Body Fat Dispositivi di misura Mercato ANALISI DIMENSIONE E QUOTA - TENDENZE DI CRESCITA E PREVISIONI (2024 - 2031)

Il mercato dei dispositivi di misura grasso del corpo è segmentato dal prodotto (analizzatore di impedenza bioelettrica, nastri di misura della circon....

Body Fat Dispositivi di misura Mercato Dimensione

Dimensione del mercato in USD Mn

CAGR6.3%

| Periodo di studio | 2024 - 2031 |

| Anno base della stima | 2023 |

| CAGR | 6.3% |

| Concentrazione del mercato | Medium |

| Principali attori | Sistemi RJL, Tanita., OMRON Società, Condizioni, Dr Trust e tra gli altri |

faccelo sapere!

Body Fat Dispositivi di misura Mercato Analisi

Il mercato dei dispositivi di misura del grasso corporeo è stimato in USD 675,5 milioni nel 2024 e si prevede di raggiungere USD 1.038 milioni di USD 2031, crescendo ad un tasso di crescita annuale composto (CAGR) del 6,3% dal 2024 al 2031.

La domanda di dispositivi di misura del grasso corporeo sta crescendo in modo significativo nel corso degli anni. Fattori come aumentare la consapevolezza della salute tra le persone, aumento dei tassi di obesità e iniziative governative per promuovere stili di vita sani stanno alimentando l'adozione di questi dispositivi.

