Thermal Management Market Size - Analysis

The thermal management market is estimated to be valued at USD 16.84 Bn in 2025 and is expected to reach USD 33.45 Bn by 2032, growing at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2032. The thermal management market is expected to grow significantly due to increasing need to manage heat generated by devices with growing processing power.

Market Size in USD Bn

CAGR10.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 10.3% |

| Market Concentration | Medium |

| Major Players | Honeywell International Inc., Vertiv Holdings Co., Boyd Corporation, Laird Thermal Systems, Advanced Cooling Technologies, Inc. and Among Others |

please let us know !

Thermal Management Market Trends

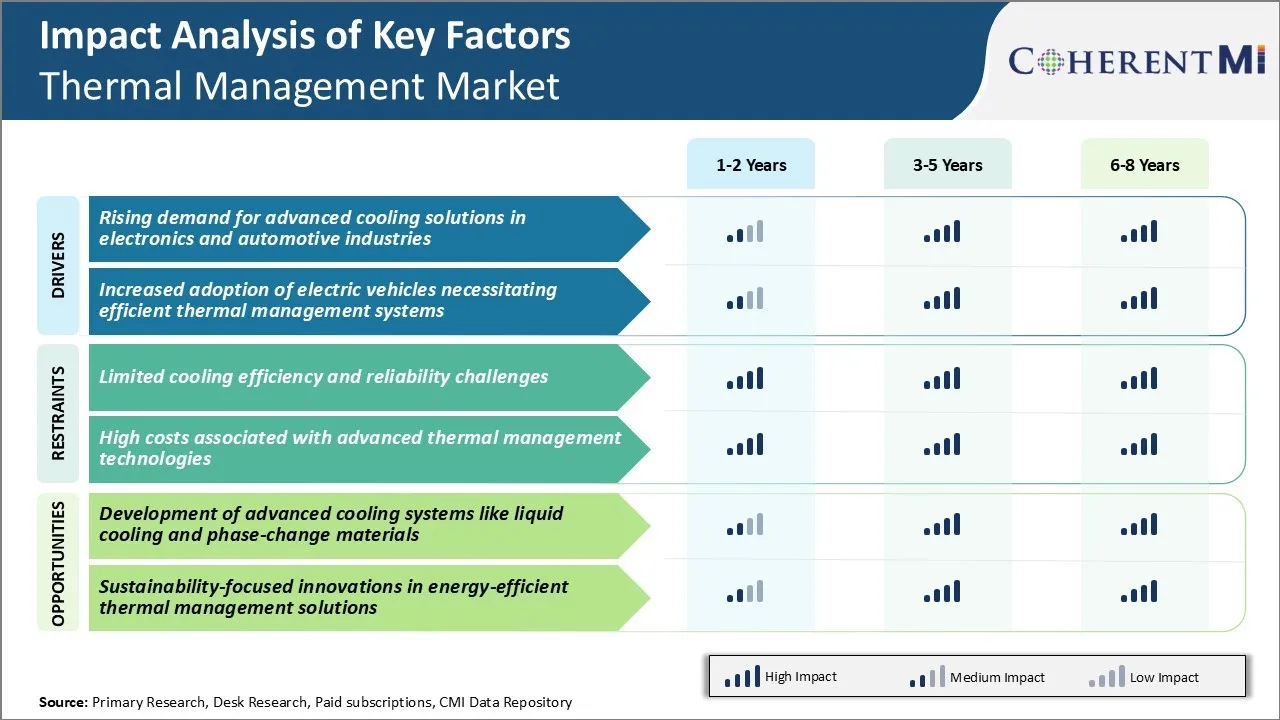

Market Driver - Rising Demand for Advanced Cooling Solutions in Electronics and Automotive Industries

The increase in computational power and miniaturization of electronic devices has led to a considerable rise in their heat generation. This has created a substantial demand for active cooling systems and thermal management solutions that can swiftly remove heat from high-powered systems.

