Sustainable Marine Fuels Market Size - Analysis

The sustainable marine fuels market is estimated to be valued at USD 19.88 billion in 2025 and is expected to reach USD 346.06 billion by 2032, growing at a compound annual growth rate (CAGR) of 15.5% from 2025 to 2032. The sustainable marine fuels market is set to witness significant growth due to the growing need to reduce carbon emissions from ships.

Market Size in USD Bn

CAGR50.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 50.4% |

| Market Concentration | High |

| Major Players | Neste Corp., FincoEnergies, Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE and Among Others |

please let us know !

Sustainable Marine Fuels Market Trends

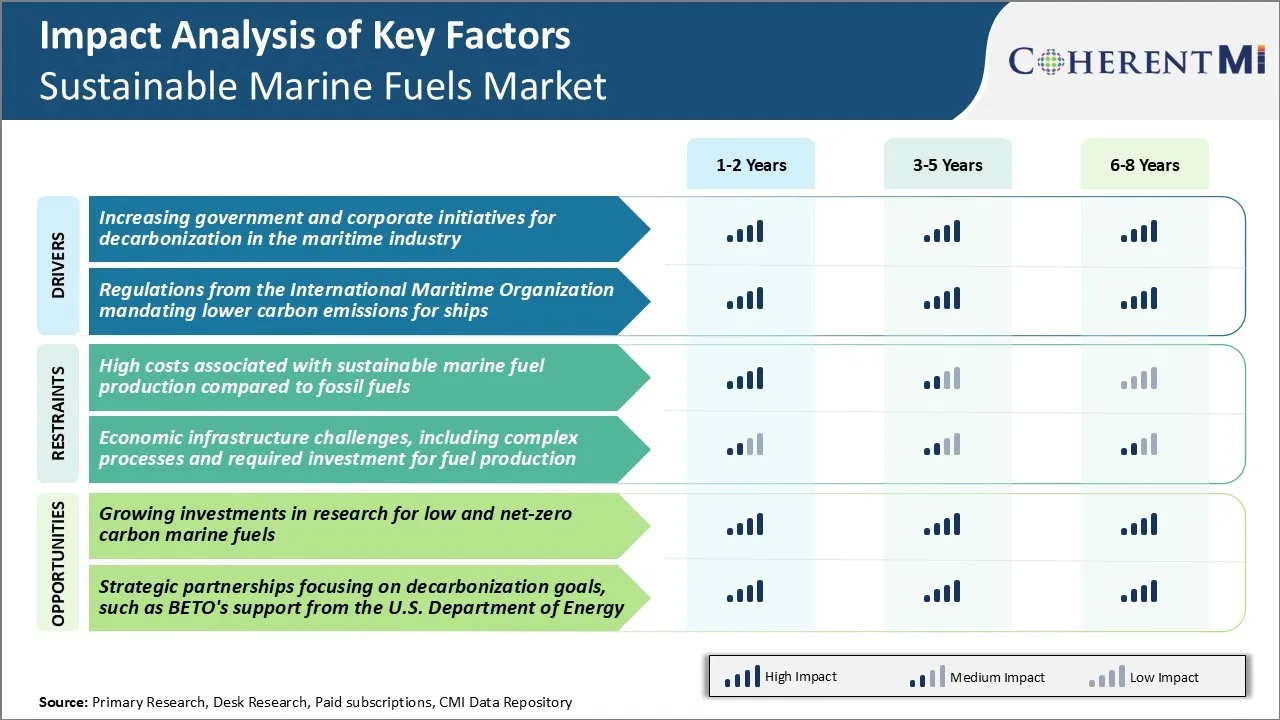

Market Driver - Increasing Government and Corporate Initiatives for Decarbonization in the Maritime Industry

Governments across the globe have launched aggressive targets to decarbonize their maritime operations and promote use of sustainable marine fuels. Shipping currently accounts for nearly 3% of the world's annual greenhouse gas emissions. There is a strong push from policymakers and businesses to make maritime transportation more sustainable.

