New Zealand Phenoxyethanol Market Size - Analysis

The New Zealand Phenoxyethanol Market is estimated to be valued at USD 6.2 Mn in 2025 and is expected to reach USD 9.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 6.00% from 2025 to 2032.

Market Size in USD Mn

CAGR6.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.00% |

| Market Concentration | High |

| Major Players | BASF SE, Clariant International Ltd, Galaxy Surfactants Limited, Jiangsu Jiafeng Chemical Co. Ltd., Haihang Industry Co. Ltd. and Among Others |

please let us know !

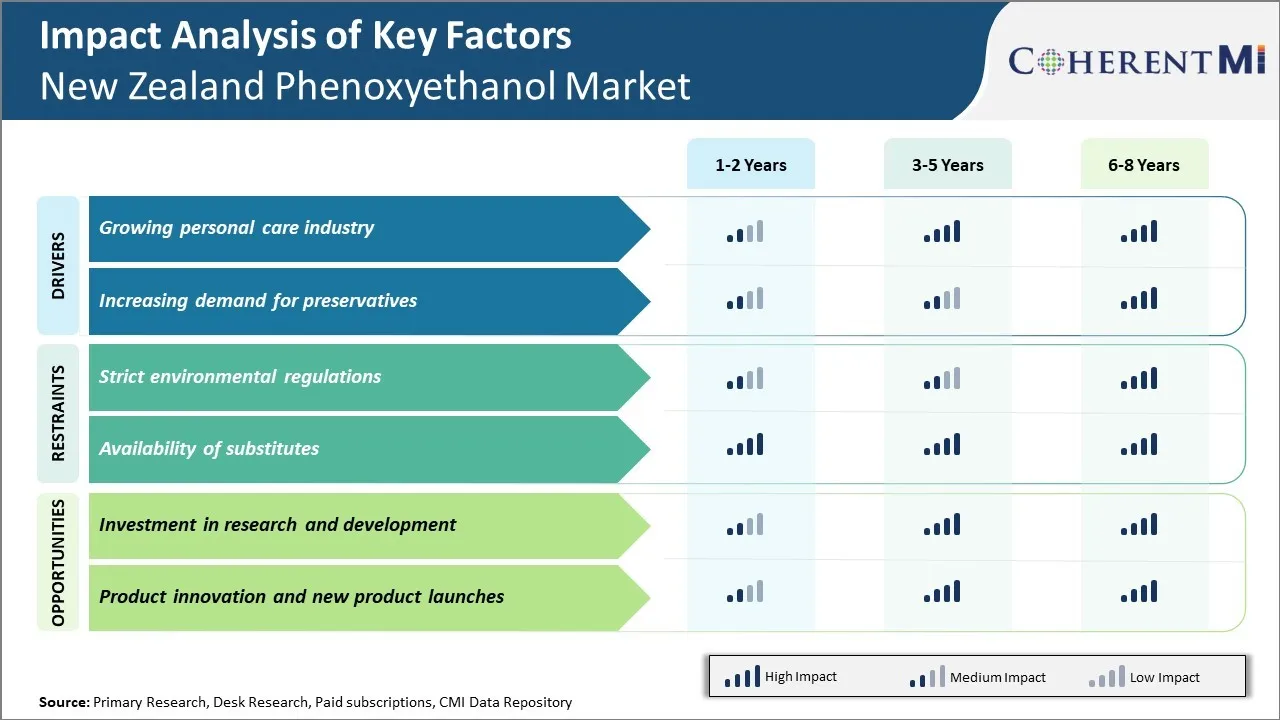

New Zealand Phenoxyethanol Market Trends

The personal care industry in New Zealand has been witnessing significant growth over the past few years. With increasing disposable income and health awareness among consumers, demand for high-quality personal care products such as cosmetics, skin care creams, hair care products etc. has witnessed a considerable surge. As people are more inclined towards using natural and organic personal care items, the demand for phenoxyethanol as a preservative in these products has also risen steadily.

