Spina Bifida In-Utero Market Size - Analysis

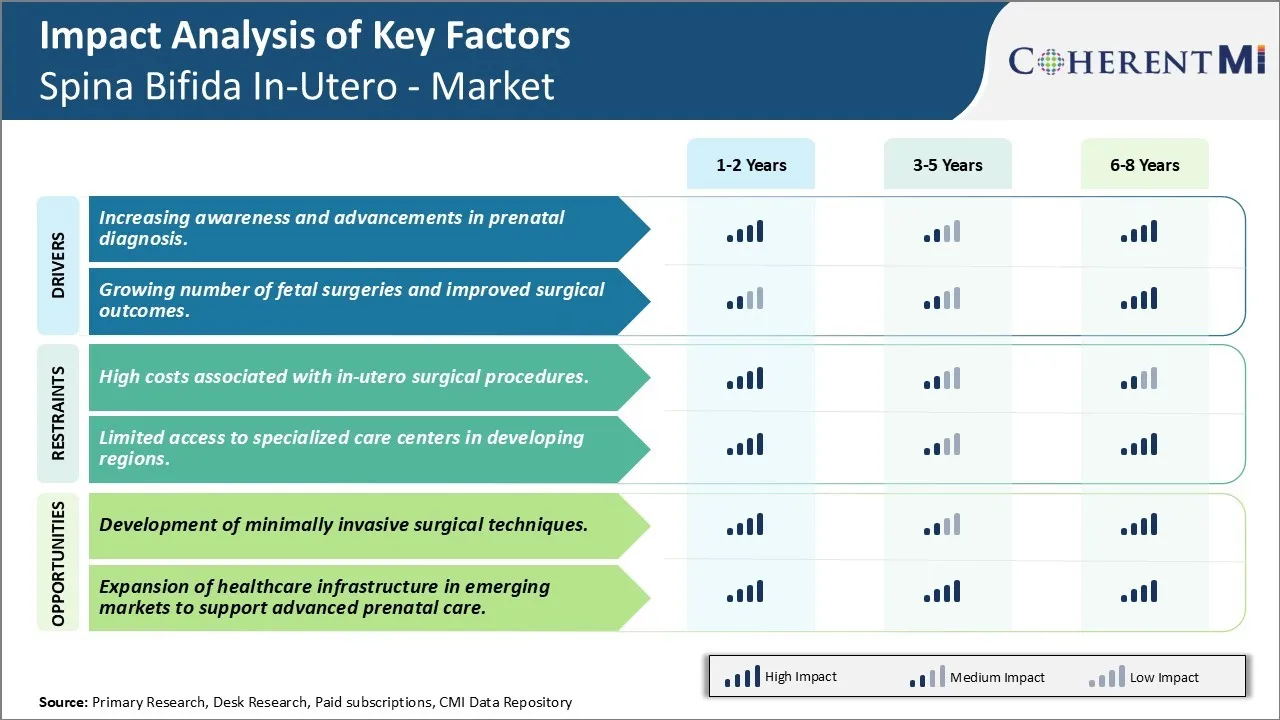

The market is expected to witness positive growth over the forecast period. Rising incidence rates of spina bifida and other neural tube defects worldwide will drive the need for screening, diagnostic and treatment procedures. Furthermore, development of advanced prenatal screening and diagnostic techniques with higher accuracy is also expected to support the market growth. However, social stigma and religious restrictions associated with abortion in some regions may hinder the market expansion to some extent.

Market Size in USD Bn

CAGR8.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.4% |

| Market Concentration | High |

| Major Players | Johnson & Johnson Inc, Pfizer Inc, Medtronic, Boston Scientific Corporation, Abbott Laboratories and Among Others |

please let us know !

Spina Bifida In-Utero Market Trends

With the advancements in medical technologies, prenatal diagnosis of spinal bifida has become more accessible than ever before. Fetal ultrasound scans and MRI have enabled physicians to identify spinal bifida in-utero with a high degree of accuracy even during early stages of pregnancy. Such screenings are now routinely offered to expecting mothers as part of standard prenatal care in many developed nations. This has significantly boosted early detection rates of spinal bifida and other neural tube defects before birth.

At the clinical level as well, diagnostic techniques continue to evolve. No longer is amniocentesis the only robust method to analyze fetal cells or amniotic fluid for abnormal markers. Minimally-invasive biopsy procedures performed under ultrasound guidance are available now that yield highly accurate results with minimal complications. Genetic counseling and testing options have also expanded in scope. All these improvements in prenatal testing have empowered physicians with more effective ways to detect spinal bifida early in pregnancy even before outward symptoms emerge. This plays a pivotal role in timely intervention planning and management of potentially life-threatening conditions.

