enhanced sensory experiences from the products they consume. Companies in the F&B sector recognize the importance of enticing consumers through attractive fragrances, flavors and tastes. This is driving them to use more aroma chemicals in formulating various food products as well as beverages. Aroma chemicals play a vital role in emulating natural flavors and in masking other flavors in food products. They also help manufacturers develop consistent flavors across different production batches. The expanding processed and packaged food market in India has particularly bolstered the usage of aroma chemicals.

India Aroma Chemicals Market Restraints

- Synthetic Chemicals Included in Perfumes and Their Possible Health Impacts: Perfumes and colognes contain a complex mixture of chemicals, including natural and synthetic aromatic compounds, that can emit more than 100 volatile organic compounds (VOCs) and pose a serious threat to human health. Synthetic chemicals, such as phthalates, parabens, triclosan, salicylates, terpenes, aldehydes, benzene, toluene, styrene, and aluminum-based salts, are commonly used in perfumes and colognes and have been shown to have adverse effects on consumer health, such as asthma and allergies, cardiovascular disease, central nervous system damage, breast cancer, endocrine cancer, respiratory disorders, reproduction, thyroid, adrenal gland function, and immune system. Researchers from the Environmental Working Group (EWG) estimate that pthalates, which have been linked to breast cancer, diabetes, sperm count reduction, reproductive deformity, and disrupted hormonal activity, are present in approximately 75% of scent products. These elements might impede market expansion as a whole.

- High Research and Development Costs: High research and development (R&D) costs are a significant factor that hinders the growth of the India aroma chemicals market. The complexity of aroma chemicals, which are highly volatile and require advanced techniques for extraction and synthesis, contributes to the high costs associated with R&D.

- Growing Demand for Flavors and Fragrances In The Food And Beverage Industry: The growing demand for flavors and fragrances in the food and beverage industry is a significant factor driving the forecast for the India aroma chemicals market. The increasing consumption of packaged and convenience foods, as well as the trend toward exotic flavors and increased disposable income, have led to a surge in demand for aroma chemicals in this sector. Additionally, the Indian food industry is anticipated to become the largest food producer in the world, which further supports the growth of the aroma chemicals market.

- Technological Advancement in The Extraction of Aroma Chemicals: The advancement in technology for the extraction of aroma chemicals is a significant growth factor in the forecast for the India aroma chemicals market. Technological innovations in this sector have led to improved efficiency, reduced costs, and increased availability of aroma chemicals, which are essential for various industries such as food and beverages, cosmetics, and personal care. Technological advancements in extraction methods, such as the use of green chemistry and biotechnology, have led to the development of more sustainable and cost-effective methods for producing aroma chemicals.

Market Size in USD Mn

CAGR5.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.5% |

| Larget Market | India |

| Market Concentration | High |

| Major Players | International Flavors & Fragrance Inc., The Anthea Group, Privi Speciality Chemicals Limited, Eternis Fine Chemical Limited., S H Kelkar and Company Limited and Among Others |

please let us know !

India Aroma Chemicals Market Trends

- Increasing Adoption of Green Products: The increasing adoption of green products is having a significant influence on the India Aroma Chemicals Market. Consumers are becoming more environmentally conscious and demanding products that are natural and sustainable. They no longer want products that are tested on animals or contain harsh chemicals. This shift in consumer behavior is forcing companies in the aroma chemicals market to move towards more eco-friendly alternatives.

