Solar Water Heaters Market Size - Analysis

The solar water heaters market is estimated to be valued at USD 6.57 Bn in 2025 and is expected to reach USD 9.75 Bn by 2032. It is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032. The solar water heaters market is expected to witness significant growth with a rising number of consumers to shift towards solar water heating systems.

Market Size in USD Bn

CAGR5.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.8% |

| Market Concentration | High |

| Major Players | Vikram Solar, Tata Power Solar Systems, SunTank, Mahindra Solar One, Azure Power India and Among Others |

please let us know !

Solar Water Heaters Market Trends

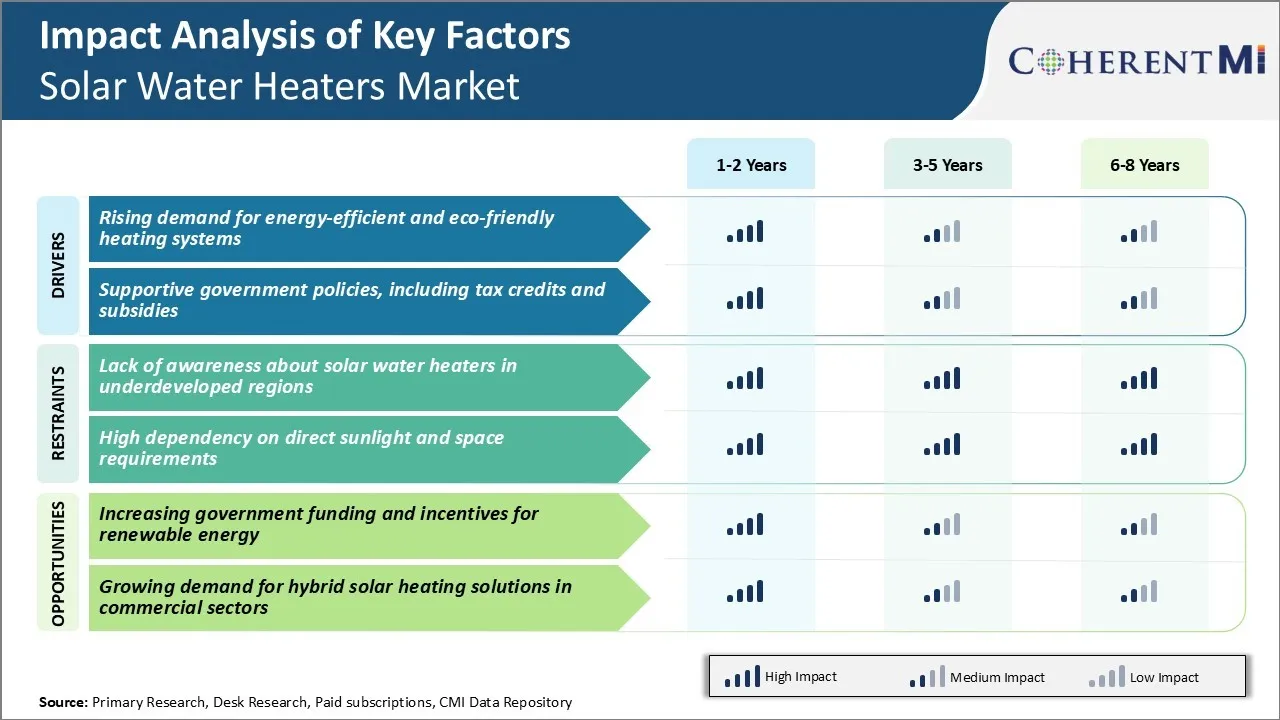

Market Driver - Rising Demand for Energy-efficient and Eco-friendly Heating Systems

As environmental issues take center stage globally, consumers are increasingly conscious about reducing their carbon footprint. They prefer products and services that cause minimal harm to the environment. Using energy from the sun, solar water heaters allow heated water with negligible emissions. This has driven strong demand for such systems in recent years.

