HVACシステム市場 규모 및 점유율 분석 - 성장 추세 및 예측 (2024 - 2031)

HVAC システム市場は、冷却装置 (ユニタリー エアコン、可変冷媒流量システム (VRF)、チラー、ルーム エアコン、その他)、タイプ (ヒート ポンプ、炉、ユニタリー ヒーター、ボイラー)、換気タイプ (エア ハンドリング ユニット、エア フィルター、除湿器、換気ファン、空気清浄機)、実装タイプ....

HVACシステム市場 크기

USD 기준 시장 규모 Bn

CAGR8.7%

| 연구 기간 | 2024 - 2031 |

| 추정 기준 연도 | 2023 |

| CAGR | 8.7% |

| 시장 집중도 | Medium |

| 주요 플레이어 | (주)다이킨산업, 회사소개, 미츠비시 전기 Corporation, Johnson 통제, LG전자 및 기타 |

저희에게 알려주세요!

HVACシステム市場 분석

Global HVAC System Market은 가치있는 것으로 추정됩니다. 2024년 USD 206.3 bn 견적 요청 2031년 USD 403.1 bn, 합성 연간 성장률 증가 (CAGR) 의 8.7% 에서 2031. 주요 경제에 걸쳐 상업 건물 및 주택의 건설 증가, 특히 아시아와 아프리카에서 국가 개발, 중앙 난방, 환기 및 공기 조절 시스템에 대한 수요 상승에.

시장은 기후 변화로 인해 지구 온도 상승에 의해 지원되는 예측 기간에 긍정적 인 추세를 목격 할 것으로 예상됩니다. 냉각 솔루션의 요구 사항을 증가시킵니다. 또한, 처분할 수 있는 소득에 있는 성장은 열 안락을 위한 HVAC 체계에 투자하는 더 많은 가구를 허용하. 에너지 효율과 실내 공기 품질에 대한 엄격한 규정도 현대 효율적인 시스템과 이전 HVAC 기술의 교체를 보완하고 있습니다.