Body Fat Dispositivi di misura Mercato Tendenze

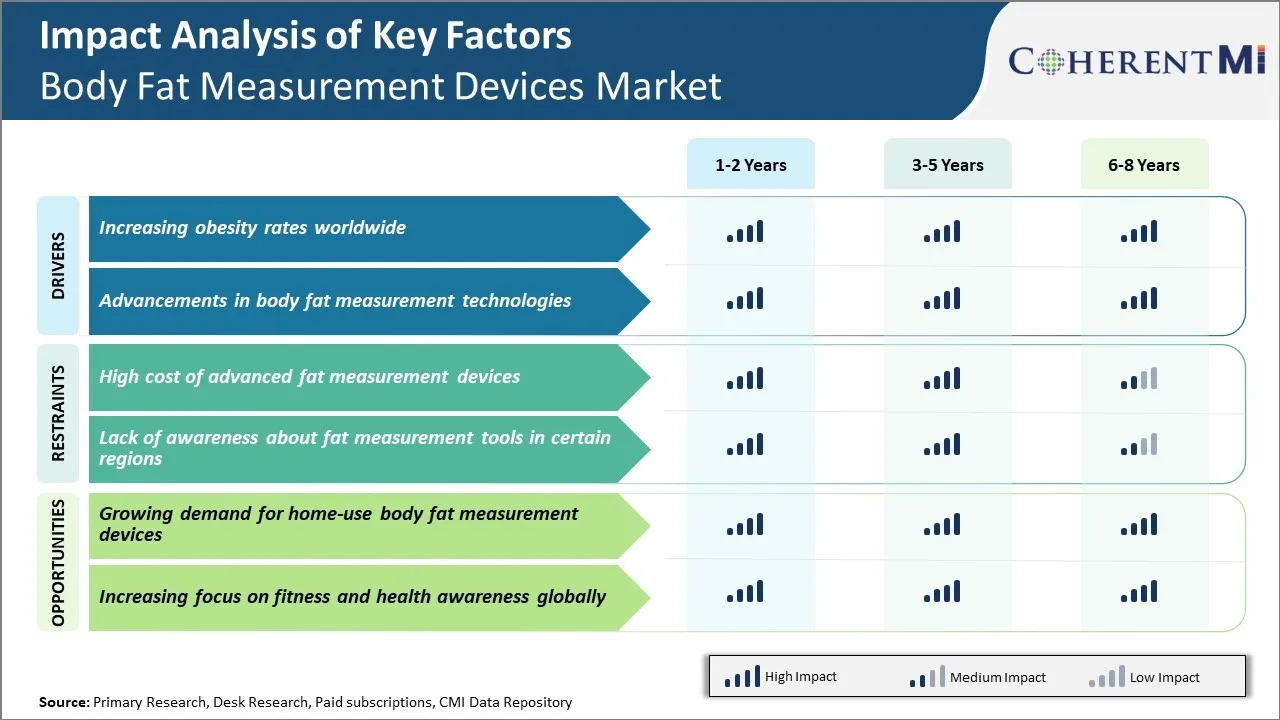

Driver di mercato - Aumentare i tassi di obesità in tutto il mondo

L'obesità è diventata una preoccupazione crescente a livello globale con tassi in aumento ad un ritmo allarmante negli ultimi decenni. Il grasso corporeo eccessivo e il peso mette lo stress significativo sulla salute generale ed è un fattore di rischio importante per le condizioni di rischio vitale come il diabete, le malattie cardiache e alcuni tumori. Secondo l'OMS, a partire dal 2016, più di 1,9 miliardi di adulti erano in sovrappeso di cui oltre 650 milioni erano obesi. Se le tendenze attuali continuano, il numero di popolazioni obese dovrebbe aumentare ulteriormente nel prossimo anno a impatto significativo sistemi sanitari pubblici.

Con la crescente consapevolezza della salute, più persone stanno ora prendendo misure preventive e stanno mantenendo un controllo sul loro peso e l'assunzione di cibo. Tuttavia, i metodi tradizionali di calcolo dell'obesità come l'utilizzo di scale di pesata e il calcolo BMI hanno i loro limiti e non offrono una corretta comprensione della composizione del corpo.

C'è una necessità di soluzioni di misura più affidabili e precise che possono determinare con precisione non solo il peso, ma altri parametri importanti come la massa grassa, la massa muscolare, il contenuto minerale osseo e i livelli di grasso viscerale. Questa tendenza ha significativamente aumentato la domanda di analizzatori di grasso corporeo tecnologicamente avanzati, precisi e facili da usare e monitor di composizione negli ultimi anni.

Driver di mercato - Avanzamenti nelle tecnologie di misura del grasso corporeo

Il rapido progresso tecnologico ha portato enormi miglioramenti nei dispositivi che monitorano varie statistiche di salute, compresi i livelli di grasso corporeo. I dispositivi precedenti per lo più fornito risultati generalizzati, ma le ultime varianti utilizzano più tecnologie in tandem per fornire analisi altamente accurate e dettagliate della composizione del corpo.

Analisi di impedenza bioelettrica o BIA è stata una delle prime tecniche utilizzate, tuttavia gli analizzatori basati su impedenza più recenti incorporano segnali di frequenza multipli e sensori ad alta precisione per tenere conto di fattori come il sesso, l'età, l'altezza che i risultati di impatto. Le scansioni avanzate DEXA o DXA che utilizzano misurazioni basate sui raggi X sono ora accessibili come unità portatili compatte che offrono densità ossea precisa e letture extracellulari/intracellulari dell'acqua.

Altri metodi emergenti come la scansione del corpo 3D, lo spostamento dell'aria plethysmography e l'interazione a infrarossi stanno entrando nel mercato pure. Tali soluzioni alimentate da AI possono estrarre metriche dettagliate in pochi secondi semplicemente in piedi su una piattaforma o indossare abbigliamento o accessori compatibili. L'innovazione costante sta rendendo disponibili queste tecnologie di alto livello clinico come dispositivi di uso domestico a prezzi contenuti.

I produttori si concentrano anche sul fattore forma e rendono i dispositivi più convenienti da usare. Bilancia intelligente, misure a nastro, analizzatori portatili, tracker indossabili con caratteristiche di composizione del corpo hanno visto una rapida adozione. L'integrazione di questi dispositivi con app per il fitness e piattaforme sanitarie consente il monitoraggio centralizzato online delle tendenze.

