New Zealand Coconut Milk and Cream Market Size - Analysis

The New Zealand Coconut Milk and Cream Market is estimated to be valued at USD 14.9 million in 2025 and is expected to reach USD 25.7 million by 2032, growing at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2032.

Consumers in New Zealand are increasingly adopting healthy and plant-based alternatives to dairy milk and cream. The demand for coconut milk and cream is driven by the popularity of Asian cuisines and health-conscious Kiwis looking for non-dairy options. The market is expected to witness steady growth over the forecast period. The growing vegan and vegetarian population, increasing incidence of dairy allergies and lactose intolerance, rising awareness about the health benefits associated with coconut milk and cream are some key factors expected to contribute to the growth of the coconut milk and cream market in New Zealand between 2025 and 2032.

Market Size in USD Mn

CAGR8.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.1% |

| Market Concentration | High |

| Major Players | Thaicoconut., Tetra Pak International S.A., Kōkiri Coconut Milk, Ceylon Kokonati, Savaii Popo and Among Others |

please let us know !

New Zealand Coconut Milk and Cream Market Trends

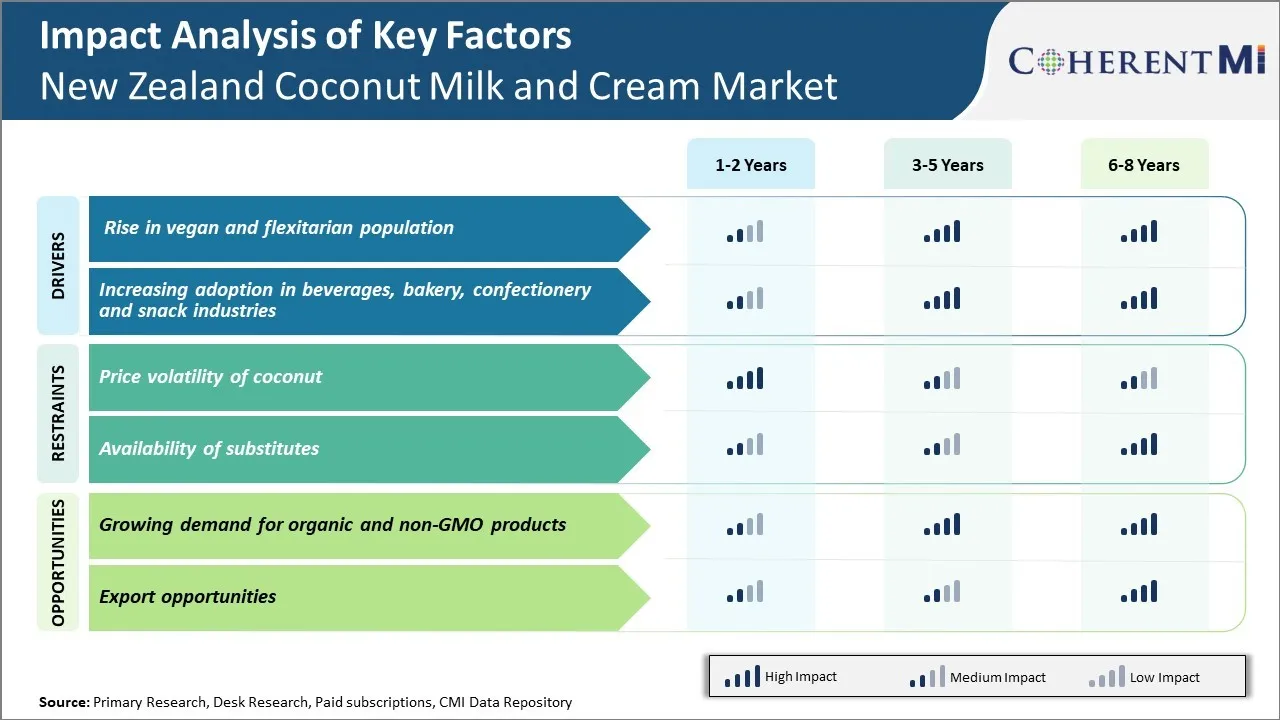

Market driver - Rise in vegan and flexitarian population

As more and more people are becoming conscious about their health and diet, they are reducing or completely avoiding consumption of animal products. The number of vegans and vegetarians has significantly grown in New Zealand in recent years. According to various surveys, nearly 15-20% of New Zealand's population now identifies themselves as vegan, vegetarian or flexitarian. Flexitarians are people who mainly follow a plant-based diet but occasionally eat meat, eggs or dairy. The main reasons behind this transition are health, ethical concerns for animal welfare and environmental impact of animal agriculture.