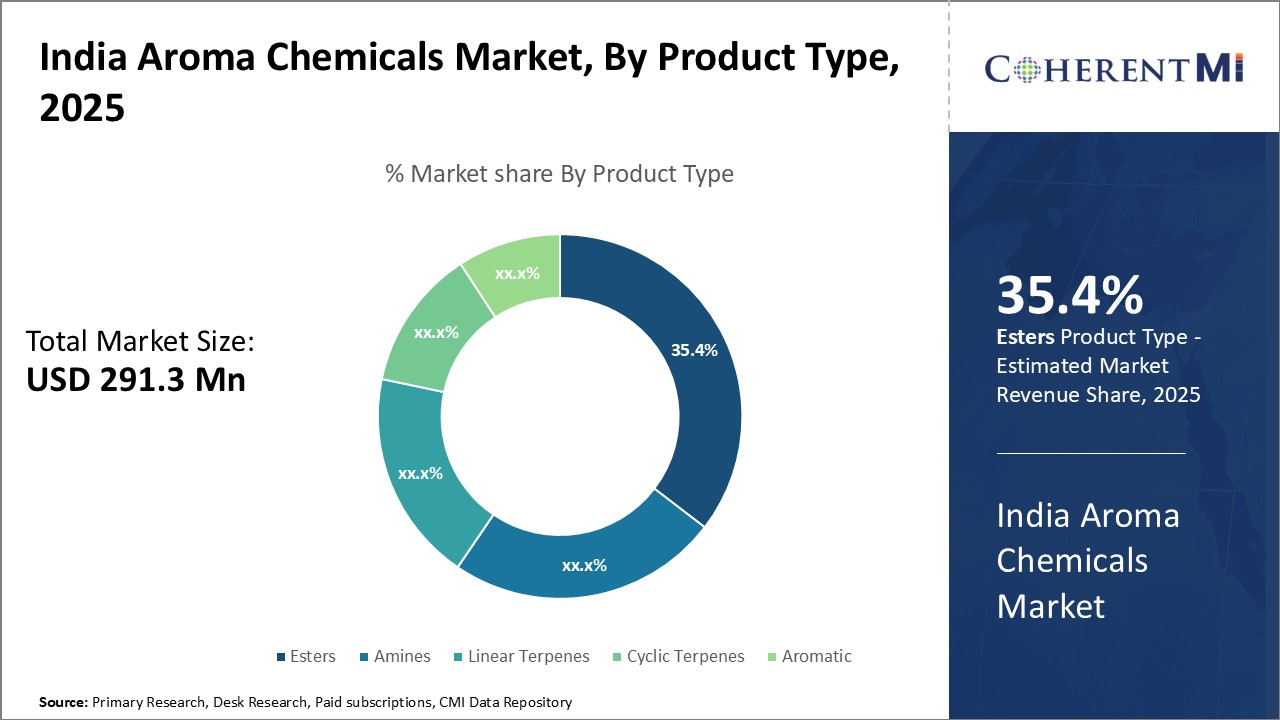

Segmental Analysis of India Aroma Chemicals Market

Competitive overview of India Aroma Chemicals Market

International Flavors & Fragrance Inc., The Anthea Group, Privi Speciality Chemicals Limited, Eternis Fine Chemical Limited., S H Kelkar and Company Limited, BASF, Bell Flavors & Fragrances Company

India Aroma Chemicals Market Leaders

- International Flavors & Fragrance Inc.

- The Anthea Group

- Privi Speciality Chemicals Limited

- Eternis Fine Chemical Limited.

- S H Kelkar and Company Limited

India Aroma Chemicals Market - Competitive Rivalry

India Aroma Chemicals Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in India Aroma Chemicals Market

In December 2020, BASF SE announced an extension of a recently built PU system product plant that uses pre-polymer reactor technology to increase production capacity and serves a variety of applications in furniture, appliances, and construction. This will raise BASF SE's revenue and sales value.

India Aroma Chemicals Market Segmentation

- India Aroma Chemicals Market, By Composition:

- Esters

- Geranyl Acetate

- Methyl Acetate

- Methyl Formate

- Methyl Propionate

- Others

- Amines

- Trimethylamine

- Cadadverine

- Pyridine

- Others

- Linear Terpenes

- Geraniol

- Myrcene

- Citronellol

- Others

- Cyclic Terpenes

- Camphor

- Menthol

- Eucalyptol

- Others

- Aromatic

- Eugenol

- Vanillin

- Anisole

- Benzaldehyde

- Others

- India Aroma Chemicals Market, By Application:

- Cosmetic and Toiletries

- Food and Beverages products

- Home care products

- Fragrances

- Soap and Detergents

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the India Aroma Chemicals Market?

The India Aroma Chemicals Market is estimated to be valued at USD 291.3 in 2025 and is expected to reach USD 423.8 Million by 2032.

What are the major factors driving the Canada adaptive clothing market growth?

The major factors driving the Canada adaptive clothing market growth are synthetic chemicals included in perfumes and their possible health impacts, high research and development costs.

Which is the leading component segment in the Canada adaptive clothing market?

The leading component segment in the Canada adaptive clothing market is the Diesel.

Which are the major players operating in the Canada adaptive clothing market?

The major players operating in the Canada adaptive clothing market are International Flavors & Fragrance Inc., The Anthea Group, Privi Speciality Chemicals Limited, Eternis Fine Chemical Limited., S H Kelkar and Company Limited, BASF, Bell Flavors & Fragrances Company and others.

What will be the CAGR of Canada adaptive clothing market?

The CAGR of Canada adaptive clothing market is expected to be 5.5% from 2025 to 2032.