In the automotive sector as well, the proliferation of advanced driver-assistance technologies such as adaptive cruise control, autonomous emergency braking, and advanced infotainment consoles have significantly increased the thermal load inside vehicles. Electronic control units and Li-ion batteries generating heat during operation require active cooling to maintain optimal performance.

The evolution of 5G networks and AI/ML workloads conducting complex tasks also result in elevated heat levels. Data centers housing millions of servers need thermal management on a massive scale to ensure seamless operation of systems. This has spurred innovations in immersion cooling and liquid cooling server technologies in the thermal management market.

Market Driver - Increased Adoption of Electric Vehicles Necessitating Efficient Thermal Management Systems

The auto industry's strategic shift towards electrification and efforts to reduce carbon footprint have intensified the demand for electric vehicles globally. However, EV batteries are susceptible to performance and life degradation issues if subjected to elevated temperatures during operation or charging.

Advanced liquid cooling loops circulating through the battery module help stabilize temperature fluctuations and optimize power output. With governments offering incentives for EV adoption and consumers embracing their benefits, vehicle manufacturers are ramping up e-mobility portfolios. This widens the scope for thermal management suppliers to partner with them and deliver solutions ensuring high battery capacity utilization and lengthy service life.

The proliferation of public fast charging infrastructure has also amplified the need for battery thermal management. Quick charging raises battery temperature rapidly, and without intervention, it can lead to loss of performance or safety issues. Innovations in liquid cooling technology enable EV batteries to withstand repeated rapid charging cycles will continue to drive thermal management market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Limited Cooling Efficiency and Reliability Challenges

One of the major challenges being faced by the thermal management market is limited cooling efficiency and reliability challenges associated with existing cooling technologies and solutions. As technology continues to advance at a rapid pace and electronic components are becoming more powerful yet compact, they generate a significant amount of heat.

There is limited space and design flexibility to incorporate larger heat sinks and fans. This thermal bottleneck is restricting innovation and innovation in the thermal management market. Moreover, existing liquid cooling solutions that aim to transfer heat away from hotspots more efficiently also introduce complexity, potential leak issues, and high costs.

With devices now expected to work flawlessly for extended period of time, inadequate or inconsistent thermal management can negatively impact reliability and potentially damage components early due to overheating. Unless advanced cooling methods are developed that can cope with rising heat loads in constrained footprints, it may hamper technological progress in thermal management market.

Market Opportunity - Development of Advanced Cooling Systems like Liquid Cooling and Phase-change Materials

The growing thermal management challenges also present promising opportunities for the development of next-generation cooling solutions. One area that holds significant potential is advanced liquid cooling technologies. Developing sophisticated micro-channel liquid cooling solutions that can fit into increasingly small enclosures could allow devices to push performance boundaries without thermal restrictions. There is also scope to leverage new phase change materials like thermoelectric cooling or heat pipes that can dissipate heat better than existing methods.

Such novel thermal management technologies provide an opportunity to overcome thermal constraints. Furthermore, integrating optimized cooling systems at the design stage itself across industries like electronics, automotive, aviation can unlock further capabilities. The growth in high performance computing also opens avenues to commercialize advanced thermal management systems. With relentless push for minimization and increasing heat loads, innovations in this field are likely to see tremendous growth in the thermal management market.

Key winning strategies adopted by key players of Thermal Management Market

Strategic Acquisitions and Partnerships: Acquisitions and partnerships have allowed companies to expand their product portfolio and geographic reach. For example, in 2019, DuPont partnered with Lydall to enhance their thermal insulation materials offering. Such strategic moves help companies offer comprehensive thermal management solutions.

Focus on Innovation: In 2021, Cisco added new capabilities to its Silicon One networking chip to enable high density computing within tight space and power constraints. Continuous innovation allows companies to stay ahead of the competition and unlock new growth opportunities.