Coconut milk and cream has emerged as one of the most popular non-dairy alternatives for vegans and flexitarians. They are derived from coconut flesh which does not require animal slaughtering or cruelty towards animals. Compared to cow milk and cream, coconut milk and cream is lower in calories and saturated fat. It is a rich source of many vitamins, minerals and plant-based nutrients. Moreover, its texture and taste resemble dairy cream and milk to a large extent which makes it suitable for direct substitution in recipes. Majority of vegans and flexitarians in New Zealand now rely on coconut milk and cream for their cooking and beverage needs.

The vegan grocery stores, cafes and restaurants have massively expanded their offerings based on coconut milk and cream in recent years to cater to this consumer segment. Even mainstream supermarkets are allocating more shelf space for various coconut milk and cream products. The coconut milk and cream industry has proactively launched new variants like barista blend coconut milk to target coffee shops. Overall, as more people cut down on animal products for health, ethical or environmental reasons in New Zealand, the demand for coconut milk and cream as a dairy alternative will continue rising sharply.

Market driver -Increasing adoption in beverages, bakery, confectionery and snack industries

Coconut milk and cream have found widespread usage beyond just direct consumption or recipes at homes. Various food processing industries in New Zealand have incorporated these products in their formulations to cater to evolving consumer preferences. The beverage industry has introduced numerous coconut milk-based drinks ranging from cold coffees to nutritious smoothies. They are ideally positioned as healthy alternatives to high sugar fruit juices or dairy-based coffees and shakes.

In bakery and confectionery segment, coconut milk and cream are utilized in various cake mixes, frostings, icings, fillings and desserts. They enhance texture and appeal of the products while allows using plant-based label. Even savoury snacks and fast foods chains have added coconut cream or milk-based dips, sauces and toppings in response to niche consumer demand. Overall, these industries foresee coconut products as lucrative ingredients for new product development.

The acceptance of coconut milk and its derivatives in both household and commercial applications presents a long-term business potential for B2B coconut product suppliers. Their expanding reach through retail chains and tie-ups with food companies act as catalysts for industrial consumption. Growing health awareness and environmental consciousness of shoppers pushes establishments to shift towards more sustainable options as well. Thus, coconut milk and cream are expected to experience heightened demand cycles across beverages, bakery and savory food space in future.

Market Challenge: Price volatility of coconut

The price volatility of coconuts poses a significant challenge for the New Zealand coconut milk and cream market. As coconuts are an agricultural commodity, their price depends heavily on weather conditions, pest infestations, and global supply and demand trends. A bad harvest in a major coconut producing country can cause international coconut prices to spike rapidly. For example, in 2021 coconut prices increased by over 25% due to Cyclone Seroja damaging crops in Indonesia and the Philippines, two of the world's largest coconut producers.

Higher international coconut prices force local producers to pay more to source the raw materials needed to make coconut milk and cream. This squeezes their margins and makes it difficult to set stable retail prices. Volatile commodity prices also make forecasting costs and profits challenging. If producers are unable to pass on higher costs to customers, price volatility can negatively impact their financial performance. To mitigate risks, producers often negotiate flexible contracts with suppliers. However, frequent price fluctuations still present an ongoing threat to the stability and growth of the New Zealand coconut market.

Market Opportunity: Growing demand for organic and non-GMO products

The growing demand for organic and non-genetically modified (non-GMO) food and beverage products presents a major opportunity for the New Zealand coconut milk and cream market. Increasing health consciousness among consumers has driven strong growth in the global organic food industry in recent years. Customers are paying attention to how products are grown and processed, and willing to pay a premium for organic options. This provides an opening for New Zealand coconut producers to tap into this lucrative niche.

