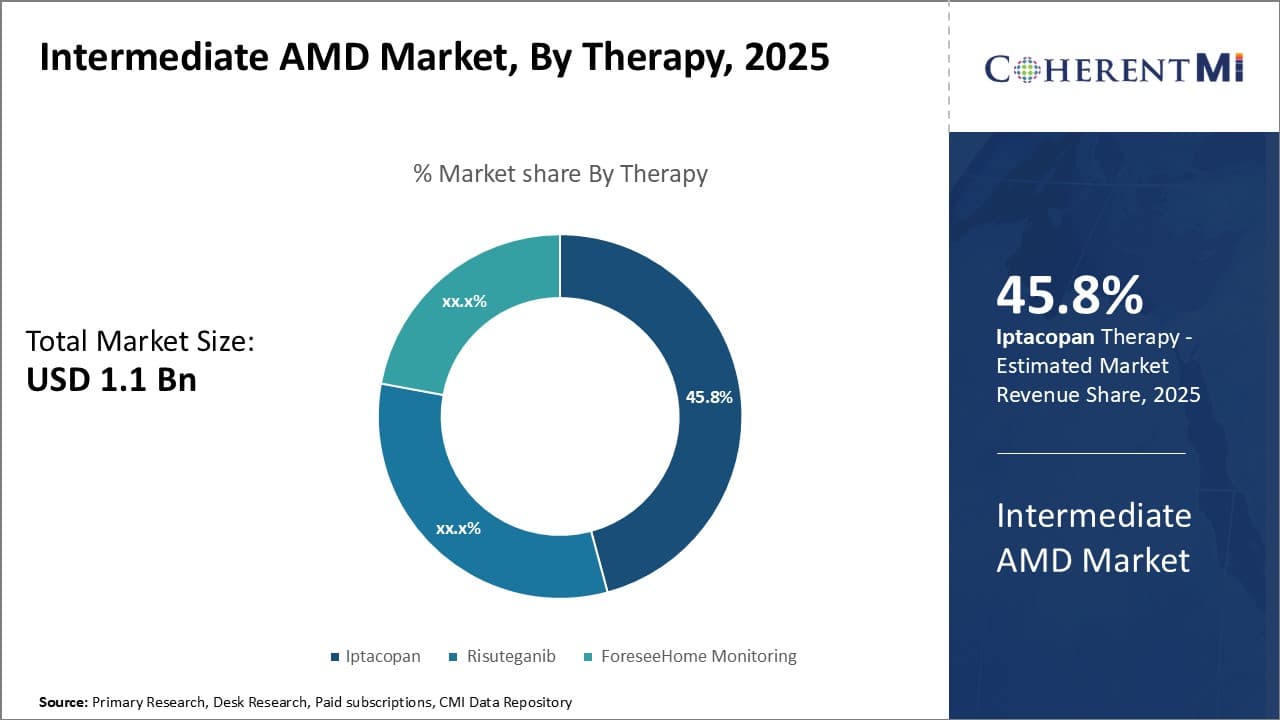

The intermediate AMD market is estimated to be valued at USD 1.10 Bn in 2025 and is expected to reach USD 1.62 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.7% from 2025 to 2032. Rising prevalence of AMD in geriatric population and growing need for effective treatment are expected to remain the top drivers of the intermediate AMD market in the coming years.

Market Size in USD Bn

CAGR5.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.7% |

| Market Concentration | Medium |

| Major Players | Alkeus Pharmaceuticals, Apellis Pharmaceuticals, Iveric Bio, Roche, Regeneron Pharmaceuticals and Among Others |

