U.K. Luxury Bedding Market Size - Analysis

- Growing Demand for Premium and Customized Bedding Products: The demand for premium and customized bedding products is increasing significantly in the UK luxury bedding market. Customers today want bedding items that perfectly match with their bedroom interiors and reflect their personality and style. They are willing to pay more for bedsheets, pillows, comforters and mattresses that come in unique designs, fabrics and fillings. This growing focus towards personalization is driving many buyers to opt for customized options available from premium brands.

- Growing Utilization of Organic, Soft Materials: Luxurious bedding businesses provide a range of soft, premium, and organic selections, including flax linen wrapped in plastic-free packaging, organic cotton, and organic flax yarn. Fine Italian and Belgian linen, rich velvet, and silky sateen are among the luxurious and delicate materials. These are cozier materials. Hard chemicals, including pesticides, strong chemical cleansers, and fabric treatments, are not used in the creation of organic bedding. The National Programme for Organic Production (NPOP), for example, is being implemented by the Ministry of Commerce & Industries, Government of India's APEDA (Agricultural and Processed Food Products Export Development Authority), beginning in December 2021. The program's objectives include the accreditation of Certification Bodies, the development of standards for organic production, the promotion of organic farming and marketing, and more. The European Commission has acknowledged the NPOP production and accreditation criteria.

U.K. Luxury Bedding Market Restraints:

- Economic slowdown: The U.K. luxury bedding market has witnessed turbulent times in recent years owing to the ongoing economic slowdown plaguing the country. With rising inflation causing a significant dent in consumer purchasing power, particularly among high-income households who typically form the target segment for luxury bedding brands, demand for such premium products has decreased substantially. Additionally, the protracted phase of uncertainty surrounding Brexit negotiations adversely impacted business confidence and consumer sentiment for a long time. With consumers choosing to cut back on discretionary spending including on home furnishings, luxury bedding makers have struggled.

- Increase Cost of Silk: Due of its expensive production and restricted availability, silk is exceedingly expensive. A kilogram of silk requires around 5,000 silkworms to create. To generate cocoons, thousands of silkworms must be farmed, killed, and harvested—a labor-intensive, expensive procedure. For example, as of November 2025, 34.1 million bales (each weighing 170 kg) of cotton were produced in India during the 2021–22 crop year. The Central Zone, which includes states like Gujarat, Maharashtra, and Madhya Pradesh, is India's largest cotton producer, with Gujarat producing 8.516 million bales annually, more than any other state in the nation.

- The increasing popularity of online shopping: The increasing popularity of online shopping is a significant opportunity factor for the Luxury Bedding Market. Online channels offer discounts that help in retaining consumers, which could increase the growth of the market. E-commerce allows mattress and textile startups to purchase products directly from manufacturers and sell directly, which reduces transportation charges and allows for a significant reduction in the price of luxury goods. The growing popularity of online shopping is driving the growth of the luxury bedding market

- The rising disposable incomes of consumers: The rising disposable incomes of consumers present an opportunity factor for the Luxury Bedding Market. As disposable incomes increase, consumers are more likely to invest in high-quality and luxurious bedding products. As disposable incomes continue rising supported by stable job market and inflation remaining under control, the preference for premium homeware and accessories is expected to stay robust over the next years. The interest in self-care, prioritizing quality sleep and experiencing luxury at home even during stressful times will drive the demand for elevated bedding solutions. Leading luxury bedding brands are innovating with new fabric technologies, sustainable materials and ergonomic designs to attract affluent consumers.

Market Size in USD Mn

CAGR4.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.6% |

| Larget Market | U.K. |

| Market Concentration | High |

| Major Players | The White Company, Savoir Beds, Frette, Vispring, John Lewis & Partners and Among Others |

please let us know !

U.K. Luxury Bedding Market Trends

- The increase focus on health and wellness: For the market for luxury bedding, one important trend factor is the increased emphasis on health and wellness. Growing consumer awareness of the significance of sleep for overall health and well-being is fueling the market for high-end bedding items that provide support and comfort. The demand for luxury bedding items that are viewed as healthier is being driven by the trend towards wellness and self-care. Additionally, technological improvements within the luxury bedding industry have resulted in the emergence of more efficient and sustainable products, which in turn have enhanced market growth.

Segmental Analysis of U.K. Luxury Bedding Market

Competitive overview of U.K. Luxury Bedding Market

The White Company, Savoir Beds, Frette, Vispring, John Lewis & Partners, Hastens, Harrods, Soak&Sleep, WestPoint Home LLC, Hollander Sleep Products LLC, Crane & Canopy Inc., John Cotton Group Ltd.