Market Driver - Growing Number of Fetal Surgeries and Improved Surgical Outcomes

Spurred by these revolutionary outcomes, fetal treatment centers equipped with high-risk obstetric and pediatric surgical capabilities have been expanding worldwide. Leading medical institutions in North America, Europe and certain parts of Asia have actively started offering fetal myelomeningocele repair as a standard care option if the pregnancy meets selection criteria. For conditions where prenatal correction yields the best chance for improved mobility and reduced neurological disabilities post-birth, more expectant parents are opting for this pathbreaking intrauterine approach compared to conventional postnatal repair.

Market Challenge - High Costs Associated with In-Utero Surgical Procedures.

One major opportunity area for the Spina Bifida In-Utero market is the development of minimally invasive surgical techniques. Currently, open fetal surgical procedures require making an incision in the uterus as well as hysterotomy, which carry risks of uterine rupture in future pregnancies and premature deliveries. The adoption of advanced technology enabled minimally invasive procedures could help address some of these risks. Ongoing research in surgical robotics, advanced intrauterine ultrasound and imaging, and flexible, steerable instruments may allow developing procedures that cause minimal fetal and uterine disruption. This can potentially make these surgeries safer for mothers and babies. With reduced procedure-related risks, more fetal surgery centers and surgeons may incorporate these techniques, and insurance payers may be convinced to provide coverage. This could significantly expand access to treatment and drive growth in the long run.

Key winning strategies adopted by key players of Spina Bifida In-Utero Market

Differentiation: Companies focus on creating unique products and services, emphasizing quality and innovation to stand out from competitors. This approach often involves developing advanced surgical techniques, specialized medical devices, or patient-centric services that offer added value to healthcare providers and patients. For example, B. Braun Melsungen AG introduced innovative medical devices like the Ster-ASSIST Sterile Peripheral IV Catheter Insertion Kit, offering unique features that differentiate it from traditional catheters. This product enhances procedural efficiency and safety, catering specifically to the needs of neonatal and pediatric patients, including those with congenital conditions like spina bifida.

Strategic Partnerships and Collaborations: Collaborations with research institutions, healthcare providers, and other organizations allow companies to share resources, accelerate development, and commercialize new therapies faster. These partnerships enhance expertise and expand market reach. Companies like Johnson & Johnson collaborate with research institutions to accelerate the development of new treatments. Such partnerships help leverage academic research and clinical expertise, leading to faster innovation and a broader market reach. Cook Medical collaborates with leading pediatric surgeons and medical centers to develop specialized instruments for fetal surgery, enhancing the effectiveness of in-utero procedures for conditions like spina bifida.