HVACシステム市場 트렌드

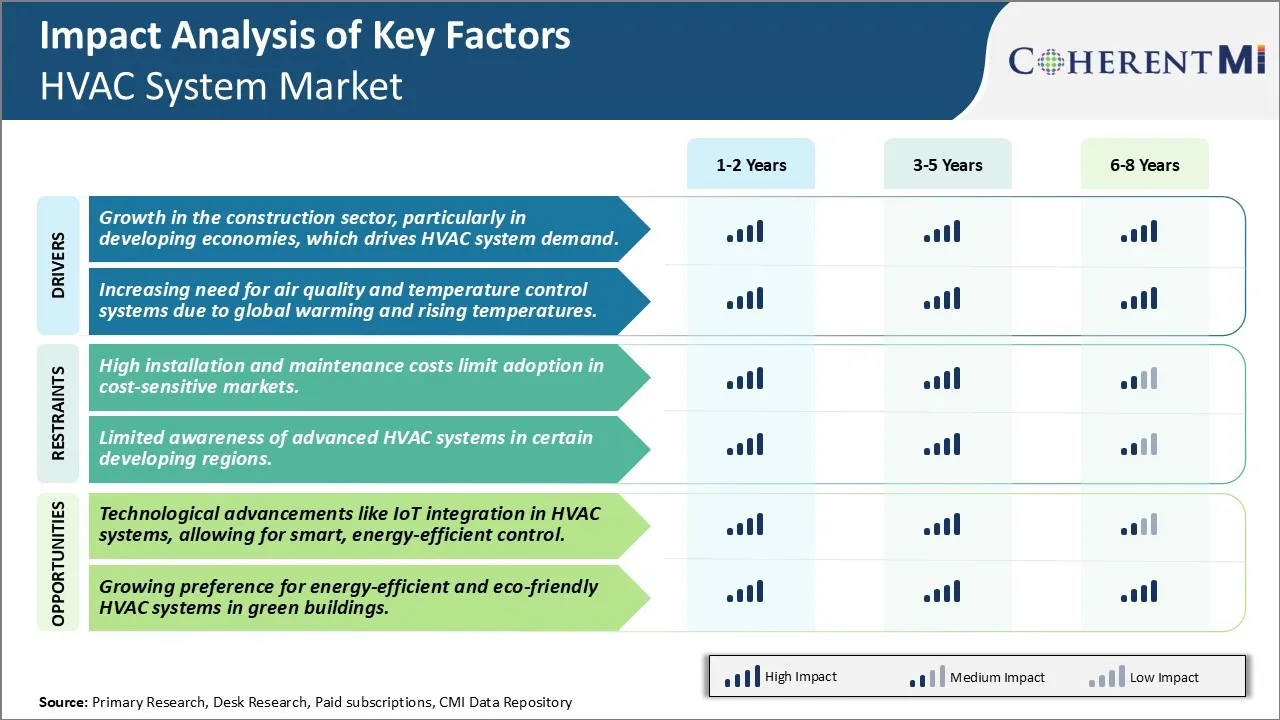

시장 드라이버 - 건설 부문의 성장, 특히 Economies 개발, 어떤 드라이브 HVAC 시스템 수요

전 세계 건설 산업은 지난 몇 년 동안 상당한 성장을 보였으며이 성장은 향후 몇 년 동안 계속 될 것으로 예상됩니다. 아시아 태평양, 중동 및 아프리카, 라틴 아메리카와 같은 지역의 경제 개발은 상업 및 주거 분야의 증가 된 건설 활동을 목격하고 있습니다. 이 경제는 새로운 인프라 개발, 도시, 쇼핑몰, 사무실, 병원 및 기타 상업 건물로 번역하는 빠른 속도의 도시화를보고 있습니다. 이 모든 구조는 능률적인 난방, 환기 및 공기조화 체계를 요구합니다 열 안락 및 좋은 실내 공기 질을 제공하기 위하여.

냉각장치, AHUs, FCUs, VRF 체계와 같은 다양한 HVAC 장비를 위한 수요는, 덕트된 분할 단위 더 많은 것과 같이 꾸준히 증가하고 더 많은 건물은 집중된 냉각 해결책으로 건설되고 개조됩니다. 주거 부문에서 특히 소득 수준을 올리고 라이프 스타일을 변화시키기 위해 주택 소유자는 다른 HVAC 솔루션과 통합 된 스마트 홈을위한 선택이다. HVAC 제조업체는 고급 기능을 갖춘 혁신적인 주거용 AC 장치를 개발하는 것을 권장합니다. tier 2의 성장과 국가 발전에 있는 층 3 도시는 또한 이 지역에 있는 작고 중간 HVAC 장비 수요를 추진하고 있습니다.

또한, 엄격한 건물 에너지 부호의 실시 및 열 절연제에 관련해 규범은, 실내 공기 질 전문화한 HVAC 해결책에 reliance를 증폭합니다. 이것은 감지기, thermostats, 여과기, 차단기 등과 같은 각종 HVAC 성분의 판매를 연속적으로 밀어줍니다. 다양한 선진국의 정부는 지속가능하고 효율적인 냉각 및 환기 기술을 활용한 새로운 스마트 도시와 친환경 건물 인프라를 개발하기 위해 노력하고 있습니다. 이 모든 Macroeconomic 및 규제 요소는 건설 성장 trajectory에 할당 된 HVAC 산업은 중간 및 긴 실행의 상승 건설 지출에서 혜택을 잘 포화.

시장 드라이버 - Air Quality 및 Temperature Control Systems에 대한 필요성을 증가 Global Warming 및 Rising Temperature

지구 온난화에 의해 유도 된 기후 변화는 전 세계의 열파와 같은 극한 기상 사건의 강도와 빈도를 늘렸습니다. 과학적인 학문은 온실 가스 농도가 다 겹으로 성장한다는 것을 건의합니다, 열대 지역에서 평균 온도는 오는 십년간에 있는 경보 비율에 계속 ascending. 이 포즈 심각한 건강, 인프라 및 생산성 문제. 믿을 수 있는 실내 기후 관리 체계를 위한 필요조건은 점점 불완전하게 되고 있습니다.

