The Rechargeable Tires Market size is expected to reach US$ 2611.5 million by 2032, from US$ 322.9 million in 2025, at a CAGR of 34.8% during the forecast period.

Rechargeable Tires Market Analysis

Rechargeable tires are innovative tires that can regenerate and recharge themselves while driving using different technologies. They provide benefits like improved fuel efficiency, low maintenance and enhanced durability. Key drivers of the market include increasing demand for eco-friendly tires, rising adoption of electric vehicles and focus on improving fuel efficiency.

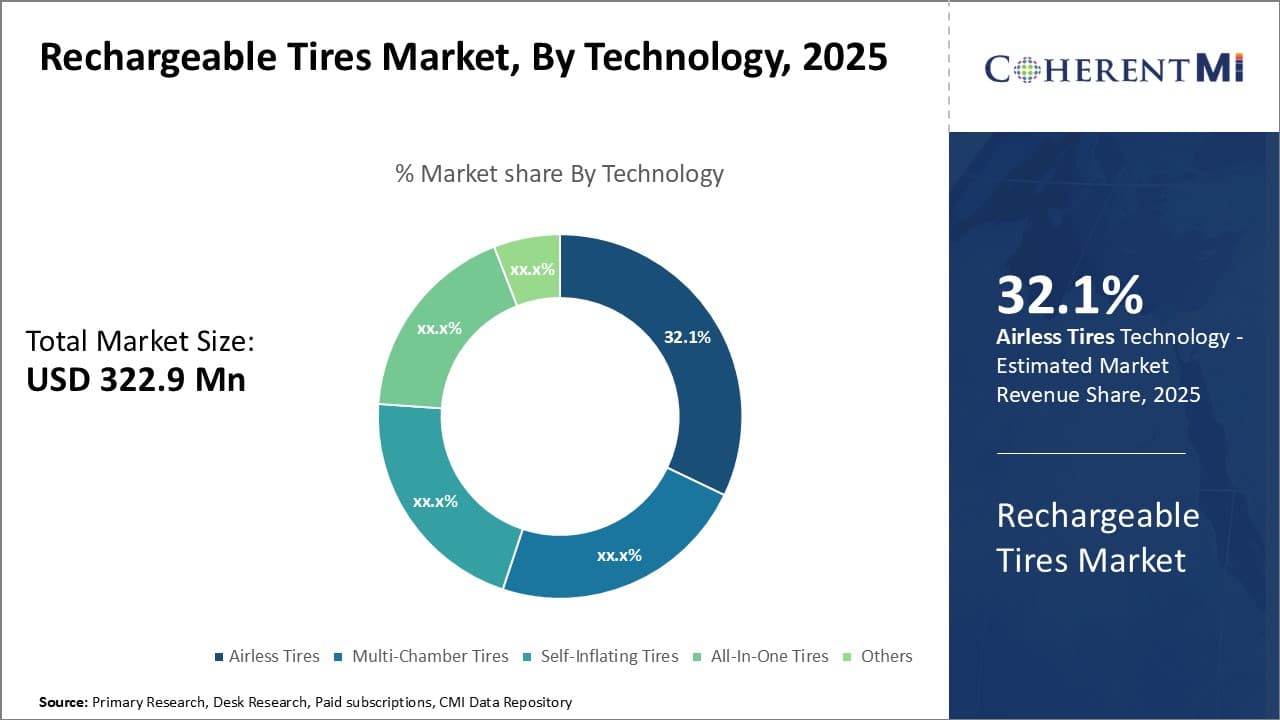

The Rechargeable Tires Market is segmented by technology, vehicle type and region. By technology, the market is segmented into airless tires, multi-chamber tires, self-inflating tires and all-in-one tires. The airless tires segment is expected to dominate the market during the forecast period owing to benefits like no risk of puncture and improved fuel efficiency.

Rechargeable Tires Market Drivers:

