PV Inverters Market Size - Analysis

Market Size in USD Bn

CAGR18.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 18.5% |

| Market Concentration | High |

| Major Players | Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group and Among Others |

please let us know !

PV Inverters Market Trends

The threat posed by climate change has become increasingly evident in recent decades. Devastating natural disasters like wildfires, hurricanes and droughts have intensified due to rising global temperatures. In response to growing environmental concerns, many countries have implemented policies to reduce greenhouse gas emissions and support renewable energy adoption.

Technological advances have made renewable power sources like solar increasingly viable and cost-competitive alternatives to fossil fuels. Photovoltaic (PV) inverters play an essential role in enabling homes and facilities to benefit from solar power generation. Growing need for robust, high-quality inverters to maximize that renewable generation will drive growth for the PV inverters market in the coming years.

Market Driver - Decreasing Solar Prices Drive Wider Accessibility and Adoption

These steep cost decreases have made rooftop solar financially accessible to vastly more homeowners and companies. Plunging prices position solar power as a compelling option compared to traditional fossil fuel sources, increasing its appeal beyond early fans and enthusiasts. Even those without existing incentive structures can find that solar provides long-term electricity cost savings.

Market Challenge - Inconsistent Regulatory Frameworks Affecting Installation and Standards

The permitting procedures and technical specifications vary widely, requiring customized solutions. This regulatory complexity increases costs for both manufacturers who must navigate a maze of certification protocols, as well as for EPC firms and installers who may face delays in getting new projects approved. Lack of harmonization at a global level has slowed the rate of technology transfer and new product introductions across borders.

The PV inverters market is poised to witness tremendous growth opportunities driven by the global surge in demand for solar photovoltaic systems aimed at reducing carbon emissions and improving energy independence. Climate change mitigation efforts are growing. As solar capacity additions expand around the world, the demand for necessary balance of systems components like PV inverters will scale up proportionately.

Key winning strategies adopted by key players of PV Inverters Market

Focus on technology innovation - Constant innovation in inverter technology has helped players gain an edge. More recently, companies like Enphase have introduced microinverters and Huawei introduced their string inverters with 96% efficiency, both boosting customer value.

Focus on after-sales service - Establishing strong service networks has helped companies increase customer satisfaction and trust. For example, Huawei and Fimer strengthened foothold in Europe in 2019 by setting up local warehouses and partner programs for faster repairs/replacements.

Target emerging markets - Early focus on China, India and other developing markets has paid off for top players.

Segmental Analysis of PV Inverters Market

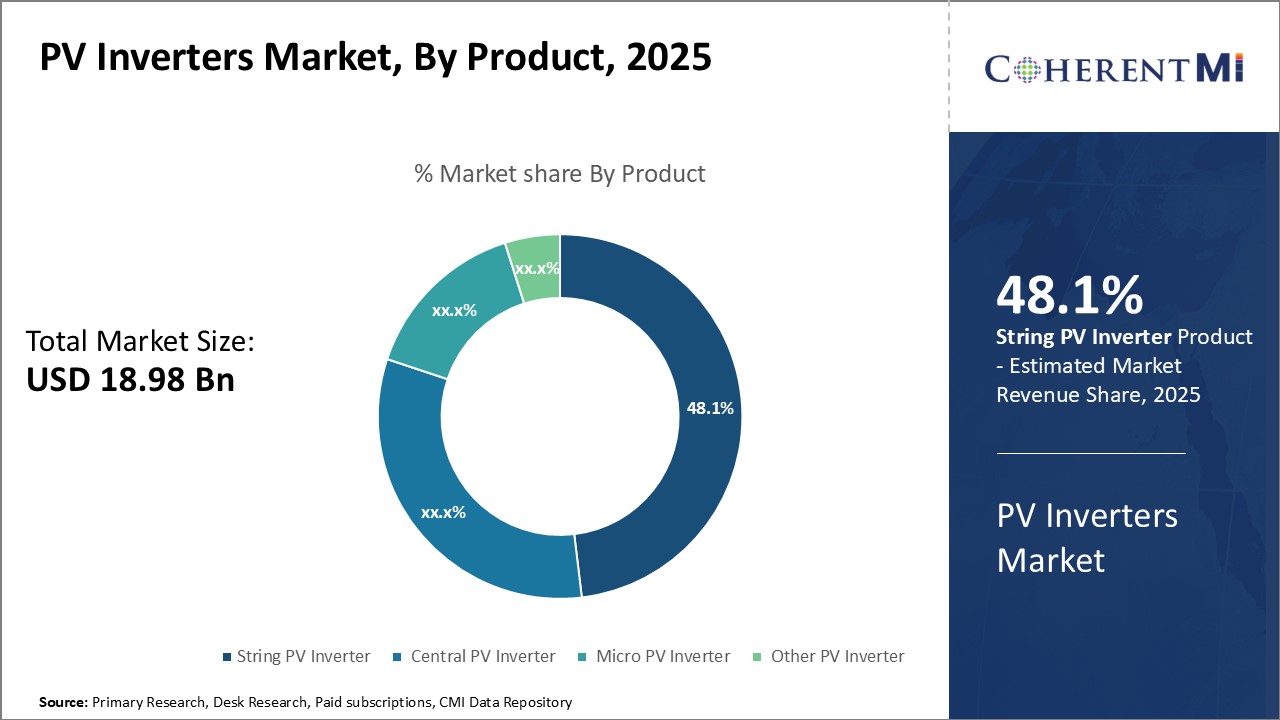

Insights, By Product: String PV Inverter Dominate the Market

Insights, By Product: String PV Inverter Dominate the MarketIn terms of product, string PV inverter contribute 48.1% share of the PV inverters market in 2025, owning to their compatibility and scalability. They are designed to handle strings of solar panels connected in series.