Soaring 온도는 주거와 상업적인 건물 둘 다에 있는 호화스러운 보다는 오히려 필요성 HVAC 장비를 만들었습니다. 그들의 사용은 전통적으로 중요한 HVAC 채택합니다. 예를 들어, 수요는 아시아, 아프리카 및 라틴 아메리카의 열대 국가에서 열의 영향을 미칩니다. 또한 유럽과 북아메리카의 특정 부분에 있는 장시간 여름 시즌은 방 ACs, 냉각장치, 환기 장치의 판매를 augmenting입니다. 또한, 도시 열 섬 효과는 현명하게 대중화 된 도시에 관찰되어 지역 냉각 네트워크의 배포 및 더 큰 규모의 중앙 냉각 인프라를 중화시킵니다.

동시에, 숲의 불을 포함한 다양한 소스에서 시작되는 가난한 공기 질은 공중 보건에 위험합니다. 이것은 오염 통제 기계장치와 통합된 진보된 HVAC &R 기술의 채택을 통해 실내 공기 정화의 중요성을 높게 했습니다. 방사성균, 입자, VOC 가스를 제거하고 통기성 환경을 제공합니다. 이 모든 요인은 현재와 미래 열 안락 필요를 위한 정교한 HVAC 체계를 선택하기 위하여 건물 소유자 및 도시 플래너를 칭찬하고 뿐 아니라 더 나은 IAQ를, 거기 몰기 enduring 기업 성장을 지킵니다.

Market Challenge - 높은 설치 및 유지 보수 비용 제한 비용 절감 시장

HVAC 시스템 시장에서 직면 한 주요 도전 중 하나는 높은 설치 및 유지 보수 비용이며, 이는 비용 감지 시장에서 채택을 제한합니다. HVAC 시스템을 설치하면 시스템의 크기와 복잡성에 따라 설치 비용으로 때때로 10,000 달러를 초과 할 수 있습니다. 이 높은 상향 투자는 가격 민감하고 비용 효율적인 시장에서 많은 가구 및 비즈니스에 대한 도달의 HVAC 시스템을 넣어. 또한 HVAC 시스템은 장비 청소, 필터 교체 및 적절한 기능을 보장하기 위해 servicing과 같은 년을 통해 정기 유지 보수가 필요합니다. 효율성과 성능을 최적화하는 데 필요한 동안, 이러한 재순환 유지 보수 비용은 고객에게 더 많은 금융 부담을 제공합니다. 신흥 시장에서 많은 잠재적 인 구매자와 경제 개발, 재량 지출이 낮은 곳, 이러한 비용을 정당화하기 어렵다. 지속적인 실행 비용과 함께 상향 자본 요구는 HVAC 시스템의 광경을 방지하고, 특히 비용 민감한 인구 통계에서 시장 성장 잠재력을 제한합니다. 이 도전을 해결하려면 제조업체는 가치 엔지니어링 및 비용 최적화에 초점을 맞추고 HVAC 시스템을보다 저렴하게 만들 필요가 있습니다.

시장 기회- HVAC 시스템에서 IoT 통합과 같은 기술 발전, 스마트, 에너지 효율적인 제어를 허용

HVAC 시스템 시장의 주요 기회 중 하나는 기능 향상 및 효율성을 최적화하는 새로운 시대 기술을 활용하고 있습니다. IoT(Internet of Things) 및 스마트 홈 연결의 통합은 이 분야에 광범위한 잠재력을 제공합니다. IoT-enabled 기능으로 HVAC 시스템은 모바일 앱이나 음성 보조를 사용하여 원격 모니터링 및 제어 할 수 있습니다. 고객은 유지 보수 필요 또는 기능 장애에 실시간 시스템 성능 업데이트 및 알림을받습니다. 이 문제를 해결하고 가동 시간을 최소화 할 수 있습니다. 또한 IoT 통합은 사용자 위치, 행동 및 선호도에 따라 지능형 환경 제어를 가능하게 합니다. 센서는 에너지 절약과 결합된 최대 편안함을위한 온도, 기류 및 기타 설정을 정확하게 조정할 수 마이크로 레버리지 데이터를 수집하고 분석합니다. 고급 알고리즘은 자동화된 자체 진단 및 적응 기능을 통해 평생 동안 HVAC 시스템에서 최고 수준의 효율성을 유지할 수 있습니다. 스마트 연결 기능은 유틸리티 청구서를 낮추는 동안 사용자 경험을 향상시킵니다. 더 많은 소비자가 IoT 전원 HVAC 시스템에 의해 감당할 수있는 편리하고 저축을 경험함에 따라 수요는 향후 몇 년 동안 멀티 배를 늘릴 가능성이 있습니다. 이 회사는 기술 혁신을 통해 더 새로운 수직 및 관할권으로 확장 할 수있는 거대한 기회를 제공합니다.

