Magnetic Filter Market Size - Analysis

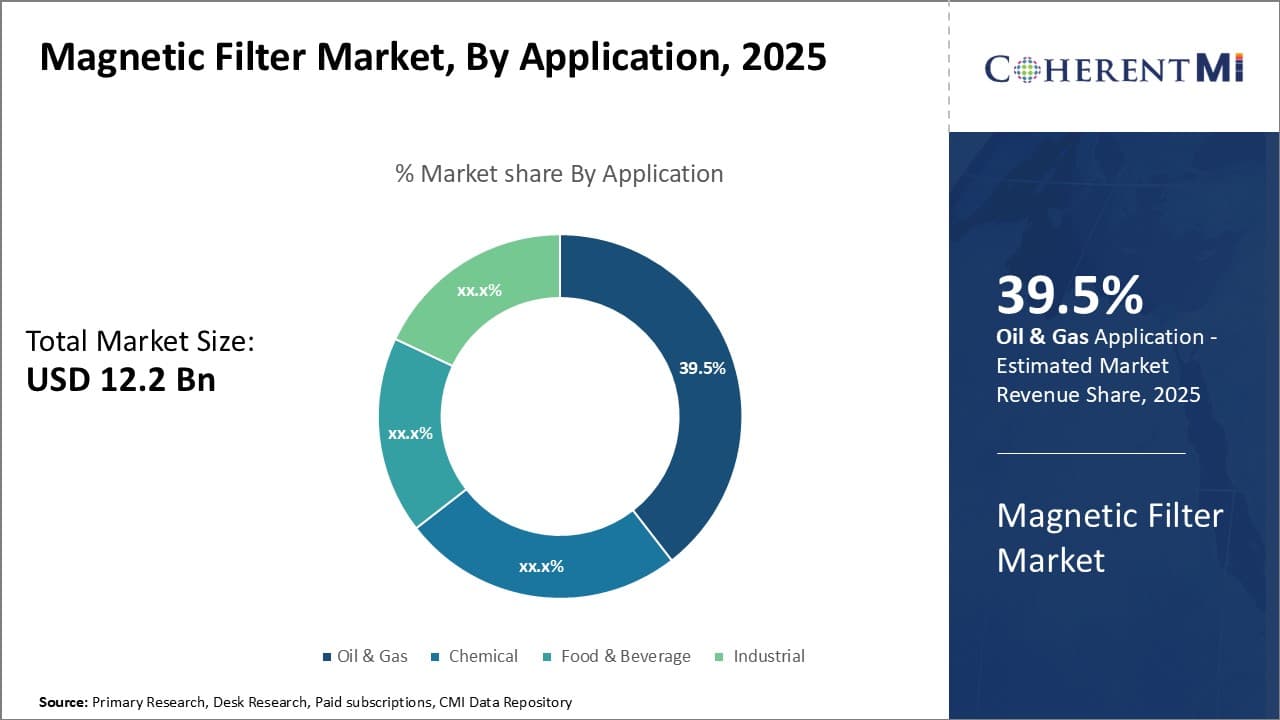

The Global Magnetic Filter Market is estimated to be valued at USD 12.20 Billion in 2025 and is expected to reach USD 19.59 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.00% from 2025 to 2032.

The magnetic filter market is experiencing positive growth trends across the globe. There is rising adoption of magnetic filters in various industrial applications such as automotive, food and beverage, manufacturing, chemicals, and others. Manufacturers are focusing on development of advanced magnetic filters with improved filtering capabilities. Also, stringent regulations regarding wastewater treatment fuels demand for magnetic filters. Growing industrialization and increasing focus towards water conservation are some of the major factors driving the growth of magnetic filter market during the forecast period.

Market Size in USD Bn

CAGR7.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.00% |

| Market Concentration | High |

| Major Players | Eclipse Magnetics, Permanent Magnets Ltd, Goudsmit Magnetics, Magnom, Procema and Among Others |

please let us know !