Ease of installation is another key factor driving the popularity of string inverters. As each string has its own dedicated microinverter, installation involves simply connecting the strings in parallel. String inverters continue to gain market share through ongoing enhancements in monitoring capabilities as well. This boosts system transparency and empowers users to maximize energy yields, contributing to recent trends in the PV inverters market.

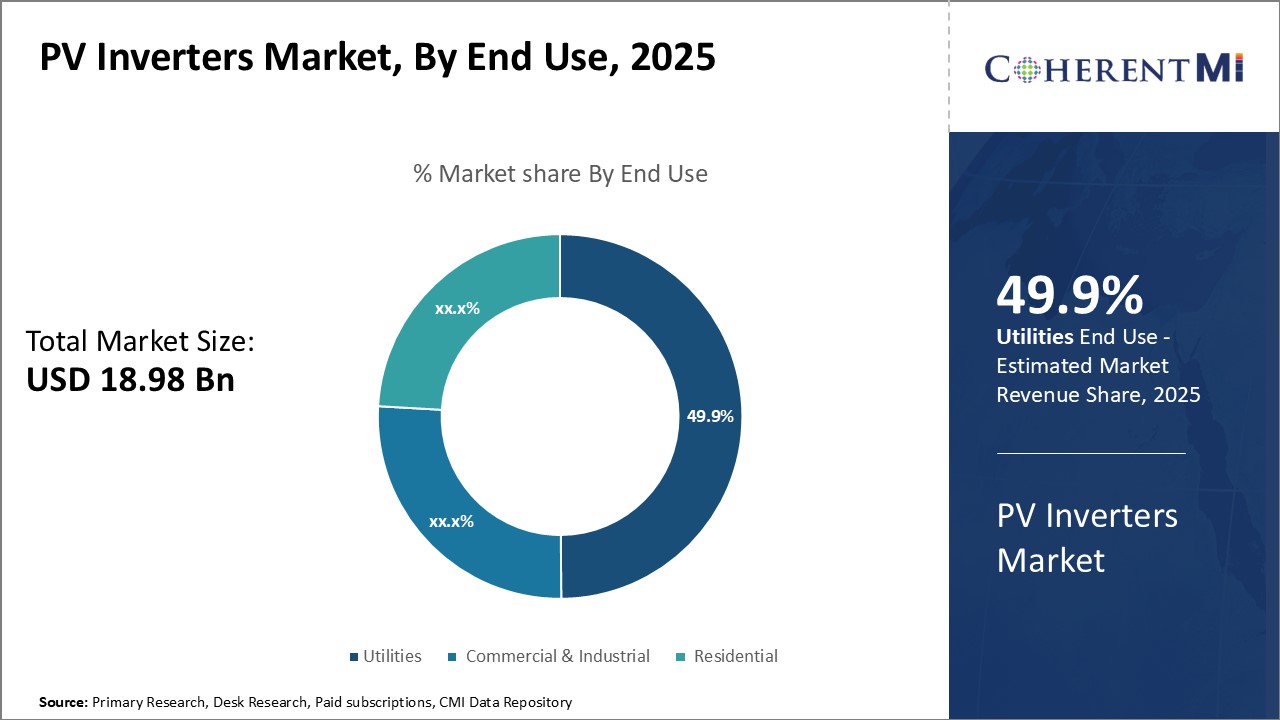

The utilities segment holds the largest share of the PV inverters market due to strong political motives for expanding the use of solar and other renewable energy sources. Many national and local governments have established mandates requiring that a certain percentage of electricity comes from clean, carbon-free generation by specific deadlines. Compliance is heavily driving utility-scale solar farm development.

As long as statutes prioritize renewable portfolio standards, the utilities segment will continue driving central and other large inverter adoption. Political will remains the primary driver of their prominence in the PV inverters market.

Additional Insights of PV Inverters Market

- Asia Pacific: The region held a 45% share in PV inverters market in 2023 due to high solar installations, notably in China and India, where government policies support renewable energy growth.

- North America: Led by the US and Canada, driven by supportive policies and research investments, further expanding the PV inverters market.

- Utilities segment dominated the PV inverters market in 2023 with a 45% share due to increased renewable energy demands and governmental incentives.

- PV inverters have achieved an average energy conversion efficiency of 98%, making them a critical component in maximizing solar power utilization.

Competitive overview of PV Inverters Market

The major players operating in the PV inverters market include Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Fronius International GmbH, and ABB Ltd.

