The ophthalmic drugs contract manufacturing market is estimated to be valued at USD 1.81 billion in 2025 and is expected to reach USD 4.23 billion by 2032, growing at a compound annual growth rate (CAGR) of 12.9% from 2025 to 2032. This consistent growth can be attributed to the rising prevalence of ophthalmic disorders like cataracts, diabetic retinopathy, and glaucoma.

The market is expected to witness significant growth over the forecast period due to increasing outsourcing of ophthalmic drug manufacturing by pharmaceutical companies. Growing geriatric population susceptible to age-related eye disorders will also drive the demand for contracted ophthalmic drug manufacturing services. Overall growth in the pharmaceutical industry and focus on core competencies are compelling drug makers to rely more on CMOs for their manufacturing needs.

Market Size in USD Bn

CAGR12.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.9% |

| Market Concentration | High |

| Major Players | Catalent, Recipharm, Akorn, Pillar5 Pharma, Sterling Pharmaceutical Services and Among Others |

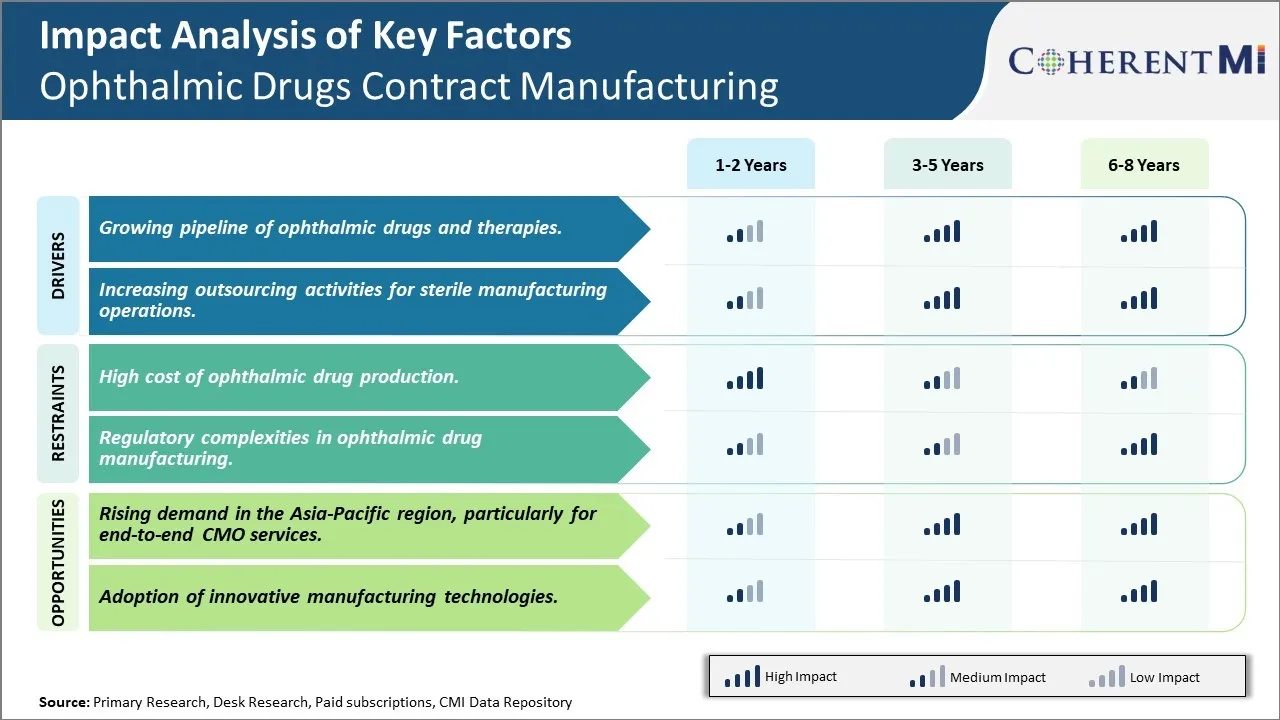

Market Driver - Growing pipeline of ophthalmic drugs and therapies

The ophthalmic drugs contract manufacturing market is expected to see significant growth over the coming years driven by the robust pipeline of ophthalmic drugs and therapies currently under development. A large number of pharmaceutical and biopharmaceutical companies are investing heavily in R&D activities to develop new and more effective treatments for various ophthalmic disorders. This has resulted in a steady rise in new molecular entities and therapeutic biologics entering late-stage clinical trials. For instance, over 50 new drug candidates are currently in phase 2/3 of clinical development targeting major indications like dry eye diseases, glaucoma, diabetic retinopathy, and age-related macular degeneration. Several of these novel therapies employ advanced drug delivery technologies like intravitreal implants, lipid nanoparticle formulations, and sustained-release gels which increases the complexity of manufacturing.

Outsourcing the specialized manufacturing needs of these sophisticated treatments to contract manufacturers with expertise and regulatory clearances makes strategic sense for most sponsors. Considering the investments required to set up dedicated sterile ophthalmic manufacturing facilities and gain necessary approvals, in-house production may not be commercially or economically viable for all projects. Contract manufacturers can leverage their existing infrastructure and capabilities to support multiple customers simultaneously. This allows sponsors to focus their resources on discovery, clinical research and marketing activities while ensuring a steady supply of investigational medicines and commercial products. As the pipeline matures and more candidates receive approvals, the demand for large-scale commercial manufacturing is expected to surge in the coming years significantly benefitting ophthalmic drugs contract manufacturers.

Market Driver - Increasing outsourcing activities for sterile manufacturing operations

The ophthalmic drugs contract manufacturing industry is projected to grow steadily propelled by ongoing rise in outsourcing of sterile manufacturing operations. Producing sterile drugs, especially those meant for intraocular use like injectables, requires adhering to the highest standards of quality and minimizing any risk of contamination. This makes ophthalmic manufacturing a highly complex process which demands specialized facilities, equipment and expertise. However, setting up the necessary infrastructure from ground up and achieving regulatory certifications like EU GMP and FDA approval entails substantial capital investment and time which not all companies especially small molecules firms are willing to undertake. As a result, they increasingly rely on specialized contract service providers to handle their sterile production requirements.