The EU is providing subsidies and incentives to shipping companies that start using cleaner fuels like bio and synthetic fuels. This is expected to significantly boost demand for sustainable marine fuels in Europe in the coming decade. Major global ports like Los Angeles and Singapore have also announced plans to help shipping lines transition away from fossil fuels.

Oil majors like BP, Shell and Trafigura have pledged multi-billion-dollar investments in production facilities for bio and synthetic marine fuels. Leading shipping lines like Maersk, CMA CGM and MSC have ordered carbon neutral vessels that will use low-carbon fuels. With the government initiatives gathering pace and private sector throwing its weight behind decarbonization, it is expected that sustainable marine fuels market will experience unprecedented growth.

Market Driver - Regulations from the International Maritime Organization Mandating Lower Carbon Emissions for Ships

In 2021, the International Maritime Organization passed amendments to MARPOL Annex VI which make the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII) mandatory. The regulations require all ships to measure and document their operating carbon intensity from 2023, with financial penalties for poor performers from 2026 onwards.

Ships will need to transition to lower carbon fuels to comply with these new efficiency and intensity benchmarks set by IMO. From 2050, the regulations aim to reduce greenhouse gas emissions from international shipping by at least 50% compared to 2008 levels. This timeline is in line with the overall goal of the Paris Agreement to limit global temperature rise to 1.5 degrees Celsius.

With these stringent IMO regulations coming into force, ship owners will have to actively seek out sustainable solutions to replace fossil fuels currently used in their vessels. Those relying primarily on heavy fuel oil will need to use increasing volumes of biofuels or invest in retrofitting vessels for ammonia or hydrogen.

Market Challenge - High Costs Associated with Sustainable Marine Fuel Production Compared to Fossil Fuels

One major challenge faced by the sustainable marine fuels market is the high costs associated with producing sustainable fuels compared to conventional fossil fuels like heavy fuel oil. The production of sustainable marine fuels like biofuels, methanol, hydrogen, and ammonia involves complex processes and technologies that drive up costs.

Similarly, producing hydrogen from renewable sources is expensive due to the costs involved with electrolysis plants and infrastructure for hydrogen transport and storage. Unless these production costs are brought down significantly through technological advances and economies of scale, it will be difficult for sustainable marine fuels to achieve price parity with fossil fuels in the near future.

The high costs also create adoption challenges as ship owners and operators prefer fuels that reduce operating costs. This further hinders the growth of sustainable marine fuels market.

Market Opportunity - Growing Investments in Research for Low and Net-zero Carbon Marine Fuels

One major opportunity for the sustainable marine fuels market is the growing investments flowing into research and development for low-carbon and net-zero carbon marine fuels. With the International Maritime Organization targets to reduce greenhouse gas emissions from ships, private companies as well as national governments are ramping up investments to develop sustainable marine fuel solutions

Major oil companies are also increasingly investing in low-carbon fuel research. There is also a surge in demo and pilot projects to test emerging marine fuel technologies at sea. This level of focus and investments into R&D is expected to accelerate the feasibility of sustainable marine fuels that can compete on both performance and cost with fossil fuels.

Successful development of commercially viable net-zero carbon fuel pathways has the potential to drive huge opportunities for companies in the sustainable marine fuels market.

Key winning strategies adopted by key players of Sustainable Marine Fuels Market

Maersk has been leading the way in sustainable marine fuels market. In 2021, it ordered 8 large container vessels capable of being operated on methanol as their primary fuel. Methanol is a promising sustainable marine fuel as it can be produced from biomass or captured CO2.

Maersk's early investment signaled to the sustainable marine fuels market that methanol will likely emerge as a frontrunner fuel for decarbonizing shipping. For example, French shipping giant CMA CGM ordered 9 container vessels powered by methanol in 2022.

Another winning strategy has been partnering to develop biofuel supply chains. In 2021, GoodFuels Marine formed partnerships with ports of Rotterdam and Antwerp to supply bio-LPG and bio-LNG to vessels.

