Pag Base Stock Market Size - Analysis

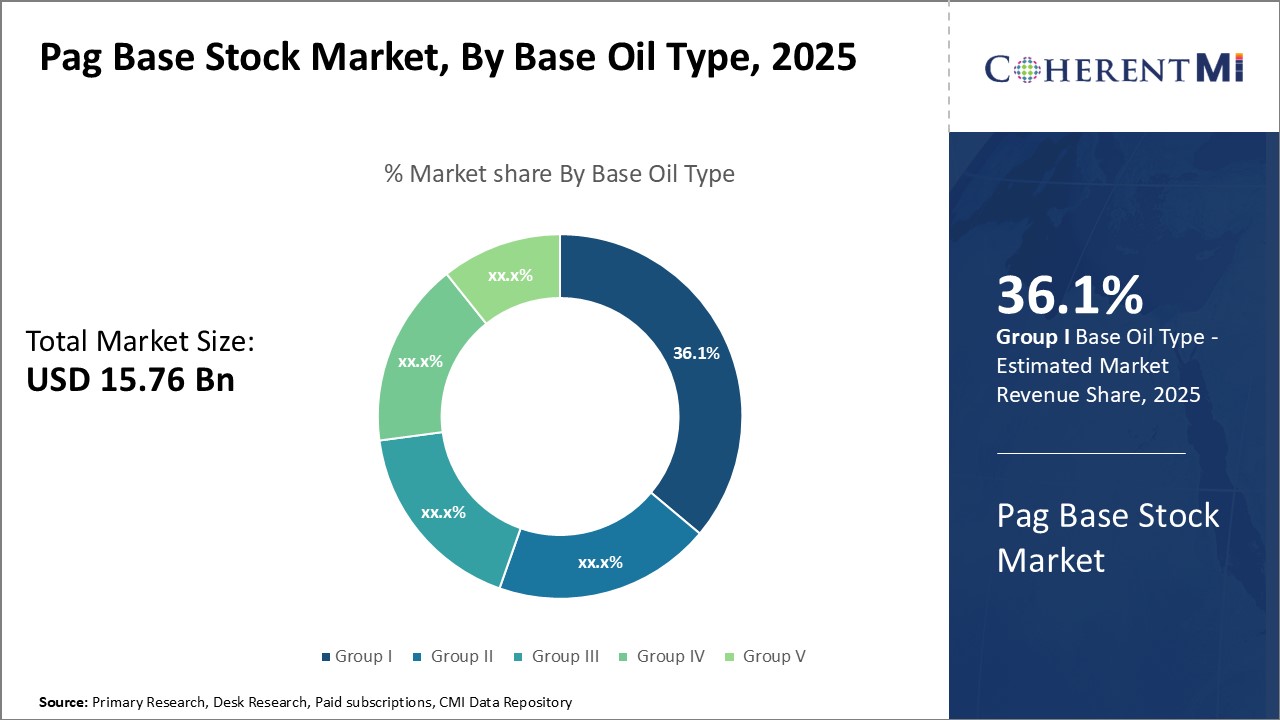

The pag base stock market is segmented by base oil type, application, end-use industry, and region. By base oil type, the market is segmented into Group I, Group II, Group III, Group IV, and Group V. The Group II segment is expected to dominate the market over the forecast period due to its higher performance properties compared to Group I and lower costs than Group III base stocks.

Pag Base Stock Market Drivers

- Increasing Automotive Production: The continuous growth in automotive production and vehicle part is a major factor driving the demand for pag base stocks. With rising disposable income and a growing middle-class population in emerging economies, the automotive sales have been increasing over the past decade. This has led to increased lubricant demand in the automotive original equipment manufacturer (OEM) and aftermarket sectors. Base oils are essential components of automotive lubricants. As such, the pag base stocks demand is projected to grow steadily with rising automotive production, especially in Asia Pacific, which accounts for over 50% of the global automotive output.

- Industrial Growth and Rising Process Automation: The need for high-performance industrial lubricants is rising due to the world's industrial sector's expansion and rising process automation. Pag base stocks are widely used to formulate industrial oils like hydraulic fluids, compressor oils, turbine oils, gear oils, etc. owing to their superior properties. The industrial growth in developing regions, driven by rapid urbanization, rising foreign investments, and government initiatives to promote manufacturing sector will fuel the need for industrial lubricants, thereby spurring the consumption of pag base stocks.