Additionally, even large biopharmaceutical firms look to limit capital exposure and maximize operational flexibility by outsourcing non-core activities. Managing sterile ophthalmic manufacturing in-house across multiple facilities worldwide poses significant challenges and costs. Contract manufacturers with decades of experience in this domain provide turnkey project solutions right from clinical manufacturing to commercial market supply through their global sterile networks. They can also easily adjust production volumes based on demand fluctuations. This makes outsourcing an attractive proposition for both innovator and generic drug companies. As new product introductions growth, complexity of formulations rises with advanced drug delivery systems, and regulatory oversight strengthens, the need for utilizing expert sterile capabilities of dedicated ophthalmic CMOs will continue propelling this market upwards.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High cost of ophthalmic drug production

One of the main challenges faced by the ophthalmic drugs contract manufacturing market is the high cost associated with ophthalmic drug production. Producing ophthalmic drugs is an expensive and complex process owing to the stringent regulatory requirements for drug delivery methods involving the eye. Specialized manufacturing equipment and facilities are required to produce the fine dosage forms suitable for ocular drug delivery such as eye drops, gels, ointments, and inserts. This necessitates significant capital investments. Additionally, the production process is sensitive and needs to be carried out in highly controlled and aseptic environments to maintain sterility and avoid contamination, which increases operational costs. Meeting regulatory standards for ocular drug manufacturing set by authorities such as the US FDA and EMA also increases compliance costs. The costs tend to rise further due to low production volumes for many niches ophthalmic drugs.

Market Opportunity - Rising demand in the Asia-Pacific region, particularly for end-to-end CMO services

The Asia-Pacific region, especially emerging economies, present a major opportunity for the ophthalmic drugs contract manufacturing market. According to market estimates, the Asia-Pacific region is poised to become one of the fastest growing markets for ophthalmic drugs due to the rising aging population, increasing healthcare expenditure, and growing prevalence of ocular diseases. Many global pharmaceutical companies are looking to penetrate this high potential regional market by outsourcing manufacturing requirements to local CMOs who offer end-to-end services from clinical trial material preparation and commercial manufacturing to packaging and regulatory filing assistance. This is generating considerable demand for end-to-end contract manufacturing organizations (CMOs) that can cater to the specific regulatory needs of the regional markets. Local CMOs also gain an advantage due to their understanding of regional market landscape. Thus, the Asia-Pacific region currently presents lucrative opportunities for CMOs to grow their business in ophthalmic drug contract manufacturing.