The rising awareness among consumers about importance of using cosmetic and personal care products with natural ingredients is driving significant demand for preservatives obtained from natural sources. Phenoxyethanol is gaining popularity as preservative derived from natural sources like green tea and glycerin. Phenoxyethanol is being widely used as preservative in products like lotions, creams, makeup and hair care items due to its ability to kill or inhibit growth of bacteria, yeasts and molds.

Market Challenge – Strict Environmental Regulations

New Zealand has implemented stringent limits on the concentration of phenoxyethanol permitted in products for young children and infants. Only up to 1% concentration is allowed, whereas the international standard permits usage of up to 5%. This regulatory threshold set by New Zealand's Environment Protection Authority is more conservative compared to other developed nations like the United States, United Kingdom, and European Union. As a result, many international cosmetic brands seeking to export products to NZ are forced to explore alternative preservative options or develop dual formulations to meet local norms.

Investment in research and development could provide a significant opportunity for growth in the New Zealand phenoxyethanol market. Phenoxyethanol is widely used as a preservative in cosmetics, personal care products, and pharmaceuticals due to its bactericidal and fungicidal properties. However, with rising health consciousness, consumers are increasingly seeking natural and plant-based preservatives that are less likely to cause sensitivity or irritation.

Data from New Zealand Ministry of Business, Innovation & Employment shows that business expenditure on R&D as a percentage of GDP increased from 1.31% in 2015 to 1.49% in 2019, indicating growing investments.