Magnetic Filter Market Trends

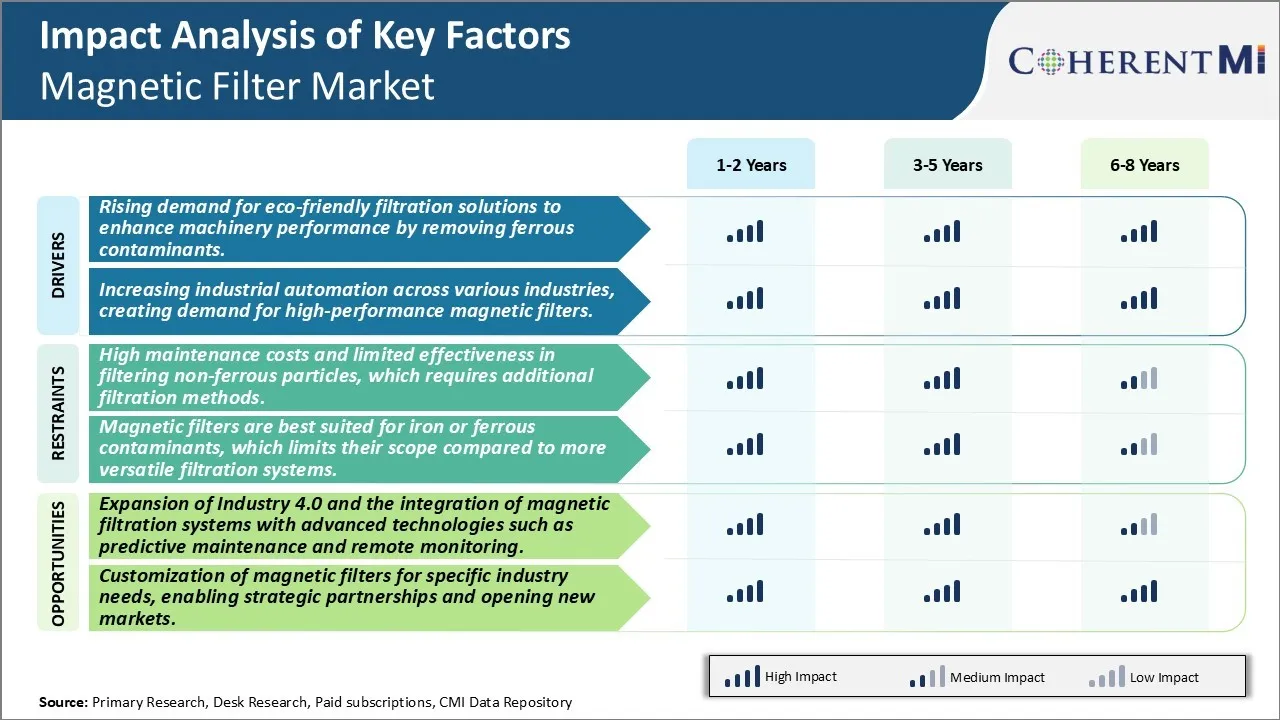

Market Driver - Rising Demand for Eco-Friendly Filtration Solutions to Enhance Machinery Performance by Removing Ferrous Contaminants

There has been a growing focus on sustainability and use of eco-friendly products across industries in recent years. Manufacturing companies are under increasing pressure from regulators as well as customers to reduce environmental footprint of their operations. One of the areas that is drawing attention is machine maintenance and extending lifespan of equipment by preventing premature failure and breakdown. Traditional filtration methods use disposable filters that end up in landfills adding to non-biodegradable waste. Magnetic filters offer a green solution as they are reusable and provide long lasting protection to machinery.

Magnetically separating tramp metal particles from hydraulic fluids, lubricating oils or other industrial liquids ensures smooth operations without risk of expensive repairs from metal debris inside valves or motors. This improves overall equipment effectiveness while reducing downtime costs. As companies focus on cutting costs through efficiency improvements as well as protecting the planet, magnetic filtration is emerging as an attractive technology. Leading industrial firms have deployed magnetic filters across their production plants globally to deliver performance benefits as well as sustainability gains. Magnets help retaining iron and steel contaminants for long durations without requiring frequent replacements.