Sfida di mercato - High Cost of Advanced Fat Measurement Devices

Una delle sfide principali attualmente affrontate dal mercato dei dispositivi di misura del grasso corporeo è l'alto costo dei dispositivi di misura del grasso avanzati. Dispositivi più sofisticati che forniscono un'analisi della composizione corporea altamente accurata, come scansioni DEXA e dispositivi plethysmography di spostamento dell'aria, possono spesso costare migliaia di dollari. Questo alto prezzo mette fuori portata tali dispositivi per la maggior parte dei consumatori ordinari e limita il loro utilizzo prevalentemente alle impostazioni cliniche.

Anche per palestre e centri fitness, le spese di capitale ripide necessarie per investire in analizzatori di composizione corporea avanzati potrebbero non essere sempre fattibili o giustificati. Gli alti costi associati alla R&D e la produzione di dispositivi così complessi tecnicamente necessari per garantire una precisione molto elevata sono fattori importanti che contribuiscono ai loro prezzi più elevati.

Questo inibisce una maggiore penetrazione e l'adozione diffusa di tecnologie avanzate di misura del grasso tra la popolazione generale per scopi di monitoraggio della salute personale e del fitness. Per il segmento dei consumatori di massa, le alternative più convenienti sono spesso preferite anche se forniscono stime con una precisione leggermente inferiore.

Opportunità di mercato - crescente domanda per dispositivi di misurazione grasso del corpo di uso domestico

Una significativa opportunità per i giocatori nel mercato dei dispositivi di misura del grasso corporeo sta nella crescente domanda di dispositivi di uso domestico per il monitoraggio della composizione del corpo. Con l'aumento della consapevolezza della salute e la concentrazione sul fitness, molti consumatori vogliono monitorare facilmente le loro percentuali di grasso corporeo e fluttuazioni di peso dal comfort delle loro case. Ciò ha portato ad una domanda più alta per dispositivi semplici, convenienti e pratici che possono fornire misurazioni ragionevolmente accurate senza richiedere visite a cliniche o palestre.

Bilancia del grasso corporeo, misuratori di impedenza, pinze e dispositivi basati su nastro sono diventati sempre più popolari come opzioni di uso domestico. I leader di mercato stanno innovando nuove varietà di prodotti all'interno di queste categorie su misura per le impostazioni residenziali con caratteristiche convenienti come connettività Bluetooth e integrazione app. La convenienza e l'efficacia dei dispositivi di uso domestico rispetto agli analizzatori di composizione del corpo clinico sono fattori importanti che alimentano la loro maggiore adozione. Questo segmento emergente ha molto potenziale per la crescita continua e sta attirando molti nuovi concorrenti e le espansioni da parte dei giocatori esistenti nel settore.

Strategie vincenti chiave adottate dai principali attori di Body Fat Dispositivi di misura Mercato

Focus sull'innovazione del prodotto - L'innovazione continua per soddisfare le esigenze dei consumatori in evoluzione ha aiutato i giocatori a mantenere la leadership. Nel 2020, Fitbit ha lanciato la sua nuova scala Aria Air che non solo misura il peso, ma anche traccia le tendenze della composizione del corpo nel tempo attraverso segmenti come BMI, massa ossea, grasso corporeo e percentuali di massa muscolare. garmin rilasciato anche indice scala intelligente che forniscono analisi approfondita della composizione del corpo, tra cui massa muscolare, acqua del corpo, e altro ancora. Tali prodotti avanzati hanno aumentato la quota di mercato.

Obiettivi specifici segmenti di consumo - La segmentazione strategica consente ai giocatori di sviluppare soluzioni personalizzate. Nel 2018, Renpho ha lanciato la sua scala intelligente T9 focalizzata sulle esigenze di auto-quantificazione dei Millennials. Il design minimalista e l'integrazione con il kit di salute Apple lo hanno reso popolare. Allo stesso modo, Greater Goods ha lanciato BodyTrack scale nel 2021 targeting budget-conscious consumatori di benessere con dispositivi convenienti e precisi.