Leaders like Santen Pharmaceutical have made significant investments in the latest manufacturing technologies like continuous manufacturing and 3D printing to produce ophthalmic drugs. Continuous manufacturing allows for real-time monitoring and controlling of critical quality attributes compared to traditional batch manufacturing. This has helped Santen reduce costs and improve product quality. 3D printing also enables personalized drug delivery and complex design capabilities. These technology investments over the last 5 years have given Santen an edge over competitors.

Other major players like Catalent and AbbVie have expanded their capabilities by building new facilities or acquiring companies with complementary strengths. For example, in 2018 Catalent acquired MAST Biosurgery to add ophthalmic surgical skills and expertise in contact lenses. This expansion allows them to provide end-to-end services from product development to commercial supply. Similarly, AbbVie's acquisition of Allergan in 2020 enhanced its offerings in eye care. Such capability expansion enables these companies to target a wider customer base and increase market share.

Some emerging companies like Aucta Pharmaceuticals have found success by focusing on niche technologies like intravitreal injections. By gaining deep expertise in technologies needed for complex ophthalmic formulations, Aucta has managed to win business from large biotechs developing advanced therapies. Their specialized manufacturing plant established in 2015 helped secure deals with companies like Alcon. This targeting of specialized expertise proved to be an effective strategy compared to broad-capability competitors.