As an island nation with a pristine environment, New Zealand is well positioned to offer organic and non-GMO coconuts and coconut products. Local producers can highlight the provenance advantage of sourcing organic coconuts grown without synthetic pesticides or fertilisers. There is also an opportunity to build on New Zealand's clean, green image to access new international markets seeking sustainably-produced goods. With the right marketing and certification, New Zealand coconut producers can charge higher prices and gain greater market share by meeting the strong demand for organic and non-GMO coconut products.

Key winning strategies adopted by key players of New Zealand Coconut Milk and Cream Market

Focus on product innovation - Leading brands like Pure Nature and PURE have focused on constant product innovation to meet evolving consumer needs and tastes. In 2019, Pure Nature launched a coconut yogurt drink made from coconut milk, appealing to health-conscious consumers looking for dairy alternatives. This was well-received in the market and helped the brand increase its market share.

Target the wellness segment - Most key players have targeted the wellness and nutrition segment by marketing their products as healthy alternatives to dairy. Coconut products are seen as a healthier option due to their plant-based nature and claimed nutritional benefits like being rich in fiber, vitamins etc. Brands like PURE highlight these aspects in their marketing campaigns. This strategy has been successful as the wellness segment in New Zealand has grown rapidly in recent years.

Expanded distribution - Market leaders constantly work to expand their distribution footprint by partnering with major supermarkets and retailers to increase accessibility and visibility for consumers. For example, in 2018 Pure Nature started stocking its products in over 350 stores of Foodstuffs, one of the major retailers in the country, up from just 50 stores previously. This strategic move helped the brand gain wider reach.

Leveraged social media - younger consumers are heavily influenced by social media. Brands like PURE have found success with Instagram marketing campaigns featuring lifestyle images and influencer endorsements to promote their products as part of a healthy diet and lifestyle. Their social following grew 3x in the last fiscal, positively impacting sales.

Focus on locally sourcing raw materials - New Zealand consumers prefer locally produced goods. Major brands ensure raw coconut material is procured from trusted local/regional sources to meet this demand. This 'Buy Local' strategy resonates well and helps gain consumer confidence in product quality and freshness.