Key players in the sustainable marine fuels market have invested in developing sustainable biofuel technologies. In 2022, Cargill invested $50 million to build one of the largest bio-ethylene plants in Poland.

Segmental Analysis of Sustainable Marine Fuels Market

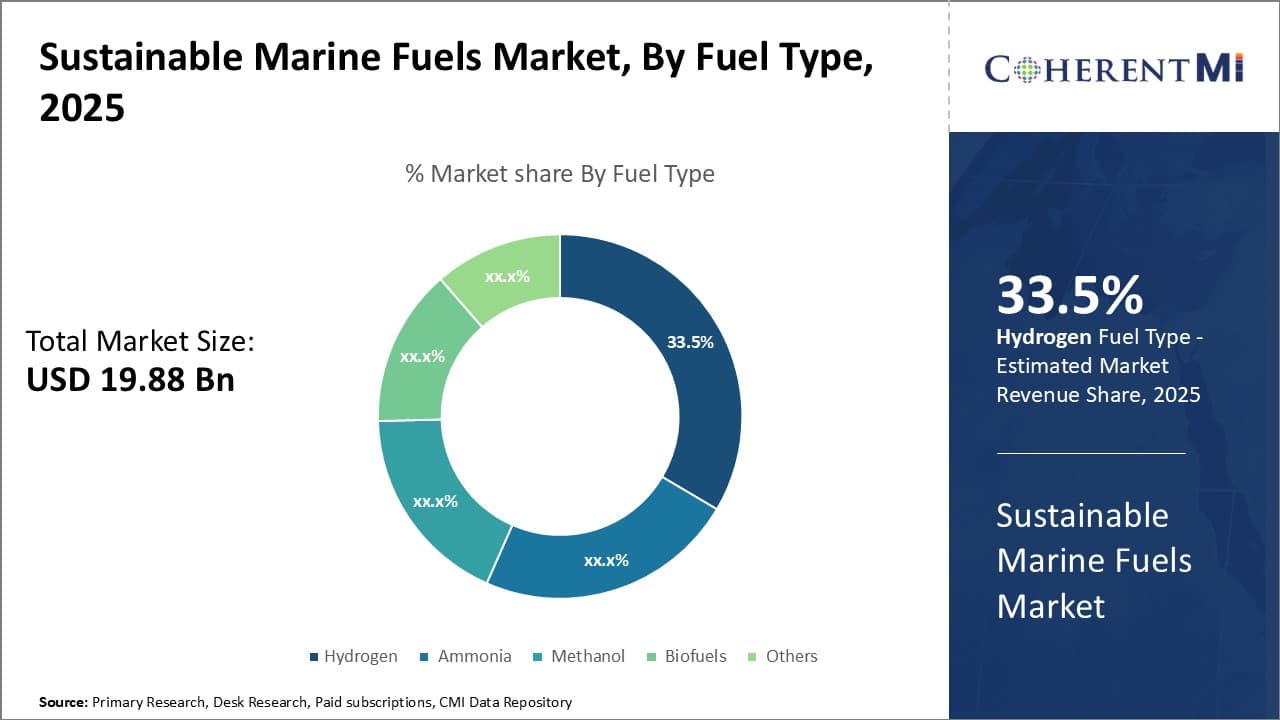

Insights, By Fuel Type: Hydrogen’s Clean Burning Nature and Role in Decarbonizing Marine Transport

In terms of fuel type, hydrogen fuels account for 33.5% share in the sustainable marine fuels market in 2025. Hydrogen has emerged as the preferred sustainable marine fuel for major ship owners and operators. Its use allows vessels to operate with zero direct carbon emissions.

From a technical perspective, hydrogen offers ship designers greater flexibility compared to other sustainable marine fuels. Its physical properties allow it to be utilized in fuel cells or internal combustion engines with relatively minor modifications. Several major engine manufacturers have developed dual-fuel engines that can operate on hydrogen as well as conventional fuels.