Leveraging Industry Megatrends: Key players closely monitor emerging trends and align their product development accordingly.

Expanding in High Growth Verticals: Companies like Honeywell, Vertiv, etc. are investing in specialized thermal solutions for medical devices and pharma applications which require stringent temperature controls. This allows companies to tap new revenue streams.

Focusing on Aftermarket Services: With the increasing complexity of systems, the ability to offer comprehensive after-sales services and support expands customer relationships.

Segmental Analysis of Thermal Management Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

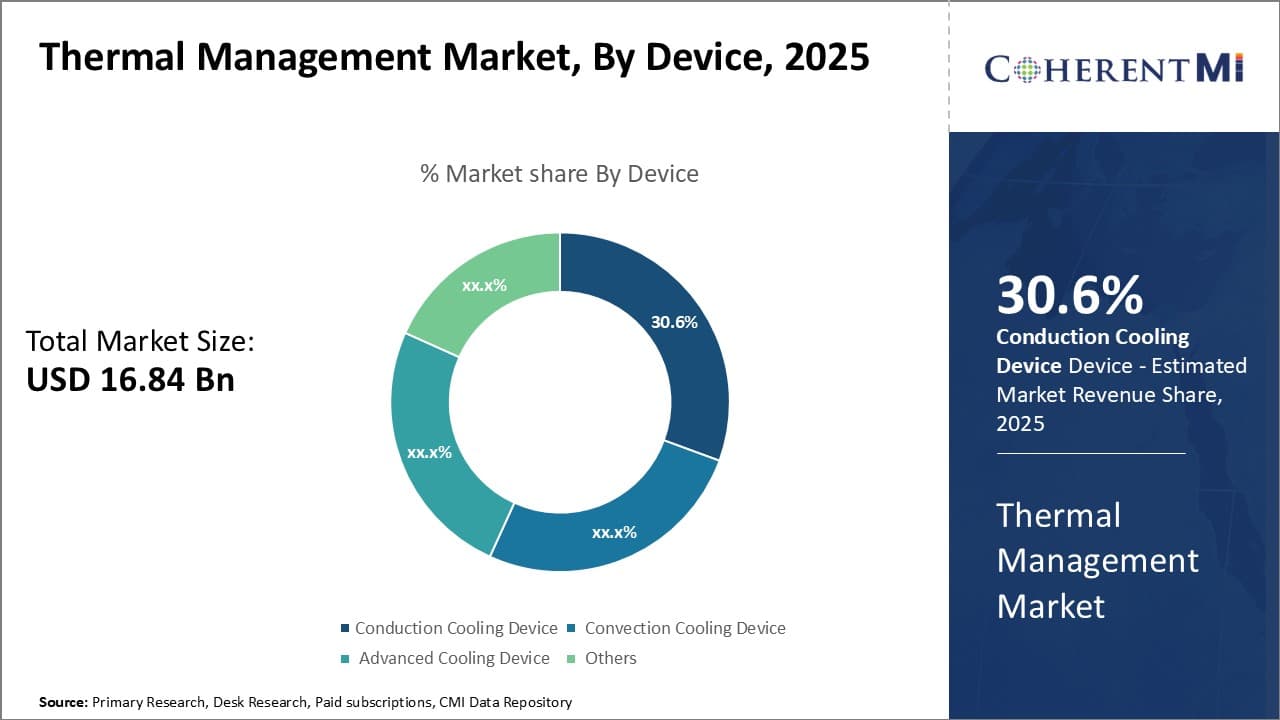

Insights, By Device: Superior Thermal Conductivity Drives Demand for Conduction Cooling Devices

In terms of device, conduction cooling device contributes 30.6% share of the thermal management market in 2025, owing to its ability to efficiently transfer excess heat away from components. Consumer electronics are a major application area due to the need to effectively cool powerful mobile CPUs and GPUs within slim form factors. Conduction cooling devices perform well in minimizing the internal footprint needed for thermal management.

