United States Lyocell Fabric Market Size - Analysis

The United States Lyocell Fabric Market is estimated to be valued at USD 185.0 Mn in 2025 and is expected to reach USD 321.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.2% from 2025 to 2032.

Market Size in USD Mn

CAGR8.2%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | LENZING AG, Invista, TOAD&CO, Riverside Fabrics, Potter & Co and Among Others |

please let us know !

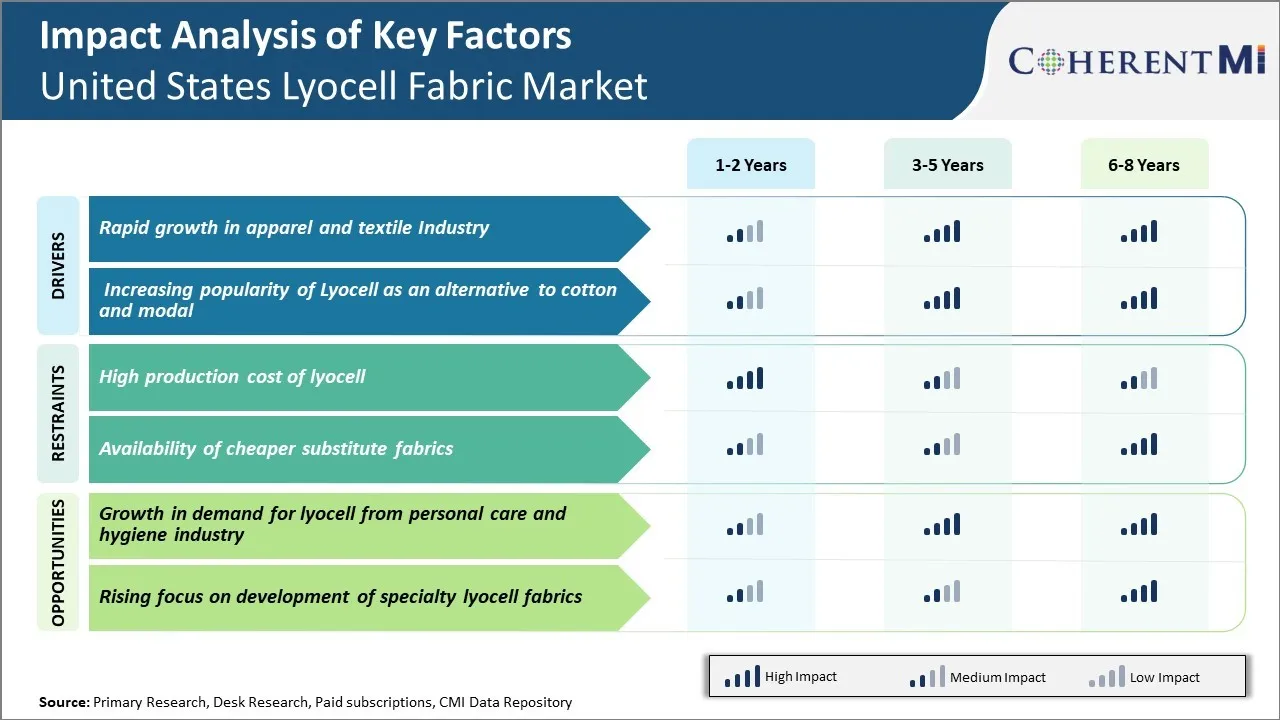

United States Lyocell Fabric Market Trends

The United States apparel market has seen significant growth over the past few years owing to rising spending power, changing fashion trends, and comfortable lifestyle adoption among consumers. Americans today are more inclined towards branded apparel and accessories that help them portray a certain style statement. This has opened opportunities for new fabrics like lyocell to gain prominence.

The textile industry has also emerged as a major end-user of lyocell due to its enhanced sustainability profile. Major US home furnishing companies have started utilizing lyocell in bedsheets, towels, drapes, and upholstery fabrics as it provides durability along with a soft handfeel. The growing emphasis on eco-friendly materials in the interiors space bodes well for lyocell fabrics. Both apparel and textiles are thriving industries in the United States, propelling the uptake of innovative fabrics like lyocell that address the modern needs of consumers. The immense potential exhibited by lyocell to disrupt incumbent cotton and modal ensures strong future growth prospects.