Policy support is a major driver favoring the adoption of hydrogen. Several ports and regions have formulated incentives for hydrogen-powered vessels through subsidies and tax exemptions. Strict emission regulations being planned along major trade lanes are expected to accelerate the shift towards zero-carbon technologies like hydrogen fuel cells.

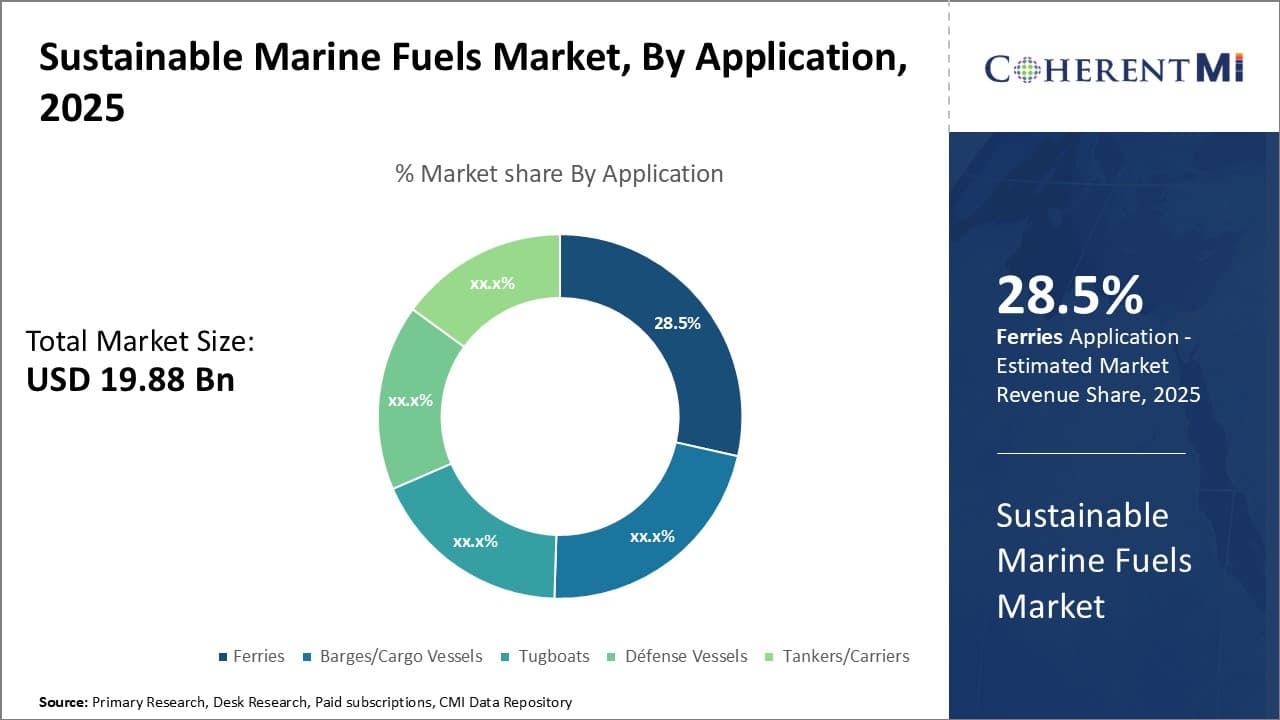

Insights, By Application: Ferries Contribute Highest Share Driven by their Requirement for Frequent Refueling

Insights, By Application: Ferries Contribute Highest Share Driven by their Requirement for Frequent Refueling

In terms of application, ferries account for 28.5% share in the sustainable marine fuels market in 2025. Ferries represent the largest application segment within sustainable marine fuels owing to their operational profile requiring frequent refueling.

Key characteristics of ferries driving the preferment of sustainable fuels include scheduled departures necessitating reliable energy sources. Multiple daily trips result in high overall fuel consumption. Given typical turnaround times spent docked, ferries can refuel using shoreside systems without impacting timetables. This allows leveraging of evolving port fueling facilities for renewable fuels.

