Pressure Pumping Market Size - Analysis

The pressure pumping market is estimated to be valued at USD 79.24 Bn in 2025 and is expected to reach USD 123.14 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2032. The pressure pumping market is expected to see steady growth over the coming years, as pressure pumping remains a major expense for oilfield service providers.

Market Size in USD Bn

CAGR6.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.5% |

| Market Concentration | Medium |

| Major Players | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc. and Among Others |

please let us know !

Pressure Pumping Market Trends

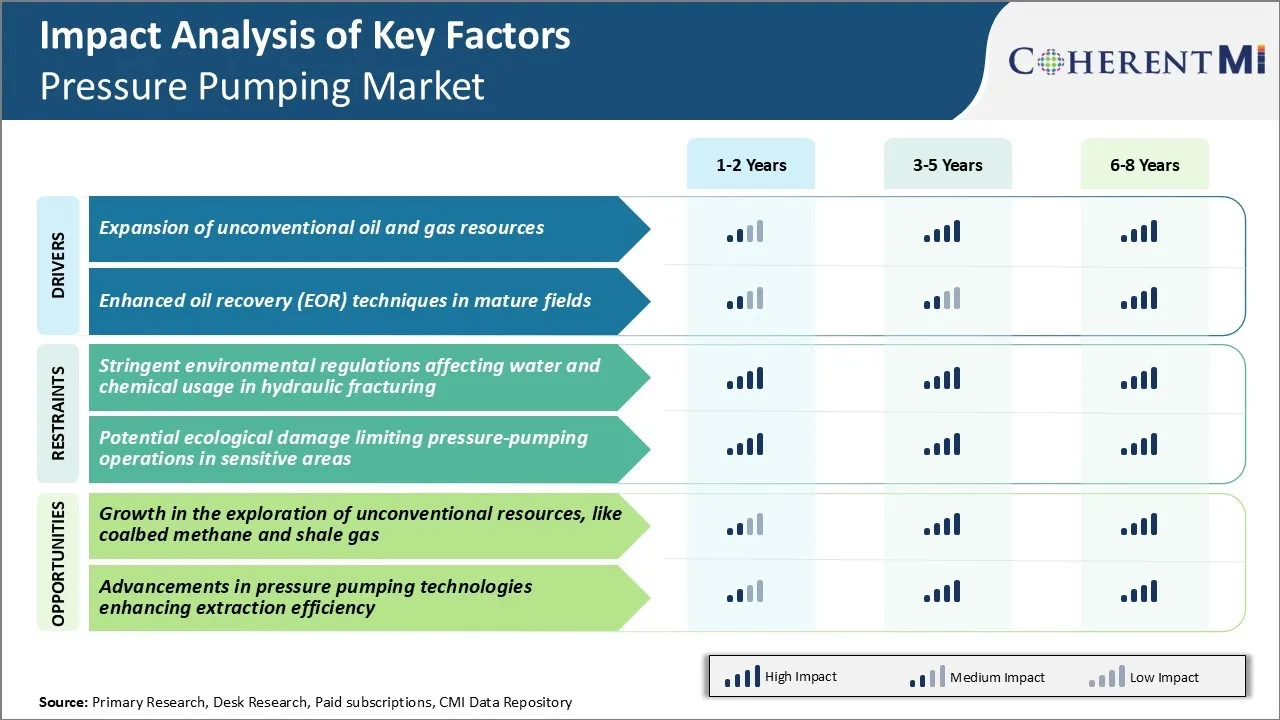

Market Driver - Expansion of Unconventional Oil and Gas Resources

Rise of unconventional oil and gas extraction from shale and other tight formations has created significant demand for pressure pumping services. This new shale revolution is driving immense pressure pumping requirements as more wells are drilled horizontally and require multiple fracture stimulation stages along the wellbore.

Many of the major shale plays such as the Marcellus, Bakken and Permian Basin continue to be extensively developed through intensive drilling campaigns. Furthermore, the applications of advanced completion techniques involving extensive fracturing of longer horizontal laterals are keeping pressure pumping contractors busy. Consequently, leading players in the pressure pumping market are assured of steady workload to unlock this vast unconventional potential through hydraulic fracturing.