- Innovation and Development of New Grades: The growing research and development activities leading to the innovation of new pag base stock grades are stimulating market growth. Base stock manufacturers are investing significantly in developing novel base stock technologies and customized grades to meet evolving customer needs. For instance, ExxonMobil’s (one of the world's largest publicly traded international oil and gas companies) EHC 50TM group III base stock enables longer oil drain intervals and fuel economy benefits. Similar product developments allow formulators to design lubricants with enhanced performance. This is expected to increase pag base stocks consumption across automotive and industrial applications.

- Growth of Transportation and Logistics: The expanding transportation sector and rising trade volumes globally are anticipated to drive the demand for high-performance pag base stocks. The pag-based lubricants find wide application in heavy vehicles like trucks, buses, and marine vessels owing to their excellent viscosity properties and resistance to high temperature, and contaminants. With growing international trade and rising consumer spending, the transportation lubricant demand is projected to increase, thereby propelling the pag base stocks market over the coming years.

- Rising Adoption in Emerging Applications: The increasing research and testing of pag base stocks for newer application areas such as refrigeration oils, textile oils and drilling fluids presents significant growth opportunities. The superior solvency and thermal stability of certain pag grades make them suitable candidates for non-conventional applications. More research and development focused on evaluating pag base stocks performance in emerging application areas could expand their consumption in the coming years.

- Growing Demand for Renewable Base Stocks: Rising consumer demand and stringent regulations regarding sustainable lubricants have compelled formulators to adopt renewable base stocks. While currently commercialized renewable base stocks have performance limitations, their blending with pag grades can offer a high-performance sustainable solution. Pag producers are also investing in developing bio-derived synthetic base stocks. The rising trend of renewable and recycled base stocks presents an opportunity for pag base stock suppliers.

- Rising Uptake in Electric Vehicles: The rapid adoption of electric vehicles (EVs) globally is opening new avenues for pag base stock suppliers. Although EVs do not require engine oils, they utilize greases, transmission fluids, brake fluids, and heat transfer fluids, which use pag base oils. The increasing penetration of EVs along with advancements in EV lubrication technology will drive pag base stocks demand. Leading base stock companies are developing optimized pag grades for EVs.

- Rising Market Share in Developing Regions: The increasing automotive production and industrial growth in developing regions like Asia Pacific, Latin America, and Middle East & Africa offers immense opportunities for pag base stock suppliers. Lubricant consumption in these regions is shifting towards higher-quality semi-synthetic and synthetic grades, in which pag base oils are widely used as blend stocks. Large multinational companies are expanding their manufacturing capacities in high potential developing markets. This would help pag base stocks gain increased market share in these regions.

Pag Base Stock Market Restraints

- Volatility in Crude Oil Prices: The fluctuations in crude oil prices driven by supply-demand imbalances, geopolitical conflicts, and other macroeconomic factors create uncertainty in the base stock value chain. The volatile crude oil prices make it challenging for base stock producers to maintain steady margins and streamline their production planning. It also compels formulators to undertake multiple price revisions. These factors restrain base stock and lubricant demand growth globally.

- Decline in Automotive Production: The global automotive production has been declining in recent years owing to various factors like supply chain disruptions, chip shortages, and an economic slowdown. For instance, in 2025, the global light vehicle production contracted by around 5-6 million units compared to 2021. Such declines in automotive manufacturing are negatively impacting the OEM lubricant demand, which in turn hinders the consumption of pag base stocks that cater to around 20% of the total lubricant demand.

- Increasing Adoption of Electric Vehicles: The rising shift from conventional internal combustion engine vehicles to electric vehicles (EVs) in regions like Europe and China is a key factor restraining the growth prospects of the pag base stock market. EVs do not utilize engine oils, which account for the largest share of pag base stocks consumption. Although pag grades are used in EV fluids, their high adoption rate will restrain pag base market growth to some extent.

Pag Base Stock Market Analyst Viewpoint

Southern Pag has emerged as the dominant and fastest-growing market, expanding at a much faster clip than other areas partly due to government incentives for industrialization. Meanwhile, the Northern Region has lagged behind due to the declining fortunes of its once flourishing export industries. Within Southern Pag, Metri and Karnal cities have been shining stars, making them hotspots for companies to focus on.

On the regulatory side, the introduction of the Goods and Services Tax and the bankruptcy code have provided impetus for the formalization of the economy. However, implementation challenges persist. Positive macroeconomic indicators and policy reforms remain key drivers to sustain recent gains in the market. But overall outlook depends on monsoon and inflation trajectory over coming quarters.

Market Size in USD Bn

CAGR8.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.1% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | ExxonMobil, Shell, Chevron, Nynas, Calumet Specialty Products Partners and Among Others |

please let us know !