Segmental Analysis of New Zealand Coconut Milk and Cream Market

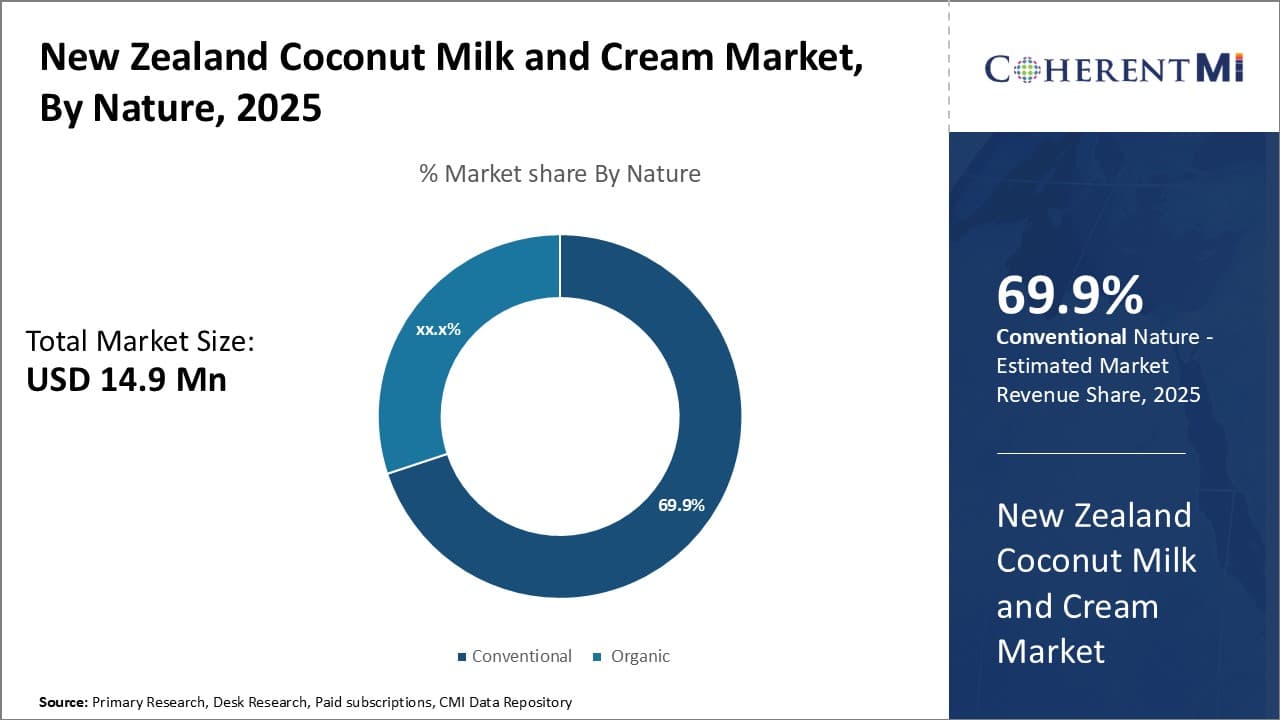

Insights by nature: Consumer preference for familiar tastes and lower prices drives demand for Conventional coconut milk and cream

Insights by nature: Consumer preference for familiar tastes and lower prices drives demand for Conventional coconut milk and cream

The Conventional segment contributes the 69.9% share of the New Zealand coconut milk and cream market in 2025, due to strong consumer preference for familiar tastes and lower prices. New Zealand consumers have grown accustomed to the taste and texture of conventional coconut products during their widespread availability. Many views conventional varieties as having a richer, creamier taste compared to organic options. This familiarity helps consolidate consumer loyalty for conventional brands.

In addition, conventional coconut milk and cream is typically priced lower than organic alternatives. The organic designation brings additional production costs that get passed onto consumers through higher retail prices. Given inflationary pressures and the economic impacts of the ongoing pandemic, price has become a major decision-making factor for many Kiwi shoppers. Opting for conventional provides good value without compromising on taste. This consideration is central to the success of the segment.