Focus sui mercati emergenti - La crescente consapevolezza della salute nelle regioni in via di sviluppo offre opportunità. Nel 2019, Nokia-owned Withings è entrato in India e ha collaborato con i rivenditori online e studi di idoneità per spingere i suoi dispositivi collegati. Ha guadagnato un vantaggio di primo livello. Xiaomi, basato sulla Cina, si concentra anche sui mercati asiatici e africani SE attraverso canali di e-commerce e si lega con palestre locali/clinici per una maggiore sensibilizzazione e vendite ripetute.

Analisi segmentale di Body Fat Dispositivi di misura Mercato

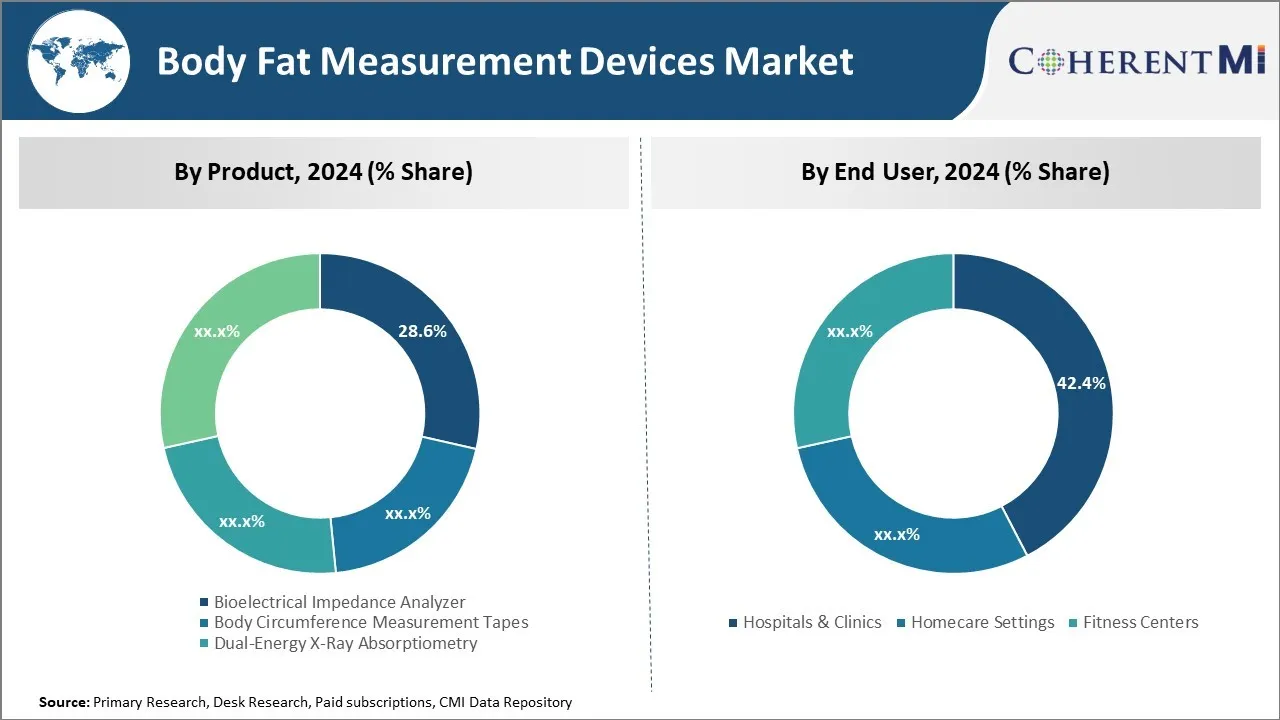

Insights, Per Prodotto: Bioelettrico Impedance Analyzer Remain High in Demand

In termini di prodotto, l'analizzatore di impedenza bioelettrica contribuisce alla quota più alta del mercato che possiede la sua convenienza e precisione. Il segmento analizzatore di impedenza bioelettrica domina il mercato dei dispositivi di misura del grasso corporeo a causa dei vantaggi chiave che offre su altri tipi di prodotto.