주요 플레이어가 채택한 주요 승리 전략 HVACシステム市場

에너지 효율 및 지속 가능성에 중점을 둡니다.

- R & D에 투자하여 에너지 소비 및 환경 영향을 줄이는 에너지 효율적인 HVAC 시스템을 개발합니다.

- 친환경 냉매 및 지속 가능한 솔루션을 제공하여 환경 규제 및 환경 의식 소비자에게 호소를 준수합니다.

- 태양광 발전 HVAC 시스템과 같은 재생 에너지 소스를 통합하여 기존 에너지에 의존도를 줄일 수 있습니다.

스마트 및 IoT 기반 솔루션

- IoT 및 스마트 기술을 HVAC 시스템에 통합하여 원격 모니터링, 제어 및 진단을 제공하여 사용자 경험 및 운영 효율성을 향상시킵니다.

- 스마트 홈 및 빌딩 관리 플랫폼과 호환되는 시스템을 개발하여 주거 및 상업 사용자를위한 편리하고 에너지 절약을 제공합니다.

- Data Analysis를 통해 예측 유지 보수 기능을 제공하여 가동 시간을 줄이고 성능을 최적화합니다.

제품 사용자 정의 및 Flexibility

- 맞춤형 HVAC 솔루션 제공은 상업용, 주거, 산업 및 의료 등 다양한 분야의 특정 요구를 충족시키기 위해 요구 사항을 크게 다를 수 있습니다.

- 모듈 및 확장 가능한 HVAC 시스템을 개발하여 건물 레이아웃 또는 요구 사항을 변경할 수 있습니다.

지역 및 시장 확장

- 아시아 태평양, 중동, 라틴 아메리카와 같은 지역에서 신흥 시장에서의 존재를 확장, 도시화 및 건설 활동이 상승하는 곳.

- 새로운 유통 채널 및 서비스 센터를 구축하여 현지 시장을 더 잘 봉사하고 더 빠른 지원을 제공합니다.

실내 공기 품질 향상 (IAQ) 솔루션

- 공기 여과 및 정화 기술에 초점을 맞추고 실내 공기 품질을 개선하기 위해 주거 및 상업용 공간 모두의 우선 순위가되었습니다. 특히 COVID-19.

- 효과적으로 습도, 공수 입자 및 병원체를 제어하는 HVAC 시스템 개발, 특히 병원 및 청정실과 같은 민감한 환경에 대한.

인수 및 파트너쉽

- 더 작은 HVAC 회사 또는 기술 회사는 혁신적인 기술, 시장 점유율 증가 및 제품 포트폴리오에 대한 액세스를 얻을 수 있습니다.

- 부동산 개발자, 건설 회사 및 스마트 기술 제공 업체와 전략적 제휴를 통해 새로운 건설 프로젝트 및 스마트 빌딩에서 HVAC 통합을 증가시킵니다.

