Sleep Tech Devices Market Size - Analysis

The sleep tech devices market is estimated to be valued at USD 23.38 Bn in 2025 and is expected to reach USD 72.30 Bn by 2032, growing at a compound annual growth rate (CAGR) of 17.5% from 2025 to 2032.

The sleep tech devices market is expected to witness promising growth trends over the forecast period. Factors such as the rising awareness about the importance of good quality sleep, increasing health issues due to sleep deprivation like stress, obesity etc., growing internet penetration and adoption of connected devices are expected to drive the demand for smart and advanced sleep tech devices. Furthermore, continuous technological advancements in sleep devices like integration of AI and sensors for real time monitoring are also anticipated to boost the adoption of smart sleep tech devices from 2025 to 2032. However, data privacy and security concerns with smart sleep tech devices might hinder the market growth.

Market Size in USD Bn

CAGR17.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 17.5% |

| Market Concentration | High |

| Major Players | Koninklijke Philips N.V., Huawei Device Co Ltd., ResMed, Xiaomi, Apple Inc. and Among Others |

please let us know !

Sleep Tech Devices Market Trends

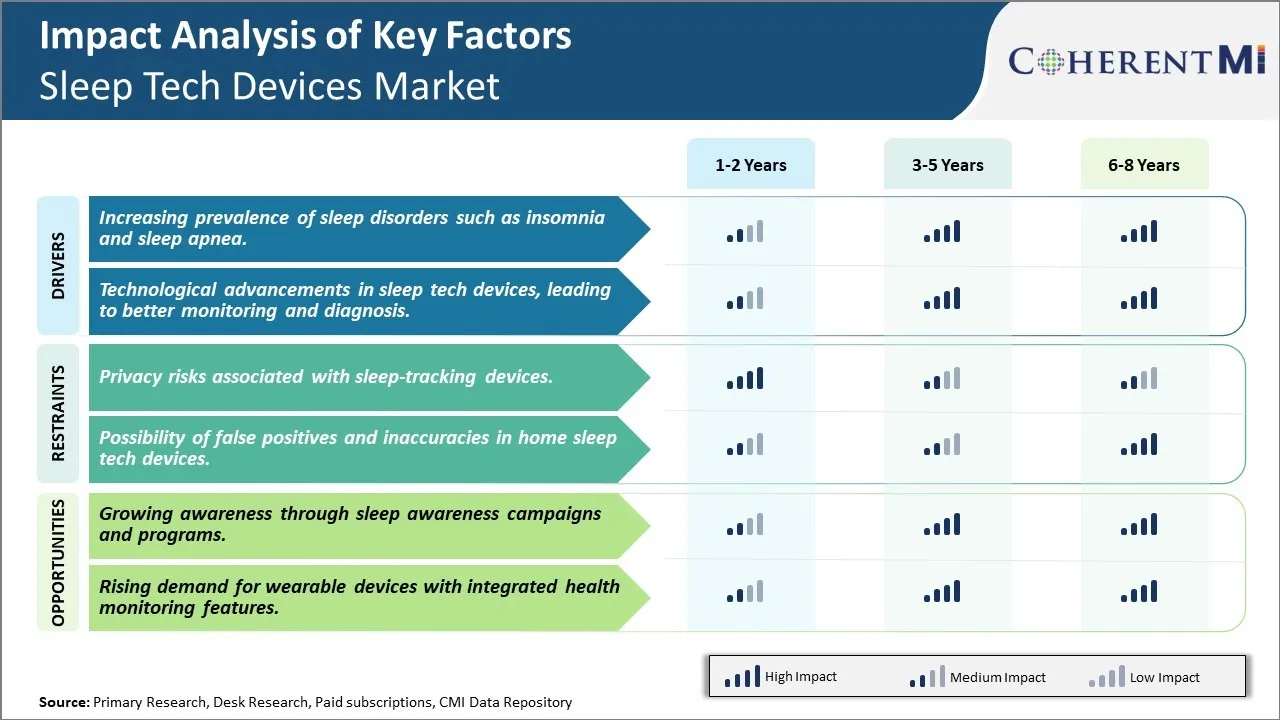

Market Driver - Increasing prevalence of sleep disorders such as insomnia and sleep apnea

The rising occurrence of sleep disorders among people across various age groups has been a significant factor augmenting growth in the sleep tech devices market. Numerous clinical research studies over the past decade have highlighted that sleep disorders like insomnia and sleep apnea are impacting a substantial proportion of the world population. It is estimated that around 10-30% of adults suffer from insomnia, characterized by difficulty falling or staying asleep. Insomnia can be both short-term, brought on by work stress or relationship issues for example, or long-term (chronic) when symptoms last for at least three nights a week for over three months.