Another advantage is that magnetically cleaned fluids can be reused multiple times before final disposal, lowering overall consumption of fresh fluids. This translates to substantial savings in material procurement spend. Magnetic filters also eliminate hazardous waste generation from disposed chemical-based cartridge filters. Growing ‘mission-critical’ nature of industrial operations is elevating importance of reliability which magnetic filtration assures at attractive life cycle costs. With stricter environmental regulations on the anvil worldwide, demand for eco-friendly magnetic separation solutions enabling cleaner manufacturing is likely to continue rising significantly.

Market Driver - Increasing Industrial Automation Across Industries Drives Industry Growth

Advanced technologies like robotics, artificial intelligence, internet of things are transforming industrial landscape at a rapid pace. Automation is increasingly becoming necessity for manufacturers across sectors to keep up with rising consumer expectations of quality, efficiency and product customization. However, industry 4.0 comes with its own set of challenges around maintaining highly sophisticated automated machinery and equipment operating for 24/7. Even minute metal particles or impurities can damage precision mechanics causing costly disruptions.

Traditional filtration practices may not provide assurances required for seamless operations of advanced robotics on the plant floor. Magnetic filters have emerged as a reliable solution catering to stringent quality demands of automated production environments. Their unique mechanism ensures ultra-fine filtration of problematic ferro-magnetic contaminants without any interruptions. This maintains critical fluid cleanliness within tight specifications needed for complex automated machinery. Robots, conveyors, programmable logic controllers and other computer-controlled systems have brought paradigm shift in how manufacturing units function today.

But this progress also increases vulnerability to unexpected breakdowns hampering throughputs. Magnetic filtration accurately warding off potential failures helps maximize equipment uptime important for time-bound automated workflows. As automated systems continue to proliferate across food processing, automotive, electronics and other vital industries, demand is surging for protective filtration maintaining performance of sensitive components. Magnetic filters are playing a key role in mission-critical industrial automation projects by guaranteeing reliable fluid filtering required for hassle-free 24/7 operations of automated assets. Their rising importance is steering healthy growth of global magnetic filter market.

Market Challenge - High Maintenance Costs and Limited Effectiveness in Filtering Non-Ferrous Particles, With Additional Filtration Methods

The magnetic filter market faces ongoing challenges related to the high maintenance costs associated with these systems. Magnetic filters require periodic cleaning and replacement of magnetic filter cartridges or magnetic rods in order to maintain optimal performance levels over time. The buildup of trapped ferrous particles on the magnetic surfaces reduces their ability to attract and remove such contaminants from fluid systems. This necessitates routine cleaning and imposes additional labor expenses.

Moreover, magnetic filters alone have limited effectiveness when it comes to filtering out non-ferrous particles such as aluminum, copper, and non-metallic debris. To address this issue, most operators employ complementary filtration methods like filter presses, centrifuges or screen baskets to remove these contaminants - further raising overall maintenance costs. Single-use filtration technologies or advanced magnetic filter designs with lower-maintenance coatings could help address this challenge and boost adoption.

Market Opportunity- Expansion of Industry 4.0 And the Integration of Magnetic Filtration Systems with Advanced Technologies

The growing expansion of Industry 4.0 concepts and technologies presents a major opportunity for the magnetic filter market. Industry 4.0 utilizes smart sensors, cloud computing, data analytics and the IoT (Internet of Things) to drive greater connectivity and automation in industrial applications. Magnetic filter manufacturers can leverage these advances by integrating predictive maintenance capabilities, remote monitoring functions as well as automated cleaning cycles into their systems.

This allows operators to more proactively address maintenance needs based on real-time performance data. It also enables remote oversight and management of magnetic filters without the need for on-site inspection. When integrated with advanced technologies, magnetic filtration solutions can deliver improved efficiency, higher uptime and reduced servicing costs for end-users. The adoption of Industry 4.0 principles thus provides a platform for magnetic filters to enhance their value proposition and boost demand going forward.