Apart from North America, other regions like China, Argentina and Mexico are also beginning to develop their shale gas and oil assets. This will spur international demand for pressure pumping in the coming years. While the technological challenge is greater overseas due to more complex geology, international oil companies are collaborating with local partners and gearing up shale drilling and completion activities.

Market Driver - Enhanced Oil Recovery Techniques in Mature Fields

Operators in the pressure pumping market are implementing various enhanced oil recovery (EOR) techniques to maintain declining production levels and boost ultimate recovery from mature assets. EOR involves injection of different chemicals, gases or microbial solutions into reservoirs to recover oil which would otherwise be unproduced through traditional methods.

Regions with vast mature reservoirs like Middle East, Mexico, Canada and Southeast Asia are devoting large investments towards extensive EOR projects using gas, water as well as surfactant-polymer formulations. This growth in tertiary oil production methods translates to rising requirement for pressure pumping contractors well-versed in injection well workover and construction.

Overall, with conventional resources declining rapidly, EOR comes across as a strategic means for operators to substantially increase recoverable reserves base and address long-term energy demands. Hence players in the pressure pumping market can bank on the continued implementation and scale-up of various EOR techniques globally to fuel long-lasting business opportunities in support of mature asset revitalization and secondary/tertiary hydrocarbon recovery.

Market Challenge - Stringent Environmental Regulations Affecting Water and Chemical Usage in Hydraulic Fracturing

One of the key challenges faced by the pressure pumping market is the stringent environmental regulations affecting water and chemical usage in hydraulic fracturing. Excessive water usage and contamination of water sources due to fracturing fluid leakages have raised several environmental concerns. Many states and regions have now imposed strict limits on the amount of water that can be used by pressure pumping companies for each fracturing job.

Additionally, public pressure is mounting on regulatory agencies to mandate detailed disclosure of fracturing fluid compositions and impose restrictions on the type of chemicals that can be used. Complying with evolving environmental norms is increasing operational costs for pressure pumping service providers. They are expected to spend more on water recycling systems, rollout of environmentally friendly fracturing fluid formulations, and adherence to complex permitting procedures.

Unless credible solutions are found to reuse/reduce water usage and replace toxic chemicals, environmental compliance will remain a significant challenge for the long-term growth of the pressure pumping market.

Market Opportunity - Growth in Exploration of Unconventional Resources

One of the major opportunities for the pressure pumping market is the rising exploration of unconventional resources like coalbed methane and shale gas reserves. According to recent estimates, shale gas reserves have the potential to meet global natural gas demand growth for several decades. More countries are also exploring their coalbed methane reserves as a cleaner energy alternative. This presents lucrative opportunities for pressure pumping companies to provide fracturing services to gas producers and mid-stream companies investing in the development of unconventional plays.

With increasing capital investments flowing into the extraction of shale oil and gas in regions like North America, Argentina, and China, demand for pressure pumping is likely to grow substantially over the next 10-15 years. Market leaders are expanding their fleet of high-powered equipment and developing specialized fracturing solutions to capitalize on the imminent boom in unconventional energy development worldwide.

Key winning strategies adopted by key players of Pressure Pumping Market

Focus on technological innovation: Technological advancements have been critical for companies to improve efficiency and reduce costs. Halliburton introduced its fleet of next-generation frac fleet in 2019 equipped with Electronic Frac technology. Another leader, Schlumberger, invested over $1 billion in 2014-16 on technologies like modular frac flowback units and its SmartFleet digital perf & frac solution.

Expand service offerings: Major players like Schlumberger, Halliburton, Baker Hughes have expanded in the pressure pumping market traditional pressure pumping to offer well completion, cementing, drilling, and data analytics services. For example, Halliburton acquired cementing company CCS in 2015 for $637 million to expand its well construction portfolio.