Dal momento che l'attuale incontra più resistenza mentre passa attraverso i tessuti grassi rispetto ai tessuti magre, può calcolare con precisione la percentuale di grasso corporeo attraverso un semplice contatto polso-goccia. Questa analisi senza dolore e rapida ha reso gli analizzatori di impedenza bioelettrica molto conveniente da usare sia per i professionisti sanitari che per gli individui.

Un altro fattore importante che alimenta la crescita di questo segmento è la sua elevata precisione. Gli analizzatori di bioimpedenza moderni utilizzano più punti di frequenza e le equazioni predittive convalidate clinicamente per fornire risultati di composizione del corpo con meno del 3% di errore. Possono quantificare separatamente grasso, massa senza grassi, acqua totale del corpo e altre metriche.

Diversi altri vantaggi come portabilità, facile manutenzione e automazione hanno ulteriormente aumentato l'adozione di analizzatori di bioimpedenza. I dispositivi sono ora disponibili anche per uso personale con connettività smartphone. I produttori stanno anche introducendo nuove tecnologie come l'analisi segmentale multi-frequenza che può rilevare alterazioni sottili nella distribuzione dell'acqua del corpo. Tutti questi fattori stanno rafforzando la leadership di questo segmento nei tempi attuali.

Insights, By End User: Ospedali & Clinics Contribuisci il più alto Condividi per necessità di valutazione accurata

Il segmento ospedali e cliniche è emerso come il principale gruppo end-user nel mercato dei dispositivi di misura del grasso corporeo. Ciò è dovuto principalmente alla crescente importanza del test di composizione del corpo nel processo decisionale clinico. I fornitori di assistenza sanitaria si affidano sempre più alla precisa stima del grasso corporeo per la valutazione nutrizionale, la valutazione dell'efficacia del trattamento e la diagnosi di condizioni croniche.

Disturbi metabolici, malattie cardiovascolari e altre malattie legate allo stile di vita spesso correlati alla distribuzione e alle percentuali di grasso di un individuo. Pertanto, le strutture ospedaliere e ambulatoriali preferiscono utilizzare strumenti di livello medico per l'analisi di composizione corporea autorevole.

Dispositivi disponibili presso ospedali e cliniche diagnostiche offrono anche livelli di precisione più elevati come richiesto per scopi medici. Essi incorporano rigidi protocolli di calibrazione e sono gestiti da professionisti addestrati, eliminando l'errore umano. Gli analizzatori Segmentali che forniscono mappe regionali di distribuzione dei grassi aggiungono preziose informazioni cliniche. Nel frattempo, lo snellimento delle misurazioni assiste gli studi di confronto per la ricerca.

I rapidi progressi tecnologici guidano ulteriormente il segmento medico. Le tecnologie di imaging Novel consentono di monitorare i cambiamenti di composizione del corpo in tempo reale con il trattamento. Questo ushers cura personalizzata basata su metriche oggettive al di là del peso o BMI da solo. Aumentare la spesa sanitaria e l'accento sulla gestione preventiva aiuta anche la crescita del mercato. Complessivamente, le esigenze accurate di stabilimento medico alimentano la maggior parte di questa categoria di utenti finali.

Ulteriori approfondimenti di Body Fat Dispositivi di misura Mercato

- L'OMS stima entro il 2030, il 47%, il 35% e il 39% della popolazione negli Stati Uniti, nel Regno Unito e in Messico saranno obesi.

Panoramica competitiva di Body Fat Dispositivi di misura Mercato

I principali giocatori che operano nel mercato dei dispositivi di misura grasso del corpo includono RJL Systems, Tanita, OMRON Corporation, Withings, Dr Trust, Hologic, Inc., seca, Bowers Group, ACCUFITNESS, LLC e COSMED.