Pag Base Stock Market Trends

- Shift Towards Higher Quality Base Stocks: Evolving customer demand and technological advancements are facilitating a transition from lower grade base stocks to higher-quality base stocks. Formulators are increasingly adopting more Group II and III base stocks owing to their superior properties and ability to enable extended drain intervals. This reduces the lubricants operating cost. The development of unconventional resources has also Verify the security of the source, facilitating their wider adoption across price-sensitive markets.

- Growing Adoption of Synthetic Lubricants: Synthetic lubricants formulated with high-performance Group IV and Group V base oils are witnessing increased uptake due to their longer lifecycles and ability to operate efficiently under extreme conditions. Pag synthetic base stocks such as polyalphaolefins (PAOs) offer exceptional thermal stability and low-temperature fluidity. The transition towards factory-fill synthetic and semi-synthetic lubricants is driving the demand for pag synthetic base stocks in automotive and industrial applications.

- Integration across Value Chain: Leading base stock companies are pursuing integration strategies across the lubricants value chain to make sure the supply is secure and meet the evolving requirements. Companies are investing to expand their refining capabilities, ensuring the supply of high-quality feedstock. Vertical integration also provides opportunities for customization of base stocks for customer-specific applications. This increasing shift towards integration is gradually changing the market dynamics.

- Continuous Innovation in Base Stock Technology: A higher focus on research and technology to develop innovative base stocks that can enhance lubricant performance, efficiency, and sustainability. Advancements like ExxonMobil’s intelligent synthetic base stocks exemplify continuous innovation. Newly developed base stock chemistries and customized combinations allow the formulation of lubricants with lower friction and enhanced protection across operating conditions. This supports the uptake of higher-quality base stocks.

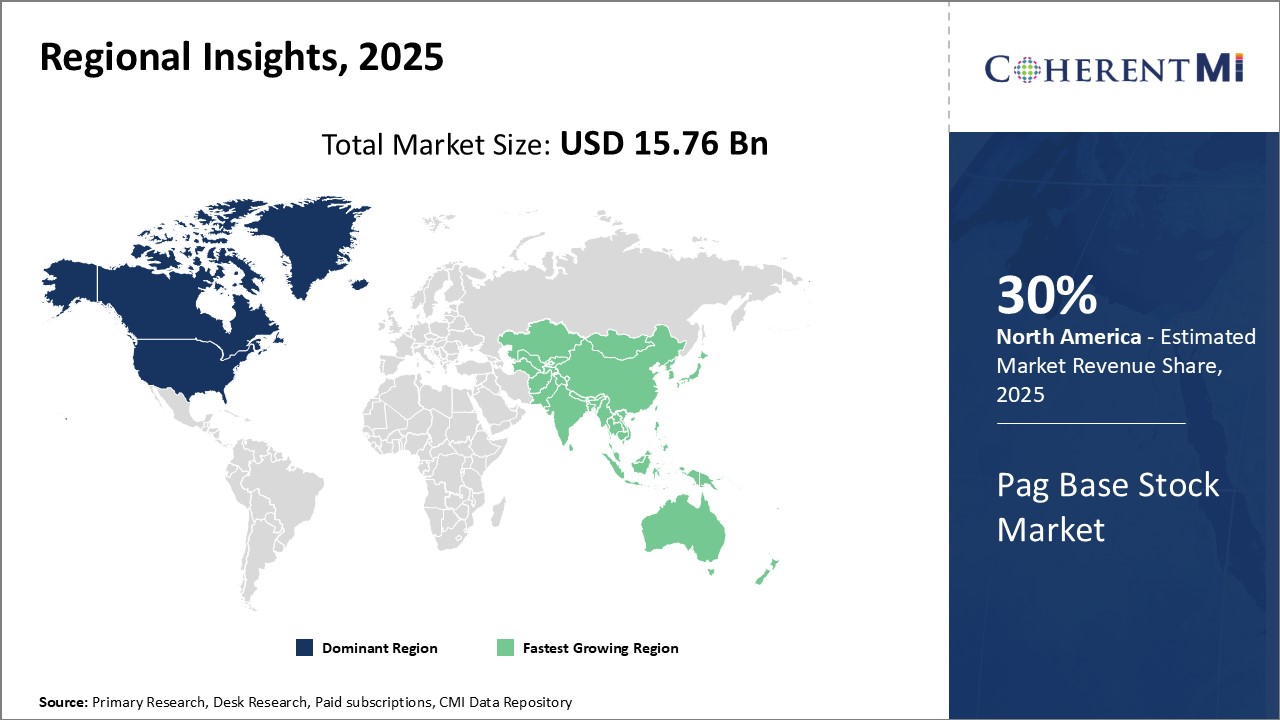

Pag Base Stock Market Regional Insights

- North America: The North America region is expected to account for the largest share of the pag base stock market in 2025, with a market share of over 30%. The growth of the market in this region is attributed to the increasing demand for pag base stocks from various industries, such as automotive, industrial, and aerospace.