People recognize that traditional water heating methods relying on electricity or gas-powered appliances expend significant energy resources. In many areas, solar can fulfill over 75% of the hot water demand annually with minimal auxiliary electricity required only during low sunlight periods in winters. Consumers like that solar is a low maintenance system with no risk of power outages affecting water supply. This is expected to bolster growth of the solar water heaters market.

Market Driver - Supportive Government Policies, including Tax Credits and Subsidies

Governments across the world are formulating policies to boost the uptake of renewable energy sources including solar power. This stems from an aim to diversify energy mixes, reduce dependence on imported fuels, and lower greenhouse gas emissions. For solar water heaters, governments offer attractive financial incentives to sweeten the higher upfront cost compared to conventional heaters. These often take the form of capital subsidies that fund 30-60% of installation expenditures. Some nations also provide tax credits worth 10-30% of the costs incurred.

In addition, some regions offer bonus feed-in-tariffs if the solar heating system is combined with a power generation setup. This makes investing in a bigger system more financially viable. Together, these policy push factors have accelerated demand growth within the sector. Retailers pass on some of the incentives to buyers, further boosting sales in the solar water heaters market.

Market Challenge - Lack of Awareness about Solar Water Heaters in Underdeveloped Regions

A major challenge faced by the solar water heaters market is the lack of awareness about solar water heating systems in underdeveloped regions. These regions have substantial potential for adopting solar water heating due to ample availability of sunlight throughout the year. However, consumers in rural areas and small towns have very little knowledge about the benefits of using solar water heating.

Manufacturers have struggled to promote the economic and environmental advantages of solar water heaters. People in underdeveloped markets often cannot appreciate the long-term savings from avoiding fuel costs for water heating. There is also a general reluctance to adopt new technologies due to lack of understanding.

Overcoming these information barriers and educating consumers on the simplest level about solar energy and solar water heating can unlock significant demand. Extensive awareness campaigns involving local leaders and mass media can help boost adoption rates in rural and remote locations.

Market Opportunity - Increasing Government Funding and Incentives for Renewable Energy

The solar water heaters market is poised to gain significantly from rising government support for renewable energy in various countries. More administrations are now offering substantial incentives and subsidies to encourage the production and usage of clean technologies like solar water heaters.

Some schemes fully or partly reimburse capital expenses of purchasing residential or commercial solar water heaters. The goal is to make solar options more affordable for customers upfront through such funding programs. Rising allocations in annual renewable energy budgets are also channelizing more investments into solar infrastructure development.

Increased government backing in forms of incentives, subsidies, and availability of low interest loans are crucial drivers that can help strengthen demand. This will drive growth prospects for solar water heaters market over the next decade.

Key winning strategies adopted by key players of Solar Water Heaters Market

One of the most successful strategies adopted by market leaders like Rheem Manufacturing and A.O. Smith was strategic acquisition of smaller players with innovative technologies. In A.O. Smith acquired ATAG Heating Group in 2019, a leading manufacturer and distributor of solar thermal systems in Europe. This gave A.O. Smith access to ATAG's expertise in solar water heating solutions.

Another prominent strategy was strong focus on research and development to launch new and improved products. Bosch launched its 'LifeSolar' series in India in 2020 with advanced features like dual heating options and anti-freezing protection. These innovative products helped gain market share.

Targeting emerging solar markets like India and Middle East through strategic partnerships was also an effective strategy. In 2017, Bosch tied up with Bharat Heavy Electricals Limited to produce and market affordable solar water heaters for India.

