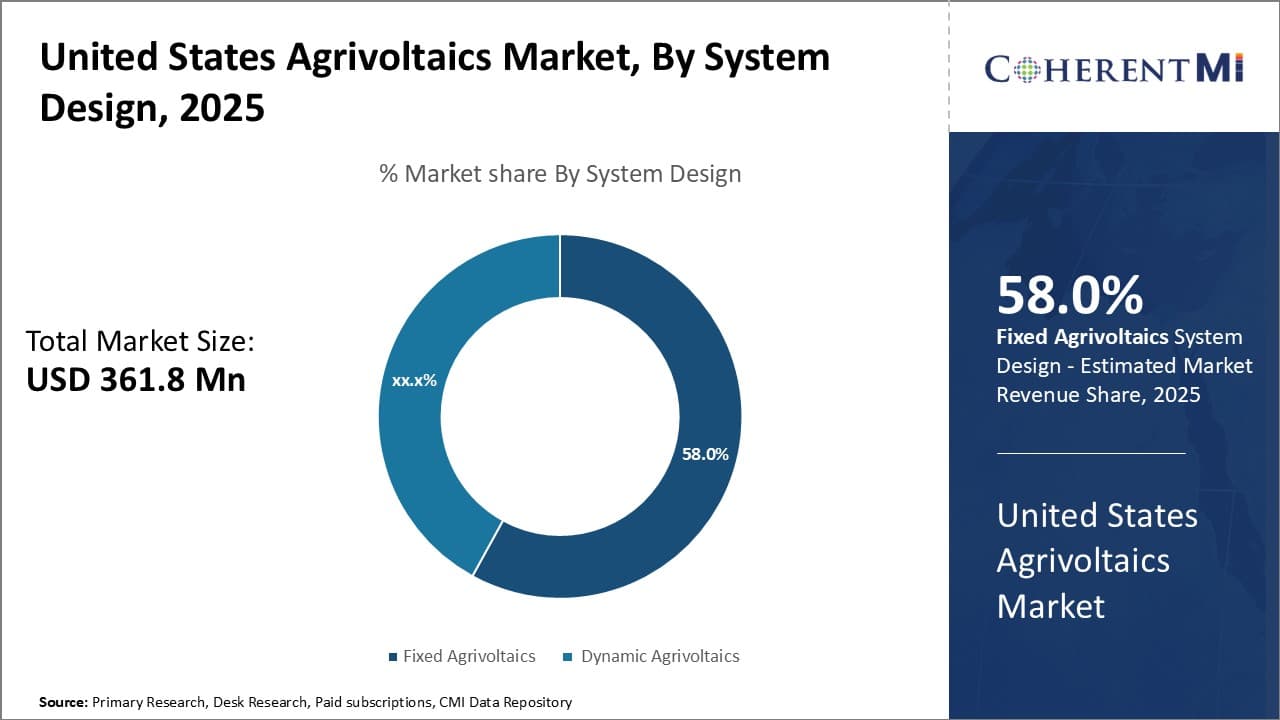

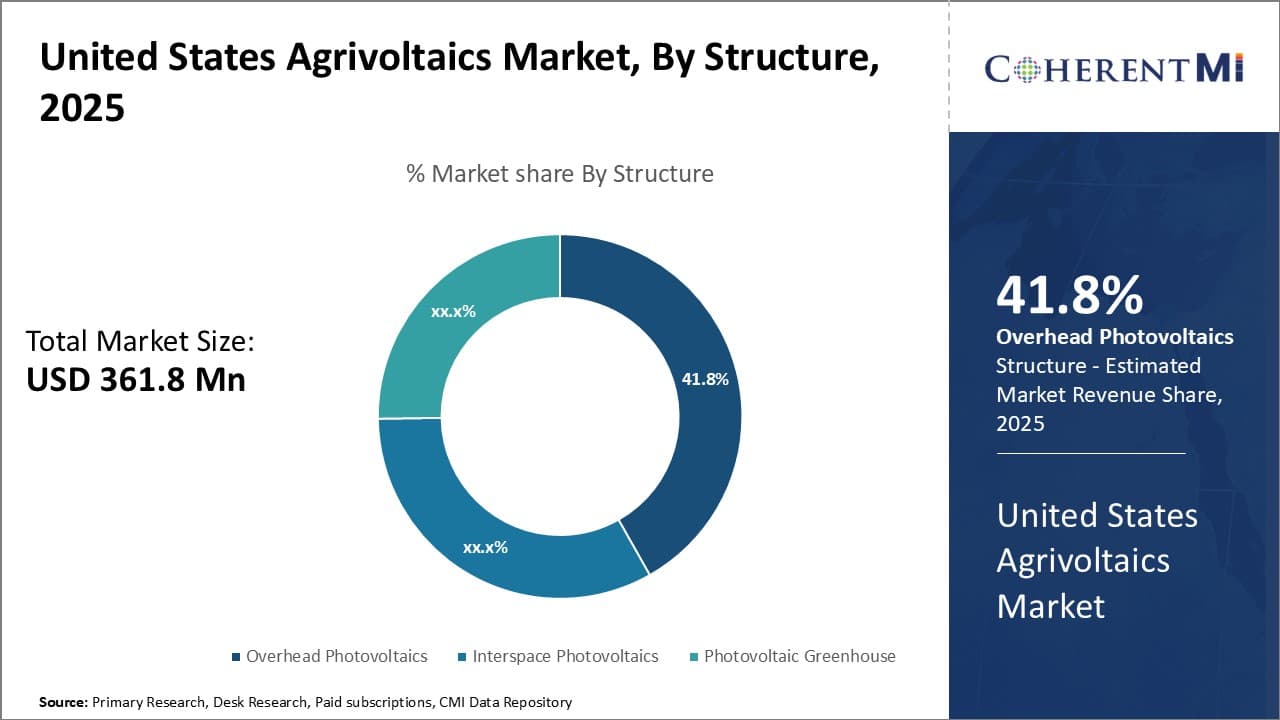

The United States Agrivoltaics Market is estimated to be valued at USD 361.8 Mn in 2025 and is expected to reach USD 789.9 Mn by 2032, growing at a compound annual growth rate (CAGR) of 11.8% from 2025 to 2032.

The agrivoltaics market in the United States is witnessing significant growth owing to rising awareness regarding sustainable energy practices, coupled with growth in implementation of favorable government policies to promote adoption of solar energy in agriculture. The government is aggressively promoting the establishment of agrivoltaic power projects through various subsidy schemes like investment tax credits. Leading utilities in the country are also proactively partnering with farmers to develop agrivoltaic installations. Additionally, ongoing research and development activities to optimize designs of agrivoltaic systems is further expanding the potential of these systems and helping the market capture a wider customer base.

Market Size in USD Mn

CAGR11.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 11.8% |

| Market Concentration | High |

| Major Players | Enel Green Power S.p.A., Boralex, Sunrise Power Solutions, McIntosh Energy Japan Co., Ltd., SolarEdge and Among Others |