Key winning strategies adopted by key players of Magnetic Filter Market

Product Innovation: Introducing innovative products tailored to specific industrial application needs has been a winning strategy. In 2020, Eaton introduced the B-Line Series magnetic filter designed for HVAC and refrigeration systems. It offers 99% filtration efficiency and a unique magnetic cartridge design for easy cleaning. This addressed a gap in the market and helped Eaton gain share.

Strategic Acquisitions: Acquiring complementary technology providers has helped companies expand their product portfolio and capabilities. In 2018, Clearwater acquired MAGNWORX, a manufacturer of magnetic separation equipment. This strengthened Clearwater's filtration product offering and allowed expansion to new industries like chemicals and plastics.

Targeted Marketing: Tailoring marketing messages and sales approaches to specific industrial segments where magnetic filters are crucial has paid off. For example, Lenntech targeted the power industry by positioning its products as improving generator reliability and uptime. Between 2015 and 2019, its market share in the power industry grew by 12%.

Strong Distribution Networks: Establishing extensive distribution networks to ensure strong worldwide presence and fast delivery times provides a competitive edge. Eaton has a network of over 300 distribution centres globally. This widespread availability and proximity to customers has helped Eaton uphold its leadership position.

These examples demonstrate how innovation, strategic transactions, targeted go-to-market plans and distribution strength have been key winning elements of magnetic filter providers' strategies in capturing greater market share. Customized solutions meeting application needs and timely availability delivered through wide networks remain critical for leadership in this space.

Segmental Analysis of Magnetic Filter Market

Insights, By Type, 10-30 μm Dominates the Magnetic Filter Market

Insights, By Type, 10-30 μm Dominates the Magnetic Filter Market

By Type, the 10-30 μm particle size range contributes the highest share to the magnetic filter market due to its optimum functionality for filtration applications. Filters within this size category can effectively trap smaller oil and fluid particles down to 10 μm while still maintaining good flow rates. This balance between filtration performance and pressure drop makes the 10-30 μm segment the golden standard for many industries that require magnetic particle separation.

Equipment manufacturers commonly specify 10-30 μm magnetic filter elements for general fluid filtration duties. The particle size distribution captured in this range removes contaminants that could damage sensitive pumps and hydraulic systems over time while avoiding excess backpressure. Many common debris types generated through wear and production processes fall within 10-30 μm, contributing to the ubiquity of filters tailored for this particle size range.

The versatility of 10-30 μm filters also enables their use across a variety of end-use sectors. General industrial machinery often employs them for circulating oil filtration. Food and beverage facilities rely on 10-30 μm magnetic drums and roll filters to meet strict contaminant removal standards for liquid products. Even the pharmaceutical industry has adopted 10-30 μm permanent magnetic separators for filtration applications requiring consistent, high-purity fluid streams.

Additional factors adding to the affluence of the 10-30 μm category include well-established fabrication methods and long-term performance data. Magnetic filter manufacturers have fine-tuned their production of thin-walled, corrugated filter elements within this size for optimal magnetic force distribution and contaminant holding capacity. Decades of proven field results give users confidence that 10-30 μm filters will deliver reliable and complete separation of problem particulates. Overall, the right balance of filtration precision and backpressure tolerance makes the 10-30 μm particle size a magnetic filter market leader. Its broad applicability and technical benefits have established this segment as an industry standard for critical fluid service applications across many industries.

Insights, By Application, Oil & Gas Keeps Fueling Magnetic Filter Adoption

By Application, the oil and gas segment is projected to register 39.5% in 2025 due to intrinsic application needs and operating challenges within the industry. Harsh downstream processing environments generating significant abrasive and ferrous wear debris demand robust particulate removal solutions. Magnetic separation seamlessly fulfills this need with a simple fail-safe design extracting problem solid from valuable production fluids.

Oil and natural gas well drilling generates prodigious amounts of ferrous cuttings that must be removed from recirculating fluid systems. Magnetic filter presses and continuous belt designs handle high volumes of turbulent drilling mud, trapping damaging solids that could erode sensitive downhole tools. Similarly, high-pressure hydraulic fracturing utilizes portable magnetic de-oilers and roll filters to remove metal shards from recycled proppant slurries, extending equipment life.