Market driver - Increasing popularity of Lyocell as an alternative to cotton and modal

Lyocell provides an eco-friendlier production method and superior strength, softness, drape and breathability qualities vis-a-vis cotton or modal. The growing environmental consciousness among Americans is compelling brands, retailers as well as end consumers to adopt more sustainable fabrics. Lyocell helps address this need with a highly renewable production process and biodegradable characteristics. In addition, lyocell fiber delivers a soft and smooth feel on skin akin to modal but offers enhanced wet strength, wrinkle resistance and moisture management lacking in modal or cotton.

Market Challenge: High Production Cost of Lyocell

The United States lyocell fabric market is expected to witness significant opportunities owing to the growth in demand for lyocell from the personal care and hygiene industry. Lyocell fibers have attributes such as high absorbency, quick drying, smooth texture, and natural appearance that make them suitable for use in personal care products such as baby wipes, adult wipes, and feminine hygiene items. The demand for sustainable and eco-friendly personal care products is on the rise among consumers. Lyocell is gaining popularity as it is derived from wood pulp through a closed-loop production process involving no hazardous chemicals. Its biodegradable nature helps reduce environmental pollution. The personal care and hygiene industry in the U.S. has been growing steadily due to rising health awareness. As manufacturers look for green alternatives to cotton and synthetic fibers, lyocell is expected to experience increasing usage in personal wipes, diapers, and other hygiene products. This growing demand from the personal care segment presents a major opportunity for lyocell producers to expand their customer base and improve market share in the U.S.

Key winning strategies adopted by key players of United States Lyocell Fabric Market

Key players like Lenzing AG, Acegreen Eco-Material Technology Co., Ltd., Aditya Birla Group have focused on product innovation and development of new sustainable fabrics to gain an edge. In 2019, Lenzing launched Tencel Luxe and Tencel Denim fibers made from wood pulp for premium and denim fabrics. These fibers offer stretch, softness and breathability. They are more sustainable than cotton or synthetics. The new product lines helped Lenzing capture nearly 15% market share in the USLyocell fabric market in 2020.

Adoption of new production technologies has also helped firms. In 2017, Aditya Birla Group set up a new lyocell spunmelt production line in USA with advanced solvent recovery processes. This reduced their production costs by 12-15% compared to competitors. The lower costs allowed them to pass on savings in cheaper fabric prices without compromising on margins. This enabled them to gain 5% market share in the US Lyocell fabric market within a year of commencing local production.