Body Fat Dispositivi di misura Mercato Leader

- Sistemi RJL

- Tanita.

- OMRON Società

- Condizioni

- Dr Trust

Body Fat Dispositivi di misura Mercato - Rivalità competitiva

Body Fat Dispositivi di misura Mercato

(Dominato dai principali attori)

(Altamente competitivo con molti attori.)

Sviluppi recenti in Body Fat Dispositivi di misura Mercato

- Nel settembre 2020, Akern ha lanciato l'analizzatore di bioimpedenza BIA 101 BIVA® PRO. Questo dispositivo è progettato per valutare lo stato nutrizionale, muscolare e idroelettrolitico utilizzando tecniche avanzate di bioimpedenza. Il BIA 101 BIVA PRO offre caratteristiche come un display IPS da 5 pollici, un flusso di lavoro ottimizzato per gli utenti e una maggiore affidabilità nelle misurazioni, rendendolo adatto a vari campi, tra cui sport, fitness, nutrizione ospedaliera e cura pediatrica. Il dispositivo supporta anche l'analisi totale del corpo e della bioimpedenza regionale, consentendo un monitoraggio preciso della composizione del corpo e dei cambiamenti in specifici gruppi muscolari.

- Nel mese di agosto 2022, Bodyport Inc. ha ricevuto FDA 510(k) clearance per il suo Bodyport Cardiac Scale. Questo dispositivo utilizza sensori e algoritmi avanzati per misurare non invasivamente i biomarcatori emodinamici chiave, come la funzione cardiaca e lo stato fluido, attraverso i piedi quando una persona passa sulla scala. È particolarmente utile per i pazienti con condizioni di gestione dei fluidi come insufficienza cardiaca e malattia renale. Integrando perfettamente le routine quotidiane, la scala trasmette i dati ai team sanitari per un monitoraggio efficiente e una cura personalizzata.

Body Fat Dispositivi di misura Mercato Segmentazione

- Per prodotto

- Analizzatore di impedenza bioelettrica

- Nastri di misura della circonferenza del corpo

- Assorbtimetria a raggi X a doppia energia

- Calici pieghevoli

- L'utente finale

- Ospedali e Cliniche

- Impostazioni dell'assistenza

- Centri fitness

Vorresti esplorare l'opzione di acquistosingole sezioni di questo report?

Domande frequenti :

Quanto è grande il mercato dei dispositivi di misura del grasso corporeo?

Il mercato dei dispositivi di misura del grasso corporeo è stimato essere valutato a 675,5 milioni di dollari nel 2024 e si prevede di raggiungere 1.038 milioni di dollari entro il 2031.

Quali sono i fattori chiave che ostacolano la crescita del mercato dei dispositivi di misura del grasso corporeo?

L'alto costo dei dispositivi di misura del grasso avanzati e la mancanza di consapevolezza sugli strumenti di misura del grasso in alcune regioni sono i principali fattori che ostacolano la crescita del mercato dei dispositivi di misura del grasso corporeo.

Quali sono i principali fattori che guidano la crescita del mercato dei dispositivi di misura del grasso corporeo?

I crescenti tassi di obesità in tutto il mondo e progressi nelle tecnologie di misura del grasso corporeo sono i principali fattori che guidano il mercato dei dispositivi di misura del grasso corporeo.

Qual è il prodotto leader nel mercato dei dispositivi di misura del grasso corporeo?

Il segmento leader del prodotto è analizzatore di impedenza bioelettrica.

Quali sono i principali giocatori che operano nel mercato dei dispositivi di misura del grasso corporeo?

RJL Systems, Tanita, OMRON Corporation, Withings, Dr Trust, Hologic, Inc., seca, Bowers Group, ACCUFITNESS, LLC e COSMED sono i principali giocatori.

Quale sarà il CAGR del mercato dei dispositivi di misura del grasso corporeo?

Il CAGR del mercato dei dispositivi di misura del grasso corporeo è previsto per il 6,3% dal 2024-2031.