Similarly, obstructive sleep apnea (OSA), which causes interrupted breathing during sleep due to collapse of the upper airway, affects around 4% of men and 2% of women globally. Risk factors like obesity, family history and other underlying medical ailments increase OSA risk multi-fold. The condition impairs daytime functioning through fragmented sleep and hypoxia, elevating health risks for high blood pressure, heart disease, diabetes and stroke over time if left untreated. Growing health awareness coupled with rising sedentary lifestyles and ageing populations are primary reasons behind the increasing prevalence of these conditions.

Market Driver - Technological advancements in sleep tech devices

Major technological innovations in recent years have enabled sleep tech devices to become more sophisticated tools for effective sleep monitoring and diagnostics. Advanced biosensor technologies along with improved computing power and data storage capabilities have transformed basic sleep activity trackers into clinically-validated medical devices. Smartwatches and fitness bands now integrate cutting-edge photoplethysmography (PPG) sensors that can accurately measure heart rate, blood oxygen saturation and other vital signs during sleep. When combined with motion sensors and proprietary algorithms, these non-contact PPG sensors allow comprehensive sleep stage tracking and apnea detection comparable to polysomnography (PSG).

At the same time, manufacturers have been miniaturizing medical-grade actigraphy devices and pulse oximeters to make overnight home sleep testing more convenient. Newer Bluetooth-enabled devices can seamlessly transmit recorded data to sleep specialists for cloud-based analysis, circumventing the need for in-lab PSG. AI and machine learning are also finding increasing usage to glean deeper insights from vast amounts of collected sleep data. This enables personalized diagnosis, therapy guidance and remote monitoring capabilities. Such pioneering technological solutions have elevated the diagnostic potential of wearables and home monitors, significantly expanding access to professional sleep healthcare.

Market Challenge - Privacy risks associated with sleep-tracking devices

One of the key challenges currently faced by the sleep tech devices market is privacy risks associated with sleep-tracking devices. These devices collect highly sensitive personal data related to user's sleep patterns, heart rate, breathing patterns and other biometrics. However, there are genuine concerns about how securely this personal data is stored and managed by various device manufacturers and related mobile apps.

Many users fear that their personal sleep data could be stolen or leaked by hackers, as sleep-tracking devices and apps often require internet connectivity. There are also issues around how user consent is obtained regarding use of their personal data and to what extent this sensitive sleep data might be shared with third parties. Device manufacturers need to work on adopting industry standard data privacy and security practices to address users' confidentiality and security concerns. Unless privacy risks are mitigated through seamless implementation of privacy by design approach, it may hinder adoption of sleep tech devices.

Market Opportunity - Growing awareness through sleep awareness campaigns and programs

One significant opportunity area for the sleep tech devices market is growing awareness about importance of quality sleep through various educational campaigns and programs. Lack of proper sleep has been identified as a global health issue by organizations like WHO. However, many people remain unaware or underestimate how insufficient or poor quality sleep impacts overall health and wellbeing.

Rising focus of healthcare providers, non-profits as well as device manufacturers on sleep health education can drive awareness and change people's sleep habits and priorities. Through initiatives like 'Sleep Awareness Week' and 'World Sleep Day', general public especially high risk demographics like college students and elder population are getting informed about significance of good sleep, common sleep disorders and role of tracking devices. Growing health consciousness and acceptance of self-monitoring trend are encouraging people to track and optimize their sleep with wearable tech solutions. Continued efforts of stakeholders in promoting sleep health awareness can help boost adoption of sleep tech devices market.

Key winning strategies adopted by key players of Sleep Tech Devices Market

Continued innovation is key to success in this growing market. Players like Sleep Number and Philips Respironics have invested heavily in R&D to develop new sleep solutions. For example, Sleep Number launched its newest 360 smart bed in 2018 which allows adjustment via app and tracks sleep data. This helped Sleep Number maintain its leading position.