Segmental Analysis of Spina Bifida In-Utero Market

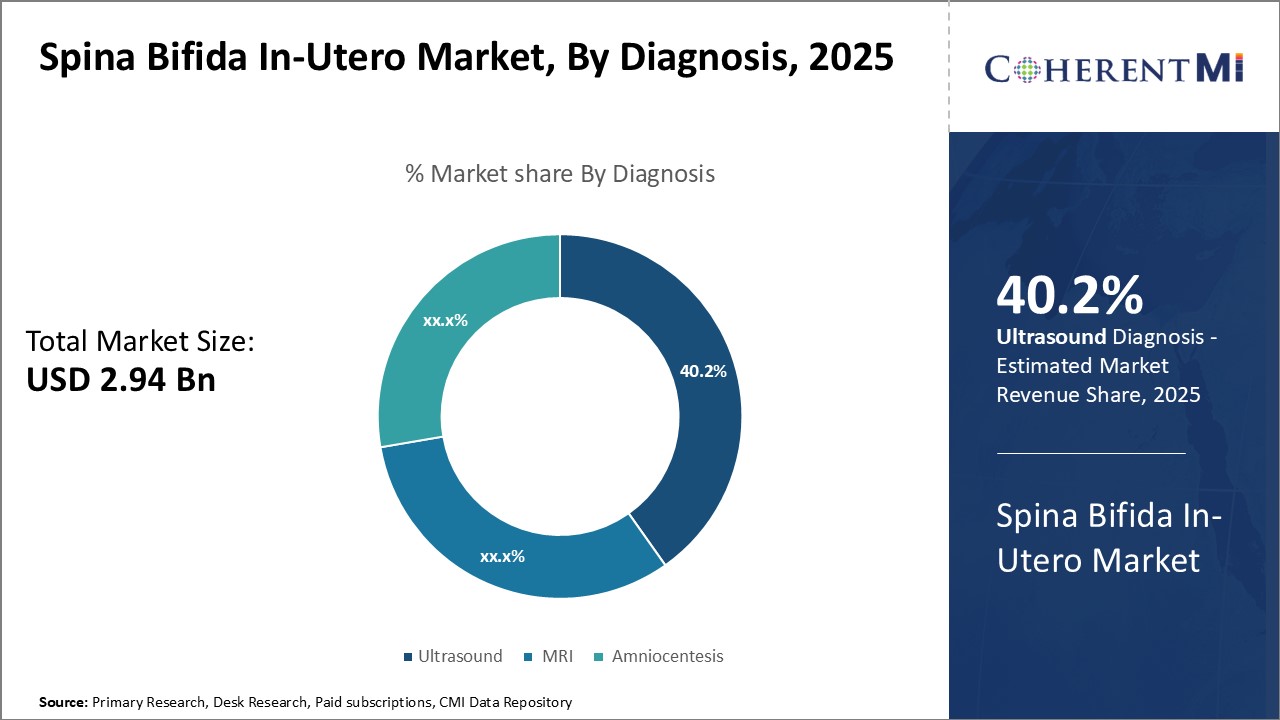

Insights, By Diagnosis, Advancements in Ultrasound Technology Drive Diagnostic Dominance.

Insights, By Diagnosis, Advancements in Ultrasound Technology Drive Diagnostic Dominance.Within the diagnosis segment of the Spina Bifida In-Utero market, ultrasound contributes the largest share at 40.20% in 2025 owing to its non-invasive nature and ability to provide early detection. Ultrasound imaging allows physicians to visualize the fetus in the womb and detect potential spinal cord abnormalities, such as Spina Bifida, as early as 18-20 weeks into pregnancy. Continuous improvements in ultrasound technology have increased resolution and expanded the diagnostic window, allowing for earlier and more accurate detection.

Beyond hardware, the development of new ultrasound techniques focused on Spina Bifida, such as standardized plane examinations, have optimized the diagnostic process. Clear imaging protocols ensure physicians systematically evaluate the entire fetal spine and surrounding tissues to avoid overlooking subtle defects. Data sharing through medical imaging archives also allows physicians to review past case examples for reference. Overall, due to continued technological and clinical improvements, ultrasound remains the primary frontline test for timely Spina Bifida diagnosis.

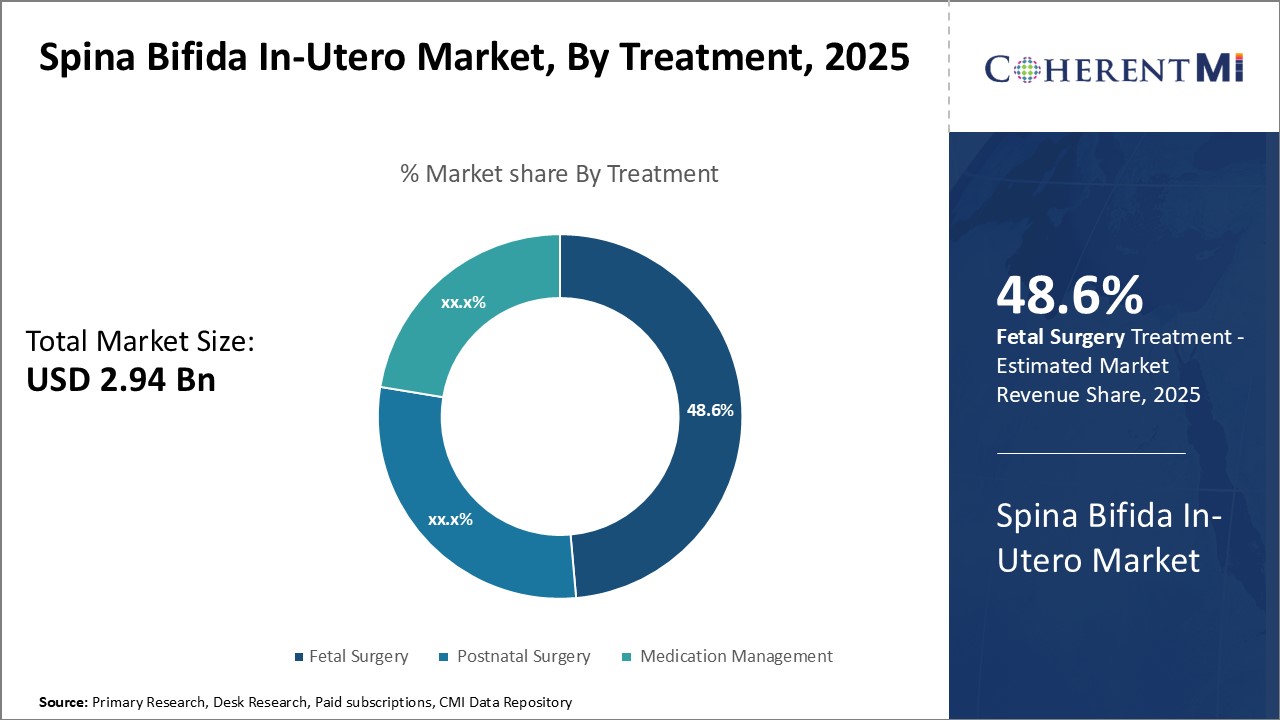

Within the treatment segment for Spina Bifida In-Utero, fetal surgery currently accounts for the highest market share at 48.60% in 2025. This is primarily driven by expanding surgical options that aim to close the spinal defect earlier in pregnancy via minimally invasive techniques in the womb. Fetal surgery addresses the root cause of Spina Bifida before neurological damage progresses, potentially improving long-term motor function outcomes over postnatal repair alone.