Pursue strategic mergers & acquisitions: Consolidation has been a key strategy adopted by players to achieve economies of scale and cost synergies. In 2014, Halliburton acquired Baker Hughes for $34.6 billion forming the world's largest oilfield services company, combining pressure pumping capabilities. Schlumberger acquired frac sand supplier Fraser Sutton in 2018 and deepwater E&P firm Cameron in 2016.

Segmental Analysis of Pressure Pumping Market

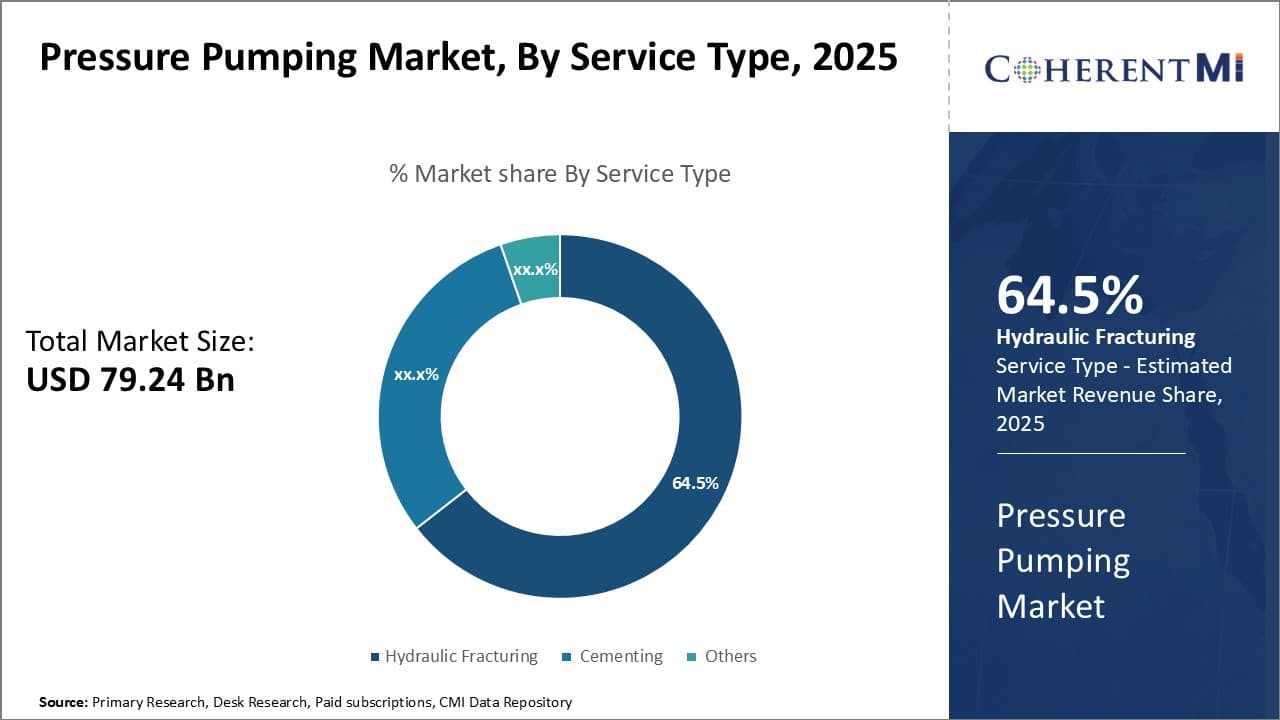

Insights, By Service Type: Technological Advancements Drive Hydraulic Fracturing Growth

In terms of service type, hydraulic fracturing services account for 64.5% share of the pressure pumping market in 2025. This is driven by continuous technological advancements that have improved efficiency and productivity.

Ongoing innovation in fracturing fluid formulations and proppant characteristics have allowed operators to achieve higher initial production rates from wells. Sophisticated hydraulic fracturing simulation and modeling software also help design optimal completion strategies tailored for specific reservoir conditions. This has supported increasing application of hydraulic fracturing even in challenging sub-surface environments.