Critical refining and petrochemical operations rely on magnetic drum filters, pulleys, and pipes to purify process streams in real-time. Extracting magnetite fines and other magnetic contaminants helps ensure on-spec product quality and protects downstream components. Minimizing downtime through filter self-cleaning capabilities adds to the appeal in continuous-run refining applications.

Magnetic separation faces little competition in oilfield and petroleum processing environments where fluids are contaminated with high concentrations of magnetic debris like welding spatter. The technology's inherent fouling resistance, self-cleaning abilities, and field-proven performance cement magnetic filtration as the preferred particulate control solution for the oil and gas sector.

Additional Insights of Magnetic Filter Market

The global magnetic filter market is experiencing strong growth, driven by rising demand across industries such as oil & gas, chemical, food & beverage, and industrial manufacturing. Magnetic filters provide efficient solutions for removing ferrous contaminants from fluids, enhancing the longevity and performance of machinery while supporting cleaner industrial processes.

Regions such as Asia-Pacific and North America lead the market due to high levels of industrialization, regulatory pressure, and investments in advanced manufacturing practices. However, the market faces challenges related to the high maintenance costs and limited effectiveness in filtering non-ferrous contaminants. Industry 4.0 offers promising growth opportunities through the integration of predictive maintenance and remote monitoring technologies. Customization of filters for industry-specific needs is another key opportunity, with partnerships and innovations expected to drive further market expansion.

Competitive overview of Magnetic Filter Market

The major players operating in the Magnetic Filter Market include Eclipse Magnetics, Permanent Magnets Ltd, Goudsmit Magnetics, Magnom, Procema, Worcester Bosch, Bunting, Magnetix, Inta, Magnattack Global, Eaton Corporation and Industrial Magnetics, Inc.

Magnetic Filter Market Leaders

- Eclipse Magnetics

- Permanent Magnets Ltd

- Goudsmit Magnetics

- Magnom

- Procema

Magnetic Filter Market - Competitive Rivalry

Magnetic Filter Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Magnetic Filter Market

- In March 2024, Metso Outotec introduced a new series of high-gradient magnetic filters designed to improve filtration efficiency in the mining industry, reducing operational costs and enhancing mineral recovery rates.

- In January 2024, Bunting launched an innovative line of magnetic filters targeting the food and beverage industry, focusing on removing fine metal contaminants from liquids during production, ensuring higher food safety standards.

Magnetic Filter Market Segmentation

- By Type

- 10-30 μm

- 30-60 μm

- Above 60 μm

- By Application

- Oil & Gas

- Chemical

- Food & Beverage

- Industrial

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How Big is the Magnetic Filter Market?

The Global Magnetic Filter Market is estimated to be valued at USD 12.20 Bn in 2025 and is expected to reach USD 19.59 Bn by 2032.

What will be the CAGR of the Magnetic Filter Market?

The CAGR of the Magnetic Filter Market is projected to be 6.8% from 2024 to 2031.

What are the major factors driving the Magnetic Filter Market growth?

The rising demand for eco-friendly filtration solutions to enhance machinery performance by removing ferrous contaminants and increasing industrial automation across various industries, creating demand for high-performance magnetic filters are the major factors driving the Magnetic Filter Market.

What are the key factors hampering the growth of the Magnetic Filter Market?

The high maintenance costs and limited effectiveness in filtering non-ferrous particles, which requires additional filtration methods. and magnetic filters are best suited for iron or ferrous contaminants, which limits their scope compared to more versatile filtration systems are the major factors hampering the growth of the Magnetic Filter Market.

Which is the leading Type in the Magnetic Filter Market?

The leading Type segment is Above 60 μm.

Which are the major players operating in the Magnetic Filter Market?

Eclipse Magnetics, Permanent Magnets Ltd, Goudsmit Magnetics, Magnom, Procema, Worcester Bosch, Bunting, Magnetix, Inta, Magnattack Global, Eaton Corporation, Industrial Magnetics, Inc are the major players.