Segmental Analysis of New Zealand Phenoxyethanol Market

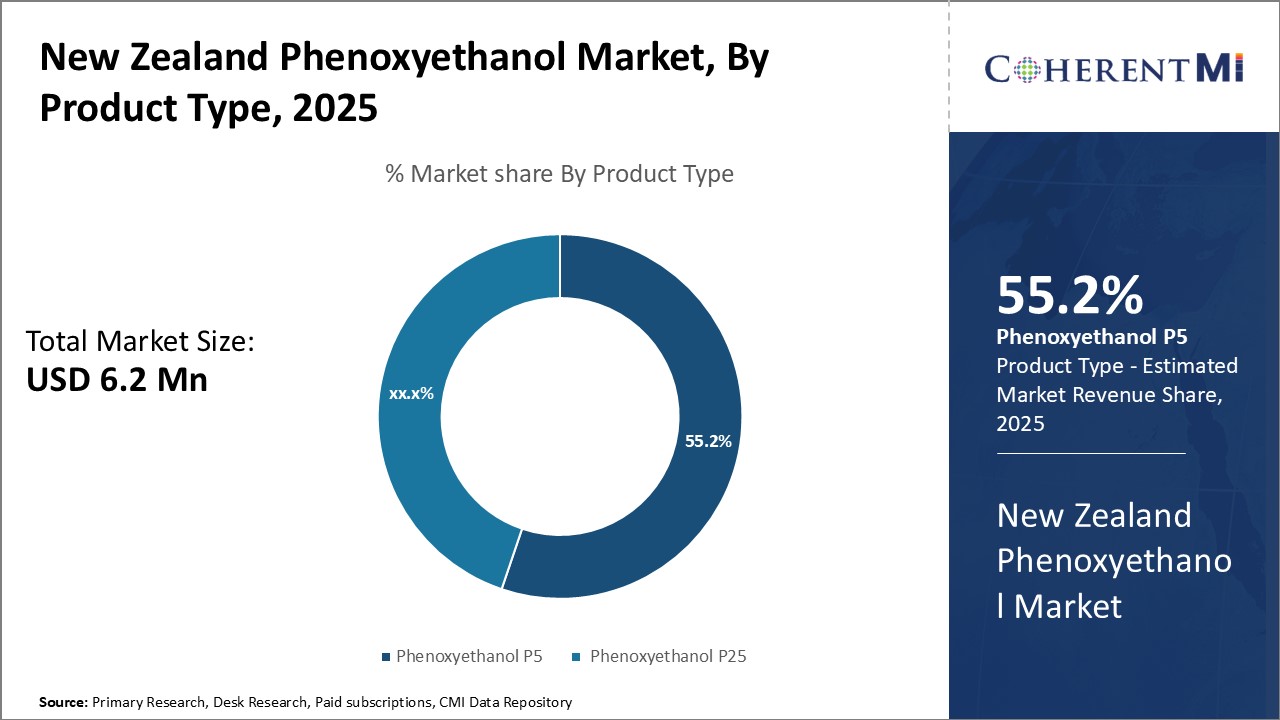

Insights, By Product Type: Phenoxyethanol P5 Drives Product Type Segment Growth

Insights, By Product Type: Phenoxyethanol P5 Drives Product Type Segment GrowthPhenoxyethanol P5 contributes the largest share of 55.2% in the New Zealand phenoxyethanol market in terms of product type. This is largely due to P5's versatility and functionality across a wide range of end uses.

Phenoxyethanol P5 also finds application in household cleaners and industrial and institutional cleaners. It is an important component of many multipurpose, glass and bathroom cleaners due to its degreasing abilities and preservative properties. P5 helps ensure such products have a long shelf life without spoiling. It is economically priced yet effective, retaining consumer and business buyer interest.

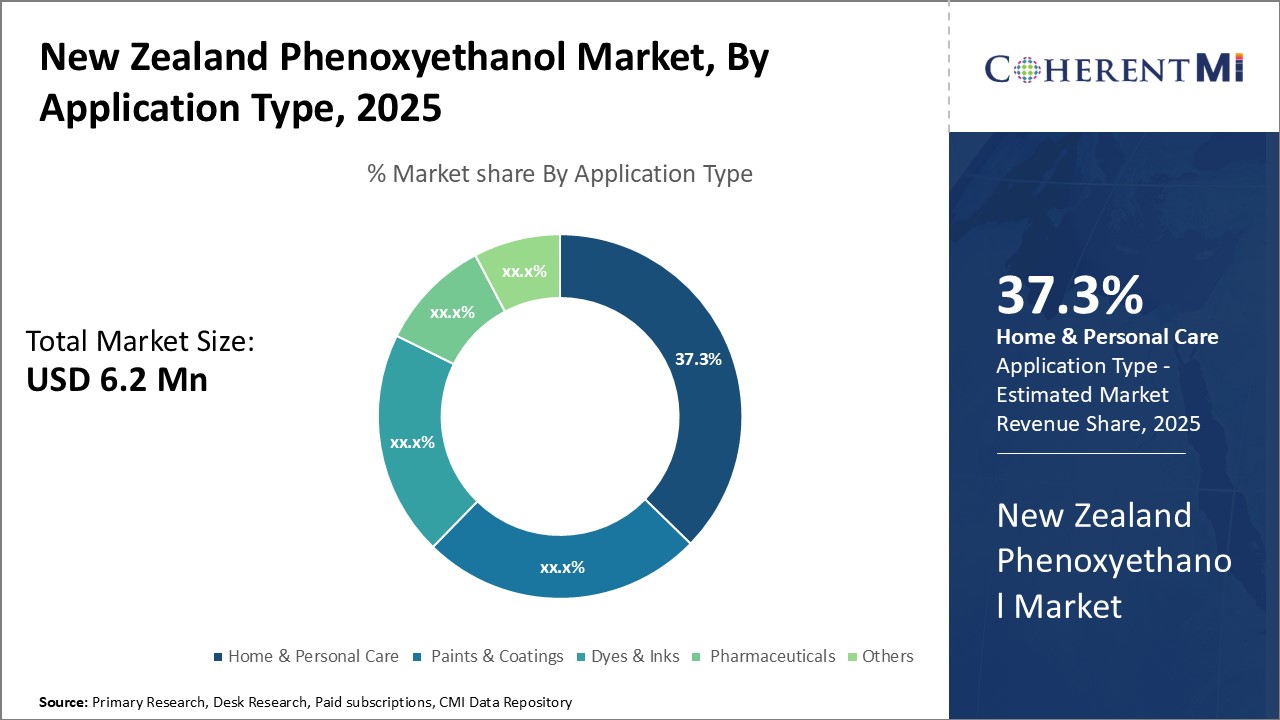

Insights, By Application Type: Home and Personal Care Fuels Largest Application Segment

Personal care formulations requiring phenoxyethanol's preservative properties include lotions, creams, shower gels, shampoos, conditioners, moisturizers and cosmetics like foundations, eyeshadows and lip products. As people maintain busy lifestyles, the ability of such frequently used products to remain fresh between uses becomes more valued. Phenoxyethanol helps ensure this requisite freshness.