To learn more about this report, Download Free Sample Copy

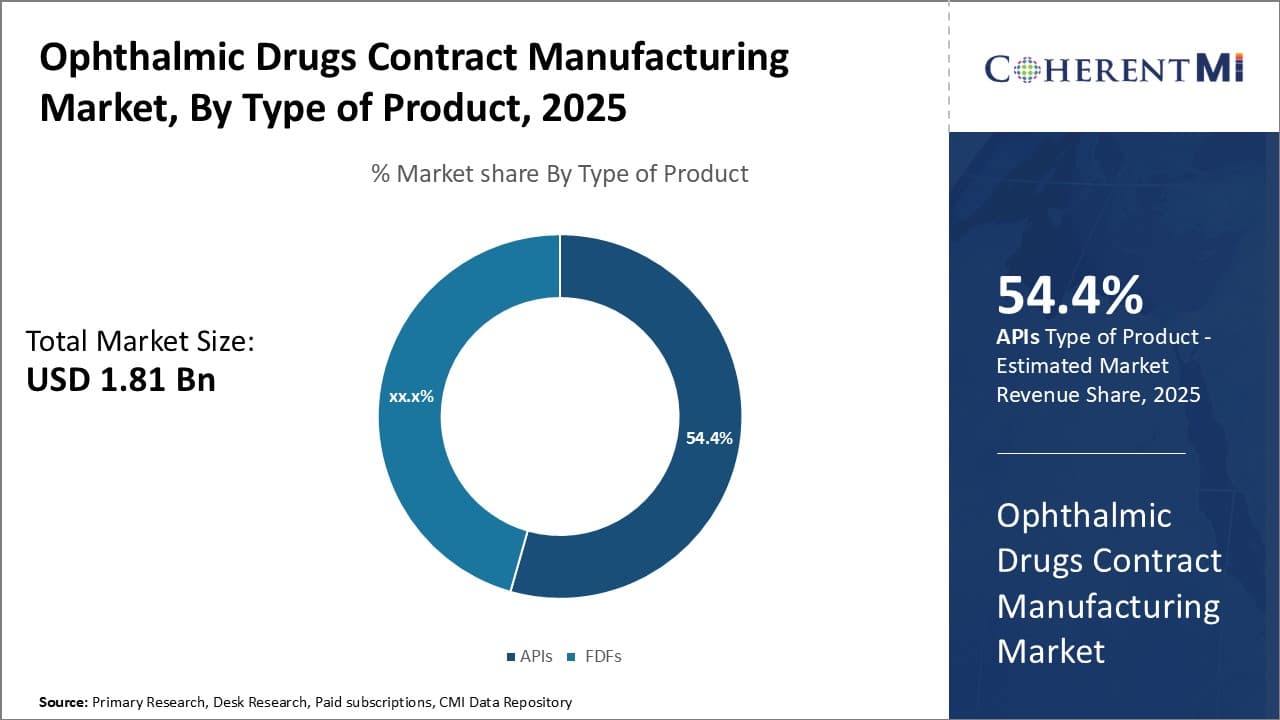

Insights, By Type of Product: APIs drive growth in the ophthalmic drugs contract manufacturing market

To learn more about this report, Download Free Sample Copy

Insights, By Type of Product: APIs drive growth in the ophthalmic drugs contract manufacturing market

In terms of type of product, APIs sub-segment contributes the highest share of 54.4% in the market owing to stability and convenience factors. As the core ingredient in any drug formulation, APIs see substantial demand from global pharmaceutical companies. Their development requires involved research and large capital investments, making them optimal for outsourcing to specialist contract manufacturers.

API production is a complex process that necessitates specialized equipment and expertise in organic synthesis, analytical testing and scale-up. Contract manufacturers with deep API experience can leverage economies of scale to produce high-quality APIs at competitive prices. This enhances drug makers' access to critical raw materials while reducing costs and timeline overheads. Furthermore, ophthalmic drug formulations often utilize sensitive APIs that must undergo stringent quality norms. Contract manufacturers' advanced API manufacturing infrastructure and quality procedures minimize compliance risks for brand owners.

The expertise required to efficiently synthesize novel ophthalmic APIs also drives pharmaceutical outsourcing. Developing in-house capabilities for every new molecule is impractical; outsourcing to specialized API manufacturers streamlines drug development. Their skilled workforce and R&D infrastructure help accelerate API commercialization. This allows drug sponsors to focus capital on core competencies like clinical trials and marketing.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