세그먼트 분석 HVACシステム市場

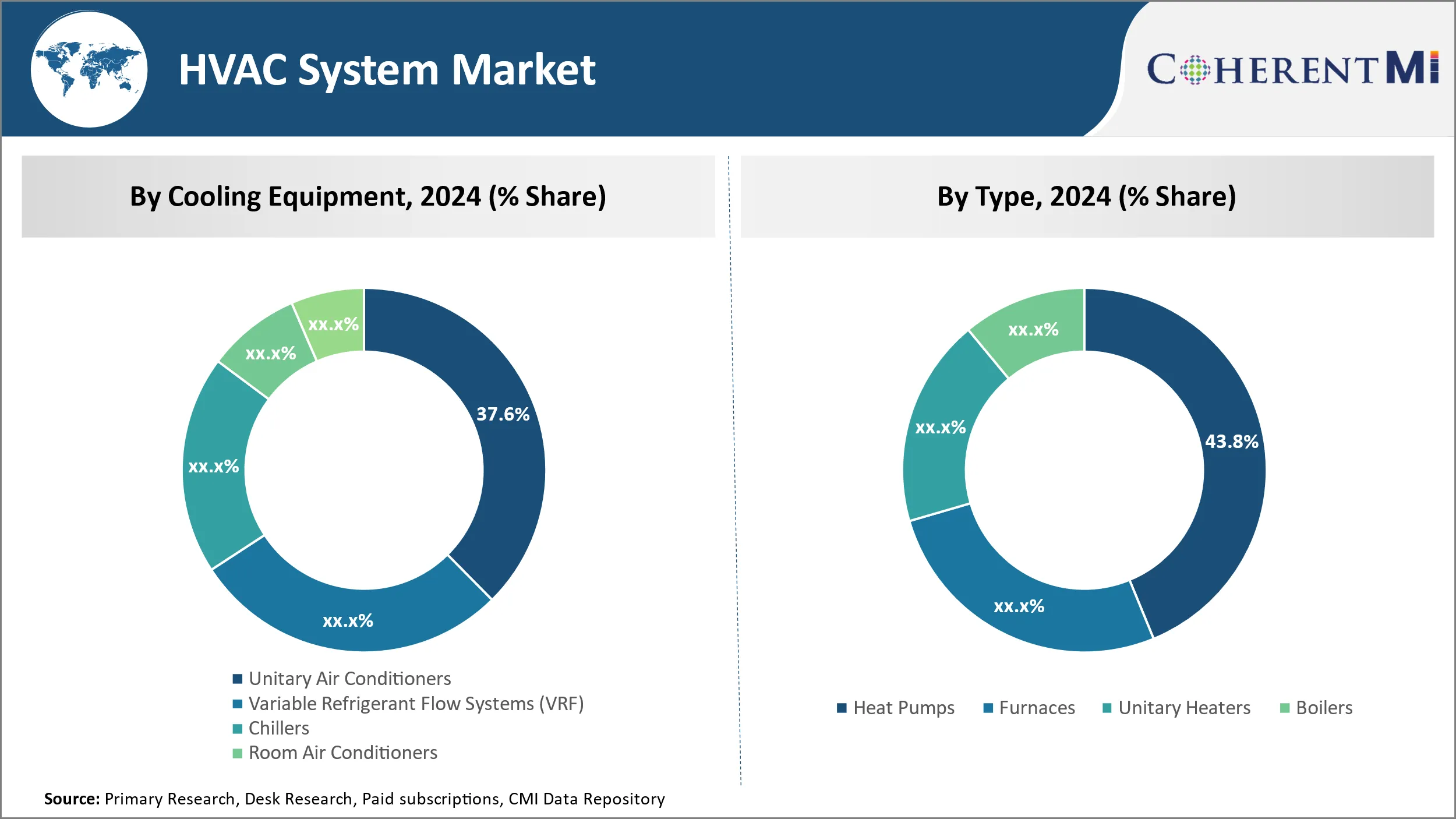

Insights, 냉각 장비, 효율성 및 Unitary 에어 컨디셔너의 설치 드라이브 채택

냉각 장비에 의하여, 단위 에어 컨디셔너 세그먼트는 임명의 그들의 효율성 그리고 용이에 2024 owing에서 37.6%에 공헌할 것으로 예상됩니다. Unitary 에어 컨디셔너는 현대 단위로 다른 선택권 보다는 더 에너지 효율적 에너지 절약을 극소화하기 위하여 디자인됩니다. 이 장치는 주거와 상업적인 재산 둘 다를 위한 긴 달리기에 비용 효과적인 해결책을 만듭니다. 그들의 소형 디자인은 단위 에어 컨디셔너 더 큰 냉각 장치에 비교된 최소 임명 일을 요구합니다. 이 drastically 중단을 감소시키고 설치와 관련된 비용. 단위 에어 컨디셔너의 자존심은 벽 설치 또는 창 설치를 포함하여 거의 어디에서든지 가동 가능하게 할 수 있습니다, 각종 건물 구조 및 개조 필요를 위해 다재다능한 만들기. 복잡한 냉각탑과 중앙 집중식 냉수 체계와 비교된 그들의 편익 그리고 상대적으로 낮은 상륙비는 두 개조와 새로운 건축 프로젝트 중 단위 에어 컨디셔너의 넓은 인기에 지도했습니다.

Insights, Type, Comfort 및 Versatility Drive 열 펌프 설정

유형에 의하여, 열 펌프는 1개의 체계에서 난방과 냉각을 제공하는 그들의 능력에 2024년에 43.8%에 공헌하기 위하여 계획됩니다. 로는 난방과 단위 히이터를 위해 주로 사용됩니다 단지 제안 난방을 위해, 열 펌프는 계절에 따라서 두 목적을 위해 사용될 수 있는 다재다능한 해결책입니다. 이것은 주거와 상업적인 재산 소유자가 일년 내내 그들의 전체 열 안락 필요를 성취하는 단 하나 HVAC 체계가 있는 것을 허용합니다. 