Segmental Analysis of United States Lyocell Fabric Market

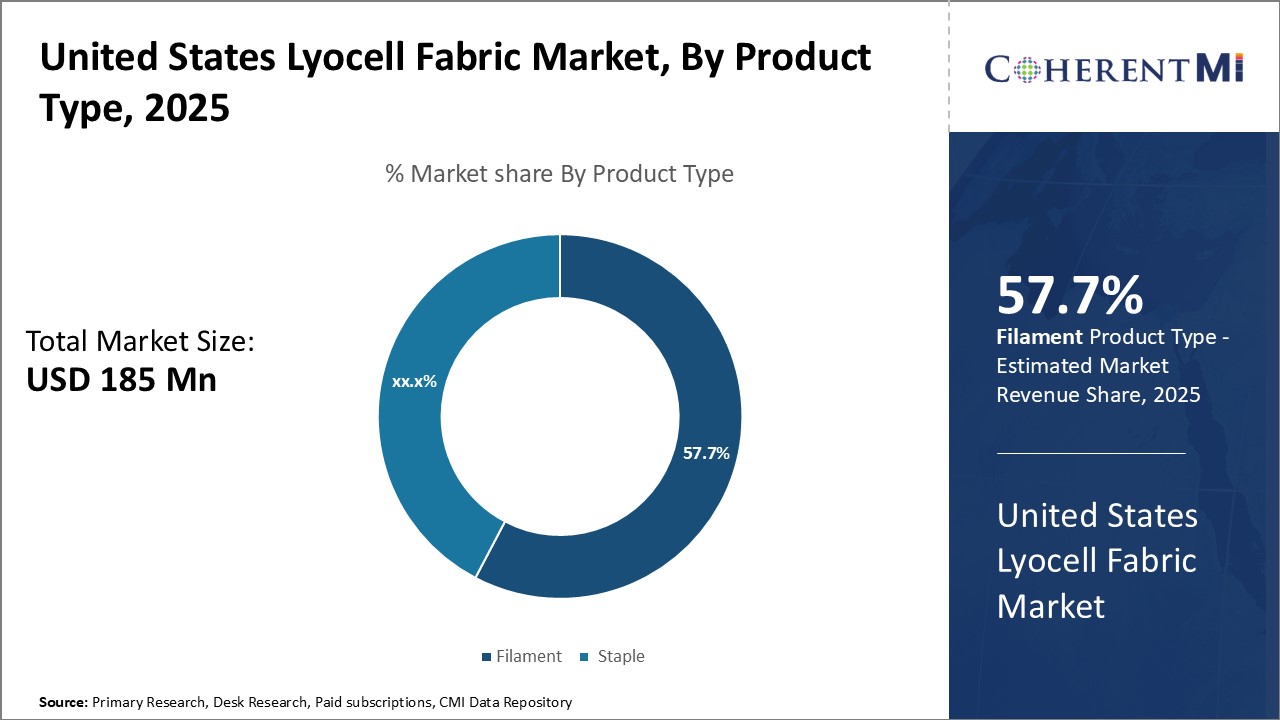

Insights by product type: Filament's Versatility Drives its Dominance in the US Lyocell Fabric Market

Insights by product type: Filament's Versatility Drives its Dominance in the US Lyocell Fabric Market Within the US Lyocell Fabric Market, the filament segment contributes the 57.7% share in 2025, owing to its versatility across various end uses. Filament lyocell fiber is produced through a continuous spinning process, allowing it to be manufactured in a wide range of denier sizes and finishes. This versatility enables it to meet diverse performance requirements across apparel, home textiles, and industrial applications.

Filament lyocell also sees widespread adoption in industrial textiles where reliability is paramount. Its inherent strength allows it to replace synthetic fibers in filter bags, conveyor belts, and geotextiles. Leading manufacturers have standardized on filament lyocell for its consistent quality across high-volume production runs. Looking ahead, ongoing R&D could expand its end uses further through novel finishes and alloying with other fibers.