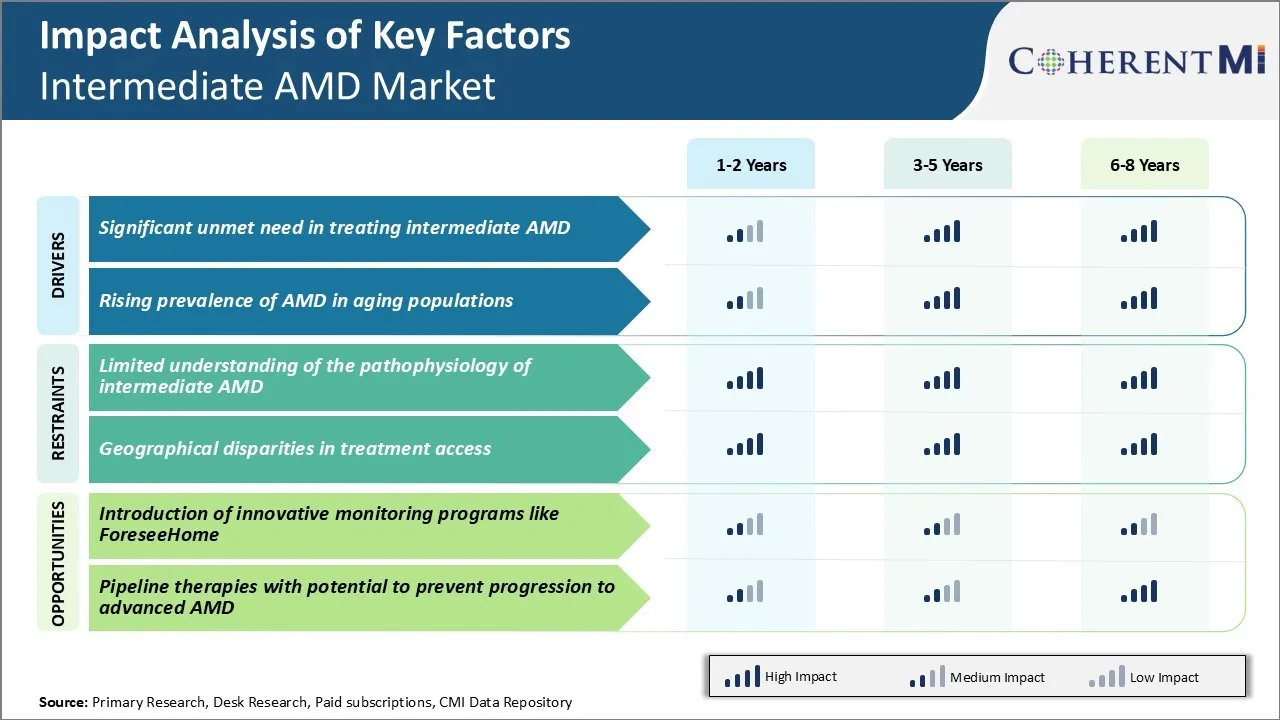

Market Driver - Significant Unmet Need in Treating Intermediate AMD

Currently, there are few treatment options available for patients diagnosed with intermediate AMD, representing a substantial proportion of the AMD patient population worldwide. At this stage, patients do not exhibit any visual impairment or vision loss, but are at high risk of progressing to the more advanced late stage of AMD known as geographic atrophy or wet AMD. Both these late-stage forms can result in severe and irreversible loss of central vision if left untreated.

The challenge is that despite being at high risk, patients with intermediate AMD cannot currently be offered any effective preventive or disease modifying therapy. While treatments such as anti-VEGF injections have revolutionized the treatment of wet AMD, they only provide benefit once the disease has progressed to the late stage. By the time intermediate AMD patients develop wet AMD, they have often already suffered significant and avoidable vision loss.

Lifestyle interventions to control cardiovascular risk factors or nutritional supplements have shown limited effectiveness in large clinical trials. There remains a pressing need to develop new pharmaceutical or gene therapy treatments that can reliably halt or slow disease progression at the intermediate AMD stage, before irreversible vision loss occurs.

Market Driver - Rising Prevalence of AMD in Aging Populations

With worldwide life expectancies continuing their upward trend, the total number of people living at ages where AMD is most rampant is growing enormously. In the United States alone, the number of Americans aged 65 and older is projected to double from 52 million to over 95 million between 2020 to 2060. Similar rapid expansions are projected across Europe and in most developed Asian countries.

As populations age in this manner, the sheer volume of AMD cases is expected to escalate tremendously in the coming decades. Even in developing regions, age structures are shifting upwards due to declining birth rates and improved healthcare. This exponential aging phenomenon will overwhelm existing vision care infrastructure and budgets if effective solutions are not implemented proactively. Already, AMD accounts for 8.7% of all blindness globally.