Customer preference for greener ferry services is a notable demand-side factor. Younger passenger demographics are increasingly conscious about choosing low emission transport options. Demonstrating use of advanced fuels helps ferry companies showcase environmental stewardship to gain competitive advantage in the sustainable marine fuels market.

Additional Insights of Sustainable Marine Fuels Market

- Asia Pacific: Dominated the sustainable marine fuels market with 54% revenue share in 2023, driven by strong government support and environmental policies.

- Ferries Segment: Accounted for 30% of the sustainable marine fuels market share in 2023, attributed to increased demand for eco-friendly passenger vessels.

Competitive overview of Sustainable Marine Fuels Market

The major players operating in the sustainable marine fuels market include Neste Corp., FincoEnergies, Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE, Exxon Mobil Corp., Shell plc, Chevron Corp., BP plc., and Gevo Inc.

Sustainable Marine Fuels Market Leaders

- Neste Corp.

- FincoEnergies

- Liquid Wind AB

- A.P. Moller-Maersk A/S

- TotalEnergies SE

Sustainable Marine Fuels Market - Competitive Rivalry

Sustainable Marine Fuels Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sustainable Marine Fuels Market

- In May 2024, Bureau Veritas (BV) awarded an Approval in Principle (AiP) to Genevos for their 250 kW Hydrogen Power Module (HPM-250), a marine fuel cell designed for zero-emission coastal and offshore vessels. This AiP indicates that the HPM-250 meets BV's preliminary design and safety standards, positioning it for full Type Approval in 2025.

- In February 2024, Hafnia Bunkers announced a strategic collaboration with FincoEnergies, the company behind GoodFuels, to advance sustainable marine fuel solutions aimed at reducing carbon emissions in vessel fueling. This partnership, part of the Hafnia Bunker Alliance, also included Unigas and facilitated seven biofuel deliveries for the Unigas fleet throughout 2023.

- In February 2024, Evergreen Marine Corporation and X-Press Feeders signed a memorandum of agreement to establish Europe's first feeder network powered by green methanol. This initiative is set to commence operations from the Port of Rotterdam, extending to ports in the Baltic Sea and Scandinavia.

- In March 2024, India's Prime Minister Narendra Modi launched the country’s first hydrogen fuel cell ferry, built by Cochin Shipyard Limited, which will operate in Varanasi.

Sustainable Marine Fuels Market Segmentation

- By Fuel Type

- Hydrogen

- Ammonia

- Methanol

- Biofuels

- Others

- By Application

- Ferries

- Barges/Cargo Vessels

- Tugboats

- Défense Vessels

- Tankers/Carriers

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the sustainable marine fuels market?

The sustainable marine fuels market is estimated to be valued at USD 19.88 billion in 2025 and is expected to reach USD 346.06 billion by 2032.

What are the key factors hampering the growth of the sustainable marine fuels Market?

High costs associated with sustainable marine fuel production compared to fossil fuels and economic infrastructure challenges, including complex processes, are the major factors hampering the growth of the sustainable marine fuels market.

What are the major factors driving the sustainable marine fuels market growth?

Increasing government and corporate initiatives for decarbonization in the maritime industry and regulations from the international maritime organization mandating lower carbon emissions for ships are the major factors driving the sustainable marine fuels market.

Which is the leading fuel type in the sustainable marine fuels market?

The leading fuel type segment is hydrogen.

Which are the major players operating in the sustainable marine fuels market?

Neste Corp., FincoEnergies, Liquid Wind AB, A.P. Moller-Maersk A/S, TotalEnergies SE, Exxon Mobil Corp., Shell plc, Chevron Corp., BP plc, and Gevo Inc. are the major players.

What will be the CAGR of the sustainable marine fuels market?

The CAGR of the sustainable marine fuels market is projected to be 50.4% from 2025-2032.