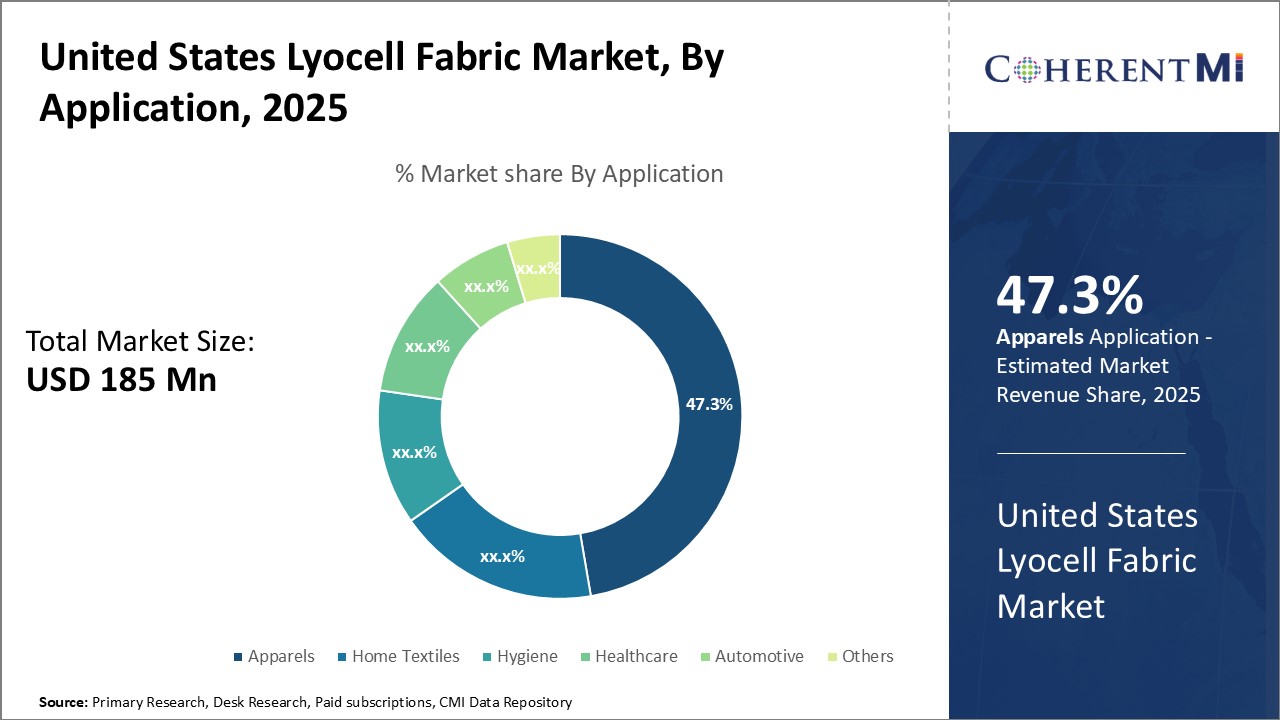

Within the US Lyocell Fabric Market, the apparel segment captures the 47.3% share of applications in 2025. Lyocell's natural softness and breathability have fueled its popularity in clothing, where comfort and performance are top priorities. Its moisture-wicking ability keeps wearers dry without the clinginess of other synthetics. Major apparel brands have transitioned lyocell fiber lines to meet demand from eco-conscious consumers as well.

Looking ahead, lyocell fabric mills will strive to develop new alloys and textured finishes to further broaden lyocell's fashion and performance profiles. As sustainability gains prominence, lyocell stands to benefit from its clean manufacturing process compared to oil-based synthetics commonly found in clothing. Barring any unforeseen challenges, apparel seems poised to sustain lyocell fabric demand in the US market.

Competitive overview of United States Lyocell Fabric Market

LENZING AG, Invista, TOAD&CO, Riverside Fabrics, Potter & Co

United States Lyocell Fabric Market Leaders

- LENZING AG

- Invista

- TOAD&CO

- Riverside Fabrics

- Potter & Co

United States Lyocell Fabric Market - Competitive Rivalry

United States Lyocell Fabric Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Lyocell Fabric Market

- On 19 October 2021, Lenzing diversifies denim offering with launch of new matte TENCEL branded lyocell fibers.

- On 18 July 2023 Lenzing introduces new resource-efficient dyeing approach for TENCEL™ Lyocell fibers. The new approach reduces water and energy usage in creating similar wash-down aesthetics, previously only achievable through a resource-intensive denim dyeing and bleaching process

United States Lyocell Fabric Market Segmentation

- By Product Type

- Filament

- Staple

- By Application

- Apparels

- Home Textiles

- Hygiene

- Healthcare

- Automotive

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the United States Lyocell Fabric Market?

The United States Lyocell Fabric Market is estimated to be valued at USD 185.0 in 2025 and is expected to reach USD 321.2 Million by 2032.

What are the major factors driving the United States Lyocell Fabric Market growth?

The rapid growth in apparel and textile industry and increasing popularity of lyocell as an alternative to cotton and modal are the major factor driving the United States Lyocell Fabric Market.

Which is the leading Product Type in the United States Lyocell Fabric Market?

The leading Product Type segment is Filament.

Which are the major players operating in the United States Lyocell Fabric Market?

LENZING AG, Invista, TOAD&CO, Riverside Fabrics, Potter & Co, Impactful Ninja , Paneros Clothing are the major players.

What will be the CAGR of the United States Lyocell Fabric Market?

The CAGR of the United States Lyocell Fabric Market is projected to be 8.2% from 2025-2032.