Segmental Analysis of Solar Water Heaters Market

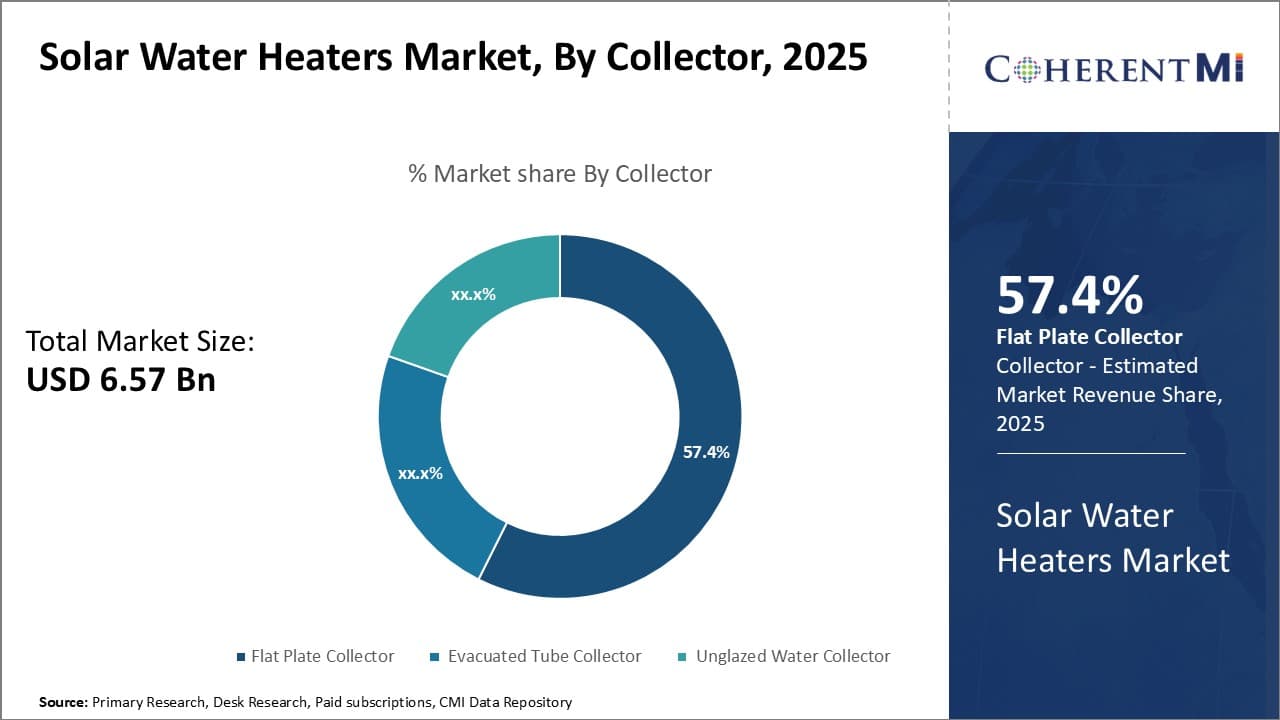

Insights, By Collector: Technology Leadership Drives Flat Plate Collector Adoption

In terms of collector type, flat plate collectors contribute 57.4% share to the global solar water heaters market in 2025. This is due to their technological superiority and cost-effectiveness. Flat plate collectors utilize a highly efficient technology that allows them to absorb solar radiation from the sun more efficiently than competing collector types.

Additionally, flat plate collectors benefit from tremendous economies of scale in their manufacturing process. Being the most widely adopted collector type globally has enabled component costs to reduce significantly. This has made flat plate collectors extremely affordable and accessible to consumers even in price sensitive regions. Their low-cost relative to competitors is a key driver of uptake, particularly in residential applications.

Together with their high reliability demonstrated over long usage, flat plate collectors provide confidence to consumers. This endorses repeat customers and referrals continue sustaining their leadership in the solar water heaters market in collector type.