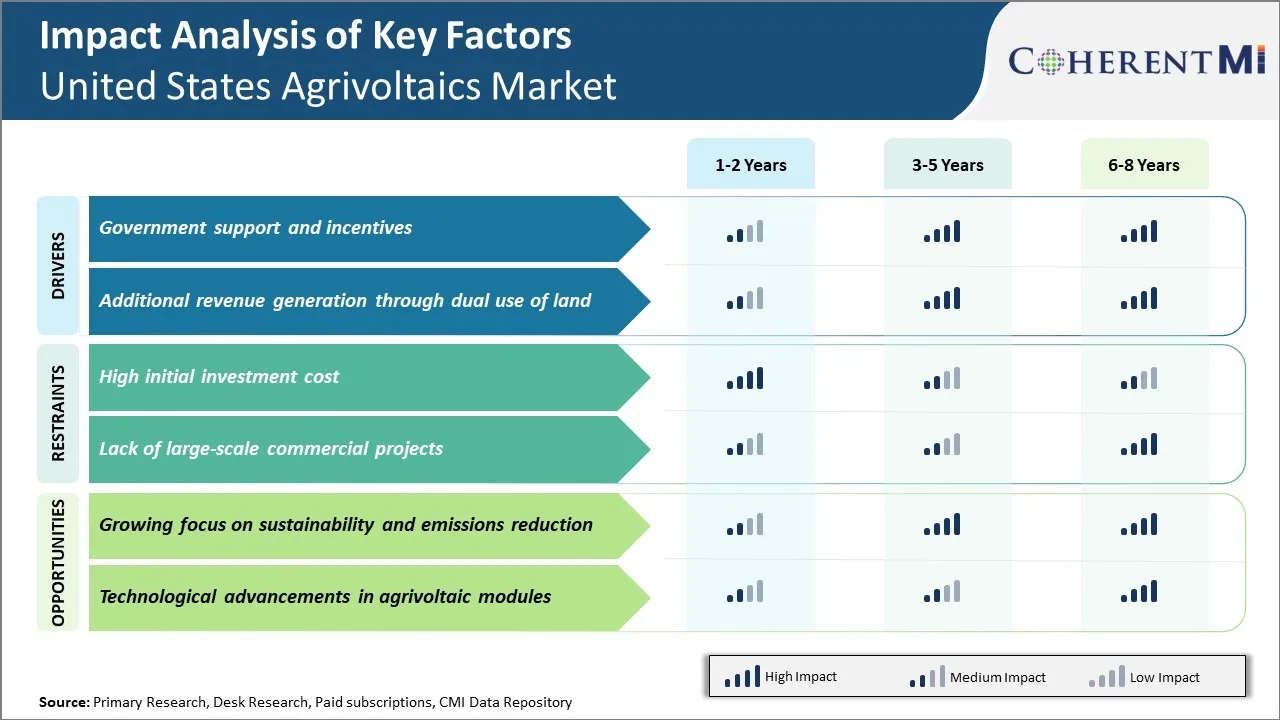

Market Driver - Government Support and Incentives

The Agrivoltaics market in the US is witnessing a strong push from the federal and state governments in terms of various support schemes and incentives. Governments across different states have recognized the potential of Agrivoltaic systems to promote renewable energy generation as well as boost agricultural production. Several states like California, Vermont, Massachusetts, etc. have rolled out various subsidy programs for farmers looking to install Agrivoltaic infrastructure on their land. These subsidy programs cover 30-40% of the total project cost, making Agrivoltaics systems a very viable option for farmers.

Another important development has been the inclusion of Agrivoltaic projects in various renewable energy mandates and targets set by states. Many states offer long term power purchase agreements and higher compensation for each unit of solar power generated through Agrivoltaics systems. This helps in better project returns. Some northeastern states offer additional incentives if the electricity generated is used to fulfill on-site agricultural needs such as for operating milking machinery, heating greenhouses, etc. The federal government too has recognized Agrivoltaics under various programs such as REAP (Rural Energy for America Program) which provides grants and loan guarantees for renewable energy and energy efficiency projects in rural areas.

A positive push has also come from the Farm Bill passed in different years. The recent 2018 Farm Bill promoted Agrivoltaics explicitly under several programs related to conservation of farmlands, diversification of farm operations and promotion of new technologies. This has stimulated a lot of research & development activity into improving Agrivoltaic designs, components and their integration with different crops and agricultural practices. Many agricultural universities and research institutes across premier farming states have also started projects to quantify benefits of Agrivoltaics. They are guiding farmers on suitable crops, optimal designs and business models.

Overall, the supportive policy environment both at federal and key state levels is facilitating significant interest among farmers in the US to install Agrivoltaics on their lands. It allows them to generate additional revenue through solar power sales while still actively farming the same land area. With ongoing technology advancement and more quantified results on higher agricultural productivity and financial gains, the driver of government support and subsidies is expected to keep boosting the Agrivoltaics market size in the coming years.

