India Fast Fashion Market Size - Analysis

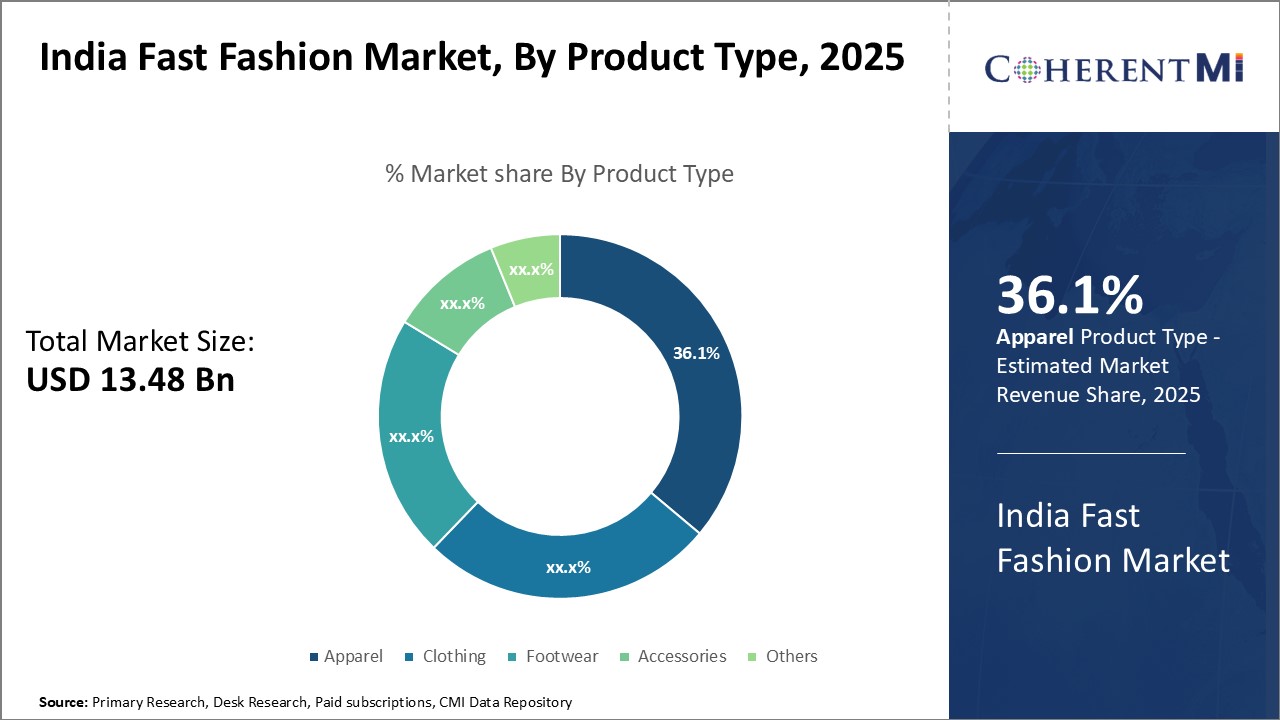

The India Fast Fashion Market is segmented by product type, end user, price range, distribution channel, and region. By product type, the market is segmented into clothing, footwear, accessories, and others. Clothing like dresses, tops, jeans, trousers, skirts, etc. account for the largest share, owing to high demand from youth population.

India Fast Fashion Market Drivers:

- Increasing disposable incomes and fashion consciousness - The increasing disposable incomes and rising fashion consciousness among Indian consumers is a major driver for the fast fashion market. With higher incomes, Indians are spending more on lifestyle products including apparel. The growing middle class and working professionals have created demand for affordable and trendy western fast fashion. Indians are becoming more brand conscious and want to flaunt latest fashion trends. The aspirational youth population is upgrading their wardrobes by purchasing fast fashion items.

- Proliferation of e-commerce and m-commerce channels - The growth in online and mobile shopping has catalyzed the fast fashion market in India. With high smartphone and internet penetration, consumers are purchasing clothes through e-commerce channels like Myntra, Jabong, AJio etc. The ease of selection, discounts, and convenience of home delivery is attracting buyers. E-commerce players have partnerships with global fast fashion brands to sell the latest collections. Social media influencers are also promoting fast fashion brands. Omni-channel strategies adopted by companies are providing consumers a seamless shopping experience.