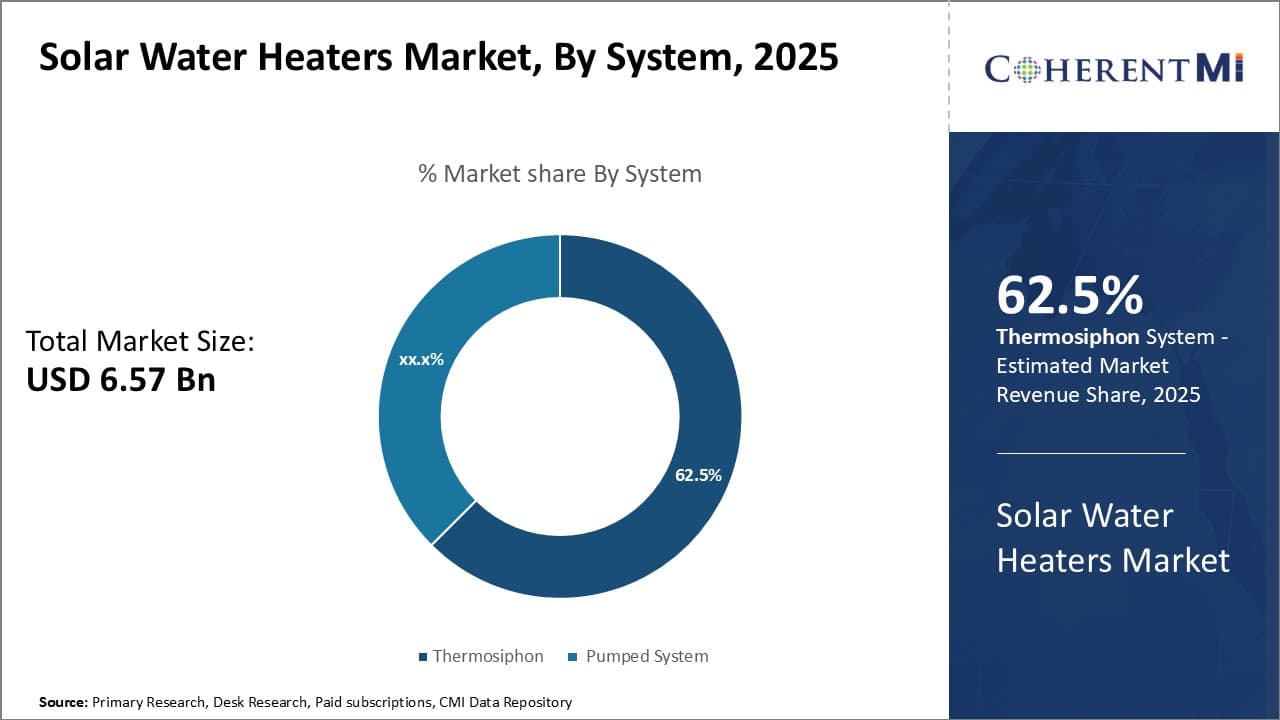

Insights, By System: Convenience Boosts Thermosiphon System Preference

Insights, By System: Convenience Boosts Thermosiphon System Preference

In terms of water heating system, thermosiphon systems account for 62.5% share of the solar water heaters market in 2025. This is due to their effortless functionality without moving parts or electricity. Thermosiphon systems utilize simple thermal buoyancy and gravity flow in their design with no pumps required.

The set-and-forget nature of thermosiphon systems is highly valued by residential users seeking effortless hot water generation. Their convenient and low-maintenance operation addresses key consumer priorities like cost and ease of use. Thermosiphon models can easily retrofit existing water heaters without electrical modifications. Installation and repair complexity is minimal, improving adoption rates.

Taken together, thermosiphon systems have achieved the optimal balance between effective functionality and effortless convenience driving widespread popularity in the residential sector.

Insights, By End Use: Cost Savings Catalyze Residential Solar Adoption

In terms of end use, the residential sector dominates solar water heater demand owing to attractive payback propositions for homeowners. Residences typically utilize 40-50% of total household hot water, providing scope for major savings through solar heating. With rising electricity tariffs worldwide, switching to solar hot water production can yield monthly bill reductions motivating many households.

Additionally, residential solar hot water systems qualify for various rebates and tax credits in numerous countries and states. Rising environmental consciousness has also driven demand as households seek renewable alternatives. The ability to reduce carbon footprints motivates many homeowners. Together, these financial and environmental benefits catalyze robust residential sector adoption of solar water heating worldwide.