U.K. Luxury Bedding Market Leaders

- The White Company

- Savoir Beds

- Frette

- Vispring

- John Lewis & Partners

U.K. Luxury Bedding Market - Competitive Rivalry

U.K. Luxury Bedding Market

(Dominated by major players)

(Highly competitive with lots of players.)

U.K. Luxury Bedding Market Segmentation

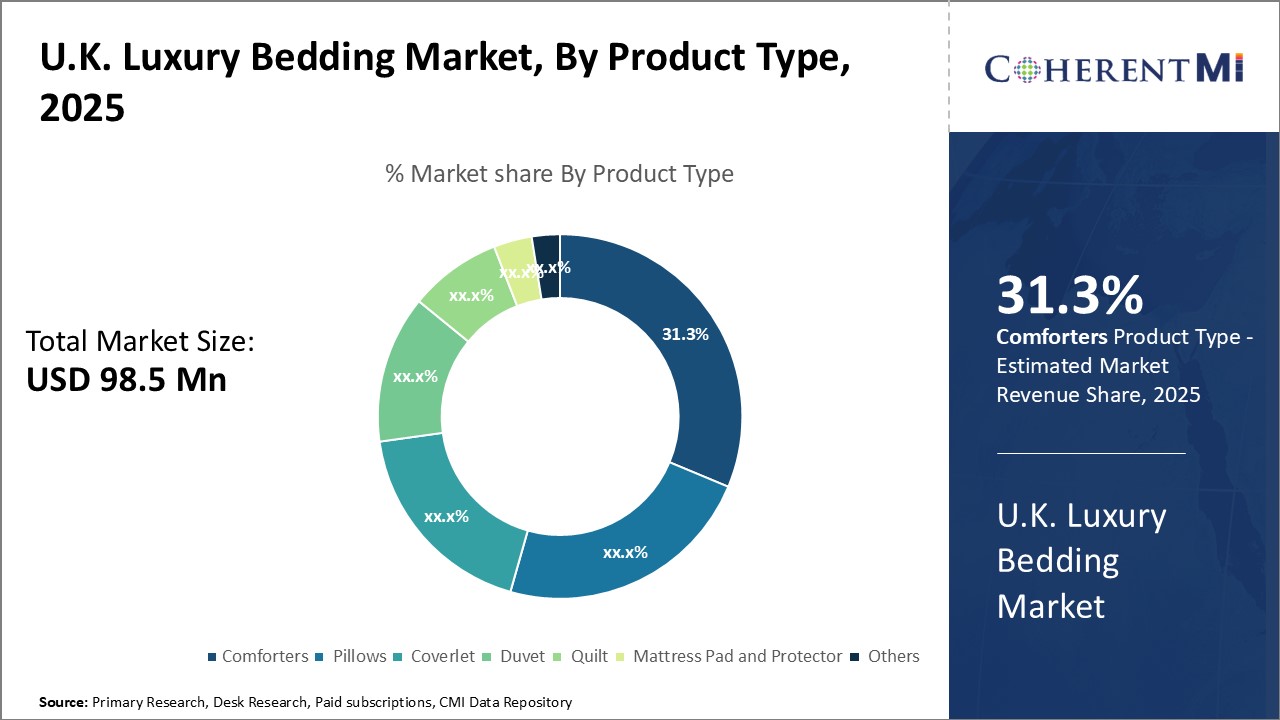

- U.K. Luxury Bedding Market, By Product Type:

- Comforters

- Pillows

- Coverlet

- Duvet

- Quilt

- Mattress Pad and Protector

- Others (Bed Skirt, Furs, and others)

- U.K. Luxury Bedding Market, By Application:

- Residential

- Commercial

- U.K. Luxury Bedding Market, By Distribution Channel:

- Supermarkets

- Hypermarkets

- Specialty Stores

- Online Channels

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the U.K. Luxury Bedding Market?

The U.K. Luxury Bedding Market is estimated to be valued at USD 98.5 in 2025 and is expected to reach USD 135.0 Million by 2032.

What are the major factors driving the U.K. Luxury bedding market growth?

The major factors driving the U.K. Luxury bedding market growth are growing demand for premium and customized bedding products, growing utilization of organic, soft materials.

Which is the leading component segment in the U.K. Luxury bedding market?

The leading component segment in the U.K. Luxury bedding market is the online channels.

Which are the major players operating in the U.K. Luxury bedding market?

The major players operating in the U.K. Luxury bedding market are The White Company, Savoir Beds, Frette, Vispring, John Lewis & Partners, Hastens, Harrods, Soak&Sleep, WestPoint Home LLC, Hollander Sleep Products LLC, Crane & Canopy Inc., John Cotton Group Ltd and others.

What will be the CAGR of U.K. Luxury bedding market?

The CAGR of U.K. Luxury bedding market is expected to be 4.6% from 2025 to 2032.