- Organized retail penetration in Tier 2 and 3 cities - Fast fashion brands are increasing their presence in smaller cities across India. Growing urbanization, nuclear families and exposure to brands via media has increased fashion awareness. Brands are opening stores in metros, mini-metros and Tier 2/3 cities to tap this demand. Mall developments in non-metros are providing retail spaces. Online and offline expansion in smaller towns is a growth driver.

- Increasing participation of women in workforce - With more women entering the workforce, the demand for office wear and contemporary western outfits has gone up. Working women with disposable income want to buy affordable tailored clothes for workwear. Indian women are also demanding designer ethnic and fusion wear for occasions. Fast fashion brands cater to this demand by providing stylish options. The women workforce is an attractive target group for retailers.

- Potential in kidswear and plus-size segments - The kidswear and plus-size segments offer untapped growth potential. Branded kidswear is still underpenetrated in India. Parents are willing to spend on quality clothes for children. Specialized lines for kids with contemporary designs provide expansion possibilities. Plus-size fashion is also a nascent segment where demand is rising. Curvy models and body positivity has created awareness. Fast fashion brands can offer trendy, flavored and well-fitted plus-size collections.

- Bridal and ethnic fast fashion lines - Indian weddings and festivals drive demand for ethnic apparel. Fast fashion retailers can launch exclusive lines for bridal wear like lehengas, gowns and fusion wear. Affordable short-run designer ethnic collections create high sales. Traditional festive wear, especially for Diwali, also offers prospects. Crafted designs combining Indian fabrics and silhouettes with western cuts provide differentiation.

- Sustainable and eco-friendly clothing - Sustainable fashion made from recycled materials, organic cotton, natural dyes etc. is an emerging opportunity. Young consumers are preferring ethical brands with transparency about sourcing and production. Implementing eco-friendly processes to reduce environmental footprint can attract buyers. Tie-ups with NGOs working with artisans and eco-factories allows access to sustainable supply chain. The cruelty-free and vegan concepts also resonate with buyers.

- Innovation in fabrics and silhouettes - Innovation is essential to keep up with changing tastes. Use of breathable, stretchable, wrinkle-free, stain-resistant fabrics adds value. Combining traditional techniques like Chikankari, Bandhani with contemporary design allows product differentiation. Crease-free sarees, readymade blouses and mixing Indian motifs with modern silhouettes are examples. Functional clothing for sports, maternity and nursing mothers also provides possibilities.

India Fast Fashion Market Restraints:

- Intense competition from value fashion brands and counterfeits - The presence of various value fashion brands results in fragmentation. Brands like Max, Westside, AND, V-Mart offer clothes at competitive price points. Unorganized players and counterfeits also restrict growth of established brands. The competition has intensified due to the entry of many international retailers. Maintaining product differentiation is challenging.

- Infrastructural and operational challenges - Under-developed infrastructure poses problems in tapping rural and semi-urban areas. Lack of retail spaces, fragmented supply chain, high logistics expenses hinders expansion. Shortage of skilled workforce and high attrition also affects store-level operations. Adapting to varied Indian consumer segments across regions is difficult.

- High real estate and operating costs - The rising real estate costs in metros affects retailers' expansion and profitability. Brands are also facing challenges in getting desired retail spaces in malls. High operating costs due to electricity, property rents and manpower expenses keeps operating margins under pressure. Infrastructural inefficiencies further add to overheads.

Market Size in USD Bn

CAGR16.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 16.7% |

| Larget Market | India |

| Market Concentration | High |

| Major Players | H&M, Zara, Forever 21, Mango, Topshop and Among Others |

please let us know !

India Fast Fashion Market Trends

- Mass personalization and customization - Customized and personalized fashion allows consumers to express individual styles. Made-to-order small batches, do-it-yourself kits, and co-designing/collaborating with buyers is rising. Digital printing, 3D virtual fitting rooms, AI-based design software enables mass personalization. Providing tailored services enhances brand affinity and experience.

- Growing adoption of omni-channel strategies - Retailers are adopting omni-channel strategies for seamless consumer experience. Browsing designs online and picking up in-store, ordering online and returning in outlets simplifies shopping. Store pickup and location tracking provides convenience. Virtual trial rooms and smart mirrors create engagement. Social commerce via Facebook, Instagram, YouTube also enables customer connect.