Aesthetic factors also buoy the home and personal care application segment. Phenoxyethanol is compatible with many formulas, retaining an invisible presence that does not negatively affect end product attributes like smell or looks. It allows items to be designed and marketed as "natural" or with other desired qualities.

Competitive overview of New Zealand Phenoxyethanol Market

The major players operating in the New Zealand Phenoxyethanol Market include BASF SE, Clariant International Ltd, Galaxy Surfactants Limited, Jiangsu Jiafeng Chemical Co. Ltd., and Haihang Industry Co. Ltd.

New Zealand Phenoxyethanol Market Leaders

- BASF SE

- Clariant International Ltd

- Galaxy Surfactants Limited

- Jiangsu Jiafeng Chemical Co. Ltd.

- Haihang Industry Co. Ltd.

New Zealand Phenoxyethanol Market - Competitive Rivalry

New Zealand Phenoxyethanol Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in New Zealand Phenoxyethanol Market

- September 2023, Dow, a leading company providing wide range of products and services in various sectors, collaborated with LanzaTech, a carbon recycling company, to launch a readily biodegradable cleaning solution EcoSense 2470 Surfactant that utilizes circular carbon capture. This solution meets sustainable standers by incorporating innovative carbon capture technology.

- In July 2022, Specialty chemicals company, LANXESS completed the acquisition of the microbial control business unit of the U.S. group International Flavours & Fragrances Inc. (IFF). Through this acquisition, LANXESS added two production sites to its network in St. Charles, Louisiana, and Institute, West Virginia, both in the U.S. The new business will be integrated into the material protection products business unit of LANXESS. The acquisition will strengthens LANXESS position in the industrial preservatives business.

- In July 2021, Rossari Biotech, a speciality chemicals manufacturer, announced the acquisition of Tristar Intermediates. Moreover, Rossari Biotech will occupy Tristar Intermediate’s business spans in preservatives, aroma chemicals, and home and personal care additives with high-tech distillation facilities.

*Definition: Phenoxyethanol is used as a preservative in various personal care products. Phenoxyethanol is also known as glycol ether or phenol ether. In fragrances, perfumes, cleansers, and soaps, phenoxyethanol is used as stabilizer, preservative, or antibacterial in order to prevent products from losing their effectiveness or spoilage. Phenoxyethanol is used as a fixative for cosmetics, perfumes, and soaps. It is also used as preservative in cleaning & furnishing home care products, pharmaceutical products, ink, toner, and colorant products.

New Zealand Phenoxyethanol Market Segmentation

- By Product Type

- Phenoxyethanol P5

- Phenoxyethanol P25

- By Application Type

- Home & Personal Care

- Paints & Coatings

- Dyes & Inks

- Pharmaceuticals

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the New Zealand Phenoxyethanol Market?

The New Zealand Phenoxyethanol Market is estimated to be valued at USD 6.2 in 2025 and is expected to reach USD 9.3 Million by 2032.

What are the major factors driving the New Zealand Phenoxyethanol Market growth?

The growing personal care industry and increasing demand for preservatives are the major factors driving the New Zealand Phenoxyethanol Market growth.

Which is the leading Product Type in the New Zealand Phenoxyethanol Market?

The leading Product Type segment is Phenoxyethanol P5.

Which are the major players operating in the New Zealand Phenoxyethanol Market?

BASF SE, Clariant International Ltd, Galaxy Surfactants Limited, Jiangsu Jiafeng Chemical Co. Ltd., and Haihang Industry Co. Ltd. are the major players.

What will be the CAGR of the New Zealand Phenoxyethanol Market?

The CAGR of the New Zealand Phenoxyethanol Market is projected to be 6.00% from 2025-2032.