Further breakthroughs in areas like advanced data analytics and fracture geometry will continue augmenting hydraulic fracturing activity, driving new trends in the pressure pumping market.

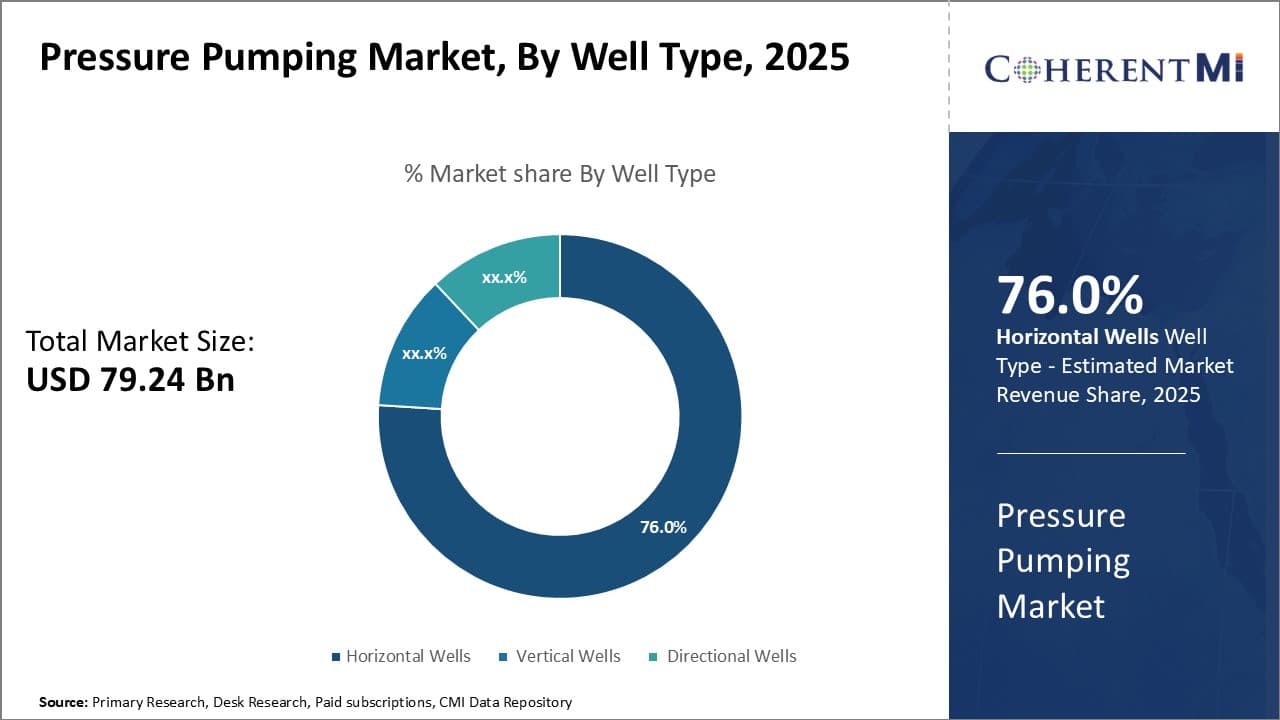

Insights, By Well Type: Abundance of Tight Oil Reserves Fuel Horizontal Well Demand

Insights, By Well Type: Abundance of Tight Oil Reserves Fuel Horizontal Well Demand

In terms of well type, horizontal wells are projected to hold 76% share of the pressure pumping market in 2025. This is due to the abundance of tight oil reserves that can be best exploited using horizontal laterals. The combination of horizontal drilling and hydraulic fracturing has unlocked huge volumes of tight oil from plays like the Bakken and Eagle Ford formations in the United States.

Horizontal laterals extending up to a kilometer in length provide maximum contact between the wellbore and formation for optimum drainage and stimulation of tight reservoirs. This has vastly increased well productivity compared to vertical wells.

Additionally, technological advances now allow highly accurate steering of horizontal laterals to optimal zones within oil-bearing formations. Such precision drilling capabilities are necessary to extract unconventional resources efficiently and maximize ultimate oil recovery from horizontal wells over the long run.