Companies are partnering or acquiring up-and-coming startups to gain access to new technologies and customers. For example, in 2017, ResMed acquired MatrixCare and Propeller Health, expanding its digital health portfolio. Fitbit also acquired sleep tracking company Pebble in 2016. These strategic moves helped companies expand their solutions offerings.

Leveraging data has been critical. Companies like SleepScore Labs are analyzing huge anonymized datasets to generate personalized insights. Fitbit launched a sleep coaching program in 2019 using data from its millions of users to better understand sleep patterns. Such data-driven services help maintain customer engagement and stickiness.

Identifying new growth avenues has aided market penetration. For example, Withings entered the professional sleep testing market in 2018 with Sommeil, helping expand its total addressable market beyond consumers. Xiaomi also focused on Asia and saw huge growth in its sleep device sales in India and China in recent years.

Positive clinical evidence: Providing clinical validation has helped gain physicians' and customers' trust. Studies have shown ResMed's APAP therapy reduced AHI events by 86% on average. Such evidence positions a company as the clinically-validated solution, aiding sales.

Segmental Analysis of Sleep Tech Devices Market

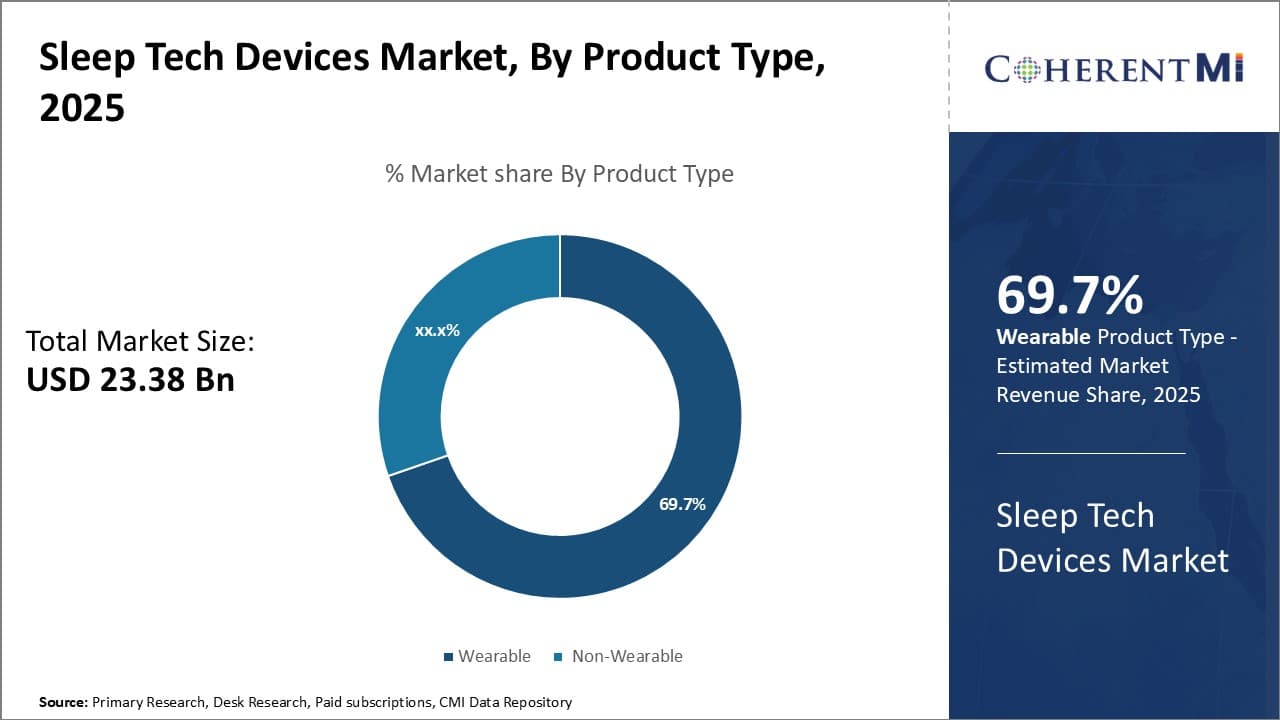

Insights, By Product Type: Wearables sub-segment dominate the sleep tech devices market due to convenience and growing health monitoring trends

Insights, By Product Type: Wearables sub-segment dominate the sleep tech devices market due to convenience and growing health monitoring trends

The wearable sub-segment contributes the highest share of 69.7% within the sleep tech devices market owing to convenience and growing interest in health monitoring. Wearables allow patients to monitor sleep quality and identify issues from the comfort of their own home, without needing medical equipment or facilities. As sleep disorders have risen in recent years, individuals are increasingly proactive about understanding their sleep patterns and catching issues early.