Failure to develop innovative strategies to prevent, detect and treat AMD earlier will likely result in massive human and economic costs worldwide from avoidable vision impairment. Advancing scientific understanding of AMD pathogenesis and expediting the development of novel therapies, therefore, takes on heightened importance in the current context of demographic change.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Limited Understanding of the Pathophysiology of Intermediate AMD

One of the key challenges faced in the intermediate AMD market is the limited understanding of the pathophysiology and progression of the disease. Intermediate AMD represents the middle stage between healthy aging of the eyes and advanced AMD with vision loss.

However, the biological processes that drive the transition from intermediate to advanced disease are still not fully clear. This lack of comprehensive knowledge makes it difficult to accurately predict a patient's risk of progression. More research is needed to understand the molecular and genetic factors that accelerate the degeneration of macular cells during intermediate AMD. Filling these gaps in knowledge about disease mechanisms is critical to develop more effective prevention and treatment strategies.

Screening and diagnostic tools also need improvement to better differentiate individuals who will remain stable from those requiring closer monitoring or intervention. Overcoming this challenge of elucidating the complex pathophysiology underlying intermediate AMD will help optimize management of the disease.

Market Opportunity: Introduction of Innovative Monitoring Programs like ForeseeHome for Market

One major opportunity for growth in the intermediate AMD market is the introduction of innovative home monitoring programs. These programs aim to increase detection of disease progression events through regular self-administered eye exams at home.

An example is the recently FDA approved ForeseeHome monitoring program. It allows patients to perform optical coherence tomography angiography scans monthly at home with a small handheld device and internet connectivity. The scans are then reviewed by health professionals. Such programs address a key need to improve surveillance of intermediate AMD patients who are at high risk of vision loss. They provide a low-cost, user-friendly solution for monitoring without frequent visits to an eye care professional. This can help to catch progression earlier when treatment may be most effective.

Wider adoption of monitoring technologies like ForeseeHome has potential to drive significant market expansion by facilitating close follow-up of more intermediate AMD patients. It also improves patient engagement and adherence to care plans through convenience.

Intermediate AMD refers to the stage between early and late AMD, where dry AMD is transitioning to the wet form. The primary lines of treatment include anti-VEGF injections and photodynamic therapy.

For newly diagnosed intermediate dry AMD, prescribers typically recommend close monitoring as the first line of treatment. If signs of wet AMD progression are noticed, anti-VEGF injections are prescribed. The leading medications used are ranibizumab (Lucentis) and aflibercept (Eylea), with ranibizumab being the preferred option due to its long history of positive response rates.

If the disease progresses despite anti-VEGF treatment, photodynamic therapy (PDT) may be considered. PDT utilizes a light-activated medication (verteporfin, brand name Visudyne) and a low-power laser to seal leaky blood vessels. While less commonly used now, it remains an option when anti-VEGF therapy is not practical or has not provided adequate benefits alone.

Other key factors influencing prescriber preferences include treatment costs, patient insurance coverage, individual response to previous medications, and presence of any contraindications. Overall, safety, efficacy and costs greatly impact prescriber decisions in choosing the optimal treatment regimens at each stage of intermediate AMD.

Intermediate AMD is characterized by the presence of intermediate drusen or retinal pigment abnormalities. It represents the growing stage between early and advanced AMD. There are two main treatment options for intermediate AMD - lifestyle modifications and nutraceuticals.

Lifestyle changes such as quitting smoking, eating a healthy diet rich in green leafy vegetables, nuts and fatty fish can help slow disease progression. Anti-oxidant vitamins and minerals called nutraceuticals have also shown efficacy.

The AREDS2 formulation is considered the gold standard. It contains vitamins C (500 mg), E (400 IU), zinc (25 mg), copper (2 mg), and lutein/zeaxanthin (10/2 mg). This multi-vitamin/mineral combination reduces the risk of progression to advanced AMD by around 25% over 5 years.

For patients who cannot tolerate zinc in the original AREDS formulation due to side effects, the AREDS2 Preservision Lutein plus report offers an alternative. It contains antioxidants like lutein, zeaxanthin, vitamins C and E, and removes zinc.

In summary, lifestyle changes and nutraceutical supplements high in antioxidants like the AREDS2 or Preservision Lutein plus formulations are the main treatment options for intermediate AMD. They help delay progression to later stages by reducing oxidative stress and supporting macular health.