Additionally, the growth of multi-specialty fetal treatment programs centered around fetal surgery brings together high-risk obstetric, pediatric neurosurgery, anesthesiology, and imaging expertise needed. This level of collaborative care coordination optimizes procedure planning and management of complications, instilling confidence among families and clinicians regarding fetal surgery's benefits. With continued research expanding the gestational age window and categories of Spina Bifida eligible for repair, fetal surgical interventions promise to play an increasingly prominent role in customized Spina Bifida care pathways over time.

Additional Insights of Spina Bifida In-Utero Market

The Spina Bifida In-Utero market is undergoing significant changes due to advancements in diagnostic and surgical technologies. Fetal surgeries have shown to improve motor and cognitive outcomes for infants affected by Spina Bifida, making them the preferred approach when detected early. The market is driven by the increased adoption of fetal surgery and the development of new prenatal intervention techniques. Despite challenges such as high costs and access issues, the market's potential is vast, with ongoing research and collaboration between medical device companies and healthcare institutions promising further advancements. The market's growth is also fueled by enhanced prenatal care protocols and increasing awareness among healthcare providers and patients alike.

Competitive overview of Spina Bifida In-Utero Market

The major players operating in the Spina Bifida In-Utero - Market include Johnson & Johnson Inc, Pfizer Inc, Medtronic, Boston Scientific Corporation, Abbott Laboratories, Stryker Corporation, B.Braun Melsungen AG, Cook Medical, Smith & Nephew and NuVasive, Inc.

Spina Bifida In-Utero Market Leaders

- Johnson & Johnson Inc

- Pfizer Inc

- Medtronic

- Boston Scientific Corporation

- Abbott Laboratories

Spina Bifida In-Utero Market - Competitive Rivalry

Spina Bifida In-Utero Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Spina Bifida In-Utero Market

- February 2023: Johnson & Johnson collaborated with leading fetal surgery centers to develop new training programs for surgeons, focusing on enhancing skills in minimally invasive fetal surgery techniques.

- January 2022: Medtronic announced the launch of an advanced prenatal surgical kit designed specifically for fetal surgeries, which aims to enhance the precision and safety of in-utero procedures.

Spina Bifida In-Utero Market Segmentation

- By Diagnosis

- Ultrasound

- MRI

- Amniocentesis

- By Treatment

- Fetal Surgery

- Postnatal Surgery

- Medication Management

Would you like to explore the option of buying individual sections of this report?

Abhijeet Kale is a results-driven management consultant with five years of specialized experience in the biotech and clinical diagnostics sectors. With a strong background in scientific research and business strategy, Abhijeet helps organizations identify potential revenue pockets, and in turn helping clients with market entry strategies. He assists clients in developing robust strategies for navigating FDA and EMA requirements.

Frequently Asked Questions :

How Big is the Spina Bifida In-Utero-Market?

The Global Spina Bifida In-Utero-Market is expected to be valued at USD 2.94 billion in 2025 and reach USD 5.17 billion in 2032.

What will be the CAGR of the Spina Bifida In-Utero - Market?

The CAGR of the Spina Bifida In-Utero - Market is projected to be 8.2% from 2024-2031.

What are the major factors driving the Spina Bifida In-Utero - Market growth?

The increasing awareness and advancements in prenatal diagnosis and growing number of fetal surgeries and improved surgical outcomes are the major factor driving the Spina Bifida In-Utero - Market.

What are the key factors hampering the growth of the Spina Bifida In-Utero - Market?

The high costs associated with in-utero surgical procedures and limited access to specialized care centers in developing regions are the major factor hampering the growth of the Spina Bifida In-Utero - Market.

Which is the leading Diagnosis in the Spina Bifida In-Utero - Market?

Ultrasound is the leading diagnosis segment.

Which are the major players operating in the Spina Bifida In-Utero - Market?

Johnson & Johnson Inc, Pfizer Inc, Medtronic, Boston Scientific Corporation, Abbott Laboratories, Stryker Corporation, B.Braun Melsungen AG, Cook Medical, Smith & Nephew, NuVasive, Inc are the major players.