In industrial contexts, conduction cooling ensures sensitive electronics can reliably operate even in harsh environments. Applications include avionics, automotive, industrial automation, medical equipment, and more. The direct contact provides a robust and maintenance-free solution capable of withstanding vibration and thermal cycling.

The superior performance of conduction cooling devices in maximizing thermal management outweighs their higher initial cost compared to alternative cooling technologies. As power requirements escalate across various industries, the ability of conduction devices to effectively manage substantial heat loads will continue bolstering their prominent market position.

To learn more about this report, Download Free Sample Copy

Insights, By Application: Growing Demand from Expanding Consumer Electronics Sector

To learn more about this report, Download Free Sample Copy

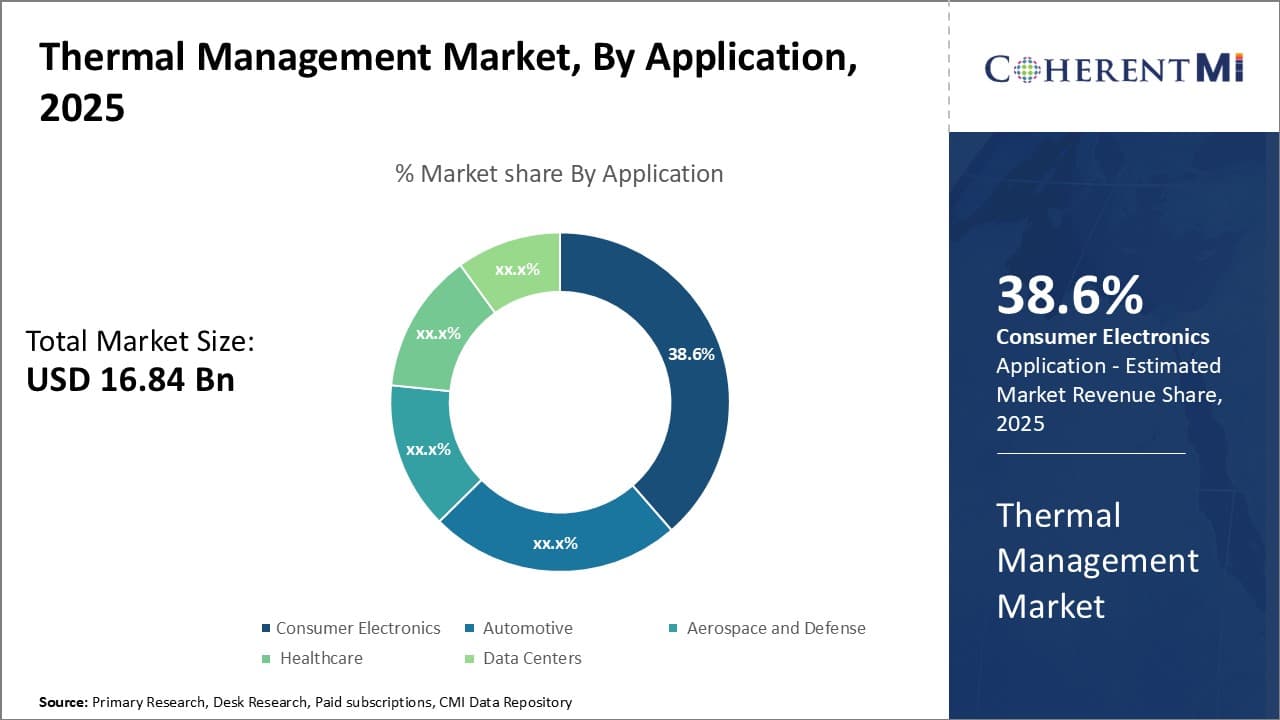

Insights, By Application: Growing Demand from Expanding Consumer Electronics Sector

In terms of application, consumer electronics contributes 38.6% share of the thermal management market in 2025. This is due to robust demand driven by continuous innovation in the consumer electronics space. Sophisticated mobile devices, laptops, gaming systems, and smart home technologies incorporate ever more powerful processors and complex integrated circuits.