Insights, By Application: Abundant Resources and Infrastructure Drive Onshore Dominance

In terms of application, onshore contributes the highest share of the market owing to abundant hydrocarbon resources and well-established infrastructure. North American onshore basins like Permian and Marcellus/Utica host giant unconventional oil and gas deposits that are economically recoverable through techniques like hydraulic fracturing and horizontal drilling.

Truly massive scales of production are possible onshore by leveraging extensive road and pipeline infrastructure for transportation of inputs and outputs. In contrast, offshore operations pose considerable infrastructure and logistical challenges besides higher development costs. In many regions like the United States, the onshore sector also faces significantly lesser regulatory barriers relative to offshore projects.

Overall, the onshore segment remains the fulcrum of growth for the pressure pumping market globally underpinned by access to prolific reserves and streamlined development pathways.

Additional Insights of Pressure Pumping Market

- North America holds approximately 55% of the global pressure pumping market share, primarily due to extensive shale gas exploration.

- The hydraulic fracturing segment accounts for over 60% of the pressure pumping market revenue, highlighting its dominance in the industry.

- Onshore applications constitute about 75% of the pressure pumping market, driven by easier accessibility and lower operational costs compared to offshore projects.

- The shift towards electric-powered fracturing fleets is becoming more prominent, aiming to reduce carbon emissions and improve efficiency in pressure pumping operations.

- Automation and digitalization are being increasingly adopted to enhance operational accuracy and safety in pressure pumping services.

Competitive overview of Pressure Pumping Market

The major players operating in the pressure pumping market include Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., Patterson-UTI Energy, Inc., Superior Energy Services, Inc. and RPC, Inc.

Pressure Pumping Market Leaders

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco, Inc.

Pressure Pumping Market - Competitive Rivalry

Pressure Pumping Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Pressure Pumping Market

- In July 2023, Schlumberger Limited partnered with a leading software company to enhance its digital pressure pumping solutions. This collaboration aims to improve real-time data analytics and operational efficiency, potentially reducing downtime and operational costs.

- In May 2023, Halliburton Company introduced a new hydraulic fracturing technology that reduces water usage by 25%. This development not only addresses environmental concerns but also lowers operational expenses, making pressure pumping more sustainable.

- In April 2023, Kirloskar Brothers Limited launched the DBxe Pump in India, aimed at significantly improving efficiency in pressure pumping processes. The pump is designed with advanced features, including a back pull-out design and options for construction materials such as cast iron, bronze, CF8, and CF8M, which contribute to its durability.

- In March 2023, Baker Hughes Company acquired a stake in an emerging tech firm specializing in electric-powered fracturing fleets. This move is expected to reduce carbon emissions and align with global sustainability goals.

Pressure Pumping Market Segmentation

- By Service Type

- Hydraulic Fracturing

- Cementing

- Others

- Acidization

- Nitrogen Services

- By Well Type

- Horizontal Wells

- Vertical Wells

- Directional Wells

- By Application

- Onshore

- Offshore

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the pressure pumping market?

The pressure pumping market is estimated to be valued at USD 79.24 Bn in 2025 and is expected to reach USD 123.14 Bn by 2032.

What are the key factors hampering the growth of the pressure pumping market?

Stringent environmental regulations affecting water and chemical usage in hydraulic fracturing and potential ecological damage limiting pressure-pumping operations in sensitive areas are the major factors hampering the growth of the pressure pumping market.

What are the major factors driving the pressure pumping market growth?

Expansion of unconventional oil and gas resources and enhanced oil recovery techniques in mature fields are the major factors driving the pressure pumping market.

Which is the leading service type in the pressure pumping market?

The leading service type segment is hydraulic fracturing.

Which are the major players operating in the pressure pumping market?

Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., Patterson-UTI Energy, Inc., Superior Energy Services, Inc., and RPC, Inc. are the major players.

What will be the CAGR of the pressure pumping market?

The CAGR of the pressure pumping market is projected to be 6.5% from 2025-2032.