Rechargeable Tires Market Opportunities

Rechargeable Tires Market Restraints

Market Size in USD Mn

CAGR34.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 34.8% |

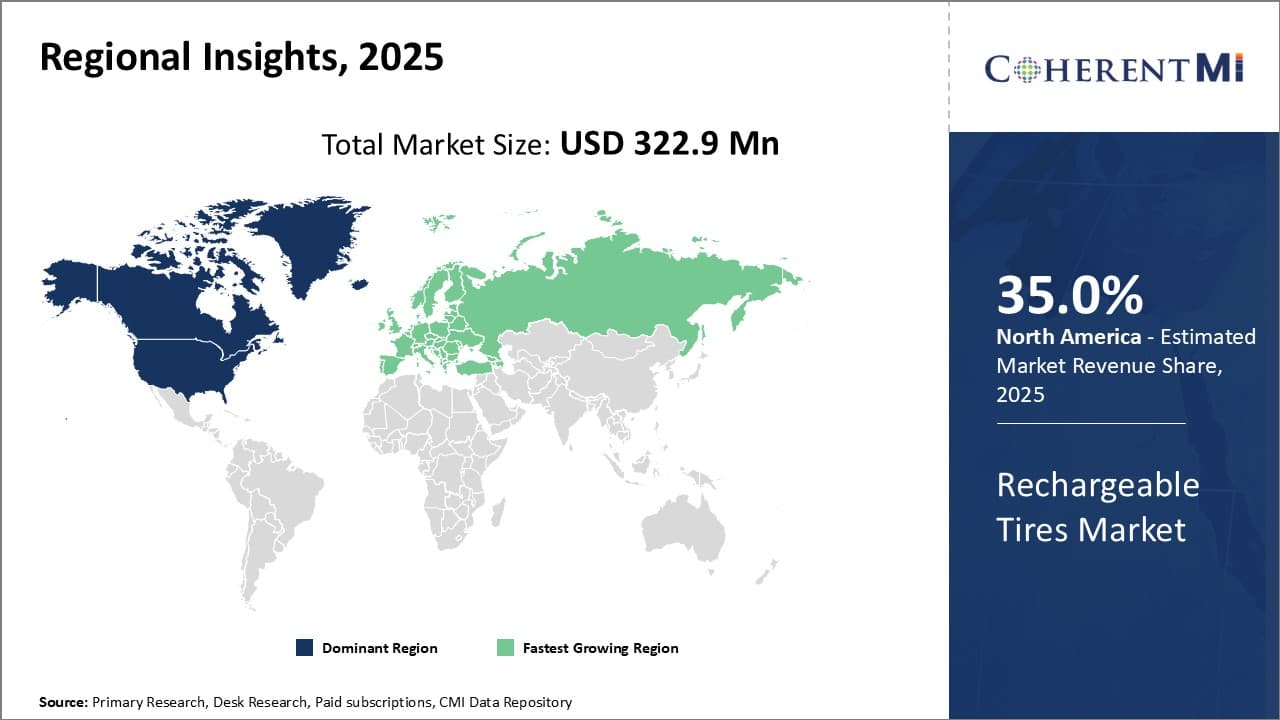

| Fastest Growing Market | Europe |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Michelin, Goodyear, Pirelli, Hankook, Continental and Among Others |

Rechargeable Tires Market Regional Insights

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample CopyMichelin, Goodyear, Pirelli, Hankook, Continental, Yokohama, Cooper Tire, Kumho Tire, Toyo Tires, Nokian Tyres.

Rechargeable Tires Market Industry Overview:

With the growing concern for environmental sustainability and the increasing demand for energy-efficient solutions, rechargeable tires have gained significant traction in the market. They contribute to reducing carbon emissions and conserving energy by eliminating the need for air pumps and frequent tire replacements.

Additionally, the automotive industry's shift towards electric and hybrid vehicles has further fueled the demand for rechargeable tires. These vehicles require tires that can withstand the unique challenges associated with battery-powered vehicles, such as increased weight and torque. Rechargeable tires provide the necessary stability and performance, making them an ideal choice for electric and hybrid vehicles.

Moreover, the global automotive market is witnessing significant growth, with a rise in vehicle sales and a surge in urbanization. This has led to an increased demand for advanced and efficient tires. Rechargeable tires offer a sustainable solution to address these market demands, promoting a greener and more efficient transportation system.

As the market for rechargeable tires continues to expand, it is crucial for industry players to stay abreast of the latest trends, technologies, and market dynamics. In this context, market research plays a vital role in providing valuable insights and strategic recommendations for businesses operating in this sector.

Would you like to explore the option of buying individual sections of this report?

Suraj Bhanudas Jagtap is a seasoned Senior Management Consultant with over 7 years of experience. He has served Fortune 500 companies and startups, helping clients with cross broader expansion and market entry access strategies. He has played significant role in offering strategic viewpoints and actionable insights for various client’s projects including demand analysis, and competitive analysis, identifying right channel partner among others.

Rechargeable Tires Market is Segmented By Technology (Airless Tires, Multi-Chamber Tires, Self-Infla...

Rechargeable Tires Market

How big is the Rechargeable Tires Market?

The Rechargeable Tires Market is estimated to be valued at USD 322.90 in 2025 and is expected to reach USD 2611.50 Million by 2032.

What are the major factors driving the Rechargeable Tires Market growth?

Demand for eco-friendly tires, adoption of EVs, focus on fuel efficiency, advancement in technologies, stringent emission norms, tire digitization.

Which is the leading component segment in the Rechargeable Tires Market?

The airless tires segment leads the Rechargeable Tires Market owing to benefits like no punctures, improved durability, better fuel efficiency.

Which are the major players operating in the Rechargeable Tires Market?

Michelin, Goodyear, Pirelli, Hankook, Continental, Yokohama, Cooper Tire, Kumho Tire, Toyo Tires, Nokian Tyres.

Which region will lead the Rechargeable Tires Market?

North America is expected to continue leading the Rechargeable Tires Market during the forecast period.

What will be the CAGR of Rechargeable Tires Market?

The Rechargeable Tires Market is expected to grow at a CAGR of 34.8% during 2025-2032.