- Europe: The European region is expected to be the second-largest market for pag base stocks in 2025, with a market share of over 25%. The growth of the market in this region is attributed to the increasing demand for pag base stocks from the automotive and industrial sectors.

- Asia Pacific: The Asia Pacific region is expected to be the fastest-growing market for pag base stock in the forecast period, with a CAGR of over 9%. The growth of the market in this region is attributed to the increasing industrialization and urbanization in countries such as China, India, and South Korea.

Segmental Analysis of Pag Base Stock Market

Competitive overview of Pag Base Stock Market

The Pag Base Stock Market is competitive and consist some players in the market are ExxonMobil, Shell, Chevron, Nynas, Calumet Specialty Products Partners, HollyFrontier, Petrobras, S-Oil, Repsol, Saudi Aramco, Gazpromneft, Lukoil, Total, SK Lubricants, Indian Oil Corporation, Bharat Petroleum, Idemitsu Kosan, Cosmo Oil Lubricants, CNOOC, Sinopec

Pag Base Stock Market Leaders

- ExxonMobil

- Shell

- Chevron

- Nynas

- Calumet Specialty Products Partners

Pag Base Stock Market - Competitive Rivalry

Pag Base Stock Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Pag Base Stock Market

New product launches

- In March 2022, ExxonMobil launched its EHC 50 synthetic base stock, an high-performance Group III base stock developed for electric vehicle transmission fluids and other demanding applications. It offers improved oxidation stability and friction reduction.

- In January 2021, Chevron launched its new line of Group II + base stocks with ISOCLEAN Certification. They offer improved performance and are suitable for marine, hydraulic, and gear oil applications.

- In June 2020, Nynas launched NYNAS T 600B Group III base oil, designed for high-performance industrial lubricants. It provides a high viscosity index, good low temperature properties, and a long service life.

Acquisition and partnerships

- In September 2022, ExxonMobil announced the expansion of its Singapore refinery to increase production of EHCTM Group II base stocks. The expansion will help meet the rising demand in Asia Pacific region.

- In June 2021, Chevron entered into a joint venture with Novvi for the production and marketing of renewable base oil products. This will support Chevron's move towards more sustainable lubricants.

- In April 2020, Petronas Lubricants acquired Malaysia's largest independent lubricant manufacturer, Penrite Oil. This acquisition expanded its presence in Malaysia and Asia Pacific region.

Pag Base Stock Market Segmentation

- By Base Oil Type

-

- Group I

- Group II

- Group III

- Group IV

- Group V

- By Application

-

- Automotive Oil

- Industrial Oil

- Hydraulic Oil

- Grease

- Metalworking Fluid

- Others (Process Oil, Marine Oil etc.)

- By End-Use Industry

-

- Automotive

- Industrial

- Construction

- Marine

- Others (mining, textile etc.)

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Frequently Asked Questions :

How big is the Pag Base Stock Market?

The Pag Base Stock Market is estimated to be valued at USD 15.8 in 2025 and is expected to reach USD 27.2 Billion by 2032.

What are the major factors driving the pag base stock market growth?

Increasing automotive production, rising industrial activity, growing demand from transportation sector, expansion of construction sector, and innovation in base stock technology this factors propel the market growth.

Which is the leading base type segment in the pag base stock market?

The Group II segment holds the largest share in the pag base stock market owing to its well-balanced properties and lower costs.

Which are the major players operating in the pag base stock market?

ExxonMobil, Shell, Chevron, Nynas, Calumet Specialty Products Partners, HollyFrontier, Petrobras, S-Oil, Repsol, Saudi Aramco, Gazpromneft, Lukoil, Total, SK Lubricants, Indian Oil Corporation, Bharat Petroleum, Idemitsu Kosan, Cosmo Oil Lubricants, CNOOC, Sinopec

Which region will lead the pag base stock market?

North America is expected to continue leading the pag base stock market during the forecast period.

What will be the CAGR of pag base stock market?

The pag base stock market is projected to grow at a CAGR of around 8.1% from 2025 to 2032.