Wearables make this possible through built-in sensors and companion mobile apps. Popular options like fitness trackers and smartwatches have expanded their focus beyond exercise to also track sleep stages, heart rate variability, oxygen levels, and other biometrics during rest. Their small, lightweight designs mean users can wear them overnight without discomfort. Data is then synced to mobile apps that provide visualizations of sleep statistics and identify areas for improvement.

Some advanced wearables go beyond basic monitoring to offer personalized sleep coaching programs and triggers to help enforce good sleep hygiene. Their always-on connectivity also enables remote monitoring by physicians, who can track patients' progress outside of in-office visits. This level of on-going oversight is crucial for managing chronic sleep disorders. As technology continues advancing sensing capabilities and artificial intelligence, wearables are positioned to diagnose issues autonomously in the future as well.

Their appeal as lifestyle devices has fueled mainstream adoption trends that drive the wearables segment. Users appreciate the additional health insights beyond just step counts. Meanwhile, aging populations and busier schedules increase demand for convenient, at-home solutions rather than facility-dependent treatments. As such, wearables remain the preferred choice for passive, long-term sleep monitoring and management within the expanding sleep tech devices industry.

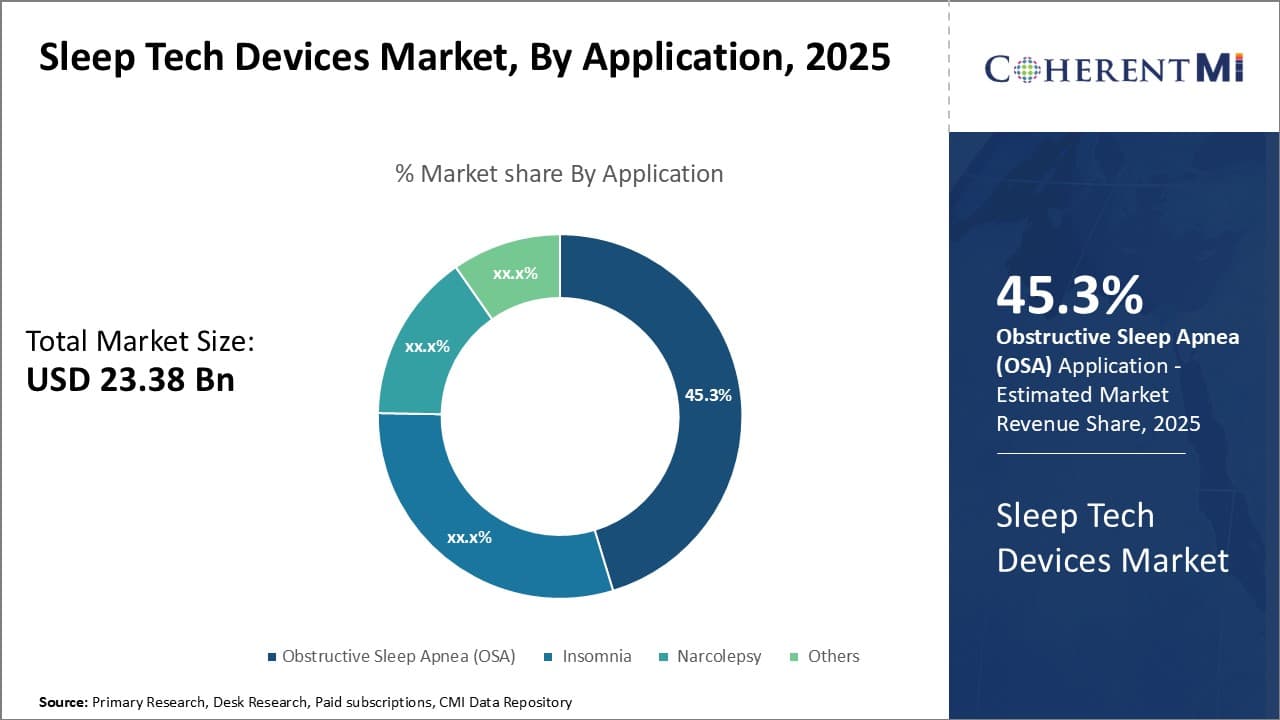

Insights, By Application: Obstructive sleep apnea remains the primary target for sleep tech devices due to its prevalence and severity