Additional Insights of Solar Water Heaters Market

- According to the report, over 70% of new residential constructions in certain European countries are expected to incorporate some form of solar water heating system by 2030, reflecting both regulatory support and heightened environmental awareness.

- The industrial segment, while smaller than residential or commercial, is anticipated to grow steadily due to an increasing emphasis on reducing carbon emissions in process heating and manufacturing applications, aligning with global sustainability targets.

- Solar water heaters offer 25-40% cost savings in winters and up to 75% in summers, making them a sustainable alternative to conventional systems.

- North America region in the global water heaters market accounts for around 43% revenue share, with the U.S. alone growing at a 5.8% CAGR during the forecast period

Competitive overview of Solar Water Heaters Market

The major players operating in the solar water heaters market include Vikram Solar, Tata Power Solar Systems, SunTank, Mahindra Solar One, Azure Power India, Viessmann, Lanco Solar Private, Websol Energy System, Rheem Manufacturing Company, A.O. Smith Corporation, Ariston Thermo Group, Rinnai Corporation, SunEarth Inc., V-Guard Industries Ltd., Himin Solar Co. Ltd., Chromagen, Viessmann Manufacturing Co. (U.S.) Inc., and Honeywell International Inc.

Solar Water Heaters Market Leaders

- Vikram Solar

- Tata Power Solar Systems

- SunTank

- Mahindra Solar One

- Azure Power India

Solar Water Heaters Market - Competitive Rivalry

Solar Water Heaters Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Solar Water Heaters Market

- In August 2024, Ariston Thermo Group launched a commercial solar water heating solution specifically designed for industrial applications. The system’s modular design and robust build extend operational life in harsh conditions and significantly reduce operational costs for industrial end-users.

- In May 2024, A.O. Smith entered into a strategic partnership with a major solar panel manufacturer. The collaboration aims to integrate cutting-edge photovoltaic-thermal hybrid technologies, resulting in multifunctional units that simultaneously generate hot water and electricity, reinforcing A.O. Smith’s leadership in the solar water heaters market.

- In November 2023, Rheem introduced a new line of high-efficiency solar water heaters integrated with advanced thermal collectors. This innovation enhances energy absorption, reduces heat loss, and significantly improves overall system performance, enabling consumers to lower energy bills and carbon footprints.

Solar Water Heaters Market Segmentation

- By Collector

- Flat Plate Collector

- Evacuated Tube Collector

- Unglazed Water Collector

- By System

- Thermosiphon

- Pumped System

- By End Use

- Residential

- Commercial

- Industrial

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the solar water heaters market?

The solar water heaters market is estimated to be valued at USD 6.57 Bn in 2025 and is expected to reach USD 9.75 Bn by 2032.

What are the key factors hampering the growth of the solar water heaters market?

Lack of awareness about solar water heaters in underdeveloped regions and high dependency on direct sunlight and space requirements are the major factors hampering the growth of the solar water heaters market.

What are the major factors driving the solar water heaters market growth?

Rising demand for energy-efficient and eco-friendly heating systems and supportive government policies, including tax credits and subsidies are the major factors driving the solar water heaters market.

Which is the leading collector in the solar water heaters market?

The leading collector segment is flat plate collector.

Which are the major players operating in the solar water heaters market?

Vikram Solar, Tata Power Solar Systems, SunTank, Mahindra Solar One, Azure Power India, Viessmann, Lanco Solar Private, Websol Energy System, Rheem Manufacturing Company, A.O. Smith Corporation, Ariston Thermo Group, Rinnai Corporation, SunEarth Inc., V-Guard Industries Ltd., Himin Solar Co. Ltd., Chromagen, Viessmann Manufacturing Co. (U.S.) Inc., and Honeywell International Inc. are the major players.

What will be the CAGR of the solar water heaters market?

The CAGR of the solar water heaters market is projected to be 5.8% from 2025-2032.