난방 물 또는 증기를 위해 적당한 보일러와는 달리, 열 펌프는 냉각을 위한 공간 난방을 위한 옥외 실내에서 열을 이동하기 위하여 전기를 이용합니다 또는 vice versa. 자연적인 온도 차별을 레버리고 그들의 운영 원리는 그(것)들을 매우 능률적인 선택권 만듭니다. 그 사이에, 실내와 옥외 작동 형태의 뒤집음은 단지 난방에 전념한 로 또는 단위 히이터에 열 펌프 강한 가치 이점을 줍니다. 다양한 기능 및 효율적인 성능은 열 펌프를 빠르게 성장하는 세그먼트를 만들었습니다.

Insights, 환기 유형, 실내 공기 품질 Concerns Drive Demand for Air Handling Units

환기 유형, 공기 처리 단위는 실내 공기 질에 주어진 중요성을 성장하는 시장의 가장 높은 점유율에 공헌합니다. 건물이 점점 더 에너지 효율을 개선하기 위해 공기가되고, 오염 물질의 가난한 환기 및 축적에 대한 우려가 있습니다. 팬, 필터 또는 청정기와 같은 단위는 특정 IAQ 측면 만, 공기 처리 장치 포괄적 인 솔루션을 제공합니다. 공기 처리 장치 중앙 상태, 순환, 청소 및 신선한 공기를 생활 또는 작업 공간으로 배포합니다. 현대 단위는 미립자 물질의 공기, 알레르기, 알레르기, 미생물 오염 물질 및 기타 오염 물질과 같은 기능과 함께 다양한 여과 단계를 갖추고 있습니다. 최적의 실내 공기 품질을 지원하기 위해 현대 단위는 다양한 여과 단계와 함께 제공됩니다. 큰 상업 시설로 100 %의 외부 공기를 효율적으로 관리 할 수있는 능력은 사무실, 병원 및 기타 중요한 환경에 대한 HVAC 시스템의 필수 구성 요소를 제공합니다. 실내 환경 품질에 주어진 이 중요성은 최근 과거에 환기 유형 중 가장 빠른 성장 세그먼트를 취급해 왔습니다.