Market Driver - Additional Revenue Generation through Dual Use of Land

One of the prominent drivers for the growing adoption of Agrivoltaics systems by farmers is the potential to generate additional revenue streams compared to conventional agricultural or solar projects. Unlike standalone solar farms which occupy vast tracts of agricultural lands, Agrivoltaic platforms allow dual use of the same piece of land for both power generation as well as crop cultivation. This opens up new avenues to boost farm revenues.

Through diverse models such as integrating solar panels mounted on structures above crop fields or livestock grazing areas, Agrivoltaics maximize land usage unlike solar farms. Farmers can continue growing high-value crops under and around the solar panels which are elevated to provide sufficient sunlight. Some common crop options being tested are berries, nuts, grapes which generate higher margins compared to traditional row crops. This dual purpose enables farmers to sign long term power purchase deals for solar energy production as well as focus on premium quality crops that fetch attractive prices in the market.

Another emerging opportunity is utilizing unused or low productivity lands within farm premises for deploying Agrivoltaic plants and then leasing out these facilities to solar developers and power producers. This serves as a new stream of rental income over the 25–30-year life of such projects. Some agricultural universities are also pioneering Agrivoltaic powered aquaculture and greenhouse farming which tremendously boosts per acre crop or fish yields.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Data for Market Concentration Infographic

Market Challenges: High Initial Investment Costs

One of the major challenges facing the growth of the United States agrivoltaic market is the high initial investment costs associated with setting up agrivoltaic systems. Agrivoltaic projects require substantial capital expenditure towards purchasing and installing solar panels, mounting structure, inverters, cables, and other auxiliary equipment. Since agrivoltaics is a relatively new concept in the country, the specialized equipment and engineering required for dual-use of land for agriculture and solar also contributes to increased costs. Further, the return on investment may take longer compared to conventional agricultural or solar projects. The high upfront costs deter many farmers and landowners from adopting agrivoltaic solutions and preference traditional modes that require lower capital expenditure. Financial incentives and subsidies from federal and state governments have helped reduce costs to some extent but have limited impact in driving mass adoption. The high capital intensity continues to be a major financial barrier for the widespread growth of the United States agrivoltaic market.

Market Opportunities: Growing Focus on Sustainability and Emissions Reduction

One of the key opportunities for the United States agrivoltaic market is the increasing focus on sustainability and reducing greenhouse gas emissions from various industries including agriculture. There is a rising consumer demand for sustainably produced food and energy which works in favor of the agrivoltaic market. Further, industries and governments are exploring renewable and clean energy solutions to achieve their decarbonization targets. Agrivoltaic systems help boost solar energy production while maintaining agricultural activities underneath. This dual benefit aligns well with the sustainability agenda of minimizing land usage for increased food and energy output. The growing policy push for sustainability also increases the incentive and financial support for agrivoltaic projects. The emphasis on lowering emissions through innovative clean technologies presents significant prospects for the development of the United States agrivoltaic market in the coming years.

One of the most successful strategies adopted was innovative product development. For example, SunPower, one of the leading solar panel manufacturers, launched its new Agrivoltaic System in 2020. The system incorporates solar panels on single-axis trackers that can be positioned at varying angles to the sun throughout the day. This allows optimal sunlight penetration for crops growing underneath. It is estimated to generate 40% more energy than traditional fixed-tilt systems while maintaining 95% of vegetation density compared to open-field farming. This innovative product helped SunPower capture a significant share of the emerging agrivoltaics market in the US.

Another strategic move was partnering with large agricultural companies. In 2021, NextEra Energy partnered with Heliospectra AB, a global leader in smart lighting technology for controlled-environment agriculture. Through this partnership, they installed one of the largest agrivoltaic projects in the US on a blueberry farm in Oregon. The 13-acre solar installation provides clean electricity while the adjustable LED lights from Heliospectra help optimize plant growth. This partnership helped NextEra gain expertise and credibility in the agrivoltaics space.