PV Inverters Market Leaders

- Delta Electronics, Inc.

- SMA Solar Technology AG

- Eaton Corporation plc

- Emerson Electric Co.

- Fimer Group

PV Inverters Market - Competitive Rivalry

PV Inverters Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in PV Inverters Market

- In June 2024, Huawei Technologies Co., Ltd. announced a strategic partnership with a major utility company to deploy large-scale PV inverter systems, expanding their footprint in the commercial sector.

- In March 2024, SolarEdge Technologies Inc. launched a new high-efficiency inverter model, enhancing performance by 15%. This development strengthens their market position and offers consumers more efficient energy solutions.

- In February 2024, Sungrow Power Supply Co. Ltd. launched the “SG iNext” string inverter series with grid support improvements, targeting efficiency gains.

- In February 2024, SMA Solar Technology AG formed a strategic partnership with ENGIE to accelerate solar and storage solutions in Europe, enhancing distributed energy capabilities.

PV Inverters Market Segmentation

- By Product

- String PV Inverter

- Central PV Inverter

- Micro PV Inverter

- Other PV Inverter

- By End Use

- Utilities

- Commercial & Industrial

- Residential

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the PV inverters market?

The PV inverters market is estimated to be valued at USD 18.98 Bn in 2025 and is expected to reach USD 62.28 Bn by 2032.

What are the key factors hampering the growth of the PV inverters market?

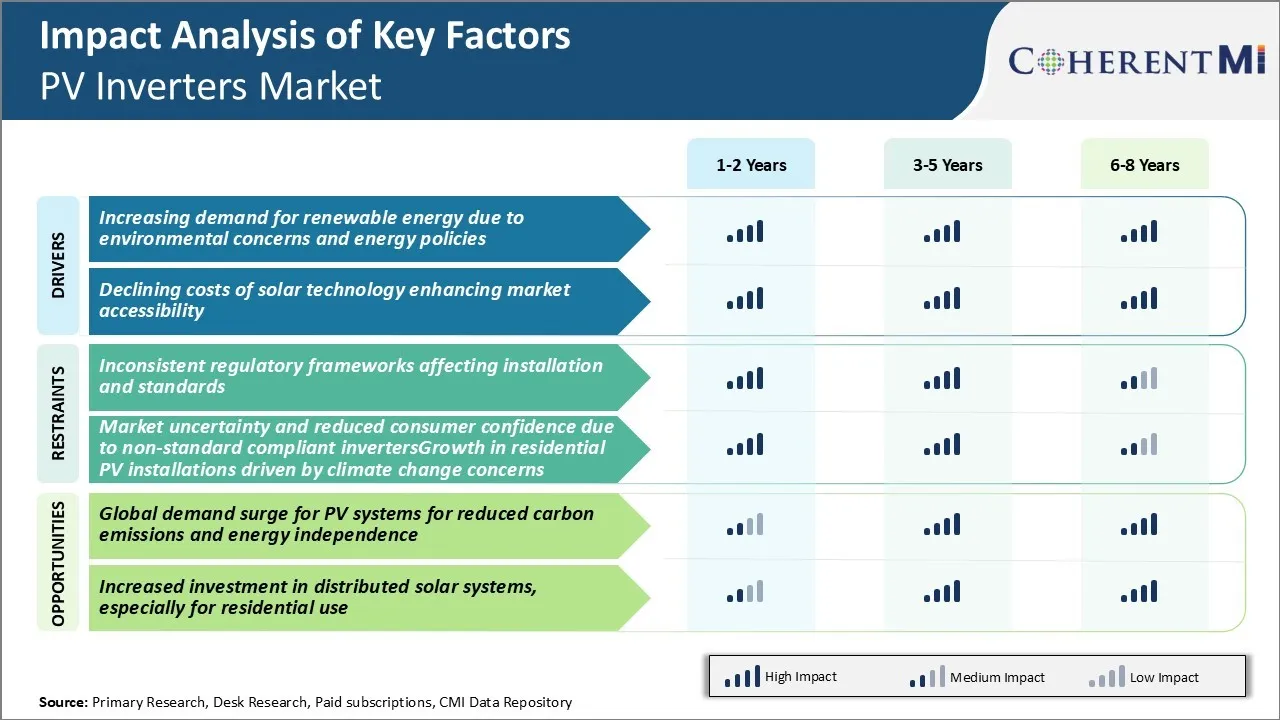

Inconsistent regulatory frameworks and reduced consumer confidence due to non-standard compliant inverters growth in residential PV installations are the major factors hampering the growth of the PV inverters market.

What are the major factors driving the PV inverters market growth?

Increasing demand for renewable energy and declining costs of solar technology enhancing market accessibility are the major factors driving the PV inverters market.

Which is the leading product in the PV inverters market?

The leading product segment is string PV inverter.

Which are the major players operating in the PV inverters market?

Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Fronius International GmbH, ABB Ltd. are the major players.

What will be the CAGR of the PV inverters market?

The CAGR of the PV inverters market is projected to be 18.5% from 2025-2032.