Players in the Intermediate AMD market have focused on improving treatment outcomes to gain a competitive edge. For example, Regeneron Pharmaceuticals adopted a strategy of developing more efficacious drugs when they launched Eylea (aflibercept) in 2011 for wet AMD treatment. Eylea provided superior vision gains compared to the previous standard of care, Lucentis (ranibizumab). Clinical trials showed patients gaining an average of 8-11 letters on the eye chart with Eylea versus 5-7 letters with Lucentis. This led to Eylea capturing over 50% of the wet AMD market by 2015.

Another strategy seen is expanding treatment options. Novartis adopted this when they received FDA approval for Beovu (brolucizumab) in 2019, the first single-drug injections for longer 3-month intervals to treat wet AMD. This offered an advantage of less frequent injections over Eylea and Lucentis which require injections every 4-8 weeks. By addressing patient compliance issues, Beovu was able to gain 10% market share within its first year.

Partnering or acquiring complementary technologies has also been a winning strategy. For example, Allergan acquired AbbVie's eye care business including treatments like Ozurdex (dexamethasone intravitreal implant) in 2020.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Therapy: Iptacopan Maintains its Dominance

In terms of therapy, Iptacopan is expected to account for 45.8% share of the market in 2025, owing to its competitive efficacy and safety profile.

Iptacopan, an oral, targeted, Factor B inhibitor, contributes the highest share in the intermediate AMD market amongst therapy segments owing to its compelling clinical profile. With high selectivity for Factor B, Iptacopan attenuates uncontrolled complement activation implicated in AMD pathology. In phase II HERON study, Iptacopan demonstrated reduction in GA lesion growth rate versus placebo. Importantly, efficacy was maintained up to 54 weeks with good tolerability.

This therapy also holds advantages over existing options. Unlike off-label systemic anti-VEGF therapies, Iptacopan directly addresses complement-driven inflammation - a key driver of disease. The oral administration offers ease of administration over frequent ophthalmic injections required with anti-VEGFs. With the proven long-term inhibition of the alternative complement pathway achieved by Iptacopan, physicians find it a reliable option to slow disease progression over extended periods.

The consistent clinical response coupled with favorable safety gives Iptacopan an upper hand over emerging pipeline assets as well. Being an oral therapy, it assures compliance unlike other options. The selective targeting of Factor B, without impacting normal functions of complement classical and lectin pathways, maintains a desirable safety profile. These distinguishing benefits have made Iptacopan the leading therapy choice for intermediate AMD patients and consultants, contributing highest market share.

The major players operating in the intermediate AMD market include Alkeus Pharmaceuticals, Apellis Pharmaceuticals, Iveric Bio, Roche, Regeneron Pharmaceuticals, Novartis, Allegro Ophthalmics, Notal Vision, AlphaRET, and ForeseeHome AMD Monitoring Program.

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Intermediate AMD Market is segmented By Therapy (Iptacopan, Risuteganib, ForeseeHome Monitoring), By...

Intermediate AMD Market

How big is the intermediate AMD market?

The intermediate AMD market is estimated to be valued at USD 1.10 Bn in 2025 and is expected to reach USD 1.62 Bn by 2032.

What are the key factors hampering the growth of the intermediate AMD market?

The limited understanding of the pathophysiology of intermediate AMD and geographical disparities in treatment access are the major factors hampering the growth of the intermediate AMD market.

What are the major factors driving the intermediate AMD market growth?

The significant unmet need in treating intermediate AMD and rising prevalence of AMD in aging populations are the major factors driving the intermediate AMD market.

Which is the leading therapy in the intermediate AMD market?

The leading therapy segment is Iptacopan.

Which are the major players operating in the intermediate AMD market?

Alkeus Pharmaceuticals, Apellis Pharmaceuticals, Iveric Bio, Roche, Regeneron Pharmaceuticals, Novartis, Allegro Ophthalmics, Notal Vision, AlphaRET, and ForeseeHome AMD Monitoring Program are the major players.

What will be the CAGR of the intermediate AMD market?

The CAGR of the intermediate AMD market is projected to be 5.7% from 2025-2032.