Targeting subsidies and policy support was also a winning strategy. Companies like National Grid and Nexamp actively lobbied state legislatures encouraging policies to drive the growth of agrivoltaics. Their efforts contributed to the passage of new bills in sunny regions like California that provided lucrative financial incentives for agrivoltaic projects. This additional push from supportive policies accelerated industry growth and high valuations for companies.

As evidenced from successful real-world examples outlined above, innovative product development, strategic partnerships, and leveraging policy subsidies have been instrumental in helping key players establish leadership positions and drive momentum for the burgeoning United States agrivoltaics market.

To learn more about this report, Download Free Sample Copy Insights by System Design: A Robust System Design for the Agrivoltaic Market

To learn more about this report, Download Free Sample Copy Insights by System Design: A Robust System Design for the Agrivoltaic Market

In terms of System Design, Fixed Agrivoltaics contributes the 58% share of the market in 2025, owning to its adaptability to various agricultural practices. Being a static structure, Fixed Agrivoltaic systems can be easily customized as per the unique needs of different farms. Farmers growing various types of crops like vegetables, fruits, nuts etc. have increasingly adopted Fixed Agrivoltaic models as they allow for unhindered access to cultivate and harvest crops beneath. The standardized and robust design of Fixed panels also makes them durable and resilient against weather vagaries faced on agricultural lands. Moreover, Fixed structures require comparatively lower maintenance efforts and costs versus dynamic mechanisms used in other system designs. This has solidified the preference for Fixed Agrivoltaics amongst agrivoltaic producers as well as agriculturalists. Overall, the hassle-free integration with crop cycles along with long-lasting performance continue to drive the widespread use of Fixed Agrivoltaics in the country's agrivoltaic domain.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights by structure: Overhead Photovoltaics: Optimizing Farmable Space

In terms of Structure, Overhead Photovoltaics contributes the 41.8% share of the market in 2025, by optimally utilizing available farm space. Mounting solar panels high above the ground allows for simultaneous cultivation of crops or grazing of livestock directly underneath. This dual-use of precious agricultural land has been a major attraction for Overhead Photovoltaics. With escalating pressure on arable areas to meet both energy and food demands, maximizing space productivity is of utmost importance. Overhead photovoltaic structures elevate solar infrastructure without compromising on agricultural output. They also face fewer shading issues compared to other configurations. As a result, Overhead Photovoltaics have emerged as the preferred structure for agrivoltaics, helping farmers make most effective use of their existing land parcels. This space-saving feature along with augmented Farm revenues from a "stacked" land-use pattern continues propelling growth of the Overhead Photovoltaics segment.

Enel Green Power S.p.A., Boralex, Sunrise Power Solutions, McIntosh Energy Japan Co., Ltd., SolarEdge

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

United States Agrivoltaics Market is Segmented By System Design (Fixed Agrivoltaics, Dynamic Agrivol...

United States Agrivoltaics Market

How big is the United States Agrivoltaics Market?

The United States Agrivoltaics Market is estimated to be valued at USD 361.8 in 2025 and is expected to reach USD 789.9 Million by 2032.

What are the major factors driving the United States Agrivoltaics Market growth?

The government support and incentives and additional revenue generation through dual use of land are the major factor driving the United States Agrivoltaics Market.

Which is the leading System Design in the United States Agrivoltaics Market?

The leading System Design segment is Fixed Agrivoltaics.

Which are the major players operating in the United States Agrivoltaics Market?

Enel Green Power S.p.A. , Boralex, First Solar, National Renewable Energy Laboratory (NREL), Jack’s Solar Garden, Sunrise Power Solutions, McIntosh Energy Japan Co., Ltd., Soltec, SolarEdge are the major players.

What will be the CAGR of the United States Agrivoltaics Market?

The CAGR of the United States Agrivoltaics Market is projected to be 11.8% from 2025-2032.