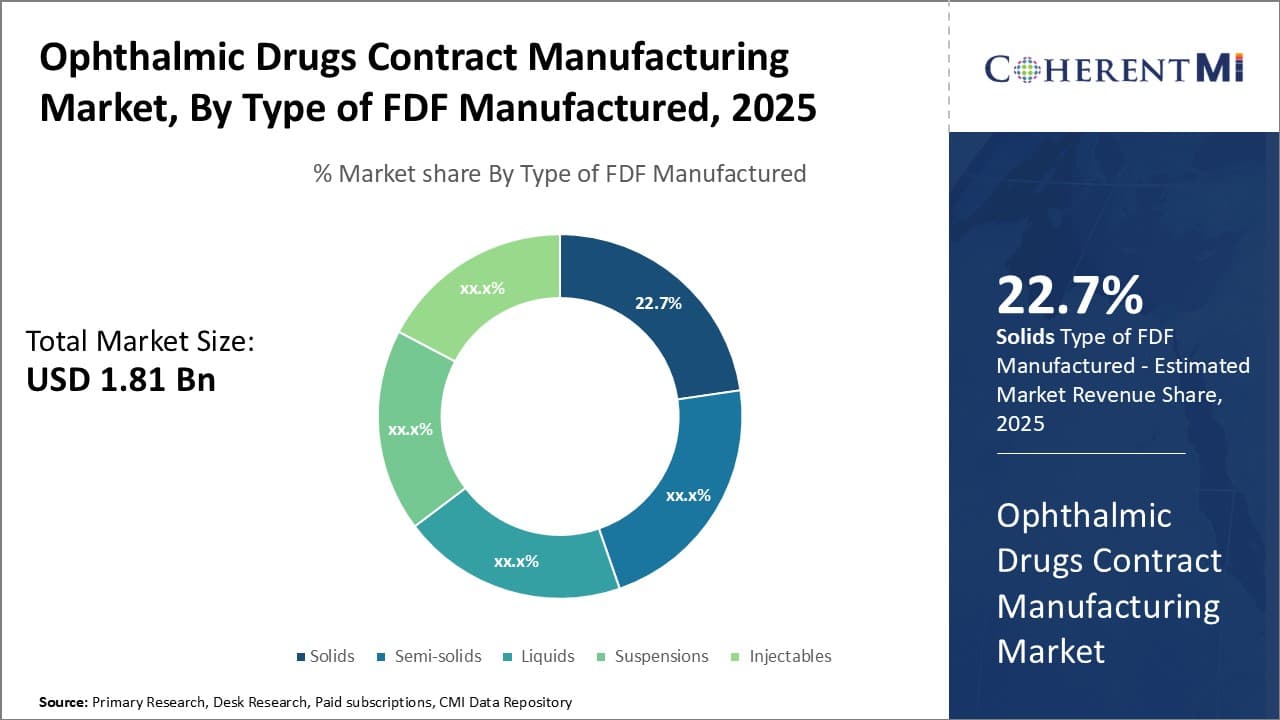

Insights, By Type of FDF Manufactured: Solids drive growth in ophthalmic drug FDF manufacturing

In terms of type of FDF manufactured, solids sub-segment contributes the highest share of 22.7% owing to dosage convenience and stability advantages. Many ophthalmic drugs rely on solid dosage forms like tablets, capsules and powders for administration due to their precision, stability and ease of production.

Producing solid ophthalmic FDFs at commercial scale requires advanced manufacturing technologies to maintain consistent physical attributes. Contract manufacturers have made large investments in tablet/capsule production capabilities featuring automated high-speed lines. Their solid dosage expertise helps ensure uniform weight and thickness for optimal drug delivery.

Furthermore, solid oral ophthalmic medications offer precise, consistent dosing advantages over semi-solids or liquids. This promotes patient compliance and therapy effectiveness especially for chronic conditions. Solids also have longer shelf lives than liquid/semi-solid alternatives due to inherent stability, reducing distribution costs.

Contract providers' strong regulatory compliance culture also gives pharmaceutical companies assurance when outsourcing proprietary solid oral drug formulations. Adherence to Current Good Manufacturing Practices (CGMP) norms mitigates quality and safety risks.

Thus, superior manufacturing efficiency, dosage accuracy benefits and longer stability have cemented solids' lead in the ophthalmic FDF segment. Looking forward, contract manufacturers are well-positioned to address future demand through their solid dosage form capabilities.

The major players operating in the ophthalmic drugs contract manufacturing market include Catalent, Recipharm, Akorn, Pillar5 Pharma, Sterling Pharmaceutical Services, Cayman Chemical, FARMIGEA, Lomapharm, Medichem, Salvat, Akums, Bal Pharma, Entod Pharmaceuticals, Glenmark Pharmaceuticals, Indiana Ophthalmics and Sunways India.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Ophthalmic Drugs Contract Manufacturing Market is segmented By Type of Product (APIs, FDFs), By Type...

Ophthalmic Drugs Contract Manufacturing Market

How big is the Ophthalmic Drugs Contract Manufacturing Market?

The Ophthalmic Drugs Contract Manufacturing Market is estimated to be valued at USD 1.81 in 2025 and is expected to reach USD 4.23 Billion by 2032.

What are the major factors driving the ophthalmic drugs contract manufacturing market growth?

The growing pipeline of ophthalmic drugs and therapies and increasing outsourcing activities for sterile manufacturing operations are the major factors driving the ophthalmic drugs contract manufacturing market.

Which is the leading type of product in the ophthalmic drugs contract manufacturing market?

The leading type of product segment is FDFs.

Which are the major players operating in the ophthalmic drugs contract manufacturing market?

Catalent, Recipharm, Akorn, Pillar5 Pharma, Sterling Pharmaceutical Services, Cayman Chemical, FARMIGEA, Lomapharm, Medichem, Salvat, Akums, Bal Pharma, Entod Pharmaceuticals, Glenmark Pharmaceuticals, Indiana Ophthalmics, and Sunways India are the major players.

What will be the CAGR of the ophthalmic drugs contract manufacturing market?

The CAGR of the ophthalmic drugs contract manufacturing market is projected to be 12.9% from 2025-2032.