추가 통찰력 HVACシステム市場

HVAC 시스템 시장은 온도 및 대기 품질 관리에 필요한 증가로 인해 강력한 성장을 위해 설정되어 지구 온도 및 오염 수준 상승. IoT 통합과 같은 기술 발전을 통해 HVAC 시스템은 더 스마트하고 에너지 효율이 높으며 주거 및 상업용 부문에서 수요에 부응합니다. 아시아 태평양은 급속한 도시화, 높은 인구 밀도 및 증가 산업 활동 때문에 지배적인 지역입니다. 북미는 설립 된 인프라로 인해 빠른 성장을 경험하고 라이프 스타일 변경에 대한 응답에 스마트 HVAC 시스템의 채택을 증가 할 것으로 예상됩니다. 그러나, 높은 비용 및 제한된 인식은 일부 시장의 문제 해결. 미래 기회는 에너지 효율적인 기술, 특히 VRF 시스템 및 태양광 발전 HVAC 솔루션에 속합니다. 에너지 의식과 환경 친화적 인 건물 설계에 필수적입니다.

경쟁 개요 HVACシステム市場

HVAC 시스템 시장에서 운영되는 주요 플레이어는 Daikin Industries, Ltd., Carrier Corporation, Mitsubishi Electric Corporation, Johnson Controls, LG Electronics, Hitachi Ltd., Trane Technologies, Haier Group, Lennox International Inc. 및 Samsung Electronics를 포함합니다.

HVACシステム市場 선두

- (주)다이킨산업

- 회사소개

- 미츠비시 전기 Corporation

- Johnson 통제

- LG전자

HVACシステム市場 - 경쟁 경쟁

HVACシステム市場

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 HVACシステム市場

- 2024년 4월에서는, Haier는 태양 에너지에 달리기 위하여 디자인된 중국에 있는 태양 잡종 AC를, 전기 비용 및 환경 충격 감소시키기 위하여 발사했습니다.

- 4 월 2024에서 Johnson Controls는 나이지리아의 Noltec Engineering과 파트너십을 맺고 상업용 및 산업용 애플리케이션에 적합한 가변 냉각 유량 (VRF) 시스템을 도입했습니다.

- 4 월 2024에서 Hitachi는 음성 명령을 사용하여 모바일 장치를 통해 제어 할 수있는 Wi-Fi 지원 스마트 에어컨 시스템 인 AirCloud Go를 공개했습니다.

HVACシステム市場 세분화

- 냉각 장비

- 에어컨

- 가변 냉매 유량 시스템 (VRF)

- 냉각 장치

- 방 에어 컨디셔너

- 이름 *

- 이름 *

- 열 펌프

- 으로

- 공급 업체

- 보일러

- 환기 유형

- 공기 처리 장치

- 공기 필터

- 공급 업체

- 환기 팬

- 공기 청정기

- 구현 유형

- 새로운 건설

- 옵션 정보

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

자주 묻는 질문 :

HVAC 시스템 시장은 얼마나 큰가요?

Global HVAC System Market은 2024년 USD 206.3 Bn에서 평가되고 2031년까지 USD 403.1 Bn에 도달 할 것으로 예상됩니다.

HVAC 시스템 시장의 CAGR는 무엇입니까?

HVAC 시스템 시장의 CAGR은 2024에서 2031로 8.7%로 예상됩니다.

HVAC 시스템 시장 성장을 주도하는 주요 요인은 무엇입니까?

건설 부문의 성장, 특히 경제 발전, HVAC 시스템 수요를 구동하고 글로벌 온난화로 인한 공기 품질 및 온도 제어 시스템에 대한 필요성을 증가하는 주요 요인은 HVAC 시스템 시장을 구동하는 주요 요인입니다.

HVAC 시스템 시장의 성장에 대한 핵심 요소는 무엇입니까?

높은 설치 및 유지 보수 비용 제한은 비용 감지 시장에서 채택 및 특정 개발 지역의 고급 HVAC 시스템의 제한된 인식은 HVAC 시스템 시장의 성장에 대한 주요 요소입니다.

HVAC 시스템 시장에서 최고의 냉각 장비는 무엇입니까?

최고의 냉각 장비 세그먼트는 Unitary 에어 컨디셔너입니다.

HVAC System Market에서 작동하는 주요 플레이어는 무엇입니까?

Daikin Industries, Ltd., Carrier Corporation, Mitsubishi Electric Corporation, Johnson Controls, LG Electronics, Hitachi Ltd., Trane Technologies, Haier Group, Lennox International Inc., Samsung Electronics는 주요 선수입니다.