- Influence of sustainable materials and processes - Consumers are preferring brands embracing sustainability across the value chain. Usage of recycled polyester from PET bottles, wood pulp, organic cotton, natural dyes reduces environmental impact. Following 'Slow Fashion' by optimizing eco-conscious processes reduces waste. Transparency using blockchain technology for ethical sourcing also gaining traction. Rental and resale of clothes is also emerging.

- Supply chain automation and optimization - Advanced technologies are enabling process improvements in inventory, warehouse management. RFID tagging, robotics, IoT provides visibility and automation. Data analytics and AI allows demand forecasting and precise merchandising. Shared distribution centers reduces transit time. Drone deliveries are being tested for faster last mile. Such supply chain optimization is helping meet dynamic consumer expectations.

Segmental Analysis of India Fast Fashion Market

Competitive overview of India Fast Fashion Market

Only, Max Fashion, GAP, Next, Vero Moda, Pantaloons, Westside, Fabindia, Global Desi, AND, Biba, W, Aurelia, H&M, Zara, Forever 21, Mango, Topshop, Uniqlo, Marks & Spencer

India Fast Fashion Market Leaders

- H&M

- Zara

- Forever 21

- Mango

- Topshop

India Fast Fashion Market - Competitive Rivalry

India Fast Fashion Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in India Fast Fashion Market

New product launches

- In April 27, 2023 Amazon Fashion Launches India’s First ‘Next Gen Store’ With 1M+ Wide Selection For GenZ Shoppers

- In June 2021, Zara launched it’s first-ever beauty line with a range of over 130 skin care and makeup products, capitalizing on growing beauty segment.

- In March 2022, Myntra launched Myntra Beauty - its dedicated beauty e-commerce platform. The launch strengthens Myntra's position in the online beauty segment.

- In November 02, 2023, Reliance-owned ecommerce platform AJIO launched a content-driven interactive ecommerce platform, AJIOGRAM, to empower D2C Fashion Startups With Interactive Ecommerce

Acquisition and partnerships

- In October 2022, Aditya Birla Fashion acquired a 51% stake in House of Masaba to strengthen its portfolio of emerging Indian designer brands.

- In December 2022, British fashion retail group Boohoo has entered the Indian market for the first time via a partnership with the region’s multi brand platform Myntra. As part of the launch, three of the group’s owned brands – Boohoo, Dorothy Perkins and Nasty Gal – are now available to shop through the site, offering over 1,500 goods across a multitude of categories.

- In November 2023, Bata India is expanding its fashion portfolio by collaborating with Authentic Brands Group (Authentic) to introduce the renowned lifestyle brand Nine West to the Indian market. The partnership aims to enhance Bata India’s premium product offerings, aligning with the brand’s premiumization strategy to cater to a fashion-conscious audience

India Fast Fashion Market Segmentation

- By Product Type:

-

- Apparel

- Clothing

- Footwear

- Accessories

- Others

- By End User:

-

- Men

- Women

- Unisex

- Kids

- Others

- By Price Range:

-

- Low Range

- Medium Range

- High Range

- Luxury Range

- By Distribution Channel:

-

- Offline:

- Company Outlets

- Multi-Brand Stores

- Independent Retailers

- Others

- Online:

- Company Website

- E-Commerce Platforms

- Others

- Offline:

Would you like to explore the option of buying individual sections of this report?

Ankur Rai is a Research Consultant with over 5 years of experience in handling consulting and syndicated reports across diverse sectors. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How big is the India Fast Fashion Market?

The India Fast Fashion Market is estimated to be valued at USD 13.5 in 2025 and is expected to reach USD 39.7 Billion by 2032.

What are the major factors driving the India Fast Fashion Market growth?

Rising disposable incomes, growing young population, rapid urbanization, increasing online shopping, westernization, low-price value proposition and growth of organized retail are some major factors driving the growth of India Fast Fashion Market.

Which is the leading product type segment in the India Fast Fashion Market?

The apparel segment accounted for the largest share of the Global Fashion Ecommerce Market. Apparel is the most popular product category purchased online due to higher availability and frequent discounts.

Which are the major players operating in the India Fast Fashion Market?

H&M, Zara, Forever 21, Mango, Topshop, Uniqlo, Marks & Spencer, GAP, Next, Vero Moda, Only, Max Fashion, Pantaloons, Westside, Fabindia, Global Desi, AND, Biba, W, Aurelia.

What will be the CAGR of India Fast Fashion Market?

The CAGR of the India Fast Fashion Market is 16.7%