The obstructive sleep apnea (OSA) sub-segment accounts for the largest share of 45.3% in the sleep tech devices market. OSA is a highly common yet under-diagnosed disorder where breathing stops intermittently during sleep due to upper airway collapse. Left untreated, it increases the risks of serious health issues like heart disease, diabetes, and depression. With estimates showing over 25 million Americans may have moderate to severe OSA, there remains a large patient pool in need of effective treatment options.

Conventional methods like CPAP therapy can be uncomfortable and lead to low compliance rates. However, the development of new oral appliances and position trainers provide alternatives through milder interventions. Meanwhile, the rise of home sleep testing using wearables and other devices has expanded diagnostic accessibility in recent years. Their ease of use facilitates testing large at-risk demographics like truck drivers or shift workers not able to schedule traditional facility-based polysomnograms.

Technological advances also allow monitoring treatment effectiveness objectively. Compliance data from CPAP machines or position tracking from oral appliances help physicians optimize therapies over time. This push for screening and effective long-term management will continue driving the market size of OSA-focused sleep tech devices. Their ability to alleviate what is often debilitating daytime sleepiness also improves patient quality of life and productivity. With OSA incidence projected to grow further with an aging population, this application segment remains vital for the sector overall.

Competitive overview of Sleep Tech Devices Market

The major players operating in the sleep tech devices market include Koninklijke Philips N.V., Huawei Device Co Ltd., ResMed, Xiaomi, Apple Inc., Emfit Corp., Masimo, Garmin Ltd., Compumedics Limited, NIHON KOHDEN CORPORATION, Cadwell Industries Inc., Eight Sleep, Oura Health Oy, Sleep Shepherd LLC, Sleepace, Apollo Neuroscience Inc., Braebon Medical Corporation, Belun Technology, Nyxoah and Somnology, Inc.

Sleep Tech Devices Market Leaders

- Koninklijke Philips N.V.

- Huawei Device Co Ltd.

- ResMed

- Xiaomi

- Apple Inc.

Sleep Tech Devices Market - Competitive Rivalry

Sleep Tech Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sleep Tech Devices Market

- In February 2022, Xiaomi launched the Redmi Smart Band Pro in India, featuring heart rate monitoring, SPO2 tracking, and sleep monitoring.

- In August 2021, ResMed introduced AirSense 11, a next-generation PAP device aimed at enhancing sleep apnea treatment.

- In June 2021, Huawei launched the HUAWEI Watch 3 Pro, which tracks sleep quality, stress levels, and other health metrics.

Sleep Tech Devices Market Segmentation

- By Product Type

- Wearable

- Non-Wearable

- By Application

- Obstructive Sleep Apnea (OSA)

- Insomnia

- Narcolepsy

- Others

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the Sleep Tech Devices Market?

The Sleep Tech Devices Market is estimated to be valued at USD 23.38 in 2025 and is expected to reach USD 72.30 Billion by 2032.

What are the major factors driving the sleep tech devices market growth?

The increasing prevalence of sleep disorders such as insomnia and sleep apnea and technological advancements in sleep tech devices, leading to better monitoring and diagnosis are the major factors driving the sleep tech devices market.

Which is the leading product type in the sleep tech devices market?

The leading product type segment is wearable.

Which are the major players operating in the sleep tech devices market?

Koninklijke Philips N.V., Huawei Device Co Ltd., ResMed, Xiaomi, Apple Inc., Emfit Corp., Masimo, Garmin Ltd., Compumedics Limited, NIHON KOHDEN CORPORATION, Cadwell Industries Inc., Eight Sleep, Oura Health Oy, Sleep Shepherd LLC, Sleepace, Apollo Neuroscience Inc., Braebon Medical Corporation, Belun Technology, Nyxoah, and Somnology, Inc. are the major players.

What will be the CAGR of the sleep tech devices market?

The CAGR of the sleep tech devices market is projected to be 17.5% from 2025-2032.