Thermal management plays a vital role in addressing the escalating heat dissipation needs of consumer electronics. Advanced thermal interface materials, heat spreaders, heat sinks, fans, and liquid cooling systems maximize cooling efficiency within tight spaces. This allows consumer devices to achieve the desired small size while still accommodating high-performance specifications.

As interactive displays and artificial intelligence enhance more tools for entertainment, productivity, and smart living, consumer reliance on digital devices will only intensify. This expanding user base and feature-driven product innovation drive continuous cycles of hardware refreshes that perpetuate demand for advanced thermal management enabling next-generation technologies. The consumer electronics sector thus remains the largest revenue generator for the overall thermal management market.

Insights, By Product: Interface Materials are Vital for Effective Thermal Transfer Between Diverse Components

In terms of product, the hardware segment accounts for the highest thermal management market share. However, the Interface Materials portion is witnessing increasing importance due to its critical function assisting hardware performance. As component densities multiply while sizes contract, thermal interfaces between parts become more significant bottlenecks impacting overall heat dissipation.

Interface materials provide a medium to facilitate heat flow between surfaces with dissimilar properties that would otherwise not contact effectively. Properties like flexibility and pressure-optimized viscosity allow interface materials to conform tightly under compressive mounting. This ensures adherence even as components thermally expand and contract during duty cycles.

Reliability over long lifecycles remains a key demand. Overall, the interface material segment will continue growing faster than traditional hardware due to its indispensable function optimizing cooling across multifaceted component landscapes.

Additional Insights of Thermal Management Market

- The adoption of 5G technology has significantly increased the need for efficient thermal management in telecom equipment due to higher power densities.

- Wearable medical devices are becoming more prevalent, requiring miniature thermal solutions to ensure patient comfort and device reliability.

- The rise of artificial intelligence (AI) and machine learning applications is driving demand for advanced cooling systems in high-performance computing environments.

- Regional Growth: The Asia-Pacific region dominates the thermal management market, accounting for over 40% of the global share, attributed to the presence of major electronics manufacturers in countries like China, Japan, and South Korea.

- Technological Advancements: Innovations in nanotechnology are leading to the development of materials with enhanced thermal management properties, which is expected to revolutionize the thermal management market.

Competitive overview of Thermal Management Market

The major players operating in the thermal management market include Honeywell International Inc., Vertiv Holdings Co., Boyd Corporation, Laird Thermal Systems, Advanced Cooling Technologies, Inc., Delta Electronics, Inc., and Aavid Thermalloy, LLC.

Thermal Management Market Leaders

- Honeywell International Inc.

- Vertiv Holdings Co.

- Boyd Corporation

- Laird Thermal Systems

- Advanced Cooling Technologies, Inc.

Recent Developments in Thermal Management Market

- In 2022, Intel's Mobileye expanded its collaborations with major automotive manufacturers, including Ford and Volkswagen (VW). The company introduced the EyeQ Ultra, a new system-on-chip (SoC) designed specifically for autonomous driving applications, which aims to enhance self-driving technologies.

Thermal Management Market Segmentation

- By Device

- Conduction Cooling Device

- Convection Cooling Device

- Advanced Cooling Device

- Others

- By Application

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Healthcare

- Data Centers

- By Product

- Hardware

- Heat Sinks

- Fans & Blowers

- Thermoelectric Coolers

- Software

- Thermal Simulation Software

- Interface Materials

- Thermal Grease

- Thermal Tapes

- Phase Change Materials

- Hardware

- By Material

- Adhesive Material

- Non-Adhesive Material

- By Service

- Installation & Calibration

- Optimization & Post-sales Service

Would you like to explore the option of buying individual sections of this report?

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.