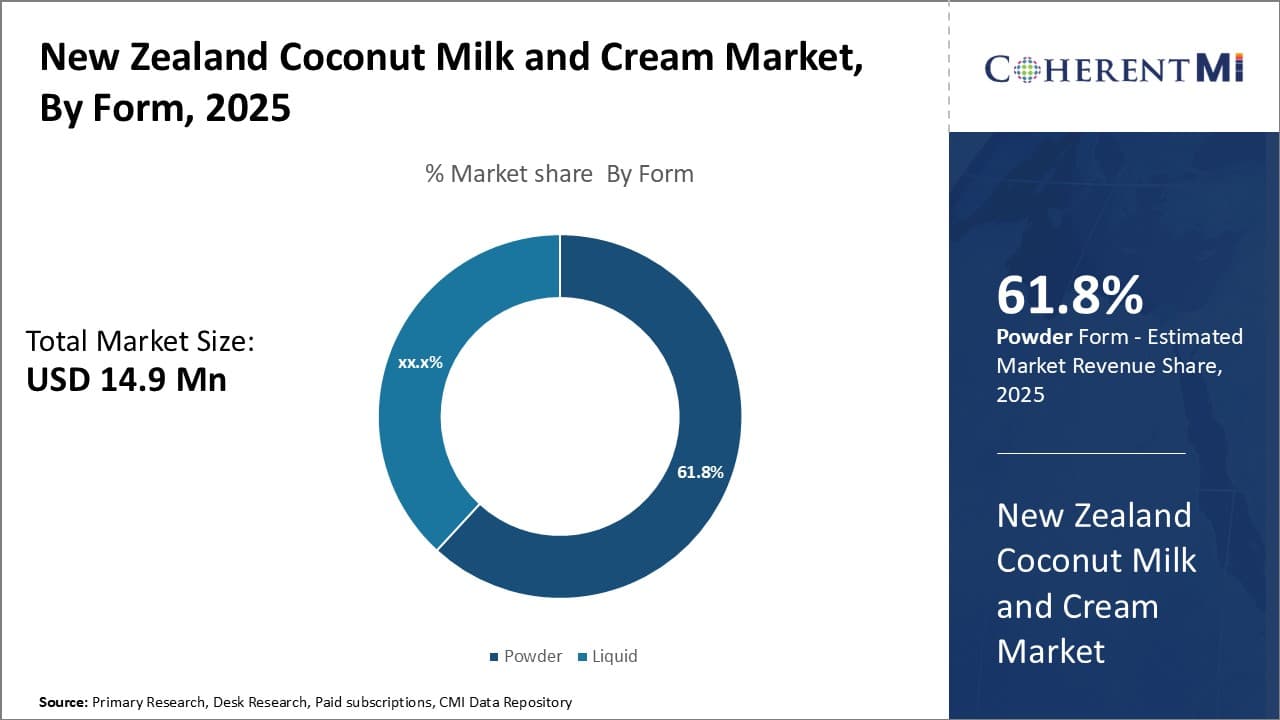

Insights by form: Powder format dominates due to convenience and longer shelf life

The Powder segment claims the largest portion of New Zealand's coconut milk and cream market thanks to key advantages in convenience and longer shelf life over liquid varieties with 61.8% in 2025. For busy consumers juggling work and family responsibilities, powdered coconut milk and cream offers an easy solution. By simply adding water, it can be easily reconstituted into liquid form whenever needed. This saves time spent searching for cans or cartons amid a packed schedule.

Additionally, the dehydrated powder format lends itself to longer freshness without refrigeration. Liquid coconut products face a risk of spoilage within only a few months of opening due to natural cream separation. In contrast, coconut powder can maintain quality for one or two years simply by being stored in a cool, dry place. This extended usability provides greater value and reduces food waste - important factors as consumers increasingly prioritize sustainability. Powder's combination of fuss-free use and durable shelf life clearly caters to New Zealanders' busy modern lifestyles, driving its popularity in the market.

Competitive overview of New Zealand Coconut Milk and Cream Market

Thaicoconut., Tetra Pak International S.A., Kōkiri Coconut Milk, Ceylon Kokonati, Savaii Popo

New Zealand Coconut Milk and Cream Market Leaders

- Thaicoconut.

- Tetra Pak International S.A.

- Kōkiri Coconut Milk

- Ceylon Kokonati

- Savaii Popo

New Zealand Coconut Milk and Cream Market - Competitive Rivalry

New Zealand Coconut Milk and Cream Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in New Zealand Coconut Milk and Cream Market

- In January 2024, MPI announced a recall of Kiwigarden brand Dairy Free Coconut Yoghurt Drops due to lack of milk allergen labeling

New Zealand Coconut Milk and Cream Market Segmentation

- By Nature

- Conventional

- Organic

- By Form

- Powder

- Liquid

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the New Zealand Coconut Milk and Cream Market?

The New Zealand Coconut Milk and Cream Market is estimated to be valued at USD 14.9 in 2025 and is expected to reach USD 25.7 Million by 2032.

What are the major factors driving the New Zealand Coconut Milk and Cream Market growth?

The rise in vegan and flexitarian population and increasing adoption in beverages, bakery, confectionery and snack industries are the major factor driving the New Zealand Coconut Milk and Cream Market.

Which is the leading Nature in the New Zealand Coconut Milk and Cream Market?

The leading Nature segment is Conventional.

Which are the major players operating in the New Zealand Coconut Milk and Cream Market?

Ceylon Kokonati, COCO Shed Organics, Thaicoconut., Tetra Pak International S.A., ceres organics, The Coco Company, Savaii Popo, K?kiri Coconut Milk are the major players.

What will be the CAGR of the New Zealand Coconut Milk and Cream Market?

The CAGR of the New Zealand Coconut Milk and Cream Market is projected to be 8.1% from 2025-2032.